Association for Information Systems

AIS Electronic Library (AISeL)

2015 International Conference on Mobile Business

International Conference on Mobile Business

(ICMB)

Winter 12-12-2015

Introducing Reach And Range For Digital Payment

Platforms

Kalina S. Staykova

Copenhagen Business School, kss.itm@cbs.dk

Jan Damsgaard

Copenhagen Business School, Copenhagen, Frederiksberg, Denmark, jd.itm@cbs.dk

Follow this and additional works at: h7p://aisel.aisnet.org/icmb2015

6is material is brought to you by the International Conference on Mobile Business (ICMB) at AIS Electronic Library (AISeL). It has been accepted

for inclusion in 2015 International Conference on Mobile Business by an authorized administrator of AIS Electronic Library (AISeL). For more

information, please contact [email protected].

Recommended Citation

Staykova, Kalina S. and Damsgaard, Jan, "Introducing Reach And Range For Digital Payment Platforms" (2015). 2015 International

Conference on Mobile Business. 5.

h7p://aisel.aisnet.org/icmb2015/5

brought to you by COREView metadata, citation and similar papers at core.ac.uk

provided by AIS Electronic Library (AISeL)

INTRODUCING REACH AND RANGE FOR DIGITAL

PAYMENT PLATFORMS

Staykova, Kalina S., Copenhagen Business School, Howitzvej 60, 2000 Frederiksberg,

Denmark, [email protected]

Damsgaard, Jan, Copenhagen Business School, Howitzvej 60, 2000 Frederiksberg, Denmark,

Abstract

Numerous digital payment solutions, which rely on new disruptive technologies, have been launched

on the payment market in the recent years. But despite the growing number of mobile payment apps,

very few solutions turn to be successful as the majority of them fail to gain a critical mass of users. In

this paper we investigate two successful digital payment solutions in order to outline some of the

factors which contribute to the widespread adoption of a digital payment platform. In order to conduct

our analysis we propose the Reach and Range Framework for Multi-Sided Platforms. Our study

indicates that the success of digital payment platforms lies with the ability of the platform to balance

the reach (number of participants) and the range (features and functionalities) of the platform.

Keywords: Digital Payments, Multi-Sided Platforms, Platform Strategy

1 Introduction

Mobile payments have been around for almost 20 years since SMS text messages were first used to

pay at Coca Cola vending machine in Finland in 1997 (Asif, 2011). Nonetheless, mobile payment

users accounted for just 7% of mobile phone subscribers worldwide in 2013 (EY, 2013). Despite the

rapid spread and adoption of smartphones and the emergence of huge array of mobile payment

solutions, the much proclaimed mobile payment revolution still hasn’t taken place as most consumers

still prefer to pay with plastic cards and cash. Indeed, most of the launched mobile payment apps have

failed to reach critical mass of users as consumers are hesitant to adopt digital payment services.

In the recent years, however, a number of successful mobile payment solutions have been launched.

Offered by new entrants and well-established actors such as banks and mobile network operators alike,

these solutions have managed to achieve significant adoption rate, thus prompting other players to

seek to replicate their success. Although the failure of mobile payment diffusion has been studied from

multiple perspectives (Ondrus et al., 2009), there is a lack of studies investigating the factors which

contribute to the success of a mobile payment solution. To address this gap, we seek to outline some of

the main principles for designing and executing successful platform strategies for digital payments.

Thus, we formulate the following research question:

What strategies successful digital payment platforms design and adopt?

To answer this question we construct a framework which helps us analyse the different strategic

choices which a platform provider faces throughout the evolution of a platform. Our initial findings

indicate that the success of digital payment platforms lies with the ability of the platform to manage its

reach (number of participants) and range (features and functionalities).

This paper proceeds as following: First, we outline the theoretical foundations of this paper and

develop the Reach and Range Framework for Multi-Sided Platforms (MSPs). Then we present briefly

the two investigated successful solutions and analyse them with our framework. In the final sections of

the paper, we discuss our findings, offer some conclusions and suggest promising areas for further

research.

2 Theoretical background

2.1 Digital Payments as Multi-Sided Platforms

Although platforms have been around for centuries, it was not just until recently when academics

started paying attention to such market constructions. Despite the growing amount of literature on

platforms, there is often confusion between the exact difference between one-sided, two-sided and

multi-sided platforms. The problem stems from the lack of a clear definition (Hagiu and Wright,

2011), which leads to an overlapping in the way two-sided and multi-sided platforms are defined

(Evans and Schmalensee, 2008; Hagiu and Wright, 2011). In this paper we investigate platforms as

systems which enable direct interactions between multiple customer types affiliated to them (Hagiu

and Wright, 2011). We also adopt a clear distinction between one-sided (enabling interactions between

participants of one distinct group), two-sided (enabling interactions between participants of two

distinct groups) and multi-sided (interactions between participants of more than two distinct groups)

platforms (Staykova and Damsgaard, 2014).

