Regime Switches, Agents’Beliefs, and Post-World War

II U.S. Macroeconomic Dynamics

Francesco Bianchi

Princeton University

November 3, 2008

Abstract

This paper is focused on the evolution of in‡ation and output dynamics over the last

50 years, the changes in the behavior of the Federal Reserve, and the role of agents’

beliefs. I consider a new Keynesian dynamic stochastic general equilibrium model

with Markov-switching structural parameters and heteroskedastic shocks. Agents are

aware of the possibility of regime changes and they form expectations accordingly. The

results support the view that there were regime switches in the conduct of monetary

policy. However, the idea that US monetary policy can be described in terms of pre-

and post- Volcker proves to be misleading. The behavior of the Federal Reserve has

instead repeatedly ‡uctuated between a Hawk- and a Dove- regime. Counterfactual

simulations show that if agents had anticipated the appointment of Volcker, in‡ation

would not have reached the peaks of the late ‘70s and the in‡ation-output trade-o¤

would have been less severe. This result suggests that in the ‘70s the Federal Reserve

was facing a serious problem of credibility and that there are potentially important

gains from committing to a regime of in‡ation targeting. Finally, I show that in the

last year the Fed has systematically deviated from standard monetary practice. As a

technical c ontribution, the paper provides a Bayesian algorithm to estimate a Markov-

switching DSGE model.

I am grateful to Chris Sims, Mark Watson, Efrem Castelnuovo, Stefania D’Amico, Jean-Philippe Laforte,

Andrew Levin, David Lucca and all seminar participants at Princeton University and at the Board of

Gove rnors of the FRS for useful suggestions and comments. Correspondence: 001 Fisher Hall, Department

1

1 Introduction

This paper aims to explain the evolution of in‡ation and output dynamics over the last 50

years taking into account not only the possibility of regime switches in the behavior of the

Federal Reserve, but also agents’beliefs around these changes. To this end, I make use of

a Markov-Switching Dynamic Stochastic General Equilibrium (MS-DSGE) model in which

the behavior of the Federal Reserve is allowed to change across regimes. In such a model,

regime changes are regarded as stochastic and reversible, and agents’beliefs matter for the

law of motion governing the evolution of the economy.

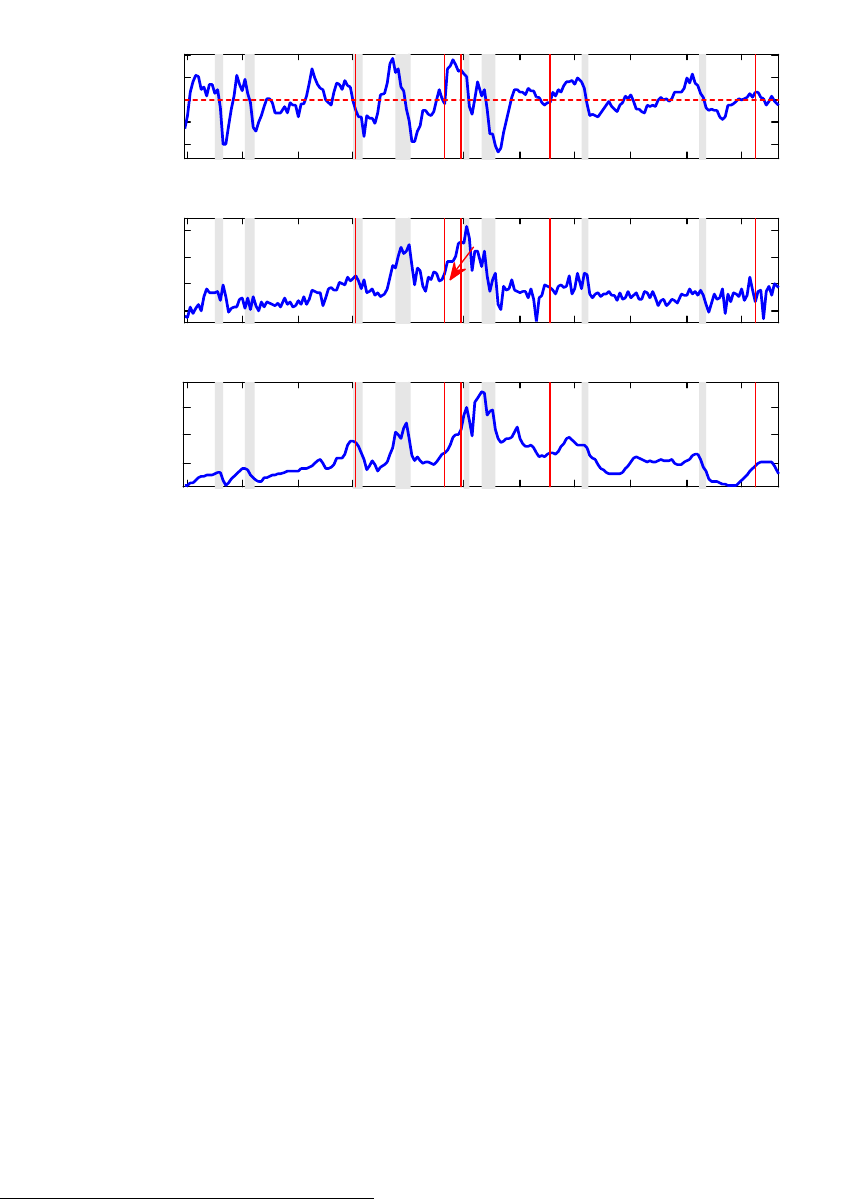

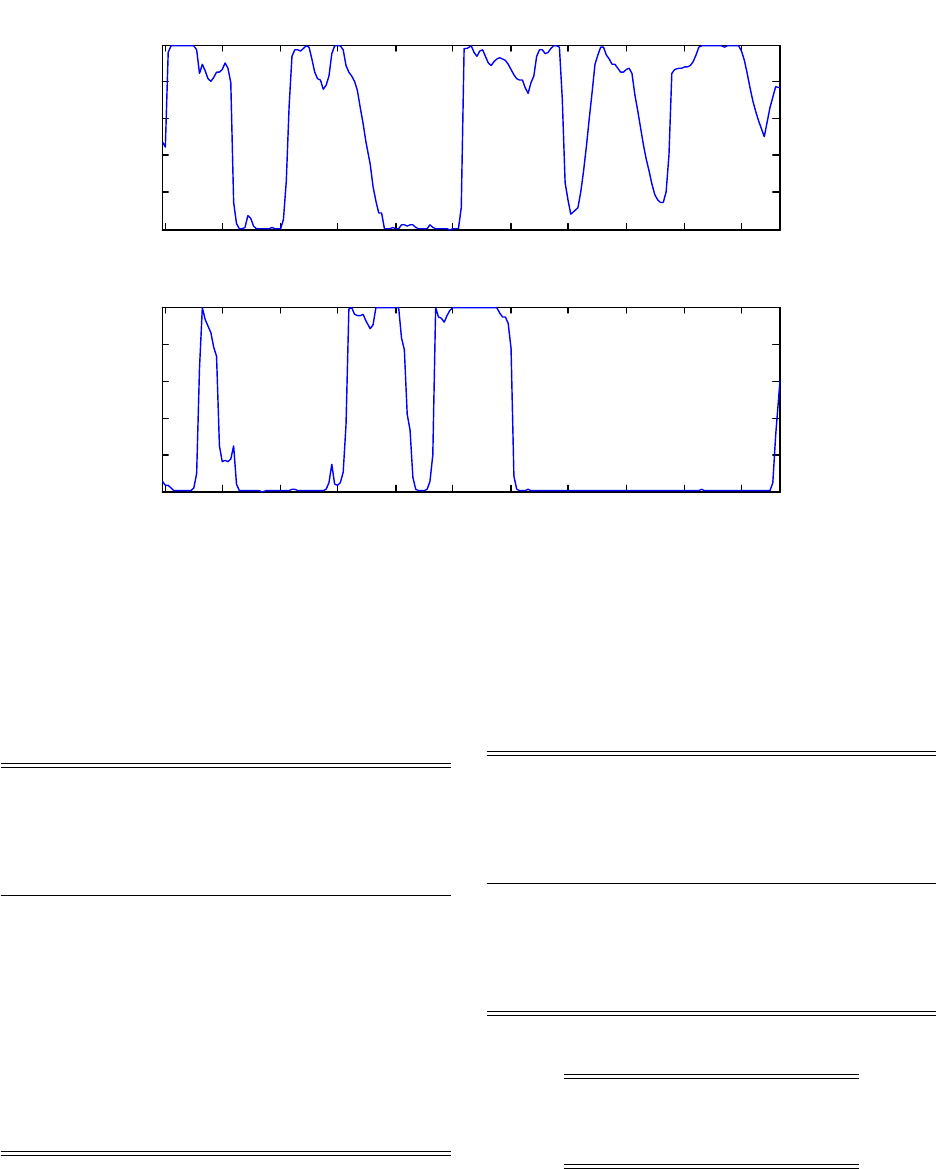

In order to contextualize the results, I shall start with a brief description of the events

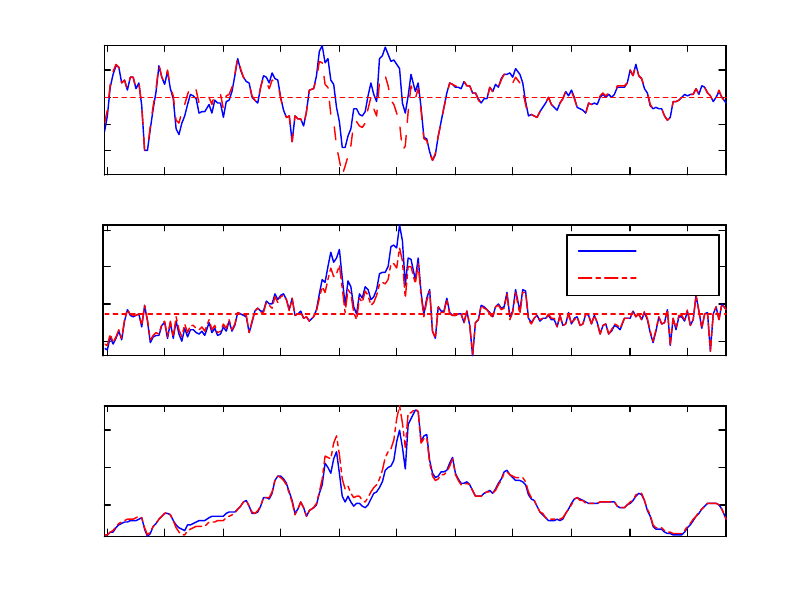

that this paper intends to interrelate. Figure 1 shows the series for output gap, annualized

quarterly in‡ation, and the Federal Funds rate for the period 1954:IV-2008:I. The shaded

areas represent the NBER recessions and the vertical lines mark the appointment dates of

the Federal Reserve chairmen. Some stylized facts stand out. Over the early years of the

sample in‡ation was relatively low and stable. Then, in‡ation started rising during the late

’60s and spun out of control in the late ’70s. At the same time the economy experienced

a deep and long recession following the oil crisis of 1974. During the …rst half of the ’80s

the economy went through a painful disin‡ation. In‡ation went back to the levels that were

prevailing before the ’70s at the cost of two severe recessions. From the mid-80s, until the

recent …nancial crisis the economy has been characterized by remarkable economic stability.

