U.S. House of Representatives

Committee on Oversight and Government Reform

Darrell Issa (CA-49), Chairman

The Internal Revenue Service’s Targeting of Conservative Tax-

Exempt Applicants: Report of Findings for the 113

th

Congress

Staff Report

113th Congress

December 23, 2014

“I’ve reviewed the Treasury Department watchdog’s report, and the misconduct

that it uncovered is inexcusable. It’s inexcusable, and Americans are right to be

angry about it, and I am angry about it. I will not tolerate this kind of behavior in

any agency, but especially in the IRS, given the power that it has and the reach

that it has into all of our lives.”

— President Barack Obama, May 15, 2013.

*

“If, on the other hand, you’ve got an office in Cincinnati, in the IRS office that – I

think, for bureaucratic reasons, is trying to streamline what is a difficult law to

interpret about whether a non-profit is actually a political organization, deserves a

tax exempt agency. And they’ve got a list, and suddenly everybody’s outraged.”

— President Barack Obama, December 5, 2013.

†

“[T]here were some bone-headed decisions . . . out of a local office . . . . Not even

mass corruption, not even a smidgeon of corruption, I would say.”

— President Barack Obama, February 2, 2014.

‡

*

The White House, Statement by the President (May 15, 2013).

†

Hardball with Chris Matthews (MSNBC television broadcast Dec. 5, 2013) (interview with President Barack

Obama).

‡

“Not even a smidgeon of corruption”: Obama downplays IRS, other scandals, FOX NEWS, Feb. 3, 2014.

i

ExecutiveSummary

On October 14, 2010, President Barack Obama stood before a youth town hall in

Washington, D.C., fielding questions during the combative midterm election campaign season.

When asked about the rising Tea Party movement, the President responded that “what has

happened is layered on top of some of that general frustration that has expressed itself through

the Tea Party, there is an awful lot of corporate money that’s pouring into these elections right

now.”

1

The President continued: “But you have these innocuous-sounding names, and we don’t

know where this money is coming from. I think that is a problem for our democracy. And it’s a

direct result of a Supreme Court decision that said they didn’t have to disclose who their donors

are.”

2

Five days later, Lois Lerner addressed a much smaller audience at Duke University.

Speaking about the upcoming election, Lerner echoed the President’s sentiments. “The Supreme

Court dealt a huge blow,” she said, “overturning a 100-year old precedent that basically

corporations couldn’t give directly to political campaigns. And everyone is up in arms because

they don’t like it. . . . They want the IRS to fix the problem. . . . I won’t know until I look at

their [tax return form] 990s next year whether they have done more than their primary activity as

political or not. So I can’t do anything right now.”

3

The pressure to “fix the problem,” as articulated by Lois Lerner, originated with

President Obama and senior party leadership. The pressure on the IRS to regulate political

speech by tax-exempt organizations mounted in the wake of the Supreme Court’s decision in

Citizens United v. Federal Election Commission. Barnstorming the country, President Obama

derided conservative tax-exempt groups as “shadowy,” “phony,” and even “a threat to our

democracy.”

4

Other prominent Democratic leaders joined the President’s call to arms,

pressuring the IRS to take an aggressive stance against political speech by tax-exempt entities.

5

For twenty-seven months, from February 2010 until May 2012, the Internal Revenue

Service systematically targeted conservative tax-exempt applicants for additional scrutiny and

delay. The IRS’s targeting of conservative tax-exempt applications was just one symptom of the

Administration’s broader response to perceived shortcomings of federal campaign-finance law

and the Citizens United decision. As prominent Democratic politicians and the media

condemned conservative non-profit groups, the IRS sought ways to rein in the groups’ political

speech. Lois Lerner initiated a “c4 project” – careful to ensure that it was not “per se political” –

and called applications filed by Tea Party groups “very dangerous” because she believed that

they could undo existing IRS limits on non-profit political speech.

1

The White House, Remarks by the President in a Youth Town Hall (Oct. 14, 2010).

2

Id.

3

See “Lois Lerner Discusses Political Pressure on IRS in 2010,” YOUTUBE (Dec.. 10, 2013),

http://www.youtube.com/watch?v=EH1ZRyq-1iM (transcription by Committee).

4

See H. COMM. ON OVERSIGHT & GOV’T REFORM, HOW POLITICS LED THE IRS TO TARGET CONSERVATIVE TAX-

E

XEMPT APPLICANTS FOR THEIR POLITICAL BELIEFS (June 16, 2014) [hereinafter “HOW POLITICS LED THE IRS TO

TARGET CONSERVATIVE TAX-EXEMPT APPLICANTS”].

5

Id.

ii

The rhetoric led the IRS to hold a deeply skeptical view of the merits of applications filed

by new conservative groups. Line-level IRS employees, trained to identify and elevate any

applications that could draw media attention, flagged the first Tea Party applications for their

Washington superiors. As Washington employees evaluated the applications, they wondered

whether the groups’ activities were “good” non-profit activities or merely “emotional”

propaganda with “little educational value.”

6

With heavy skepticism, the IRS subjected these

groups to years of needless delays and burdensome questioning, causing real harm to many of

the applicants. Of the applications that received additional scrutiny, only seven contained the

word “progress” or “progressive,”

7

all of which were subsequently approved by the IRS,

8

while

Tea Party groups received unprecedented review and experienced years-long delays. Unlike the

applications from conservative groups, the small batch of applications from liberal-oriented

groups received additional scrutiny for non-political reasons.

Flagrant and pervasive management failures by Washington officials contributed

substantially to the misconduct. When asked to answer questions about allegations of IRS

targeting, these senior officials – including former Commissioner Doug Shulman and Exempt

Organizations Director Lois Lerner – covered up the wrongdoing by providing incomplete and

misleading information to Congress. Shulman specifically gave Congress “assurances” that the

IRS was not targeting Tea Party groups, when he knew at that time that those groups had been

identified using inappropriate criteria, that they had been subjected to excessive delays, and that

they had been harassed with unnecessary and burdensome questioning. Lerner, likewise, made

several false statements to the Committee, and specifically defended to the Committee the IRS’s

use of certain questions that the IRS had already identified internally as inappropriate.

The IRS’s misconduct had real consequences, and its leadership’s knowing failure to be

fully candid with Congress exacerbated the injuries of the groups awaiting a resolution. The

targeting silenced conservative non-profits during the 2012 election cycle. As the IRS ignored

tax-exempt applications, donors stopped giving to the groups, overall interest waned, and some

groups even stopped their operations.

9

The IRS’s delays also resulted in the automatic

revocation of some groups’ exemptions by operation of law because the groups had been waiting

for resolutions so long that they did not file for renewal within the statutorily proscribed period.

The Committee’s investigation highlights the unfortunate reality of the IRS. Because

“[t]he power to tax involves the power to destroy,”

10

American taxpayers expect the IRS to be

neutral, independent, and apolitical. The modern-day IRS, however, with its vast authority, has

violated these basic tenets. The IRS’s outsized role in implementing ObamaCare – a highly

partisan law rammed through Congress without any meaningful bipartisan compromise – has

fundamentally transformed the tax agency. Evidence shows an IRS responsive to the partisan

6

See Gregory Korte, IRS List Reveals Concerns over Tea Party ‘Propaganda,’ USA TODAY, Sept. 18, 2013.

7

“The IRS’s Systematic Delay and Scrutiny of Tea Party Applications”: Hearing before the H. Comm. on Oversight

& Gov’t Reform, 113th Cong. (2013) (statement of J. Russell George).

8

Hearing on the Internal Revenue Service’s Exempt Organizations Division Post-TIGTA Audit: Hearing before the

Subcomm. on Oversight of the H. Comm. on Ways & Means, 113th Con. (2013) (opening statement of Chairman

Boustany).

9

See Patrick O’Connor, Groups Recount Tax Battle’s Toll, WALL ST. J., May 14, 2013.

10

McCulloch v. Maryland, 17 U.S. 316, 431 (1819).

iii

policy objectives of the White House and an IRS leadership that coordinates with political

appointees of the Obama Administration.

The Treasury Department – the IRS’s absentee parental agency – is not blameless in this

scandal. With the IRS, the Treasury Department secretly considered potential regulations on the

political speech of 501(c)(4) non-profits. As the IRS considered how to leak information about

the targeting before the TIGTA audit report’s release, it informed and coordinated with the

Treasury Department. Senior Departmental leadership, after consulting with the White House,

tacitly condoned the IRS’s ill-advised strategy of minimizing the fallout by apologizing for the

targeting through a planted question at an obscure tax conference. Most disconcerting, according

to the IRS’s independent inspector general, the Treasury Department’s senior leadership was

informed of the IRS targeting before the 2012 presidential election.

Lois Lerner’s faux apology on May 10, 2013, sparked a firestorm that led to the departure

of five IRS officials and caused fundamental damage to the agency’s credibility. Lerner’s words

triggered initial outrage. From the White House, President Obama called the targeting

“inexcusable,” promising to work “hand in hand” with Congress as “it performs it oversight

role” in examining the IRS’s misconduct.

11

But as weeks wore on and the initial outrage faded, a

deliberate effort emerged to minimize and obfuscate the misconduct. The Administration

claimed the misconduct was the responsibility of rogue line-level agents in the IRS Cincinnati

office.

12

A senior congressional Democrat proclaimed the “case is solved” just as the

investigation began.

13

Treasury Secretary Lew implied that the misconduct amounted to a

“phony” scandal.

14

The President, who had earlier called the conduct “inexcusable,” now wrote

it off to a bureaucratic “list” in “an office in Cincinnati.”

15

The Obama Administration refuses to accept any responsibility or accountability in wake

of the IRS’s targeting of conservative tax-exempt applicants. Attorney General Eric Holder

appointed a substantial contributor to President Obama as a leading Justice Department

investigator. The other Justice Department entities involved in the IRS investigation – the Public

Integrity Section and the Federal Bureau of Investigation – are similarly conflicted, meeting with

Lois Lerner and the IRS in 2010 to discuss the possible prosecution of non-profit groups. Before

all the facts were gathered, politicized leaks from the Justice Department promised that no

criminal charges would be filed. A week later, President Obama told a national television

audience that there was “not even a smidgeon of corruption” in the IRS targeting.

16

Meanwhile,

11

The White House, Statement by the President (May 15, 2013).

12

The White House, Press Briefing by Jay Carney (May 21, 2013) (noting that “IRS line personnel had improperly

targeted conservative groups”); Chelsea J. Carter, Drew Griffin, & David Fitzpatrick, ‘Angry’ Obama Announces

IRS Leader’s Ouster after Conservatives Targeted, CNN (May 16, 2013),

http://www.cnn.com/2013/05/15/politics/irs-conservative-targeting/ (noting that “the IRS has identified two ‘rogue’

employees in the agency’s Cincinnati office as being principally responsible”).

13

State of the Union with Candy Crowley (CNN television broadcast June 9, 2013) (interview with Rep. Elijah E.

Cummings).

14

Fox News Sunday (Fox News television broadcast July 28, 2013) (interview with Treasury Secretary Jacob Lew).

15

Hardball with Chris Matthews (MSNBC television broadcast Dec. 5, 2013) (interview with President Barack

Obama).

16

“Not even a smidgeon of corruption”: Obama downplays IRS, other scandals, FOX NEWS, Feb. 3, 2014.

iv

the Obama White House, which earlier pledged its unfettered assistance, outright refused to

cooperate with the Committee’s fact-finding.

Not to be outdone, the IRS and congressional Democrats sought to obstruct the

investigation and confuse the facts. Ranking Member Elijah Cummings publicly declared the

“case is solved” only weeks after the investigation began. Working with the IRS, congressional

Democrats peddle a false narrative of bipartisan targeting using self-serving documents produced

by the IRS on a prioritized schedule. The IRS slow-rolled document productions to the

Committee, delayed the Committee’s access to key witnesses, and withheld documents prior to

Committee interviews. The IRS has still not fully complied with three Committee subpoenas for

documents.

The Committee on Oversight and Government Reform has conducted a comprehensive

investigation to date of the IRS’s inappropriate treatment of conservative applicants for tax-

exempt status. The Committee released a series of reports to update the public on the findings to

date and to recommend reforms. To date, the Committee has released five reports:

“Interim update on IRS Investigation of tax exempt applicants” (September 17, 2013);

“Lois Lerner’s Involvement in the IRS Targeting of Tax-Exempt Organizations (March

11, 2014)”;

“Debunking the Myth that the IRS Targeted Progressives (April 7, 2014)”;

“Pressure from the Left Led the IRS and DOJ to Restrict Freedom of Speech (June 16,

2014)”; and,

“Making Sure Targeting Never Happens: Getting Politics Out of the IRS and Other

Solutions” (July 12, 2014).

This staff report updates the five that precede it and details the Committee’s investigative

findings as of the end of the 113th Congress. The fact-finding is not yet complete. Several

categories of documents and records subpoenaed by the Committee have not been produced.

Additionally, TIGTA recently announced that it restored approximately 30,000 e-mails to and

from Lois Lerner that the IRS previously claimed were permanently lost or destroyed. While

investigators continue to gather information from all sources, the Committee releases the

findings contained herein to improve the transparency and accountability of the nation’s tax

administration.

v

Findings

The Committee’s investigation has resulted in the following findings to date about the

Internal Revenue Service’s inappropriate treatment of tax-exempt applicants:

The Internal Revenue Service targeted conservative-oriented applicants for tax-

exempt status;

Unlike applications from conservative groups, the small batch of applications from

liberal-oriented groups received additional scrutiny for non-political reasons. Of the

applications that received additional scrutiny, only seven contained the word

“progress” or “progressive,” all of which were subsequently approved by the IRS,

while Tea Party groups were subjected to an unprecedented degree of review and

years-long delays.

Senior Internal Revenue Service officials covered up the misconduct and misled

Congress about the existence and nature of the targeting;

The Internal Revenue Service sought to rein in conservative-oriented non-profits as

early as 2010;

The Administration is using the targeting as pretext to support its proposed regulation

to limit political speech of conservative non-profits;

Mismanagement among the senior leadership of the Internal Revenue Service

contributed to the targeting;

The Internal Revenue Service and the Obama Administration knowingly and wrongly

blamed line-level employees for the misconduct;

Employees of the Internal Revenue Service inappropriately used non-official e-mail

to conduct official government business;

The Internal Revenue Service has compromised its traditional position as an

independent tax administrator;

The Obama Administration exhibited a lack of accountability for the IRS misconduct;

Lois Lerner’s refusal to testify hindered the Committee’s investigation;

The Internal Revenue Service obstructed the Committee’s investigation; and

The White House and congressional Democrats obstructed the Committee’s

investigation.

vi

TableofContents

Executive Summary ......................................................................................................................... i

Findings........................................................................................................................................... v

Findings........................................................................................................................................... v

Table of Contents ........................................................................................................................... vi

Table of Names .............................................................................................................................. ix

Internal Revenue Service ........................................................................................................... ix

Department of the Treasury ....................................................................................................... xi

Department of Justice ............................................................................................................... xii

The White House ...................................................................................................................... xii

Table of Figures ........................................................................................................................... xiii

Introduction ..................................................................................................................................... 1

Background of the targeting............................................................................................................ 3

Section 501 organizations and political speech .......................................................................... 3

Citizens United v. Federal Election Commission ....................................................................... 5

Rhetorical Backlash to Citizens United ...................................................................................... 6

How the IRS targeted conservatives: A narrative of wrongdoing .................................................. 9

February 2010: The initial applications are identified and elevated to Washington due to

“media attention” ........................................................................................................................ 9

March 2010: Washington requests additional Tea Party applications to work as “test” cases

and orders Cincinnati to “hold” the rest .................................................................................... 11

April 2010: Washington creates a Sensitive Case Report to alert senior IRS leadership about

the potential for Tea Party “media attention” ........................................................................... 12

April 2010: Washington employee Carter Hull is assigned to work the test applications and

oversee Cincinnati’s work ........................................................................................................ 14

Summer 2010: Hull works the test applications as other applications sit in Cincinnati ........... 15

Fall 2010: Cincinnati’s requests for guidance go unanswered ................................................. 16

February 2011: Lerner orders a “multi-tier review” of the Tea Party test applications ........... 17

April 2011: Lerner’s advisor Judith Kindell reviews the test applications ............................... 19

June-July 2011: Lerner is fully briefed on the treatment of Tea Party applications ................. 21

Summer 2011: Chief Counsel’s office reviews the test applications ....................................... 23

Summer 2011: Hull is replaced by novice IRS specialist Hilary Goehausen ........................... 24

Fall 2011: Goehausen futilely attempts to triage the growing Tea Party backlog .................... 25

Fall 2011: Washington develops a guide sheet to shape Cincinnati’s review of the backlogged

applications ............................................................................................................................... 27

January 2012: Washington’s guide sheet leads to objectionable questions to applicants ........ 28

February 2012: The Oversight Committee seeks information from Lerner ............................. 29

Spring 2012: The IRS’s internal review identifies misconduct ................................................ 30

vii

May 2013: The IRS finally acknowledges and apologizes for the targeting ............................ 35

Lessons from the targeting: What the Committee has found about the IRS’s inappropriate

treatment of conservatives ............................................................................................................ 37

The IRS targeted conservative groups ...................................................................................... 38

The IRS was acutely aware of political rhetoric pressing the IRS to regulate conservative

tax-exempt groups engaged in political activity ................................................................... 39

The IRS treated conservative-affiliated applicants distinctly from other similarly situated

applicants .............................................................................................................................. 47

Senior IRS officials covered up and misled Congress about the existence and nature of the

IRS’s targeting .......................................................................................................................... 54

Lerner made false statements to the Committee ................................................................... 54

Shulman gave false statements to Congress ......................................................................... 57

Miller withheld information from Congress about the targeting .......................................... 62

The IRS’s false claim that key evidence was lost or destroyed prolonged the investigation ... 66

The IRS claimed that years of e-mails sent and received by Lois Lerner and other IRS

employees were destroyed .................................................................................................... 67

IRS Commissioner John Koskinen misled Congress about the IRS’s destruction of Lois

Lerner’s e-mails .................................................................................................................... 70

IRS employees openly sought to avoid congressional scrutiny by shielding e-mail

communications .................................................................................................................... 76

The IRS targeting and cover-up directly harmed conservative groups applying for tax-exempt

status ......................................................................................................................................... 78

IRS actions suppressed conservative voices during the 2012 election ................................. 79

IRS delays in processing applications led to the auto-revocation of exempt status ............. 80

There is conflicting evidence on whether the Treasury Department was aware of the IRS

targeting in 2012 ....................................................................................................................... 81

The IRS sought other methods to rein in politically active non-profits as early as 2010 ......... 87

The IRS sought to curb politically active non-profits ........................................................... 88

The IRS sought to deny tax-exempt applicants engaged in political speech ........................ 94

The IRS sought to publicize that it was taking action on tax-exempt groups engaged in

political speech ...................................................................................................................... 96

The IRS sought to regulate politically active social-welfare groups .................................. 102

The IRS’s plans mirrored Administration-wide attempts to stifle free political speech ..... 104

The IRS targeting is a pretext for the Administration’s proposed regulation on political speech

of social welfare organizations ............................................................................................... 106

Mismanagement by senior IRS leadership failed to effectively prevent and later to stop the

targeting of conservative-oriented groups .............................................................................. 111

Doug Shulman, former Commissioner ............................................................................... 112

Jonathan Davis, Chief of Staff to Commissioner Shulman ................................................ 116

Steven Miller, Acting Commissioner ................................................................................. 119

viii

Nikole Flax, Chief of Staff to Steven Miller ....................................................................... 124

William Wilkins, Chief Counsel ......................................................................................... 126

Joseph Grant, Acting Commissioner, Tax Exempt and Government Entities .................... 128

Lois Lerner, Director, Exempt Organizations ..................................................................... 131

Holly Paz, Director, Rulings and Agreements .................................................................... 140

The IRS and the Obama Administration knowingly and wrongly blamed line-level IRS

employees for the misconduct ................................................................................................ 143

Washington was involved from the beginning ................................................................... 144

Washington was heavy handed in its approach to the cases ............................................... 146

The IRS and the Obama Administration coordinated on Lerner’s apology ....................... 147

Cincinnati IRS employees felt that Washington threw them “under the bus” .................... 153

The Obama Administration’s IRS is not an independent tax administrator ........................... 157

ObamaCare has politicized the IRS .................................................................................... 157

The IRS acts as a political arm of the Obama Administration, rather than an independent tax

administrator ....................................................................................................................... 159

There are indications of political bias in the IRS ................................................................ 161

The Administration’s investigation of the targeting ............................................................... 165

The Department of Justice’s role in the targeting ............................................................... 172

Administrative oversight of the IRS failed to prevent the targeting or disclose the misconduct

in a timely manner .................................................................................................................. 180

Lois Lerner’s refusal to testify hindered the Committee’s investigation ................................ 181

Lerner’s failed assertion of her Fifth Amendment privilege .............................................. 182

Lerner continued to defy the Committee’s subpoena ......................................................... 186

Lerner’s testimony is critical to the Committee’s investigation ......................................... 189

The IRS obstructed and delayed the Committee’s investigation ............................................ 191

The IRS failed to comply with three Committee subpoenas .............................................. 192

The IRS destroyed documents relevant to the Committee’s investigation ......................... 194

The IRS slow-rolled document productions and excessively redacted documents ............ 196

The IRS withheld documents relevant to witness interviews and prolonged the Committee’s

investigative efforts ............................................................................................................. 198

The White House and Congressional Democrats obstructed the Committee’s investigation 199

The White House refused to assist the Committee’s fact-finding efforts ........................... 199

The Ranking Member sought to disrupt the investigation .................................................. 201

The case of True the Vote ................................................................................................... 203

Tax administration working for the taxpayers: Suggested reforms ........................................... 207