Digital payment solutions function as digital platforms which facilitate the direct interaction between

customers affiliated to them (Hagiu and Wright, 2011; Kazan and Damsgaard, 2013; Ondrus, 2015;

Staykova and Damsgaard, 2014). More often than not they are launched as one-sided platforms and

gradually evolve to being two-sided and eventually multi-sided (Staykova and Damsgaard, 2014). This

is in contrast to payment cards which are traditionally launched and function as two-sided platforms

that enable the interaction between both merchants and consumers and remain two-sided throughout

their existence (Rochet and Tirole, 2003; Evans and Schmalensee, 2013). Unlike traditional payment

platforms such as credit and debit cards, digital payment platforms are extremely scalable with high

development costs and low marginal costs. Costs are almost fixed and the platform’s value increases

with the widespread platform adoption (Eisenmann, 2002). This means that once the payment platform

is developed, it costs very little to add and service additional users. Thus, payment platforms exhibit

lower acquisition costs and economies of scale as the fixed development costs can be spread over a

growing revenue user base.

The research on digital payment platforms mainly encompasses studies on payment platform design

(Kazan and Damsgaard, 2013), business models (Chae and Hedman, 2015), factors leading to platform

failure (Gannamaneni et al., 2015), transformation of the digital payment ecosystem (Henningsson and

Hedman, 2014), payment platforms’ evolutionary models (Staykova and Damsgaard, 2014).

Significant less emphasis, however, is put on investigating strategies for successful entry and

expansion strategies for digital payment platforms (Staykova and Damsgaard, 2015). We address this

research gap by outlining the factors and conditions which contribute to the successful entry and

expansion of digital payment platforms.

MSPs create value for their participants, and profit for themselves, by enabling multiple and frequent

interactions between the affiliated to the platform participants. In order to do so, platform providers

need to create and manage network effects which occur when the value of a product/service depends

on the number of other users (Shapiro and Varian, 1999). The concept of the same-side network

effects presupposes that consumers may value a product more if similar consumers use that product as

well. Cross-side network effects are present when users value the presence of the other side of the

platform. The demand by one side depends on the participation of the other sides and vice versa.

Platforms are characterized by homing costs, which are related to the adoption, operation, or any other

costs incurred due to platform affiliation (Armstrong, 2006), and by switching costs, or the costs

which consumers pay for switching from one platform to another (Shapiro and Varian, 1999).

The success of the platform depends on its ability to attract participants in the right proportions, or

platform’s ability to achieve critical mass (Evans, 2009). To solve this conundrum, Evans (2009)

proposes a two-stage model to explain platform’s market entry and growth. During the first ignition

stage, customers are trying the platform and assessing its value. In the second “growth” phase, the

platform relies on network effects to drive growth to a long-run equilibrium level. Another solution of

the chicken-and-egg problem is the gradual transition from one-sided to two - (or multiple) sided

platforms (Hagiu, 2006). This approach requires the crafting of an expansion strategy, a precondition

for which is achieving platform’s depth (Hagiu, 2006). Depth relates to creating more value for

existing constituents and intensifies cross-side network effects by making transactions among them

more efficient or more frequent. Deepening is achieved by adding functionalities to the already

existing platforms. While depth means emphasizing on the existing services to generate more value

from the same source, the quest for breadth is for unlocking new sources of value for the platform by

adding new sides. Thus, a platform needs to constantly evolve by adding new features and sides to its

initial value proposition.

2.2 Reach and Range Framework

In order to map out the participants affiliated to the platform and the functionalities associated with

them, we adopt the reach and range framework proposed by Keen (1991), who states that the business

functionalities of an IT platform can be defined in terms of the concept of reach and range (p. 179).

