2022 Annual Report

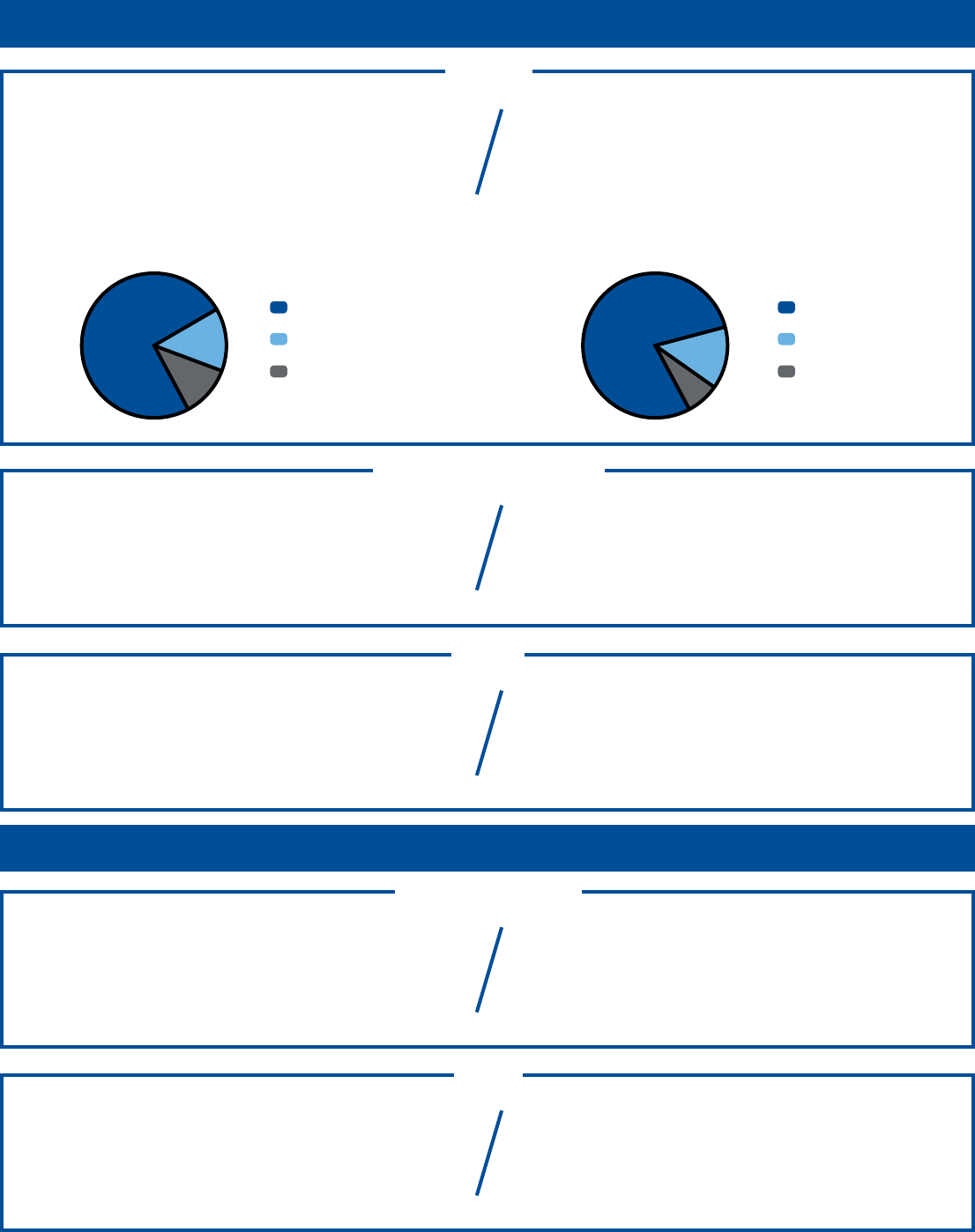

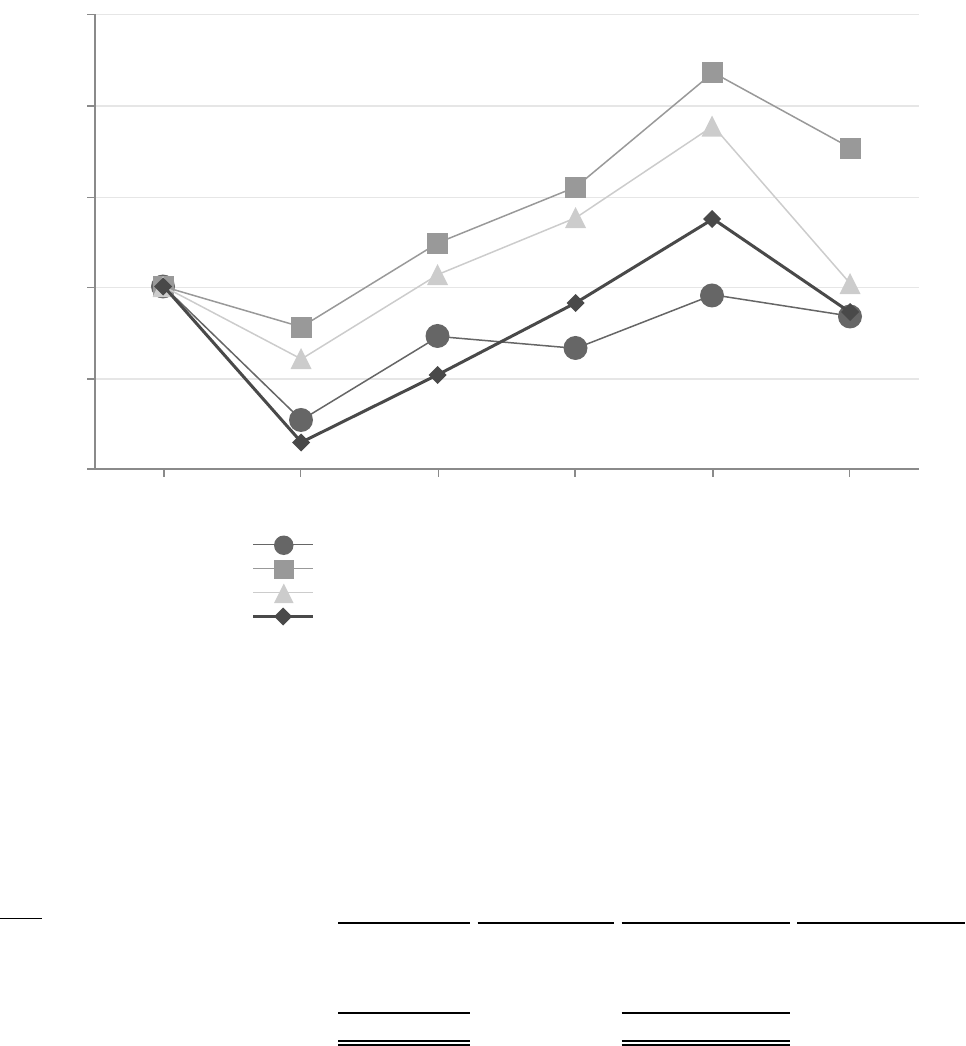

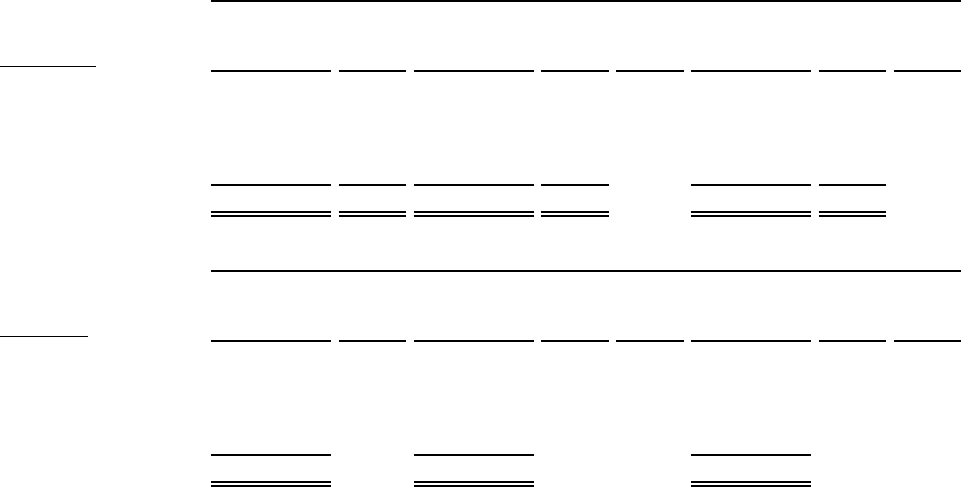

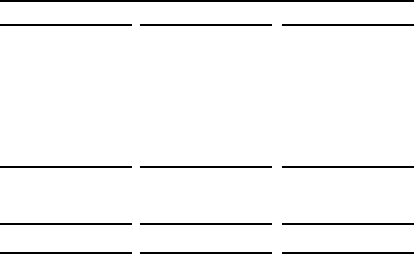

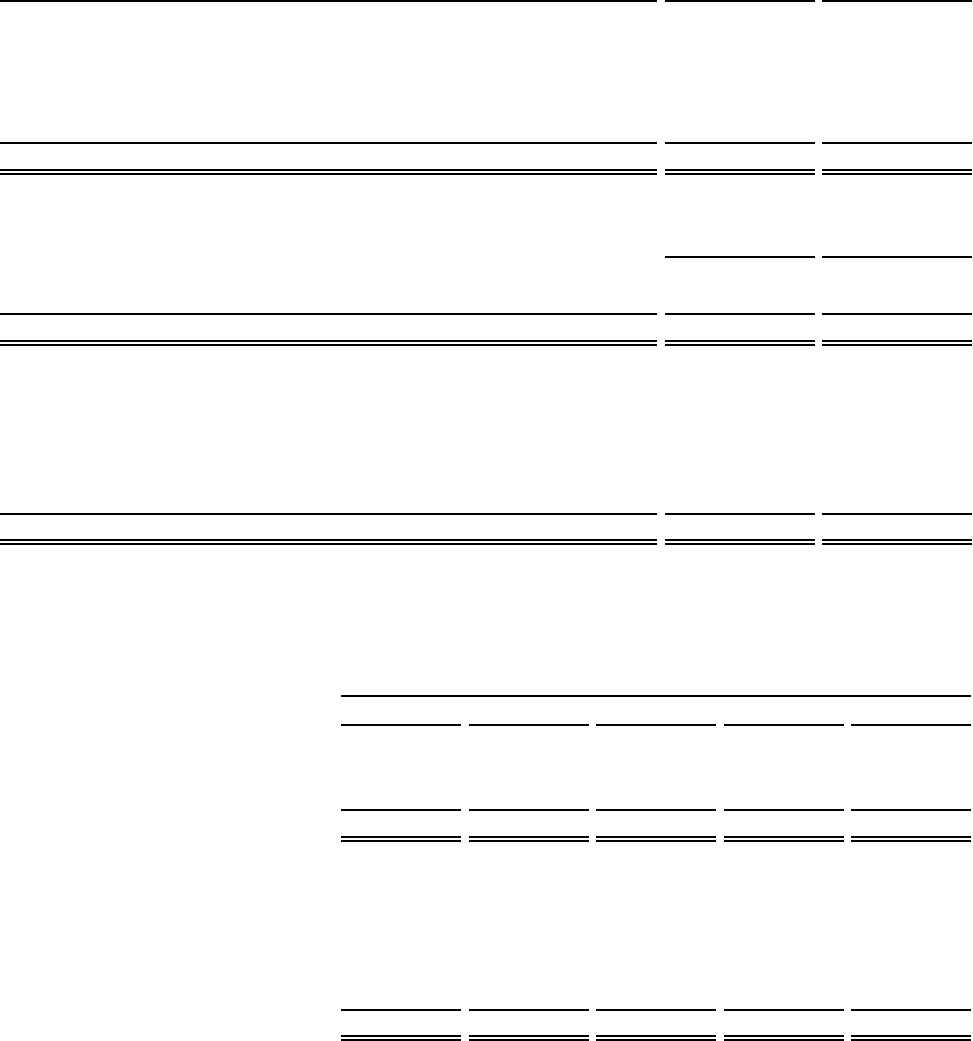

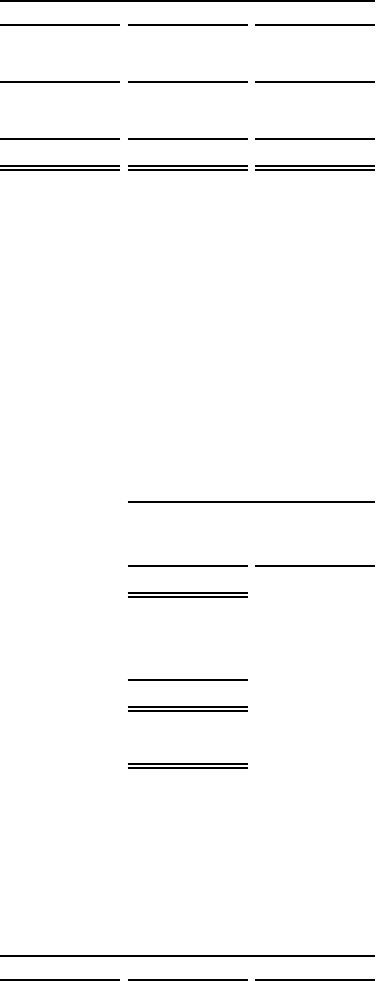

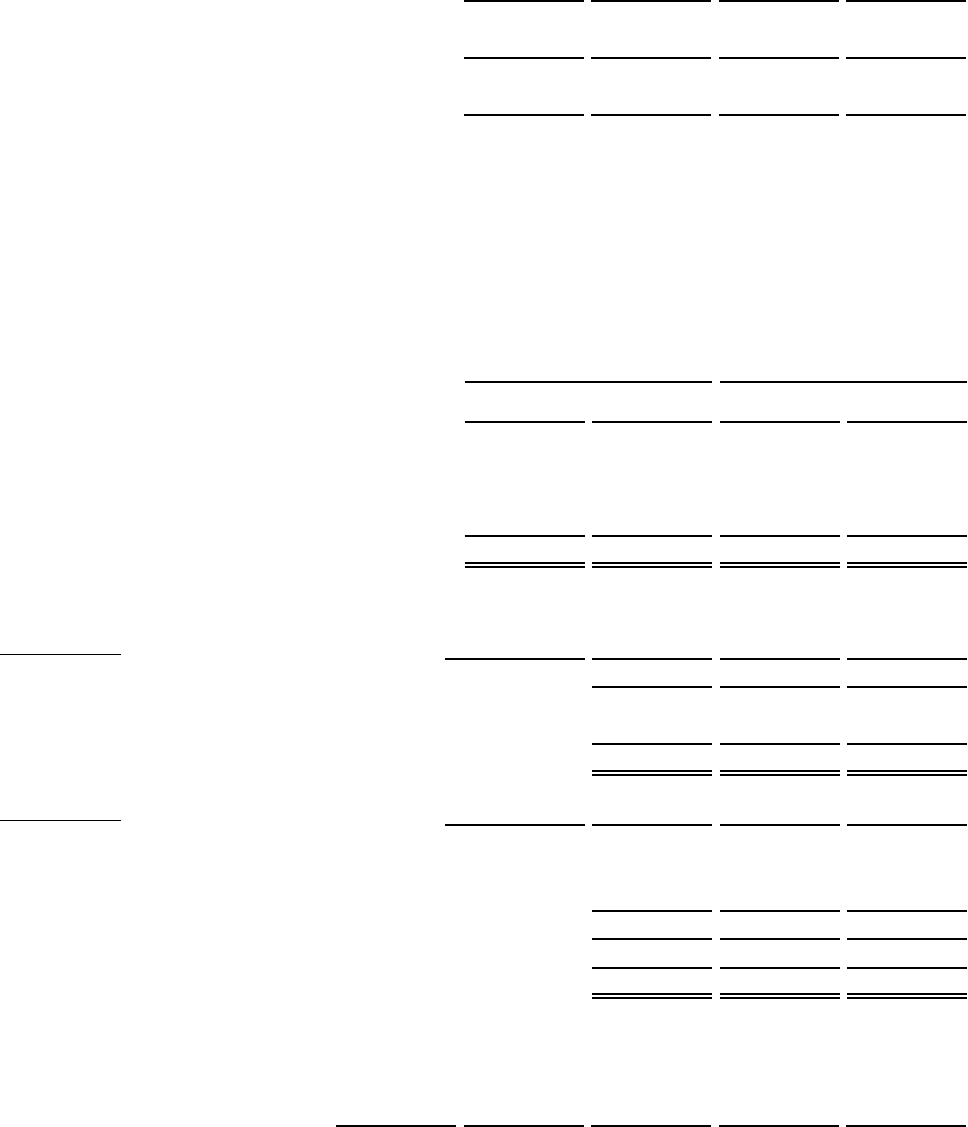

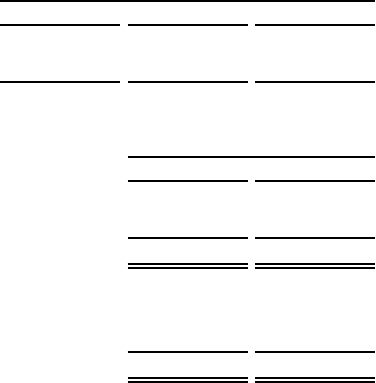

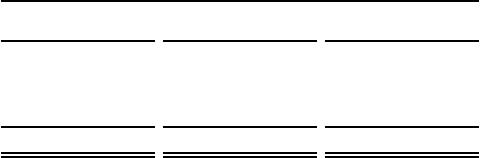

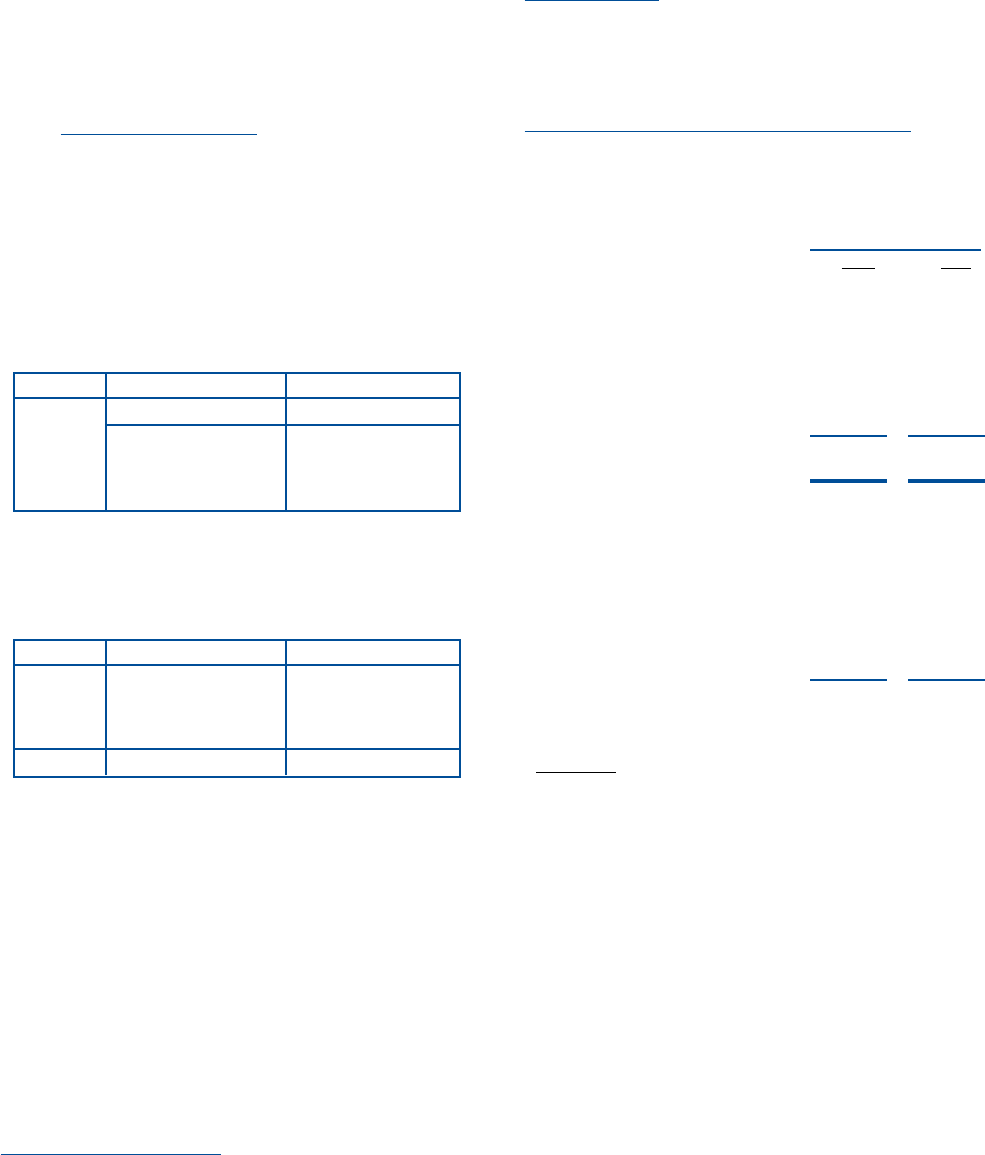

2022 AT A GLANCE | REPORTED RESULTS

Sales by Segment Sales by Geography

MILLION v PY

v PY

v PY