Conclusion .................................................................................................................................. 208

ix

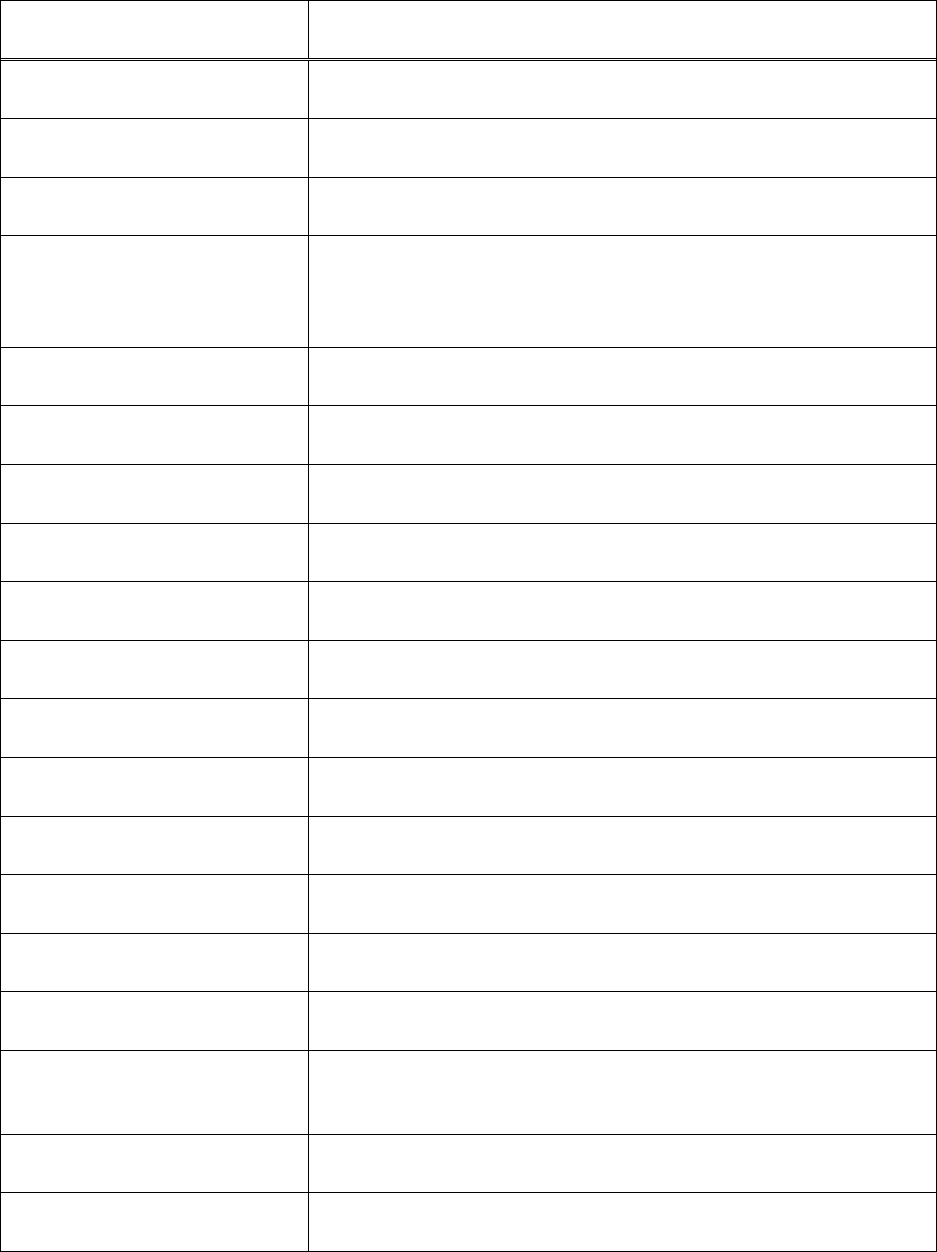

TableofNames

InternalRevenueService

Name Title

Catherine Barre Acting Director, Legislative Affairs

Ronald Bell

Exempt Organizations Specialist, Exempt Organizations

Determinations Unit

Steven Bowling Senior Manager, Exempt Organizations Determinations Unit

Robert Choi

Director, Employee Plans (January 2011 – present)

Director, Exempt Organizations, Rulings and Agreements

(April 2007 – December 2010)

Janine Cook

Deputy Division Counsel/Deputy Associate Chief Counsel,

Office of Chief Counsel, Tax Exempt and Government

Entities

Eric Corwin Deputy Chief Counsel, Technical, Office of Chief Counsel

Jonathan Davis Chief of Staff to Douglas Shulman

Nanette Downing Director, Exempt Organizations, Examinations

Catherine Duval

Counselor to the Commissioner (November 2013 – August

2014)

Donna Elliot-Moore Tax Law Specialist, Exempt Organizations Technical Unit

David Fish Manager, Exempt Organizations Guidance Unit

Nikole Flax Chief of Staff to Steven Miller

Amy Franklin-Giuliano

Attorney-Advisor, Office of Chief Counsel, Tax Exempt and

Government Entities, Exempt Organizations Branch

Hilary Goehausen Tax Law Specialist, Exempt Organizations Technical Unit

Joseph Grant

Commissioner, Tax Exempt and Government Entities Division

(May 2013 – June 2013)

Acting Commissioner, Tax Exempt and Government Entities

Division (December 2010 – May 2013)

Steven Grodnitzky Group Manager, Exempt Organizations Technical Unit

x

Name Title

Joseph Herr Revenue Agent, Exempt Organizations Determinations Unit

Elizabeth Hofacre Revenue Agent, Exempt Organizations Determinations Unit

Carter Hull

Senior Tax Law Specialist, Exempt Organizations Technical

Unit

Sarah Hall Ingram

Director, Affordable Care Act Office (December 2010 – April

2014)

Commissioner, Tax Exempt and Government Entities Division

(April 2009 – December 2010)

Victoria Judson

Division Counsel/Associate Chief Counsel, Office of Chief

Counsel, Tax Exempt and Government Entities

Thomas Kane

Deputy Associate Chief Counsel, Procedure and

Administration, Office of Chief Counsel

Elizabeth Kastenberg Tax Law Specialist, Exempt Organizations Technical Unit

Frank Keith Chief, Communications and Liaison

Judith Kindell

Senior Technical Advisor to the Director, Exempt

Organizations

John Koester Revenue Agent, Exempt Organizations Determinations Unit

John Koskinen Commissioner (December 2013 – present)

Lois Lerner Director, Exempt Organizations

Sharon Light

Senior Technical Advisor to the Director, Exempt

Organizations

Justin Lowe

Technical Advisor to the Commissioner, Tax Exempt and

Government Entities Division

Nancy Marks

Senior Technical Advisor to the Commissioner, Tax Exempt

and Government Entities Division

David Marshall

Attorney, Office of Chief Counsel, Tax Exempt and

Government Entities, Exempt Organizations Branch

Steven Miller

Acting Commissioner (November 2012 – May 2013)

Deputy Commissioner for Services and Enforcement (2009 –

November 2012)

Gary Muthert Revenue Agent, Exempt Organizations Determinations Unit

Jennifer O’Connor Counselor to the Commissioner (May 2013 – November 2013)

xi

Name Title

Leonard Oursler Director, Legislative Affairs

Holly Paz

Director, Exempt Organizations, Rulings and Agreements

(January 2011 – June 2013);

Acting Manager, Exempt Organizations Technical Unit

(September 2009 –March 2010, September 2010 – December

2010)

Stephen Seok Group Manager, Exempt Organizations Determinations Unit

Michael Seto Manager, Exempt Organizations Technical Unit

John Shafer Group Manager, Exempt Organizations Determinations Unit

Ronald Shoemaker

Supervisory Tax Law Specialist, Exempt Organizations

Technical Unit

Douglas Shulman Commissioner (March 2008 – November 2012)

Don Spellmann

Senior Counsel, Office of Chief Counsel, Tax Exempt and

Government Entities, Exempt Organizations Branch

Christopher Sterner Deputy Chief Counsel, Operations, Office of Chief Counsel

Cindy Thomas Manager, Exempt Organizations Determinations Unit

Joseph Urban

Technical Advisor to the Commissioner, Tax Exempt and

Government Entities Division

Daniel Werfel Principal Deputy Commissioner (May 2013 – December 2013)

William Wilkins Chief Counsel

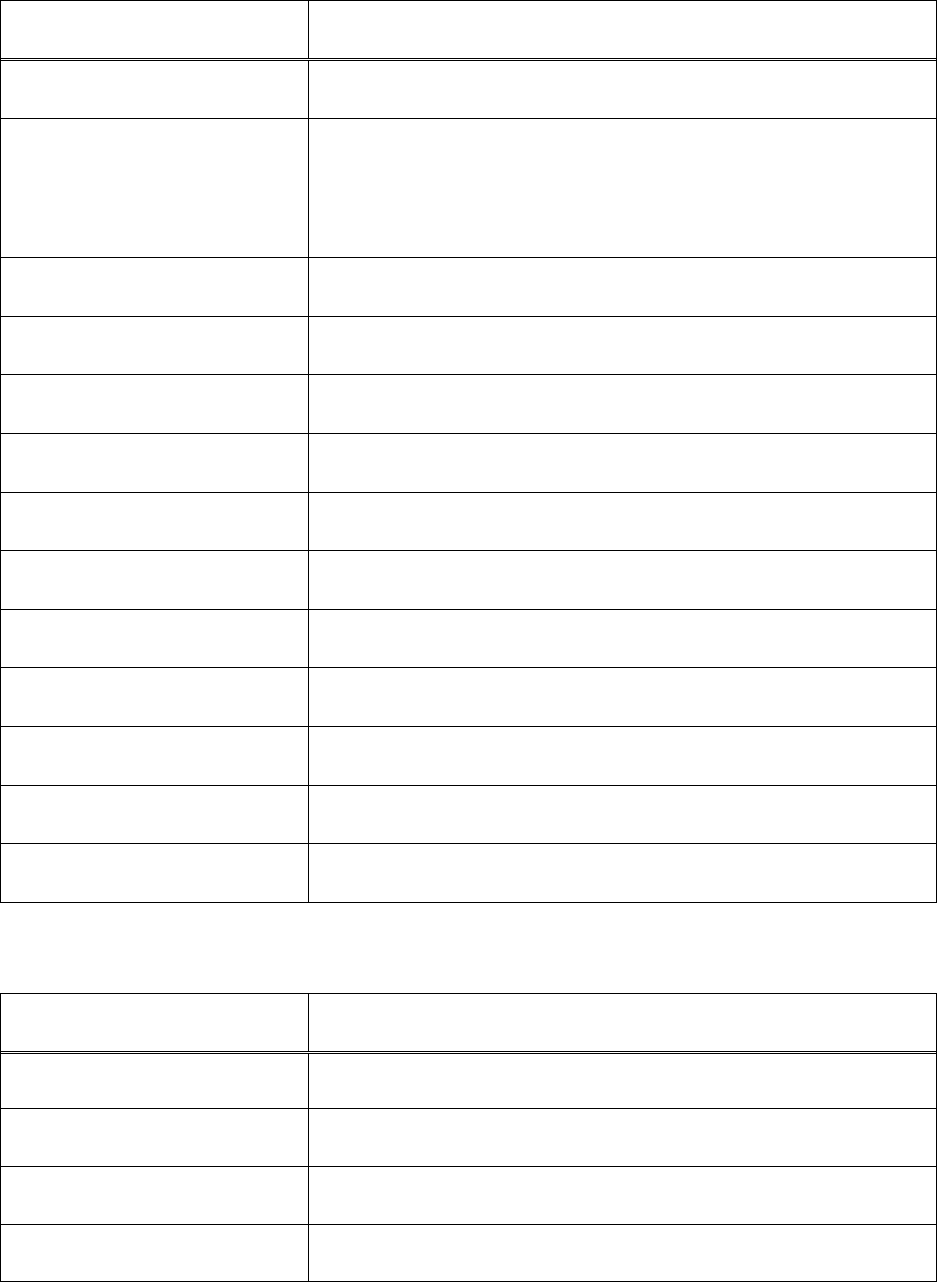

DepartmentoftheTreasury

Name Title

Adewale “Wally” Adeyemo Deputy Chief of Staff

Hannah Stott-Bumsted Senior Counsel, Office of General Counsel

J. Russell George Treasury Inspector General for Tax Administration

Ruth Madrigal Attorney-Advisor, Office of Tax Policy

xii

Name Title

Mark Mazur Assistant Secretary for Tax Policy

Christopher Meade General Counsel

Mark Patterson Chief of Staff (January 2009 – May 2013)

Christian Weideman

Chief of Staff (May 2013 – present)

Deputy General Counsel (March 2010 – May 2013)

DepartmentofJustice

Name Title

Barbara Bosserman Attorney, Civil Rights Division

James Cole Deputy Attorney General

James Comey Director, Federal Bureau of Investigation

Eric Holder Attorney General

Richard Pilger

Director, Election Crimes Branch, Public Integrity Section,

Criminal Division

Jack Smith Chief, Public Integrity Section, Criminal Division

Andrew Strelka Attorney, Tax Division

TheWhiteHouse

Name Title

Mark Childress Deputy Chief of Staff

Eric Schultz Deputy Press Secretary

Ed Siskel Deputy White House Counsel

Jonathan Su Special Counsel to the President

xiii

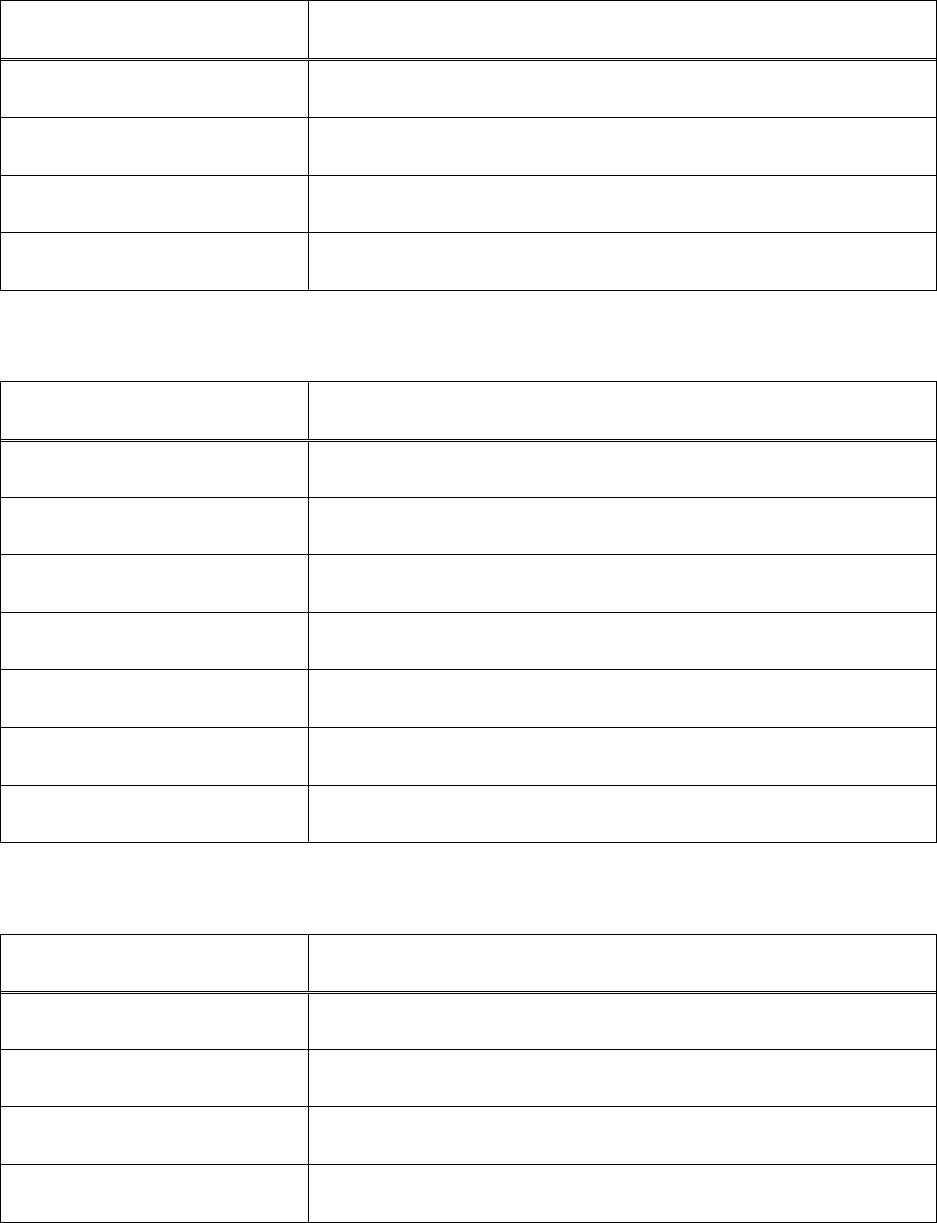

TableofFigures

Figure 1: E-mail from Sharon Camarillo to Cindy Thomas, Feb. 25, 2010 ................................. 10

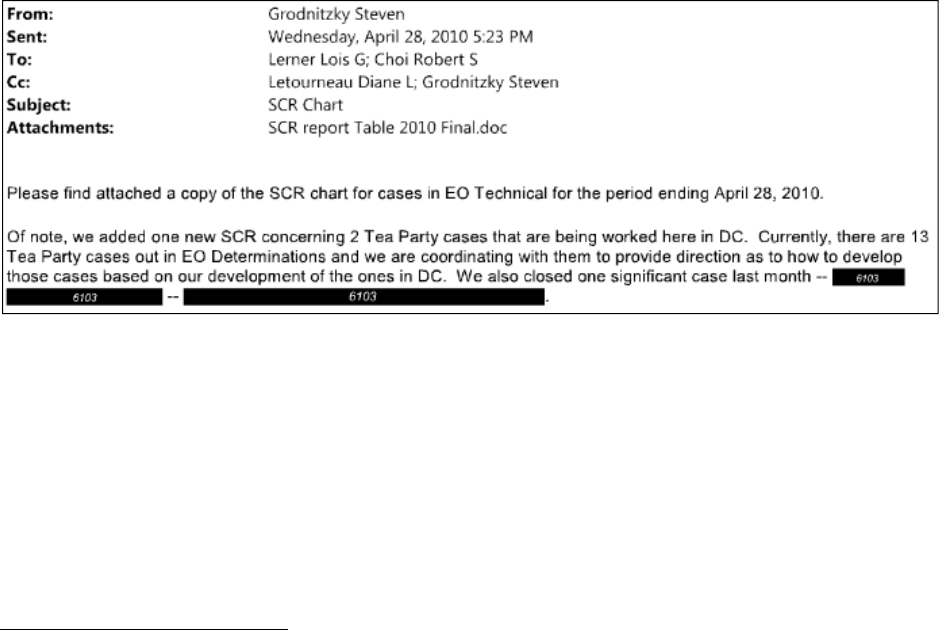

Figure 2: E-mail from Steven Grodnitzky to Lois Lerner & Robert Choi, Apr. 28, 2010 ........... 13

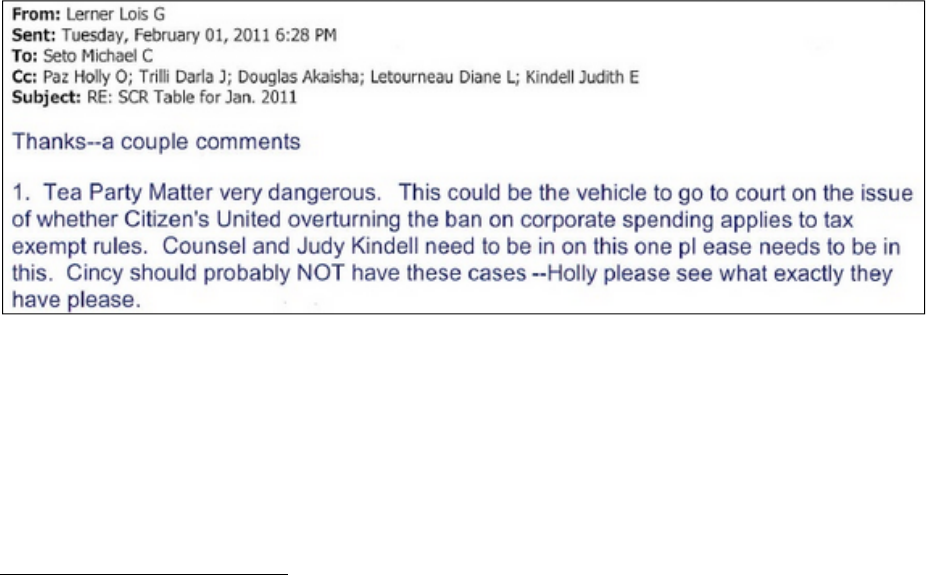

Figure 3: E-mail from Lois Lerner to Michael Seto, Feb. 1, 2011 ............................................... 18

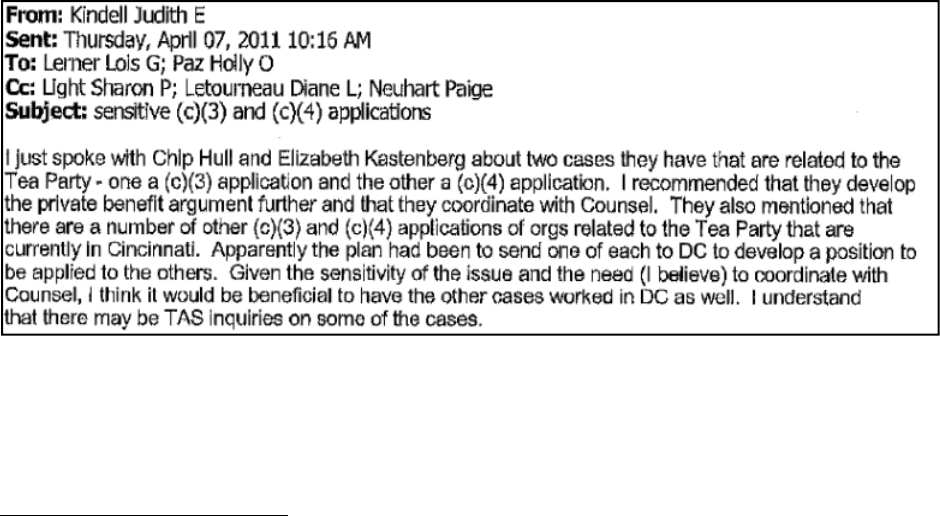

Figure 4: E-mail from Judith Kindell to Lois Lerner & Holly Paz, Apr. 7, 2011 ........................ 20

Figure 5: IRS Briefing Document Prepared for Lois Lerner ........................................................ 22

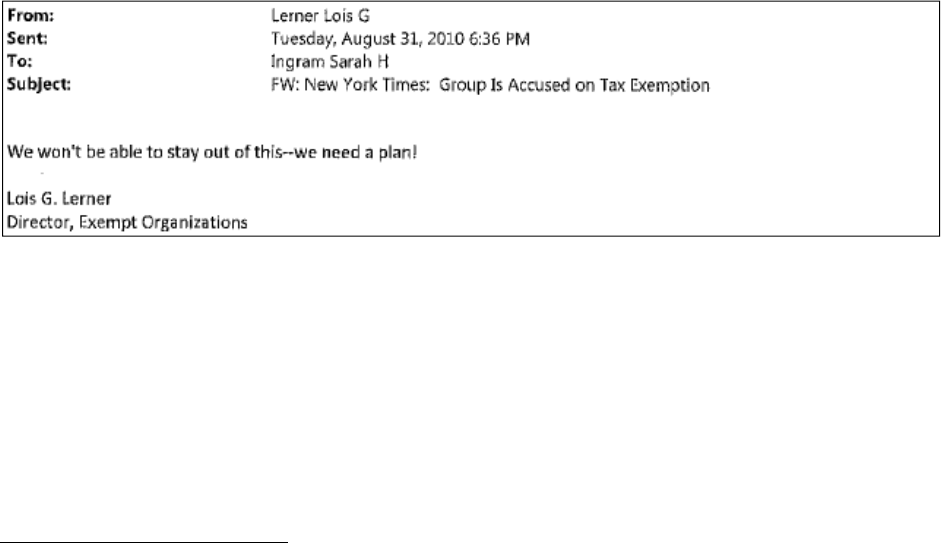

Figure 6: E-mail from Lois Lerner to Sarah Hall Ingram, Aug. 31, 2010 .................................... 40