Reach determines the location and people which the IT platform is capable of connecting, with the

ultimate goal is to be able to connect to anyone, anywhere. Reach also sets the rules about who can

access firm’s information and online services (Keen, 1997). The concept of range refers to the degree

to which information can be directly and automatically shared across systems and services. Later,

Keen’s (1991) definition of range was extended by Weill and Broadbent (2000) to include

functionality of shared business activities. The concept of range also encompasses the extent to which

services are integrated instead of being offered as separate services and systems (Keen, 1997). The

purpose of the Reach and Range framework is to identify typical business activities (range) for each of

the added participants (reach) and to show the correlation between them. Thus, the framework serves

as a useful tool to map the functionalities associated with specific groups of people. The Range and

Reach framework can also be used to better plan and manage the expansion of an IT platform. As

Deans and Karwan (2013) point out the ability of an IT platform to enhance in time its reach and

range can lead to significant competitive advantages and help fend off competitors (p. 215).

3 Reach-Range Framework for Multi-Sided Platforms

MSPs enable interactions between distinct groups of participants affiliated to the platform in order to

create and capture value. Thus, the main goal of a platform is to increase the frequency of the

interactions among the different participants affiliated to the platform as well as the type of

interactions within one side and across several sides. In order to achieve this, a platform provider

needs to make a series of strategic choices regarding the affiliation of different sides to the platform as

well as the features and functionalities offered on the platform. Platforms, however, are not static

entities as they evolve over time. Thus, a platform provider has to decide on the nature and number of

participants and features and functionalities of the platform. Building upon Keen’s Range and Reach

framework, we propose a framework for MSPs which helps us identify the different strategic

considerations which a platform needs to take into account throughout its evolutionary path.

Every platform’s side can be characterized by its reach and range. When reach refers to a platform’s

side, it represents the number of participants of one distinct group affiliated to the platform. Reach can

also refer to the overall platform’s reach which is a sum of the reach of each side affiliated to the

platform. Range, on the other hand, encompasses the features and functionalities associated with a

particular side or several sides. Thus, by combining all the features offered by the various sides and

across the sides, we can estimate the overall platform’s range. The concepts of reach and range are

interconnected and the success of both depends on the right timing within which they are executed. A

platform provider usually designs and offer specific set of features (range) in order to attract more

participants (reach). Thus, a platform expands its range in order to increase its reach. On the other

hand, if the number of participants increases (reach), but the platform has limited amount of features

(range), a platform provider needs to guarantee the further entrenchment of the already joined

participants by offering new features and functionalities (range) which will result in more reoccurring

interactions. Thus, a platform provider needs to strike a balance between the reach and range in order

to create and manage multiple reoccurring interactions, which are the main generator of value for the

platform.

Platforms exist as one-sided, two-sided or multi-sided. Upon their launch one-sided platforms have

limited number of features which serve to attract participants. As a platform needs to gain a critical

mass or a certain number of participants in order to become viable, a platform provider adds features

which will attract more users, thus expanding the platform’s range in order to increase the platform’s

reach. As one-sided platform gains a critical mass of participants, it comes to a point of saturation,

which slows down the growth of a platform. A platform provider can decide to stay in such position as

the one-sided platform has already become viable in terms of network effects (but not necessarily

economically viable) after it reached critical mass.

The achievement of significant reach and range, however, can trigger an opportunity for the platform

to reconsider its design further if needed so (f. e. the platform is under threat from new entrants or has

to adapt to newly introduced regulation). A platform provider may decide to expand the platform by

adding a new side (i.e. a distinct group of participants) to its early value proposition, thus transforming

the platform into being two-sided. A platform may also expand its reach by launching a platform

envelopment attack. Thus, a platform can bundle functionalities offered by other platforms to its

existing products and services if there is a high degree of user overlap between the two platforms

(Eisenmann et al., 2006; Eisenmann et al., 2011).

The transformation of a platform into being two-sided results in the creation of significant cross-side

network effects and new types of interactions. Just as the first group of participants, the second distinct

group of participants (or the second side of the platform) is also characterized by its own reach and

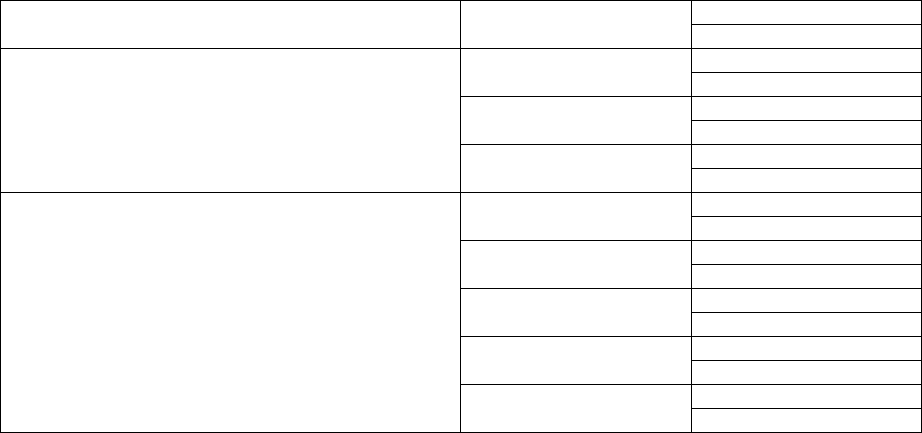

range. The transformation from one-sided to two-sided platform implies that the reach and range of

