MS 1315 – WORKING CAPITAL FUND (P)

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Form 1221-2

(June 1969)

DEPARTMENT OF THE INTERIOR

BUREAU OF LAND MANAGEMENT

MANUAL TRANSMITTAL SHEET

Release

1-797

Date

10/04/2018

Subject

1315 - WORKING CAPITAL FUND

1.

Explanation of Material Transmitted: This release transmits a revised version of BLM

Manual Section 1315, Working Capital Fund (WCF). It has been revised to include the new

programs related to WCF and to incorporate the changes to the operational procedures for

the WCF.

2.

Reports Required: None.

3.

Material Superseded: The Manual Section supersedes Rel. 1-1538

4.

Filing Instructions: File as directed below.

REMOVE INSERT

Rel. 1-1538 Rel. 1-797

27 Pages

S:/ Ann DeBlasi

Acting Assistant Director

Business, Fiscal, and Information

Resources Management

MS 1315 – WORKING CAPITAL FUND (P)

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Contents

Chapter 1. Overview ................................................................................................................. 1-1

1.1 Purpose. ............................................................................................................................. 1-1

1.2 Objectives. ......................................................................................................................... 1-1

1.3 Authority. .......................................................................................................................... 1-1

1.4 Responsibility. ................................................................................................................... 1-1

1.5 References. ........................................................................................................................ 1-2

1.6 Policy. ................................................................................................................................ 1-3

Chapter 2 WCF Motorized and Towed Fleet (L9310) ........................................................... 2-1

2.1 WCF Motorized and Towed Fleet Overview. ................................................................ 2-1

2.2 WCF Sources of Revenue (Motorized and Towed Fleet). ............................................ 2-5

2.3 WCF Expenses (Motorized and Towed Fleet). .............................................................. 2-9

2.4 WCF Cost Coding of Financial Documents (Motorized and Towed Fleet). ............. 2-11

2.5 WCF Fleet Card Purchases. .......................................................................................... 2-12

2.6 WCF Purchase Requisitions. ......................................................................................... 2-12

2.7 Utilization Reporting Requirements............................................................................. 2-13

2.8 Bulk Fuel. ........................................................................................................................ 2-13

2.9 WCF Boats. ..................................................................................................................... 2-13

Chapter 3 WCF Stores (L9322). ............................................................................................... 3-1

3.1 Sources of Revenue and Capital Formation (Stores). ................................................... 3-1

3.2 Expenses (Stores). ............................................................................................................. 3-1

3.3 Cost Coding of Financial Documents (Stores). .............................................................. 3-2

3.4 Reporting Requirements (Stores). .................................................................................. 3-4

Chapter 4 WCF National Sign Center (L9323). ...................................................................... 4-1

4.1 Sources of Revenue and Capital Formation (National Sign Center)........................... 4-1

4.2 Expenses (National Sign Center). ................................................................................... 4-1

4.3 Cost Coding of Financial Documents (National Sign Center). .................................... 4-1

4.4 Reporting Requirements (National Sign Center). ......................................................... 4-2

Chapter 5 WCF Sign Program (L9324). .................................................................................. 5-1

5.1 Sources of Revenue and Capital Formation (Sign Program). ...................................... 5-1

5.2 Expenses (Sign Program)................................................................................................. 5-1

MS 1315 – WORKING CAPITAL FUND (P)

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

5.3. Cost Coding of Financial Documents (Sign Program). ................................................ 5-1

Chapter 6 WCF Department Forms Center (L9360). ............................................................ 6-1

6.1 Sources of Revenue and Capital Formation (Department Forms Center). ................ 6-1

6.2 Expenses (Department Forms Center). .......................................................................... 6-1

6.3 Cost Coding of Financial Documents (Department Forms Center). ........................... 6-2

6.4 Reporting Requirements (Department Forms Center). ............................................... 6-2

Chapter 7 WCF Reimbursable Program (L9390). ................................................................. 7-1

MS 1315 – WORKING CAPITAL FUND (P)

1-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 1. Overview

1.1 Purpose.

This section provides information and guidance regarding the functions of the Bureau of Land

Management’s (BLM’s) Working Capital Fund (WCF).

1.2 Objectives.

The objectives of the WCF are:

A. To improve the BLM’s ability to plan and control financing, use, and replacement of

capital resources and to manage certain inventories and internal services.

B. To develop rates to be levied against benefiting BLM activities as well as external

customers in an amount approximately equal to the cost of goods or services provided.

1.3 Authority.

The Federal Land Policy and Management Act of 1976 (FLPMA), Section 306, authorized the

BLM to establish a WCF in order to supply and equip BLM programs. The initial capital of the

fund consisted of appropriations made for that purpose ($2 million) together with the fair and

reasonable value at the fund's inception of the inventories, equipment, receivables, and other

assets, less the liabilities, transferred to the fund. After the WCF was established and

operational, the original $2 million was returned to the U.S. Treasury. Additional WCF

appropriations are not anticipated. Increases in budgetary authority and assets must be derived

from WCF operations or contributions.

1.4 Responsibility.

Functional WCF responsibilities are as follows:

A. Headquarters Offices

1. The Assistant Director, Business, Fiscal and Information Resources

Management (WO800), assisted by the Deputy Assistant Director,

Business, Fiscal and Information Resources Management Business,

Fiscal, and Information Resources Management, is responsible for overall

coordination of the activities of the WCF. Responsibilities include reviewing

WCF procedures to assure conformity with the Office of Management and

Budget (OMB) and Treasury requirements, Federal Accounting and Standards

Advisory Board (FASAB) standards, and Departmental and Bureau policies

and directives; establishing policy on WCF methodology, reporting, and

accounting procedures; and applying financial expertise to management of the

WCF.

2. The Chief, Division of Budget (WO880), provides liaison for integration of

WCF into a complete Bureau program and is a conduit for OMB reports and

requirements.

3. The Chief, Division of Business Resources (WO850), provides policy

oversight for contracting, procurement, property management, and use, space

management, and for all vehicles/equipment, supplies, materials and services

MS 1315 – WORKING CAPITAL FUND (P)

1-2

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

provided through the WCF. The Division Chief assures that WCF procedures

comply with applicable Bureau, Department, and Federal Property

Management regulations. The Division Chief also issues directives, when

necessary, to supplement existing directives in the Administrative Services

area in connection with WCF operations.

B. National Operations Center (NOC)

1. The WCF Manager (OC612) is responsible for the financial operations of

the WCF, which includes developing financial and related procedures,

preparing budgets and projections, establishing class based WCF rates,

determining the availability of funds for purchases by the WCF, developing

and preparing current operating reports, making cost estimates, acting as

financial advisor on WCF matters, and monitoring the liquidity of the WCF

funds. The WCF Manager assists the Division of Budget in budget

preparation.

2. The Chief, National Property and Support Branch (OC650), provides

overall property management services for all property in the WCF. This

includes maintaining centralized property records and providing counsel and

assistance in the acquisition, use, and disposal of WCF property, including

vehicles, equipment, stores inventories, Sign Center materials, and forms and

publications inventories. The Branch Chief is responsible for classifying

vehicles/equipment, establishing and maintaining property replacement

schedules, estimating useful life of property, setting utilization standards,

supplying information to the WCF Manager for use in setting fixed ownership

and Use Rates, scheduling inventories, preparing WCF property reports,

initiating purchase of replacement items for some classes of property, and

developing property management procedures and directives in connection

with WCF property management.

C. All Employees involved in the management of WCF programs and use of WCF

vehicles/equipment are responsible for knowing and following the guidelines and

instructions contained in this Manual Section.

1.5 References.

A. FLPMA

B. Handbook 1525-1 Fleet Management

C. Manual Section 1525- Fleet Management

D. Interior Property Management Directives 410 Addition to IPMD. Accountability—

Subpart 114-60.201-2 – Capitalization Threshold

MS 1315 – WORKING CAPITAL FUND (P)

1-3

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

1.6 Policy.

A. The BLM’s WCF is established to finance and account for services and goods

furnished to the Bureau's various benefiting activities as well as non-BLM customers.

Amounts expended or to be expended by the WCF are funded by user rates or

donations from other funds to ensure that adequate funds are available to support

authorized Bureau and other customer programs.

B. The WCF encompasses six distinct programs as follows:

1. WCF Motorized and Towed Fleet (L9310)

2. WCF Stores (L9322)

3. WCF National Sign Center (L9323)

4. WCF Sign Program (L9324)

5. WCF Department Forms Center (L9360)

6. WCF Reimbursable Program (L9390)

Any expansion or contraction of the number of programs requires a change in

BLM policy.