v PY

v PY

Off Road United States

On Road International

Marine Canada

$8,589

22.8%

12.5%

$10.04

$10.40

+15%

-72

bps

-33bps

+27%

+15%

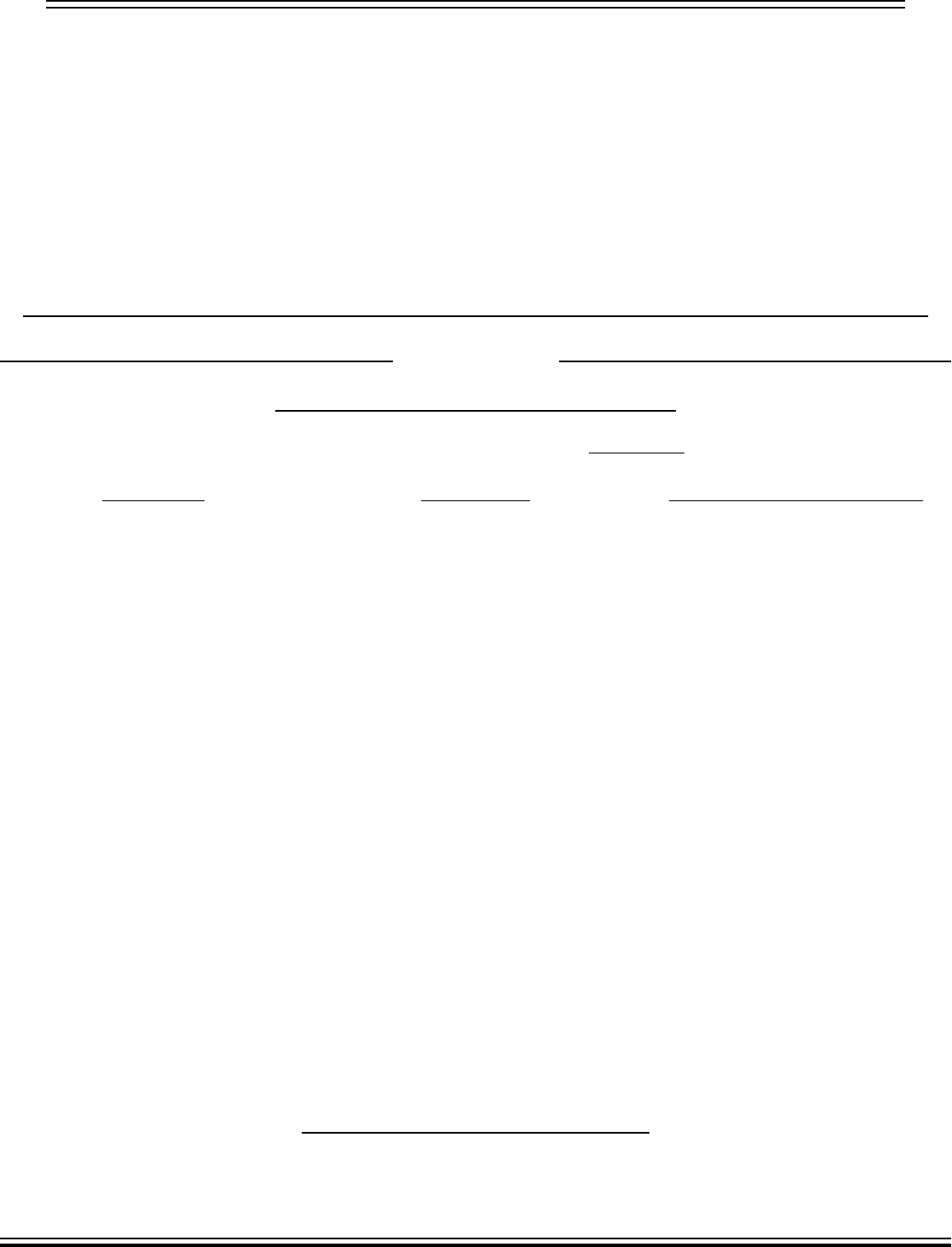

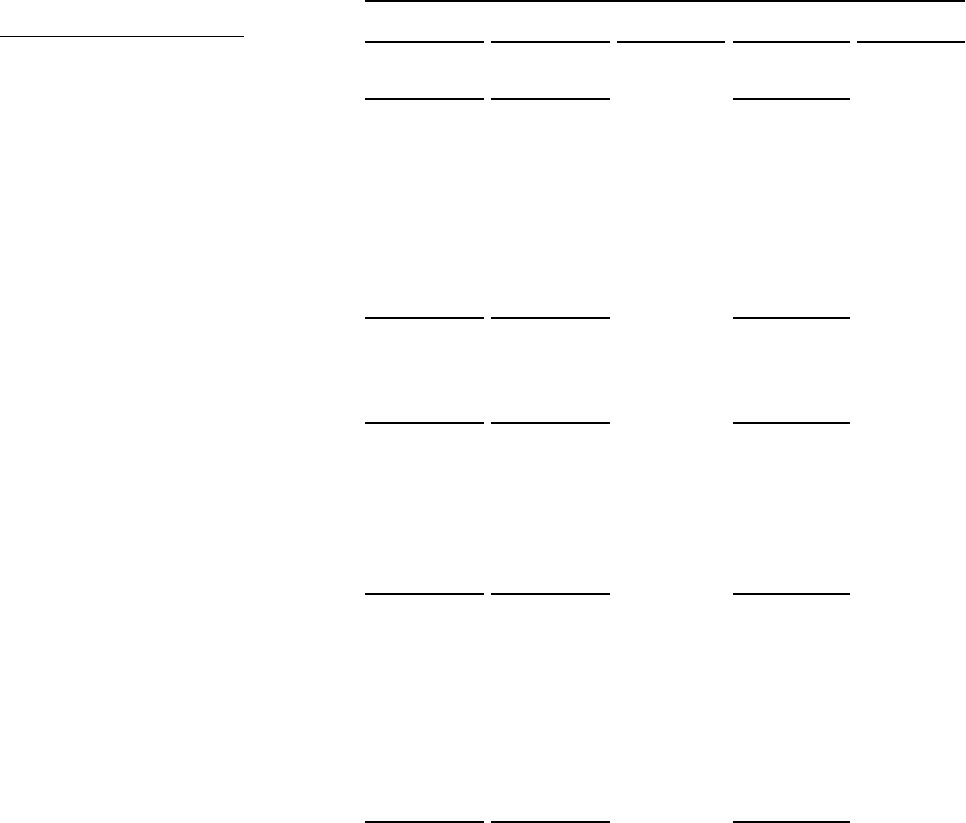

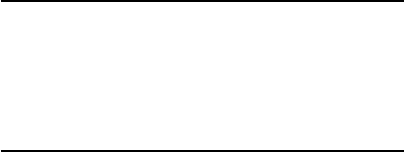

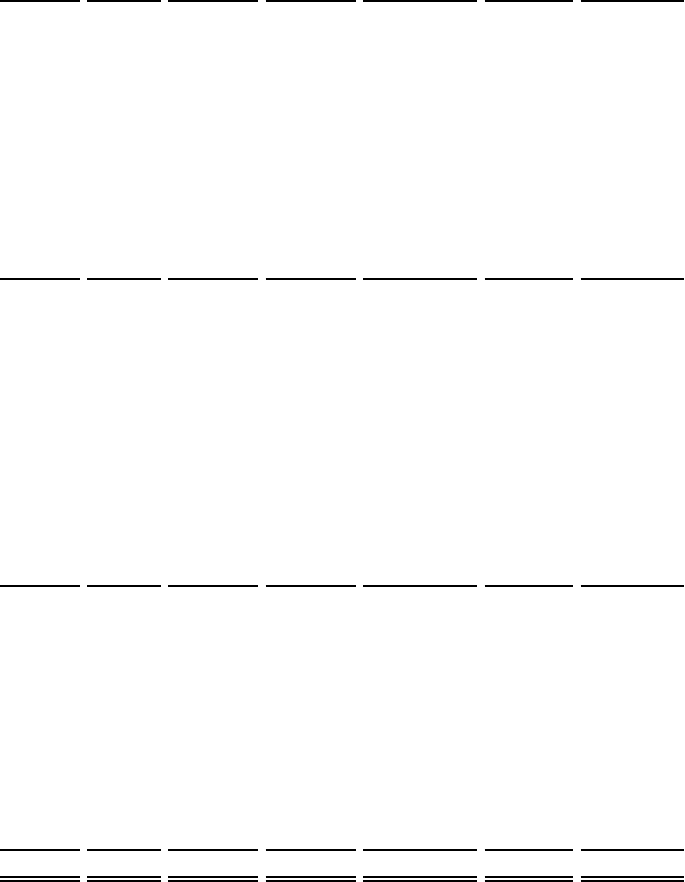

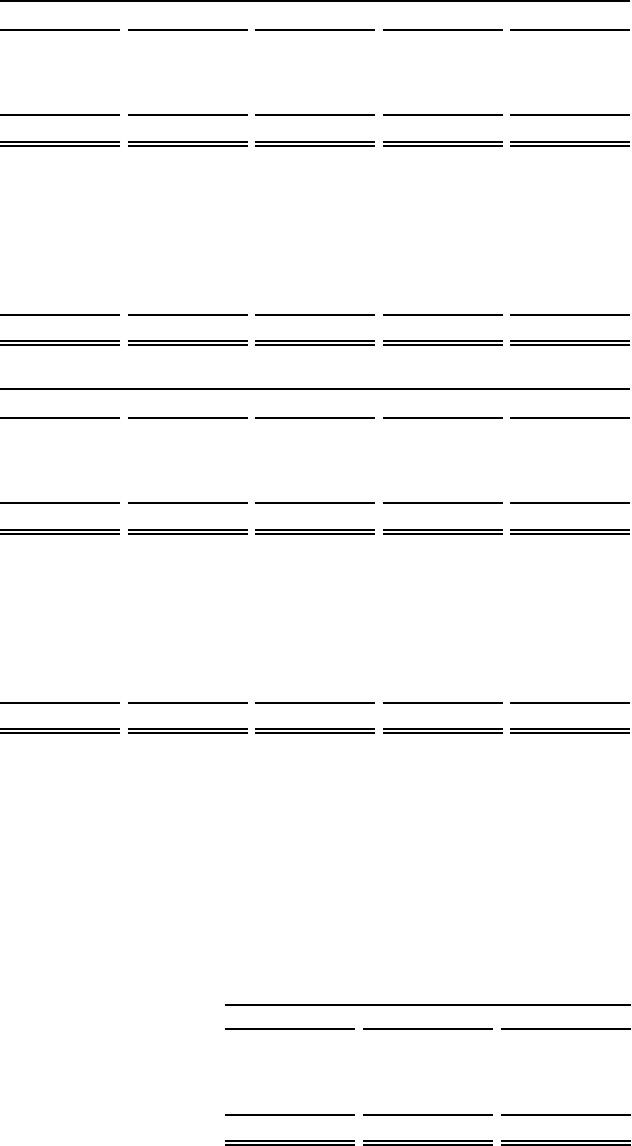

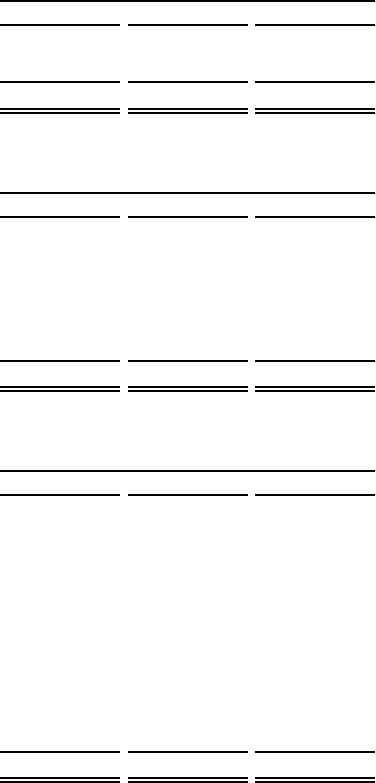

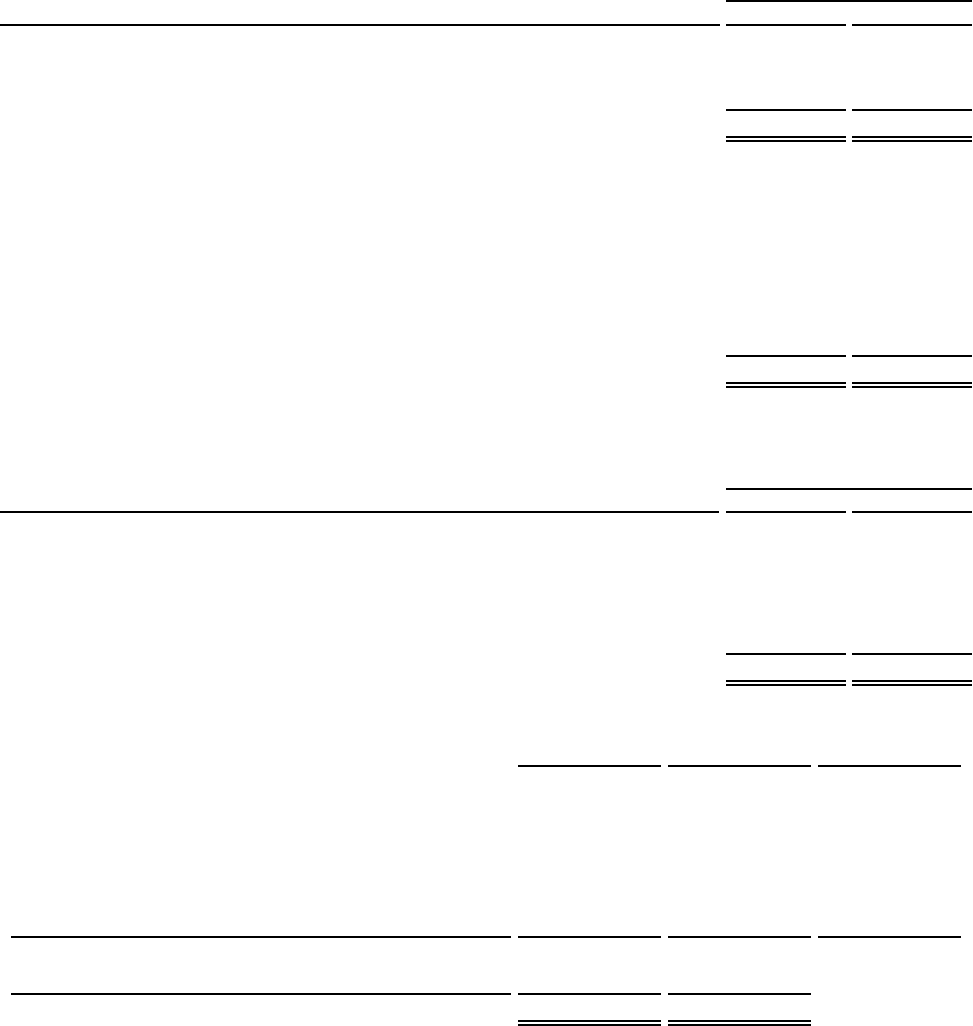

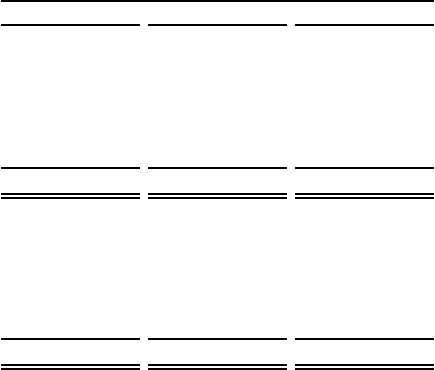

2022 AT A GLANCE | ADJUSTED RESULTS

14%

11%

75% 79%