Economists like to refer to this last period with the term "Great Moderation", while the

name "Great In‡ation" is often used to label the turmoil of the ’70s. The sharp contrast

between the two periods is evident. Understanding the causes of these remarkable changes

in the reduced form properties of the macroeconomy is crucial, particularly now that policy

makers are facing a potentially devastating crisis, along with rising in‡ation. If these changes

are the result of exogenous shocks, events similar to those of the Great In‡ation could occur

again. If, on the other hand, p olicy makers currently posses a better understanding of the

economy, then we could be somewhat optimistic about the long run consequences of the

current economic crisis.

With regard to this, it can hardly go unnoticed that the sharp decline in in‡ation started

shortly after Paul Volcker was appointed chairman of the Federal Reserve in August 1979. It

is de…nitely tempting to draw a line between the two events and conclude that a substantial

change in the conduct of monetary policy must have occurred in those years. Even if several

economists would agree that this was in fact the case, there is much less consensus around

2

the notion that this event represented an unprecedented and once-and-for-all regime change.

Economists that tend to establish a clear link between the behavior of the Fed and the

performance of the economy would argue that the changes described above are the result of

a substantial switch in the anti-in‡ationary stance of the Federal Reserve ("Good Policy").

The two most prominent examples of this school of thought are Clarida et al. (2000) and

Lubik and Schorfheide (2004). These authors point out that the policy rule followed in the

’70s was one that, when embedded in a stochastic general equilibrium model, would imply

nonuniqueness of the equilibrium and hence vulnerability of the economy to self-ful…lling

in‡ationary shocks. Their estimated policy rule for the later period, on the other hand,

implied no such indeterminacy. Therefore, the Fed would be blamed for the high and volatile

in‡ation of the ’70s and to praise for the stability that has characterized the recent years.

On the other hand, Bernanke and Mihov (1998), Leeper and Zha (2003), and Stock and

Watson (2003) perform several econometric tests and do not …nd strong evidence against

stability of coe¢ cients. Moreover, Canova and Gambetti (2004), Kim and Nelson (2004),

Cogley and Sargent (2006) and Primiceri (2005) show little evidence in favor of the view that

the monetary policy rule has changed drastically. Similarly, Sims and Zha (2006), using a

Markov-switching VAR, identify changes in the volatilities of the structural disturbances as

the key driver b ehind the stabilization of the U.S. economy. Thus, at least to some extent,

the Great Moderation would be due to "Good Luck", i.e. to a reduction in the magnitude

of the shocks hitting the economy.

The …rst contribution of this paper is to shed new light on this controversy. I consider a

Dynamic Stochastic General Equilibrium (DSGE) model in which the Taylor rule parameters

characterizing the behavior of the Federal Reserve are allowed to change across regimes. In

the model agents are aware of the possibility of regime changes and they take this into

account when forming expectations. Therefore the law of motion of the variables of interest

depends not only on the traditional microfounded parameters, but also on the beliefs around

alternative regimes.

Two main results emerge from the estimates. First, the model supports the idea that

US monetary policy was indeed subject to regime changes. The best performing model is

one in which the Taylor rule is allowed to move between a Hawk- and a Dove- regime. The

former implies a strong response to in‡ation and little concern for the output gap, whereas

the latter comes with a weak response to in‡ation. In particular, while the Hawk regime, if

taken in isolation, would satisfy the Taylor principle, the Dove regime would not.

1

Following

1

The Taylor principle asserts that central banks can stabilize the macroeconomy by moving their interest

3

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

-4

-2

0

2

4

Output gap

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

0

5

10

15

Burns Volcker Greenspan Bernanke

Annualized quarterly Inflation

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

5

10

15

Federal Funds Rate

Miller

Martin

Figure 1: Output gap, in‡ation, and policy interes rate for the US. Output gap is obtained

HP …ltering the series of real per capita GDP. The shaded areas represent NBER recessions,

while the vertical lines mark the appointment dates of the Chairmen.

an adverse technology shock, the Fed is willing to cause a deep recession to …ght in‡ation

only under the Hawk regime. Under the Dove regime, the Fed tries to minimize output

‡uctuations.

Second, the idea that US economic history can be divided into pre- and post- Volcker

turns out to be misleading. Surely the results corroborate the widespread belief that the

appointment of Volcker marked a change in the stance of the Fed toward in‡ation. In

fact, around 1980, right after his appointment, the Fed moved from the Dove to the Hawk

regime. However, the behavior of the Federal Reserve has repeatedly ‡uctuated between the

two alternative Taylor rules and regime changes have been relatively frequent. Speci…cally,

the Dove regime was certainly in place during the second half of the ’70s, but also during

the …rst half of the ’60s, again around 1991, and with high probability toward the end of the

sample.

The second contribution of the paper relates to the role of agents’beliefs in explaining

rate instrument more than one-for-one in response to a change in in‡ation.

4

the Great In‡ation. Were agents aware of the possibility of the appointment of an extremely

conservative chairman like Volcker? Were they expecting to go back to the Hawk regime any

time soon? Or were they making decisions assuming that the Burns/Miller regime would

have lasted forever?

Counterfactual simulations suggest that this last hypothesis is more likely to explain what

was occurring in the ’70s. It seems that in those years the Fed was facing a severe credibility

problem and beliefs about alternative monetary policy regimes were indeed playing a crucial

role. To address this hypothesis, I introduce a third regime, the Eagle regime, that is even

more hawkish than the Hawk regime. This regime is meant to describe the behavior of an

extremely conservative chairman like Volcker. It turns out that if agents had assigned a

relatively large probability to this hypothetical regime, in‡ation would not have reached the

peaks of the mid- and late- ’70s, independent of whether or not the Eagle regime occurred.

Furthermore, the costs in terms of lower output would have not been extremely large. Quite

interestingly, simply imposing the Hawk regime throughout the entire sample would have

implied modest gains in terms of in‡ation and a substantial output loss.

These last results point toward two important conclusions. First, beliefs about alternative

regimes can go a long way in modifying equilibrium outcomes. Speci…cally, in the present

model, the e¤ective sacri…ce ratio faced by the Federal Reserve depends on the alternative

scenarios that agents have in mind. If agents had anticipated the appointment of a very

conservative chairman, the cost of keeping in‡ation down would have been lower. Second,

monetary policy does not need to be hawkish all the time in order to achieve the desired

goal of low and stable in‡ation. What is truly necessary is a strong commitment to bring

the economy back to equilibrium as soon as adverse shocks disappear. It seems that in the

’70s the main problem was not simply that the Fed was accommodating a series of adverse

technology shocks, but rather that there was a lack of commitment to restoring equilibrium

once the economy had gone through the peak of the crisis.

The last contribution of this paper is methodological. I propose a Bayesian algorithm to

estimate a Markov Switching DSGE model via Gibbs sampling. The algorithm allows for

di¤erent assumptions regarding the transition matrix used by agents in the model. Specif-

ically, this matrix may or may not coincide with the one that is observed ex-post by the

econometrician. To the best of my knowledge this paper represents the …rst attempt to esti-

mate a fully speci…ed DSGE model in which the behavior of the Federal Reserve can switch

across regimes.

2

2

Schorfheide (2005), Ireland (2007), and Liu et al. (2007) consider models in which the target for in‡ation

5

I b elieve that a MS-DSGE model represents a promising tool to better understand the

Great Moderation as well as the rise and fall of in‡ation because it combines the advantages

of the previous approaches, as well as mitigating the drawbacks. Consider the Good Luck-

Good Policy literature. It is quite striking that researchers tend to …nd opposite results

moving from di¤erent starting points. The two most representative papers of the "Good

Policy" view are based on a subsample analysis: Clarida et al. (2000) draw their conclu-

sions according to instrumental variable estimators based on single equations. Lubik and

Schorfheide (2004) obtain similar results using Bayesian methods to construct probability

weights for the determinacy and indeterminacy regions in the context of a New Keynesian

business-cycle model. However, in both cases, estimates are conducted breaking the period

of interest into subsamples: pre- and post-Volcker. Instead, authors supporting the "Good

Luck" hypothesis draw their conclusions according to models in which parameter switches

are modeled as stochastic and reversible. In other words, they do not impose a one-time-only

regime change but they let the data decide if there was a break and if this break can be

regarded as a permanent change.

At the same time, both approaches have some important limitations when taking into

account the role of expectations. The Good Policy literature, based on subsample analysis,

falls short in recognizing that if a regime change occurred once, it might occur again, and

that agents should take this into account when forming expectations. At the same time,

reduced form models do not allow for the presence of forward-looking variables that play a

key role in dynamic stochastic general equilibrium models. This has important implications

when interpreting those counterfactual exercises which show that little would have changed

if more aggressive regimes had been in place during the ’70s.

In a MS-DSGE, regime changes are not regarded as once-and-for-all and expectations

are formed accordingly. Thus, the law of motion of the variables included in the model can

change in response to changes in beliefs. These could deal with the nature of the alternative

regimes or simply with the probabilities assigned to them. Consequently, counterfactual

simulations are more meaningful and more robust to the Lucas critique, because the model

is re-solved not only incorporating eventual changes in the parameters of the model, but also

taking into account the assumptions about what agents know or believe. This is particularly

relevant, for example, when imposing that a single regime be in place throughout the sample.

Furthermore, given that the model is microfounded, all parameters have a clear economic

can change. Justiniano and Primiceri (2008) and Laforte (2005) allow for heteroskedasticity. See section 2

for more details.

6

interpretation. This implies that a given hypothesis around the source(s) of the Great Mod-

eration can explicitly be tested against the others. The benchmark speci…cation considered

in this paper accommodates both explanations of the Great Moderation given that it allows

for a Markov-switching Taylor rule and heteroskedastic volatilities. As emphasized by Sims

and Zha (2006) and Cogley and Sargent (2006), it is essential to account for the stochastic

volatility of exogenous shocks when trying to identify shifts in monetary policy. In fact, it

turns out that a change in the volatilities of the structural shocks contributes to the broad

picture. A high volatility regime has been in place for a large part of the period that goes

from the early ’70s to the mid-80s. Interestingly, 1984 is regarded as the year in which the

Fed was …nally able to gain control of in‡ation.

Finally, I also consider a variety of alternative speci…cations that are meant to capture

the competing explanations of the Great Moderation. Speci…cally, I use a model in which

only the volatilities are allowed to change across regimes as a proxy for the ’Just Good Luck’

hypothesis, while the ’Just Good Policy’ is captured by a model with a once-and-for-all

regime change. All the models are estimated with Bayesian methods and model comparison

is conducted in order to determine which of them is favored by the data.