the platform now consists of the reach and range of the both sides of the platform (see Table 1). Thus,

a platform provider needs to manage the reach and range of each side in order to increase the number

of participants and functionalities on a particular side (same-side interactions). At the same time a two-

sided platform creates and nurtures cross-side interactions, which requires a platform provider to also

balance the reach and range across the different distinct groups of participants. For example, the more

card holders join a payment card platform, the more merchants will also participate. Thus, the change

in the reach in one side results in expansion of the reach on the other side and vice versa. At the same

time MSPs consists of multiple sides each of which has its own reach and range, thus making the

management of MSP extremely complex.

One-Sided Platform

Side 1

Reach

Range

Two-Sided Platform

Side 1

Reach

Range

Side 2

Reach

Range

Interside

Reach

Range

Multi-Sided Platform

Side 1

Reach

Range

Side 2

Reach

Range

Interside

Reach

Range

Side N

Reach

Range

Interside

Reach

Range

Table 1. Reach and Range Framework for Multi-Sided Platforms

4 Method

In order to illustrate the usefulness of our framework and to provide an answer to our research

question, we use a qualitative research method utilizing case study analysis. Thus, our study adopts an

explorative research approach of digital payment platforms with two cases of successful mobile

payment solutions. Case studies, which are rich, empirical descriptions of particular instances of a

phenomenon that are typically based on a variety of data sources (Yin, 2003), provide tools for

researchers to study complex phenomena within their contexts (Baxter and Jack, 2008) and to explore

differences and replicate findings across cases (Yin, 2003).

4.1 Case Selection

In this paper we aim to investigate successful digital payments platforms, thus the selection process

requires first defining what constitutes a successful payment platform and then identifying solutions

which meet these criteria. As the success of a digital payment platform can be measured by the size of

its installed base of users relative to the market (Zhu and Iansiti, 2007), we define a successful digital

payment platform as a solution with more than 2 million registered users. Through our analysis of

various mobile payment solutions, we managed to identify two payment apps which exceed the limit

of 2 million users. The first solution is the UK-based Barclays’s Pingit app which currently has 2,7

million registered users. The second solution is MobilePay offered by the Danish-based Danske Bank,

which has managed to attract more than 2,6 million users. Thus, we select to study these two digital

payment apps as both have managed to attract and maintain significant amount of users.

4.2 Data Collection and Analysis

Our research is informed by both primary and secondary data. We collected primary data for

MobilePay by conducting interviews with senior managers based on questionnaires in the period April

– May 2014. A significant amount of secondary data was also collected. The data we gathered for

Pingit were exclusively secondary. We collected and analysed 838 press releases from Barclays for the

period 2012-2015. We also consulted publicly available sources: annual reports, online news and

interviews. The two apps were installed on the researchers’ phones so that better insights into the

apps’ functionalities could be obtained. The data was gathered in the span of 8 months and systemized

in tables in order to identify the specific evolutionary path of the two selected platforms.

5 MobilePay

Danske Bank’s MobilePay app is a bank-operated, card-based mobile payment solution which allows

users to transfer money from a card to a bank account via a mobile phone number and a PIN code. The

app was launched in May 2013 and proved to be extremely popular among the Danes as more than 50

per cent of the adult population has downloaded it since its launch. Currently the app has 2,6 million

registered users.

5.1 MobilePay as one-sided platform

MobilePay was launched as one-sided platform which facilitated the interaction between a sender and

a receiver, thus forming one distinctive group of users with interchangeable roles (user A can send

money to the receiver B; the next day B can become the sender by sending money to A).

5.1.1 Range

The MobilePay app allows a user to transfer money by selecting the mobile number of the person, who

is to receive the money, without thinking about exchanging account or card numbers or using

complicated sign-in procedure. Initially, users could send no more than 201 EUR per day to other

users. In February 2015, this payment range was extended further to allow larger sums to be

transferred. A new version of the app was released in September 2013, just 5 months after the initial

launch. The updated app introduced new features such as split the bill and allowed for higher amounts

per transaction. The introduction of these new features is a concrete step to increase the range of the

app in order to increase the frequency of the interactions (i.e. by enabling a new use such as split the

bill) and achieve lock-in effects. The increase of the range is also aimed at attracting more users, thus

strengthening the same-side effects.