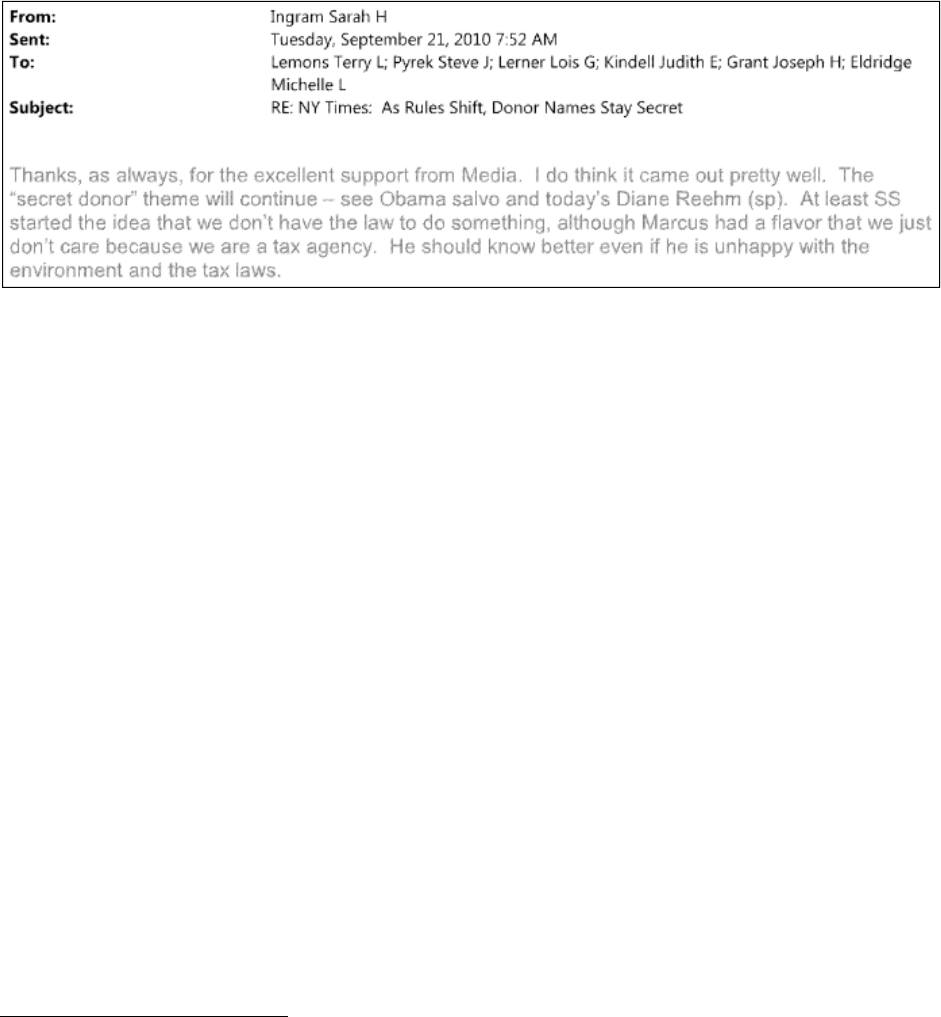

Figure 7: E-mail from Sarah Hall Ingram to Terry Lemons et al., Sept. 21, 2010 ....................... 41

Figure 8: IRS Significant Case Report Summary, August 2011 (enlarged) ................................. 49

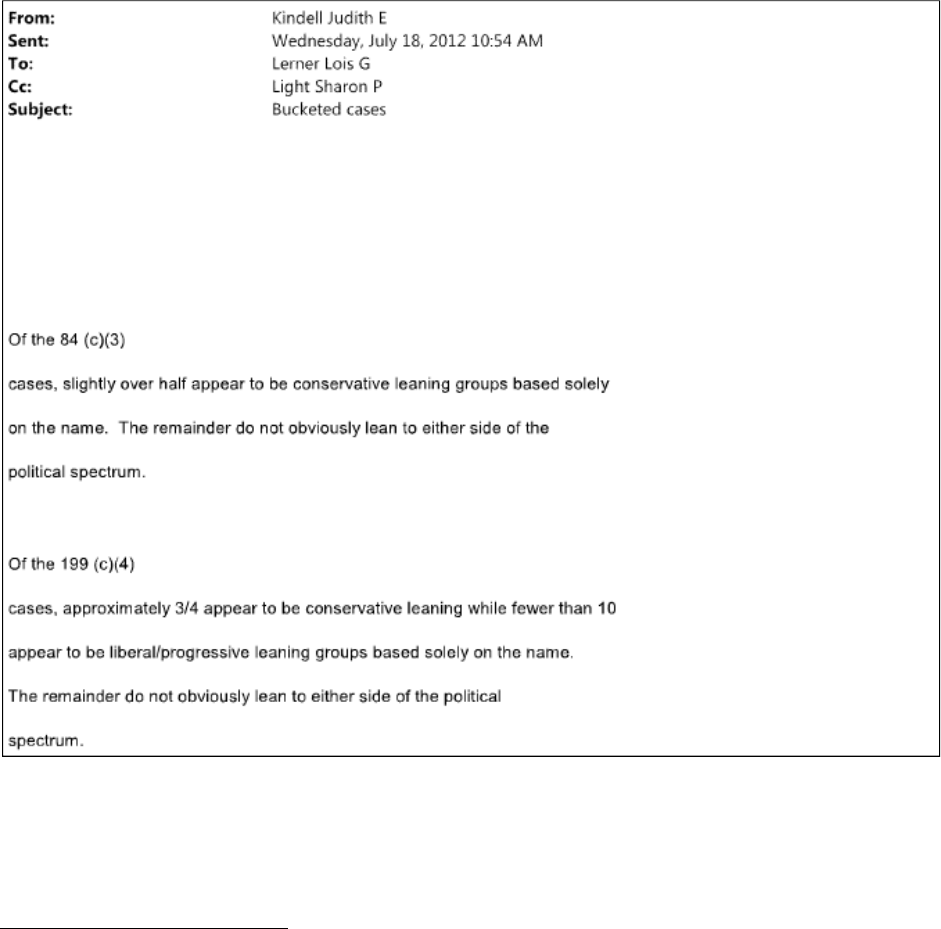

Figure 9: E-mail from Judith Kindell to Lois Lerner, July 18, 2012 ............................................ 53

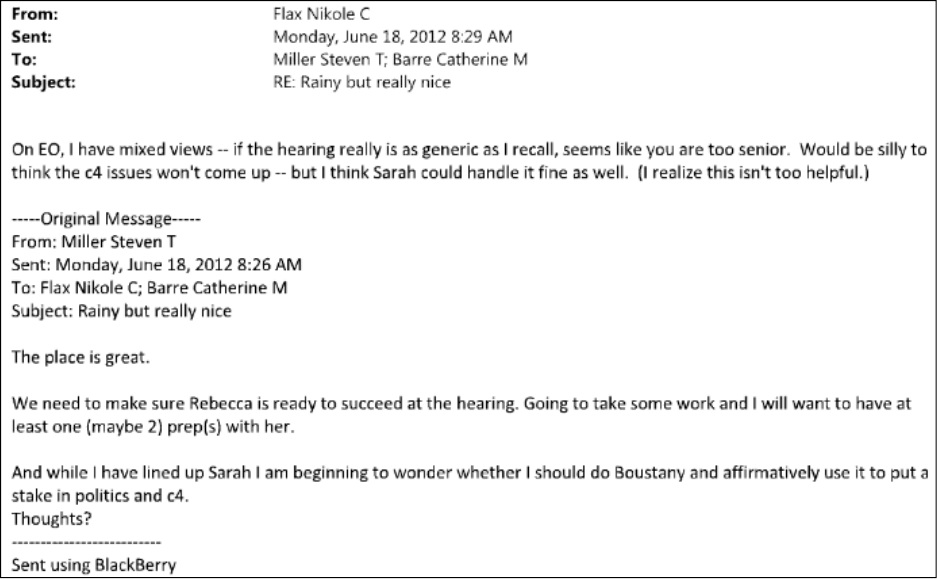

Figure 10: E-mail exchange between Steven Miller & Nikole Flax, June 18, 2012 .................... 63

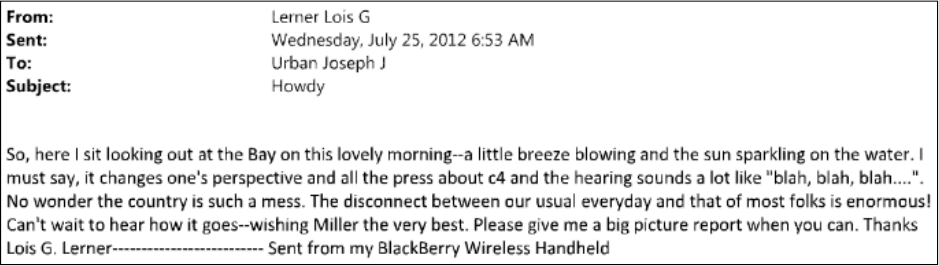

Figure 11: E-mail from Lois Lerner to Joseph Urban, July 25, 2012 ........................................... 65

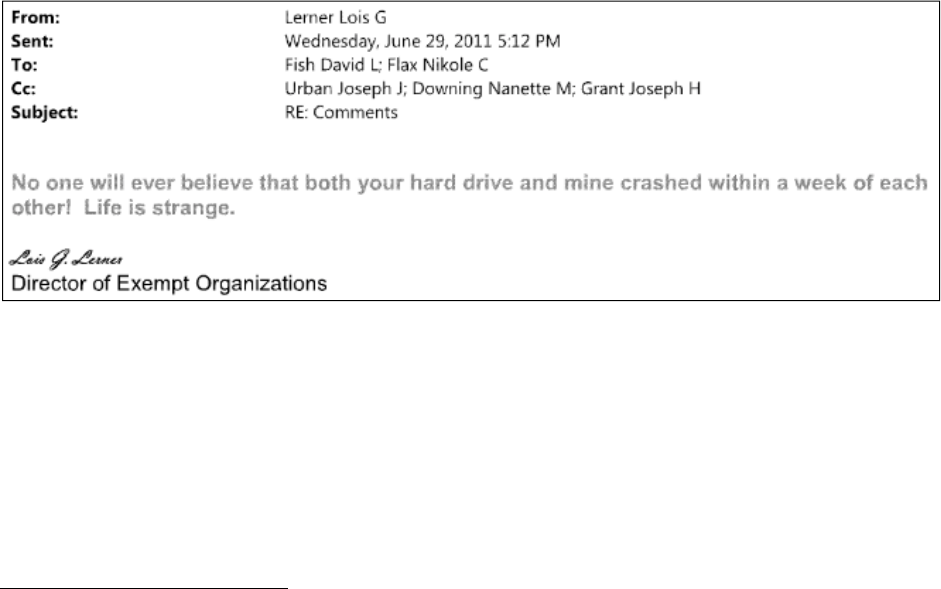

Figure 12: E-mail from Lois Lerner to David Fish & Nikole Flax, June 29, 2011 ...................... 70

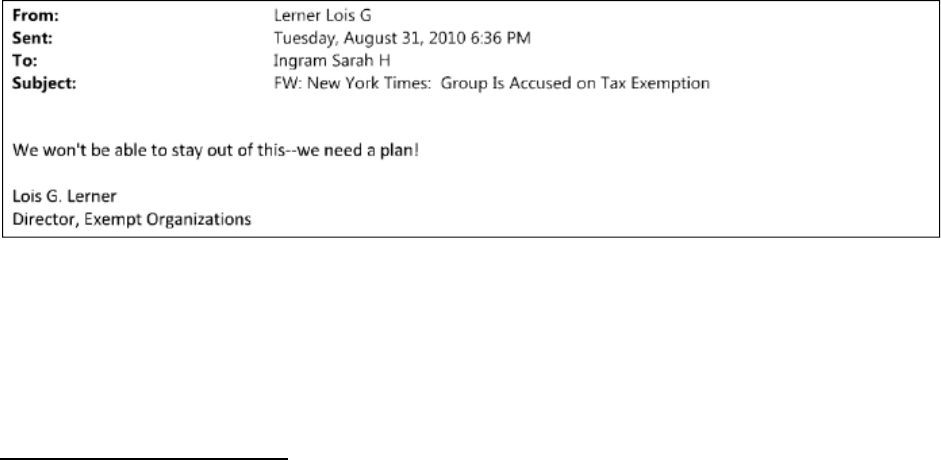

Figure 13: E-mail from Lois Lerner to Sarah Hall Ingram, Aug. 31, 2010 .................................. 88

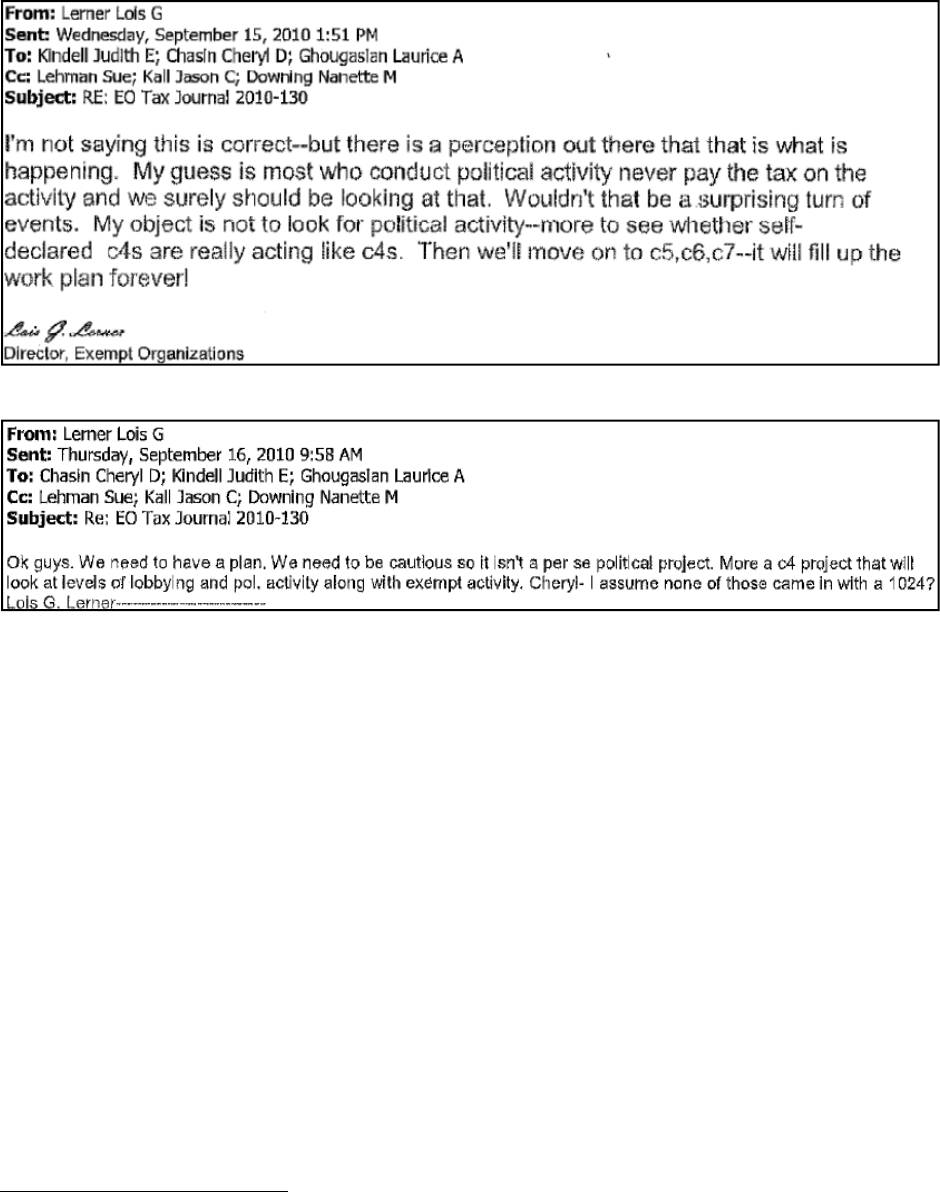

Figure 14: E-mail from Lois Lerner to Judith Kindell et al., Sept. 15, 2010 ................................ 89

Figure 15: E-mail from Lois Lerner to Cheryl Chasin et al., Sept. 16, 2010 ................................ 89

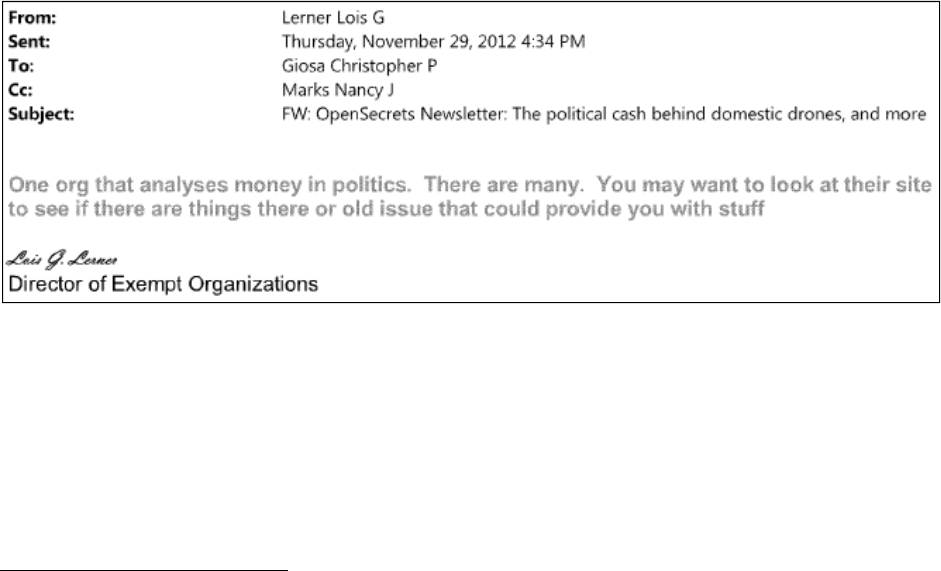

Figure 16: E-mail from Lois Lerner to Christopher Giosa, Nov. 29, 2012 .................................. 90

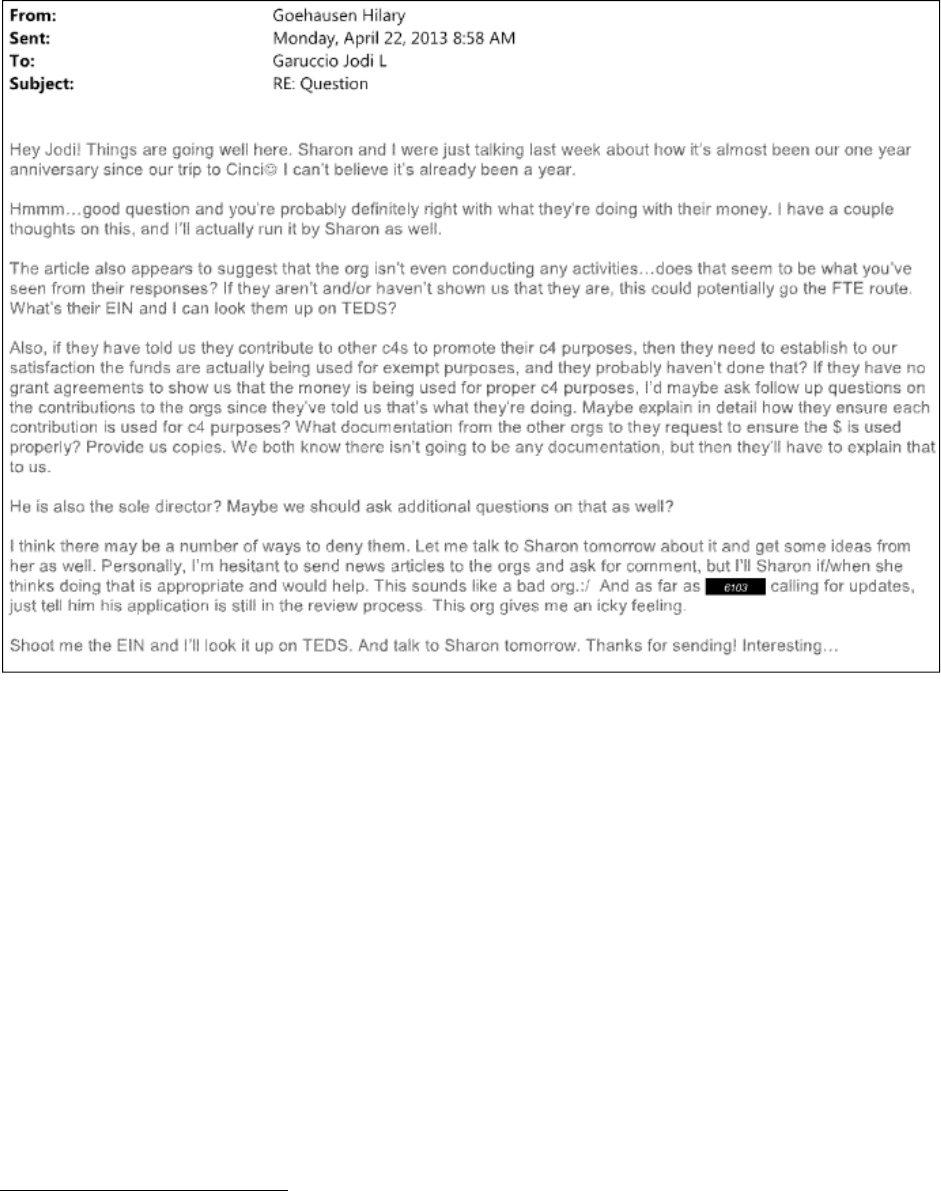

Figure 17: E-mail from Hilary Goehausen to Jodi Garuccio, Apr. 22, 2013 ................................ 96

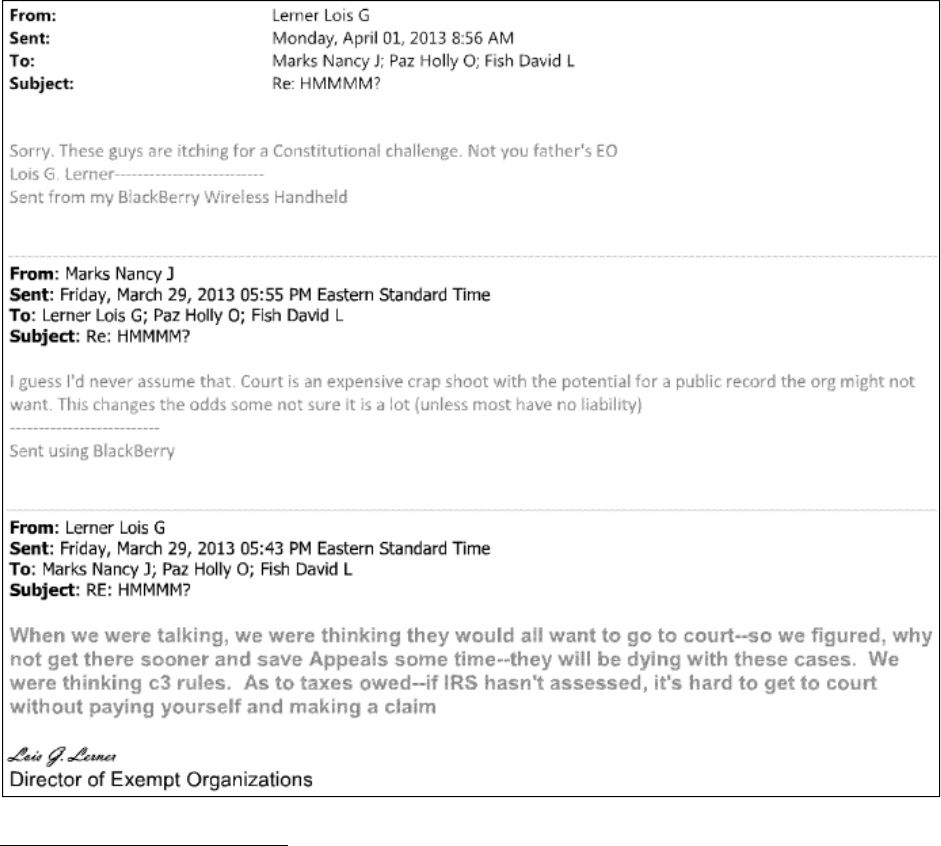

Figure 18: E-mail exchange between Lois Lerner & Nancy Marks, Apr. 1, 2013 ....................... 97