The content of this paper can be summarized as follows. Section 2 gives a brief summary

of the related literature. Section 3 contains a description of the model and an outline of

the solution method proposed by Farmer et al. (2006). Section 4 describes the estimation

algorithms. Section 5 presents the results for the benchmark model in which the behavior

of the Fed can switch between two Taylor rules. Section 6 displays impulse responses and

counterfactual exercises for the benchmark model. Section 7 considers alternative speci…ca-

tions that o¤er competing explanations for the source of the Great Moderation. Section 8

confronts the di¤erent models with the data computing the marginal data densities. Section

9 concludes.

2 Related literature

This paper is related to the growing literature that allows for parameter instability in micro-

founded models. Justiniano and Primiceri (2008) consider a DSGE model allowing for time

variation in the volatility of the structural innovations. Laforte (2005) models heteroskedas-

ticity in a DSGE model according to a Markov-switching process. Liu et al. (2007) test

empirical evidence of regime changes in the Federal Reserve’s in‡ation target. They also

allow for heteroskedastic shock disturbances. Along the same lines, Schorfheide (2005) es-

7

timates a dynamic stochastic general equilibrium model in which monetary policy follows

a nominal interest rate rule that is subject to regime switches in the target in‡ation rate.

Interestingly, he also considers the case in which agents use Bayesian updating to infer the

policy regime. Ireland (2007) also estimates a New Keynesian model in which Federal Re-

serve’s unobserved in‡ation target drifts over time. In a univariate framework, Castelnuovo

et al. (2008) combine a regime-switching Taylor rule with a time-varying policy target. They

…nd evidence in favor of regime shifts, time-variation of the in‡ation target, and a drop in

the in‡ation gap persistence when entering the Great Moderation period.

King (2007) proposes a method to estimate dynamic-equilibrium models subject to per-

manent shocks to the structural parameters. His approach does not require a model solution

or linearization. Time-varying structural parameters are treated as state variables that are

both exogenous and unobservable, and the model is estimated with particle …ltering. Davig

and Leeper (2006b) estimate Markov-switching Taylor and Fiscal rules, plugging them into

a calibrated DSGE model. The two rules are estimated in isolation (while here I estimate all

the parameters of the model jointly). Whereas Davig and Leeper (2006b) use the monotone

map method of Coleman (1991), the solution method employed in this paper is based on

the work of Farmer et al. (2006),. I shall postpone the discussion of the advantages and

disadvantages of the two approaches until section 3.5.

Finally, Bikbov (2008) estimates a structural VAR with restrictions imposed according to

an underlying New-Keynesian model with Markov-switching parameters. Regime changes are

identi…ed extracting information from the yield curve. The yield curve contains information

about expectations of future interest rates that in turn re‡ect the probabilities assigned to

di¤erent regimes. In this paper there is no attempt to attach an economic interpretation

to all parameters nor to conduct a rigorous investigation around the sources of the Great

Moderation through model comparison. The author is more interested in the e¤ects of regime

changes on the real economy and the nominal yield curve.

3 The Model

I consider a small size microfounded DSGE model resembling the one used by Lubik and

Schorfheide (2004). Details about the model can be found in appendix B.

8

3.1 General setting - Fixed parameters

Once log-linearized around the steady state, the model reduces to a system of three equations

(1)-(3), that, with equations (4) and (5), describe the evolution of the economy:

e

R

t

=

R

e

R

t1

+ (1

R

)(

1

e

t

+

2

ey

t

) +

R;t

(1)

e

t

= E

t

(e

t+1

) + (ey

t

z

t

) (2)

ey

t

= E

t

(ey

t+1

)

1

(

e

R

t

E

t

(e

t+1

)) + g

t

(3)

z

t

=

z

z

t1

+

z;t

(4)

g

t

=

g

g

t1

+

g;t

(5)

e

R

t

, ey

t

, and e

t

are respectively the monetary policy interest rate, output, and quarterly

in‡ation. The tilde denotes percentage deviations from a steady state or, in the case of

output, from a trend path. The process z

t

, captures exogenous shifts of the marginal costs of

production and can b e interpreted as a technology shock. Finally, the process g

t

summarizes

changes in preferences or a time-varying government spending.

In‡ation dynamics are described by the expectational Phillips curve (2) with slope .

Intuitively a boom, de…ned as a positive value for ey

t

; is in‡ationary only when it is not

supported by a (temporary) technology improvement (z

t

> 0):

The behavior of the monetary authority is described by equation (1). The central bank

responds to deviations of in‡ation and output from their respective target levels adjusting

the monetary policy interest rate. Unanticipated deviation from the systematic component

of the monetary policy rule are captured by

R;t

: Note that the Central Bank tries to stabilize

ey

t

, instead of ey

t

z

t

. Therefore, following a technology shock, a trade-o¤ arises: It is not

possible to keep in‡ation stable and at the same time have output close to the target.

Wo odford (2003) (chapter 6) shows that it is ‡uctuations in ey

t

z

t

rather than ey

t

that

are relevant for welfare. However, Woodford himself (Woodford (2003), chapter 4) points

out that there are reasons to doubt that the measure of output gap used in practice would

coincide with ey

t

z

t

. There are several measures of output gap and a Central Bank is likely to

look at all of them when making decisions. More importantly, the assumption that the Fed

responds to ey

t

z

t

is at odds with some recent contributions in the macro literature: Both

Primiceri (2006) and Orphanides (2002) show that during the ’70s there were important

misjudgments around the path of potential output. Admittedly, the ideal solution would

be to assume that the Fed faces a …ltering problem, perhaps along the lines of Boivin and

9

Giannoni (2008) and Svensson and Wo odford (2003). However, this approach would add a

substantial computational burden. Therefore, at this stage, the Taylor rule as speci…ed (1)

must be preferred.

Equation (3) is an intertemporal Euler equation describing the households’optimal choice

of consumption and bond holdings. Since the underlying model has no investment, output

is proportional to consumption up to the exogenous process g

t

. The parameter 0 < < 1 is

the households’discount factor and

1

> 0 can be interpreted as intertemporal substitution

elasticity.

The model can be solved using gensys.

3

The system of equations can be rewritten as:

0

S

t

=

1

S

t1

+ C +

t

+

t

where

S

t

=

h

ey

t

; e

t

;

e

R

t

; g

t

; z

t

; E

t

(ey

t+1

); E

t

(e

t+1

)

i

0

t

= [

R;t

;

g;t

;

z;t

]

0

t

N (0; Q) ; Q = diag

2

R

;

2

g

;

2

z

(6)

Let be the vector collecting all the parameters of the model:

=

; ;

1

;

2

;

r

;

g

;

z

; ln r

; ln

;

R

;

g

;

z

0

Gensys returns a …rst order VAR in the state variable:

S

t

= T ()S

t1

+ R()

t

(7)

The law of motion of the DSGE state vector can be combined with an observation equa-

tion:

y

t

= D() + ZS

t

+ v

t

(8)

v

t

N (0; U) ; U = diag

2

x

;

2

;

2

r

(9)

3

http://sims.princeton.edu/yftp/gensys/.

10

Y

t

=

2

6

4

x

t

ln P

t

ln R

A

t

3

7

5

D() =

2

6

4

0

ln

4(ln

+ ln r

)

3

7

5

Z =

2

6

4

1 0 0 0 0 0 0

0 1 0 0 0 0 0

0 0 4 0 0 0 0

3

7

5

where v

t

is a vector of observation errors and x

t

, ln P

t

, and ln R

A

t

represent respectively the

output gap, quarterly in‡ation, and the monetary policy interest rate.

4

Then the Kalman

…lter is used to evaluate the likelihood `

; M;

&

jY

T

.

3.2 Markov-switching Taylor rule

In this section I extend the model to allow for heteroskedasticity and switches in the parame-

ters describing the Taylor rule. This speci…cation is chosen as the benchmark case because

it nests the two alternative explanations of the Great Moderation. A change in the behavior

of the Fed is often regarded as the keystone to explain the Great Moderation, therefore the

model allows for two distinct Taylor rules. At the same time, the Good Luck argument

is captured by the Markov-switching volatilities. However, the solution method described

below holds true even when all structural parameters are allowed to switch.

As a …rst step partition the vector of parameters in three subvectors:

sp

,

ss

and

er

contain respectively the structural parameters, the steady state values and the standard

deviations of the shocks:

sp

=

; ;

1

;

2

;

r

;

g

;

z

0

ss

= [ln r

; ln

]

0

;

er

= [

r

;

g

;

z

]

0

Now suppose that the coe¢ cients of the Taylor rule describing the behavior of the Federal

Reserve can assume m

sp

di¤erent values:

e

R

t

=

R

(

sp

t

)

e

R

t1

+ (1

R

(

sp

t

))(

1

(

sp

t

) e

t

+

2

(

sp

t

) ey

t

) +

R;t

(10)

4

The time series are extracted from the Global Insight database. Output gap is measured as the percentage

deviations of real per capita GDP from a trend ob tained with the HP …lter. In‡ation is quarterly percentage

change of CPI (Urban, all items). Nominal interest rate is the average Federal Funds Rate in percent.

11

where

sp

t

is an unobserved state capturing the monetary policy regime.

Heteroskedasticity is modelled as an independent Markov-switching process. Therefore,

(6) becomes:

t

N (0; Q (

er

t

)) ; Q (

er

t

) = diag (

er

(

er

t

)) (11)

where

er

t

is an unobserved state that describes the evolution of the stochastic volatility

regime.

The unobserved states

sp

t

and

er

t

can take on a …nite number of values, j

sp

= 1; : : : ; m

sp

and j

er

= 1; : : : ; m

er

; and follow two independent Markov chains. Therefore the probability

of moving from one state to another is given by:

P [

sp

t

= ij

sp

t1

= j] = h

sp

ij

(12)

P [

er

t

= ij

er

t1

= j] = h

er

ij

(13)

The model is now described by (2)-(5), (10), (11), H

sp

= [h

sp

ij

] and H

er

= [h

er

ij

].

3.3 Solving the MS-DSGE model

The model with Markov-switching structural parameters is solved using the method proposed

by Farmer et al. (2006) (FWZ). The idea is to expand the state space of a Markov-switching

rational expectations model and to write an equivalent model with …xed parameters in

this expanded space. The authors consider the class of minimal state variable solutions

(McCallum (1983), MSV) to the expanded model and they prove that any MSV solution is

also a solution to the original Markov-switching rational expectations model. The class of

solutions considered by FWZ is large, but it is not exhaustive. The authors argue that MSV

solution is likely to be the most interesting class to study given that it is often stable under

real time learning (Evans and Honkapohja (2001), McCallum (2003)). They provide a set of

necessary and su¢ cient conditions for the existence of the MSV solution and show that the

MSV solution can be characterized as a vector-autoregression with regime switching, of the

kind studied by Hamilton (1989) and Sims and Zha (2006). This property of the solution

turns out to be extremely convenient when estimating the model.

In what follows I provide an outline of the solution method that should su¢ ce for those

readers interested in using the algorithm for applied work. Please refer to Farmer et al.

(2006) for further details.