C. The BLM WCF Committee is an advisory board comprised of six members as

follows:

A. Deputy Assistant Director of Business, Fiscal and Information Resources

Management (W0800).

B. Two State Office Representatives selected by the Business Management

Council (BMC)

C. National Fire Equipment Program Representative selected by National

Interagency Fire Center Management (NIFC)

D. National Fleet Manager (OC650)

E. WCF Manager (OC612)

D. The committee functions in the capacity of reviewing any major policy considerations

which affect the BLM’s WCF and is chaired by the Deputy Assistant Director,

Business, Fiscal, and Information Resources Management. The committee acts as a

recommending unit only, and all final policy decisions must be approved by the

Assistant Director, Business, Fiscal, and Information Resources Management

(W0800).

MS 1315 – WORKING CAPITAL FUND (P)

2-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 2 WCF Motorized and Towed Fleet (L9310)

2.1 WCF Motorized and Towed Fleet Overview.

WCF Motorized and Towed Fleet – Functional Area L9310 - is managed at the NOC. The WCF

Fleet program allows for the replacement, operations, maintenance, and repairs of BLM-owned

vehicles/equipment. Fixed Ownership Rate (FOR) and Use Rate assessments are collected to

fund these objectives. The WCF Manager is responsible for rate-setting to ensure adequate

collections. The WCF Fleet is comprised of capitalized vehicles/equipment with exception of

the items listed in .11.B (Excluded Vehicles/Equipment). WCF Fleet may at times include

betterments (or sub-assets) that fall below the capital threshold.

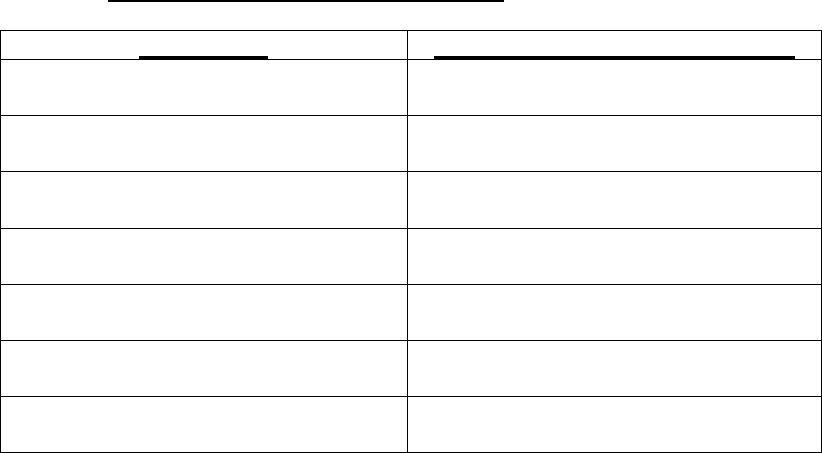

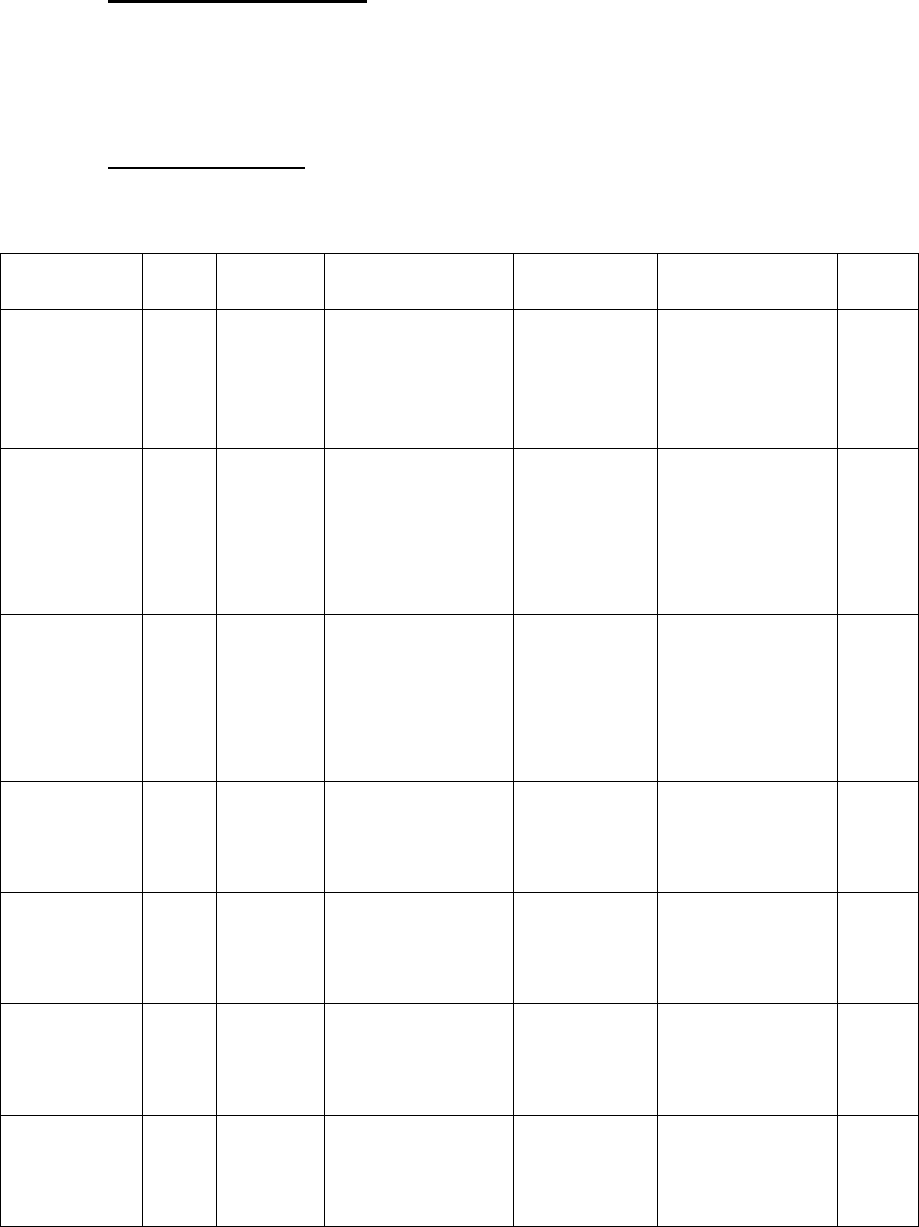

A. WCF Fleet Vehicle/Equipment Classes. WCF Fleet is categorized in seven major

groups of classes as illustrated in the following table:

Class Group

Work Breakdown Structure Range

(1) General Purpose Vehicles

LW.MV.01000000 to

LW.MV.01990000

(2) Special Purpose Vehicles

LW.MV.03000000 to

LW.MV.03990000

(3) Miscellaneous Equipment

LW.MV.04000000 to

LW.MV.04990000

(4) Wildland Fire Equipment

LW.MV.06000000 to

LW.MV.06990000

(5) Oregon Heavy Equipment

LW.MV.07000000 to

LW.MV.07990000

(6) Motor Equipment, Heavy Duty

Construction, and Miscellaneous

LW.MV.08000000 to

LW.MV.08990000

(7) Seed Drills

LW.MV.09000000 to

LW.MV.09990000

Note: Classes and Work Breakdown Structure are used synonymously throughout this

document.

1. General Purpose Vehicles. General Purpose Vehicles include any licensed,

motorized vehicle used primarily for transportation of people or property and

driven on highways. No underutilization is charged on general purpose

vehicles. General Purpose replacement standards are based on miles/hours

and years of use are not considered.

2. Special Purpose Vehicles. Special Purpose Vehicles are determined to have

a time-limited mission need and will not be replaced. Since these

vehicles/equipment will not be replaced, there are no FOR assessments

charged on special purpose vehicles. Use Rate assessments are still charged

on special purpose equipment to cover limited maintenance items. Under no

circumstances are repairs of Special Purpose Vehicles/equipment authorized

to be funded by the WCF regardless of negligence. See Fleet Management

Manual 1525 for additional guidance concerning Special Purpose

vehicles/equipment.

MS 1315 – WORKING CAPITAL FUND (P)

2-2

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Class 399 vehicles, which are part of the Special Purpose Vehicles/equipment

group, are in the WCF for reporting purposes only and are not charged either a

Use Rate assessment or a FOR assessment. As such class 399 vehicles cannot

charge any costs against the WCF. No fleet cards will be issued to class 399

vehicles/equipment.