14%

7%

Sales

Gross Prot Margin

EPS*

EBITDA Margin

EPS*

*from Continuing Operations

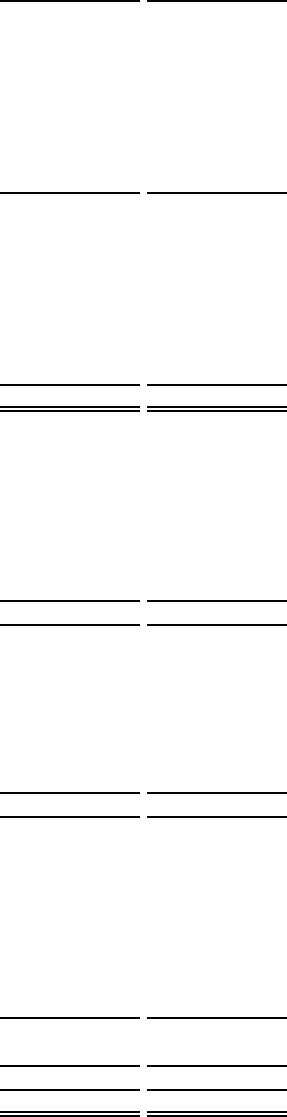

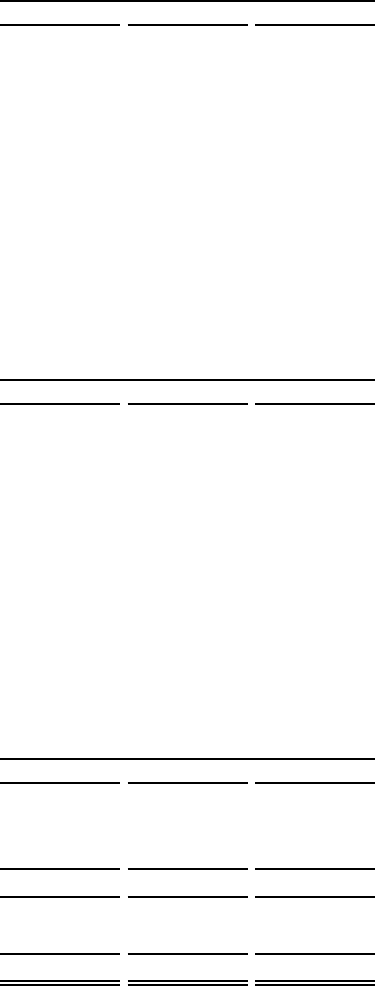

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

☒ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2022

OR

☐TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission file number 001-11411

POLARIS INC.

(Exact name of registrant as specified in its charter)

Minnesota 41-1790959

(State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.)