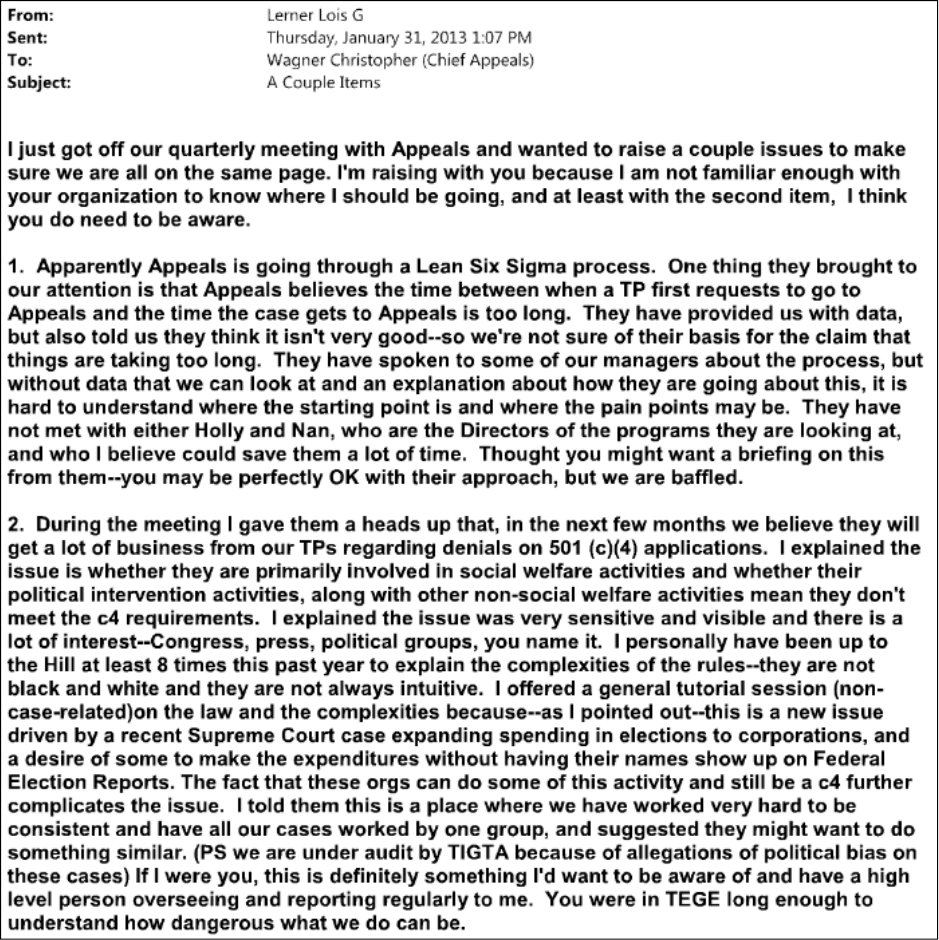

Figure 19: E-mail from Lois Lerner to Christopher Wagner, Jan. 31, 2013 ................................. 99

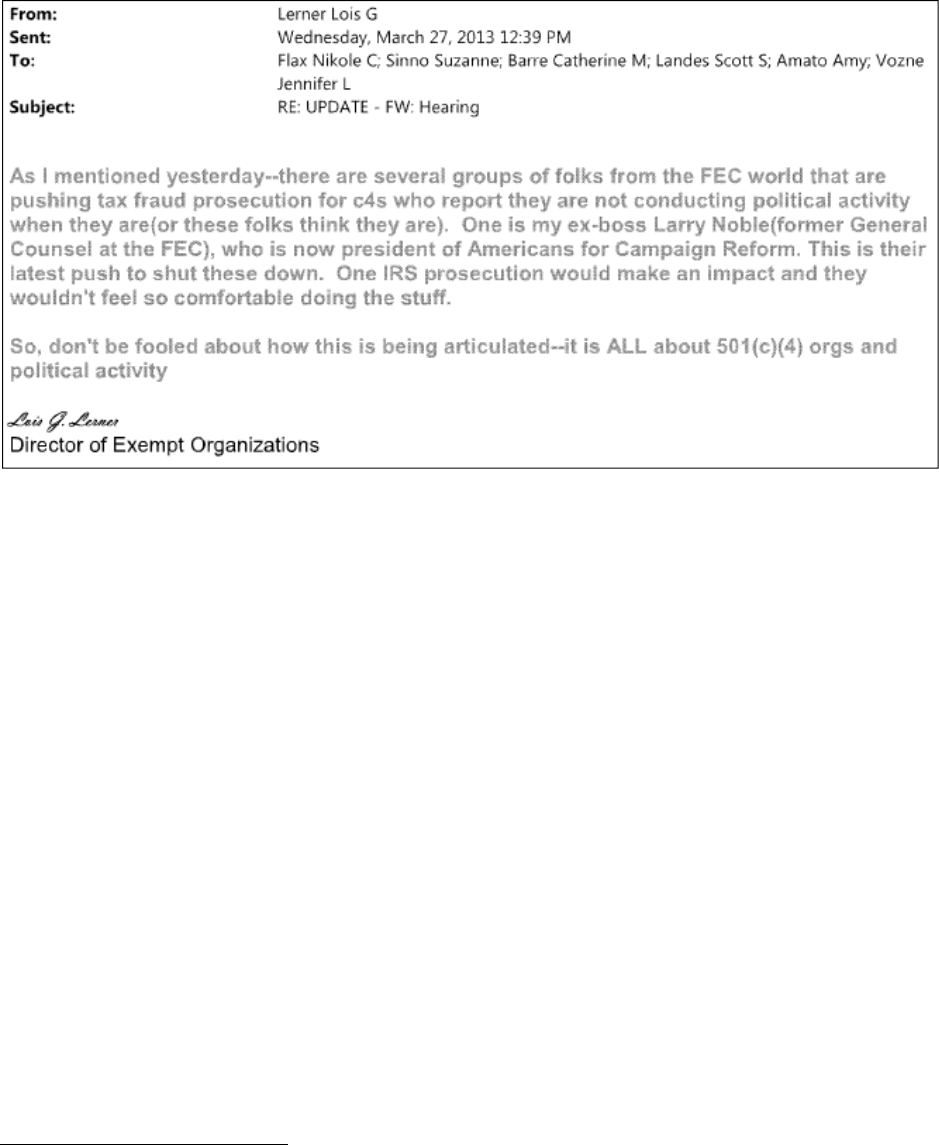

Figure 20: E-mail from Lois Lerner to Nikole Flax et al., Mar. 27, 2013 .................................. 101

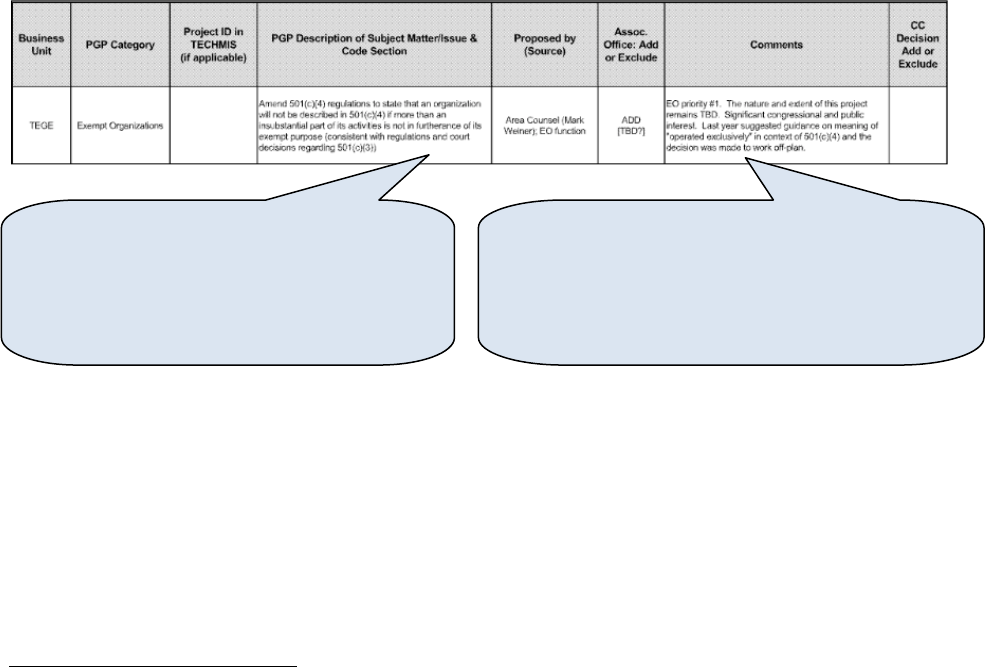

Figure 21: TEGE (EO) New Projects Proposed for FY 2013-2014 PGP ................................... 103

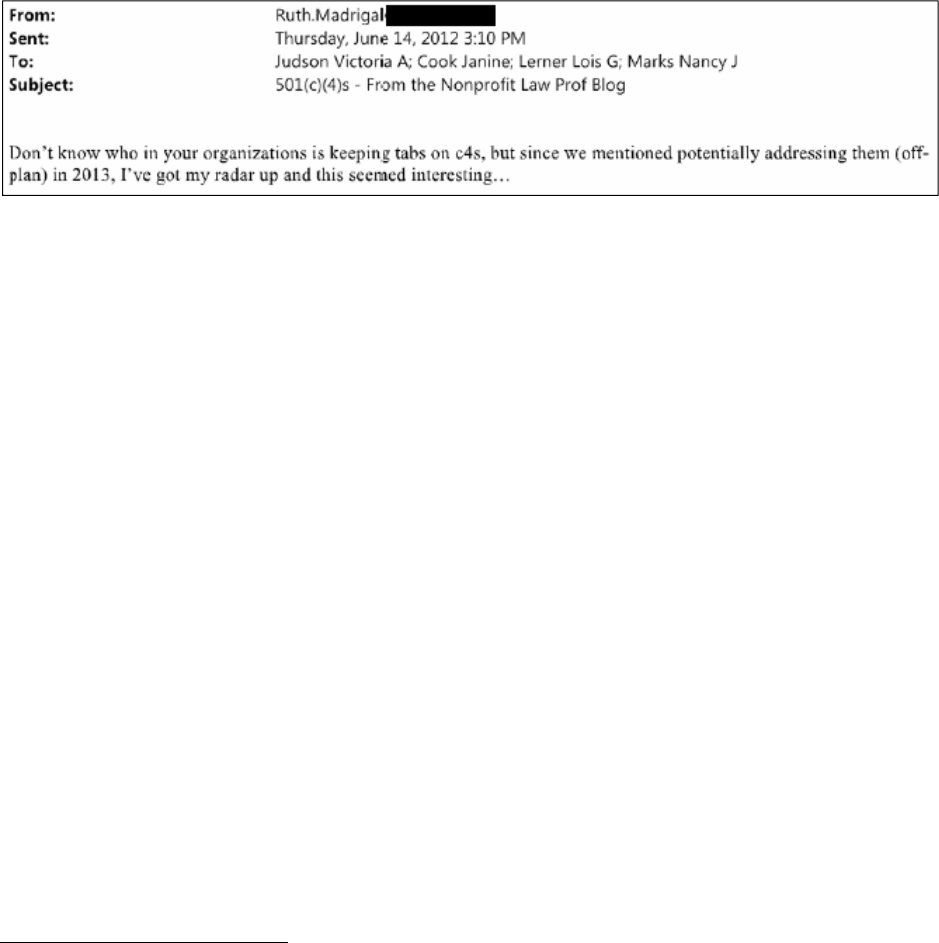

Figure 22: E-mail from Ruth Madrigal to Victoria Judson et al., June 14, 2012 ....................... 107

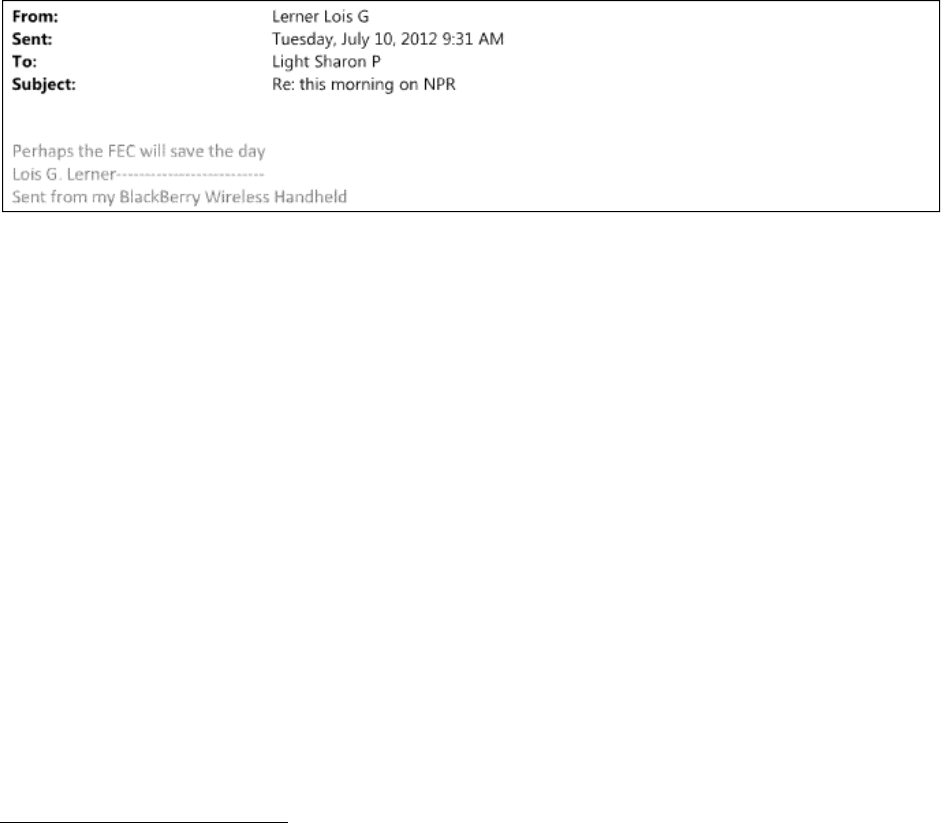

Figure 23: E-mail from Lois Lerner to Sharon Light, July 10, 2012 .......................................... 132

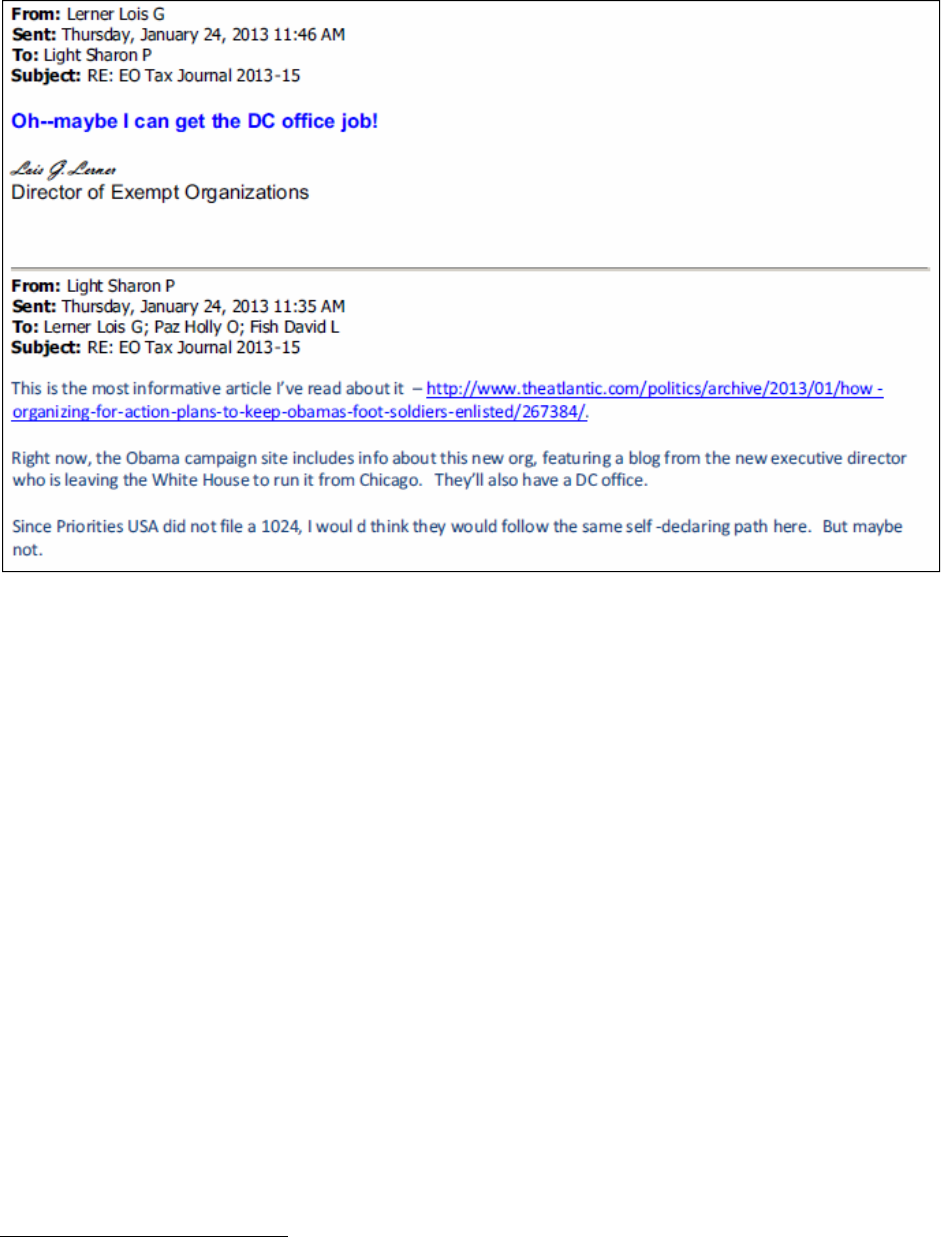

Figure 24: E-mail from Lois Lerner to Sharon Light, Jan. 24, 2013 .......................................... 133

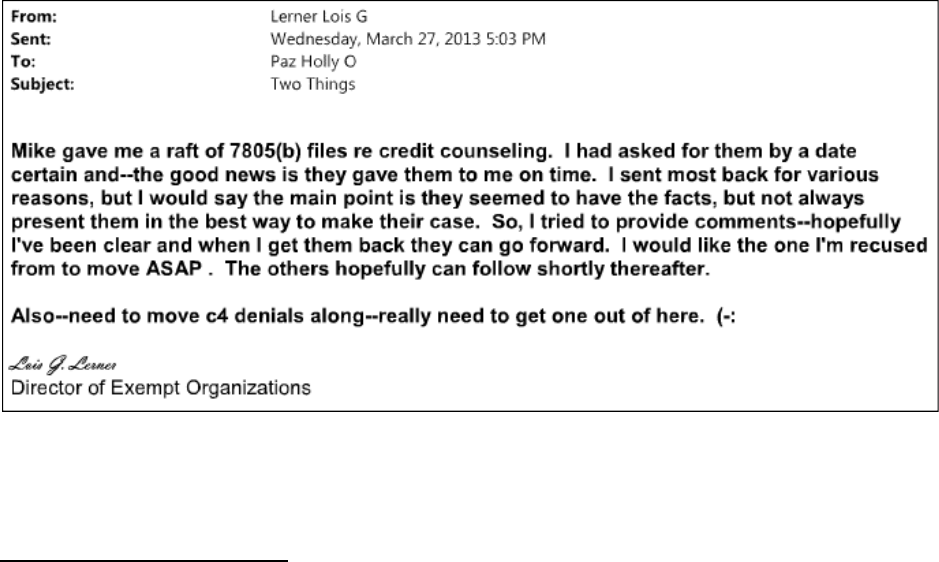

Figure 25: E-mail from Lois Lerner to Holly Paz, Mar. 27, 2013 .............................................. 134

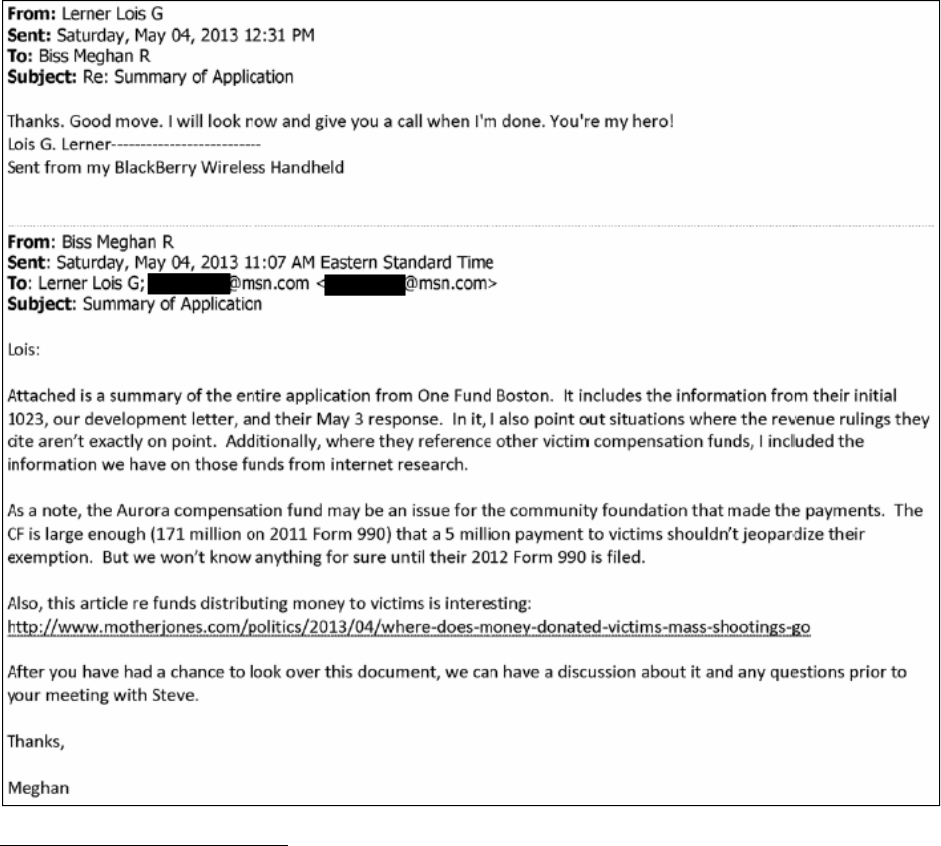

Figure 26: E-mail exchange between Lois Lerner & Meghan Biss, May 4, 2013 ..................... 135