3. Miscellaneous Equipment. Miscellaneous equipment includes equipment

not covered by any other class of vehicles/equipment such as skid-steers,

forklifts, and snow tractors. Miscellaneous Equipment items are charged an

underutilization assessment annually if they do not meet the established

annual utilization standard. Underutilization will be charged against the

standard cost structure associated with the piece of equipment or vehicle.

Replacement standards are based on both utilization units as well as years of

use.

4. Wildland Fire Equipment. Wildland Fire Equipment includes any

vehicles/equipment that are outfitted with fire lights, stripes, and/or sirens.

This class of equipment includes Command Vehicles, Type 3 Engines, Type 4

Engines, Type 6 Engines, Water Tenders, Remote Automated Weather Station

(RAWS) Vehicles, and Fire Boats. Fire equipment FOR and Use Rate costs

are charged against fire projects in which the equipment is used using

exception cost structure(s). If the equipment is not used in connection with

fire activity, then the use shall be charged against a non-suppression related

cost structure.

Due to the unpredictability of fire seasons, underutilization is not charged on

fire equipment. Fire equipment replacement standards are based on miles or

hours of operation with no consideration of years except when extenuating

circumstances require early replacement partially funded by a contribution.

5. Oregon Heavy Equipment. Due to the number of pieces of heavy equipment

in the Oregon heavy equipment fleet, these items are managed separately from

all other heavy equipment. Oregon Heavy Equipment includes construction

equipment, materials handling equipment, and other mobile equipment used to

maintain existing infrastructure in Oregon.

Oregon Heavy Equipment is financially managed at the state balance level.

Financial management data is sent monthly by the NOC to the Oregon Heavy

Equipment Committee. Oregon’s Heavy Equipment Committee evaluates the

current and future need of Oregon and determines the make-up of its fleet and

if like-for-like replacements are necessary or if new types of equipment are

needed.

For additional guidance on Oregon Heavy Equipment, see the Heavy

Equipment section (.11.A.6).

MS 1315 – WORKING CAPITAL FUND (P)

2-3

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

6. Motor Equipment, Heavy Duty Construction, and Miscellaneous. State

Heavy Equipment Committees are established and chartered by State

Directors to promote the efficient and cost-effective use of all heavy

equipment within their respective states. WCF heavy equipment classes are

managed at the BLM organizational state balance level.

Periodically NOC WCF Accountants send each state, either the State Engineer

or the State Heavy Equipment committee representative, its Heavy Equipment

State Balance report. The Heavy Equipment State Balance report, when

properly used as a decision-making tool, is a key component of the state’s

management of its fleet and fund availability balance. The report includes

both the available state balance (including all collections and expenditures)

and the amount of FOR revenue collected on all active equipment.

State Heavy Equipment Committees or State Engineers evaluate the current

and future heavy equipment needs of their state and determine if an identical

or similar replacement is necessary or if new types of equipment are needed to

accomplish changing program objectives within their state. As purchase

needs are identified, the states initiate their purchase requisitions.

All heavy equipment acquisition purchase requisitions must be approved by

the state’s Heavy Equipment Committee or the State Engineer and be

electronically documented in the Financial and Business Management System

(FBMS). Acceptable forms of approval may be either (1) the electronic

approval of the FBMS Purchase Requisition, or (2) the electronic attachment

to the FBMS Purchase Requisition of a signed approval by the Committee’s

representative or state engineer. Additional Purchase Request approvals must

be granted by both the National Fleet Manager and the WCF Manager. Heavy

equipment Purchase Requisitions not meeting the aforementioned approval

requirements are rejected at the NOC until met.

Depending on the planned equipment needs of a state, and how much that

state expects to spend on equipment in relationship to its State Heavy

Equipment balance, and provided the National Fleet Manager gives approval,

WCF funding may be certified to purchase new augmentations to the fleet or

replacement equipment. The WCF Manager certifies these funds based on

various factors including, but not limited to, the adequacy of available balance

for immediate needs and the adequacy of expected cash balances for future

needs. Under certain circumstances (such as the purchase of nonstandard,

optional equipment, upgrades, downgrades, etc.), a state may be required to

contribute additional funding before a purchase request is certified, or an

allowance may be made. The funding decision ultimately rests with the WCF

Manager.

Sometimes the best use of a state’s available balance and the management of

its asset portfolio may be to share assets across offices and districts, or even,

to transfer assets to other states or downsize altogether. Depending on the

MS 1315 – WORKING CAPITAL FUND (P)

2-4

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

decision or transaction, there could be a financial impact with respect to the

state’s available balance (for instance, transfers out from one state to another

could mean a decrease in the available balance in one state and an increase in

available balance in another’s due to the transfer of any associated FOR

assessment).

In any case, heavy equipment decisions – whether at the State Heavy

Equipment Committee level, the NOC level, or otherwise, must be made in a

manner that promotes the efficient and cost-effective use of all heavy

equipment within the bureau and complies with applicable bureau policy.

7. Seed Drills. Seed Drills consist of both 3-cart and single-cart drills. The

drills are used in the stabilization and restoration of areas affected by wildland

fires. FOR and Use Rates are charged on a per-acre drilled basis. There is no

under-utilization assessment on drills. While drills must report usage, Drill-

Carts are not utilization-relevant.

Drill maintenance is performed at the Drill Shop located in Vale, OR. Drill

Shop maintenance is charged to the WCF and expenses are recouped through

Use Rate assessment.

B. Excluded Vehicles/Equipment. Subject to review by the National Fleet Manager,

certain exceptions to the capitalized vehicles/equipment requirement may exist.

Additional vehicles/equipment may be excluded at the discretion of the National Fleet

Manager in conjunction with the WCF Manager. Any Non-WCF vehicles/equipment

bought without the review and approval of the BLM Fleet Team at the NOC will be

reviewed by property/ acquisition for further action.

Whenever an asset is excluded from the WCF yet meets the capital threshold, DOI

and Bureau policy dictate it must still be capitalized. This capitalization occurs

outside the WCF.

C. Holdover Vehicles/Equipment. Holdover vehicles/equipment are

vehicles/equipment that have been replaced, have not yet been disposed of, and are

still available for use. Holdover vehicles/equipment are not subject to

underutilization charges. All costs charged to the WCF for hold-over

vehicles/equipment are reviewed monthly and determination is made if the cost is an

authorized WCF charge or if the cost needs to be reallocated to the benefitting

activity.

The fixed ownership rate (FOR) assessment will continue to be charged on holdover

vehicles/equipment. As vehicles/equipment are continued to be used, the estimated

salvage value of the vehicle/equipment is reduced. The continued assessment of FOR

is meant to offset the reduced expected salvage value.

MS 1315 – WORKING CAPITAL FUND (P)

2-5

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

See Fleet Management, H-1525-1 for additional information about holdover

vehicles/equipment.

2.2 WCF Sources of Revenue (Motorized and Towed Fleet).

Since the WCF does not receive an annual appropriation, the operation of the WCF Fleet

program primarily relies on revenue from the assessment of user fees. The fees are charged

against the benefiting activity for the use of vehicles/equipment.

A. Vehicle/Equipment Use Rate. The Use Rate assessment is the cost charged against

a benefitting activity for the program using the WCF vehicle/equipment. The

assessments are charged monthly based on the number of miles, hours, or acres the

vehicle/equipment is used multiplied by the class-wide Use Rate. The Use Rate

assessment is used to cover the operating costs of the fleet. The rates are set at a level

that covers fuel and allows for WCF vehicles/vehicles/equipment to be maintained in

a safe operating condition. For Special Purpose classes, see section (.11.A.2).

Preventative care not only helps keep vehicles/equipment safe, but it also reduces

downtime, extends their life, and increases sales proceeds. Funds received by the

WCF through the assessment of Use Rates are used to pay for routine repairs and

maintenance not deemed to be caused by abuse, neglect, human caused damage with

or without intent, Acts of God, or nature (weather, animals, etc.). State-specific

expenses such as emission requirements are not covered by the WCF. See H-1525-1

for guidance related to non-allowable repairs. Use Rate revenue is never used to pay

for the acquisition of equipment. Overhead cost associated with managing the WCF

are also incorporated into Use Rates. Overhead consists of personnel costs for the

WCF Manager and Accountants, NOC Fleet staff, and certain NIFC Fire Equipment

Specialists. Other individuals may charge time to the WCF if authorized by the WCF

Manager.

