GOVERNMENT OF INDIA

BUDGET 2024-2025

SPEECH

OF

NIRMALA SITHARAMAN

MINISTER OF FINANCE

July 23, 2024

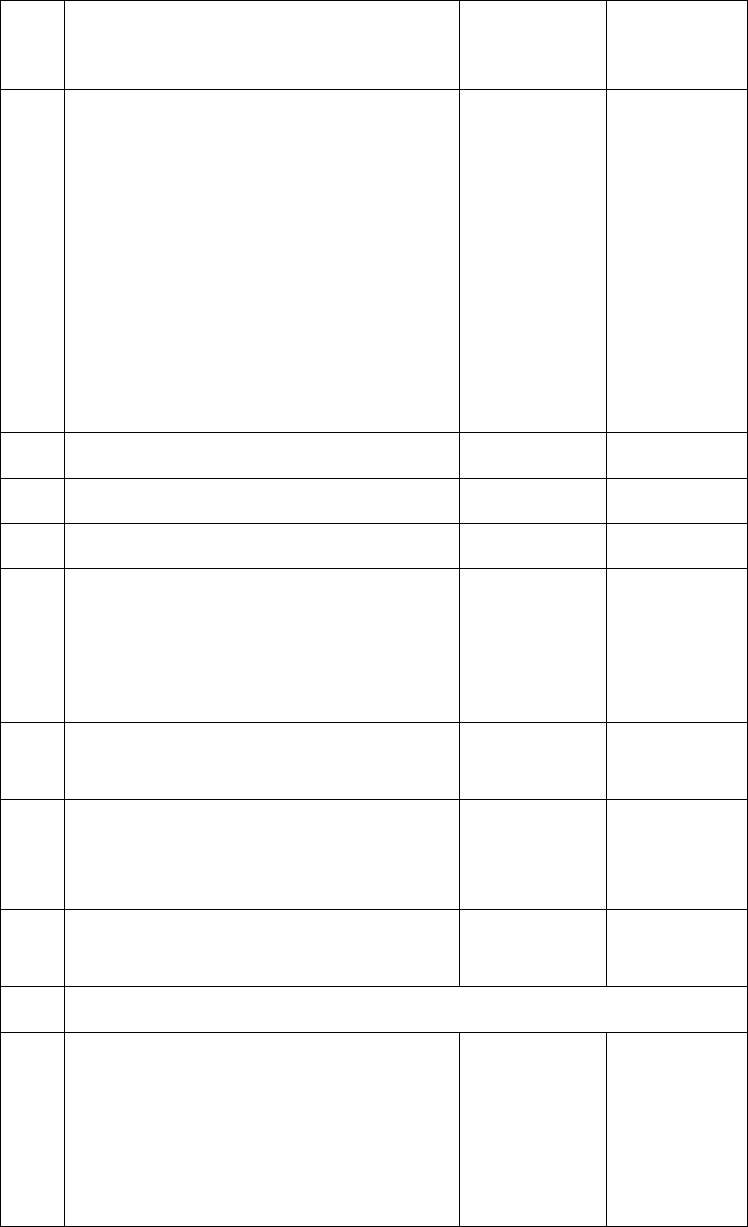

CONTENTS

PART – A

Page No.

Introduction 1

Global Context 1

Interim Budget 2

Budget Theme 2

Budget Priorities 2

(i) Productivity and resilience in Agriculture

(ii) Employment & Skilling

(iii) Inclusive Human Resource Development and Social Justice

(iv) Manufacturing & Services

(v) Urban Development

(vi) Energy Security

(vii) Infrastructure

(viii) Innovation, Research & Development

(ix) Next Generation Reforms

Budget Estimates 2024-25 20

PART – B

Indirect taxes 22

Direct Taxes 25

Annexure to Part-A 31

Annexure to Part-B 36

Budget 2024-2025

Speech of

Nirmala Sitharaman

Minister of Finance

July 23, 2024

Hon’ble Speaker,

I present the Budget for 2024-25.

Introduction

1. The people of India have reposed their faith in the government led by

the Hon’ble Prime Minister Shri Narendra Modi and re-elected it for a historic

third term under his leadership. We are grateful for their support, faith and

trust in our policies. We are determined to ensure that all Indians, regardless

of religion, caste, gender and age, make substantial progress in realising their

life goals and aspirations.

Global Context

2. The global economy, while performing better than expected, is still in

the grip of policy uncertainties. Elevated asset prices, political uncertainties

and shipping disruptions continue to pose significant downside risks for

growth and upside risks to inflation.

3. In this context, India’s economic growth continues to be the shining

exception and will remain so in the years ahead. India’s inflation continues to

be low, stable and moving towards the 4 per cent target. Core inflation (non-

food, non-fuel) currently is 3.1 per cent. Steps are being taken to ensure

supplies of perishable goods reach market adequately.

2

Interim Budget

4. As mentioned in the interim budget, we need to focus on 4 major

castes, namely ‘Garib’ (Poor), ‘Mahilayen’ (Women), ‘Yuva’ (Youth) and

‘Annadata’ (Farmer). For Annadata, we announced higher Minimum Support

Prices a month ago for all major crops, delivering on the promise of at least a

50 per cent margin over costs. Pradhan Mantri Garib Kalyan Anna Yojana was

extended for five years, benefitting more than 80 crore people.

5. Administrative actions for approval and implementation of various

schemes announced in the interim budget are well underway. The required

allocations have been made.

Budget Theme

6. Turning attention to the full year and beyond, in this budget, we

particularly focus on employment, skilling, MSMEs, and the middle class. I am

happy to announce the Prime Minister’s package of 5 schemes and initiatives

to facilitate employment, skilling and other opportunities for 4.1 crore youth

over a 5-year period with a central outlay of ` 2 lakh crore. I will speak about

them shortly, while more details may be seen in the annexure. This year, I

have made a provision of ` 1.48 lakh crore for education, employment and

skilling.

Budget Priorities

7. The people have given a unique opportunity to our government to

take the country on the path of strong development and all-round prosperity.

In the interim budget, we promised to present a detailed roadmap for our

pursuit of ‘Viksit Bharat’. In line with the strategy set out in the interim

budget, this budget envisages sustained efforts on the following 9 priorities

for generating ample opportunities for all.

1) Productivity and resilience in Agriculture

2) Employment & Skilling

3) Inclusive Human Resource Development and Social Justice

4) Manufacturing & Services

5) Urban Development

6) Energy Security

7) Infrastructure

3

8) Innovation, Research & Development and

9) Next Generation Reforms

8. Subsequent budgets will build on these, and add more priorities and

actions. A more detailed formulation will be carried out as part of the

‘economic policy framework’ about which I will speak later in this speech.

9. This budget details some of the specific actions to be initiated in the

current year towards fulfilment of these priorities with potential for

transformative changes. The budget also covers some of the previously

made announcements with an intent to strengthen them and step up their

implementation for expediting our journey towards the goal of Viksit Bharat.

Priority 1: Productivity and resilience in Agriculture

Transforming agriculture research

10. Our government will undertake a comprehensive review of the

agriculture research setup to bring the focus on raising productivity and

developing climate resilient varieties. Funding will be provided in challenge

mode, including to the private sector. Domain experts both from the

government and outside will oversee the conduct of such research.

Release of new varieties

11. New 109 high-yielding and climate-resilient varieties of 32 field and

horticulture crops will be released for cultivation by farmers.

Natural Farming

12. In the next two years, 1 crore farmers across the country will be

initiated into natural farming supported by certification and branding.

Implementation will be through scientific institutions and willing gram

panchayats. 10,000 need-based bio-input resource centres will be

established.

Missions for pulses and oilseeds

13. For achieving self-sufficiency in pulses and oilseeds, we will

strengthen their production, storage and marketing. As announced in the

interim budget, a strategy is being put in place to achieve ‘atmanirbharta’ for

oil seeds such as mustard, groundnut, sesame, soybean, and sunflower.

4

Vegetable production & Supply Chains

14. Large scale clusters for vegetable production will be developed closer

to major consumption centres. We will promote Farmer-Producer

Organizations, cooperatives and start-ups for vegetable supply chains

including for collection, storage, and marketing.

Digital Public Infrastructure for Agriculture

15. Buoyed by the success of the pilot project, our government, in

partnership with the states, will facilitate the implementation of the Digital

Public Infrastructure (DPI) in agriculture for coverage of farmers and their

lands in 3 years. During this year, digital crop survey for Kharif using the DPI

will be taken up in 400 districts. The details of 6 crore farmers and their lands

will be brought into the farmer and land registries. Further, the issuance of

Jan Samarth based Kisan Credit Cards will be enabled in 5 states.

Shrimp Production & Export

16. Financial support for setting up a network of Nucleus Breeding

Centres for Shrimp Broodstocks will be provided. Financing for shrimp

farming, processing and export will be facilitated through NABARD.

National Cooperation Policy

17. Our government will bring out a National Cooperation Policy for

systematic, orderly and all-round development of the cooperative sector.

Fast-tracking growth of rural economy and generation of employment

opportunities on a large scale will be the policy goal.

18. This year, I have made a provision of ` 1.52 lakh crore for agriculture

and allied sector.

Priority 2: Employment & Skilling

Employment Linked Incentive

19. Our government will implement following 3 schemes for ‘Employment

Linked Incentive’, as part of the Prime Minister’s package. These will be

based on enrolment in the EPFO, and focus on recognition of first-time

employees, and support to employees and employers.

5

Scheme A: First Timers

20. This scheme will provide one-month wage to all persons newly

entering the workforce in all formal sectors. The direct benefit transfer of

one-month salary in 3 instalments to first-time employees, as registered in

the EPFO, will be up to ` 15,000. The eligibility limit will be a salary of

` 1 lakh per month. The scheme is expected to benefit 210 lakh youth.

Scheme B: Job Creation in manufacturing

21. This scheme will incentivize additional employment in the

manufacturing sector, linked to the employment of first-time employees. An

incentive will be provided at specified scale directly both to the employee

and the employer with respect to their EPFO contribution in the first 4 years

of employment. The scheme is expected to benefit 30 lakh youth entering

employment, and their employers.

Scheme C: Support to employers

22. This employer-focussed scheme will cover additional employment in

all sectors. All additional employment within a salary of ` 1 lakh per month

will be counted. The government will reimburse to employers up to ` 3,000

per month for 2 years towards their EPFO contribution for each additional

employee. The scheme is expected to incentivize additional employment of

50 lakh persons.

Participation of women in the workforce

23. We will facilitate higher participation of women in the workforce

through setting up of working women hostels in collaboration with industry,

and establishing creches. In addition, the partnership will seek to organize

women-specific skilling programmes, and promotion of market access for

women SHG enterprises.

Skilling programme

24. I am happy to announce a new centrally sponsored scheme, as the 4

th

scheme under the Prime Minister’s package, for skilling in collaboration with

state governments and Industry. 20 lakh youth will be skilled over a 5-year

period. 1,000 Industrial Training Institutes will be upgraded in hub and spoke

arrangements with outcome orientation. Course content and design will be

6

aligned to the skill needs of industry, and new courses will be introduced for

emerging needs.

Skilling Loans

25. The Model Skill Loan Scheme will be revised to facilitate loans up to

` 7.5 lakh with a guarantee from a government promoted Fund. This measure

is expected to help 25,000 students every year.