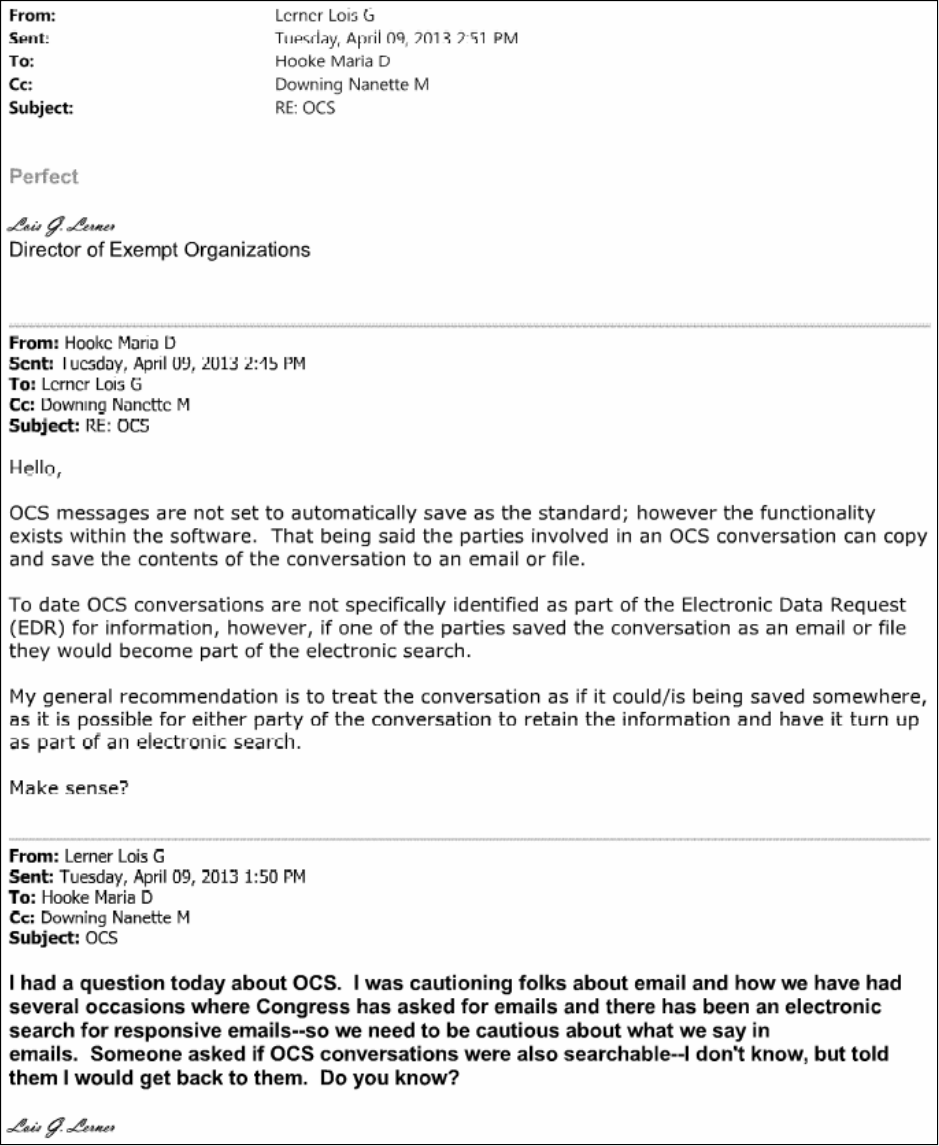

Figure 27: E-mail from Lois Lerner to Maria Hooke, Apr. 9, 2013 ........................................... 137

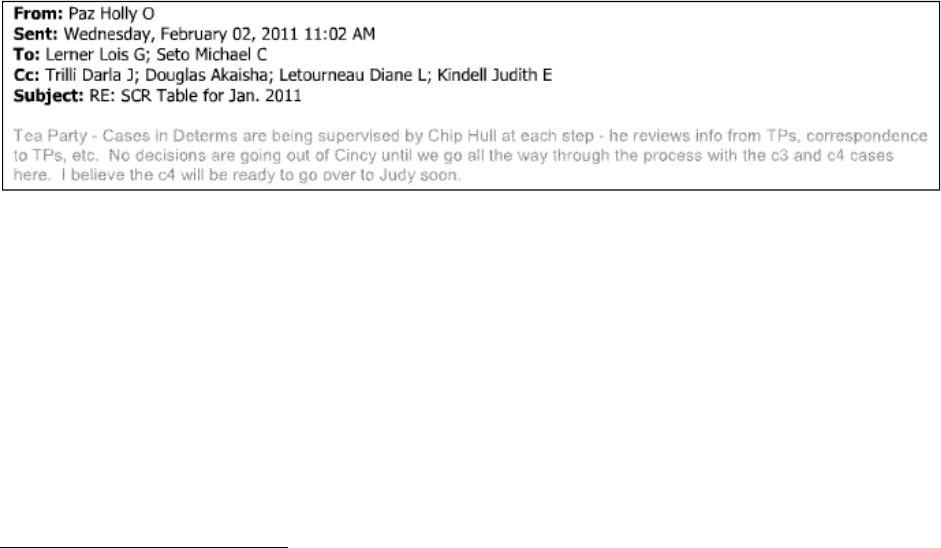

Figure 28: E-mail from Holly Paz to Lois Lerner et al., Feb. 2, 2011 ........................................ 141

Figure 29: E-mail from Nikole Flax to Adewale Adeyemo, Apr. 22, 2013 ............................... 149

Figure 30: E-mail exchange between Christian Weideman & Jonathan Su, Apr. 24, 2013 ....... 152

Figure 31: E-mail from Jonathan Su to Christian Weideman, Apr. 25, 2013 ............................. 152

Figure 32: E-mail from Cindy Thomas to Lois Lerner, May 10, 2013 ...................................... 154

Figure 33: E-mail from Pamela LaRue to Jonathan Davis & Beth Tucker, Sept. 19, 2012 ....... 160

Figure 34: E-mail from Floyd Williams to Doug Shulman et al., Mar. 8, 2012 ......................... 160

Figure 35: E-mail exchange between Don Spellmann & Janine Cook, July 19, 2011 ............... 163

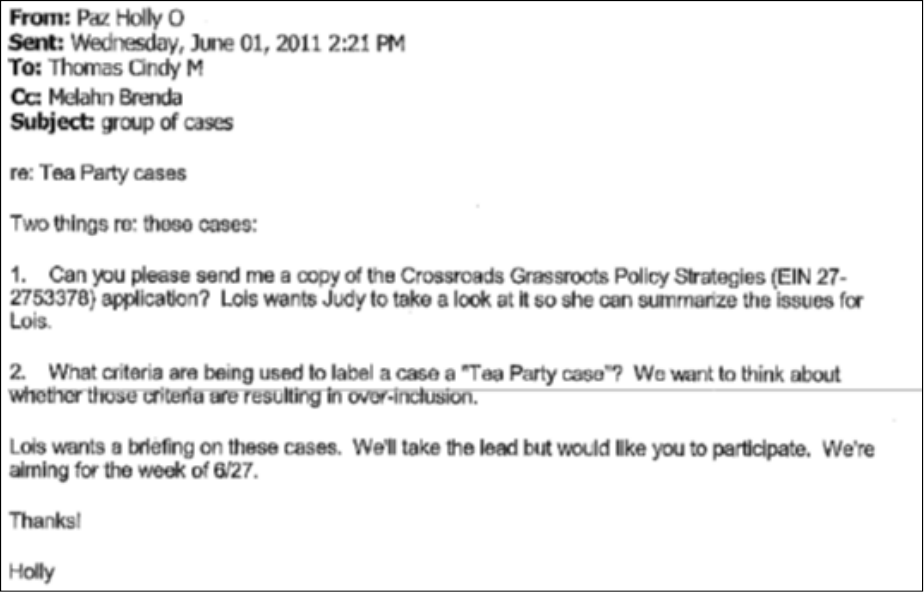

Figure 36: E-mail from Holly Paz to Cindy Thomas, June 1, 2011 ........................................... 164

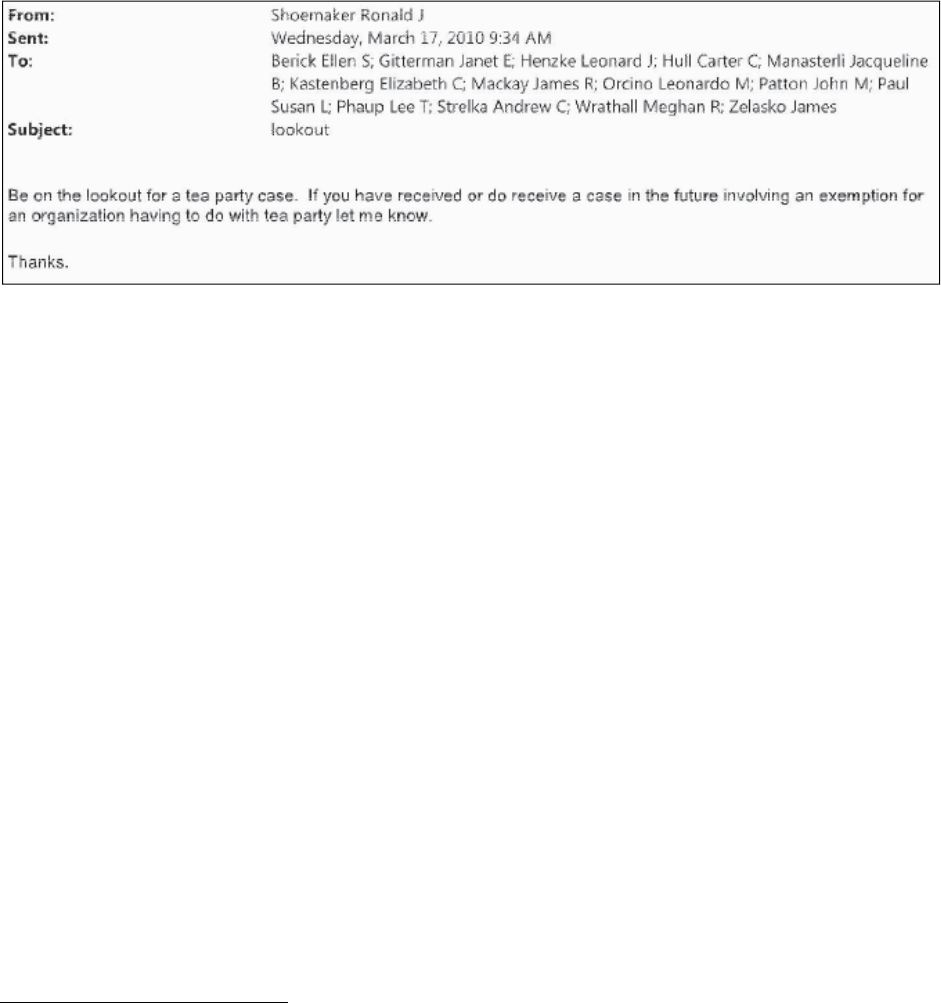

Figure 37: E-mail from Ronald Shoemaker to Andrew Strelka et al., Mar. 17, 2010 ................ 169

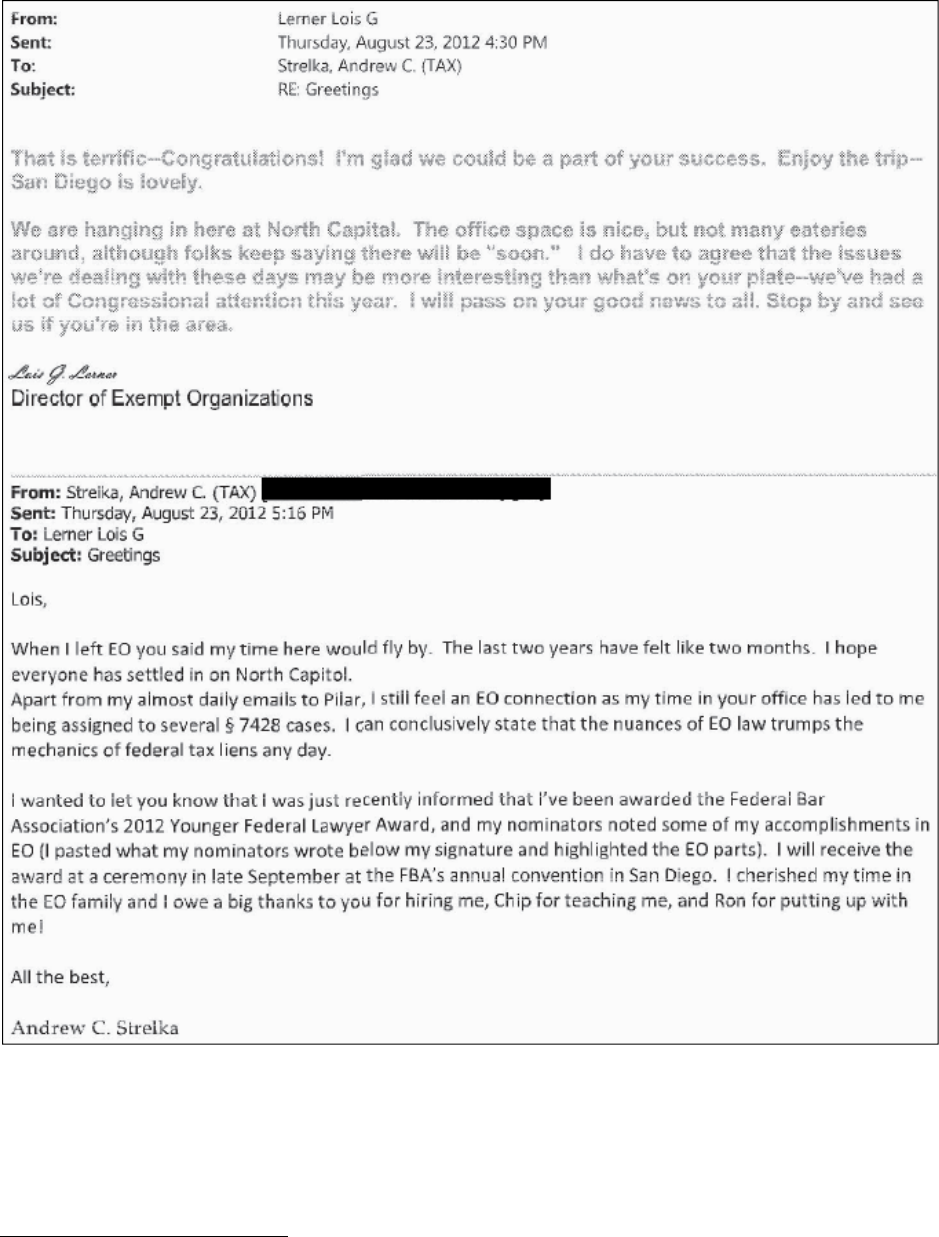

Figure 38: E-mail exchange between Lois Lerner & Andrew Strelka, Aug. 23, 2013 ............... 170

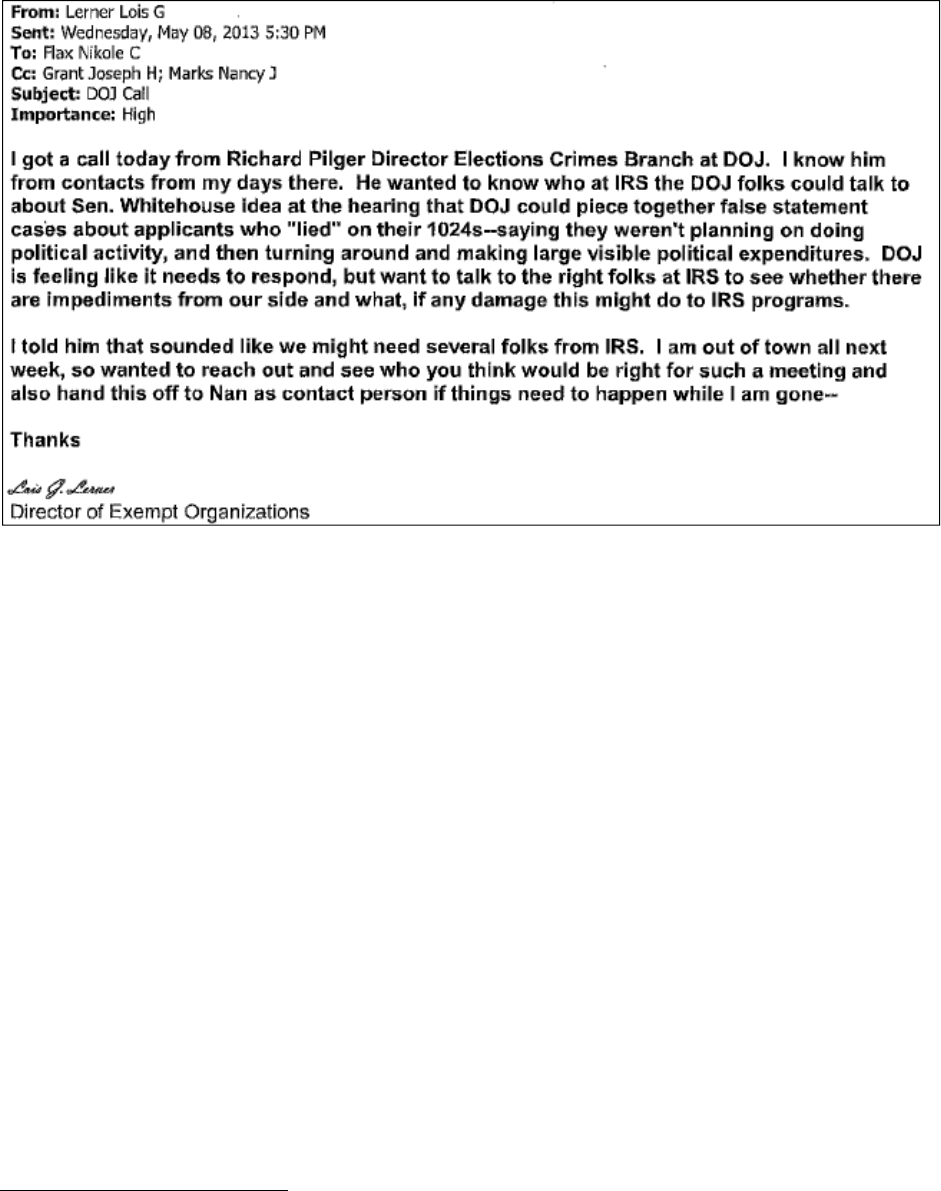

Figure 39: E-mail from Lois Lerner to Nikole Flax, May 8, 2013 ............................................. 173

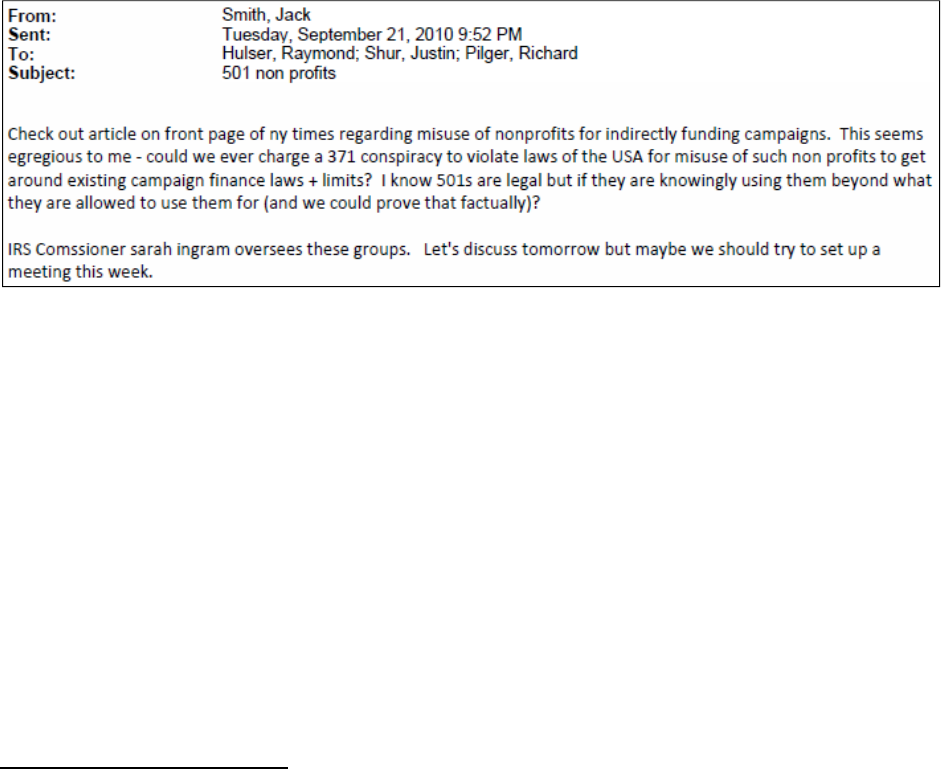

Figure 40: E-mail from Jack Smith to Raymond Hulser et al., Sept. 21, 2010 .......................... 174

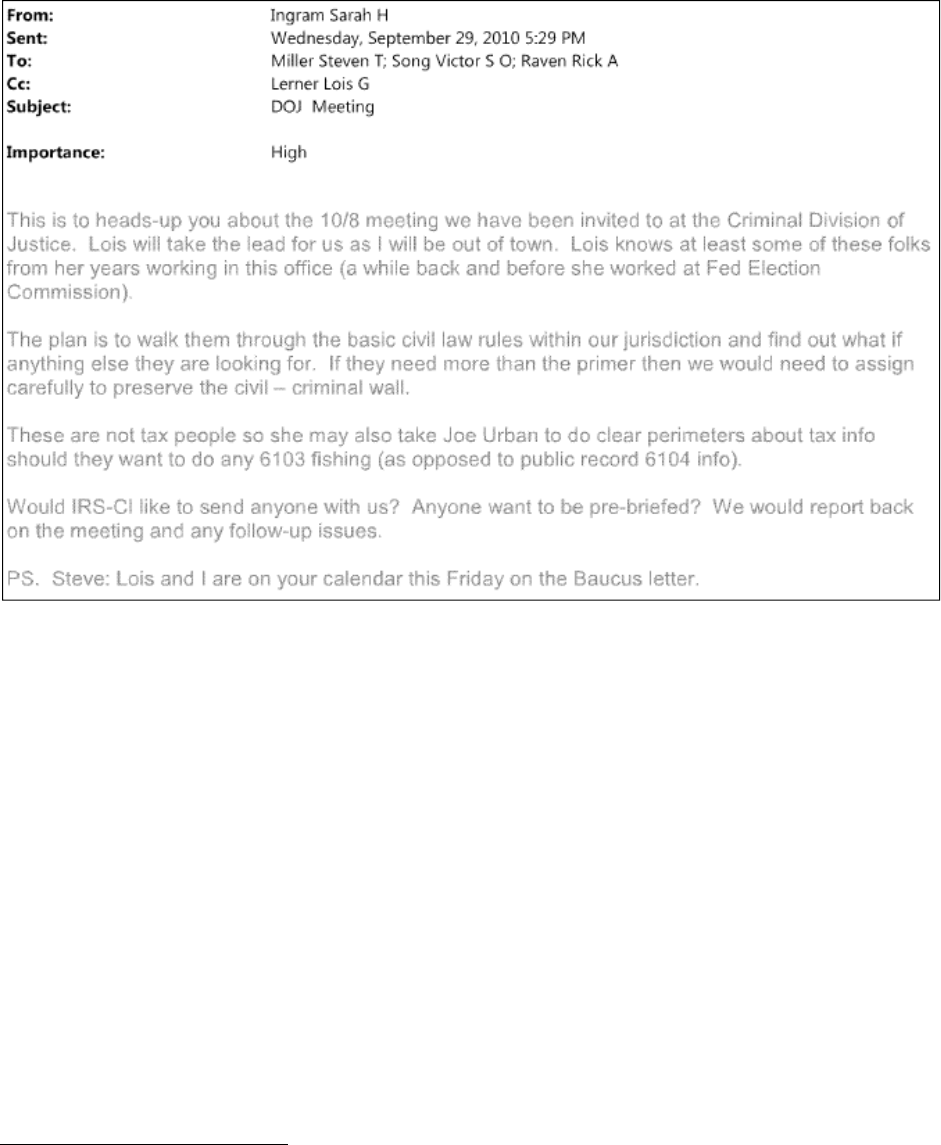

Figure 41: E-mail from Sarah Hall Ingram to Steve Miller et al., Sept. 29, 2010 ...................... 175