2100 Highway 55, Medina, Minnesota 55340

(Address of Principal Executive Offices) (Zip Code)

Registrant's telephone number, including area code: (763) 542-0500

Securities registered pursuant to Section 12(b) of the Act:

Title of each class Trading Symbol(s) Name of each exchange on which registered

Common Stock, $.01 par value PII New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to

such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to

Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required

to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☒Accelerated filer ☐Non-accelerated filer ☐Smaller reporting company ☐Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its

internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting

firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included

in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation

received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $5,911,815,000 as of

June 30, 2022, based upon the last sales price per share of the registrant’s Common Stock, as reported on the New York Stock Exchange on such

date. As of February 10, 2023, 57,076,372 shares of Common Stock, $.01 par value, of the registrant were outstanding.

DOCUMENTS INCORPORATED BY REFERENCE:

Portions of the definitive Proxy Statement for the registrant’s Annual Meeting of Shareholders to be held on or about April 27, 2023, to be filed

with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this report (the “2023 Proxy

Statement”), are incorporated by reference into Part III of this Form 10-K.

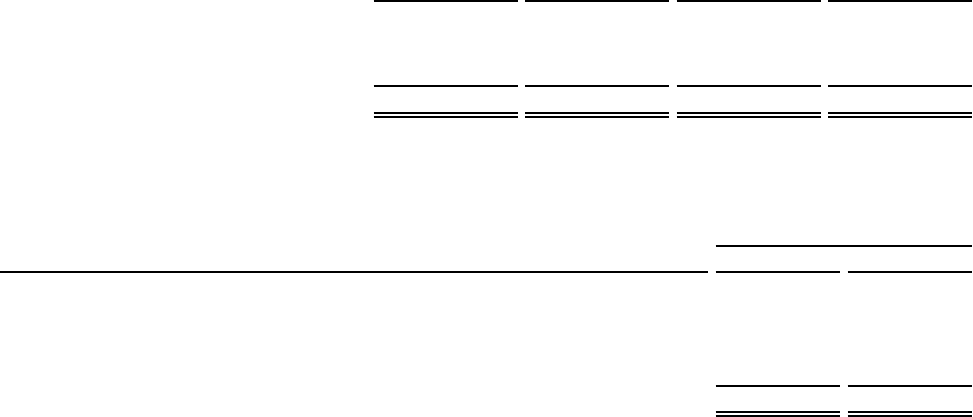

POLARIS INC.

2022 FORM 10-K ANNUAL REPORT

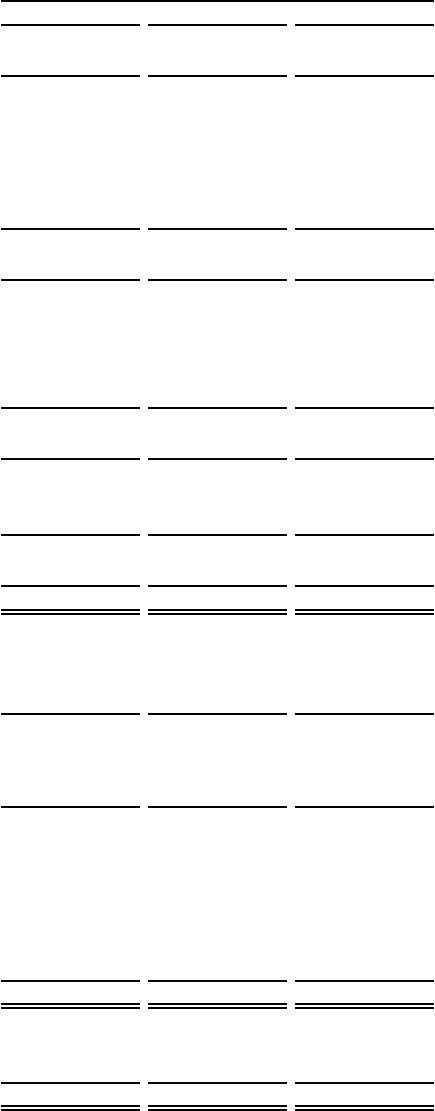

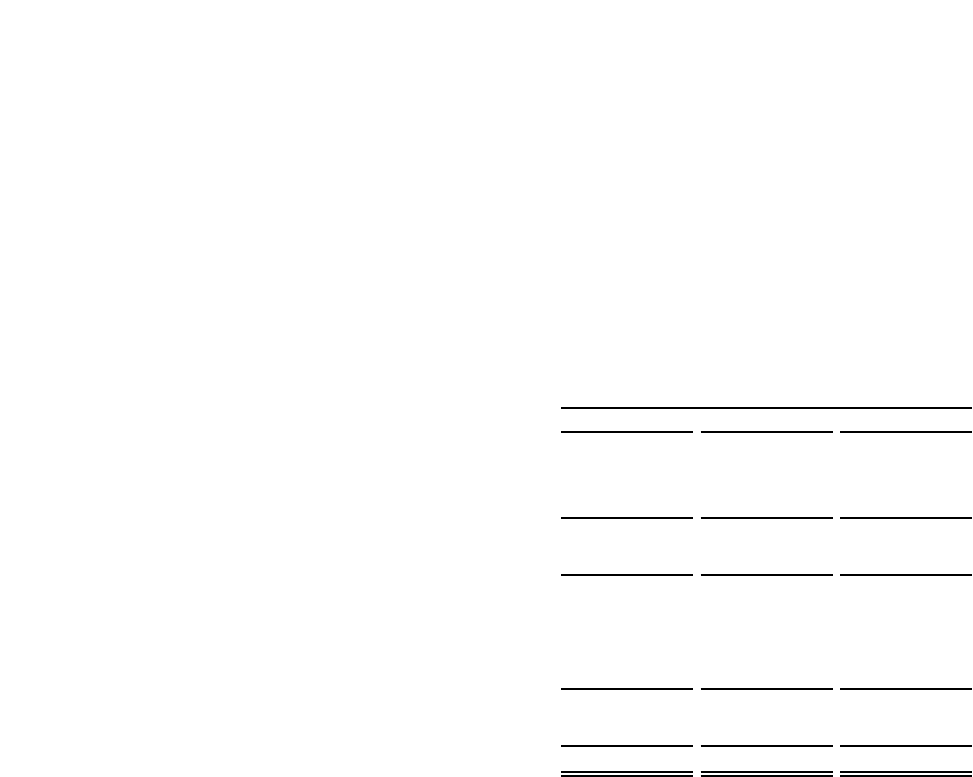

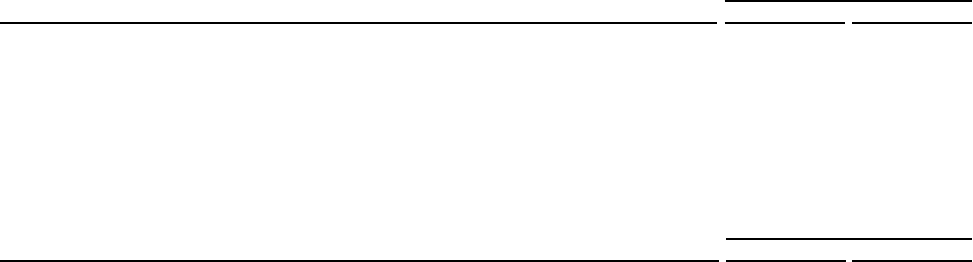

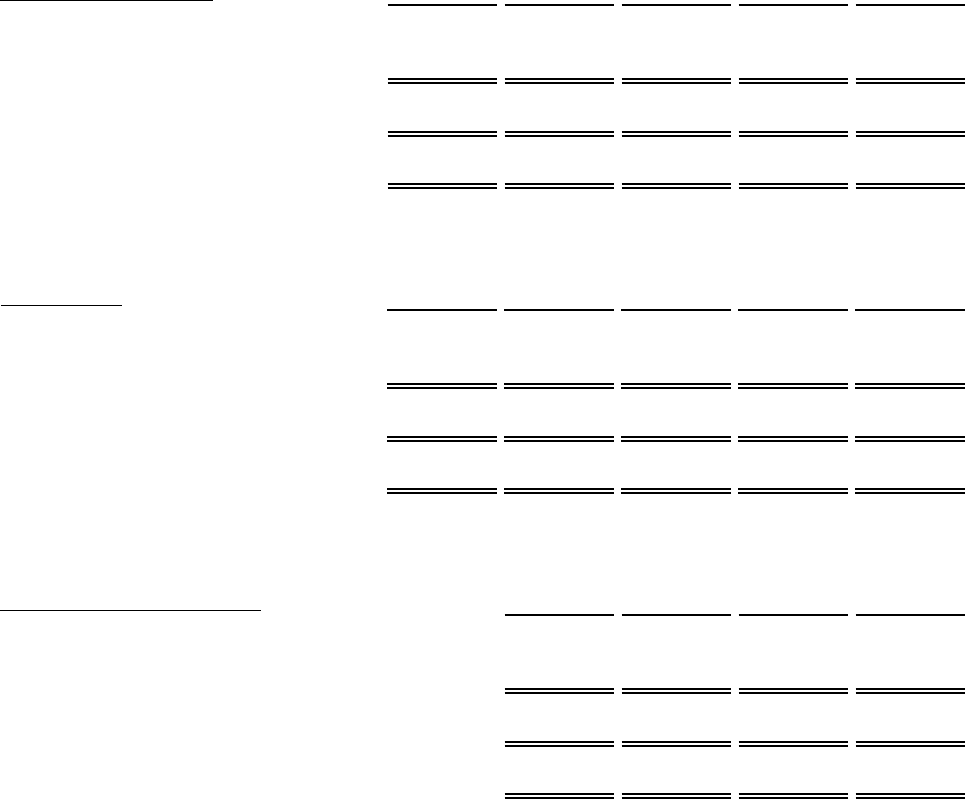

TABLE OF CONTENTS

PART I

Item 1. Business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Item 1A. Risk Factors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

Item 1B. Unresolved Staff Comments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

Item 2. Properties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Item 3. Legal Proceedings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 20

Item 4. Mine Safety Disclosures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21

PART II

Item 5.

Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity

Securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

Item 6. [Reserved] . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations . . . . . . . . . . . 24

Item 7A. Quantitative and Qualitative Disclosures about Market Risk . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

Item 8. Financial Statements and Supplementary Data . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure . . . . . . . . . . . 71

Item 9A. Controls and Procedures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Item 9B. Other Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

Item 9C. Disclosure Regarding Foreign Jurisdictions that Prevent Inspections . . . . . . . . . . . . . . . . . . . . . . . . . . . . 71

PART III

Item 10. Directors, Executive Officers and Corporate Governance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

Item 11. Executive Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

Item 12. Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters . . 72

Item 13. Certain Relationships and Related Transactions, and Director Independence . . . . . . . . . . . . . . . . . . . . . . 72

Item 14. Principal Accounting Fees and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

PART IV

Item 15. Exhibit and Financial Statement Schedules . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Item 16. Form 10-K Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 73

Signatures . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 80

Page

2

PART I

Item 1. Business

Polaris Inc., formerly known as Polaris Industries Inc., a Minnesota corporation, was formed in 1994 and is the successor

to Polaris Industries Partners LP. The terms “Polaris,” the “Company,” “we,” “us,” and “our” as used herein refer to the

business and operations of Polaris Inc., its subsidiaries and its predecessors, which began doing business in 1954. We

design, engineer and manufacture powersports vehicles which include: off-road vehicles (“ORV”), including all-terrain

vehicles (“ATV”) and side-by-side vehicles; snowmobiles; motorcycles; moto-roadsters; quadricicycles; and boats. We

also design and manufacture or source parts, garments and accessories (“PG&A”), which includes aftermarket

accessories and apparel. Our products are sold online and through dealers and distributors principally located in the

United States, Canada, Western Europe, Australia, and Mexico.

Business Segments

We operate in three business segments; Off Road, On Road, and Marine. Our products are sold through a network of

over 2,500 independent dealers in North America, over 1,500 independent international dealers through over 25

subsidiaries, and over 90 independent distributors in over 100 countries outside of North America. A majority of our

dealers and distributors are multi-line and also carry competitor products, however some dealers carry our full line of

products and, while relatively consistent, the actual number of dealers carrying our products can vary from time to time.

Off Road:

The Off Road segment primarily consists of ORVs and snowmobiles. ORVs are four-wheel vehicles designed for off-

road use and traversing a wide variety of terrain, including dunes, trails, and mud. The vehicles can be multi-passenger or

single passenger, are used for recreation in such sports as fishing and hunting and for trail and dune riding, and for utility

purposes on farms, ranches, and construction sites. The ORV industry is comprised of ATVs and side-by-side vehicles.

Internationally, ATVs and side-by-sides are sold primarily in Western European countries by similar manufacturers as in

North America.

Estimated North America and worldwide ORV industry retail sales are summarized as follows:

Estimated* Approximate Industry Sales (in units) 2022 2021 2020

North America ATV retail sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 255,000 285,000 345,000

North America side-by-side retail sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 515,000 560,000 640,000

North America ORV retail sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 770,000 845,000 985,000

Worldwide ATV retail sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 360,000 415,000 465,000

Worldwide side-by-side retail sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 570,000 620,000 690,000

Worldwide ORV retail sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 930,000 1,035,000 1,155,000

*Estimates are unaudited and based on internally generated management estimates, including estimates based on extrapolations from third party

surveys of the industries in which we compete. See Market and Industry Data section for additional information.