Education Loans

26. For helping our youth who have not been eligible for any benefit

under government schemes and policies, I am happy to announce a financial

support for loans upto ` 10 lakh for higher education in domestic institutions.

E-vouchers for this purpose will be given directly to 1 lakh students every

year for annual interest subvention of 3 per cent of the loan amount.

Priority 3: Inclusive Human Resource Development and Social Justice

Saturation approach

27. Our government is committed to all-round, all-pervasive and all-

inclusive development of people, particularly, farmers, youth, women and

poor. For achieving social justice comprehensively, the saturation approach

of covering all eligible people through various programmes including those

for education and health will be adopted to empower them by improving

their capabilities.

28. Implementation of schemes meant for supporting economic activities

by craftsmen, artisans, self-help groups, scheduled caste, schedule tribe and

women entrepreneurs, and street vendors, such as PM Vishwakarma, PM

SVANidhi, National Livelihood Missions, and Stand-Up India will be stepped

up.

Purvodaya

29. The states in the Eastern part of the country are rich in endowments

and have strong cultural traditions. We will formulate a plan, Purvodaya, for

the all-round development of the eastern region of the country covering

Bihar, Jharkhand, West Bengal, Odisha and Andhra Pradesh. This will cover

7

human resource development, infrastructure, and generation of economic

opportunities to make the region an engine to attain Viksit Bharat.

30. On the Amritsar Kolkata Industrial Corridor, we will support

development of an industrial node at Gaya. This corridor will catalyze

industrial development of the eastern region. The industrial node at Gaya will

also be a good model for developing our ancient centres of cultural

importance into future centres of modern economy. This model shall

showcase “Vikas bhi Virasat bhi” in our growth trajectory.

31. We will also support development of road connectivity projects,

namely (1) Patna-Purnea Expressway, (2) Buxar-Bhagalpur Expressway, (3)

Bodhgaya, Rajgir, Vaishali and Darbhanga spurs, and (4) additional 2-lane

bridge over river Ganga at Buxar at a total cost of ` 26,000 crore. Power

projects, including setting up of a new 2400 MW power plant at Pirpainti, will

be taken up at a cost of ` 21,400 crore. New airports, medical colleges and

sports infrastructure in Bihar will be constructed.

32. An additional allocation to support capital investments will be

provided. The requests of Bihar Government for external assistance from

multilateral development banks will be expedited.

Andhra Pradesh Reorganization Act

33. Our government has made concerted efforts to fulfil the

commitments in the Andhra Pradesh Reorganization Act. Recognizing the

state’s need for a capital, we will facilitate special financial support through

multilateral development agencies. In the current financial year ` 15,000

crore will be arranged, with additional amounts in future years.

34. Our government is fully committed to financing and early completion

of the Polavaram Irrigation Project, which is the lifeline for Andhra Pradesh

and its farmers. This will facilitate our country’s food security as well.

35. Under the Act, for promoting industrial development, funds will be

provided for essential infrastructure such as water, power, railways and

roads in Kopparthy node on the Vishakhapatnam-Chennai Industrial Corridor

and Orvakal node on Hyderabad-Bengaluru Industrial Corridor. An additional

allocation will be provided this year towards capital investment for economic

growth.

8

36. Grants for backward regions of Rayalaseema, Prakasam and North

Coastal Andhra, as stated in the Act, will also be provided.

PM Awas Yojana

37. Three crore additional houses under the PM Awas Yojana in rural and

urban areas in the country have been announced, for which the necessary

allocations are being made.

Women-led development

38. For promoting women-led development, the budget carries an

allocation of more than ` 3 lakh crore for schemes benefitting women and

girls. This signals our government’s commitment for enhancing women’s role

in economic development.

Pradhan Mantri Janjatiya Unnat Gram Abhiyan

39. For improving the socio-economic condition of tribal communities, we

will launch the Pradhan Mantri Janjatiya Unnat Gram Abhiyan by adopting

saturation coverage for tribal families in tribal-majority villages and

aspirational districts. This will cover 63,000 villages benefitting 5 crore tribal

people.

Bank branches in North-Eastern Region

40. More than 100 branches of India Post Payment Bank will be set up in

the North East region to expand the banking services.

41. This year, I have made a provision of ` 2.66 lakh crore for rural

development including rural infrastructure.

Priority 4: Manufacturing & Services

Support for promotion of MSMEs

42. This budget provides special attention to MSMEs and manufacturing,

particularly labour-intensive manufacturing. We have formulated a package

covering financing, regulatory changes and technology support for MSMEs to

help them grow and also compete globally, as mentioned in the interim

budget. I am happy to announce the following specific measures.

9

Credit Guarantee Scheme for MSMEs in the Manufacturing Sector

43. For facilitating term loans to MSMEs for purchase of machinery and

equipment without collateral or third-party guarantee, a credit guarantee

scheme will be introduced. The scheme will operate on pooling of credit risks

of such MSMEs. A separately constituted self-financing guarantee fund will

provide, to each applicant, guarantee cover up to ` 100 crore, while the loan

amount may be larger. The borrower will have to provide an upfront

guarantee fee and an annual guarantee fee on the reducing loan balance.

New assessment model for MSME credit

44. Public sector banks will build their in-house capability to assess

MSMEs for credit, instead of relying on external assessment. They will also

take a lead in developing or getting developed a new credit assessment

model, based on the scoring of digital footprints of MSMEs in the economy.

This is expected to be a significant improvement over the traditional

assessment of credit eligibility based only on asset or turnover criteria. That

will also cover MSMEs without a formal accounting system.

Credit Support to MSMEs during Stress Period

45. I am happy to announce a new mechanism for facilitating

continuation of bank credit to MSMEs during their stress period. While being

in the ‘special mention account’ (SMA) stage for reasons beyond their

control, MSMEs need credit to continue their business and to avoid getting

into the NPA stage. Credit availability will be supported through a guarantee

from a government promoted fund.

Mudra Loans

46. The limit of Mudra loans will be enhanced to ₹ 20 lakh from the

current ₹ 10 lakh for those entrepreneurs who have availed and successfully

repaid previous loans under the ‘Tarun’ category.

Enhanced scope for mandatory onboarding in TReDS

47. For facilitating MSMEs to unlock their working capital by converting

their trade receivables into cash, I propose to reduce the turnover threshold

of buyers for mandatory onboarding on the TReDS platform from ` 500 crore

to ` 250 crore. This measure will bring 22 more CPSEs and 7000 more

10

companies onto the platform. Medium enterprises will also be included in

the scope of the suppliers.

SIDBI branches in MSME clusters

48. SIDBI will open new branches to expand its reach to serve all major

MSME clusters within 3 years, and provide direct credit to them. With the

opening of 24 such branches this year, the service coverage will expand to

168 out of 242 major clusters.

MSME Units for Food Irradiation, Quality & Safety Testing

49. Financial support for setting up of 50 multi-product food irradiation

units in the MSME sector will be provided. Setting up of 100 food quality and

safety testing labs with NABL accreditation will be facilitated.

E-Commerce Export Hubs

50. To enable MSMEs and traditional artisans to sell their products in

international markets, E-Commerce Export Hubs will be set up in public-

private-partnership (PPP) mode . These hubs, under a seamless regulatory

and logistic framework, will facilitate trade and export related services under

one roof.

Measures for promotion of Manufacturing & Services

Internship in Top Companies

51. As the 5

th

scheme under the Prime Minister’s package, our

government will launch a comprehensive scheme for providing internship

opportunities in 500 top companies to 1 crore youth in 5 years. They will gain

exposure for 12 months to real-life business environment, varied professions

and employment opportunities. An internship allowance of ` 5,000 per

month along with a one-time assistance of ` 6,000 will be provided.

Companies will be expected to bear the training cost and 10 per cent of the

internship cost from their CSR funds.

Industrial Parks

52. Our government will facilitate development of investment-ready

“plug and play” industrial parks with complete infrastructure in or near 100

11

cities, in partnership with the states and private sector, by better using town

planning schemes.

53. Twelve industrial parks under the National Industrial Corridor

Development Programme also will be sanctioned.

Rental Housing

54. Rental housing with dormitory type accommodation for industrial

workers will be facilitated in PPP mode with VGF support and commitment

from anchor industries.

Shipping industry

55. Ownership, leasing and flagging reforms will be implemented to

improve the share of the Indian shipping industry and generate more

employment.

Critical Mineral Mission

56. We will set up a Critical Mineral Mission for domestic production,

recycling of critical minerals, and overseas acquisition of critical mineral

assets. Its mandate will include technology development, skilled workforce,

extended producer responsibility framework, and a suitable financing

mechanism.

Offshore mining of minerals

57. Our government will launch the auction of the first tranche of

offshore blocks for mining, building on the exploration already carried out.

Digital Public Infrastructure Applications

58. Turning to the services sector, I propose development of DPI

applications at population scale for productivity gains, business

opportunities, and innovation by the private sector. These are planned in the

areas of credit, e-commerce, education, health, law and justice, logistics,

MSME, services delivery, and urban governance.

Integrated Technology Platform for IBC eco-system

59. An Integrated Technology Platform will be set up for improving the

outcomes under the Insolvency and Bankruptcy Code (IBC) for achieving

12

consistency, transparency, timely processing and better oversight for all

stakeholders.

Voluntary closure of LLPs

60. The services of the Centre for Processing Accelerated Corporate Exit

(C-PACE) will be extended for voluntary closure of LLPs to reduce the closure

time.

National Company Law Tribunals

61. The IBC has resolved more than 1,000 companies, resulting in direct

recovery of over ` 3.3 lakh crore to creditors. In addition, 28,000 cases

involving over ` 10 lakh crore have been disposed of, even prior to

admission.

62. Appropriate changes to the IBC, reforms and strengthening of the

tribunal and appellate tribunals will be initiated to speed up insolvency

resolution. Additional tribunals will be established. Out of those, some will be

notified to decide cases exclusively under the Companies Act.

Debt Recovery

63. Steps for reforming and strengthening debt recovery tribunals will be

taken. Additional tribunals will be established to speed up recovery.

Priority 5: Urban Development

Cities as Growth Hubs

64. Working with states, our government will facilitate development of

‘Cities as Growth Hubs’. This will be achieved through economic and transit

planning, and orderly development of peri-urban areas utilising town

planning schemes.

Creative redevelopment of cities

65. For creative brownfield redevelopment of existing cities with a

transformative impact, our government will formulate a framework for

enabling policies, market-based mechanisms and regulation.

13

Transit Oriented Development

66. Transit Oriented Development plans for 14 large cities with a

population above 30 lakh will be formulated, along with an implementation

and financing strategy.

Urban Housing

67. Under the PM Awas Yojana Urban 2.0, housing needs of 1 crore urban

poor and middle-class families will be addressed with an investment of ₹ 10

lakh crore. This will include the central assistance of ₹ 2.2 lakh crore

in the next 5 years. A provision of interest subsidy to facilitate loans at

affordable rates is also envisaged.

68. In addition, enabling policies and regulations for efficient and

transparent rental housing markets with enhanced availability will also be put

in place.

Water Supply and Sanitation

69. In partnership with the State Governments and Multilateral

Development Banks we will promote water supply, sewage treatment and

solid waste management projects and services for 100 large cities through

bankable projects. These projects will also envisage use of treated water for

irrigation and filling up of tanks in nearby areas.