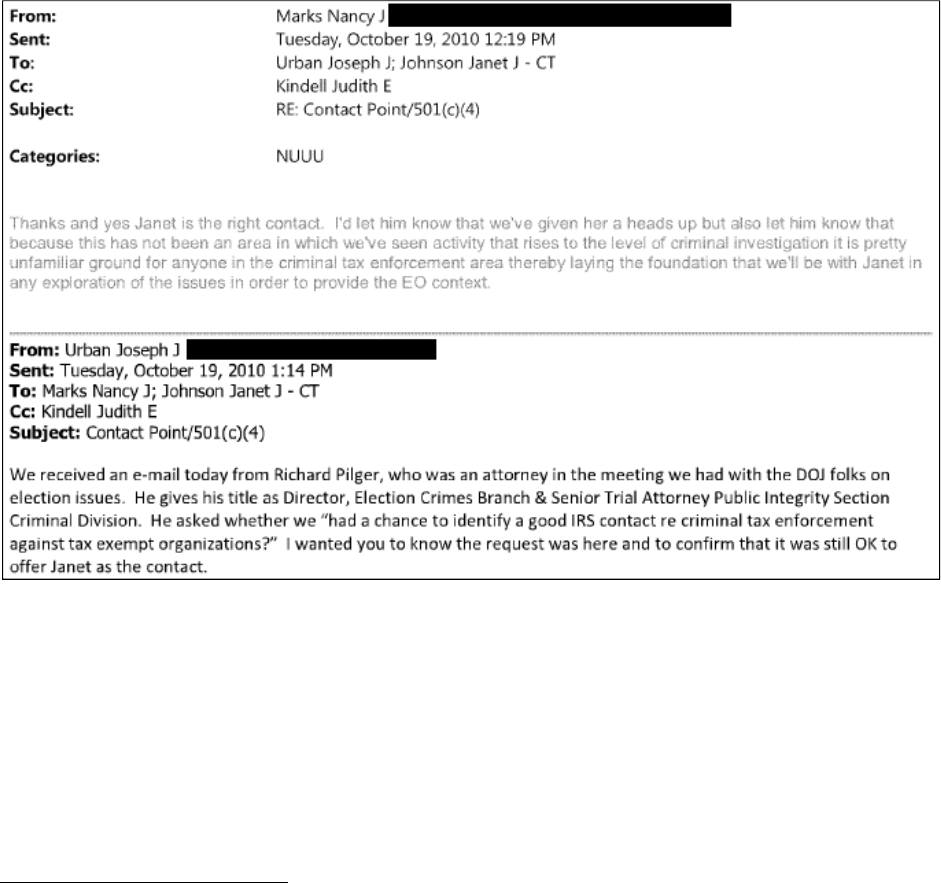

Figure 42: E-mail exchange between Joseph Urban & Nancy Marks, Oct. 19, 2010 ................ 176

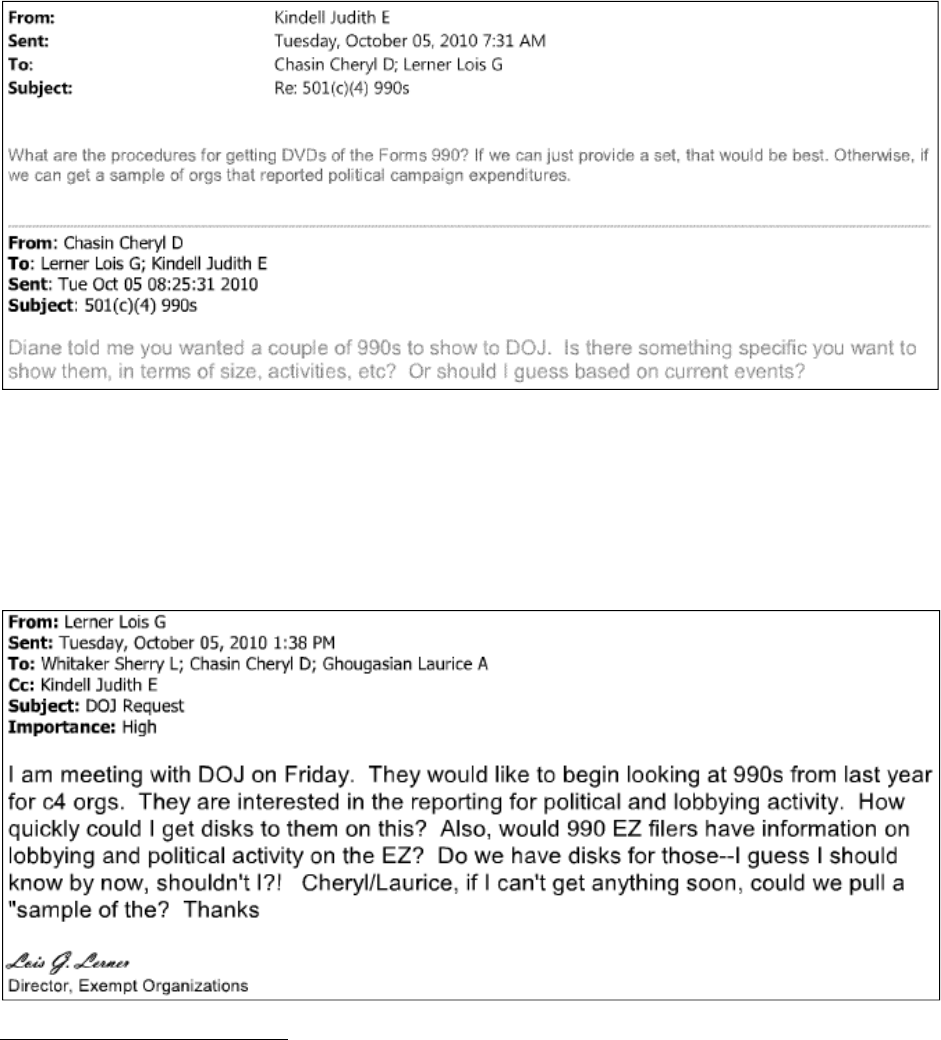

Figure 43: E-mail exchange between Cheryl Chasin & Judith Kindell, Oct. 5, 2010 ................ 177

xiv

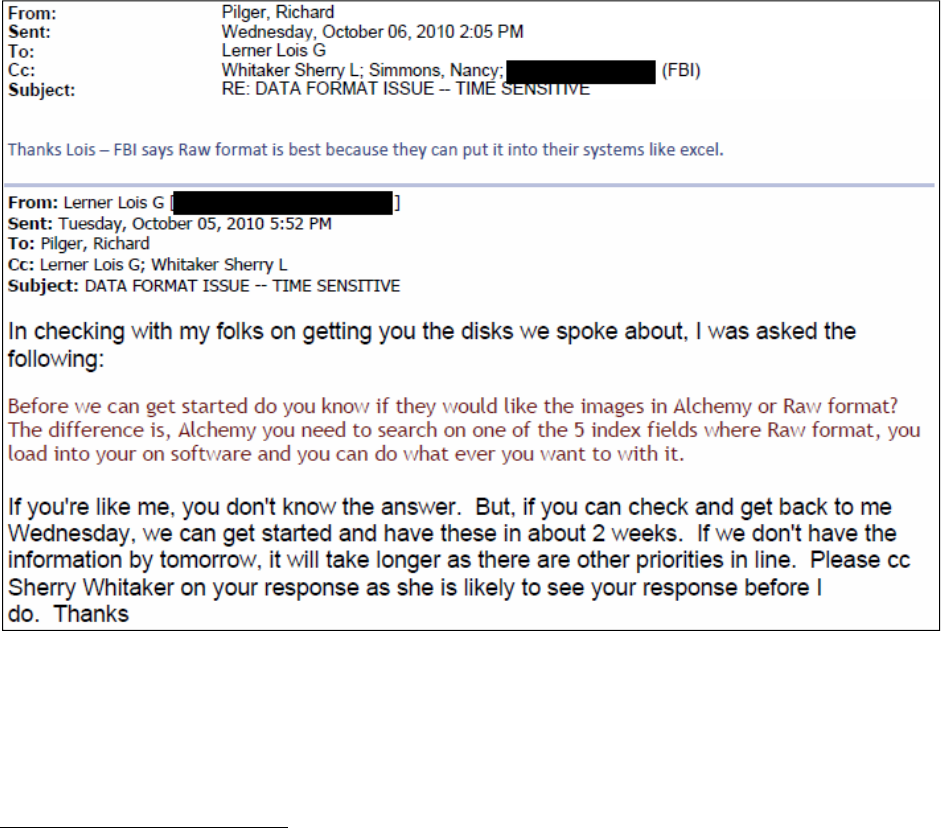

Figure 44: E-mail from Lois Lerner to Sherry Whitaker et al., Oct. 5, 2010 ............................. 177

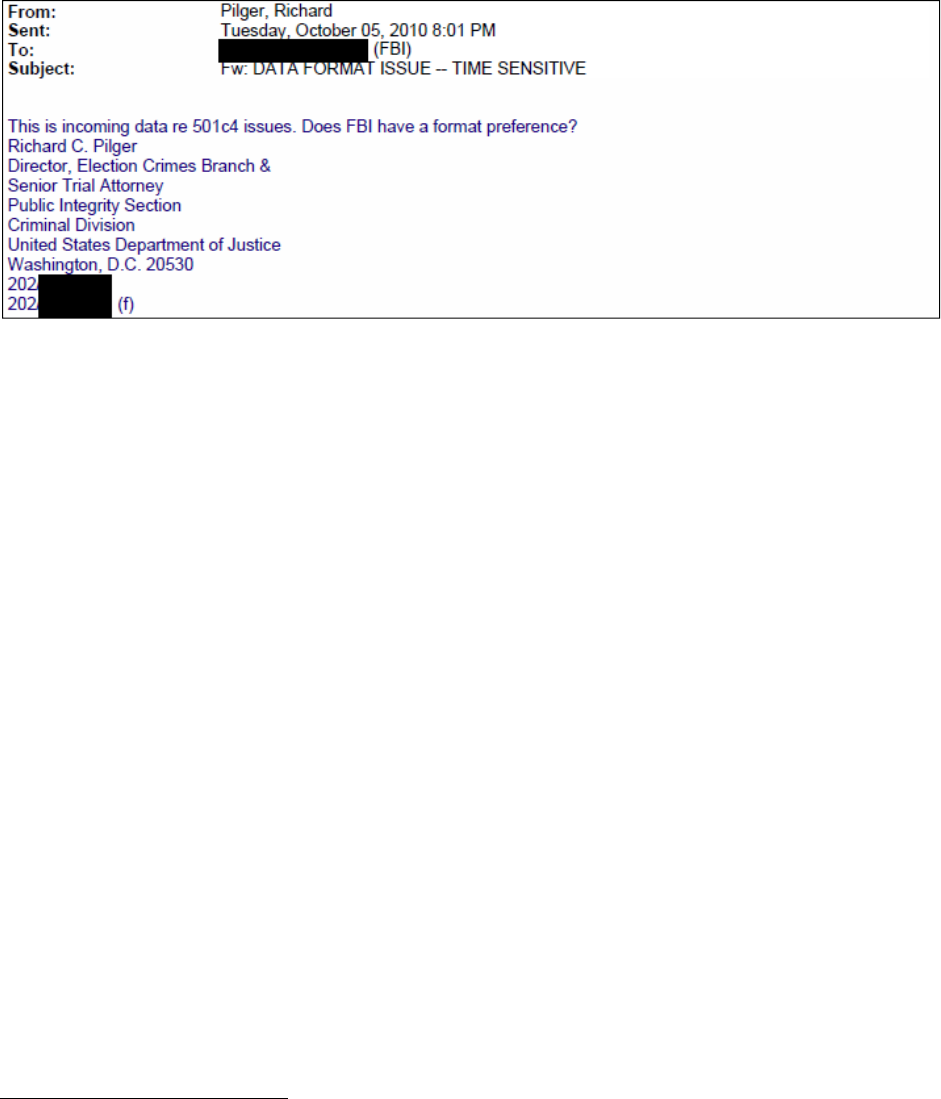

Figure 45: E-mail exchange between Lois Lerner & Richard Pilger, Oct. 6, 2010 .................... 178

Figure 46: E-mail from Richard Pilger to Unnamed FBI Agent, Oct. 5, 2010 ........................... 179

Figure 47: Excessive IRS redaction ............................................................................................ 197

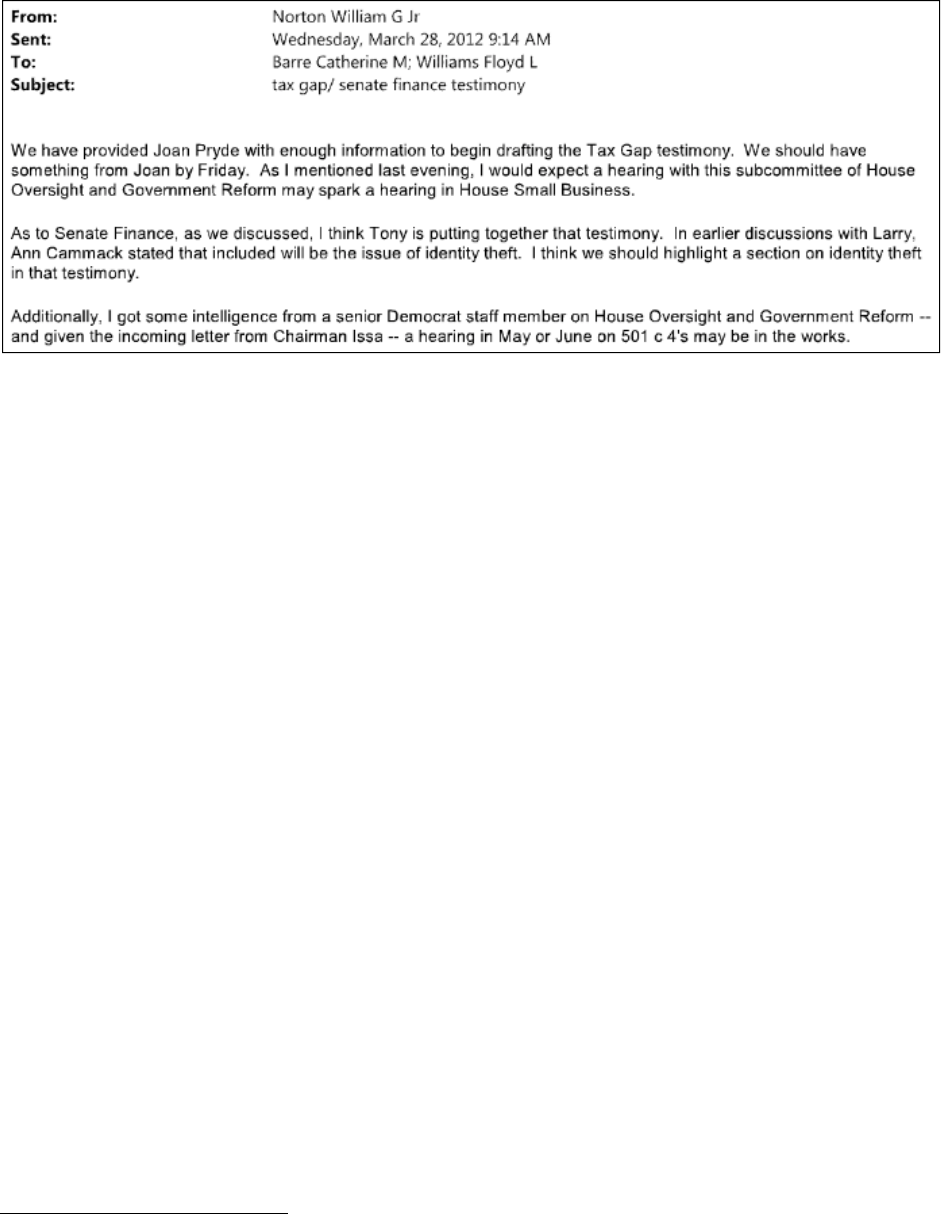

Figure 48: E-mail from William Norton to Catherine Barre & Floyd Williams, Mar. 28, 2012 202

1

Introduction

The Committee on Oversight and Government has conducted a thorough investigation of

the IRS misconduct reported in an audit conducted by the Treasury Inspector General for Tax

Administration (TIGTA).

20

Since May 10, 2013 – when former IRS official Lois Lerner leaked

the findings of the TIGTA report – the Committee has reviewed more than 1,317,000 pages of

documents from the IRS, TIGTA, the Department of Treasury, the Department of Justice, the

Federal Election Commission, the IRS Oversight Board, former and current IRS employees, and

other sources. The Committee shared documents and information with House Ways and Means

Committee investigators, and relied on the Ways and Means Committee’s unique ability to

obtain documents covered by Section 6103 of Title 26 of the U.S. Code, which generally

prohibits the release of tax information by an IRS employee.

The Committee conducted 44 comprehensive transcribed interviews of current and

former IRS officials, ranging from front-line employees in the IRS’s Cincinnati office to the

former Commissioner of the IRS. The Committee conducted six transcribed interviews with

current and former Treasury Department officials and two transcribed interviews with Justice

Department attorneys. The Committee also held several public hearings on the misconduct. The

findings contained herein represent the state of the Committee’s investigation as of the end of the

113th Congress. In light of the November 2014 discovery that TIGTA located an estimated

30,000 e-mails to and from Lois Lerner that the IRS had previously declared to be lost forever,

and because the IRS has still not fully complied with three Committee subpoenas, the

investigation is ongoing.

The Committee found that the IRS targeted conservative-oriented applicants for tax-

exemption by treating them in a manner distinct from other applicants. This disparate treatment

of conservative tax-exempt applicants grew out of Democratic rhetoric critical of the Supreme

Court decision in Citizens United v. Federal Election Commission and calling on the IRS to

carefully scrutinize the groups.

Beginning in February 2010, conservative tax-exempt applicants were identified for

additional scrutiny based solely upon their name and political beliefs. Upon direction of Lois

Lerner, the IRS did not process these applications until Washington IRS employees – including

attorneys in the IRS Chief Counsel’s office – evaluated and developed two “test” cases. As a

result, a large backlog of overwhelmingly conservative-oriented applicants developed and these

applicants suffered substantial and unjustified delays. When the IRS attempted to work through

this backlog in late 2011 and early 2012, the agency asked inappropriate and burdensome

questions of these groups, including questions about the identity of the organizations’ donors.

Only seven applications in the IRS backlog contained the word “progress” or “progressive,”

21

all

20

See TREASURY INSPECTOR GEN. FOR TAX ADMIN., INAPPROPRIATE CRITERIA WERE USED TO IDENTIFY TAX-

E

XEMPT APPLICATIONS FOR REVIEW (May 14, 2013) [hereinafter “TIGTA Audit Rpt.”].

21

“The IRS’s Systematic Delay and Scrutiny of Tea Party Applications”: Hearing before the H. Comm. on

Oversight & Gov’t Reform, 113th Cong. (2013) (statement of J. Russell George).

2

of which were then approved by the IRS,

22

while Tea Party groups received unprecedented

review and experienced years-long delays. While some liberal-oriented groups were singled out

for scrutiny, evidence shows it was for reasons other than their political beliefs.

Senior leadership within the IRS knew about the inappropriate treatment of tax-exempt

applicants as early as 2011. In 2012, Commissioner Doug Shulman and Chief Counsel William

Wilkins separately became aware of the backlog of tax-exempt applicants. Commissioner

Shulman, despite knowing of the backlog and delays and the IRS’s use of inappropriate donor

questions, gave “assurances” to Congress in March 2012 that the IRS was not targeting

conservative-oriented applicants. His testimony, then and now, was misleading and incomplete

at best. Although the witnesses interviewed by the Committee have denied any knowledge of

intentional targeting, the fundamental fact remains that the IRS systematically treated

conservative-oriented applicants in a manner different from other applicants. This disparate

treatment began because of IRS concern about the extension of the Citizens United holding to

federal tax law.

This report details the Committee’s investigation to date. This investigation has furthered

the findings explained in TIGTA’s audit report dated May 14, 2013. Although TIGTA admirably

highlighted the grievous problems present in the IRS, the nature of its review as an audit, rather

than an investigation, prevented a better examination. Other serious deficiencies existed in

TIGTA’s review. First, TIGTA allowed a senior IRS official to be present every time it

interviewed an IRS employee, thereby contaminating the information given in those sessions. In

addition, TIGTA regularly updated the IRS of its findings and also shared multiple versions of its

audit report with IRS management, affording the IRS an opportunity to preemptively spin the

contents of the nonpublic audit report and then attempt to bury the news by acknowledging the

misconduct at a Friday morning tax-law seminar.

Based on lessons learned during this investigation, one matter is clear: the Internal

Revenue Service is broken and in need of serious reform. Toward that end, the Committee

released a report in July 2014 that contained fifteen proposals to address politicization of the

IRS.

23

The report recommended, among other things, that the IRS is removed as a regulator of

political speech for social-welfare groups. On September 17, 2014, the U.S. House of

Representatives approved five bills by voice vote that respond to the Internal Revenue Service’s

targeting of conservative organizations and other abuses of taxpayers at the IRS.

24

Two of the

bills were authored by Oversight and Government Reform Committee members, and three were

written by Ways and Means Committee members.

22

Hearing on the Internal Revenue Service’s Exempt Organizations Division Post-TIGTA Audit: Hearing before the

Subcomm. on Oversight of the H. Comm. on Ways & Means, 113th Con. (2013) (opening statement of Chairman

Boustany).

23

H. Comm. on Oversight & Gov’t Reform, Staff Report: Making Sure Targeting never Happens: Getting Politics

out of the IRS and Other Solutions, 113th Cong. (July 12, 2014).

24

3

Backgroundofthetargeting

Tax-exempt organizations have existed since the birth of the United States. Legislators

have considered tax exemption for certain organizations as far back as 1894, during the first

attempt at instituting a federal income tax.