Twelve months ended December 31,

The side-by-side market has been consistently strong over the past several years primarily due to continued innovation

by manufacturers. In 2022, we continued to be the North America market share leader in off-road vehicles. Our ORV

lineup includes the RZR sport side-by-side, the RANGER utility side-by-side, the GENERAL

crossover side-by-side, and

the Sportsman

ATV. The full line spans 91 models, including two-, four- and six-wheel drive general purpose and

recreational vehicles. In many of our segments, we offer youth, value, mid-size, premium and extreme-performance

vehicles, which come in both single passenger and multi-passenger seating arrangements. Key 2022 ORV product

introductions included the RANGER CREW XP 1000 NorthStar Big Game Edition, GENERAL XP 1000 Sport, and

GENERAL 1000 Sport.

We design, engineer, produce or supply a variety of replacement parts and Polaris Engineered Accessories for our ORVs.

ORV accessories include winches, bumper/brushguards, plows, racks, wheels and tires, pull-behinds, cab systems,

lighting and audio systems, cargo box accessories, tracks and oil. We also market a full line of gear and apparel related to

our ORVs, including helmets, jackets, gloves, pants and hats. Gear and apparel is designed to our specifications,

purchased from independent vendors and sold by us through our dealers, distributors, and online.

3

We sell our ORVs directly to a network of over 1,400 dealers in North America and over 1,100 international dealers.

Many of our ORV dealers and distributors are also authorized snowmobile dealers. We produce and deliver our products

throughout the year based on dealer, distributor, and customer orders. ORV retail sales activity at the dealer level drives

orders which are incorporated into each product’s production scheduling. International distributor ORV orders are taken

throughout the year. We utilize our Retail Flow Management (“RFM”) ordering system for ORV dealers, which allows

dealers to order daily and create a segment stocking order which helps to reduce order fulfillment times.

The ORV industry in the United States, Canada and other global markets is highly competitive. As an ORV original

equipment manufacturer (“OEM”), our competition primarily comes from North American and Asian manufacturers.

Competition in such markets is based upon a number of factors, including price, quality, reliability, styling, product

features and warranties and a manufacturer’s ability to timely produce vehicles in response to increased consumer

demand.

Snowmobiles have been manufactured under the Polaris name since 1954. We estimate that worldwide industry sales of

snowmobiles totaled approximately 130,000, 135,000, and 125,000 units for the 12 month seasons ended March 31,

2022, 2021, and 2020, respectively.

For the 12 month season ended March 31, 2022, we held the number two market share position for North America. We

produce a full line of snowmobiles consisting of 68 models, ranging from youth models to utility and economy models to

performance and competition models. Polaris snowmobiles are sold principally in the United States, Canada, and

Northern Europe.

Key model introductions in 2022 included the new Patriot Boost Indy VR1, Patriot Boost Switchback Assault, 9R Pro

RMK Slash, and 9R RMK Khaos Slash. We also launched the ProStar S4 engine available for Indy, Voyageur and Titan

snowmobiles. We also manufacture a snow bike conversion kit system under the Timbersled brand and in 2022 we

launched the ARO 3 Gen 2 Platform, Quick Drive Timbersled (QDT) belt drive system, and more trim levels and

options.

We design, engineer, produce or supply a variety of replacement parts and Polaris Engineered Accessories for our

snowmobiles and snow bike conversion kits. Snowmobile accessories include covers, traction products, reverse kits,

electric starters, tracks, bags, windshields, oil and lubricants. We also market a full line of gear and apparel for our

snowmobiles, including helmets, goggles, jackets, gloves, boots, bibs, pants and hats. Gear and apparel is purchased

from independent vendors and sold by us through our dealers, distributors, and online.

We sell our snowmobiles directly to a network of over 580 dealers in North America, primarily located in the snowbelt

regions of the United States and Canada, and over 300 international dealers. We offer a pre-order SnowCheck program

in the spring for our customers that assists us in production planning. This program allows our customers to order a true

factory-customized snowmobile by selecting various options, including chassis, track, suspension, colors and

accessories. Manufacturing of snowmobiles generally commences in late winter of the previous season and continues

through late autumn or early winter of the current season.

The global snowmobile industry is primarily comprised of North American and Japanese competitors. Competitive

market share position is driven heavily by product news (styling, technology, performance) and attractiveness of

promotional incentives.

Our commercial and government/defense businesses design and manufacture vehicles that support various commercial

and government applications for transporting people and hauling equipment, as well as tactical defense vehicles. Our

defense vehicles, which include ATVs and side-by-side vehicles with features specifically designed for military

applications, provide versatile mobility for up to nine passengers, and include our DAGOR, Sportsman MV and MRZR

models. We offer 39 models across our brands.

Our commercial and government/defense businesses each have their own distribution networks outside of our traditional

dealer channels through which their respective vehicles are distributed. ProXD, one of our vehicle brands, is sold through

a growing network of over 190 dealers and also direct to customer where permitted.

4

The Off Road segment also designs and sells various PG&A related to its vehicles and aftermarket products. These

products include our OEM brands as well as other portfolio brands including Kolpin, Pro Armor, Klim, 509, and Trail

Tech. Kolpin, Pro Armor and Trail Tech serve various accessory related needs, where Kolpin is a lifestyle brand

specializing in purpose-built and universal-fit accessories for a variety of off-road vehicles and off-road outdoor

enthusiasts and Pro Armor offers a lineup that specializes in accessories for performance side-by-side vehicles,

snowmobiles and ATVs. Brands in our Apparel category include Klim, which specializes in premium technical riding

gear for snowmobile and off-road activities, and 509, which is an aftermarket leader in snowmobile and off-road apparel,

helmets and goggles. Kolpin, Pro Armor and Trail Tech are marketed through Apex Product Group, a unified sales,

customer service, distribution and vertically integrated manufacturing organization. Apex allows us to access customers

through strategic retail and e-commerce marketplaces, as well as dealerships (Polaris and non-Polaris), to reach owners

of Polaris and other OEM’s products. Klim and 509 each have their own dealer/distributor networks.

On Road:

Our On Road segment designs and manufactures motorcycles, moto-roadsters, light duty hauling, and passenger

vehicles.

Motorcycles are utilized as a mode of transportation as well as for recreational purposes. The industry is comprised of

several segments. We currently compete in three segments: cruisers, touring (including three-wheel), and standard

motorcycles. Competition in these segments of the motorcycle industry is based on a number of factors, including

styling, price, quality, reliability and the dealer network supporting the brand.

Estimated combined 900cc and above cruiser, touring, and standard market segments (including the moto-roadster

Slingshot

®

) motorcycle industry sales in North America and worldwide are summarized as follows:

Estimated* Industry Sales (in units) 2022 2021 2020

North America 900cc cruiser, touring, and standard retail sales . . . . . . . . . . 195,000 220,000 190,000

Worldwide 900cc cruiser, touring, and standard retail sales . . . . . . . . . . . . . 315,000 350,000 330,000

*Estimates are unaudited and based on internally-generated management estimates, including estimates based on extrapolations from third party

surveys of the industries in which we compete. See Market and Industry Data section for additional information.

Twelve months ended December 31,

In 2022, we held the number two position in North America market share for the 900cc+ category. Our motorcycles

lineup includes Indian Motorcycle and Slingshot, a three-wheel open air roadster. Our 2023 model year line of

motorcycles for Indian Motorcycle and Slingshot consists of 35 models. In 2022, Indian Motorcycle launched its all-new

2023 lineup featuring enhanced style and technology with its groundbreaking FTR lineup and three new limited edition

Elite motorcycles. Polaris Slingshot launched its all-new 2023 lineup, including the Slingshot ROUSH® Edition as a

new partnership collaboration with ROUSH® Performance.

We design, engineer, produce or source a variety of replacement parts and accessories for our motorcycles. Motorcycle

accessories include saddle bags, handlebars, backrests, exhausts, windshields, seats, oil and various chrome accessories.

We also market a full line of gear and apparel for our motorcycles, including helmets, jackets, leathers and hats. Gear

and apparel is purchased from independent vendors and sold by us through our dealers, distributors, and online under our

brand names.

Indian Motorcycle and Slingshot are distributed directly through independently owned dealers and distributors. Indian

Motorcycles are sold through a network of over 200 dealers in North America and over 350 international dealers.

Slingshot currently has over 350 dealers globally. We utilize our RFM ordering system for motorcycle dealers, which

allows dealers to order daily and create a segment stocking order which helps to reduce order fulfillment times.

We also design and manufacture vehicles that support various commercial and industrial work applications and include

products in the light-duty hauling, industrial and urban/suburban commuting sub-sectors. Our vehicle brands include

Goupil and Aixam which are primarily marketed in Western Europe. We offer 14 models across these brands. These

businesses each have their own distribution networks through which their respective vehicles are distributed. Goupil and

Aixam sell directly to customers in France, through subsidiaries in certain Western European countries and through

several dealers and distributors for markets outside such countries.

5

The On Road segment also designs and sells various PG&A related to its vehicles and aftermarket products. These

products include our OEM brands as well as other portfolio brands including Klim.

Marine:

Our Marine segment designs and manufactures boats which are designed to compete in key segments of the recreational

marine industry, specifically pontoon and deck boats. Inclusive of the segments in which we compete, we estimate total

U.S. 2022 powerboats market sales were approximately $14.0 billion, with pontoon being one of the larger segments

therein.

Our brands include Bennington, Godfrey, and Hurricane, which together provide a full offering of pontoon and deck

boats. These brands are strategically positioned with over 500 base models across a range of price points. We also offer

custom layouts and features and work with most engine manufacturers enabling customers to build a boat that meets

their specifications. We believe that the combination of our Bennington and Godfrey brands is projected to be the market

share leader in pontoon boats.

In 2022, Polaris Marine launched the MY 2023 boats for the Bennington, Godfrey and Hurricane brands. Notable

launches include Bennington’s LX Sport that introduced sleek rails, sport furniture, and intuitive helm design features

normally found on premium models on this mid-range boat at an attractive price; Godfrey’s Mighty G cruising and

fishing series designed to be powered by electric or gas propulsion; Hurricane’s refreshed lineup of Fun Deck models

(1960, 2260, 2360) and the Hurricane SunDeck 2600 OB deck boat as the flagship model with its spacious design, plush

interior, and power action tower.

Our extensive, experienced and loyal network of over 550 active dealers is a competitive advantage, helping to generate

steady demand. Concentrated primarily in North America, this dealer network is organized into distinct sales territories

supported by experienced sales representatives and leadership. Through the use of offseason incentive programs, we

adhere to level production throughout the year, minimizing disruption to the workforce and vendor network.

Polaris Adventures

Our Polaris Adventures business partners with local outfitters to deliver unique ride experiences leveraging many of our

global vehicle platforms. The Polaris Adventures network completed over 350,000 rides in over 190 locations in 2022.

The financial results of the Polaris Adventures business is included within the Off Road and On Road segments, based

on the related vehicle.

Financial Services Arrangements

Floor plan financing. We have arrangements with Polaris Acceptance (United States), a joint venture between Polaris

and a subsidiary of Wells Fargo Bank, N.A., Wells Fargo affiliates (Australia, Canada, France, Germany, the United

Kingdom, China and New Zealand), and a subsidiary of Huntington Bancshares Incorporated to provide floor plan

financing for many of our dealers. A majority of our sales of ORVs, snowmobiles, motorcycles, boats, and related

PG&A are financed under these arrangements whereby we receive payment within a few days of shipment of our

product. We participate in the cost of dealer financing and have agreed to repurchase products from the finance

companies under certain circumstances and subject to certain limitations. No material losses have been incurred under

these agreements during the periods presented. See Note 11 of Notes to Consolidated Financial Statements for a

discussion of these financial services arrangements.

Customer financing. We do not offer consumer financing directly to the end users of our products. Instead, we have

agreements in place with third-party financing companies to provide financing services to those end consumers. We have

no material contingent liabilities for residual value or credit collection risk under these agreements.

Manufacturing and Distribution Operations

Our products are primarily assembled at our 19 global manufacturing facilities, many of which are shared across

business segments. We are vertically integrated in several key components of our manufacturing process, including

plastic injection molding, precision machining, welding, clutch assembly and painting. Raw materials and other

component parts are purchased from third-party vendors. We have a long-term supply contract with a boat engine

manufacturer, which requires a certain volume of total engine purchases, and includes favorable pricing, as well as

various growth and volume incentives.

6

Contract carriers ship our products from our manufacturing and distribution facilities to our customers. We maintain

several leased wholegoods distribution centers where final set-up and up-fitting is completed for certain models before

shipment to dealers, distributors, and customers.

Our products are distributed to our dealers, distributors, and customers through a network of over 40 distribution centers,

including third-party providers.

Sales and Marketing

Our marketing activities are designed primarily to promote and communicate with consumers to enable the marketing

and selling efforts of our dealers and distributors globally. We make available and advertise discount or rebate programs,

retail financing or other incentives for our dealers and distributors to remain price competitive to accelerate retail sales to

consumers. We advertise our brands directly to consumers via digital, television, print, out of home, radio, events and

sponsorships. We utilize public relations and partnerships to drive earned media. We provide advertising assets and

content and partially underwrite dealer and distributor advertising to a degree and on terms which vary by brand and

from year to year. We also provide print materials, signage and other promotional items for use by dealers. We spent

$480.8 million, $458.2 million and $429.8 million for sales and marketing activities in 2022, 2021 and 2020,

respectively. Our corporate headquarters facility is in Medina, Minnesota, and we maintain numerous sales and

administrative facilities across the world.