The Use Rate assessment is charged monthly to vehicles/equipment based on the

amount of usage the vehicles/equipment reported during the monthly utilization

reporting window. The Use Rate assessment can be based on hours, miles, or acres of

use. Use Rate Revenue is coded to commitment item WMRUI0 in the accounting

system (currently the Financial and Business System, or FBMS).

All vehicles/equipment in FBMS are assigned a standard cost structure(s) to which all

utilization charges incurred are charged against on a percentage basis unless a field

office enters an exception cost center(s). Multiple exception cost centers may be

entered during the utilization reporting window on a reporting unit basis. If exception

cost centers reporting units do not sum to the total reported utilization for the month,

the remaining reporting units are charged to the standard cost structure(s).

WCF Finance personnel recalculate Use Rates for each vehicle class every fiscal year

or as necessary based on actual vehicle use expenses compared with actual use

revenues from previous fiscal year(s), the objective being for each vehicle class to

break even over its cumulative inception-to-date life. These rates may be viewed in

FBMS table ZUSE_RATE.

MS 1315 – WORKING CAPITAL FUND (P)

2-6

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

B. Vehicle/Equipment Fixed Ownership Rate (FOR). The FOR assessment is the

cost charged against a benefitting activity for the program using the WCF

vehicle/equipment. The FOR assessment is used to collect sufficient funds for the

eventual replacement of the vehicle/equipment being charged the FOR assessment,

including all costs associated with the acquisition of the asset (e.g., shipping and

taxes).

The FOR assessment is charged monthly to vehicles/equipment based on the amount

of usage the vehicles/equipment reported during the monthly utilization reporting

window. FOR can be based on hours, miles, or acres of use. FOR revenue is coded

to commitment item WMRFI0 in the accounting system.

All vehicles/equipment in FBMS are assigned a standard cost structure(s) to which all

FOR assessments are charged against on a percentage basis unless a field office

enters an exception cost center(s). Multiple exception cost centers may be entered

during the utilization reporting window on a reporting unit basis. If exception cost

centers reporting units do not sum to the total reported utilization for the month, the

remaining reporting units are charged to the standard cost structure(s). Additional

FOR revenue is received by the WCF from an underutilization charge assessment on

equipment that takes place annually in September or whenever the equipment is

transferred/disposed. The purpose of the assessment is to collect enough revenue to

pay for equipment replacement. The assessment is used as a tool to ensure sufficient

funds are available to cover the cost of replacements when specific equipment has

met the age replacement standard but not the miles/hours replacement standard.

Equipment units that are underutilized are charged for the difference between the

minimum utilization and the actual utilization for each fiscal year at the end of the

year or a prorated amount if the equipment unit transferred to a different office or

disposed of during the year, with the result multiplied by the FOR unit cost.

Fire-fighting equipment in classes 0611 through 0689 (Work Breakdown Structures

LWMV06110000 through LWMV06890000) as well as general purpose classes are

not charged underutilization assessments.

The FBMS Utilization Status Report tracks under-utilization from the beginning of

the fiscal year. This report is then sent to field office managers during the 3

rd

and 4

th

quarter. This report projects potential under-utilization charges that will post in

September after the normal utilization charges have posted. The Utilization Status

Report is intended to alert managers and/or budget analysts of charges that may be

incurred in September.

WCF Finance personnel set the FOR rates annually or as necessary based on the

following factors: the annually adjusted estimated vehicle/equipment replacement

cost, expected inflation, salvage value, and estimated useful life (years and

miles/hours). The determined rate is charged over the estimated useful life of the

vehicle/equipment based on reported usage. FOR charges are levied against the

standard cost structure associated with the vehicle/equipment unless an exception cost

MS 1315 – WORKING CAPITAL FUND (P)

2-7

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

structure is reported. The cumulative revenue collected from the FOR assessment on

a vehicle/equipment stays with the vehicle/equipment throughout the life of the

vehicle/equipment regardless of the office to which the vehicle/equipment is initially

assigned. These rates may be viewed in FBMS table ZUSE_RATE.

Whenever a vehicle in an FOR-paying class is not replaced or residual funds exist

after replacement occurs, FOR funds paid into the WCF remain in the WCF. These

funds are available for use by the States for future acquisitions. The WCF tracks

these funds by the state that possessed the vehicle/equipment at date of disposal.

These funds are available to use in lieu of a contribution. For policy on contribution

requirements see section .12F below.

C. Vehicle/Equipment Donations. Before any capitalized asset can be replaced by the

WCF, it must first be donated to the fund. Any used equipment donation must have a

thorough inspection prior to being donated to the WCF. The cost of the inspection

plus any necessary repairs to ensure that the vehicle is safe working condition must be

paid for by non-WCF funds. All used equipment donations will be classified as

special purpose vehicles/equipment.

D. Sales Proceeds from the Sale of WCF Assets. The WCF has statutory authority

under FLPMA to retain income derived from the sale of WCF assets. The proceeds

received are used to cover part of the acquisition cost of the replacement

vehicle/equipment. Estimated sales proceeds are compared to actual proceeds

received. If a buyout contribution was received, excess contribution proceeds will be

returned to the office that made the contribution or if the actual proceeds were less

than expected, an additional contribution may be required.

Disposal of Vehicles/Equipment – All vehicles/equipment must be disposed of using

the General Services Administration (GSA) disposal process. The NOC (OC653) is

the only authorized entity for managing the disposal of vehicles/equipment. For

details on the disposal process see MS 1520- Personal Property Management.

Trade-ins of vehicles/equipment - In certain circumstances, a trade-in of a vehicle or

equipment is authorized as a means of disposal. Trade-ins are authorized when the

economic benefit of trading in the vehicle/equipment is greater than the economic

benefit of disposing the vehicle through GSA. All trade-in contracts must adhere to

all contracting requirements. All trade-ins must be approved by OC653. Reductions

in the acquisition cost, given due to the trade-in of a vehicle/equipment, are treated as

salvage proceeds of the vehicle/equipment being traded-in. The NOC creates

additional FBMS entries in order to properly record the acquisition cost of the

acquired vehicle.

Sales proceeds (salvage) received on the disposition of all vehicles/equipment not

being replaced are deposited to the miscellaneous receipts fund of the U.S. Treasury

as the WCF is not authorized to retain these sales proceeds. This would include all or

most Special Purpose vehicles/equipment.

MS 1315 – WORKING CAPITAL FUND (P)

2-8

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

E. Insurance Proceeds from Accident Damage. All reimbursement checks for

accident damage to WCF vehicles/equipment paying a Use Rate must be sent to the

NOC (OC621). The check must be submitted along with the Collection and Billings

System (CBS) system-generated Collection Transmittal, Form 1370-8. The sender

must notate in the text field of Form 1370-8 the WCF vehicle license number and

Standing Work Order (ST01) and Maintenance Work Order (ME01). Payments for

repairable damage are posted as Use Rate Revenue and are coded to Commitment

Item WMRUI0 in FBMS. Proceeds received from the disposition of wrecked

vehicle/equipment deemed a total loss, by a report of survey, are posted as sales

proceeds and are coded to Commitment Item WORVS0.

F. Contributions. Contributions are funds transferred into the WCF at the direction of

and communicated by WCF Finance in order to provide necessary funding for

acquisitions when current WCF funds are not sufficient. The benefitting activity

ordering the asset completes Form 1510-18v and submits it to the NOC Fleet

Manager (OC653) who, in turn, processes the document and delivers it to the NOC

WCF Accountant (OC612) who processes the FBMS contribution document.

Contributions can be classified as a new purchase, betterment, non-standard options,

or early buyout contribution. Contributions are estimates and are refunded if the

contribution made into the WCF is greater than what was actually needed.

Conversely, if the estimated contribution ends up being less than what was actually

needed, then an additional contribution is required.

1. New Purchase Contributions. New Purchase contributions are deposited

into the WCF if an office needs a vehicle or piece of equipment that is an

addition to the WCF fleet that does not replace a current WCF

vehicle/equipment

2. Betterment Contributions. Betterments are assets that cannot stand alone

and are an addition to the base vehicle/equipment. Betterment contributions

to the WCF are necessary to authorize the WCF procurement as well as

document the added value of the equipment.

3. Non-Standard Options Contributions. Non-Standard Option contributions

are deposited into the WCF when an office is purchasing a vehicle/equipment

that includes options not covered by the FOR (e.g., backup cameras). For a

list of options covered by the WCF refer to BLM Fleet Manual 1525.

4. Early Buyout Contributions. Early Buyout contributions are required to be

deposited into the WCF if a vehicle/equipment is being replaced before

reaching its estimated useful life. The WCF Finance team will determine the

early buyout contribution required.