12

The model described by equations (2)-(5), (10) and (11) can be rewritten as:

0

(

sp

t

)

2

6

4

0;1

(

sp

t

)

(nl)n

0;2

ln

3

7

5

S

t

n1

=

1

(

sp

t

)

2

6

4

1;1

(

sp

t

)

(nl)n

1;2

ln

3

7

5

S

t1

n1

+

(

sp

t

)

2

6

4

(

sp

t

)

(nl)k

0

lk

3

7

5

t

k1

+

2

4

0

(nl)n

ln

3

5

t

l1

(14)

where

sp

t

follows an m

sp

-state Markov chain,

sp

t

2 M

sp

f1; :::; m

sp

g, with stationary

transition matrix H

sp

, n is the number of endogenous variables (n = 7 in this case), k is

the number of exogenous shocks (k = 3), and l is the number of endogenous shocks (l = 2).

The fundamental equations of (14) are allowed to change across regimes but the parameters

de…ning the non-fundemental shocks do not depend on

sp

t

.

The …rst step consists in rewriting (14) as a …xed parameters system of equations in the

expanded state vector S

t

:

0

S

t

=

1

S

t1

+ u

t

+

t

(15)

where:

0

npnp

=

2

6

4

diag (a

1

(1) ; :::; a

1

(m

sp

))

a

2

; :::; a

2

3

7

5

(16)

1

npnp

=

2

6

4

[diag (b

1

(1) ; :::; b

1

(m

sp

))] (H

sp

I

n

)

b

2

; :::; b

2

0

3

7

5

(17)

npl

=

2

6

4

0

0

3

7

5

;

(m

sp

1)lnp

=

2

6

6

4

e

0

2

2

.

.

.

e

0

m

sp

m

sp

3

7

7

5

(18)

=

2

6

4

I

(nl)m

sp

diag ( (1) ; :::; (m

sp

))

0 0

0 0

3

7

5

S

t

=

2

6

6

4

(

sp

t

=1)

S

t

.

.

.

(

sp

t

=m

sp

)

S

t

3

7

7

5

13

where will be described later. The vector of shocks u

t

is de…ned as:

u

t

=

"

sp

t

e

sp

t1

(1

0

m

sp

I

n

) S

t1

e

sp

t

t

#

with

i

(nl)hnh

= (diag [b

1

(1) ; :::; b

1

(m

sp

)]) [(e

i

1

0

m

sp

H

sp

) I

n

]

The error term u

t

contains two types of shocks: the switching shocks and the normal

shocks. The normal shocks (e

sp

t

t

) carry the exogenous shocks that hit the structural

equations, while the switching shocks turn on or o¤ the appropriate blocks of the model to

represent the Markov-switching dynamics. Note that both shocks are zero in expectation.

De…nition 1 A stochastic process

S

t

;

t

1

t=1

is a solution to the model if:

1.

S

t

;

t

1

t=1

jointly satisfy equation (14)

2. The endogenous stochastic process f

t

g satis…es the property E

t1

f

t

g = 0

3. S

t

is bounded in expectation in the sense that

E

t

S

t+s

< M

t

for all s > 0

As mentioned above, FWZ focus on MSV solutions. They prove the equivalence be-

tween the MSV solution to the original model and the MSV solution to the expanded …xed

coe¢ cient model (15).

The matrix plays a key role. De…nition 1 requires boundness of the stochastic process

in solving the model. To accomplish this the solution of the expanded system is required to

lie in the stable linear subspace. This is accomplished by de…ning a matrix Z such that

Z

0

S

t

= 0 (19)

To understand how the matrix Z and are related, consider the impact of di¤erent

regimes. Supposing regime 1 occurs, the third block of (15) imposes a series of zero restric-

tions on the variables referring to regimes i = 2:::m

sp

. These restrictions, combined with the

ones arising from the …rst block of equations, set the correspondent element of S

t

to zero.

If regime i = 2:::m

sp

occurs, we would like a similar block of zero restrictions imposed on

regime 1. Here I describe the de…nition of such that, using (19), it is possible to accomplish

the desired result :

14

Algorithm 2 Start with a set of matrices

0

i

m

sp

i=2

and construct

0

. Next compute the

QZ decomposition of fA

0

; Bg: Q

0

T

0

Z

0

= B and Q

0

S

0

Z

0

= A

0

. Reorder the triangular

matrices S = (s

i;j

) and T = (t

i;j

) in such a way that t

i;i

=s

i;i

is in are in increasing order.

Let q 2 f1; 2:::; m

sp

g be the integer such that t

i;i

=s

i;i

< 1 if i q and t

i;i

=s

i;i

> 1 if i > q. Let

Z

u

be the last np q rows of Z. Partition Z

u

as Z

u

= [z

1

; :::; z

m

sp

] and set

1

i

= z

1

i

. Repeat

the procedure until convergence.

If convergence occurs the solution to (15) is also a solution to (14) and it can be written

as a VAR with time dependent coe¢ cients:

S

t

= T (

sp

t

;

sp

; H

m

) S

t1

+ R (

sp

t

;

sp

; H

m

)

t

(20)

Note that the law of motion of the DSGE states depends on the structural parameters

(

sp

), the regime in place (

sp

t

), and the transition matrix used by agents in the model (H

m

).

This does not necessarily coincide with the objective transition matrix that is observed ex-

post by the econometrician (H

sp

). From now on, a more compact notation will be used:

T (

sp

t

) = T (

sp

t

;

sp

; H

m

)

R (

sp

t

) = R (

sp

t

;

sp

; H

m

)

3.4 Alternative solution methods

The solution method described in the previous section is not the only one available. Davig

and Leeper (2006b) and Davig et al. (2007) consider models that are more general than the

linear-in-variables model that are considered here and, in certain special cases, they can be

solved explicitly. Their solution method makes use of the monotone map method, based on

Coleman (1991). The algorithm requires a discretized state space and a set of initial decision

rules that reduce the model to a set of nonlinear expectational …rst-order di¤erence equations.

A solution consists of a set of functions that map the minimum set of state variables into

values for the endogenous variables. This solution method is appealing to the extent that is

well suited for a larger class of models, but it su¤ers from a clear computational burden. This

makes the algorithm impractical when the estimation strategy requires solving the model

several times, as is the case in this paper. Furthermore, at this stage local uniqueness of a

solution must be proved perturbing the equilibrium decision rules.

Another solution algorithm for a large class of linear-in-variables regime-switching mod-

15

els is provided by Svensson and Williams (2007). This method returns the same solution

obtained with the FWZ algorithm when the equilibrium is unique. However, Svensson and

Williams (2007) do not provide conditions for uniqueness. Therefore, the algorithm can

converge to a unique solution, to one of a set of indeterminate solutions, or even to an

unbounded stochastic di¤erence equation that does not satisfy the transversality conditions.

Bikbov (2008) generalizes a method proposed by Moreno and Cho (2005) for …xed coe¢ -

cient New-Keynesian models, to the case of regime switching dynamics. The method returns

a solution in the form of a MS-VAR, as in FWZ. However, this is the only similarity between

the two approaches. In Bikbov (2008) there is no need to write an equivalent model in the

expanded state space: The solution is achieved by working directly on the original model

through an iteration procedure. For the …xed coe¢ cient case, Moreno and Cho (2005) report

that, in the case of a unique stationary solution, their method delivers the same solution as

obtained with the QZ decomposition method. If the rational expectations solution is not

unique the method yields the minimum state variable solution. Unfortunately, it is not clear

if a similar argument applies to the case with Markov-switching dynamics and how to check

if a unique stationary equilibrium exists. Furthermore, the algorithm imposes a "no-bubble

condition" that, to the best of my knowledge, must be veri…ed by simulation.

To summarize, the method of FWZ is preferred to the methods presented above for two

reasons. First, it is computationally e¢ cient: Usually the algorithm converges very quickly.

Second, it provides the conditions necessary to establish existence and boundness of the

minimum state variable solution. Obviously, uniqueness of the MSV solution does not imply

uniqueness in a larger class of solutions. However, the problem of indeterminacy/determinacy

in a MS-DSGE model is a very complicated one and, as far as I know, it has not yet been

solved. Davig and Leeper (2007) make a step in this direction, but, as shown by Farmer

et al. (2008), the generalization of the Taylor principle that they propose rules out only a

subset of indeterminate equilibria.

5

4 Estimation strategies

The solution method of FWZ returns the VAR with time dependent coe¢ cients (20). This

can be combined with the system of observation equations (8). The result is once again a

5

Davig and Leeper (2007) re-write the original model in an expanded state space and they provide

conditions for this model to have a unique solution. However, there are solutions of the original system that

do n ot solve the expanded model. Therefore, determinacy of the expanded model turns out to be only a

necessary condition for determinacy of the original system.

16

model cast in state space form:

y

t

= D(

ss

) + ZS

t

+ v

t

(21)

S

t

= T (

sp

t

) S

t1

+ R (

sp

t

)

t

(22)

t

N (0; Q (

er

t

)) ; Q (

er

t

) = diag (

er

(

er

t

)) (23)

v

t

N (0; U) ; U = diag

2

x

;

2

;

2

R

(24)

H

sp

(; i) D(a

sp

ii

; a

sp

ij

); H

er

(; i) D(a

er

ii

; a

er

ij

) (25)

For a DSGE model with …xed parameters the likelihood can be easily evaluated using

the Kalman …lter and then combined with a prior distribution for the parameters. When

dealing with a MS-DSGE model the Kalman …lter cannot be applied in its standard form.

Given an observation for Y

t

; the estimate of the underlying DSGE state vector S

t

is not

unique. At the same time, the Hamilton …lter, that is usually used to evaluate the likelihood

of Markov-switching models, cannot be applied because it relies on the assumption that

Markov states are history independent. This does not occur here: Given that we do not

observe S

t

, the probability assigned to a particular Markov state depends on the value of

S

t1

, whose distribution depends on the realization of

sp;t1

.

6

Note that if we could observe

sp;T

and

er;T

, then it would be straightforward to apply the

Kalman …lter because given Y

t

it would be possible to unequivocally up date the distribution

of S

t

. In the same way, if S

T

were observable, then the Hamilton …lter could be applied to

the MSVAR described by (22), (23) and (25). These considerations suggest that it is possible

to sample from the posterior using a Gibbs sampling algorithm. This algorithm is described

in section 4.1.

Because the posterior density function is very non-Gaussian and complicated in shape, it

is extremely important to …nd the posterior mode. The estimate at the mode represents the

most likely value and also serves as a crucial starting point for initializing di¤erent chains of

MCMC draws.

The standard method to approximate the posterior is based on Kim’s approximate eval-

uation of the likelihood (Kim and Nelson (1999)) and relies on an approximation of the

DSGE state vector distribution. This algorithm is illustrated in section 4.2.1. In section

4.2.2 I propose an alternative method to evaluate the likelihood: Instead of approximating

the DSGE state vector distribution, I keep track of a limited number of alternative paths for

6

Here and later on

sp;t1

stands for f

sp

s

g

t1

s=1

.

17

the Markov-switching states. Each of them is associated with a speci…c distribution for the

DSGE states. Paths that are unlikely are trimmed or approximated with Kim’s algorithm.