Street Markets

70. Building on the success of PM SVANidhi Scheme in transforming the

lives of street vendors, our Government envisions a scheme to support each

year, over the next five years, the development of 100 weekly ‘haats’ or

street food hubs in select cities.

Stamp Duty

71. We will encourage states which continue to charge high stamp duty to

moderate the rates for all, and also consider further lowering duties for

properties purchased by women. This reform will be made an essential

component of urban development schemes.

14

Priority 6: Energy Security

Energy Transition

72. In the interim budget, I had announced our strategy to sustain high

and more resource-efficient economic growth, along with energy security in

terms of availability, accessibility and affordability. We will bring out a policy

document on appropriate energy transition pathways that balances the

imperatives of employment, growth and environmental sustainability.

PM Surya Ghar Muft Bijli Yojana

73. In line with the announcement in the interim budget, PM Surya Ghar

Muft Bijli Yojana has been launched to install rooftop solar plants to enable 1

crore households obtain free electricity up to 300 units every month. The

scheme has generated remarkable response with more than 1.28 crore

registrations and 14 lakh applications, and we will further encourage it.

Pumped Storage Policy

74. A policy for promoting pumped storage projects will be brought out

for electricity storage and facilitating smooth integration of the growing

share of renewable energy with its variable & intermittent nature in the

overall energy mix.

Research and development of small and modular nuclear reactors

75. Nuclear energy is expected to form a very significant part of the

energy mix for Viksit Bharat. Towards that pursuit, our government will

partner with the private sector for (1) setting up Bharat Small Reactors, (2)

research & development of Bharat Small Modular Reactor, and (3) research &

development of newer technologies for nuclear energy. The R&D funding

announced in the interim budget will be made available for this sector.

Advanced Ultra Super Critical Thermal Power Plants

76. The development of indigenous technology for Advanced Ultra Super

Critical (AUSC) thermal power plants with much higher efficiency has been

completed. A joint venture between NTPC and BHEL will set up a full scale

800 MW commercial plant using AUSC technology. The government will

provide the required fiscal support. Moving forward, development of

indigenous capacity for the production of high-grade steel and other

15

advanced metallurgy materials for these plants will result in strong spin-off

benefits for the economy.

Roadmap for ‘hard to abate’ industries

77. A roadmap for moving the ‘hard to abate’ industries from ‘energy

efficiency’ targets to ‘emission targets’ will be formulated. Appropriate

regulations for transition of these industries from the current ‘Perform,

Achieve and Trade’ mode to ‘Indian Carbon Market’ mode will be put in

place.

Support to traditional micro and small industries

78. An investment-grade energy audit of traditional micro and small

industries in 60 clusters, including brass and ceramic, will be facilitated.

Financial support will be provided for shifting them to cleaner forms of

energy and implementation of energy efficiency measures. The scheme will

be replicated in another 100 clusters in the next phase.

Priority 7: Infrastructure

Infrastructure investment by Central Government

79. Significant investment the Central Government has made over the years

in building and improving infrastructure has had a strong multiplier effect on the

economy. We will endeavour to maintain strong fiscal support for infrastructure

over the next 5 years, in conjunction with imperatives of other priorities and

fiscal consolidation. This year, I have provided ` 11,11,111 crore for capital

expenditure. This would be 3.4 per cent of our GDP.

Infrastructure investment by state governments

80. We will encourage states to provide support of similar scale for

infrastructure, subject to their development priorities. A provision of ` 1.5

lakh crore for long-term interest free loans has been made this year also to

support the states in their resource allocation.

Private investment in infrastructure

81. Investment in infrastructure by private sector will be promoted

through viability gap funding and enabling policies and regulations. A market-

based financing framework will be brought out.

16

Pradhan Mantri Gram Sadak Yojana (PMGSY)

82. Phase IV of PMGSY will be launched to provide all-weather

connectivity to 25,000 rural habitations which have become eligible in view

of their population increase.

Irrigation and Flood Mitigation

83. Bihar has frequently suffered from floods, many of them originating

outside the country. Plans to build flood control structures in Nepal are yet

to progress. Our government, through the Accelerated Irrigation Benefit

Programme and other sources, will provide financial support for projects with

estimated cost of ` 11,500 crore such as the Kosi-Mechi intra-state link and

20 other ongoing and new schemes including barrages, river pollution

abatement and irrigation projects. In addition, survey and investigation of

Kosi related flood mitigation and irrigation projects will be undertaken.

84. Assam grapples with floods every year by the Brahmaputra River and

its tributaries, originating outside India. We will provide assistance to Assam

for flood management and related projects.

85. Himachal Pradesh suffered extensive losses due to floods last year.

Our government will provide assistance to the state for reconstruction and

rehabilitation through multilateral development assistance.

86. Uttarakhand too suffered losses due to cloud bursts and massive

landslides. We will provide assistance to the state.

87. Recently Sikkim witnessed devastating flash floods and landslides that

wreaked havoc across the state. Our Government will provide assistance to

the state.

Tourism

88. Tourism has always been a part of our civilization. Our efforts in

positioning India as a global tourist destination will also create jobs, stimulate

investments and unlock economic opportunities for other sectors. In addition

to the measures outlined in the interim budget, I propose the following

measures.

89. Vishnupad Temple at Gaya and Mahabodhi Temple at Bodh Gaya in

Bihar are of immense spiritual significance. Comprehensive development of

17

Vishnupad Temple Corridor and Mahabodhi Temple Corridor will be

supported, modelled on the successful Kashi Vishwanath Temple Corridor, to

transform them into world class pilgrim and tourist destinations.

90. Rajgir holds immense religious significance for Hindus, Buddhists and

Jains. The 20th Tirthankara Munisuvrata temple in the Jain Temple complex

is ancient. The Saptharishi or the 7 hotsprings form a warm water

Brahmakund that is sacred. A comprehensive development initiative for

Rajgir will be undertaken.

91. Our government will support the development of Nalanda as a tourist

centre besides reviving Nalanda University to its glorious stature.

92. Odisha’s scenic beauty, temples, monuments, craftsmanship, wildlife

sanctuaries, natural landscapes and pristine beaches make it an ultimate

tourism destination. Our government will provide assistance for their

development.

Priority 8: Innovation, Research & Development

93. We will operationalize the Anusandhan National Research Fund for

basic research and prototype development. Further, we will set up a

mechanism for spurring private sector-driven research and innovation at

commercial scale with a financing pool of ` 1 lakh crore in line with the

announcement in the interim budget.

Space Economy

94. With our continued emphasis on expanding the space economy by 5

times in the next 10 years, a venture capital fund of ` 1,000 crore will be set

up.

Priority 9: Next Generation Reforms

Economic Policy Framework

95. We will formulate an Economic Policy Framework to delineate the

overarching approach to economic development and set the scope of the

next generation of reforms for facilitating employment opportunities and

sustaining high growth.

96. Our government will initiate and incentivize reforms for (1) improving

productivity of factors of production, and (2) facilitating markets and sectors

to become more efficient. These reforms will cover all factors of production,

18

namely land, labour, capital and entrepreneurship, and technology as an

enabler of improving total factor productivity and bridging inequality.

97. Effective implementation of several of these reforms requires

collaboration between the Centre and the states and building consensus, as

development of the country lies in development of the states. For promoting

competitive federalism and incentivizing states for faster implementation of

reforms, I propose to earmark a significant part of the 50-year interest-free

loan. Working with the states, we will initiate the following reforms.

Land-related reforms by state governments

98. Land-related reforms and actions, both in rural and urban areas, will

cover (1) land administration, planning and management, and (2) urban

planning, usage and building bylaws. These will be incentivized for

completion within the next 3 years through appropriate fiscal support.

Rural Land related actions

99. Rural land related actions will include (1) assignment of Unique Land

Parcel Identification Number (ULPIN) or Bhu-Aadhaar for all lands, (2)

digitization of cadastral maps, (3) survey of map sub-divisions as per current

ownership, (4) establishment of land registry, and (5) linking to the farmers

registry. These actions will also facilitate credit flow and other agricultural

services.

Urban Land related actions

100. Land records in urban areas will be digitized with GIS mapping. An IT

based system for property record administration, updating, and tax

administration will be established. These will also facilitate improving the

financial position of urban local bodies.

Labour related reforms

Services to Labour

101. Our government will facilitate the provision of a wide array of services

to labour, including those for employment and skilling. A comprehensive

integration of e-shram portal with other portals will facilitate such one-stop

solution. Open architecture databases for the rapidly changing labour

19

market, skill requirements and available job roles, and a mechanism to

connect job-aspirants with potential employers and skill providers will be

covered in these services.

Shram Suvidha & Samadhan Portal

102. Shram Suvidha and Samadhan portals will be revamped to enhance

ease of compliance for industry and trade.

Capital and entrepreneurship related reforms

Financial sector vision and strategy

103. For meeting financing needs of the economy, our government will

bring out a financial sector vision and strategy document to prepare the

sector in terms of size, capacity and skills. This will set the agenda for the

next 5 years and guide the work of the government, regulators, financial

institutions and market participants.

Taxonomy for climate finance

104. We will develop a taxonomy for climate finance for enhancing the

availability of capital for climate adaptation and mitigation. This will support

achievement of the country’s climate commitments and green transition.

Variable Capital Company structure

105. We will seek the required legislative approval for providing an

efficient and flexible mode for financing leasing of aircrafts and ships, and

pooled funds of private equity through a ‘variable company structure’.

Foreign Direct Investment and Overseas Investment

106. The rules and regulations for Foreign Direct Investment and Overseas

Investments will be simplified to (1) facilitate foreign direct investments, (2)

nudge prioritization, and (3) promote opportunities for using Indian Rupee as

a currency for overseas investments.

NPS Vatsalya

107. NPS-Vatsalya, a plan for contribution by parents and guardians for

minors will be started. On attaining the age of majority, the plan can be

converted seamlessly into a normal NPS account.

20

Use of Technology

108. We have successfully used technology for improving productivity and

bridging inequality in our economy during the past 10 years. Public

investment in digital infrastructure and innovations by the private sector

have helped in improving access of all citizens, particularly the common

people, to market resources, education, health and services. We will step up

adoption of technology towards digitalization of the economy.

Ease of Doing Business

109. For enhancing ‘Ease of Doing Business’, we are already working on the

Jan Vishwas Bill 2.0. Further, states will be incentivized for implementation of

their Business Reforms Action Plans and digitalization.

Data and Statistics

110. For improving data governance, collection, processing and

management of data and statistics, different sectoral data bases, including

those established under the Digital India mission, will be utilized with active

use of technology tools.

New Pension Scheme (NPS)

111. The Committee to review the NPS has made considerable progress in

its work. I am happy that the Staff Side of the National Council of the Joint

Consultative Machinery for Central Government Employees have taken a

constructive approach. A solution will be evolved which addresses the

relevant issues while maintaining fiscal prudence to protect the common

citizens.

Budget Estimates 2024-25

112. For the year 2024-25, the total receipts other than borrowings and

the total expenditure are estimated at ` 32.07 lakh crore and ` 48.21 lakh

crore respectively. The net tax receipts are estimated at ` 25.83 lakh crore.

The fiscal deficit is estimated at 4.9 per cent of GDP.

21

113. The gross and net market borrowings through dated securities during

2024-25 are estimated at ` 14.01 lakh crore and ` 11.63 lakh crore

respectively. Both will be less than that in 2023-24.