MS 1315 – WORKING CAPITAL FUND (P)

2-9

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

5. Other. Contributions may be required in other circumstances (e.g., a

contribution deposited into a state Heavy Equipment balance to make up for

known shortages.)

2.3 WCF Expenses (Motorized and Towed Fleet).

Personnel using Bureau-owned vehicles/equipment against which Use Rates are charged

must code the operation, maintenance, and repair costs of this equipment to the WBS of the

equipment being utilized.

A. Operations, Maintenance and Repair Costs.

1. Equipment Operation Costs. Equipment operation costs consist of fuel) and

oil. All purchases of fuel for consumption by Bureau-owned vehicles that pay

Use Rates are charged to the WCF.

2. Maintenance Costs (Preventative). Maintenance costs are those incurred to

keep Bureau-owned vehicles/equipment covered by Use Rates under the WCF

in a safe, serviceable condition. Preventative maintenance not only keeps

vehicles/equipment safe, but it also reduces downtime and increases sales

proceeds. See H-1525-1 for a list of covered preventative maintenance costs.

Offices with approved maintenance shops can charge mechanic wages to the

WCF for the time spent working on BLM-owned vehicles/equipment.

Approval must be obtained from WO800 to establish a motor vehicle

maintenance shop before mechanics employed there may charge their time to

the WCF for maintenance or repair work on BLM-owned vehicles/equipment.

3. Holdover Costs. Only fuel, windshield repair at time of disposal, oil changes,

reasonable disposal detailing expenses, and final inspection costs are paid by

the WCF for holdovers. Other holdover charges must be coded directly to the

benefiting activity. On a monthly basis, the NOC (OC612) reviews all

holdover charges ensuring all charges are authorized to be funded by the

WCF. If charges are deemed not be authorized for WCF funding, then the

field must reallocate the charges.

4. Repair Costs. Repair costs are those that are incurred to maintain the specific

WCF Fleet item of in safe efficient operating condition through the restoration

or replacement of parts, components, or assemblies of Bureau-owned

vehicles/equipment as necessitated by wear and tear, or the failure of parts.

All repair costs that meet the above criteria are charged to the WCF if the

vehicle/equipment is charged a Use Rate. WCF disallows repair costs

resulting from abuse, neglect, human-caused damage with or without intent,

Acts of God, or nature (weather, animals, etc.). Any receipts payable to the

WCF for Reports of Survey, other than total-loss incidents, are credited

against the repair costs associated with the report. If a warranty is still in

effect for the vehicle/equipment being repaired, the warranty must be used.

MS 1315 – WORKING CAPITAL FUND (P)

2-10

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

See H-1525-1 for guidance concerning repairs not authorized to be charged to

the WCF.

5. Accident Damage. All unreimbursed repair costs for accident damage must

be charged to the benefitting activity from the using office and not to the

WCF. If a vehicle is totaled in an accident, and it is in a class that pays an

FOR fee, part of the replacement cost for a new vehicle will come from the

WCF. The remainder of the replacement cost must come from the benefitting

activity from the using office. The proportion that the WCF contributes

toward the replacement cost is equal to the dollar amount of FOR revenue

already charged against the demolished vehicle, plus the estimated proceeds

from the sale of the vehicle. Unless other arrangements are made with the

WCF Manager, if the using office does not desire a replacement, it must still

reimburse the WCF for the difference between the amount of FOR revenue

paid plus the salvage value, and the cost of a new replacement, which will be

issued to another BLM office expressing a need. See H-1525-1 for

documentation requirements related to accidents.

6. Vehicle Options Not Paid For by WCF. Certain add-ons and modifications

to vehicles/equipment which are not standard options will not be paid for by

the WCF. Costs of this nature must be paid by the benefiting activities by

making a deposit into the WCF. See H-1525-1 for more information about

not standard options.

B. Vehicle Replacement. BLM vehicles which meet replacement standards must be

replaced.

1. Useful Life Standards. Generally, all bureau-owned vehicles/equipment

charged the FOR assessment are replaced with monies from the WCF. The

normal criteria for vehicle/equipment replacement are based on age or the

number of miles driven or hours used. The replacement standards are applied

on a vehicle class-wide basis. Earlier replacement due to excessive repair and

maintenance costs will be considered on a case-by-case basis. The

replacement standards for specific classes of vehicles/equipment are found in

the FBMS utilization rate table (ZUSE_RATE). An extraction of the rate

table is emailed annually by the NOC (OC612) to the BLM fleet management

community during the first quarter of each fiscal year. The table displays the

recommended replacement years and the annual minimum use standards.

2. Vehicle/Equipment Replacements. The procedures for ordering WCF

replacement vehicles/equipment may be found in BLM Handbook H-1525-1.

The National Fleet Manager (OC653) is responsible for the development and

coordination of the replacement plan. WCF Finance (OC612) determines

fund availability and must certify funds for all obligations incurred for the

purpose of replacing WCF vehicles and equipment. If a vehicle is to be

MS 1315 – WORKING CAPITAL FUND (P)

2-11

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

disposed without replacement, then a 1525-11 form must be submitted to the

National Property Fleet Section (OC653)

2.4 WCF Cost Coding of Financial Documents (Motorized and Towed Fleet).

All financial documents, e.g., requisitions, oral orders, purchase orders and contracts relating to

the operation of the Bureau's Motorized and Towed Fleet must be coded in FBMS as follows:

A. Fund Code. XXXL4525RV (WCF) (Revolving Fund)

B. Functional Area. L93100000.* - WCF Motorized and Towed Fleet

C. Program Element.

1. Fleet Operations and Maintenance. 120000

2. Fleet Capital Acquisitions (Must use Commitment Item 311*). 130000

3. Fleet Charges (Bulk Fuel only). 140000

D. Work Breakdown Structure (WBS). (LW.MV.0*) All financial transactions

involving functional area L9310 must be coded with a twelve-digit project number.

The first digit of the eight-digit project code is always zero. The next three digits of

the code are normally the vehicle class number(s) for which the transaction was

initiated. The last four digits of the code are zeros (e.g., LW.MV.0XXX0000.).

There are two categories of project numbers which do not reflect vehicle classes: The

first category is the LWMV06000000-LWMV06050000 classes which pertain to

National Interagency Fire Center (NIFC) fire administrative charges. These numbers

are assigned to specific financial transactions by NIFC. The second category is

utilized for financial transactions for which a particular vehicle class(es) cannot be

identified, even by estimating. Non-identifiable financial transactions for the Oregon

Heavy Equipment program should be charged to project number LWMV07000000

for Administrative, LWMV07100000 for Bulk Fuel, and LWMV07110000 –

LWMV07320000 for specified maintenance and indirect costs. All other non-

identifiable project number financial transactions should be charged to project

number LWMV05000000 Administrative, LWMV05100000 Bulk Fuel, and

LWMV05200000 – LWMV05210000 for maintenance shop overhead. Projects

LWMV05000000 and LWMV07000000 must never be viewed as "catch all"'

accounts for WCF costs. No project number other than a valid vehicle class and those

specifically identified above may be used except by approval of the WCF Manager.

E. Work Order. System-generated, 8-character, numeric value associated with either

the Standing Work Order (ST01) or Maintenance Work Order (ME01) of the

equipment. This value is required when using Functional Area L93100000.120000,

and it derives the values for Fund, Functional Area, and WBS.

MS 1315 – WORKING CAPITAL FUND (P)

2-12

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

F. Funds Center. LL* (use appropriate funds center)

G. Commitment Item. Commitment items are used to classify similar expenses in a

category. All expenses incurred by the Working Capital Fund must have a

commitment item. Commitment item is the FBMS term for the U.S. Treasury term

“budget object class (BOC).”

2.5 WCF Fleet Card Purchases.

A Fleet charge card is issued with each WCF vehicle or piece of equipment. The Fleet card is to

be used for authorized WCF fuel, maintenance, and repairs up to the fleet charge card limit. Any

unauthorized charges made on a Fleet card must be reallocated to the benefitting activity. There

is to be no fueling of motorcycles, UTV’s, snow-blowers, lawn mowers, etc., using BLM Fleet

cards. Fleet cards have an associated standing work order (STO1). The default cost center in the

standing work order must be the same as the default cost center on the associated asset’s

Equipment Master Record. This helps ensure that fleet costs post to the same cost center as any

associated revenue from utilization postings. For additional details on Fleet charge cards, see

BLM Manual 1512.