Engineering, Research and Development, and New Product Introduction

We have over 1,400 employees who are engaged in the development and testing of existing products and research and

development of new products and improved production techniques, located primarily in Roseau, Minnesota, Wyoming,

Minnesota, Elkhart, Indiana, Burgdorf, Switzerland, and Bangalore, India.

We utilize internal combustion engine testing facilities to design engine configurations for our products. We utilize

specialized facilities for matching engine, exhaust system and clutch performance parameters in our products to achieve

desired fuel consumption, power output, noise level and other objectives. Further, we are currently executing an

electrification initiative to position the Company as a leader in powersports electrification. Our engineering department is

equipped to make small quantities of new product prototypes for testing and for the planning of manufacturing

procedures. In addition, we maintain numerous facilities where each of the products is extensively tested under actual use

conditions. We utilize our Wyoming, Minnesota facility for engineering, design and development personnel for our line

of engines and powertrains, ORVs, and motorcycles, and our Roseau, Minnesota facility for our snowmobile, ATV and

powertrain research and development. We utilize our Elkhart, Indiana facility for engineering, design and development

for our boats research and development. We also own Swissauto Powersports Ltd., an engineering company that

develops high-performance and high-efficiency engines and innovative vehicles.

Intellectual Property

Our products are marketed under a variety of valuable trademarks. Some of the more important trademarks used in our

global operations include POLARIS, RANGER, RZR, GENERAL, SPORTSMAN, INDIAN MOTORCYCLE,

SLINGSHOT, BENNINGTON, and KLIM. We protect these marks as appropriate through registrations in the United

States and other jurisdictions. Depending on the jurisdiction, trademarks are generally valid as long as they are in use or

their registrations are properly maintained and they have not been found to have become generic. Registrations of

trademarks can also generally be renewed indefinitely for as long as the trademarks are in use.

We continue our focus on developing and marketing innovative, proprietary products, many of which use proprietary

expertise, trade secrets, and know-how. We consider the collective rights under our various patents, which expire from

time to time, a valuable asset, but we do not believe that our businesses are materially dependent upon any single patent

or group of related patents.

Product Safety & Regulatory Affairs

Federal, state/provincial and local governments around the world have promulgated and/or are considering promulgating

laws and regulations relating to product safety and consumer use. For example: (i) the United States, the Consumer

Product Safety Commission (“CPSC”) has federal oversight over product safety issues related to snowmobiles, snow-

bikes and off-road vehicles; (ii) the National Highway Traffic Safety Administration (“NHTSA”) has federal oversight

over product safety issues related to motorcycles and Slingshot; and (iii) and the U.S. Coast Guard and its foreign

equivalents have oversight over the marine safety regulations for our marine products. In addition, we design our

products to comply with various applicable voluntary safety standards promulgated by industry associations. While we

7

are currently effectively managing compliance with these various regulatory schemes and standards around the world,

changes in the regulatory climate in any of the jurisdictions where we operate could have a material adverse effect on our

total sales, financial condition, profitability, or cash flows. For a more detailed discussion of these risks, please see Item

1A. Risk Factors of this Annual Report.

Human Capital Management

Best Team, Best Culture is a Polaris guiding principle. Our greatest asset is our employee base. We are committed to

providing an inclusive and engaging work environment, and we aim to leverage our Polaris values to drive a positive

culture. Our employees are also among our largest shareholder groups, driven by our Employee Stock Ownership Plan

(“ESOP”) and our equity compensation program.

Headcount. Due to the seasonality of our business and changes in production cycles, total employment levels vary

throughout the year. Despite such variations in employment levels, employee turnover has not been materially disruptive

to operations. As of December 31, 2022, we had approximately 16,200 full-time employees globally, with approximately

5,100 in salaried roles. Our employees are based in 19 countries with approximately 45% of our employees located

outside of the United States.

Commitment to diversity, equity, and inclusion. Our commitment to diversity, equity, and inclusion is foundational to our

success. We have committed to a multi-year strategy, R.I.D.E. Together, that defines and progresses our commitment to

Respect, Inclusion, Diversity, and Equity, with our assertion that we will make meaningful progress leveraging our full

workforce (“Together”). The composition of our Board of Directors reflects our actions to make diversity a key priority.

In the last four years, the Company has added three new directors resulting in a Board with a comprehensive skillset

relevant to our industry and future including adding two diverse directors.

Our leaders are equipped to foster a diverse and inclusive workplace through unconscious bias training and access to

similar tools to drive inclusive team conversations. We engaged an external firm to review our performance management

and talent acquisition processes for any unintended biases and are leveraging the findings to inform and reinforce our

market-leading practices in these areas. As members of the Corporate Partnership Council of the Society of Women

Engineers (“SWE”) and the Women in Manufacturing Association (“WiM”), we have enabled team development

opportunities and a pipeline for future talent. We have also created partnerships with People of Color Careers,

RippleMatch, Women in Business (“WIB”), Disability Solutions, DoD Skillbridge and others to further our ability to

reach a diverse candidate base. Our relationship with Code2College is helping us create a non-traditional talent pipeline

for technical talent, and our early career leadership development programs are a catalyst for future diverse leaders.

Employee engagement. As a core element of our human capital management strategy, in 2021 we deployed our bi-annual

engagement survey of global salaried employees. In 2021, 96% of our employees participated in the survey, and the

positive responses rated Polaris in the top quartile compared with a best-in-class global normative database, on par with

high performing company norms. We furthered our employee listening strategy by deploying a new hire feedback survey

across our global salaried employees, soliciting feedback from employees throughout the first 18 months of employment.

In 2022, our teams have been actively working to evaluate and implement opportunities for improvement identified by

these sources of employee feedback.

Leadership development. As a part of our growth strategy, we are committed to strategically and intentionally developing

our current employees to become the next generation of leaders through external partnerships and employee development

programs such as Succeeding as a Polaris Leader and Polaris Leadership Development 1 and 2. These programs provide

high potential employees opportunities to grow and prepare for next-level roles. In 2022, we expanded that investment

with virtual and in-person leadership trainings across a large number of leaders and we deployed additional manager and

employee skill trainings aligned to organizational capabilities. We have bolstered our succession and development

processes for senior leadership, partnering with top executives to improve our pipeline for critical executive roles.

Attracting and developing early career talent remains a key element of our talent strategy. We returned to in-person

internships in 2022 and leveraged our learnings from remote internships to create agile development opportunities

culminating with a 3-day summit event in Minnesota providing an opportunity to learn from executives, network with

other interns, participate in professional development, and ride Polaris products. Our internship programs are a key

pipeline to our early career leadership development programs across engineering, operations, sales, marketing, finance,

human resources and information technology. Our first leadership development program launched over 20 years ago, and

the structured rotations and formal development within the programs have proven successful in bolstering our functional

and management leadership succession

8

Employee well-being. We believe the holistic focus on well-being, including our employees’ health, safety, and financial

security drives our success and is a key focus of our guiding principles. We offer our employees a total rewards package

that includes competitive base pay, annual incentives, product discounts, comprehensive health and wellness benefits,

and equity compensation plans that include the ESOP, Employee Stock Purchase Plan (“ESPP”), and additional incentive

equity grants (for certain levels). Employees are provided with customized comprehensive total rewards statements and a

guide to understanding the various pay and benefits elements of our total rewards program. Over the past year, our strong

safety culture remained a primary focus as our office teams transitioned back onsite. We have continued to evolve our

safety controls to protect employees working onsite. The agility of our employee base remained an advantage, with our

office teams shifting to a hybrid work environment and optimizing the benefits of remote and in-person work. Wellness

is a significant focus with the personalized well-being model that provides employees with the tools to manage their

situations better. Financial well-being has been a focus in a multifaceted way, including an expanded 401(k) investment

lineup. We also offer financial wellness education via an award-winning investment advisory firm, which teaches our

employees about the navigation of market volatility and provides inflation and free one-on-one counseling sessions to

employees. We expect to launch an employee relief program in 2023 that supports employees in need due to unforeseen

crises. We view a comprehensive total rewards package such as this with a broad focus on employee well-being as

instrumental in our ability to attract, motivate and retain quality candidates and employees to drive our strategic mission

to be the global leader in powersports.

Market and Industry Data

We have obtained the market and industry data presented in this Annual Report from a combination of internal surveys,

third-party information and estimates by management. There are limited sources that report on our markets and

industries. As such, much of the market and industry data presented in this Annual Report is based on internally-

generated management estimates, including estimates based on extrapolations from third-party surveys of the industries

in which we compete. While we believe internal surveys, third-party information and our estimates are reliable, we have

not verified them, nor have they been verified by any independent sources and we have no assurance that the information

contained in third party websites is current, up-to date, or accurate. While we are not aware of any misstatements

regarding the market and industry data presented in this Annual Report, whether any such future-looking data will be

accurate involves risks and uncertainties and are subject to change based on various factors, including those factors

discussed under the “Forward-Looking Statements” and in our “Risk Factors.”

Available Information

Our Internet website is http://www.polaris.com. We make available free of charge, on or through our website, our

annual, quarterly and current reports, and any amendments to those reports, as soon as reasonably practicable after

electronically filing such reports with the Securities and Exchange Commission. We also make available through our

website our corporate governance materials, including our Corporate Governance Guidelines, the charters of the Audit

Committee, Compensation Committee, Corporate Governance and Nominating Committee and Technology Committee

of our Board of Directors, our Code of Business Conduct and Ethics, and our Corporate Responsibility Report. Any

shareholder or other interested party wishing to receive a copy of these corporate governance materials should write to

Polaris Inc., 2100 Highway 55, Medina, Minnesota 55340, Attention: Investor Relations or email

[email protected]. Information contained on our website is not part of this report. In addition, the

SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding

issuers that file electronically with the SEC and state the address of that side (http://www.sec.gov).

Forward-Looking Statements

This Annual Report contains not only historical information, but also “forward-looking statements” intended to qualify

for the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These “forward-looking

statements” can generally be identified as such because the context of the statement will include words such as we or our

management “believes,” “anticipates,” “expects,” “estimates” or words of similar import. Similarly, statements that

describe our future plans, objectives or goals, such as future sales, shipments, future cash flows and capital requirements,

operational initiatives, supply chain, tariffs, currency fluctuations, interest rates, and commodity costs, are forward-

looking statements that involve certain risks and uncertainties that could cause actual results to differ materially from

those forward-looking statements, are also forward-looking. Forward-looking statements may also be made from time to

time in oral presentations, including telephone conferences and/or webcasts open to the public.

Potential risks and uncertainties include such factors as Company’s ability to successfully source necessary parts and

materials on a timely basis; the ability of the Company to manufacture and deliver products to dealers to meet demand;

9

the Company’s ability to identify and meet optimal dealer inventory levels; the Company’s ability to accurately forecast

and sustain consumer demand; the Company’s ability to mitigate increasing input costs through pricing or other

measures; the Company’s ability to successfully implement its manufacturing operations strategy and supply chain

initiatives; product offerings, promotional activities and pricing strategies by competitors that make our products less

attractive to consumers; economic conditions that impact consumer spending, including recessionary conditions; the

severity and duration of the COVID-19 pandemic and the resulting impact on the Company’s business, supply chain, and

the global economy; disruptions in manufacturing facilities; product recalls and/or warranty expenses; product rework

costs; impact of changes in Polaris stock price on incentive compensation plan costs; foreign currency exchange rate

fluctuations; environmental and product safety regulatory activity; effects of weather; commodity costs; freight and tariff

costs (tariff relief or ability to mitigate tariffs); changes to international trade policies and agreements; uninsured product

liability claims and other litigation expenses incurred due to the nature of the Company’s business; uncertainty in the

consumer retail and wholesale credit markets; performance of affiliate partners; changes in tax policy; relationships with

dealers and suppliers; and the general overall global economic, social and political environment. The risks and

uncertainties discussed in this report are not exclusive and other factors that we may consider immaterial or do not

anticipate may emerge as significant risks and uncertainties.

Any forward-looking statements made in this report or otherwise speak only as of the date of such statement, and we

undertake no obligation to update such statements to reflect actual results or changes in factors or assumptions affecting

such forward-looking statements. We advise you, however, to consult any further disclosures made on related subjects in

future quarterly reports on Form 10-Q and current reports on Form 8-K that are filed with or furnished to the Securities

and Exchange Commission.