In the latter case, the trimming approximation is, by de…nition, more accurate. This ap-

proximation requires a larger computational burden, but might be more appropriate when

dealing with switches in the structural parameters of a DSGE model since the laws of motion

can vary quite a lot across regimes.

A detailed description of the prior distributions and the sampling method is given in

appendix A. Readers that are not interested into the technical details of the estimation

strategies might want to skip the following two sections (4.1 and 4.2).

4.1 Gibbs sampling algorithm

Here I summarize the basic algorithm which involves the following steps:

At the beginning of iteration n we have:

sp

n1

;

ss

n1

;

er

n1

; S

T

n1

;

sp;T

n1

;

er;T

n1

; H

m

n1

; H

sp

n1

;

and H

er

n1

:

1. Given S

T

n1

, H

sp

n1

and H

er

n1

, (22), (23) and (25) form a MSVAR. Use the Hamilton

…lter to get a …ltered estimate of the MS states and the then use the backward drawing

method to get

sp;T

n

and

er;T

n

.

2. Given

sp;T

n

and

er;T

n

, draw H

sp

n

and H

er

n

according to a Dirichlet distribution.

3. Conditional on

sp;T

n

and

er;T

n

, the likelihood of the state space form model (21)-(24)

can be evaluated using the Kalman …lter. Draw

e

H

sp;m

; #

sp

, #

ss

, and #

er

from the

proposal distributions. The proposal parameters are accepted or rejected according

to a Metropolis-Hastings algorithm. The new set of parameters are accepted with

probability min f1; rg where

r =

`

#

sp

; #

er

; #

ss

;

e

H

m

jY

T

;

sp;T

n1

;

er;T

n1

; ::

p

#

sp

; #

er

; #

ss

;

e

H

m

`

sp

n1

;

ss

n1

;

er

n1

; H

m

n1

jY

T

;

sp;T

n1

;

er;T

n1

; ::

p

sp

n1

;

er

n1

;

er

n1

; H

m

n1

This step also returns …ltered estimates of the DSGE states:

e

S

T

n

.

4. Draw S

T

n

: Start drawing the last DSGE state S

T;n

from the terminal density p

S

T;n

jY

T

; :::

and then use a backward recursion to draw p

S

t;n

jS

t+1;n

; Y

T

; :::

.

18

5. If n < n

sim

, go back to 1, otherwise stop, where n

sim

is the desired number of iterations.

In the algorithm described above no approximation of the likelihood is required, given

that the DSGE parameters are drawn conditional on the Markov-switching states. If agents

in the model know the transition matrix observed ex-post by the econometrician (i.e. H

sp

=

H

m

= H

sp;m

), step 4 needs to be modi…ed to take into account that a change in the transition

matrix also implies a change in the law of motion of the DSGE states. In this case, I employ

a Metropolis-Hastings step in which the DSGE states are regarded as observed variables.

Please refer to appendix A for further details.

4.2 Approximation of the Likelihood

This section contains a description of the two algorithms used to approximate the likelihood

when maximizing the posterior mode and computing the marginal data density.

4.2.1 Kim’s approximation

In this section I describe Kim’s approximation of the likelihood (Kim and Nelson (1999)).

Consider the model described by (21)-(25). Combine the MS states of the structural para-

meters and of the heteroskedastic shocks in a unique chain,

t

.

t

can assume m di¤erent

values, with m = m

sp

m

er

, and evolves according to the transition matrix H = H

sp

H

er

.

For a given set of parameters, and some assumptions about the initial DSGE state variables

and MS latent variables, we can recursively run the following …lter:

S

(i;j)

tjt1

= T

j

S

i

t1jt1

T

j

= T (

t

= j)

P

(i;j)

tjt1

= T

j

P

i

t1jt1

T

0

j

+ R

j

Q

j

R

0

j

Q

j

= Q (

t

= j) ; R

j

= R (

t

= j)

e

(i;j)

tjt1

= y

t

D ZS

(i;j)

tjt1

f

(i;j)

tjt1

= ZP

(i;j)

tjt1

Z

0

+ U

19

S

(i;j)

tjt

= S

(i;j)

tjt1

+ P

(i;j)

tjt1

Z

0

f

(i;j)

tjt1

1

e

(i;j)

tjt1

P

(i;j)

tjt

= P

(i;j)

tjt1

P

(i;j)

tjt1

Z

0

f

(i;j)

tjt1

1

Ze

(i;j)

tjt1

At end of each iteration the M M elements of S

(i;j)

tjt

and P

(i;j)

tjt

are collapsed into M

elements which are represented by S

j

tjt

and P

j

tjt

:

S

j

tjt

=

P

M

i=1

Pr

t1

= i;

t

= jjY

t

S

(i;j)

tjt

Pr [

t

= jjY

t

]

P

j

tjt

=

P

M

i=1

Pr

t1

= i;

t

= jjY

t

P

(i;j)

tjt

+

S

j

tjt

S

(i;j)

tjt

S

j

tjt

S

(i;j)

tjt

0

Pr [

t

= jjY

t

]

Finally, the likelihood density of observation y

t

is given by:

` (y

t

jY

t1

) =

m

X

j=1

m

X

i=1

f

y

t

j

t1

= i;

t

= j; Y

t1

Pr

t1

= i;

t

= jjY

t

f

y

t

j

t1

= i;

t

= j; Y

t1

= (2)

N=2

jf

(i;j)

tjt1

j

1=2

exp

1

2

e

(i;j)0

tjt1

f

(i;j)

tjt1

e

(i;j)

tjt1

4.2.2 Trimming approximation

This section proposes an alternative algorithm to approximate the likelihood of a MS-DSGE

model. This approach is computationally more intensive, but returns a better approximation

of the likelihood, especially when dealing with structural breaks. The idea is to keep track

of a limited number of alternative paths for the Markov-switching states. Paths that have

been assigned a low probability are trimmed or approximated using Kim’s algorithm.

Combine

sp

t

and

er

t

to obtain

t

.

t

can assume all values from 1 to m, where m =

m

sp

m

er

, and it evolves according to the transition matrix H = H

sp

H

er

. Suppose

the algorithm has reached time t. From previous steps, we have a ((t 1) l

t1

) matrix

L containing the l

t1

retained paths, a vector L

p

collecting the probabilities assigned to

the di¤erent paths, and a (n l

t1

) matrix L

S

and a (n n l

t1

) matrix L

P

containing

respectively means and covariance matrices of the DSGE state vector corresponding to each

of the l

t1

paths.

The goal is to approximate the likelihood for time t, ` (y

t

jY

t1

) for a given a set of

20

parameters:

1. 8 i = 1:::l

t1

, 8 j = 1:::m, compute a one-step-ahaed Kalman …lter with S

i

t1jt1

=

L

s

(:; i) and P

i

t1jt1

= L

P

(:; :; i). This will return f

y

t

j

t1

= i;

t

= j; Y

t1

, i.e. the

probability of observing y

t

given history i and

t

= j. At the end of this step we will

have a total of l

t1

m possible histories that are stored in L

0

. 8 i and 8 j save

e

S

(i;j)

tjt

and

e

P

(i;j)

tjt

and store them in L

0

S

and L

0

P

.

2. Compute the ex-ante probabilities for each of the l

t1

m possible paths using the

transition matrix H:

p

tjt1

(j; i) = p

t1jt1

(i) H (j; i)

p

t1jt1

(i) = L

p

(i)

3. Compute the likelihood density of observation y

t

as a weighted average of the condi-

tional likelihoo ds:

f (y

t

jY

t1

) =

m

X

j=1

l

t

X

i=1

p

tjt1

(j; i) f

y

t

j

t1

= i;

t

= j; Y

t1

4. Update the probabilities for the di¤erent paths:

ep

tjt

(i

0

) =

p

tjt1

(j; i) f

y

t

j

t1

= i;

t

= j; Y

t1

f (y

t

jY

t1

)

i

0

= 1:::l

t1

m

and store them in L

0

p

:

5. Reorder L

0

p

in decreasing order and rearrange L

0

S

, L

0

P

and L

0

accordingly. Retain l

t

of

the possible paths where l

t

= min fB; lg, where B is an arbitrary integer and l > 0 is

such that

l

X

i

0

=1

ep

tjt

(i

0

) tr

where tr > 0 is an arbitrary threshold (for example: B = 100, tr = 0:99). Update the

21

matrices L

P

, L

S

, and L:

L

P

= L

0

P

(:; :; 1 : l

t

)

L

S

= L

0

S

(:; 1 : l

t

)

L = L

0

(:; 1 : l

t

)

6. Rescale the probabilities of the retained paths and update L

p

:

L

p

(i) = p

tjt

(i) =

ep

tjt

(i)

P

l

t

j=1

ep

tjt

(j)

; i = 1:::l

t

Note that Kim’s approximation can be applied to the trimmed paths. In this case, the

algorithm explicitly keeps track of those paths that turn out to have the largest probability,

whereas all the others are approximated.

5 The Benchmark Model

The benchmark model allows for both explanations of the Great Moderation: Good Policy

and Good Luck. The structural parameters of the Taylor Rule are allowed to change across

regimes, while all the other structural parameters are kept constant. The model also allows

for heteroskedastic shocks. Taylor rule parameters and heteroskedastic shocks evolve accord-

ing to two independent chains

sp

t

and

er

t

. The transition matrix that enters the model and

is used by agents to form expectations, H

m

, is assumed to coincide with the one observed

by the econometrician, H

sp

.

5.1 Parameters estimates and regime probabilities

Table 1 reports means and 90% error bands for the DSGE parameters and the transition

matrices. Concerning the parameters of the Taylor rule, we …nd that under regime 1 (

sp

t

= 1)

the Federal Funds Rate reacts strongly to deviations of in‡ation from its target, while output

gap does not seem to be a major concern. The opposite occurs under regime 2. The degree

of interest rate smoothing turns out to be similar across regimes. For obvious reasons, I shall

refer to regime 1 as the Hawk regime, while regime 2 will b e the Dove regime. Interestingly

enough, if the two regimes were taken in isolation and embedded in a …xed coe¢ cient DSGE

model, only the former would imply determinacy.