2.6 WCF Purchase Requisitions.

Purchase Requisitions (PRs) are required for WCF maintenance/repair charges over the fleet card

limit and for acquisitions of WCF Fleet Asset acquisitions, described as follows:

A. Maintenance/Repairs. Maintenance/Repair charges to the WCF over fleet card limit

amount will require a PR. All PRs charging the WCF fund must be fleet- or ad-hoc

approved by the National Operations Center Fleet Property Section (OC653).

Maintenance PRs may be multi-funded. Determination of funding of Maintenance

PRs is made by the ad-hoc or fleet approver. Exceptions for Oregon Heavy

Equipment and Fire Vehicles/equipment Maintenance/Repairs exist, as follows:

1. Oregon Heavy Equipment Maintenance/Repairs. Purchase Requisitions

are approved by the head of the Oregon Heavy Equipment Committee

Chairs. The Oregon Heavy Equipment Chairs must adhere to the same

standards of review that all BLM fleet is subject to, ensuring that only

authorized WCF expenses are approved.

2. Fire Vehicle/Equipment Maintenance/Repairs. The NIFC is authorized to

approve maintenance and repairs PRs under $10,000. The NIFC must adhere

to the same standards of review that all BLM fleet is subject to, ensuring that

only authorized WCF expenses are approved. For Maintenance and repairs

greater than $10,000 but less than $15,000, the NIFC must consult the OC653

prior to approval. For expenses greater than $15,000, OC653 is the only

authorized approver.

B. Acquisitions. All Acquisitions of WCF fleet assets with the exception of fire

equipment in the LWMV06* WBS series must be approved by OC653. All

Acquisitions of WCF fire equipment must be approved by the National Fire

MS 1315 – WORKING CAPITAL FUND (P)

2-13

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Equipment Program (NFEP) Manager. Only WCF funds are authorized to purchase

vehicles/equipment. If funds other than WCF funds are needed for the acquisition,

they must first be contributed to the WCF and then the WCF funding will pay for the

acquisition. Finally, due to safety and other full lifecycle management requirements

of a federal revolving fund, WCF acquisitions of vehicles/equipment are strictly

limited to new equipment, thereby precluding the purchase of used equipment.

2.7 Utilization Reporting Requirements.

BLM vehicles/equipment utilization must be reported every month, even if utilization for the

month is equal to zero, for all utilization-relevant classes. Utilization must be reported through

the Financial and Business Management System (FBMS) Monthly Utilization Reporting Screen

for each WCF and GSA-owned vehicle/equipment. Utilization is reported in hours, miles, or

acres depending on the class of vehicle/equipment. Use Rate and FOR assessments will be

charged against the standard cost structure(s) associated with the vehicle/equipment reporting

utilization unless an exception cost structure is entered. GSA vehicles are charged a flat monthly

rate plus a mileage rate.

2.8 Bulk Fuel.

Several field offices throughout the BLM have bulk fuel tanks. Bulk fuel tanks are intended to

be in locations where fuel stations are not readily accessible. Bulk fuel tanks are only authorized

to provide fuel to WCF vehicles/equipment subject to a Use Rate fee. All bulk fuel tank activity

must be reported on the Fuel and Oil Issue Record (Form 1520-28). A monthly reconciliation

must be performed and reported on the Fuel Reconciliation Record (Form 1520-28a). The two

forms must be sent to the National Operations Center (OC612) each month. Acquisition of fuel

to fill the bulk fuel tank must be done through the PR process, or in some instances purchase

card. When individual vehicles receive bulk fuel the number of gallons and cost must be entered

in the Fuel Acquisition Quantities area of the FBMS Monthly Utilization Screen.

2.9 WCF Boats.

All boats $50,000 and higher in acquisition cost are placed in the WCF, Functional Area L9310*,

WBS LWMV*. Capitalized boats that meet the aforementioned threshold are considered WCF

equipment. FOR is charged in order to pay for the replacement of the boat (shell only, except in

the case of fire boats, a shell and pump).

WCF boat-trailers are capitalized under separate WCF classes and collect their own FOR. Non-

cap boat-trailers, whether controlled or uncontrolled – are considered non-WCF equipment.

Both operations (gasoline, oil, etc.) and maintenance (O&M) and repairs are covered in

establishing use rates. Whenever it is necessary – and pending the structure of the use rate for a

given boat class -- midlife engine replacements may be covered in use rates as well. A fleet card

is issued for O&M and repairs. Engine replacements follow the normal purchasing process

(requisition, obligation, etc.).

BLM Fleet Management Team at the NOC provides property management for boats including

safety, plating, maintenance (including engine replacements), etc.

MS 1315 – WORKING CAPITAL FUND (P)

3-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 3 WCF Stores (L9322).

The WCF Stores program is comprised of materials and supplies acquired and stored for

subsequent issue to projects or using activities. Stores are consumed, lose their identity, or

become an integral part of other property when put in use. Currently the authorized stores

programs are seed inventory handled at the warehouses in Boise, Idaho and Ely, Nevada.

Commercially-made signs are handled at the warehouse at the NOC.

3.1 Sources of Revenue and Capital Formation (Stores).

The WCF Stores program must recover revenue in an amount approximately equal to the cost of

stores purchased, operating expenses, administrative overhead costs, write-offs and inventory

losses, and transfers of excess inventory without reimbursement.

A. Stores Issue Revenue. When stores are issued, the benefiting activity must

reimburse the WCF for the cost of the stores item(s).

B. Stores Surcharge Revenue. When stores are issued from the WCF to a benefiting

activity, one or more surcharge(s) will be charged to cover operating expenses,

administrative overhead, write-offs and inventory losses, and transfers of excess

inventory without reimbursement.

C. Stores Donations. When the stores program was established in the WCF, inventories

were transferred to the WCF. Transfer was made by donation, at no cost, to the WCF

without reimbursement to the donating activities. The revenue generated when stores

inventory is issued other than that derived from surcharge revenue is made available

to reinvest in additional stores inventory.

3.2 Expenses (Stores).

Cost are incurred by the WCF when stores are purchased; indirect cost such as operating and

administrative operating costs are incurred for salary, travel, equipment, and supplies; write-offs

or inventory losses occur; or transfers are made without reimbursement to the WCF.

A. Stores Inventory Costs. When stores are initially purchased for subsequent issue to

projects or using activities, the full cost of the purchase including freight charges will

be charged to the WCF. Stores purchases should not exceed anticipated stores issues

in the following 12 months. Approval must be requested from the WCF Manager

(OC612) if this condition is anticipated for WCF stores.

B. Operating Overhead Costs. Operating costs identified to the stores expense are

borne by the WCF. Only organizations authorized to have a stores program may

charge allowable costs to the WCF.

C. Administrative Overhead Costs. National Operations Center administrative costs

identified to the stores program are borne by the WCF. No administrative cost may

be charged to the WCF by any office other than the National Operations Center.

MS 1315 – WORKING CAPITAL FUND (P)

3-2

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

D. Cost of Inventory Losses. When inventory shrinkage occurs due to loss, damage, or

theft, this cost must generally be covered by the WCF, unless there is an appropriate

identifiable cause.