114. The fiscal consolidation path announced by me in 2021 has served our

economy very well, and we aim to reach a deficit below 4.5 per cent next

year. The Government is committed to staying the course. From 2026-27

onwards, our endeavour will be to keep the fiscal deficit each year such that

the Central Government debt will be on a declining path as percentage of

GDP.

I will, now, move to Part B.

22

PART B

Indirect Taxes

115. I start with GST. It has decreased tax incidence on the common man;

reduced compliance burden and logistics cost for trade and industry; and

enhanced revenues of the central and state governments. It is a success of

vast proportions. To multiply the benefits of GST, we will strive to further

simplify and rationalise the tax structure and endeavour to expand it to the

remaining sectors.

116. My proposals for customs duties intend to support domestic

manufacturing, deepen local value addition, promote export

competitiveness, and simplify taxation, while keeping the interest of the

general public and consumers surmount.

117. In Budget 2022-23, we reduced the number of customs duty rates.

I propose to undertake a comprehensive review of the rate structure over the

next six months to rationalise and simplify it for ease of trade, removal of

duty inversion and reduction of disputes.

118. I shall now take up sector specific customs duty proposals.

Medicines and Medical Equipment

119. To provide relief to cancer patients, I propose to fully exempt three

more medicines from customs duties.

120. I also propose changes in the BCD on x-ray tubes & flat panel

detectors for use in medical x-ray machines under the Phased Manufacturing

Programme, so as to synchronise them with domestic capacity addition.

Mobile Phone and Related Parts

121. With a three-fold increase in domestic production and almost

100-fold jump in exports of mobile phones over the last six years, the Indian

mobile phone industry has matured. In the interest of consumers, I now

propose to reduce the BCD on mobile phone, mobile PCBA and mobile

charger to 15 per cent.

23

Critical Minerals

122. Minerals such as lithium, copper, cobalt and rare earth elements are

critical for sectors like nuclear energy, renewable energy, space, defence,

telecommunications, and high-tech electronics. I propose to fully exempt

customs duties on 25 critical minerals and reduce BCD on two of them. This

will provide a major fillip to the processing and refining of such minerals and

help secure their availability for these strategic and important sectors.

Solar Energy

123. Energy transition is critical in the fight against climate change. To

support energy transition, I propose to expand the list of exempted capital

goods for use in the manufacture of solar cells and panels in the country.

Further, in view of sufficient domestic manufacturing capacity of solar glass

and tinned copper interconnect, I propose not to extend the exemption of

customs duties provided to them.

Marine products

124. India’s seafood exports in the last financial year touched an all-time

high of more than ₹ 60,000 crore. Frozen shrimp accounted for about

two-thirds of these exports. To enhance their competitiveness, I propose to

reduce BCD on certain broodstock, polychaete worms, shrimp and fish feed

to 5 per cent. I also propose to exempt customs duty on various inputs for

manufacture of shrimp and fish feed.

Leather and Textile

125. Similarly, to enhance the competitiveness of exports in the leather

and textile sectors, I propose to reduce BCD on real down filling material

from duck or goose. I am also making additions to the list of exempted goods

for manufacture of leather and textile garments, footwear and other leather

articles for export.

126. To rectify inversion in duty, I propose to reduce BCD, subject to

conditions, on methylene diphenyl diisocyanate (MDI) for manufacture of

spandex yarn from 7.5 to 5 per cent.

24

127. Furthermore, the export duty structure on raw hides, skins and

leather is proposed to be simplified and rationalized.

Precious Metals

128. To enhance domestic value addition in gold and precious metal

jewellery in the country, I propose to reduce customs duties on gold and

silver to 6 per cent and that on platinum to 6.4 per cent.

Other Metals

129. Steel and copper are important raw materials. To reduce their cost of

production, I propose to remove the BCD on ferro nickel and blister copper. I

am also continuing with nil BCD on ferrous scrap and nickel cathode and

concessional BCD of 2.5 per cent on copper scrap.

Electronics

130. To increase value addition in the domestic electronics industry,

I propose to remove the BCD, subject to conditions, on oxygen free copper

for manufacture of resistors. I also propose to exempt certain parts for

manufacture of connectors.

Chemicals and Petrochemicals

131. To support existing and new capacities in the pipeline, I propose to

increase the BCD on ammonium nitrate from 7.5 to 10 per cent.

Plastics

132. PVC flex banners are non-biodegradable and hazardous for

environment and health. To curb their imports, I propose to raise the BCD on

them from 10 to 25 per cent.

Telecommunication Equipment

133. To incentivise domestic manufacturing, I propose to increase the BCD

from 10 to 15 per cent on PCBA of specified telecom equipment.

Trade facilitation

134. To promote domestic aviation and boat & ship MRO, I propose to

extend the period for export of goods imported for repairs from six months

to one year. In the same vein, I propose to extend the time-limit for re-import

of goods for repairs under warranty from three to five years.

25

Direct Taxes

135. We will continue our efforts to simplify taxes, improve tax payer

services, provide tax certainty and reduce litigation while enhancing revenues

for funding the development and welfare schemes of the government.

136. It has been our endeavour to simplify taxation. We have taken a

number of measures in the last few years including introduction of simplified

tax regimes without exemptions and deductions for corporate tax and

personal income tax. This has been appreciated by tax payers. 58 per cent of

corporate tax came from the simplified tax regime in financial year 2022-23.

Similarly, as per data available till now for the last fiscal, more than two-

thirds have availed the new personal income tax regime.

Comprehensive Review of the Income-tax Act, 1961

137. I am now announcing a comprehensive review of the Income-tax Act,

1961. The purpose is to make the Act concise, lucid, easy to read and

understand. This will reduce disputes and litigation, thereby providing tax

certainty to the tax payers. It will also bring down the demand embroiled in

litigation. It is proposed to be completed in six months.

138. A beginning is being made in the Finance Bill by simplifying the tax

regime for charities, TDS rate structure, provisions for reassessment and

search provisions and capital gains taxation.

Simplification for Charities and of TDS

139. The two tax exemption regimes for charities are proposed to be

merged into one. The 5 per cent TDS rate on many payments is being merged

into the 2 per cent TDS rate and the 20 per cent TDS rate on repurchase of

units by mutual funds or UTI is being withdrawn. TDS rate on e-commerce

operators is proposed to be reduced from one to 0.1 per cent. Moreover,

credit of TCS is proposed to be given in the TDS to be deducted on salary.

Further, I propose to decriminalize delay for payment of TDS up to the due

date of filing statement for the same. I also plan to provide a standard

operating procedure for TDS defaults and simplify and rationalise the

compounding guidelines for such defaults.

26

Simplification of Reassessment

140. I propose to thoroughly simplify the provisions for reopening and

reassessment. An assessment hereinafter can be reopened beyond three

years from the end of the assessment year only if the escaped income is

₹ 50 lakh or more, up to a maximum period of five years from the end of the

assessment year. Even in search cases, a time limit of six years before the

year of search, as against the existing time limit of ten years, is proposed.

This will reduce tax-uncertainty and disputes.

Simplification and Rationalisation of Capital Gains

141. Capital gains taxation is also proposed to be hugely simplified.

142. Short term gains on certain financial assets shall henceforth attract a

tax rate of 20 per cent, while that on all other financial assets and all

non-financial assets shall continue to attract the applicable tax rate.

143. Long term gains on all financial and non-financial assets, on the other

hand, will attract a tax rate of 12.5 per cent. For the benefit of the lower and

middle-income classes, I propose to increase the limit of exemption of capital

gains on certain financial assets to ₹ 1.25 lakh per year.

144. Listed financial assets held for more than a year will be classified as

long term, while unlisted financial assets and all non-financial assets will have

to be held for at least two years to be classified as long-term.

145. Unlisted bonds and debentures, debt mutual funds and market linked

debentures, irrespective of holding period, however, will attract tax on

capital gains at applicable rates.

Tax Payer Services

146. All the major tax payer services under GST and most services under

Customs and Income Tax have been digitalised. All remaining services of

Customs and Income Tax including rectification and order giving effect to

appellate orders shall be digitalized and made paper-less over the next two

years.

Litigation and Appeals

147. While our concerted efforts to reduce pendency of appeals at various

appellate fora are beginning to show good results, it will continue to engage

our highest attention.

27

148. To dispose of the backlog of first appeals, I plan to deploy more

officers to hear and decide such appeals, especially those with large tax

effect.

149. For resolution of certain income tax disputes pending in appeal, I am

also proposing Vivad Se Vishwas Scheme, 2024.

150. Further, I propose to increase monetary limits for filing appeals

related to direct taxes, excise and service tax in the Tax Tribunals, High Courts

and Supreme Court to ₹ 60 lakh, ₹ 2 crore and ₹ 5 crore respectively.

151. With a view to reduce litigation and provide certainty in international

taxation, we will expand the scope of safe harbour rules and make them

more attractive. We will also streamline the transfer pricing assessment

procedure.

Employment and Investment

152. I have a few proposals to promote investment and foster

employment.

153. First of all, to bolster the Indian start-up eco-system, boost the

entrepreneurial spirit and support innovation, I propose to abolish the so-

called angel tax for all classes of investors.

154. Second, there is tremendous potential for cruise tourism in India. To

give a fillip to this employment generating industry, I am proposing a simpler

tax regime for foreign shipping companies operating domestic cruises in the

country.

155. Third, India is a world leader in the diamond cutting and polishing

industry, which employs a large number of skilled workers. To further

promote the development of this sector, we would provide for safe harbour

rates for foreign mining companies selling raw diamonds in the country.

156. Fourth, to attract foreign capital for our development needs,

I propose to reduce the corporate tax rate on foreign companies from 40 to

35 per cent.

28

Deepening the tax base

157. I have a couple of proposals for deepening the tax base. First, Security

Transactions Tax on futures and options of securities is proposed to be

increased to 0.02 per cent and 0.1 per cent respectively. Second, for reasons

of equity, I propose to tax income received on buy back of shares in the

hands of the recipient.

Others

158. To improve social security benefits, deduction of expenditure by

employers towards NPS is proposed to be increased from 10 to 14 per cent of

the employee’s salary. Similarly, deduction of this expenditure up to 14 per

cent of salary from the income of employees in private sector, public sector

banks and undertakings, opting for the new tax regime, is proposed to be

provided.

159. Indian professionals working in multinationals get ESOPs and invest in

social security schemes and other movable assets abroad. Non-reporting of

such small foreign assets has penal consequences under the Black Money

Act. Such non-reporting of movable assets up to ₹ 20 lakh is proposed to be

de-penalised.

160. Other major proposals in the Finance Bill relate to:

• Withdrawal of equalization levy of 2 per cent;

• Expansion of tax benefits to certain funds and entities in IFSCs; and

• immunity from penalty and prosecution to benamidar on full and

true disclosure so as to improve conviction under the Benami

Transactions (Prohibition) Act, 1988.

Personal Income Tax

161. Coming to Personal Income Tax Rates, I have two announcements to

make for those opting for the new tax regime. First, the standard deduction

for salaried employees is proposed to be increased from ₹50,000/- to

₹75,000/-. Similarly, deduction on family pension for pensioners is proposed

to be enhanced from ₹ 15,000/- to ₹ 25,000/-. This will provide relief to

about four crore salaried individuals and pensioners.