10

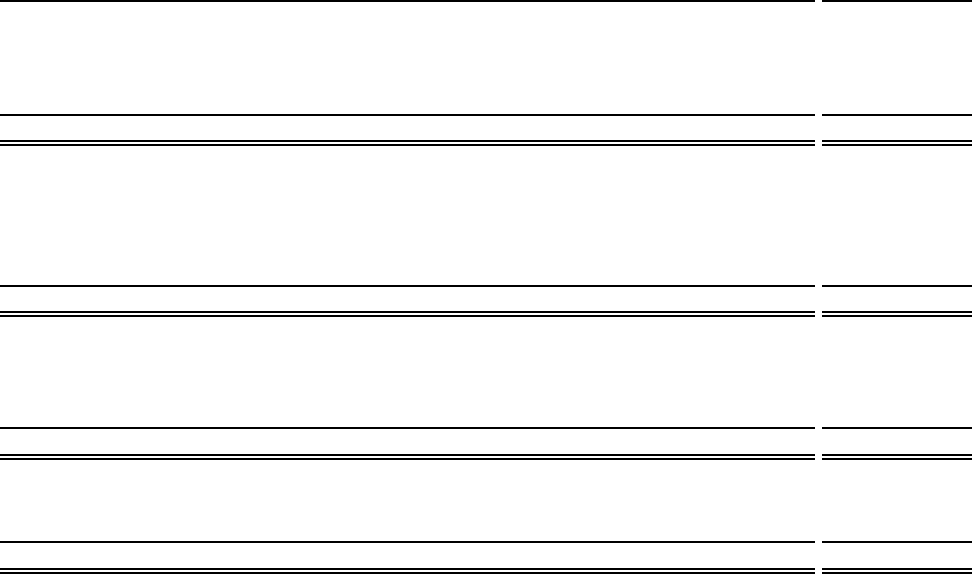

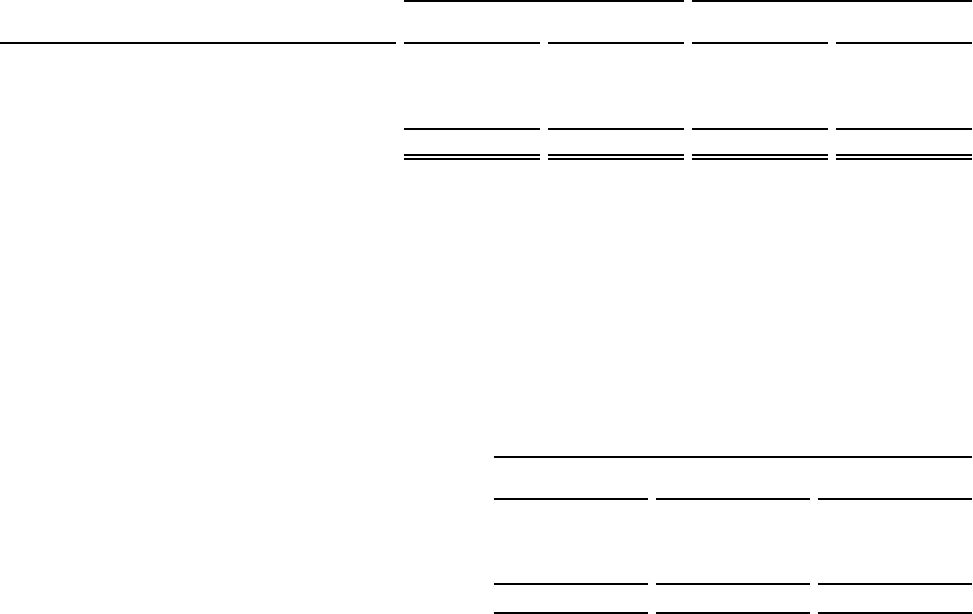

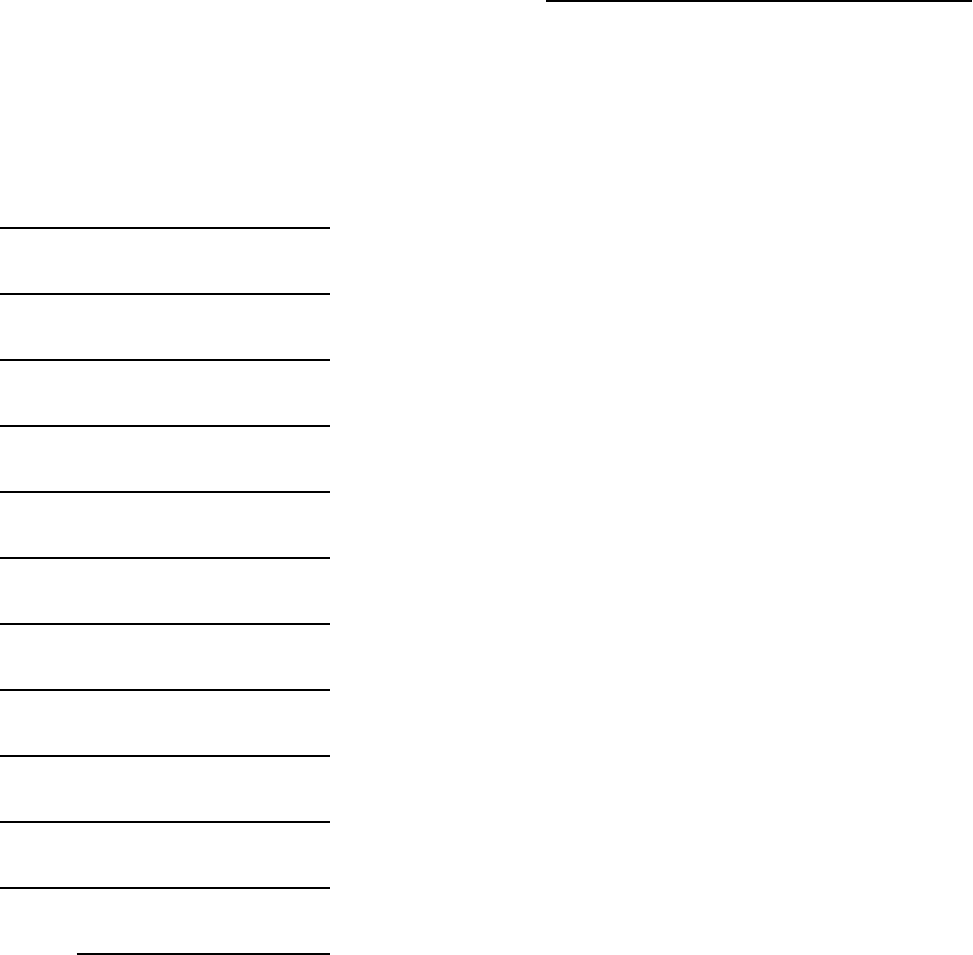

Information about our Executive Officers

Set forth below are the names of our executive officers as of February 17, 2023, their ages, titles, the year first appointed

as an executive officer, and employment for the past five years:

Michael T. Speetzen

Chief Executive Officer

53 Mr. Speetzen was appointed Chief Executive Officer in April 2021;

proceeding this, Mr. Speetzen was Interim Chief Executive Officer since

January 2021. Mr. Speetzen joined Polaris in August 2015 as Executive

Vice President and Chief Financial Officer.

Lucy Clark Dougherty

Senior Vice President, General

Counsel and Corporate Secretary

53 Ms. Clark Dougherty joined Polaris in January 2018 as Senior Vice

President—General Counsel, Compliance Officer and Corporate Secretary.

Michael D. Dougherty

President of On Road and

International

55 Mr. Dougherty was appointed President of On Road and International in

December 2019. Prior to this, Mr. Dougherty was President of

International since September 2015.

Benjamin D. Duke

President of Marine

50 Mr. Duke was appointed President of Marine in May 2022. Prior to this,

Mr. Duke was General Manager of Godfrey and Hurricane Boats since

joining Polaris in 2019. Prior to joining Polaris, Mr. Duke was President of

the Job Site and Standby Power Group at Briggs and Stratton.

Stephen L. Eastman

President of PG&A and

Aftermarket

58 Mr. Eastman was appointed President of PG&A and Aftermarket in

September 2015. Prior to this, Mr. Eastman was Vice President of PG&A

since joining Polaris February 2012.

Robert P. Mack

Chief Financial Officer and

Executive Vice President of

Finance and Corporate

Development

53 Mr. Mack was appointed Chief Financial Officer in April 2021. Mr. Mack

also serves as Executive Vice President of Finance and Corporate

Development. Prior to this, Mr. Mack was Interim Chief Financial Officer

since January 2021 and Senior Vice President of Corporate Development

and Strategy, and President of Global Adjacent Markets and Marine.

Steven D. Menneto

President of Off Road

57 Mr. Menneto was appointed President of Off Road in December 2019.

Prior to this, Mr. Menneto was President of Motorcycles since September

2015.

Kenneth J. Pucel

Executive Vice President—Global

Operations and Chief Technology

Officer

56 Mr. Pucel joined Polaris in December 2014 as Executive Vice President—

Global Operations, Engineering, and Lean.

James P. Williams

Senior Vice President and Chief

Human Resources Officer

60 Mr. Williams joined Polaris in April 2011 as Senior Vice President and

Chief Human Resources Officer.

Name and Position Age Business Experience During the Last Five or More Years

Executive officers of the Company are elected at the discretion of the Board of Directors with no fixed terms. There are

no family relationships between or among any of the executive officers or directors of the Company.

Item 1A. Risk Factors

The following are factors known to us that could materially adversely affect our business, financial condition, cash

flows, or operating results, as well as adversely affect the value of an investment in our common stock.

Macroeconomic Risks

Our business may be sensitive to economic conditions, including those that impact our customers’ spending.

Our results of operations may be sensitive to changes in overall economic conditions, primarily in North America and

Europe, that impact spending on our products, including discretionary spending. Weakening of, and fluctuations in,

economic conditions affecting disposable consumer income or our customers’ budgets, such as employment levels,

inflation, business conditions, the level of governmental financial assistance, changes in housing market conditions,

capital markets, tax rates, savings rates, interest rates, fuel and energy costs, the economic impacts of natural disasters or

other severe weather conditions, acts of war, including the conflict between Russia and Ukraine, and acts of terrorism,

the availability of consumer credit could reduce overall spending or reduce spending on our products. A general

reduction in consumer spending or a reduction in consumer spending on powersports, boats and aftermarket products

11

could adversely affect our sales growth and profitability. A general reduction in spending by our customers for

commercial equipment or a reduction in government budgets could adversely affect our related sales.

Adverse changes in these factors could lead to a decreased level of demand for our products, which could negatively

impact our business, results of operations, financial condition and cash flows.

In addition, we have financial services partnership arrangements with subsidiaries of Wells Fargo Bank, N.A. and a

subsidiary of Huntington Bancshares Incorporated that require us to repurchase products financed and repossessed by the

partnership, subject to certain limitations. If adverse changes to economic conditions result in increased defaults on the

loans made by this financial services partnership, our repurchase obligation under the partnership arrangement could

adversely affect our liquidity and harm our business.

Shortages or increases in the cost of raw materials, commodities, component parts, and transportation could

negatively impact our business.

The primary commodities used in manufacturing our products are aluminum, steel, petroleum-based resins and certain

rare earth metals used in our charging systems, as well as diesel fuel to transport products. Our profitability has been

affected by fluctuations in the prices of the raw materials and commodities we use in our products and in the cost of

freight and shipping to source materials, commodities, and other component parts necessary to assemble our products.

We have experienced significant increases in the cost of these commodities and materials due generally to an inflationary

environment driven by high demand and supply chain disruptions. Additionally, fluctuating policies and the

implementation of trade regulations and trade agreements could further disrupt our supply chain or increase the cost of

raw materials and commodities necessary to manufacture our products. The impact from tariffs or other trade regulations

could require us to shift our manufacturing footprint or result in decreased demand for our products or restructuring

actions that could impact our work force and/or our investments in research and development or other growth initiatives.

All of these could increase our operational costs and materially and adversely affect our results of operations and

financial condition.

Market and Competitive Risks

We face intense competition in all product lines. Failure to compete effectively against competitors could negatively

impact our business and operating results.

The markets in which we operate are highly competitive. Competition in such markets is based upon several factors,

including price, quality, reliability, styling, product features and warranties. At the dealer level, competition is based on

additional factors, including product availability, sales and marketing support programs (such as financing and

cooperative advertising), and dealer and customer perception. Certain of our competitors are more diversified and have

advantageous manufacturing footprints, and may invest more heavily in intellectual property, product development,

promotions and advertising. If we are not able to compete with new or enhanced products or models of our competitors,

our ability to retain and attract customers and future business performance may be materially and adversely affected.

Internationally, our products typically face more competition where certain foreign competitors manufacture and market

products in their respective countries. This allows those competitors to sell products at lower prices, which could

adversely affect our competitiveness. In addition, our products compete with many other recreational, utility, and work

products for the discretionary spending of our customers. A failure to effectively compete with these other competitors or

adjust pricing to offset inflation or increased supply chain costs could materially and adversely affect our financial results

and have a material adverse effect on our performance.

If we are unable to continue to enhance existing products and develop and market new or enhanced products that

respond to customer needs and preferences, we may experience a decrease in demand for our products and our

business could suffer.

Our sales from new products in the past have represented a significant component of our sales and are expected to

continue to represent a significant component of our future sales. We may not be able to compete as effectively in the

market, and ultimately satisfy the needs and preferences of our customers, unless we can continue to enhance existing

product, execute on our electrification strategy, and develop new and innovative products in the global markets in which

we compete. Product development requires significant financial, technological and other resources. There can be no

assurance that our level of investment in research and development will be a sufficient competitive advantage in product

innovation, which could cause our business to suffer. Product improvements and new product introductions also require

significant engineering, planning, design, development, and testing at the technological, product, and manufacturing

process levels and we may not be able to timely develop product improvements or new products. Our competitors’ new

12

products may be of a better quality, beat our products to market, and be more attractive in terms of features and price

than our products.

Our continued success is dependent on positive perceptions of our Polaris brands which, if impaired, could adversely

affect our sales.

We believe the strength of our Polaris brands is one of the reasons our customers choose our products. To be successful,

we must preserve our reputation. Reputational value is based in large part on perceptions and opinions, and broad access

to social media makes it easy for anyone to provide public feedback that can influence perceptions of our company. It

may be difficult to control negative publicity, regardless of whether it is accurate. While reputations may take decades to

build, any negative incidents can quickly erode trust and confidence, particularly if they result in negative mainstream

and social media publicity, governmental investigations, or litigation. Negative incidents, such as quality and safety

concerns or incidents related to our products or actions or statements of our employees, suppliers or dealers, could lead to

tangible adverse effects on our business, including lost sales or employee retention and recruiting difficulties. In addition,

the reputation of our vendors and others with whom we choose to do business may affect our reputation.