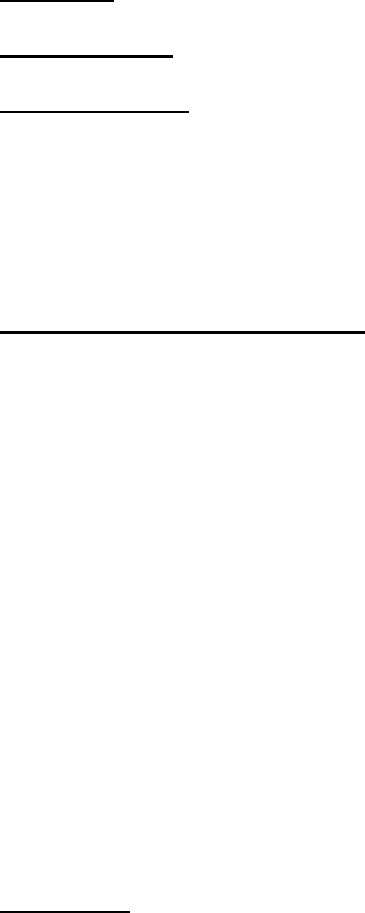

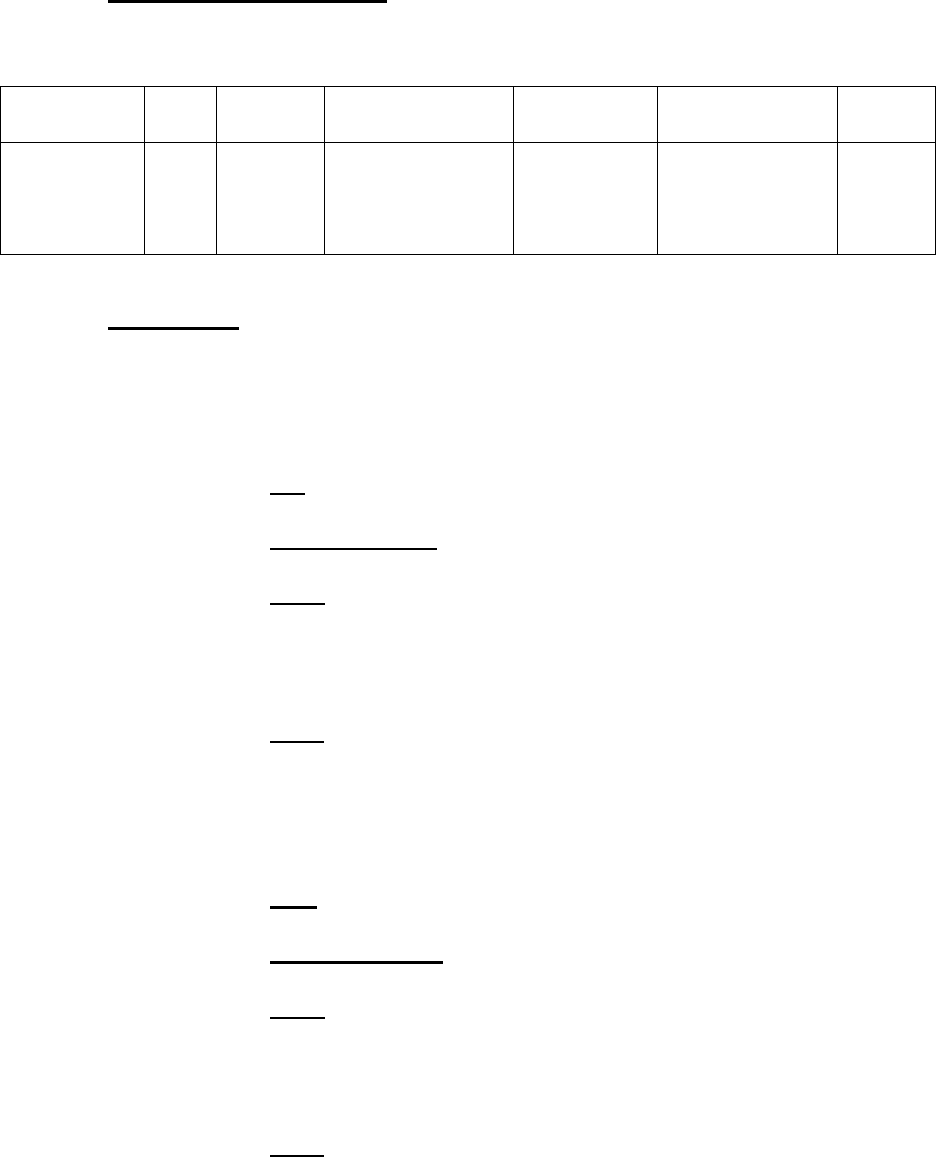

3.3 Cost Coding of Financial Documents (Stores).

A. Stores Acquisitions. Acquisitions through such procurement documents as

contracts, purchase orders, etc., for which BLM pays a vendor for the stores supplies,

are cost coded in FBMS as follows:

Program

Fund

Activity

Type

Functional Area

Funds

Center

WBS

GL

BLM

National

Seed

Warehouse

Program

XX

XL4

525

RV

(blank)

L93220000.1100

00

LLBW3000

00

LWWFBSEED

000

Multi.

BLM SEED

WHSE

Plant

Overhead

XX

XL4

525

RV

(blank)

L93220000.1200

00,

L93220000.XZ0

000

L93220000.XJ00

00

LLBW30A1

00

LWWFBSEED

A00

Multi.

BLM SEED

WHSE Non

Plant

Overhead

XX

XL4

525

RV

(blank)

L93220000.1200

00,

L93220000.XZ0

000

L93220000.XJ00

00

LLBW30A2

00

LWWFBSEED

A00

Multi.

BLM SEED

WHSE

Production

XX

XL4

525

RV

LS0000,

LS0001

L93220000.XZ0

000

LLBW30P1

00

LWWFBSEED

000

Multi.

BLM SEED

WHSE Dry

Storage

XX

XL4

525

RV

(blank)

L93220000.1200

00,

LLBW30W

100

LWWFBSEED

000

6100.

2*

BLM SEED

WHSE

Cold

Storage

XX

XL4

525

RV

(blank)

L93220000.1200

00,

LLBW30W

200

LWWFBSEED

000

6100.

2*

Denver

Sign

XX

XL4

525

RV

N/A

L93220000.1100

00

LLOC*

LWWFDSIGN

000

6100.

261C

0

MS 1315 – WORKING CAPITAL FUND (P)

3-3

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

B. Stores Capital Acquisitions. Acquisitions through such procurement documents as

contracts, purchase orders, etc., for which BLM pays a vendor for the stores capital

equipment, are cost coded in FBMS as follows:

Program

Fund

Activity

Type

Functional Area

Funds

Center

WBS

GL

Seed

Operations

XX

XL4

525

RV

(blank)

L93220000.1300

00

LLBW*

LWWFBSEED

A00

1750.3

11A0

C. Stores Issues.

1. Seed. All seed issues are recorded in the Inventory Module of FBMS. A

project seed request form is required to be submitted to the Warehouse

manager for an issue to be recorded.

a. GL. 6100.264S0 (Seed).

b. Functional Area. Determined by the benefiting program.

c. Fund. Determined by the benefiting fund in connection with the

benefiting Functional Area. Only need to insert the first three

characters of the Fund as FBMS derives the balance of the Fund

code.

d. WBS. Determined by the benefiting program

2. Denver Sign. The purchase of signs from the Denver Sign Center is

completed using a Purchase card. CBS records all entries associated with the

purchase of signs.

a. GL. 6100.261C0 (Denver Sign).

b. Functional Area. Determined by the benefiting program.

c. Fund. Determined by the benefiting fund in connection with the

benefiting Functional Area. Only need to insert the first three

characters of the Fund as FBMS derives the balance of the Fund

code.

d. WBS. Determined by the benefiting program.

MS 1315 – WORKING CAPITAL FUND (P)

3-4

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

3.4 Reporting Requirements (Stores).

A. Stores Issues. Monthly, or more frequently as necessary, reporting of stores issues is

accomplished by field stores personnel either by entering issue transactions into the

FBMS Inventory Module for seed issues or by entering issue transactions into the

Automated Inventory Management System (AIMS) for signs issues. Stores personnel

should enter their data no later than five working days prior to the end of the month to

ensure that errors can be corrected prior to the month-end financial close.

B. Receiving Report (DI-102), Report of Survey/Certificate of Loss (DI-103), and

Transfer of Property (DI-104). The originating office must assign a document

number to each Receiving Report, Report of Survey/Certificate of Loss, and Transfer

of Property form. The original copy of the Receiving Report for the donation of

materials to WCF Stores should be sent to OC612. The original copy of the Report of

Survey/Certificate of Loss and Transfer of Property should be sent to the NOC

Property Operations Section (OC653) upon receiving all the required signatures.

Upon logging the Report of Survey/Certificate of Loss and Transfer of Property

forms in their records, OC653 will forward the original copy to OC612 to be posted

to the general ledger.

C. Annual Stores Inventory. An annual reconciliation must be performed between

physical warehouse inventory and system inventory ledger. The Boise Regional Seed

Warehouse Manager is responsible for coordinating the annual inventory observation.

Results of the observation must be sent to OC612.

MS 1315 – WORKING CAPITAL FUND (P)

4-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 4 WCF National Sign Center (L9323).

The Bureau Sign Center Program became part of the WCF in FY 1984. The Sign Center is

located in Rawlins, Wyoming. The WCF pays for the materials used in the construction of

custom BLM signs, and benefiting sub-activities are charged for the cost of ordered signs.

4.1 Sources of Revenue and Capital Formation (National Sign Center).

The Commitment Item associated with National Sign Center Revenue, in either case

below, is WORRS0.

A. National Sign Center Revenue – Custom Made Signs. The major source of

operational revenue comes from the sales of custom signs. The National Sign Center

sets prices of the signs at a level at which the cost of materials and labor used to

construct the sign(s) and any overhead are covered.