29

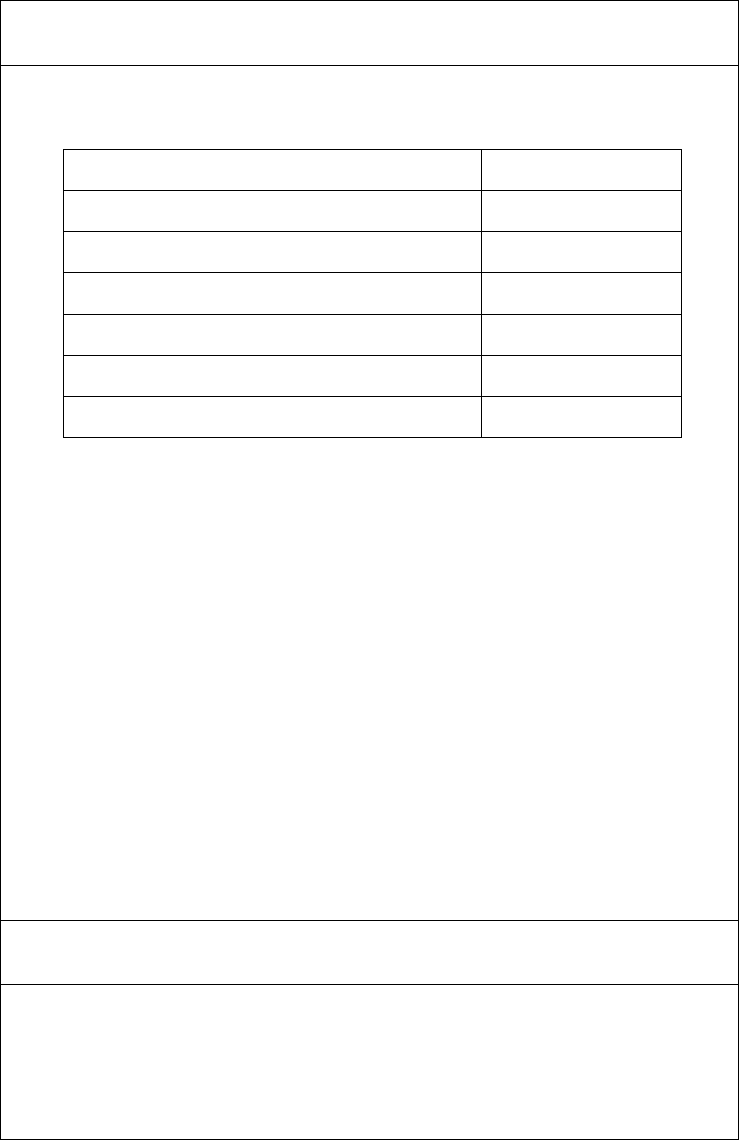

162. Second, in the new tax regime, the tax rate structure is proposed to

be revised, as follows:

0-3 lakh rupees Nil

3-7 lakh rupees 5 per cent

7-10 lakh rupees 10 per cent

10-12 lakh rupees 15 per cent

12-15 lakh rupees 20 per cent

Above 15 lakh rupees

30 per cent

As a result of these changes, a salaried employee in the new tax regime

stands to save up to ₹ 17,500/- in income tax.

163. Apart from these, I am also making some other changes as given in

the annexure.

164. As a result of these proposals, revenue of about ₹ 37,000 crore –

₹ 29,000 crore in direct taxes and ₹ 8,000 crore in indirect taxes – will be

forgone while revenue of about ₹ 30,000 crore rupees will be additionally

mobilized. Thus, the total revenue forgone is about ₹ 7,000 crore annually.

165. Mr. Speaker Sir, with this, I commend the budget to this august

House.

Jai Hind.

