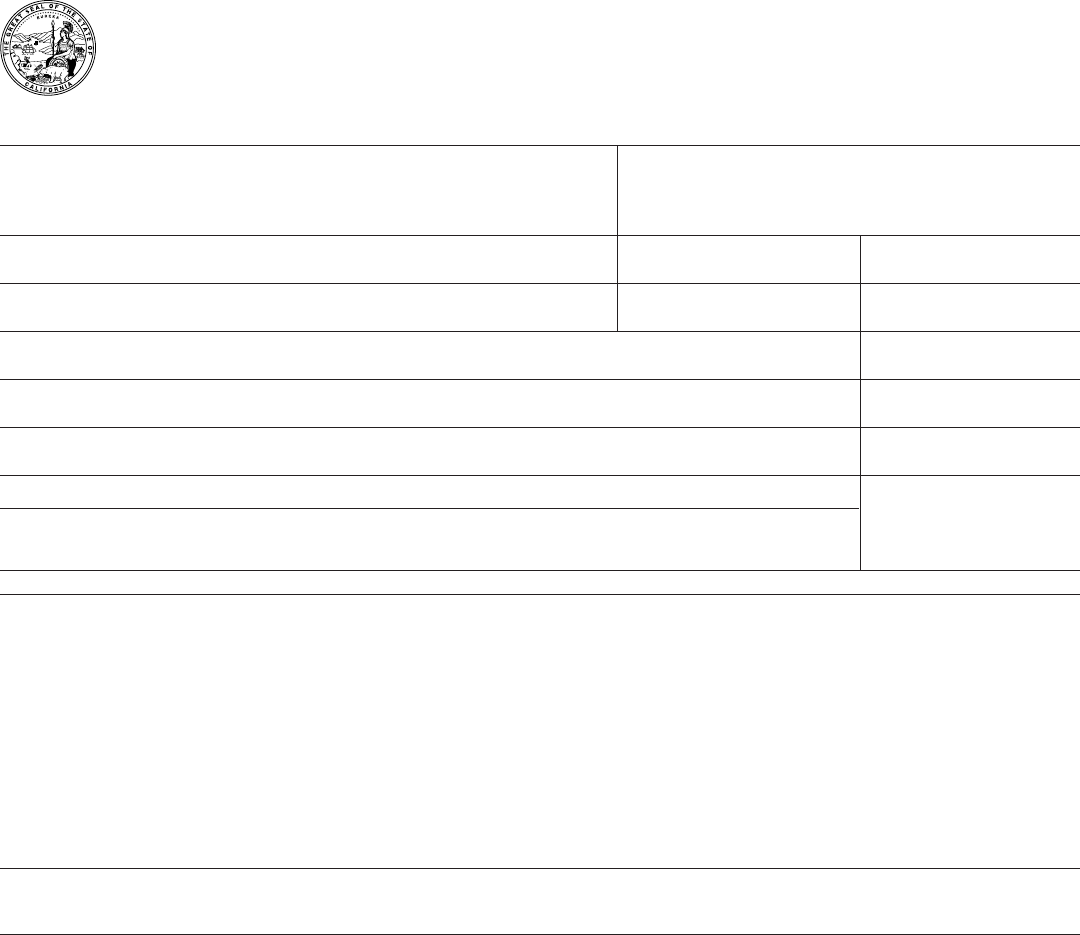

FTB 3571 C2 (REV 03-2005) SIDE 1

REQUEST FOR ESTATE

INCOME TAX CLEARANCE CERTIFICATE

As required under California Revenue

and Taxation Code Section 19513

Expedite Request (see instructions)

STATE OF CALIFORNIA

FRANCHISE TAX BOARD

Telephone (916) 845-4210

PLEASE READ INSTRUCTIONS ON SIDE 2 BEFORE COMPLETING THIS FORM

Estate of Federal Employer Id. No. Date of Death

Name of Fiduciary Area Code and Phone No. Decedent’s Social Security No.

Address of Fiduciary (Number and Street) Probate No.

City or Town, State, and ZIP Code County of Probate

Name of Attorney Area Code and Phone No.

Address of Attorney (Number and Street) Mail Tax Clearance Certificate to:

City or Town, State, and ZIP Code

Attorney

Fiduciary

ANSWER THESE QUESTIONS AND FURNISH THE REQUIRED DOCUMENTS

1. Was decedent a resident of the State of California on the date of death? ______________

(If “no,” furnish a copy of the California Estate Tax Return (Form ET-1) and Declaration Concerning Residence (Form IT-2) if filed

with the California State Controller).

2. Have probate proceedings been instituted in any other state? _____________

3. Value of the assets of this estate on date of death. (Please attach federal Form 706.) __________________________

(If not exceeding $1,000,000, you do not need an Estate Income Tax Clearance Certificate. See instructions on Side 2.)

4. Are assets exceeding $250,000 distributable to one or more nonresident beneficiaries? ________________

(If “no,” you do not need an Estate Income Tax Clearance Certificate. See instructions on Side 2.)

5. Has a preliminary distribution been made? _______________

(If “yes,” furnish a copy of the court order authorizing the distribution.)

You must file a return for all taxable years that have ended (even if a return is not yet due), or submit a deposit in

the form of check or bond in an amount to be determined by this office. We require a Specialized Tax Service Fee

for Expedited Estate Income Tax Clearance Certificate Requests. See instructions on Side 2.

DECLARATION REGARDING CALIFORNIA RETURNS FOR DECEDENT AND FOR ESTATE

(To be completed for the four taxable years immediately preceding the date of this request.)

A. DECEDENT

California Individual Income Tax Returns (Form 540, 540A, 540 2EZ, or Long or Short Form 540NR) have been filed by

or on behalf of the decedent for the following years: ________ ________ ________ ________ . If the returns were

not filed for any of the above years, explain in full: _____________________________________________________

_____________________________________________________________________________________________

B. ESTATE

California Fiduciary Income Tax Returns (Form 541) have been filed for the following years:

________ ________ ________ ________ . If fiduciary returns were not filed for any of the last four years during

which the estate was in existence, explain in full: ______________________________________________________

_____________________________________________________________________________________________

I declare, under penalties of perjury, that the information given above is true to the best of my knowledge and belief.

_________________________________________ __________________________________ ___________________

SIGNATURE OF FIDUCIARY OR REPRESENTATIVE TITLE DATE

ALLOW AT LEAST 30 DAYS FOR A RESPONSE TO THIS APPLICATION

FILE AT LEAST 30 DAYS PRIOR TO THE COURT

HEARING ON FINAL ACCOUNT. APPROXIMATE

DATE OF COURT HEARING _____________________

MAIL TO: ESTATE INCOME TAX CLEARANCE CERTIFICATE UNIT MS D-7

FRANCHISE TAX BOARD

PO BOX 1468

SACRAMENTO CA 95812-1468