B. National Sign Center Revenue – Outsourced Signs. If an order for signs is

received at the National Sign Center and the National Sign Center cannot fill the

order, the National Sign Center has the ability to outsource the production of the sign.

The National Sign Center will pass along all costs of procuring the sign from an

outsourced vendor to the field office ordering the sign.

4.2 Expenses (National Sign Center).

Expenses associated with the National Sign Center are incurred by the WCF when materials are

purchased to be used in the construction of signs. The salaries of the personnel employed to

construct the signs are paid directly out of the WCF. The costs associated with the shipping and

mailing of the finished signs is charged directly to the benefiting activities. Administrative

overhead is also chargeable to this program.

4.3 Cost Coding of Financial Documents (National Sign Center).

A. Fund Code. XXXL4525RV

B. Functional Area. WCF National Sign Center L93230000.*

C. Program Element.

1. Revenue Billing and Collect. 770000

2. Undistributed Labor Cost. 880000

3. Undistributed Vehicle Cost. 970000

4. Maint. Finance SYS/RPT Reg. XJ0000

5. PRV PERS PRP/FLT/OTHR SUP. XZ0000

MS 1315 – WORKING CAPITAL FUND (P)

4-2

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

D. Work Breakdown Structure (WBS). LWWFRSIGN000

E. Funds Center. LLWYD03000

4.4 Reporting Requirements (National Sign Center).

The National Sign Center Transaction Report must be sent to the National Sign Coordinator on a

monthly basis by the National Sign Center in Rawlins. A negative report is required when no

signs are shipped during the reporting month. The National Sign Center Transaction Report

should arrive no later than five working days before the end of the every month to ensure current

month processing. It should include the following data: Identifier (internally-generated by the

National Sign Center), Cost Center, Fund Code, Functional Area, WBS (if required), and Cost

(or Sales Price). The National Sign Coordinator instructs the NOC (OC612) to prepare a FBMS

journal voucher (Document Type VB) in conjunction with the Transaction Report prepared by

the National Sign Center in order to record both the revenue from sold signs and the expense to

the purchasing organization.

MS 1315 – WORKING CAPITAL FUND (P)

5-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 5 WCF Sign Program (L9324).

The Sign Program tracks all WCF funding and expenditures associated with the National Sign

Initiative Program. All acquisition of signs within this program must be coordinated through the

National Sign Coordinator and WCF Accountants. This functional area of the WCF consists of

two funded programs. One program is responsible for all custom signs procured for National

Landscape Conservation System sites and the other program is for all other custom signs

procured for BLM.

5.1 Sources of Revenue and Capital Formation (Sign Program).

The source of operational revenue for both programs comes from contributions to the program

from benefiting activities

5.2 Expenses (Sign Program).

Expenses associated with the Sign Program are incurred when signs are procured for an office.

Signs are procured from the Bureau Sign Center or outside vendors. The National Sign

Coordinator determines the vendor from which signs will be procured.

5.3. Cost Coding of Financial Documents (Sign Program).

A. Fund Code. XXXL4525RV

B. Functional Area. Sign Program L93240000.*

C. Program Element.

1. Revenue Billing and Collection. 770000

2. Sign Procurement. 110000

D. Commitment Item.

1. Revenue. WORSI0

2. Expenses. 264B00

E. Work Breakdown Structure (WBS).

1. National Landscape Conservation System – LWWFNLCS0000

2. All other signs – FPDEFAULT (No WBS required)

F. Funds Center. The state will procure or contribute for signs. (LL*)

MS 1315 – WORKING CAPITAL FUND (P)

6-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 6 WCF Department Forms Center (L9360).

The DOI forms function was transferred from the Office of the Secretary to the BLM by a

memorandum of understanding signed December 10, 1984. The Forms Center operation is

administered under the Bureau's WCF. The Forms Center is physically located at the NOC and

the physical operation of the program is managed by the NOC Property Operations Section

(OC653), and the financial management of the program is handled by the NOC Financial

Programs and Investments Section (OC612). Departmental and bureau forms and other

publications such as brochures are provided upon request to various BLM offices, DOI offices,

DOI Bureaus, and other federal agencies.

6.1 Sources of Revenue and Capital Formation (Department Forms Center).

The WCF must recover revenue in an amount approximately equal to the cost of forms

purchased, shipping and mailing costs, and direct and indirect costs associated with the operating

of the departmental forms activity.

A. Forms Issue Revenue. When forms are issued to DOI offices, DOI Bureaus, or

BLM offices, the cost of the forms must be reimbursed to the WCF. In the case of

non-BLM ordering offices, reimbursement is made through the use of purchase cards.

For forms issued to BLM offices, cost transfers are made to the WCF from a Bureau-

wide department forms account maintained at the Headquarters level, Washington

Office.

B. Shipping and Mailing Revenue. The actual costs of shipping and mailing of

departmental forms are collected when forms are issued and are treated as revenue to

the WCF.

C. Surcharge Revenue. At the time departmental forms inventory is issued, a surcharge

amount is incorporated into the cost of the forms. This surcharge is to cover the

direct costs such as wages, equipment lease and maintenance, supplies and inventory

obsolescence, and shrinkage associated with the forms operation. The surcharge

amount is calculated as a percentage of the total cost of forms issued. The surcharge

rate is adjusted annually based upon actual costs.

D. Indirect Cost Revenue. The BLM indirect cost rate for reimbursable BLM accounts

is also charged when forms are issued. This does not provide revenue to the WCF.

6.2 Expenses (Department Forms Center).

Expenses associated with the Department forms operation are incurred by the WCF when

forms are purchased and shipping, mailing, and direct costs associated with the forms

operation are paid. Administrative overhead is also chargeable to this program.

A. Forms Inventory Cost. When forms are initially purchased for subsequent issue, the

full cost of the purchase including freight charges will be charged to the WCF. Due

to tight monetary constraints imposed upon WCF funding, it is necessary that forms

inventories are limited to no more than a 6-month supply at any time. If, for any

MS 1315 – WORKING CAPITAL FUND (P)

6-2

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

reason, it is believed that a larger supply is required, written permission must be

received from the WCF Manager.

B. Direct Costs. There are direct costs associated with operation of the Department

Forms Center, which must be paid for from WCF monies. Those direct costs are for

salaries for administration of the forms operations, equipment lease and maintenance

costs, cost of supplies, and the costs associated with inventory shrinkage and

obsolescence.

6.3 Cost Coding of Financial Documents (Department Forms Center).

A. Fund Code. XXXL4525RV(WCF)

B. Functional Area. L9360 Department Forms Center

C. Program Element.

1. Stores Purchased. .110000

2. Revenue Billing and Collecting. .770000

3. Undistributed Labor Cost. .880000

4. Maint Finance Sys/RPT REG. .XJ0000

5. PRV PERS PRP/FLT/OTHR SUP. .XZ0000

D. Funds Center. LLOC*

E. Work Breakdown Structure (WBS). (LW.WF.DFORM000)

F. Commitment Item. 261C (Stores Inventory Expense - must be used with program

element 11). Other appropriate object classes are utilized for supplies, maintenance,

etc.

6.4 Reporting Requirements (Department Forms Center).

Issues require the recording of transactions into the Automated Inventory Management

System (AIMS) as well as the Collections and Billing System (CBS) for charge card

transaction. Issues to BLM offices are charged to a central account, which is accomplished

by National Operation Center (OC612) personnel entering a journal voucher documents into

FBMS. Separate lines of accounting data are used to show the WCF Revenue (cost of forms,

freight, and surcharge) and the BLM Indirect Cost Reimbursable Revenue.

MS 1315 – WORKING CAPITAL FUND (P)

7-1

BLM MANUAL Rel. 1-797

SUPERCEDES Rel. 1-1538 10/04/2018

Chapter 7 WCF Reimbursable Program (L9390).

BLM is authorized under the authority of the FLPMA to provide services to other Interior

bureaus, other Federal agencies, and other parties. Before any work may be performed, an

Intra/Inter-agency Agreement (IAA) is required to be completed, signed, and input into FBMS.

The IAA specifies the agreement terms and conditions. Any program developed for and

operated on behalf of non-BLM entities must be done in a manner consistent with all laws,

regulations, and policies under which the WCF is subject. At the time this Manual was released,

this program provided services to support Wildland Fire Fighting Equipment replacements for

the Bureau of Indian Affairs, Fish and Wildlife Service, and the National Park Service.