22

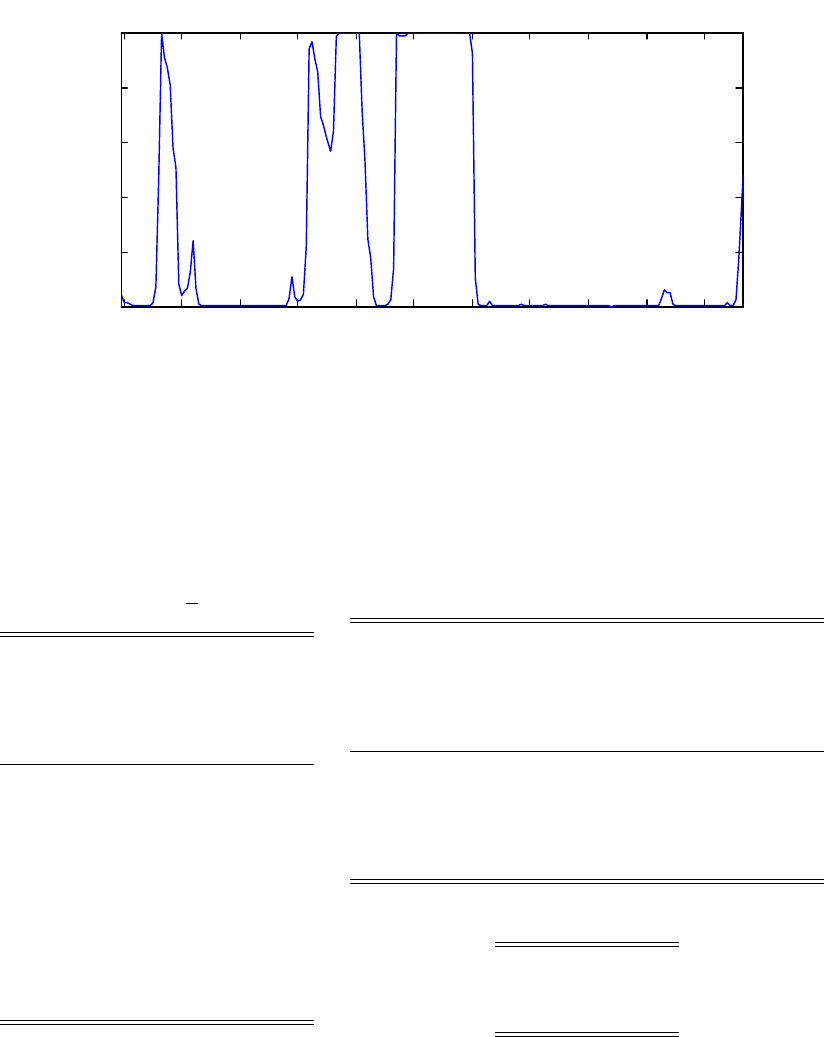

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

0.2

0.4

0.6

0.8

Structural parameters - prob regime 1

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

0.2

0.4

0.6

0.8

Stochastic volatilities - prob regime 1

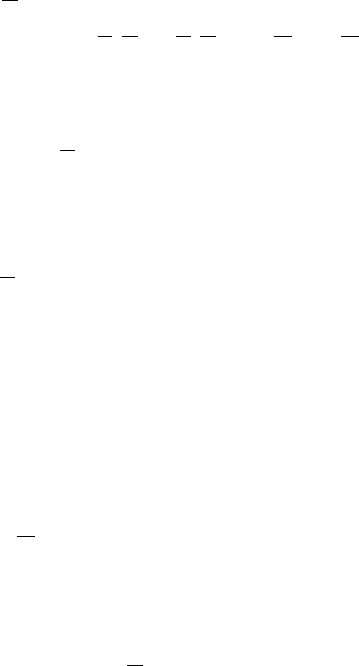

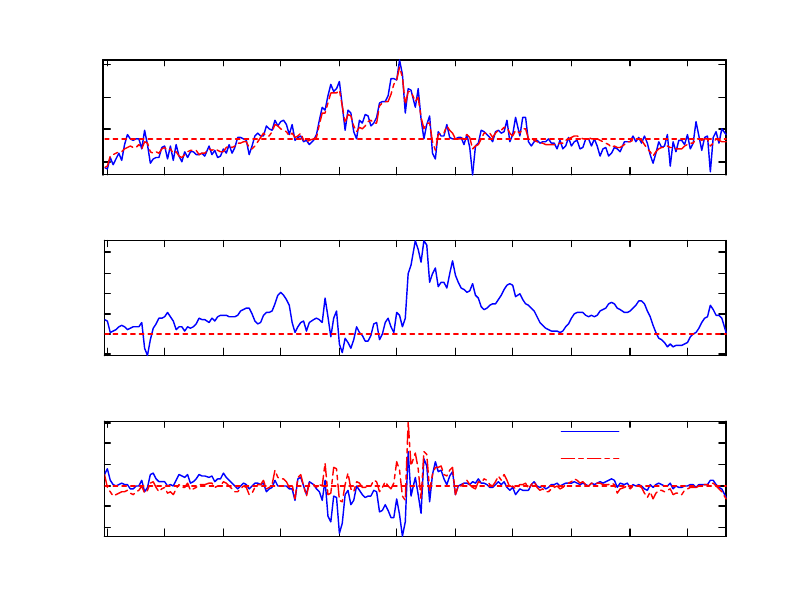

Figure 2: MSDSGE model, posterior mode estimates. Top panel, probability of regime 1

for the structural parameters, the Hawk regime; lower panel, probability of regime 1 for the

stochastic volatilities, high volatility regime.

Parameter

sp

t

= 1

sp

t

= 2

1

2:0651

(1:4054;2:6225)

0:6451

(0:4258;0:9189)

2

0:3212

(0:1744;0:5145)

0:2795

(0:1545;0:4188)

R

0:7919

(0:7296;0:8506)

0:7625

(0:6659;0:8375)

2:9227

(2:1497;3:8294)

0:0288

(0:0198;0:0374)

g

0:8359

(0:7962;0:8788)

z

0:8804

(0:8456;0:9182)

r

0:4552

(0:3459;0:5397)

0:8117

(0:6874;0:9374)

Parameter

er

= 1

er

= 2

R

0:3134

(0:2494;0:3872)

0:0763

(0:0623;0:0928)

g

0:3569

(0:2841;0:4532)

0:1494

(0:1156;0:1793)

z

1:9948

(1:3778;2:7163)

0:6292

(0:4563;0:8143)

y

0:0723

(0:0316;0:1526)

p

0:2968

(0:2632;0:3322)

r

0:0289

(0:0155;0:0470)

diag (H

sp

) diag (H

er

)

0:9254

(0:8237;0:9851)

0:8958

(0:8152;0:9564)

0:9162

(0:8322;0:9716)

0:9538

(0:9190;0:9802)

Table 1: Means and 90 percent error bands of the DSGE and transition matrix parameters

23

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

0

5

10

15

Annualized quarterly Inflation

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

-2

0

2

4

6

8

Real FFR

1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005

-4

-2

0

2

4

6

Deviations of the FFR from TR values

DReg 1

DReg 2

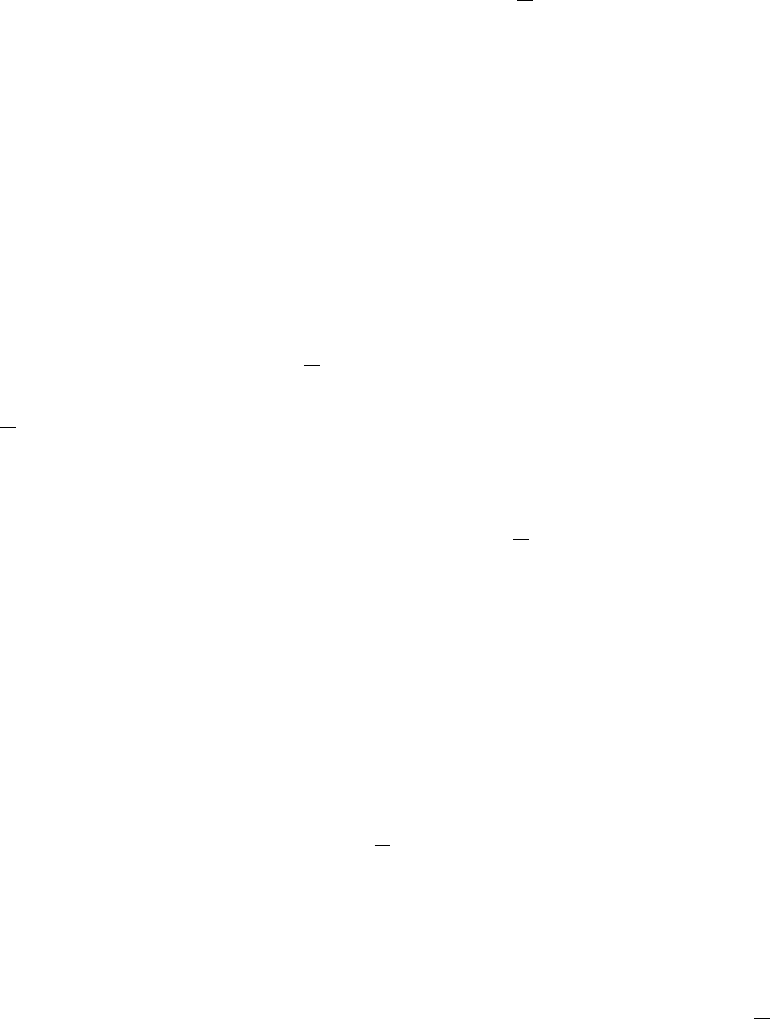

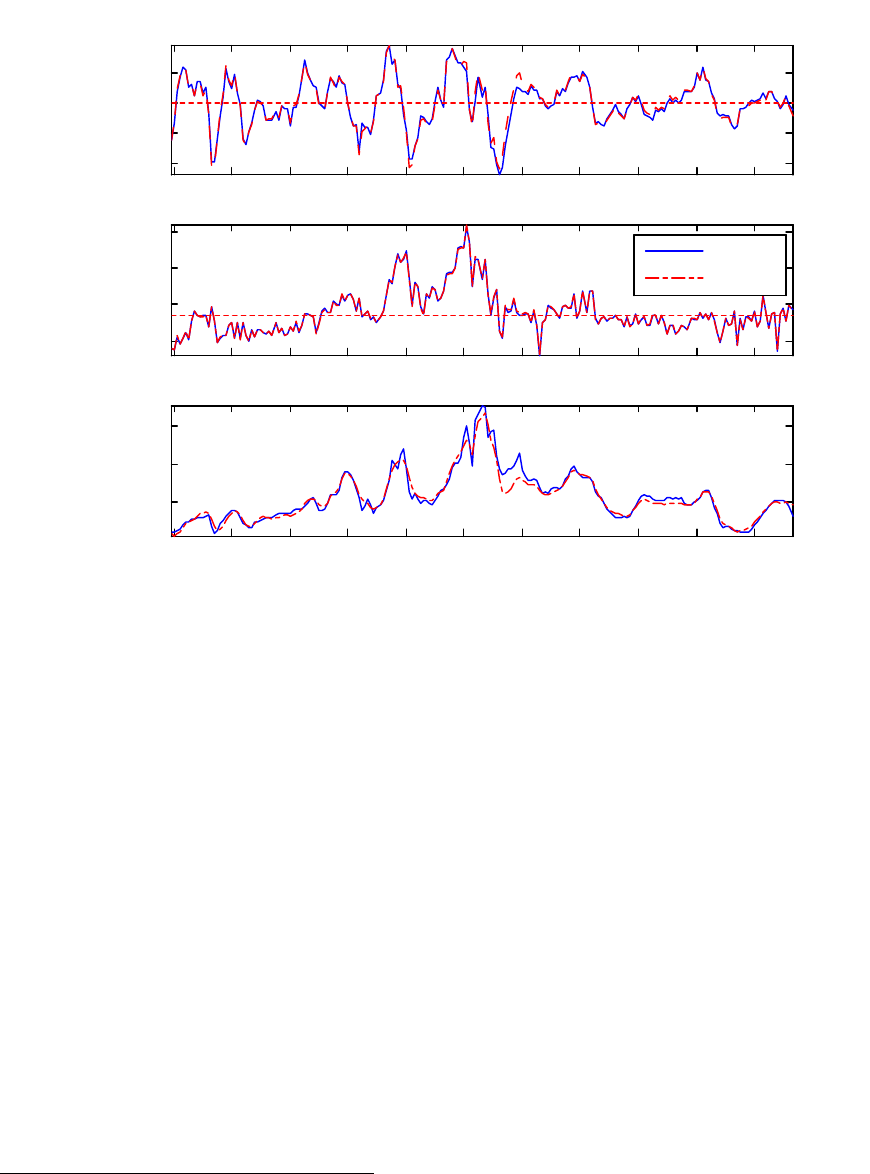

Figure 3: The top panel reports annualized quaterly in‡ation (observed and …ltered) and

the in‡ation target. The second panel contains the real FFR as implied by the model. The

last panel displays the di¤erences between the observed FFR and the ones implied by the

two alternative Taylor rules. Note how in the ’60s the interest rate was too high compared

to the one that would have prevailed if the Hawk regime had b een in place, while in the ’70s

the Hawk regime would have required a much higher interest rate.