25

The Revenue Act of 1913, which established the

federal tax system, included numerous exemptions for organizations usually operated not-for-

profit.

26

In the 1950s, a revision of the tax code established the current categories of tax

exemption in section 501 of the Internal Revenue Code.

27

Since then, federal law has recognized

several categories of tax-exemption.

In 2010, the Supreme Court issued an opinion that found a federal election law to be an

unconstitutional limitation of free speech.

28

Affirming fundamental rights to free speech, the

Court held that Congress could not bar a corporation or union from independently expressing

support or disapproval of a candidate for public office. The decision incited criticism from many

members of the media and the Obama Administration. The resulting political backlash was swift

and severe. President Obama, allies in Congress, and the media started a public relations

campaign to demonize the Court’s decision and delegitimize the non-profit organizations

affected by it. This political atmosphere created the conditions for the IRS’s targeting of

conservative groups.

Section501organizationsandpoliticalspeech

The Internal Revenue Code recognizes several different types of organizations exempt

from federal taxation.

29

The most common types are § 501(c)(3) for charitable, religious, and

educational organizations; § 501(c)(4) for organizations promoting social welfare; § 501(c)(5)

for labor unions; and § 501(c)(6) for business and trade associations.

30

Federal law protects the

names and identities of contributors to organizations that qualify for exemption under § 501(c).

31

The law also restricts the level of political speech permissible by the various categories of tax-

exempt organizations.

Section 501(c)(4) of the federal tax code explicitly recognizes as tax-exempt any “[c]ivic

leagues or organizations not organized for profit but operated exclusively for the promotion of

social welfare.”

32

The applicable Treasury regulation, issued in 1959, clarifies the statute. The

regulations states: “An organization is operated exclusively for the promotion of social welfare if

25

See PAUL ARNSBERGER, MELISSA LUDLUM, MARGARET RILEY, AND MARK STANTON, A HISTORY OF THE TAX-

E

XEMPT SECTOR: AN SOI PERSPECTIVE, available at http://www.irs.gov/pub/irs-soi/tehistory.pdf.

26

Tariff Act, ch. 16, §2(G) (1913) (current version at I.R.C. §501).

27

ARNSBERGER, LUDLUM, RILEY, AND STANTON, supra note 25.

28

Citizens United v. Fed. Election Comm’n, 558 U.S. 310 (2010).

29

See I.R.C. § 501(c).

30

See ERIKA K. LUNDER, CONG. RESEARCH SERV., TAX-EXEMPT ORGANIZATIONS: POLITICAL ACTIVITY

RESTRICTIONS AND DISCLOSURE REQUIREMENTS (2010), available at https://www.charitableplanning.com/

cpc_1790452-1.pdf.

31

See I.R.C. § 6104.

32

I.R.C. § 501(c)(4).

4

it is primarily engaged in promoting the common good and general welfare of the people of the

community.”

33

The IRS reiterated in 1981 that an entity organized under § 501(c)(4) could

engage in political speech, stating that “an organization may carry on lawful political activities

and remain exempt under section 501(c)(4) as long as it is primarily engaged in activities that

promote social welfare.”

34

For decades, the IRS has interpreted the law to mean that a § 501(c)(4) group must be

primarily engaged in social welfare activities.

35

However, under § 501(c)(4), an organization

could still lawfully engage in political speech. A § 501(c)(4) group may engage in unlimited

issue advocacy – that is, activities in support or opposition of a public policy issue – and a

limited amount of political campaign intervention.

36

The IRS makes this determination using an

informal 51 to 49 percent ratio and a “facts and circumstances” test to assess whether a group is

primarily engaged in social welfare.

37

Under the IRS’s long-held interpretation, a § 501(c)(4)

group’s primary purpose may be social welfare even if the group engages in a significant amount

of political campaign intervention.

Some Democratic politicians and commentators have vocally lobbied that the IRS should

abandon its decades-long interpretation of tax law. They argue that the IRS should bar §

501(c)(4) organizations from engaging in political activity.

38

Some assert, incorrectly, that §

501(c)(4) groups should not conduct political advocacy because the groups receive taxpayer-

funded benefits as public charities.

39

But § 501(c)(4) groups are not charities; they are social

welfare organizations. Their statuses as social welfare organizations make them fundamentally

different from public charities organized under § 501(c)(3), which receive a benefit derived from

their eligibility to receive tax-deductible contributions.

40

Entities organized under § 501(c)(4) do

not receive any tax-deductible contributions; there is no revenue effect to their tax-exemption.

If, as some Democrats and members of the media have urged, the IRS changes the way it

treats § 501(c)(4) groups, those groups would have to reorganize as § 527 organizations, subject

to disclosure requirements under federal law.

41

This change would allow political adversaries of

those groups, or the causes that they advocate for, to identify and harass their donors. For this

reason, and others, the Supreme Court protects anonymous political speech.

42

In fact,

33

Treas. Reg. § 1.501(c)(4)-1(a)(2).

34

Revenue Ruling 81-95, 1981-1 C.B. 332.

35

See ERIKA K. LUNDER & L. PAIGE WHITAKER, CONG. RESEARCH SERV., 501(C)(4)S AND CAMPAIGN ACTIVITY:

ANALYSIS UNDER TAX AND CAMPAIGN FINANCE LAWS (2013), available at http://electionlawblog.org/wp-

content/uploads/CRS-Report-on-IRS-Line-Between-Issue-Advocacy-and-Campaign-Activity-2013.pdf.

36

I.R.C. § 501(c)(4); Treas. Reg. § 1.501(c)(4)-1(a)(2).

37

See, e.g., Transcribed interview of Ronald Bell, Internal Revenue Serv., in Wash., D.C. (June 13, 2013); Raymond

Chick & Amy Henchey, M. Political Organizations and IRC 501(c)(4), I.R.S. Cont. Prof. Ed. Text (1995), available

at http://www.irs.gov/pub/irs-tege/eotopicm95.pdf.

38

Cf., e.g., “A Review of Criteria Used by the IRS to Identify 501(c)(4) Applications for Greater Scrutiny”: Hearing

before the S. Comm. on Finance, 113th Cong. (2013) (statement of Senator Carper) (“[T]he code says that these

501(c)(4) non-profit organizations, their activities must be, I think, exclusive for social welfare. . . . And it doesn’t

say anything about giving tax-exempt status for any political activity. It says exclusively for social welfare.”).

39

See Bradley A. Smith, The Latest IRS Power Grab, WALL ST. J., Dec. 8, 2013.

40

I.R.C. § 170.

41

I.R.C. § 527(j).

42

See, e.g., NAACP v. Alabama, 357 U.S. 449 (1958).

5

harassment of the sort that the Supreme Court sought to prevent has already occurred. In 2008,

the general counsel to President Obama’s campaign wrote the Department of Justice demanding

a criminal investigation into the “anonymous donors” of a prominent conservative non-profit.

43

The calls for greater disclosure coincided with the emergence of grassroots conservative-

leaning groups organized in opposition to Obama Administration policies during the 111th

Congress, when Democrats controlled Congress.

44

As more groups formed in opposition to the

President’s policies, specifically his economic and health reform agenda, they coalesced into a

loose affiliation that came to be known as the Tea Party movement.

45

Many of these new

community-based, conservative-leaning groups began to seek tax-exempt status under §

501(c)(4). As they did, Democrats called for greater donor disclosure.

46

These calls only grew

louder in the wake of a 2010 Supreme Court decision that President Obama himself declared

“damaging to our democracy” because it would “allow corporate and special interest takeovers

of our elections.”

47

At a time when Democrats controlled both chambers of Congress, President

Obama expressed a specific concern that “no one will actually know who’s really behind”

campaign advertisements that are run against incumbent politicians.

48

CitizensUnitedv.FederalElectionCommission

In 2008, Citizens United – a non-profit that advocates for “traditional American values of

limited government, freedom of enterprise, strong families, and national sovereignty and

security”

49

– released a documentary critical of then-Senator Hillary Clinton. Expecting the

documentary to air through the Democratic primary and in anticipation of possible Federal

Election Commission (FEC) enforcement action, Citizens United sought an injunction to prevent

the FEC’s enforcement and allow the group to air the documentary without any campaign

finance liability.

50

The case eventually made its way up to the Supreme Court as Citizens United

v. Federal Election Commission.

The Supreme Court issued its decision on January 21, 2010. The Court struck down parts

of speech restrictions in the Bipartisan Campaign Reform Act as violations of the First

Amendment’s guarantee of free speech. The Court “rejected the argument that political speech

of corporations or other associations should be treated differently under the First Amendment”

and upheld numerous precedents that recognized First Amendment protections for

corporations.

51

Describing the law as “an unprecedented governmental intervention into the

realm of speech,” the Court noted that “[n]o sufficient governmental interest justifies limits on

43

See Kimberley A. Strassel, Conservatives became targets in 2008, WALL ST. J., May 23, 2013.

44

See, e.g., Ben McGrath, The Movement, THE NEW YORKER, Feb. 1, 2010.

45

See Andres Madestam, Daniel Shoag, Stan Veuger, & David Yanagizawa-Drott, Do Political Protests Matter?

Evidence from the Tea Party Movement, 128 Q.J.

OF ECON. 1633, 1666 (Nov. 2013).

46

See, e.g., Press Release, Durbin Urges IRS to Investigate Spending by Crossroads GPS (Oct. 12, 2010), available

at http://www.durbin.senate.gov/public/index.cfm/pressreleases?ID=833d8f1e-bbdb-4a5b-93ec-706f0cb9cb99.

47

The White House Blog (Jul. 26, 2010).

48

Id.

49

Citizens United, Who We Are, http://www.citizensunited.org/who-we-are.aspx (last visited July 8, 2014).

50

Citizens United v. Fed. Election Comm’n, 558 U.S. 310 (2010).

51

Id. at 342-45.

6

the political speech of non-profit or for-profit corporations.”

52

The Court therefore struck down

the arbitrary restrictions on free political speech, explaining that “political speech must prevail

against laws that would suppress it, whether by design or inadvertence.”

53

RhetoricalBacklashtoCitizensUnited

As the Committee detailed in its June 2014 staff report, the reaction to the Citizens

United opinion was immediate.

54

On the same day of the decision, Robert Gibbs, President

Obama’s Press Secretary, warned that Americans “should be worried that special interest groups

that have already clouded the legislative process are soon going to get involved in an even more

active way in doing the same thing in electing men and women to serve in Congress.”

55

On

January 23, 2010, President Obama proclaimed that the “ruling strikes at our democracy itself”

and “opens the floodgates for an unlimited amount of special interest money into our

democracy.”

56

Less than a week later, the President publicly chastised the Supreme Court during

his State of the Union address. With Justices in attendance, the President declared:

With all due deference to separation of powers, last week the Supreme

Court reversed a century of law that I believe will open the floodgates for

special interests – including foreign corporations – to spend without limit

in our elections. I don’t think American elections should be bankrolled by

America’s most powerful interests, or worse by foreign entities. They

should be decided by the American people.

57

The Citizens United decision sparked a prolonged campaign to disparage conservative-

leaning groups that many left-leaning politicians and commentators feared would be aided by the

decision. From January 2010 through the November 2010 election, President Obama and his

allies orchestrated a rhetorical assault against conservative-leaning groups. In speeches around

the country, the President derided these organizations as “shadowy” groups with “benign-

sounding” names that are pouring millions of dollars into “attack ads against Democratic

candidates.”

58

The President called these groups “phony” and urged a “fix” to the Supreme

Court’s Citizens United decision.

59

Throughout this rhetorical campaign, the President and other prominent Democratic

politicians questioned the legitimacy of conservative-leaning tax-exempt groups and accused

them of deception and ill-intent. For example, in a weekly address in May 2010, President

Obama stated:

52

Id. at 336, 365.

53

Id. at 336-37.

54

HOW POLITICS LED THE IRS TO TARGET CONSERVATIVE TAX-EXEMPT APPLICANTS, supra note 4.

55

The White House, Briefing by White House Press Secretary Robert Gibbs and PERAB Chief Economist Austan

Goolsbee (Jan. 21, 2010).

56

The White House, Weekly Address: President Obama Vows to Continue Standing Up to the Special Interest on

Behalf of the American People (Jan. 23, 2010).

57

The White House, Remarks by the President in the State of the Union Address (Jan. 27, 2010).

58

See HOW POLITICS LED THE IRS TO TARGET CONSERVATIVE TAX-EXEMPT APPLICANTS, supra note 4.

59

Id.

7

We’ve all seen groups with benign-seeming names sponsoring television

commercials that make accusations and assertions designed to influence

the public debate and sway voters’ minds. Now, of course every

organization has every right in this country to make their voices heard.

But the American people also have the right to know when some group

like “Citizens for a Better Future” is actually funded entirely by

“Corporations for Weaker Oversight.”

60

Later, in a July 2010 White House Rose Garden speech, the President proclaimed:

Because of the Supreme Court’s decision earlier this year in the Citizens

United case, big corporations . . . can buy millions of dollars worth of TV

ads – and worst of all, they don’t even have to reveal who’s actually

paying for the ads. . . . These shadow groups are already forming and

building war chests of tens of millions of dollars to influence the fall

elections.

61

The next month, the President sounded the same theme, this time singling out one conservative

group by name. He declared:

Right now all around this country there are groups with harmless-sounding

names like Americans for Prosperity, who are running millions of dollars

of ads against Democratic candidates all across the country. And they

don’t have to say who exactly the Americans for Prosperity are. You

don’t know if it’s a foreign-controlled corporation. You don’t know if it’s

a big oil company, or a big bank. You don’t know if it’s a [sic] insurance

company that wants to see some of the provisions in health reform

repealed because it’s good for their bottom line, even if it’s not good for

the American people.

62

As the 2010 midterm election neared, President Obama amplified his rhetoric. In a September

campaign stop, he stated:

[L]ast year, there was a Supreme Court decision called Citizens United.

They’re allowed to spend as much as they want without ever revealing

who’s paying for the ads. That’s exactly what they’re doing. Millions of

dollars. And the groups are benign-sounding: Americans for Prosperity.

Who’s against that? Or Committee for Truth in Politics. Or Americans

for Apple Pie. Moms for Motherhood. I made those last two up. None of

them will disclose who’s paying for these ads. You don’t know if it’s a

Wall Street bank. You don’t know if it’s a big oil company. You don’t

60

The White House, Weekly Address: President Obama Calls on Congress to Enact Reforms to Stop a “Corporate

Takeover of Our Elections” (May 1, 2010).

61

The White House, Remarks by the President on the DISCLOSE ACT (July 26, 2010).

62

The White House, Remarks by the President at a DNC Finance Event in Austin, Texas (Aug. 9, 2010).

8

know if it’s an insurance company. You don’t even know if it’s a foreign-

controlled entity.”

63

Days later during his weekly radio address, the President said:

Now, as an election approaches, it’s not just a theory. We can see for

ourselves how destructive to our democracy this can become. We see it in

the flood of deceptive attack ads sponsored by special interests using front

groups with misleading names. We don’t know who’s behind these ads or

who’s paying for them.

64

During another campaign event two days later for a Democratic Senatorial candidate, the

President made it clear that his concern stemmed from how Citizens United affected the electoral

prospects of Democratic candidates. He proclaimed:

Right now, all across this country, special interests are running millions of

dollars of attack ads against Democratic candidates. And the reason for

this is last year’s Supreme Court decision in Citizens United, which

basically says that special interests can gather up millions of dollars – they

are now allowed to spend as much as they want without limit, and they

don’t have to ever reveal who’s paying for these ads.

65

Senior White House advisor David Axelrod similarly warned that conservative groups were

“spending tens of millions of dollars. In some districts, they’re spending more money than the

candidate – candidates themselves on negative ads from benign-sounding Americans for

Prosperity, the American Crossroads Fund. No. These are front groups for special interests.”

66

The rhetorical campaign culminated only weeks before the election, as President Obama

tied his disdain for Citizens United with the emergence of conservative-leaning groups. During a

youth town hall event, the President stated:

I do think that what has happened is layered on top of some of that general

frustration that has expressed itself through the Tea Party, there is an

awful lot of corporate money that’s pouring into these elections right now.

. . . But if you’re in a battleground state right now, you are being

bombarded with negative ads every single day and nobody knows who is

paying for these ads. They’ve got these names like “Americans for

Prosperity” or “Moms for Motherhood” or – actually that last one I made

up. But you have these innocuous-sounding names, and we don’t know

63

The White House, Remarks by the President at a Reception for Connecticut Attorney General Richard Blumenthal

(Sept. 16, 2010).

64

The White House, Weekly Address: President Obama Castigates GOP Leadership for Blocking Fixes for the

Citizens United Decision (Sept. 18, 2010).

65

The White House, Remarks by the President at Finance Reception for Congressman Sestak (Sept. 20, 2010).

66

ABC News, ‘This Week’ Transcript: Axelrod, McConnell, and Queen Rania (Sept. 26, 2010), available at

http://abcnews.go.com/ThisWeek/week-transcript-axelrod-mcconnell-queen-rania/story?id=11729101

&singlePage=true.

9

where this money is coming from. I think that is a problem for our

democracy. And it’s a direct result of a Supreme Court decision that said

they didn’t have to disclose who their donors are.

67

Throughout 2010, President Obama forcefully pushed his rhetoric against Citizens

United, so-called “secret money” in politics, and the emergence of conservative non-profit

groups. The President very publicly called these groups “shadowy” front groups for foreign

special interests. He challenged the motives of these conservative groups and implied that their

donors sought to remain anonymous for nefarious reasons. In short, the President questioned the

legitimacy of these groups and their political activities, going so far as to call them a “threat to

our democracy.” Indisputably, this persistent and very public campaign had a real effect on how

the IRS approached these groups.

HowtheIRStargetedconservati ves:Anarrativeofwrongdoing

Within the backdrop of Citizens United and anonymous political speech, the IRS

systematically targeted and delayed tax-exempt applications filed by conservative-leaning

organizations. The story of how the targeting began and how it progressed is a complex

narrative. The audit report issued by the Treasury Inspector General for Tax Administration in

May 2013 only tells part of the story. This report attempts – with the information known at this

time – to present the narrative of bias, mismanagement, and wrongdoing within the Obama

Administration’s IRS.

February2010:Theinit ialapplicationsareidentifiedandelevatedto

Washingtondueto“mediaattention”

In late February 2010, a screener in the IRS’s Cincinnati office spotted an application for

tax-exempt status from a Tea Party group whose identity has still not been disclosed. Although

two similar applications had been processed and approved previously, the Cincinnati office

elevated this application to the Washington office due to “media attention” surrounding the Tea

Party movement. The next day, the Washington office confirmed that it would work the

application due to the potential for media attention. Over the next two-plus years, the IRS would

not approve any application for tax-exempt filed by a Tea Party-related group.

On February 25, 2010, Jack Koester, a Cincinnati screener, alerted his supervisor, John

Shafer, about the Tea Party application, noting “[r]ecent media attention to this type of

organization indicates to me that this is a ‘high profile’ case.”

68

Shafer forwarded Koester’s

e-mail to his supervisor, Sharon Camarillo.

69

Camarillo, in turn, elevated the e-mail to her

67

The White House, Remarks by the President in a Youth Town Hall (Oct. 14, 2010).

68

E-mail from John Koester, Internal Revenue Serv., to John Shafer, Internal Revenue Serv. (Feb. 25, 2010)

(emphasis added) [IRSR 428452].

69

E-mail from John Shafer, Internal Revenue Serv., to Sharon Camarillo, Internal Revenue Serv. (Feb. 25, 2010)

[IRSR 428452].

10

supervisor, Exempt Organizations Determinations (“EO Determinations”) Manager Cindy

Thomas.

70

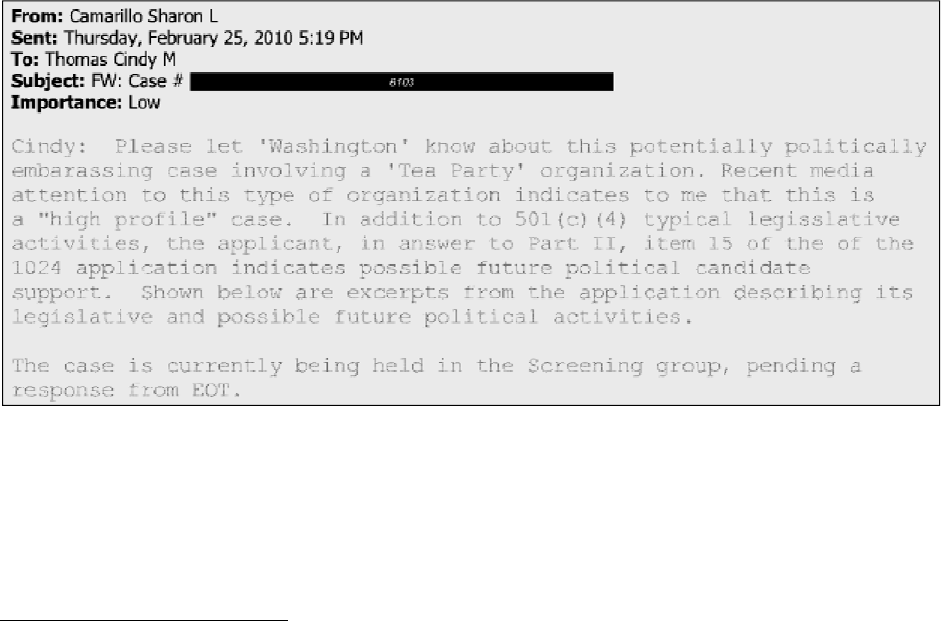

Camarillo wrote:

Cindy: Please let ‘Washington’ know about this potentially politically

embarrassing case involving a ‘Tea Party’ organization. Recent media

attention to this type of organization indicates to me that this is a ‘high

profile’ case.

71

Thomas likewise elevated the application to the attention of her supervisor, Holly Paz, the then-

Manager of the Exempt Organizations Technical Unit in Washington (“EO Technical”), asking

“whether EO Technical wants this case because of recent media attention.”

72

The following day,

February 26, Paz responded, writing: “I think sending it up here is a good idea given the

potential for media interest.”