30

31

Annexure to Part – A

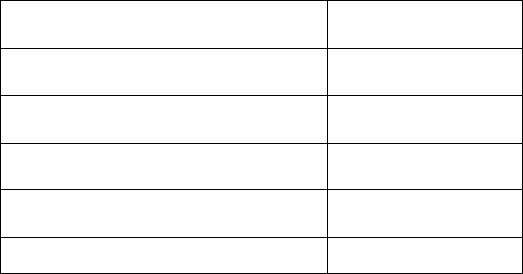

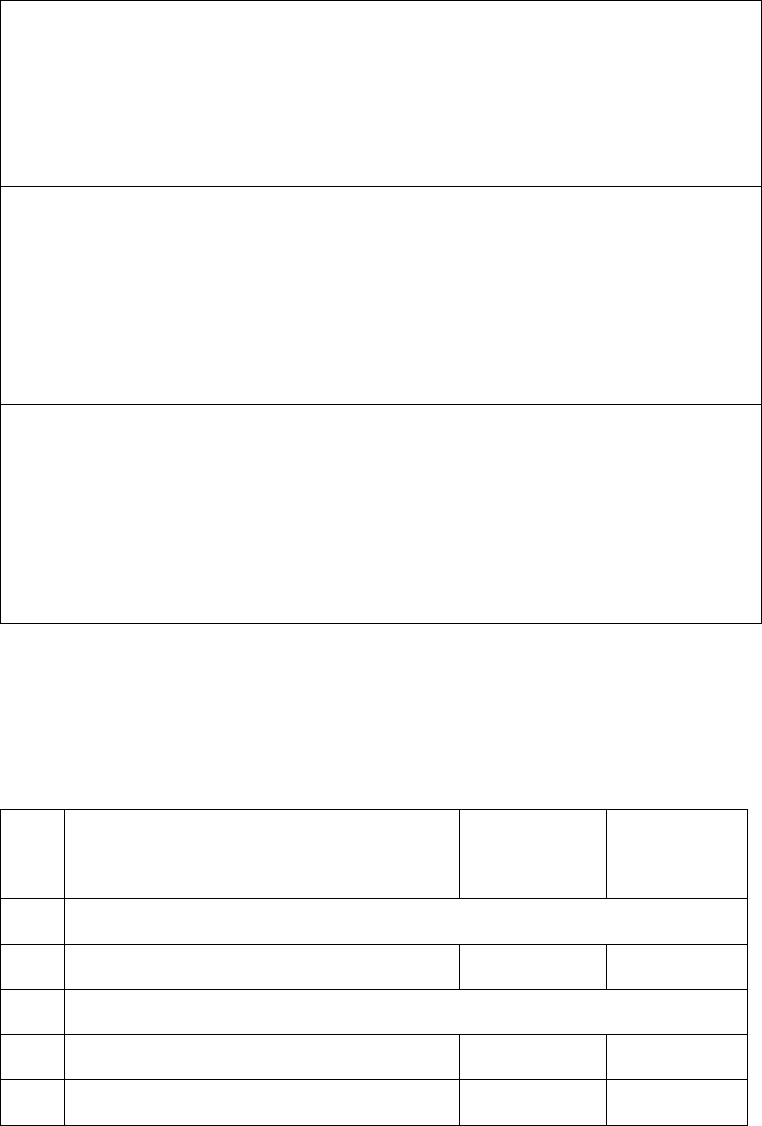

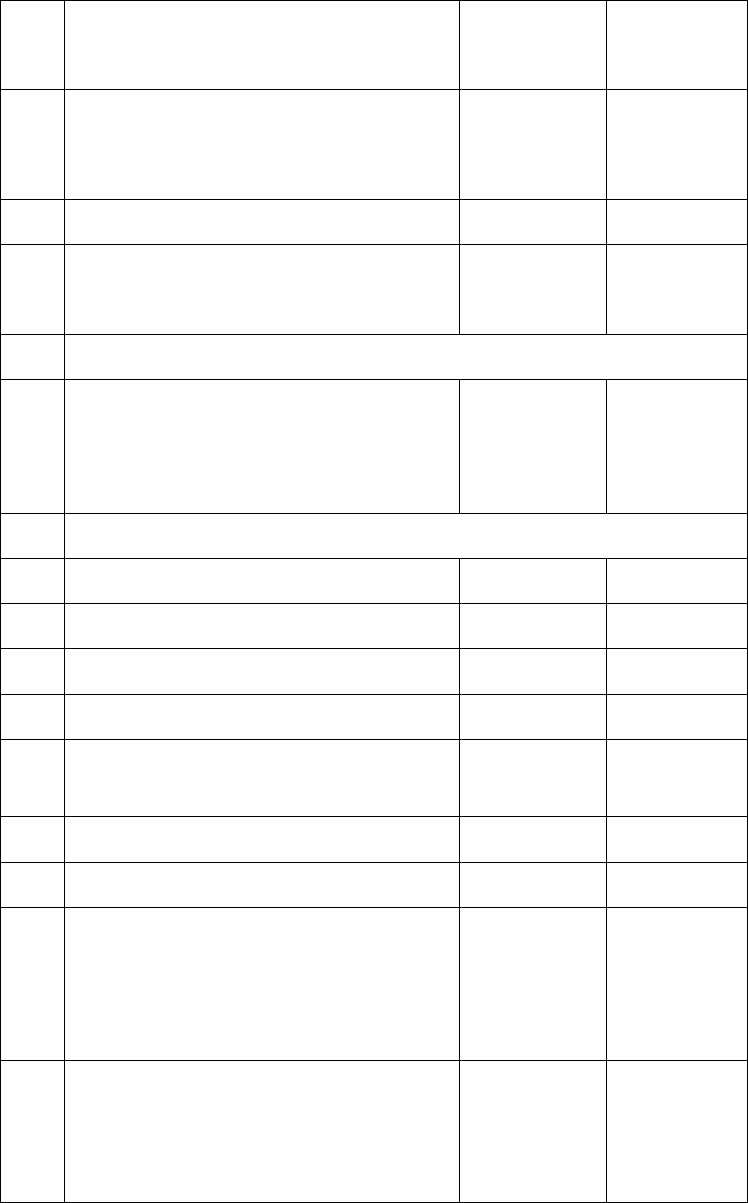

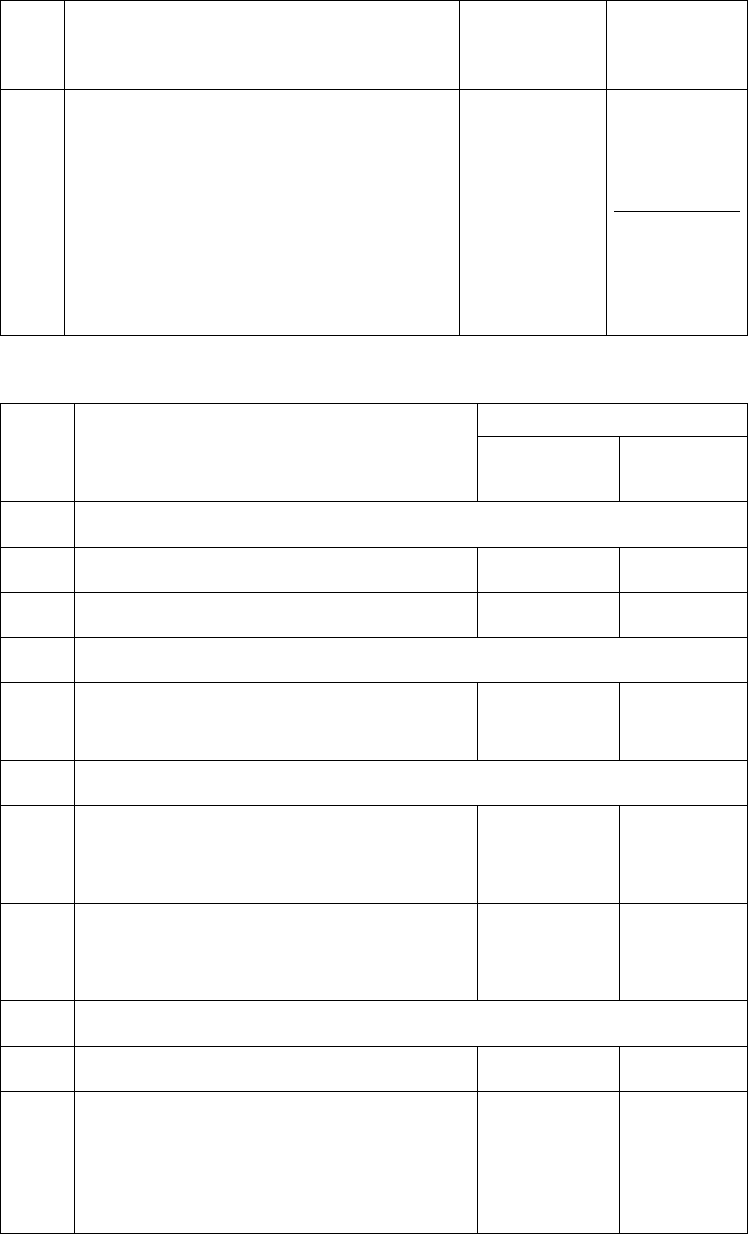

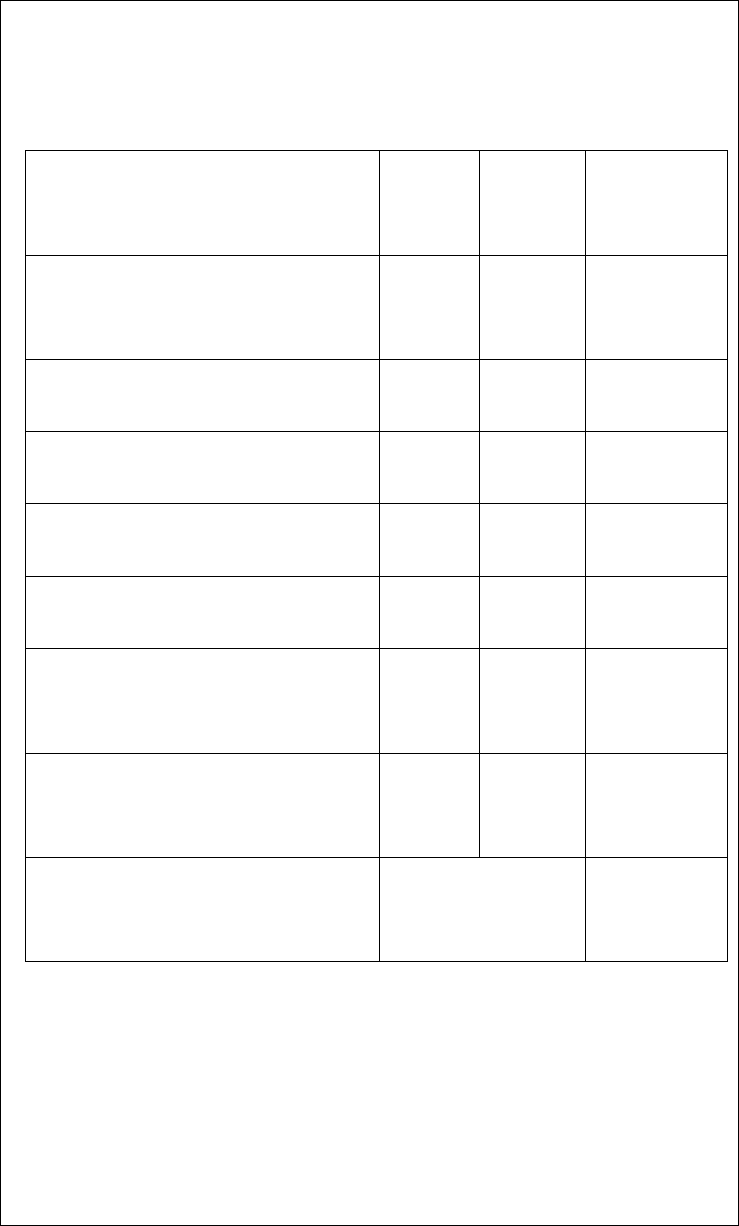

Prime Minister’s Package for Employment and Skilling

Coverage and Estimated Central Outlay

Enrolment

Duration

Expenditure

Duration

Beneficiaries

Central

Outlay

Years

(lakhs)

(`Crore)

Employment Linked

Incentive

Scheme A (first

timers)

2

3

210

23,000

Scheme B

(bulk hiring of first

timers in

manufacturing)

2

6

30

52,000

Scheme C (job

creation)

2

6

50

32,000

Internship Programme

(Phase-1)

2

3

30

19,000

Internship Programme

(Phase-2)

3*

4*

70

44,000

Upgradation of ITIs

N/A

5

20

30,000

Total

410

2,00,000

*Starting from third year

Outline of Schemes

1. Employment Linked Incentive Scheme A: First Timers (Para 20)

• One month’s wage as subsidy (maximum `15,000)

• Applicable to all sectors

• First timers have a learning curve before they become fully

productive; subsidy is to assist employees and employers in hiring of

first timers.

32

• Applicable to all persons newly entering the workforce (EPFO) with

wage/salary less than `1 lakh per month.

• Subsidy will be paid to the employee in three instalments

• Employee must undergo compulsory online Financial Literacy course

before claiming the second instalment.

• Subsidy to be refunded by employer if the employment to the first

timer ends within 12 months of recruitment.

• Expected to cover approximately one crore persons per annum.

• Scheme will be for 2 years

2. Employment linked Incentive Scheme B: Job creation in manufacturing

(Para 21)

• Applicable for substantial hiring of first time employees in the

manufacturing sector

• All employers which are corporate entities and those non-corporate

entities with a three year track record of EPFO contribution will be

eligible.

• Employer must hire at least the following number of previously non-

EPFO enrolled workers:

50 or

25% of the baseline (previous year’s number of EPFO employees)

[whichever is lower]

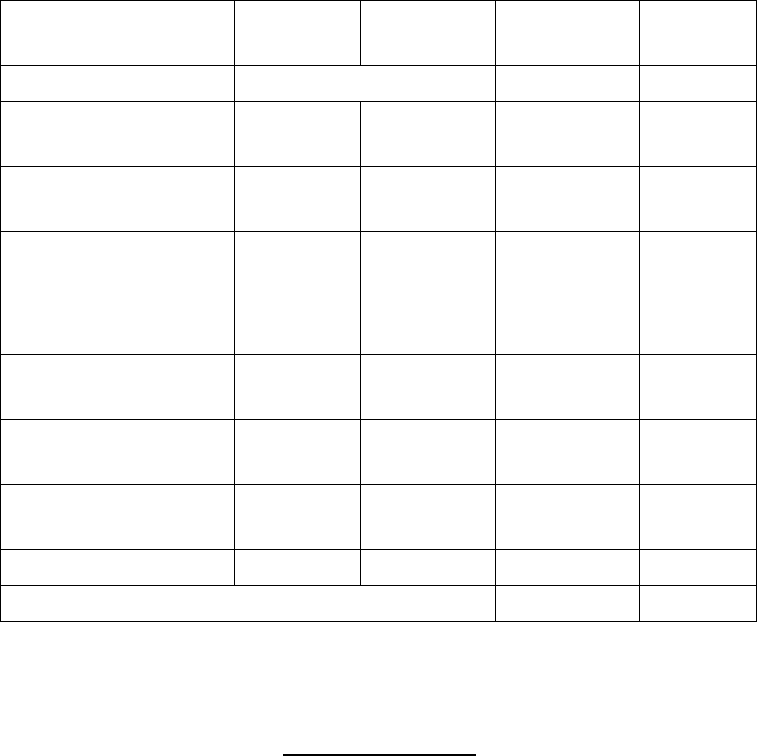

• Incentive will be paid for four years partly to the employee and partly

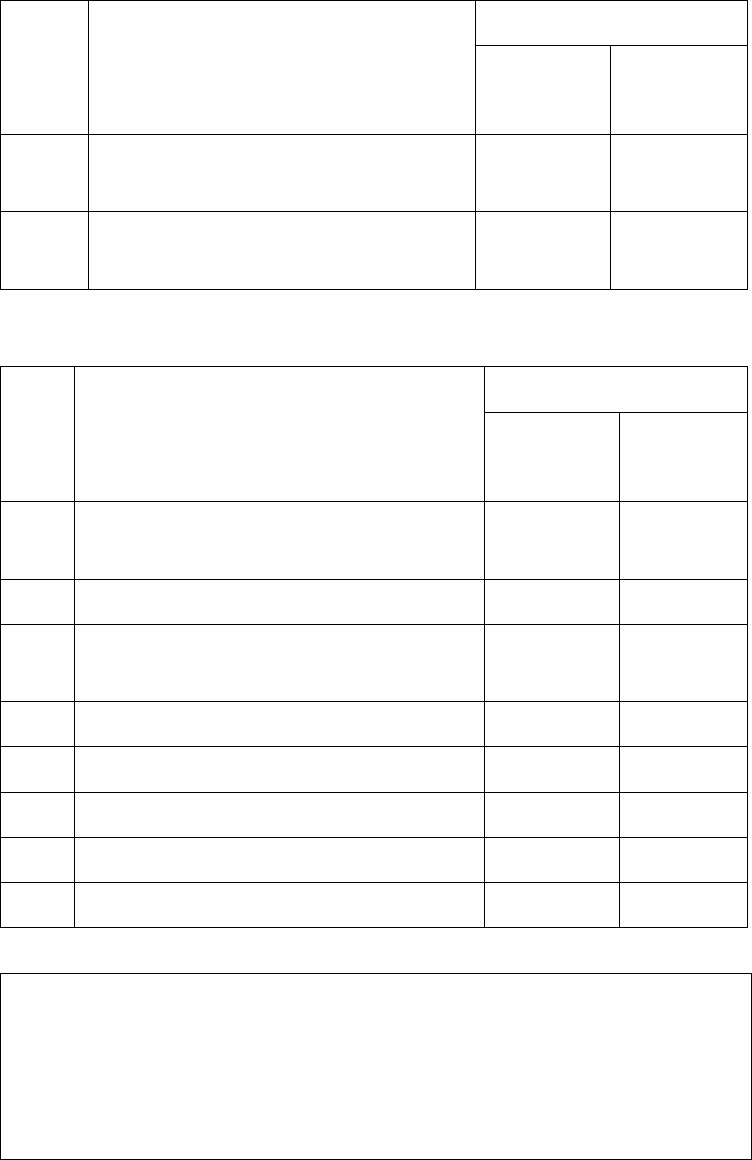

to the employer as follows:

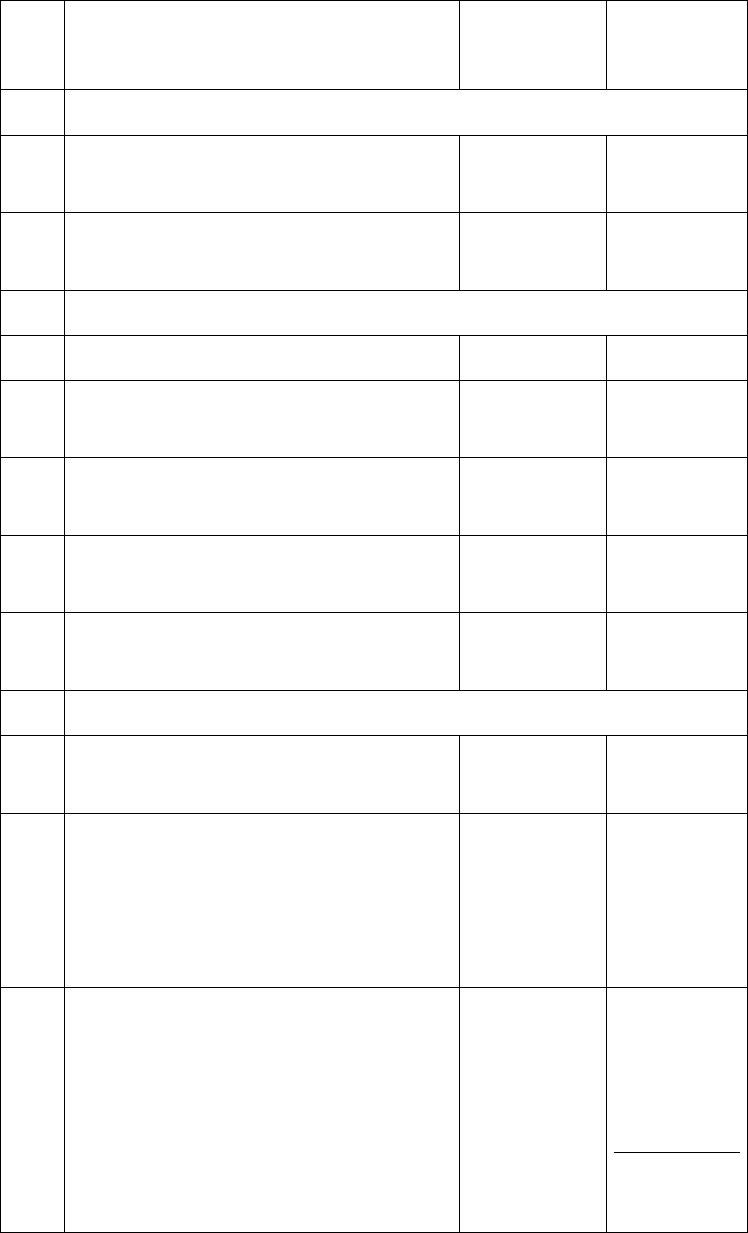

Year

Incentive (as % of wage / salary, shared

equally between employer & employee)

1

24

2

24

3

16

4

8

• Employer must maintain threshold level of enhanced employment

throughout, failing which subsidy benefit will stop.

33

• Employee must be directly working in the entity paying salary/wage

(i.e. in-sourced employee).

• Employees with a wage/ salary of up to `1 lakh per month will be

eligible, subject to contribution to EPFO.

• For those with wages/salary greater than `25,000/month, incentive

will be calculated at `25,000/month.

• Subsidy to be refunded by employer if the employment to first timer

ends within 12 months of recruitment.

• This subsidy will be in addition to benefit under Part-A

• Scheme will be for 2 years

3. Employment Linked Incentive Scheme C: Support to employers (Para 22)

• Applicable to an employer who:

Increases employment above the baseline (previous year’s

number of EPFO employees) by at least two employees (for those

with less than 50 employees) or 5 employees (for those with 50

or more employees) and sustains the higher level, and

For employees whose salary does not exceed `1,00,000/month

New employees under this Part need not be new entrants to

EPFO

• For two years Government will reimburse EPFO employer

contribution [up to] `3,000/month to the Employer for the additional

Employees hired in the previous year.

• If the employer creates more than 1000 jobs:

Reimbursement will be done quarterly for the previous quarter

Subsidy will continue for the 3

rd

and 4

th

year on the same scale as

Employer benefit in Part-B

• Not applicable for those Employees covered under Part-B.

• This subsidy will be in addition to benefit under Part-A.

• Scheme will be for 2 years

4. Skilling Programme and Upgradation of Industrial Training Institutes

(Para 24)

• 1000 Industrial Training Institutes (ITIs) to be upgraded in hub and

spoke arrangements in five years

34

• New Centrally Sponsored Scheme in collaboration with states and

industry

• Focus on outcome and quality of skilling

• Course content and design aligned to needs of industry

• Total outlay of ` 60,000 crore over five years

o Government of India—` 30,000 crore

o State Governments—` 20,000 crore

o Industry—` 10,000 crore (including CSR funding)

• 200 hubs and 800 spoke ITIs –all with industry collaboration

o Re-design and review of existing courses

o New courses

o 1 to 2 year courses in all 1000 ITIs

o Short term specialised courses in Hub ITIs

• Capacity augmentation of 5 national institutes for training of trainers

• 20 lakh students expected to benefit

5. Internship in Top Companies (Para 51)

• One crore youth to be skilled by India’s top companies in five years.

• Twelve months Prime Minister’s Internship with monthly allowance of

`5,000

• Applicable to those who are not employed and not engaged in full

time education.

• Youth aged between 21 and 24 will be eligible to apply.

• Cost sharing (per annum):

Government – `54,000 towards monthly allowance (plus `6,000

grant for incidentals)

Company – Rs 6,000 from CSR funds towards monthly allowance

Training cost to be borne by the Company from CSR funds.

Administrative costs to be borne by respective parties (for the

Company, reasonable administrative expenses can be counted as

CSR expenditure)

• Participation of companies is voluntary

35

• Applications through an online portal

• Company to select from a short list; short listing based on objective

criteria with emphasis on those with lower employability

• Ineligible candidates (indicative list)

Candidate has IIT, IIM, IISER, CA, CMA etc as qualification

Any member of the family is assessed to Income Tax

Any member of the family is a government employee, etc.

• Company is expected to provide the person an actual working

experience on a skill in which the company is directly involved.

• At least half the time should be in actual working experience/job

environment, not in classroom.

• In case the Company cannot directly do so, it must tie-up with:

Companies in its forward and backward supply chain (e.g.

suppliers or customers) or

Other Companies/Institutions in its Group or otherwise

• Will be co-ordinated with State Government initiatives wherever

applicable.

• Phase 1 of the scheme will be for 2 years followed by Phase 2 for 3

years

Note: Details of the schemes are subject to modification during the process of appraisal and approval.

36

Annexure to Part B

Amendments relating to Indirect Taxes

A. LEGISLATIVE CHANGES IN CUSTOMS LAWS

A.1 Amendments in the Customs Act, 1962

(i) Section 28 DA is being amended to enable the acceptance of

different types of proof of origin provided in trade

agreements in order to align the said section with new trade

agreements which provide for self-certification.

(ii) A proviso to sub-section (1) of Section 65 is being inserted to

empower the Central Government to specify certain

manufacturing and other operations in relation to a class of

goods that shall not be permitted in a warehouse.

(iii) The expression “a class of importers or exporters” is being

substituted with “a class of importers or exporters or any

other persons” in Section 143AA of the Customs Act for

purposes of facilitating trade. Consequential changes are

being carried out in clause (m) of subsection (2) of Section

157 of the Customs Act.

These changes shall come into effect from date of assent to the

Finance (No.2) Bill

A.2 Amendments in the Customs Tariff Act, 1975

(i) Section 6 is being omitted on account of winding up of the

Tariff Commission.

(ii) The First Schedule to the Customs Tariff Act, 1975 is being

amended to,-

a) increase the rates on certain tariff items with effect

from 24.07.2024.

b) create new tariff lines in respect of defence

products, technical textiles, sustainable blended

aviation fuel, products used in Indian semiconductor

machines, e-

bicycles, natural menthol, printer

cartridge etc. This is to align the tariff lines with

WCO classification and better identification of goods.

These changes shall come into effect from

01.10.2024.

37

A.3 Amendment of Customs Tariff (Identification, Assessment and

Collection of Countervailing Duty on Subsidized Articles and for

Determination of Injury) Rules, 1995

The Customs Tariff (Identification, Assessment and Collection of

Countervailing Duty on Subsidized Articles and for Determination of

Injury) Rules, 1995 have been amended to insert a provision for New

Shipper Review. This will be effective from 24.07.2024.

B. LEGISLATIVE CHANGES IN GST LAWS

[Save as otherwise provided, these changes will be brought into effect from

a date to be notified in coordination with States, as per recommendations

of the GST council]

AMENDMENT FOR TRADE FACILITATION

B.1 Amendment to keep Extra Neutral Alcohol outside the purview of

central tax:

Section 9 is being amended to take

Extra Neutral Alcohol used in

manufacture of alcoholic liquor for human consumption out of the purview

of central tax. Similar amendments are also

proposed in IGST Act and

UTGST Act.

B.2 Amendment to regularize non-levy and short-

levy of central tax

due to general practice

Section 11A is being inserted to empower the government to regularize

non-levy or short levy of central tax due to any general practice prevalent

in trade. Similar power is being proposed in IGST Act, UTGST Act and GST

(Compensation to States) Act.

B.3 Amendment to relax the time limits to avail input tax credit

New sub-sections (5) and (6) are being inserted in section 16 of CGST Act to

relax the time limit to avail input tax credit as per section 16(4) of the CGST

Act with effect from 01.07.2017, as follows:

a)

In respect of initial years of implementation of GST, i.e.,

financial years 2017-18, 2018-19, 2019-20 and 2020-21:

In respect of an invoice or debit note for the Financial Years 2017-

18, 2018-19, 2019-20 and 2020-21, the registered person shall be

entitled to take input tax credit in any return under section 39

38

which is filed upto the 30th day of November, 2021

b) with respect to cases where returns have been filed after

revocation:

The time limit to avail input tax credit in respect of an invoice or

debit note, in cases where returns for the period from the date of

cancellation of registration/ effective date

of cancellation of

registration till the date of revocation of cancellation of the

registration, will be extended till the date of filing the said GSTR-3B

return, subject to certain conditions, if the said return is filed by the

registered person within thirty days of the order of revocation of

cancellation of registration.

B.4

Insertion of new section to provide a common time limit for

issuance of demand notices and orders

Section 74A is being inserted in the CGST Act to provide a common time

limit for issuance of demand notices and orders in respect of demands for

FY 2024-25 onwards, for cases involving charges of fraud, suppression of

facts or wilful misstatement and the cases not involving the charges of

fraud, suppression of facts or wilful misstatement etc. Also, the time limit

for the taxpayers to avail the benefit of reduced penalty, by paying the tax

demanded along with interest, is being increased from 30 days to 60 days.

B.5 Amendment to reduce the maximum amount of pre-

deposit for

filing appeals

Sections 107 and 112 of CGST Act are

being amended to reduce the

maximum amount of pre-

deposit for filing appeal with the Appellate

Authority from Rs. 25 crore of central tax to Rs. 20 crore of central tax and

to reduce the amount of pre-deposit for filing appeal with the Appellate

Tribunal from 20% with a maximum amount of Rs. 50 crore of central tax to

10 % with a maximum of Rs. 20 crore of central tax. Besides, the time limit

for filing appeals before the Appellate Tribunal is being modified w.e.f. 1st

August, 2024 to avoid the appeals from getting time barred, on account of

Appellate Tribunal not coming into operation.