Increased negative public perception of our products or any increased restrictions on the access or the use of our

products in certain locations could materially adversely affect our business or results of operations.

Demand for the Company’s products depends in part on their social acceptability. Public concerns about the

environmental impact of the Company’s products or their perceived safety could result in diminished public perception

of the products we sell. Government, media, or activist pressure to limit emissions or perceived land and water impacts

could also negatively impact consumers’ perceptions of the Company’s products or limit access to areas where

customers can use our products. Any decline in the social acceptability of the Company’s products could negatively

impact sales or lead to changes in laws, rules and regulations that prevent their access to certain locations or restrict their

use or manner of use in certain areas or during certain times, which could also negatively impact sales. Any material

decline in the social acceptability of the Company’s products could impact the Company’s ability to retain existing

customers or attract new ones which, in turn, could have a material adverse effect on its business, results of operations or

financial condition.

From time to time, we manage our portfolio and grow our business through acquisitions, non-consolidating

investments, alliances and new joint ventures and partnerships, which could be risky and could harm our business.

From time to time, we drive growth in our businesses and accelerate opportunities to expand our global presence and

customer base through targeted acquisitions, non-consolidating investments, alliances, and new joint ventures and

partnerships (each a “Strategic Transaction”) that we believe add value to our existing brands and product portfolio.

Alternatively, we may not be able to identify an attractive Strategic Transaction. The benefits of a Strategic Transaction

may take more time than expected to develop or integrate into our operations, and we cannot guarantee that any Strategic

Transaction will ultimately produce the expected benefits.

There can be no assurance that Strategic Transactions will be completed or that, if completed, they will be successful.

Strategic Transactions pose risks with respect to our ability to project and evaluate market demand, potential synergies

and cost savings, make correct accounting estimates and achieve anticipated business goals and objectives. As we

continue to grow, in part, through Strategic Transactions, our success depends on our ability to anticipate and effectively

manage these risks. If acquired businesses do not achieve forecasted results or otherwise fail to meet projections, it could

affect our results of operations.

In many cases, Strategic Transactions present a number of integration risks. For example, the acquisition may: disrupt

operations in core, adjacent or acquired businesses; require more time or resources than anticipated to be fully integrated

into our operations and systems; create more costs than projected; divert management attention; create the potential of

losing customer, supplier or other critical business relationships; and pose difficulties retaining employees. The inability

to successfully integrate new businesses may result in higher production costs, lost sales or otherwise negatively affect

earnings and financial results.

Potential divestiture activity poses similar risks, including the potential to: disrupt operations in core, adjacent or

acquired businesses; require more time or resources than anticipated to be fully completed; deleverage manufacturing

operations or reduce sourcing efficiencies; reduce gross profit if the Company is not able to reduce fixed cost (including

corporate overhead); not deliver the value anticipated for shareholders; divert management attention; create the potential

of losing customer, supplier or other critical business relationships; and pose difficulties retaining employees. The

13

inability to successfully manage the risks associated with the Company’s divestiture activity may result in higher

production costs, lost sales or otherwise negatively affect earnings and financial results.

Operational Risks

Disruption in our suppliers’ operations could disrupt our production schedule.

Our operations and ability to maintain production is dependent upon our suppliers delivering sufficient quantities of

systems, components, raw materials and parts on time to manufacture our products and meet our production schedules.

For example, we have continued to experience supply disruptions and sourcing challenges for various components

critical to the manufacture of our products.

In some instances, we purchase systems, components, raw materials and parts that are ultimately derived from a single

source or geography and may be at an increased risk for supply disruptions. If necessary, we may not be able to develop

alternate sourcing quickly or at all. Any number of factors, including labor disruptions, catastrophic weather events, the

occurrence of a contagious disease or illness, contractual or other disputes, unfavorable economic or industry conditions,

port, rail, or truck delivery delays or other performance problems or financial difficulties or solvency problems, could

disrupt our suppliers’ operations and lead to uncertainty in our supply chain or cause supply disruptions for us, which

could, in turn, disrupt our operations.

Material disruptions of our production schedule caused by a worsening, prolonged, or other unexpected shortage of

systems, components, raw materials or parts have caused, and could continue to cause, us to not be able to meet customer

demand, to alter production schedules, to delay product launch schedules, or to suspend production entirely, which could

cause a loss of revenues, which could materially and adversely affect our results of operations. These disruptions have

had and may continue to have in the future an adverse impact on our prospects and operating results.

We manufacture our products at, and distribute our products from, several locations in North America and

internationally. An unforeseen increase in demand for our products or any disruption at any of these facilities or

manufacturing delays could adversely affect our business and operating results.

We assemble vehicles at various facilities around the world. Our facilities are typically designed to produce particular

models for particular geographic markets. No single facility is designed to manufacture our full range of vehicles. We

also have several locations that serve as wholegoods and PG&A distribution centers, warehouses and office facilities. In

addition, we have agreements with other third-party manufacturers to manufacture products on our behalf. Should these

or other facilities become unavailable either temporarily or permanently for any number of reasons, including supply

chain constraints, labor disruptions, the occurrence of a contagious disease or illness or catastrophic weather events

(including events caused by climate change), the inability to manufacture at the affected facility may result in harm to

our reputation, increased costs, lower revenues and the loss of customers. We may not be able to easily shift production

to other facilities or to make up for lost production. In addition, our ability to meet customer demand has been

constrained by our ability to manufacture product driven largely by supply chain constraints, among other factors. There

can be no assurance that our current or future manufacturing footprint will be sufficient to meet customer demand or that

we will be able to successfully expand or contract our manufacturing capacity to meet demand, which could result in loss

of revenue and market share.

Although we maintain insurance for damage to our property and disruption of our business from casualties, such

insurance may not be sufficient to cover all of our potential losses. Any disruption in our manufacturing capacity could

have an adverse impact on our ability to produce sufficient inventory of our products or may require us to incur

additional expenses in order to produce sufficient inventory, and therefore, may adversely affect our net sales and

operating results. Disruptions or delays at our manufacturing facilities could impair our ability to meet the demands of

our customers, and our customers may cancel orders or purchase products from our competitors, which could adversely

affect our business and operating results.

We depend on suppliers, financing sources and other strategic partners who may be sensitive to economic conditions

that could affect their businesses in a manner that adversely affects their relationship with us.

We source component parts and raw materials through numerous suppliers and have relationships with a limited number

of product financing sources for our dealers and consumers. Our sales growth and profitability could be adversely

affected if deterioration of economic or business conditions results in a weakening of the financial condition of our

suppliers or financing sources, or if uncertainty about inflation, the economy or the demand for our products causes these

business partners to voluntarily or involuntarily reduce or terminate their relationship with us.

14

Failure to establish and maintain the appropriate level of dealers and distributor relationships or weak economic

conditions impacting those relationships may negatively impact our business and operating results.

We distribute our products through numerous dealers and distributors and rely on them to retail our products to our end

customers and provide service on these products. Our sales growth and profitability could be adversely affected if

deterioration of business conditions or reputational harm results in a weakening of the financial condition of our dealers

and distributors. Additionally, weak demand for, or quality issues with, our products may cause dealers and distributors

to voluntarily or involuntarily reduce or terminate their relationship with us. Further, if we fail to establish and maintain

an appropriate level of dealers and distributors for each of our products, we may not obtain adequate market coverage for

the desired level of retail sales of our products.

Our operations require significant management attention and financial resources, expose us to difficulties presented

by global economic, political, regulatory, accounting, and business factors, and may not be successful or produce

desired levels of sales and profitability.

Investments to increase our global presence, including adding employees and dealers and continuing to invest in business

infrastructure and operations, might not produce the returns we expect, which could adversely affect our profitability.

Our operations and sales are also subject to risks related to political and economic instability, including those caused by

the war between Russia and Ukraine, increased costs of customizing products for foreign countries, labor market

conditions, the imposition of tariffs and other trade barriers or costs, the impact of government laws and regulations, the

effects of income and withholding taxes, governmental expropriation and differences in business practices in different

markets, and multiple, changing, and often inconsistent enforcement of laws, rules, and regulations, including rules

relating to environmental, health, and safety matters. The realization of any of these risks or unfavorable changes in the

political, regulatory and business climate in any of the jurisdictions where we operate could have a material adverse

effect on our total sales, financial condition, profitability, or cash flows.

Weather conditions may reduce demand and negatively impact net sales and production of certain of our products.

Unfavorable weather conditions may reduce demand and negatively impact sales of certain of the Company’s products.

Unfavorable weather, including conditions caused in part by climate change, in any particular geographic region may

have an adverse effect on sales of the Company’s products in that region. For example, lack of snowfall during winter

may materially adversely affect snowmobile sales; excessive rain before and during spring and summer may materially

adversely affect sales of off-road vehicles ATVs, and boats; a lack of rain in certain areas may limit boat usage and may

materially adversely affect sales of boats; and wild fires can limit areas where our customers ride our off-road vehicles

and ATVs. There can be no assurance that weather conditions or natural disasters will not have a material effect on our

sales, production capability or component supply continuity for any of our products.

Our operations are dependent upon attracting and retaining senior executives and skilled employees. Our future

success depends on our continuing ability to identify, hire, develop, motivate, retain and promote skilled personnel for

all areas of our organization and to retain or provide for adequate succession planning for our senior executives.

Our success depends on attracting and retaining qualified personnel. Our ability to sustain and grow our business

requires us to hire, retain and develop a highly skilled and diverse management team and workforce. Many members of

the Company’s management team and other key employees have extensive experience in the Company’s industry and

with its business, products and customers. The unplanned loss of members of the Company’s management team or other

key employees, particularly if combined with difficulties in finding qualified replacements, could negatively affect the

Company’s ability to develop and pursue its business strategy, which could materially adversely affect the Company’s

business, results of operations or financial condition. In addition, the Company’s success depends to a large extent upon

its ability to attract and retain skilled employees. There is intense competition for qualified and skilled employees, and a

failure to recruit, train and retain such employees could have a material adverse effect on its business, results of

operations or financial condition.

The demand, supply, and operational challenges associated with the actual or perceived effects of COVID-19 and the

related widespread impact on global supply chains may negatively impact our business and operating results.

Our business has been, and may continue to be, negatively impacted by the fear of exposure to or actual effects of the

COVID-19 pandemic in the United States and other countries where we operate or our dealers or suppliers are located.

Impacts on our operations include, but are not limited to:

• Reductions in demand or significant future volatility in demand for one or more of our products;

15

• Inability to meet our dealers’ or consumers’ demands due to disruptions in our manufacturing and supply

arrangements caused by the loss or disruption of essential manufacturing and supply elements such as raw

materials or other finished product components, transportation, workforce, or other manufacturing and

distribution capability;

• Failure of third parties on which we rely, including our suppliers, contract manufacturers, distributors, and

contractors to meet their obligations to the Company or to timely meet those obligations, which may be caused

by their own financial or operational difficulties and may adversely impact our operations;

These impacts may have a negative effect on our business, financial condition, results of operations and cash flows, as

well as the trading price of our securities. While we have seen increased demand for our products resulting in part from

effects of the COVID-19 pandemic, there can be no assurance that we can maintain or continue to expand demand for

products in a post-pandemic era. Furthermore, COVID-19 and related supply chain disruptions have impacted and may

further impact the broader economies of affected countries, including negatively impacting economic growth, the proper

functioning of financial and capital markets, foreign currency exchange rates, interest rates, and liquidity. Despite our

efforts to manage and remedy COVID-19 related impacts to the Company, their ultimate impact also depends on factors

beyond our knowledge or control, including the duration and severity of the COVID-19 pandemic, third-party actions

taken to contain its spread and mitigate its public health effects, including efficacy and distribution of available vaccines

to our employees and the general population, and the related impact on consumer confidence and spending.

Product-Specific Risks

A significant adverse determination in any material litigation claim against us could adversely affect our operating

results or financial condition.

The manufacture, sale and usage of products expose us to significant risks associated with product liability, economic

loss, and other claims. If our products are found to be defective or are used incorrectly by our customers, bodily injury,

property damage or other injury, including death, may result. This could give rise to material product liability or

economic loss claims against us or adversely affect our brand image or reputation. Any losses that we may suffer from

any such claims, and the effect that any such liability may have upon the reputation and marketability of our products,

may have a negative impact on our business and operating results.

The Company purchases excess insurance coverage for product liability claims for incidents occurring subsequent to the

policy date that exceed our self-insured retention levels. Disputes with insurers could impact our recoveries under these

policies. Furthermore, certain claims, such as economic loss claims, false marketing claims, and punitive damages, are

uninsured.

Product liability claims have not historically resulted in any material adverse effects on our financial statements,

however, no assurance can be given that this will not change or that material product liability or other claims against us

will not be made in the future. An unanticipated adverse determination of a material product liability claim or other

material claim (particularly an uninsured issue) made against us could materially and adversely affect our financial

condition.

Significant product repair and/or replacement costs due to product warranty claims or product recalls could have a

material adverse impact on our results of operations.

We generally provide limited warranties for our vehicles and boats. We may also provide longer warranties in certain

geographical markets as determined by local regulations and customary practice or related to certain promotional

programs. We also provide a limited emission warranty for certain emission-related parts in our ORVs, snowmobiles,

and motorcycles as required by the EPA and CARB. Our standard warranties require us, through our dealer network, to