73

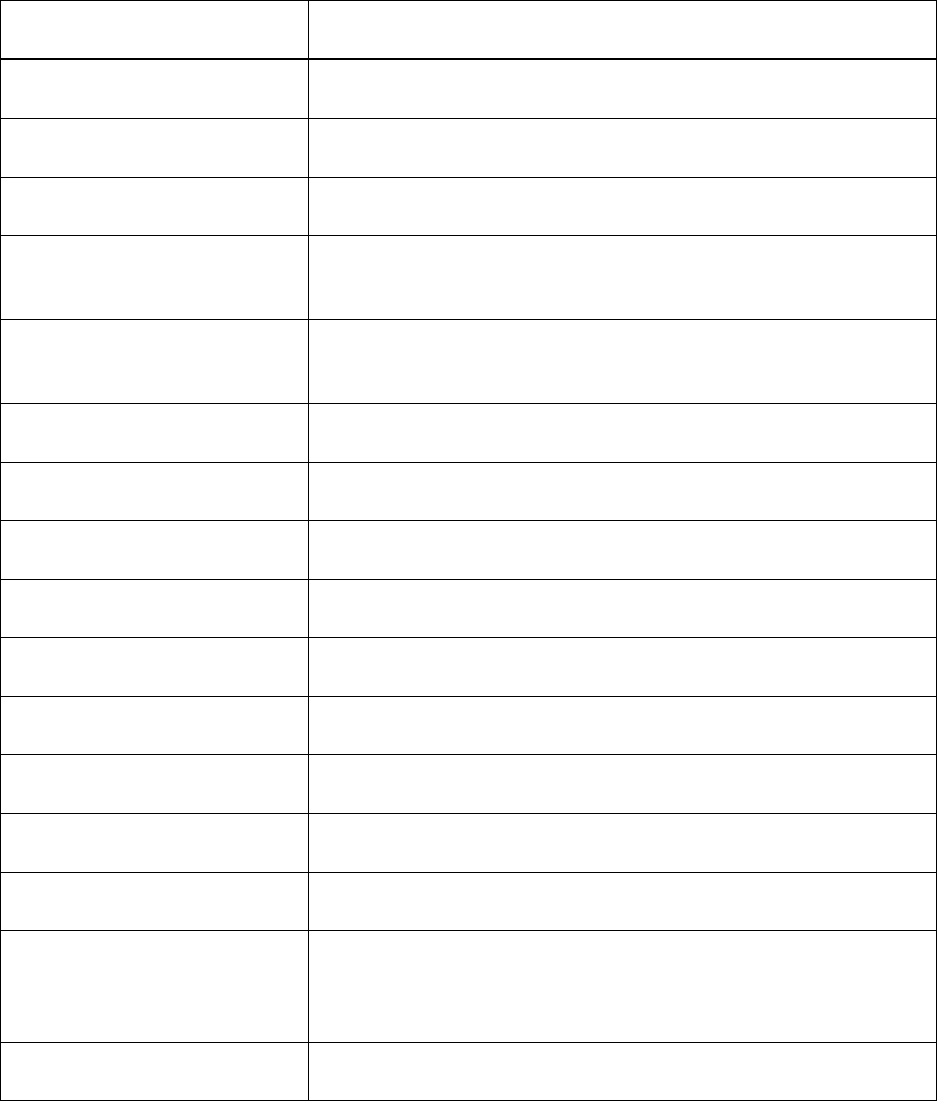

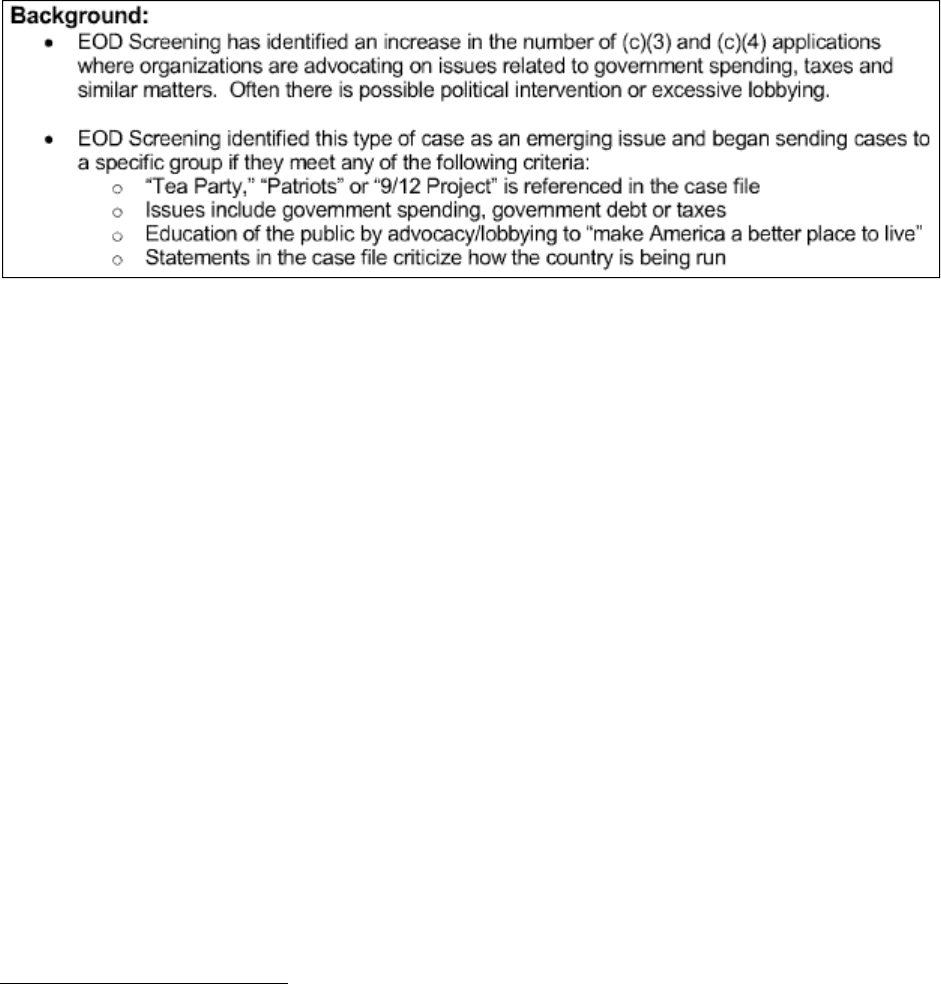

Figure 1: E-mail from Sharon Camarillo to Cindy Thomas, Feb. 25, 2010

At the time, the Tea Party movement was in the news often. The movement arose in

response to the economic and healthcare policies of the Obama Administration and the

Democratic-led 111th Congress.

74

The media covered various Tea Party-led protests in

Washington, D.C., and other cities in opposition to the President’s policies, including

ObamaCare.

75

News outlets also covered the movement’s opposition to the President’s policies

during the inaugural Tea Party convention, held in early February 2010.

76

As the movement

70

E-mail from Sharon Camarillo, Internal Revenue Serv., to Cindy Thomas, Internal Revenue Serv. (Feb. 25, 2010)

[IRSR 428451].

71

E-mail from Sharon Camarillo, Internal Revenue Serv., to Cindy Thomas, Internal Revenue Serv. (Feb. 25, 2010)

(emphasis added) [IRSR 428451].

72

E-mail from Cindy Thomas, Internal Revenue Serv., to Holly Paz, Internal Revenue Serv. (Feb. 25, 2010) [IRSR

428451].

73

E-mail from Holly Paz, Internal Revenue Serv., to Cindy Thomas, Internal Revenue Serv. (Feb. 26, 2010) [IRSR

428451].

74

Philip Rucker, Tea Party convention begins in Nashville, W

ASH

.

P

OST

, Feb. 5, 2010.

75

See, e.g., David Barstow, Tea Party lights fuse for rebellion on right, N.Y.

T

IMES

, Feb. 15, 2010.

76

Kate Zernike, Palin assails Obama at Tea Party meeting, N.Y.

T

IMES

, Feb. 6, 2010.

11

grew, some – including then-Speaker Nancy Pelosi – used the national media to publicly

question the funding sources for the groups and the level of grassroots support.

77

March2010:WashingtonrequestsadditionalTeaPartyapplicationsto

workas“test”casesandordersCincinnatito“hold”therest

The Washington IRS office’s interest in the initial Tea Party application forced the

Cincinnati office to assess how many similar applications were pending in the IRS’s queue.

When the line employees discovered several additional applications by mid-March 2010, the

Washington office asked for two additional applications to work as “test” cases. It ordered the

Cincinnati employees to “hold” the remainder of the applications until Washington specialists

evaluated the test cases.

Following the Washington office’s acceptance of the initial application, Cincinnati

screening group manager John Shafer asked his employees to identify similar applications

pending at that time with the phrase “Tea Party.”

78

By March 16, 2010, the screening group had

identified ten more Tea Party applications.

79

Cincinnati manager Cindy Thomas notified Holly

Paz, asking: “Did you know about these additional 10 tea party cases? Do you want all of them

or do you want a few and then give us advice as to what to do with remaining?”

80

Paz replied: “I

think we should take a few more cases (I’d say 2) and would ask that you hold the rest until we

get a sense of what the issues may be.”

81

On April 2, Washington received the two applications,

a 501(c)(3) application filed by the Prescott Tea Party, and a 501(c)(4) application filed by the

Albuquerque Tea Party.

82

Meanwhile, at the same time that Paz ordered Cincinnati to hold all Tea Party

applications, the Washington IRS office sought to determine whether it held any additional Tea

Party cases. Ronald Shoemaker, a group manager in EO Technical, sent an e-mail to a number

of IRS agents with the subject “lookout,” writing: “Be on the lookout for a tea party case. If you

have received or do receive a case in the future involving an exemption for an organization

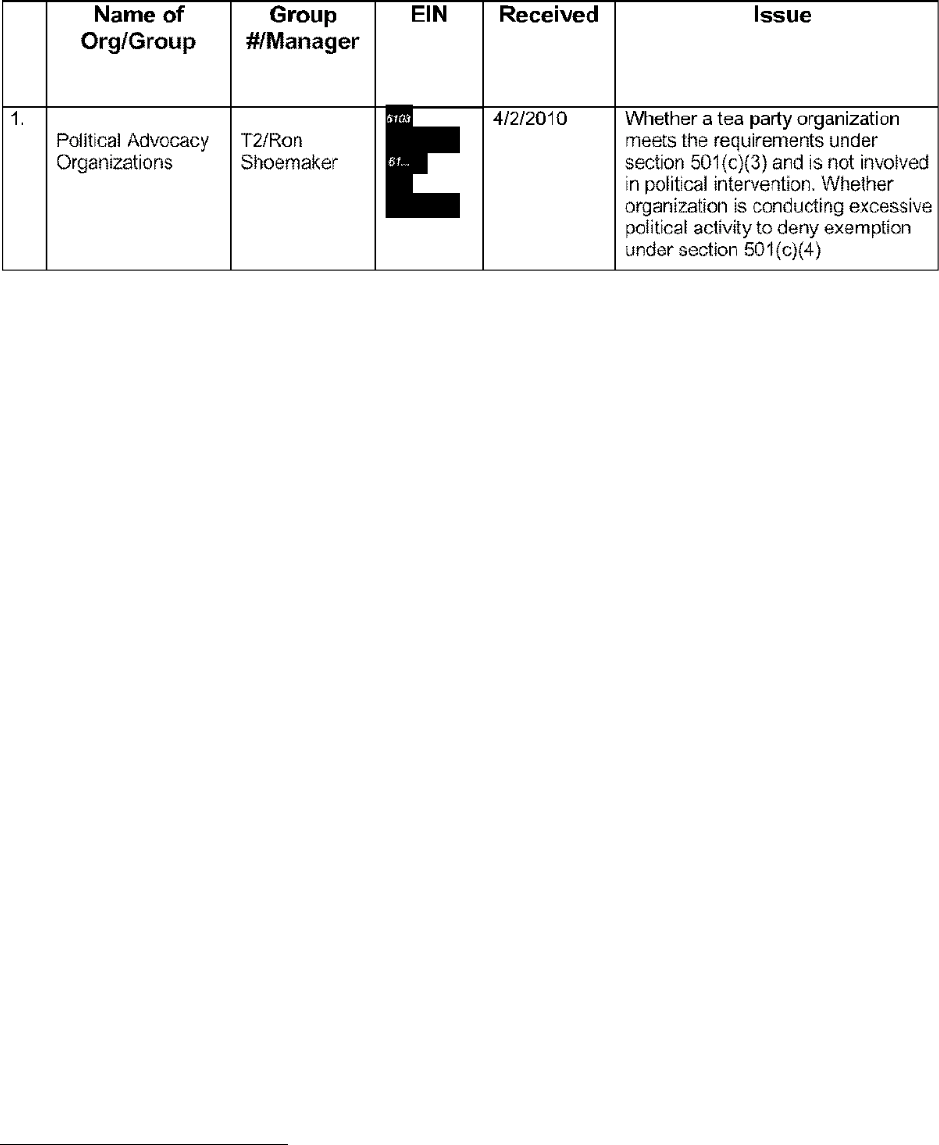

having to do with [the] tea party let me know.”

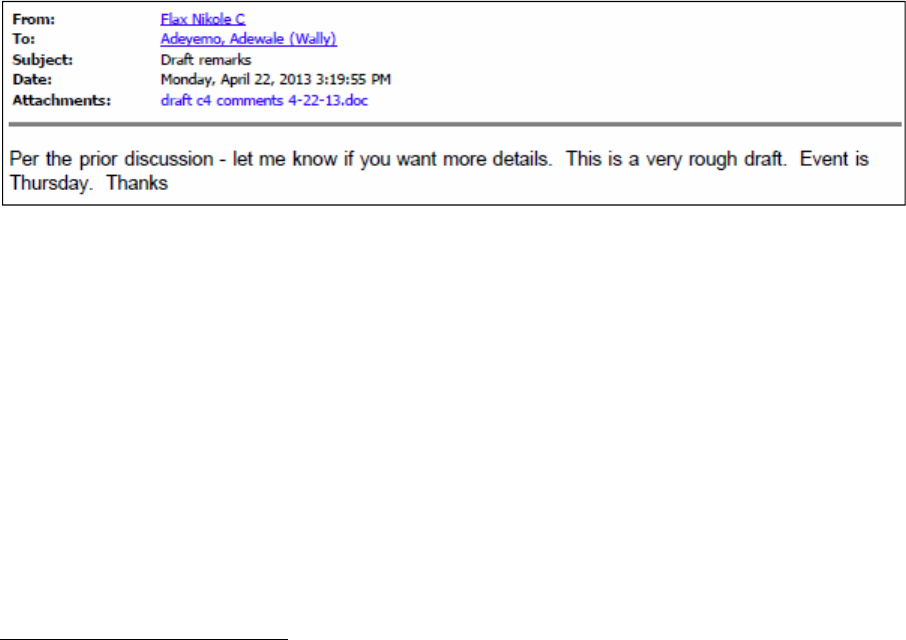

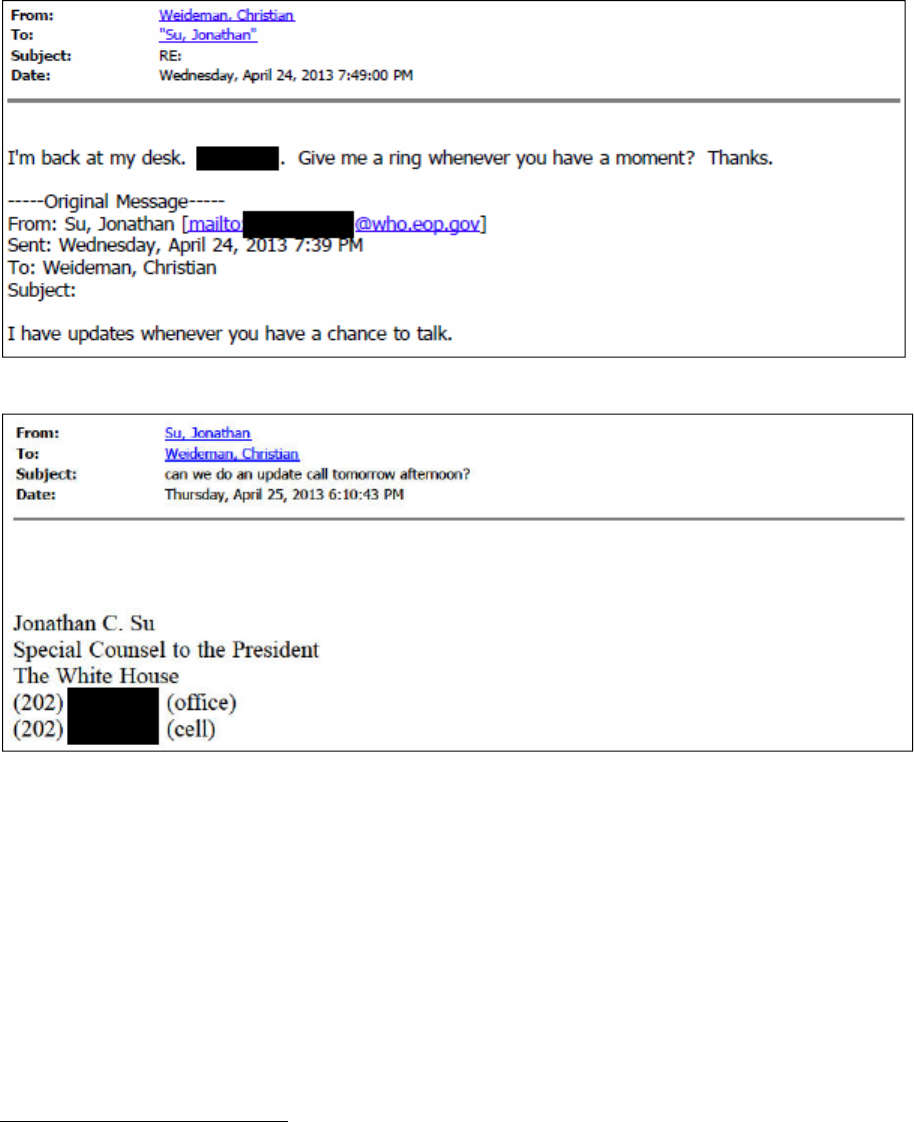

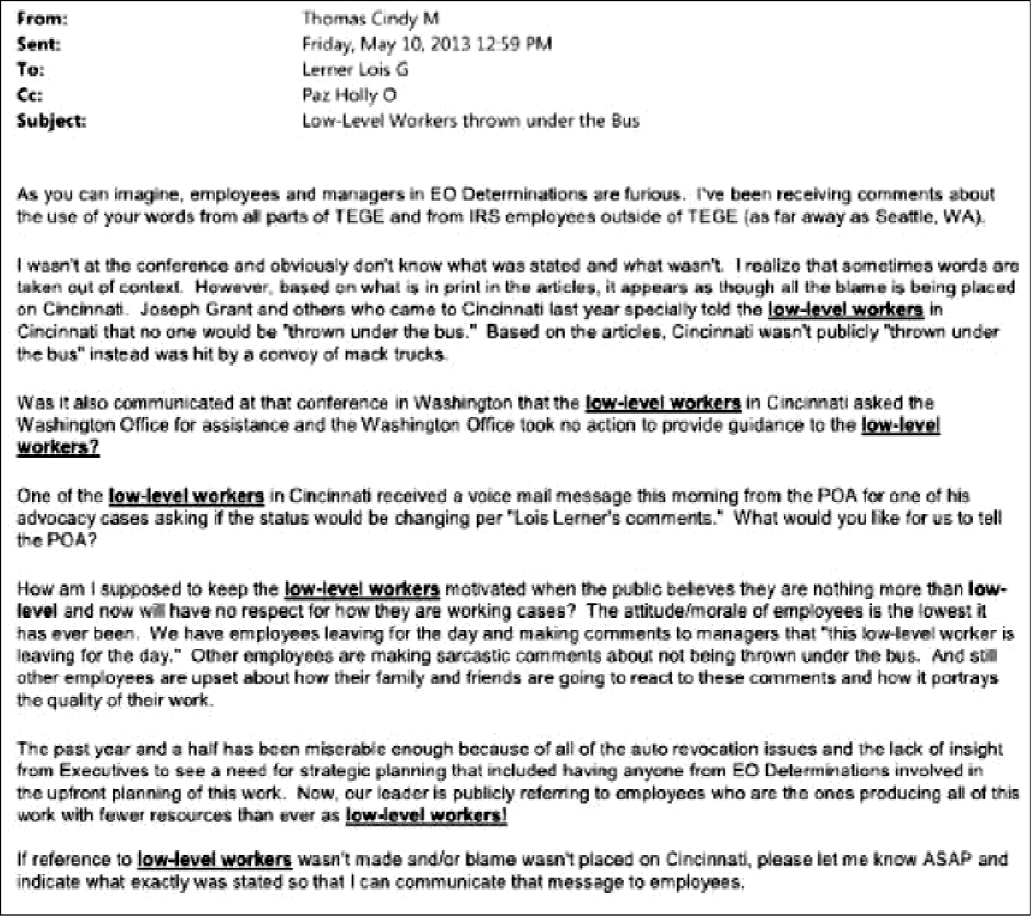

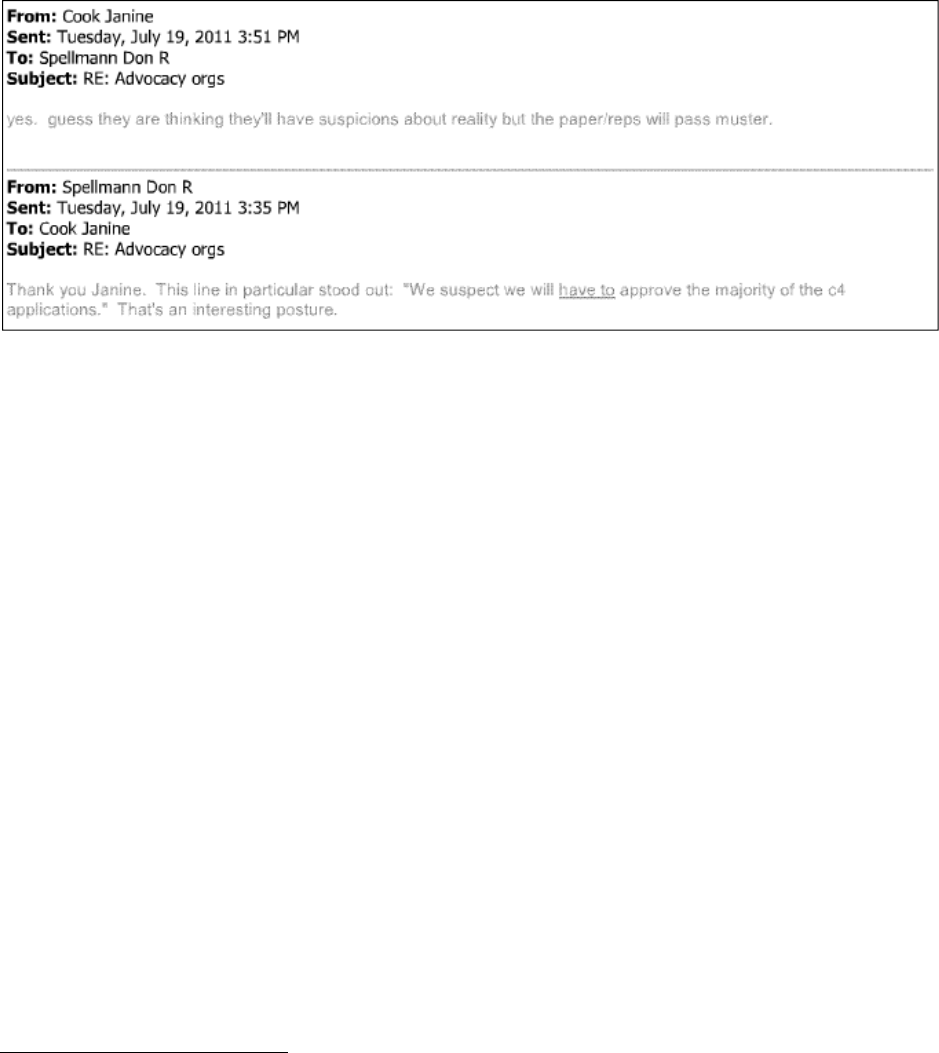

83