B.6 Amendment to provide conditional waiver of interest or penalty or

both relating to demands raised under section 73, for certain tax periods

Section 128A is being inserted in the CGST Act to provide for a conditional

waiver of interest and penalty in respect of demands pertaining to financial

39

years 2017-18, 2018-19 and 2019-20, in cases where demand notices have

been issued under section 73 and full tax liability is paid by the taxpayer

before a date to be notified.

B.7

Amendment to enable availment of the transitional credit of

eligible CENVAT credit by Input Services Distributor in respect of invoices

received prior to the appointed date

Section 140(7) of CGST Act is being amended with effect from 01.07.2017,

to enable availment of transitional credit in respect of input services

received by an Input Services Distributor prior to the appointed day, where

invoices were also received prior to the appointed day.

B.8 Amendment to empower Government to notify Appellate Tribunal

to handle anti-profiteering cases and to provide for a sunset clause for

accepting anti-profiteering cases

Section 171 of CGST Act is being amended to enable the Government to

notify the GST Appellate Tribunal to handle anti-profiteering cases and to

empower the Government to notify a date after which the Authority for

anti-profiteering shall not accept applications for examination.

B.9

Amendment to clarify various activities in insurance sector as

neither a supply of goods nor a supply of services

Paragraphs 8 and 9 are being inserted in Schedule III of CGST Act to

provide that the activity of apportionment of co-

insurance premiums by

the lead insurer to the co-insurers in the co-insurance agreement and the

services by insurers to reinsurers in respect of ceding/re-insurance

commission will, subject to certain conditions,

be treated neither as a

supply of goods nor as a supply of services.

OTHER LAW AMENDMENTS IN CGST ACT

B10. Amendment to clarify time of supply of services in reverse charge

supplies.

Amendment is proposed in Section 13 of CGST Act to provide for time of

supply of services

where the invoice is required to be issued by the

recipient of services in cases of reverse charge supplies.

40

B11. Amendment to restrict blockage of input tax credit for tax paid

under section 74 to demands upto Financial Year 2023-24

Clause (i) of Section 17 of CGST Act is being amended to restrict blockage of

input tax credit for tax paid under Section 74 for demands pertaining up to

FY 2023-24.

B12.

Amendment to provide for conditions and restrictions for

revocation of cancellation of registration

Section 30 of the CGST Act is being amended to enable the government to

prescribe

conditions and restrictions for revocation of cancellation of

registration.

B13. Amendment to prescribe the time period for issuance of invoice by

recipient in Reverse Charge Mechanism supplies

Clause (f) of section 31 of CGST Act is being amended to provide for an

enabling provision to prescribe the time period within which the invoice

has to be issued by the recipient under reverse charge mechanism and to

clarify that a person registered solely for purpose of deducting TDS under

section 51 of CGST Act shall be treated as a person not registered for the

purpose of clause (f) of section 31(3) of the said Act.

B14. Amendment to make filing of monthly returns by TDS deductors

mandatory.

Section 39 is being amended to mandate filing of returns by TDS deductors

for every month, even if no deductions are made during the said month,

and also to provide for an enabling clause for prescribing the time limit for

filing such returns.

B15.

Amendment to prohibit refund in zero rated supply of goods

where such goods are subjected to export duty.

Section 54 of CGST Act and section 16 of IGST Act are being amended to

prohibit refund of unutilized input tax credit or integrated tax on zero-

rated supply of goods, which are subjected to export duty.

B16. Amendment for allowing appearance by authorised representative

on behalf of a summoned person

Sub-

section 1A is being inserted in section 70 of the CGST Act to enable

appearance by an authorized representative on behalf of a summoned person.

41

B17. Amendment to empower the government to notify cases which shall

be heard only by the principal Bench of GST Appellate Tribunal

Section 109 of CGST Act is being amended to empower the government to

specify cases to be heard only by

the Principal Bench of the Appellate

Tribunal.

B18. Amendment to restrict applicability of penal provisions under

Section 122(1B) to Electronic Commerce Operators who deduct TCS

Section 122(1B) of CGST Act is being amended w.e.f. 01.10.2023 to restrict

the applicability of penal provisions under this section to only those

Electronic Commerce Operators who are required to collect tax at source

under section 52.

B19. Consequential amendments due to insertion of new section 74A in

the CGST Act

Sections 73 and 74 of CGST Act are being amended to limit the applicability

of these sections to demands up to FY 2023-24, since from FY 2024-25

onwards demands are to be ascertained as per provisions of newly inserted

section 74A. Also, Section 75 of CGST Act is being amended to allow for

redetermination of penalties if the charges of fraud, suppression, or wilful

misstatement are not established. Further, references to section 74A or the

concerned sub-sections of section 74A are

being inserted in section 10,

section 21, section 35, section 49, section 50, section 51, section 62, section

63, section 64, section 65, section 66, section 104 and section 127.

C. OTHER PROVISIONS IN THE FINANCE (No. 2)BILL

C.1 Amendment of Customs duty notification dated 10.5.2023

Notification No. 37/2023- Customs dated 10.5.23 is being validated for the

period from 1

st

April, 2023 up to and inclusive of 10

th

May,2023 to provide

exemption from basic customs duty and AIDC

on imports of crude

soyabean oil and crude sunflower seed oil

subject to availability of

unutilized quota in TRQ authorization for FY 2022-23 allotted by DGFT and

Bill of lading issued on or before 31

st

March,2023. The changes will come

into effect from date of assent to the Finance (No.2) Bill 2024

42

C.2 Amendment of Central excise duty notification dated 17.3.2012

Notification No 12/2012-Central Excise

dated 17.3.2012 is being amended

to extend the time period for submission of the final Mega Power Project

certificate from 120 months to 156 months. The

changes will come into

effect from date of assent to the Finance (No.2) Bill 2024

C.3 Exemption from Clean Environment Cess

The Clean Environment Cess , levied and collected as a duty of excise, is

being exempted on excisable goods lying in stock as on 30

th

June, 2017 ,

subject to payment of appropriate GST Compensation Cess on supply of

such goods on or after 1

st

July, 2017.The changes will come into effect from

date of assent to the Finance (No.2) Bill 2024

C.4 Exemption GST Compensation Cess ,2017

Based on the recommendation of the GST Council in its 53rd meeting, GST

Compensation Cess is being exempted with effect from 1st

July, 2017 on

imports in SEZ by SEZ units or developers for authorized operations. The

changes will come into effect from date of assent to the Finance(No.2) Bill

2024

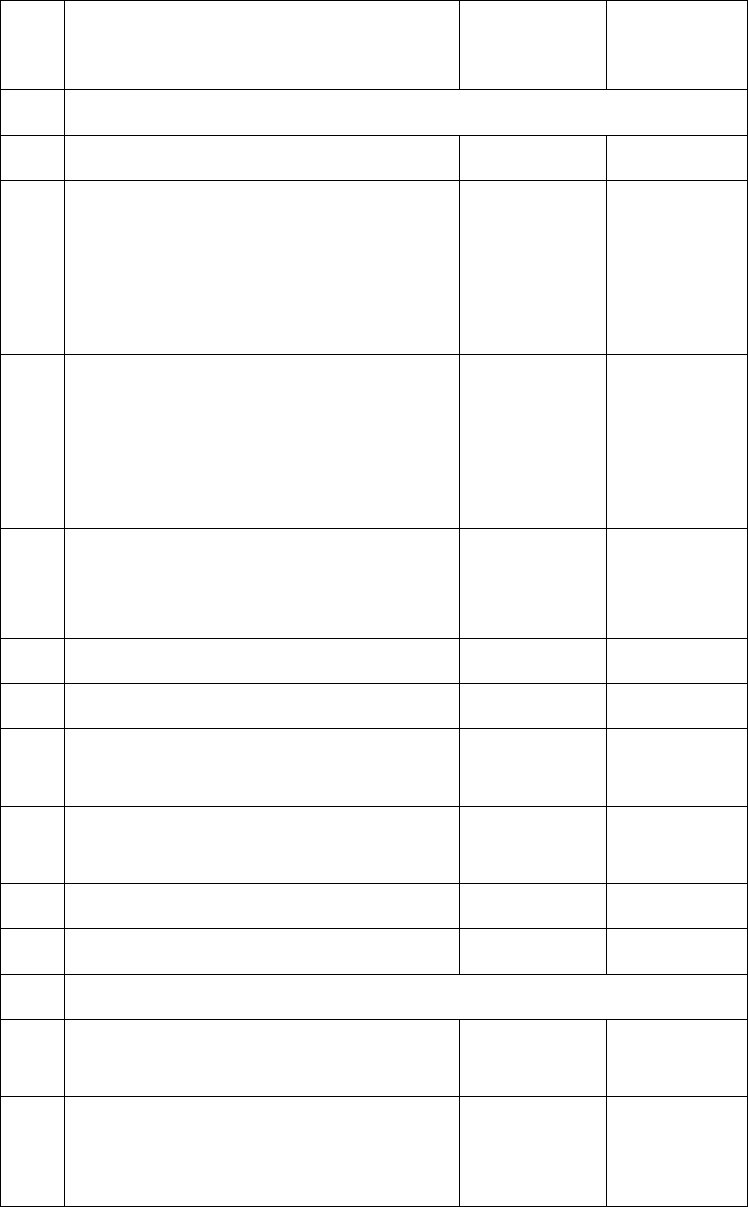

D. CUSTOMS DUTY RATE CHANGES

D.1. Reduction in customs duty to reduce input costs, deepen value

addition, promote export competitiveness, correct inverted duty

structure, boost domestic manufacturing etc [with effect from

24.07.2024]

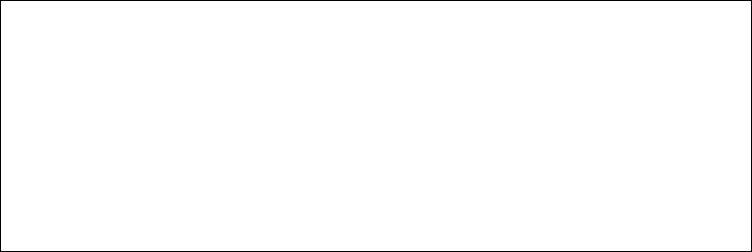

S.

No.

Commodity

From

(per cent)

To

(per cent)

I.

Agricultural Products

1.

Shea nuts

30

15

II.

Aquafarming & Marine exports

1

Prawn and Shrimps feed

15

5

2

Fish feed

15

5

43

S.

No.

Commodity

From

(per cent)

To

(per cent)

3.

Following inputs for manufacture of

Prawn and Shrimps feed or fish feed:

(i) Mineral &vitamin pre mixes

(ii) Krill Meal

(iii) Fish lipid oil

(iv) Crude fish oil

(v) Algal prime (flour)

(vi) Algal oil

30/15/5 Nil

4

Artemia

5

Nil

5

Artemia cysts

5

Nil

6

SPF Polychaete worms

30

5

7

Live SPF Vannamei shrimp

(Litopenaeus vannamei) broodstock &

Live

Black tiger shrimp (Penaeus