The point estimate of the in‡ation target is 0.8117, implying a target for annual in‡ation

around 3:25%. The top panel of …gure 3 displays the series of quarterly annualized in‡a-

tion and the corresponding target/steady state value. There are some notable deviations,

especially during the ’60s and the ’70s.

As for the other parameters, I regard the low value of the slope of the Phillips curve

( = 0:0288) as particularly relevant, since such a small value implies a very high sacri…ce

ratio. In other words, in order to bring in‡ation down the Federal Reserve needs to generate

a severe recession.

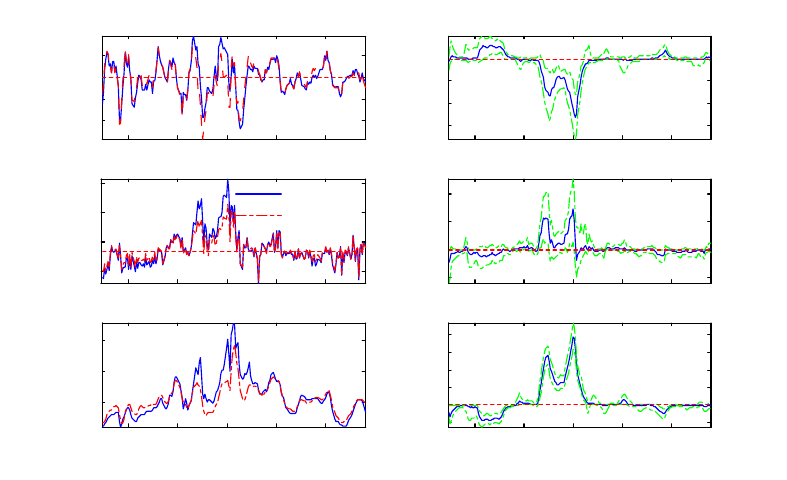

Figure 2 shows the (smoothed) probabilities assigned to

sp

t

= 1 (top panel) and

er

t

= 1

(lower panel). Confronting these probabilities with narrative accounts of monetary policy

24

history is a way to understand how reasonable the results are. However, before proceeding,

a caveat is in order. In interpreting the probabilities assigned to the two regimes the reader

should take into account how these are related to the estimate of the in‡ation target. In

other words, a high probability assigned to the Dove regime does not automatically imply a

loose monetary policy, but only that the Fed is being relatively unresponsive to deviations

of in‡ation from the target. To facilitate the interpretation of the results, the third panel

of …gure 3 reports the di¤erence between the observed Federal Funds rate and the interest

rate that would be implied by the two Taylor rules. A large positive di¤erence between the

observed interest rate and its counterfactual value under regime 1 (DReg 1), implies that

the Fed is responding very strongly to in‡ation deviations, even under the assumption that

the Hawk regime is in place. On the other hand, a large negative value of this same variable

suggests that the Fed is not active enough.

Monetary policy turns out to be active during the early years of the sample, from 1955 to

1958, and with high probability during the following three years. Romer and Romer (2002)

provide narrative evidence in favor of the idea that the stance of the Fed toward in‡ation

during this period was substantially similar to that of the 90s. They also show that a

Taylor rule estimated over the sample 1952:1-1958:4 would imply determinacy. Furthermore,

after the presidential election of 1960, Richard Nixon blamed his defeat on excessively tight

monetary policy implemented by the Fed. At that time, Fed chairman Martin had clear

in mind that the goal of the Fed was "to take away the punch bowl just as the party gets

going", i.e. to raise interest rates in response to an overheated economy.

Over the period 1961-1965 the Dove regime was the rule. This should not be interpreted

as evidence of a lack of commitment to low in‡ation. In fact, the truth is exactly the

opposite. The Dove regime prevails because, given the target for in‡ation, the Hawk regime

would require lowering the FFR. The Hawk regime regains the lead over the last …ve years

of Martin’s chairmanship.

On February 1970, Arthur F. Burns was appointed chairman by Richard Nixon. Burns

is often regarded as responsible for the high and variable in‡ation that prevailed during the

’70s. It is commonly accepted that on several occasions he had to succumb to the requests

of the White House. In fact, for almost the entire duration of his mandate, the Fed followed

a passive Taylor rule. During these years, the Hawk regime would have required a much

higher monetary policy interest rate.

7

7

Here the use of the words active and passive follows Leeper (1991). Monetary policy is active when the

interest rate is highly responsive to in‡ation.

25

This long period of passive monetary policy ended in 1980, shortly after Paul Volcker

took o¢ ce in August 1979. Volcker was appointed with the precise goal of ending the

high in‡ation. The high probability of the Hawk regime during these years con…rms the

widespread belief that he delivered on his commitment.

The middle panel of …gure 3 contains the pattern of real interest rates as implied by the

model (computed as R

t

4 E

t

(

t+1

)). During Burns’chairmanship real interest rates were

negative or very close to zero, whereas, right after the appointment of Volcker, they suddenly

increased to unprecedented high values. During the following years, in‡ation started moving

down and the economy experienced a deep recession, while the Fed was still keeping the

FFR high. Note that the probability of the Dove regime from zero becomes slightly positive,

implying that, given the target for in‡ation, a lower FFR would have been desirable. In

other words, there is a non-zero probability, that Volcker set the FFR in a manner less

responsive to changes in in‡ation: Regardless of in‡ation being on a downward sloping path

and a severe recession, monetary policy was still remarkably tight.

For the remainder of the sample the Hawk regime has been the rule with a couple of

important exceptions. The …rst one occurred during the 1991 recession. In this case there

is no uncertainty regarding how the high probability assigned to the Dove regime should be

interpreted. On the other hand, the relatively high values for the probability of the Dove

regime during the second half of the 90s and toward the end of sample point toward a FFR

too high compared to what would be implied by the Hawk regime.

These results strongly support the idea that the appointment of Volcker marked a change

in Fed’s in‡ation stance and that the ’70s were characterized by a passive monetary policy

regime. At the same time, they question the wide spread-belief that US monetary policy

history can be described in terms of a permanent and one-time-only regime change: pre- and

post-Volcker. While a single regime prevails constantly during the chairmanships of Burns

and Volcker, the same cannot be said for the remainder of the sample.

Up to this point nothing has been said about the Good Luck hypothesis. Looking at the

second panel of …gure 2, it emerges that regime 1, characterized by large volatilities for all

shocks, prevails for a long period that go es from the early ’70s to 1985, with a break between

the two oil crises. This result is quite informative because 1984 is regarded as a turning

point in US economic history. There are two alternative ways to interpret this …nding. On

the one hand, even if a regime change occurred well before 1984, perhaps the conquest of

American in‡ation was actually determined by a break in the uncertainty characterizing

the macroeconomy. On the other hand, this same break might have occurred in response

26

to the renewed commitment of the Federal Reserve to a low and stable in‡ation. Both

interpretations require that the uncertainty characterizing the economy and the behavior of

the Fed are likely to be interdependent. Just as the Great In‡ation was characterized by high

volatilities and loose monetary policy, in a similar vein the Great Moderation emerged after

a reduction in the volatilities of the structural shocks and a drastic change in the conduct of

monetary policy.

Quite interestingly the probability of the high volatility regime rises again at the end of

the sample. To interpret this result, it might be useful to take a closer look at the third panel

of …gure 3. It cannot go unnoticed that in recent times both the Hawk and the Dove regime

would have required higher interest rates, implying that monetary policy has been relatively

loose.

8

This is not surprising, given that the Fed is currently dealing with a deep …nancial

crisis. However, should the Fed continue to deviate from standard monetary practice for a

long period of time, it would be fair to expect revisions in agents’beliefs.

5.2 Impulse response analysis

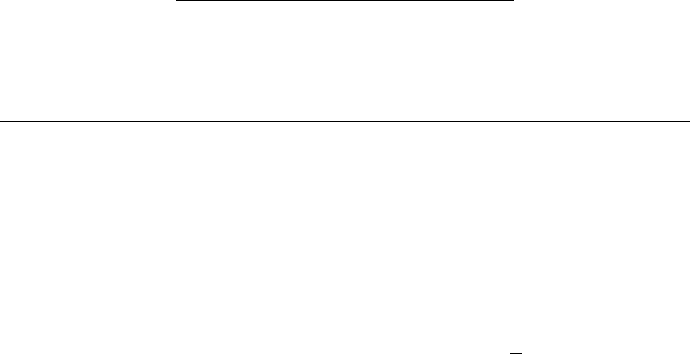

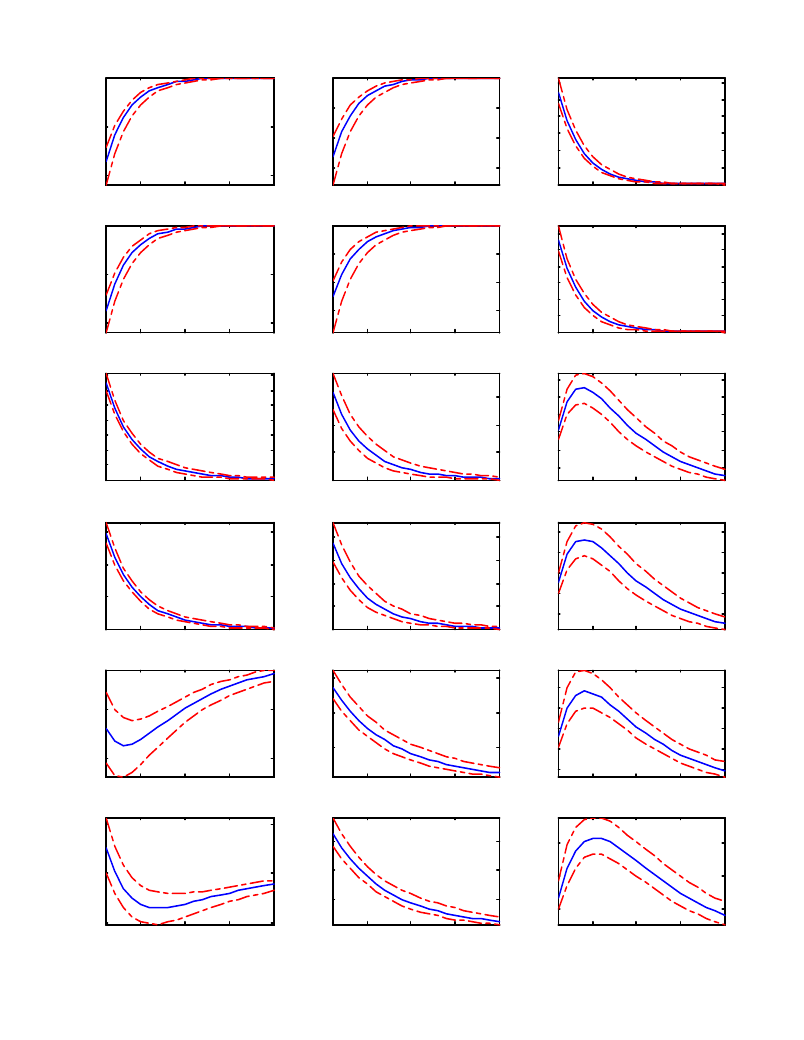

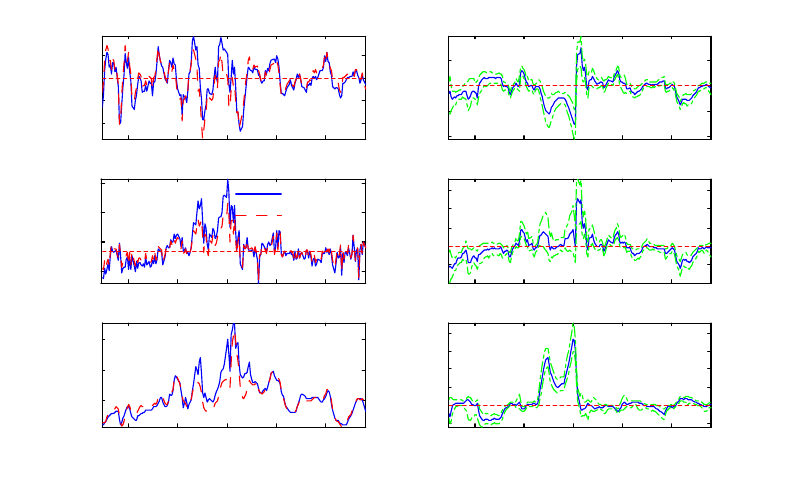

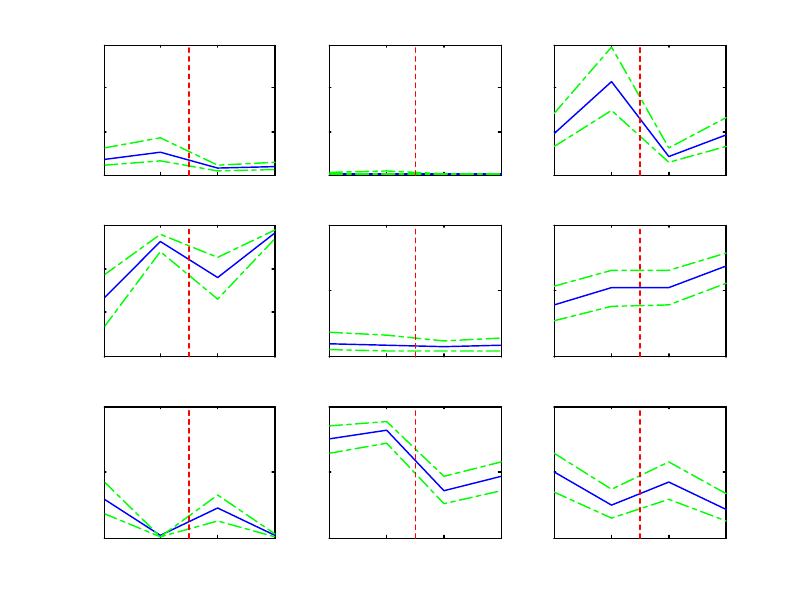

The …rst two rows of …gure 4 show respectively the impulse responses to a monetary policy

shock under the Hawk and Dove regimes. The initial shock is equal to the standard deviation

of the monetary policy shock under regime 1, the high volatility regime. Both in‡ation and

output decrease following an increase in the FFR. The responses are remarkably similar

across the two regimes.

The third and the fourth rows illustrate the impulse responses to a demand shock. Output

and in‡ation increase under both regimes but their responses are stronger under the Dove

regime. This is consistent with the response of the Federal Funds rate that is larger under

the Hawk regime, both on impact and over time. Note that the dynamics of the variables are

otherwise similar across the two regimes. The Fed does not face any trade-o¤ when deciding

how to respond to a demand shock, therefore, the only di¤erence lies in the magnitude of

the response.

Finally, the last two rows contain the impulse responses to an adverse supply shock, i.e.

to an unexpected decrease in z

t

. This last set of results is particularly interesting given

that, as several economists would agree, one of the causes of the high in‡ation of the ’70s

was a series of unfavorable supply-side shocks. The behavior of the Federal Reserve di¤ers

substantially across the two regimes. Under the Hawk regime the Fed is willing to accept

8

This pattern is even more evident using the latest data.

27

5 10 15 20

-0.4

-0.2

R - Hawk

y

5 10 15 20

-0.4

-0.2

R - Dove

5 10 15 20

-0.15

-0.1

-0.05

p

5 10 15 20

-0.15

-0.1

-0.05

5 10 15 20

0.2

0.4

0.6

0.8

1

1.2

R

5 10 15 20

0.2

0.4

0.6

0.8

1

1.2

5 10 15 20

0.2

0.4

0.6

0.8

1

1.2

1.4

g - Hawk

5 10 15 20

0.5

1

1.5

g - Dove

5 10 15 20

0.2

0.4

0.6

5 10 15 20

0.2

0.4

0.6

0.8

5 10 15 20

0.2

0.4

0.6

0.8

1

1.2

5 10 15 20

0.2

0.4

0.6

0.8

1

5 10 15 20

-0.4

-0.2

z - Hawk

5 10 15 20

-0.2

0

0.2

z - Dove

5 10 15 20

0.5

1

1.5

5 10 15 20

0.5

1

1.5

5 10 15 20

0.2

0.4

0.6

0.8

1

5 10 15 20

0.2

0.4

0.6

Figure 4: Impulse response functions. The graph can b e divided in three blocks of two rows

each. The three blocks display respectively the impulse responses to a monetary policy shock

(R), a demand shock (g), and an adverse technology shock (z). For each block, the …rst row

shows the response of output gap, annualized quarterly in‡ation, and the FFR under the

Hawk regime, whereas the second one assumes that the Dove regime is in place.

28

a recession in order to contrast in‡ation. The Federal Funds rate reacts strongly on impact

and it keeps rising for one year. On the contrary, under the Dove regime the response of the

policy rate is much weaker because the Fed tries to keep the output gap around zero, at the

cost of higher in‡ation. Note that on impact the economy experiences a boom: the increase

in expected in‡ation determines a negative real interest rate that boosts the economy in the

short run.

Three considerations are in order. First, it is quite evident that the gains in terms of

lower in‡ation achieved under the Hawk regime are modest. This can be explained in light

of the low value of , the slope of the Phillips curve. Second, under the Dove regime the

Fed is not able to avoid a recession, but the recession turns out to be signi…cantly milder.

Third, it is commonly accepted that the ’70s were characterized by important supply shocks.

At the same time, the results of the previous section show that the Dove regime has been

in place for a large part of those years. Therefore, it might well be that in those years a

dovish monetary p olicy was perceived as optimal in consideration of the particular kind of

shocks hitting the economy. This seems plausible especially if the Fed was regarding the

sacri…ce ratio as particularly high, as suggested by Primiceri (2006). However, to explore

this argument more in detail the probability of moving across regimes should be endogenized

(Davig and Leeper (2006a)). This extension would further complicate the model, especially

for what concerns the solution algorithm. I regard it as a fascinating area for future research.

5.3 Counterfactual analysis

An interesting exercise when working with models that allow for regime changes consists of

simulating what would have happened if regime changes had not occurred, or had occurred at

di¤erent points in time, or had occurred when they otherwise did not. This kind of analysis

is even more meaningful in the context of the MS-DSGE model employed in this paper. First

of all, like a standard DSGE model, the MS-DSGE can be re-solved for alternative policy

rules to address the e¤ects of fundamental changes in the policy regime. The entire law of

motion changes in a way that is consistent with the new assumptions around the behavior

of the monetary policy authority. Furthermore, the solution depends also on the transition

matrix used by agents when forming expectations and on the nature the of alternative

regimes. Therefore, we can investigate what would have happened if agents’beliefs about

the probability of moving across regimes had been di¤erent. This has important implications

for counterfactual simulations in which a regime is assumed to have been in place throughout

29

the sample because the expectation mechanism and the law of motion are consistent with

the fact that no other regime would have been observed. Finally, it is also possible to

conduct counterfactual simulations in which agents are endowed with beliefs about regimes

that never occurred and that will never occur, but that could have important e¤ects on the

dynamics of the variables. An example that I will be explore concerns the appointment of

a very conservative Chairman whose behavior can be described by a remarkably hawkish

Taylor rule. This particular kind of counterfactual analysis is not possible in the context of

time-varying VAR models like the ones used by Primiceri (2005), Cogley and Sargent (2006),

and Sims and Zha (2006).

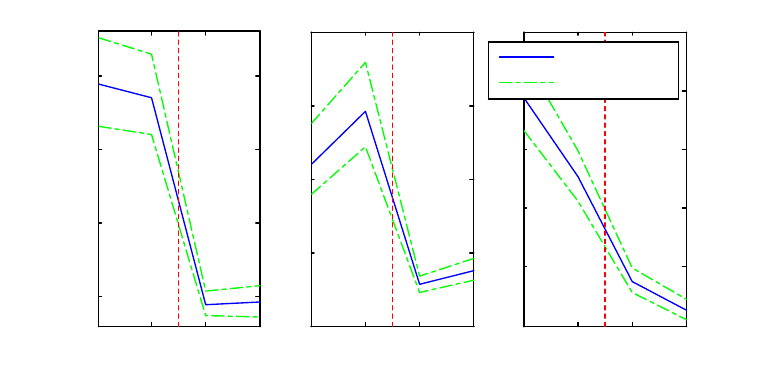

Two main conclusions can be drawn according to the results of this section. First, little

would have changed for the dynamics of in‡ation if the Hawk regime had been in place

through the entire sample or if agents had put a large probability on going back to it.

According to the results shown below, the only way to avoid high in‡ation would have been

to cause a long and deep recession. The reason is quite simple: The model attributes the