5.1.2 Reach

The app targets both Danske bank customers and non-Danske bank customers, which contributed to its

high adoption rate. 10 weeks after public launch MobilePay was downloaded almost 300.000 times.

Approximately 64 per cent of the MobilePay’s users are non-Danske Bank customers. Danske Bank

put considerable efforts in attracting new consumers and growing its user base. The app was initially

developed only for iPhone and Android devices, but in September 203 a version for Windows phones

was launched. Users were also able to send money to receiver who had not downloaded the app, who

in order to claim the money, had to sign up for the app. Getting a critical mass upon launch and

reaching as many users as possible was critical for the success of the solution. Thus, during the first

few months after the launch of the solution, the efforts were focused on gaining significant user base

with strong same-sided network effects.

5.2 MobilePay as Two-Sided Platform

As MobilePay managed to attract significant amount of users by expanding its range, it gradually

became attractive to small businesses that form another distinctive group of participants who wanted

access to the large user base of the app. Thus, by adding first small merchants and later big retail

chains, MobilePay transformed from being one-sided to being two-sided platform which creates cross-

side effects.

5.2.1 Range

In October 2013, Danske Bank started a trial period with selected small merchants (coffee shop

owners, hot dog stand owners, taxis) which could accept payments from customers. After the

successful pilot, MobilePay solution for business was launched in February 2014. As most of the

MobilePay users use the service to transfer small amount of sums, it was considered logical first to test

C2B low-value payments. The solution uses the businesses’ phone number to execute the transaction

with shop owners being equipped with a smartphone with a MobilePay app. After the money is

transferred from the consumer’s bank account, he or she gets a receipt with the company’s name, logo

and time of payment on it. At the same time businesses can easily verify the transactions and the

overall amount of money sent to them, display their logo on the receipt, export transaction data, and

point out to consumers the location of their shops. Thus, with the introduction of new platform

interactions (between users and business), a platform has to design features which support these

interactions on both sides. Thus, the adding of a second distinct group of participants requires the

management of the range of the both affiliated sides.

In June 2014, a coffee shop in Denmark incorporated MobilePay as a payment method in its own app

(Andersen, 2014), thus expanding MobilePay’s range by enabling new ways of using the app. In July

2014, MobilePay entered the e-commerce sphere by partnering with 5 online stores which now use

MobilePay as a payment method. Danske Bank continued to bring more merchants in the solution by

enabling online shops to use MobilePay as a payment method. In May 2015 MobilePay app integrated

technology from m-commerce vendor Powa. By integrating PowaTag, through Powa's SDK, Danske

Bank can enable mobile payments from more than 1200 companies around the world (Finextra, 2015).

The expansion of the MobilePay’s range was further reinforced in July 2015 when large retail chains

introduced MobilePay in their stores, thus expanding the range of the second platform side even

further. Unlike the solutions for small merchants and online shops, payment transactions with

MobilePay in large retail shops are executed much faster and more conveniently with the help of NFC

and Bluetooth technology.

5.2.2 Reach

MobilePay extended gradually the reach of the second distinct group which was added to its initial

value proposition. Initially, the solution for businesses targeted only small merchants and consisted of

an app which needed to be installed on the merchant’s smartphone. Approximately 1,975 small

business places, such as coffee shops, clothing companies, hairdressers, bike repair shops, doctors etc.,

have adopted the solution as of September 2014. Later, MobilePay was incorporated as a method of

payment on the websites of various online shops, thus the reach of the business side was extended as

to encompass Internet retailers. Initially big retailers were reluctant to use MobilePay in the same way

as small merchants do mainly due to the high volume of transactions which a larger retailer has to

process in a quick and efficient way. Thus, MobilePay had to design different functionalities if wanted

to bring large retailers on board. After couple of months of trial, the large retail chains in Denmark

launched MobilePay. Thus, MobilePay’s reach on the business side was gradually extended to

encompass small merchants, online traders and large retail chains. The extension of the reach was

facilitated by the introduction of new features for each of the business types, thus expanding the range

of the platform’s business side.

6 Pingit

The UK-based Barclays bank launched in 2012 its P2P transfer app Pingit which allows one user to

send money to another user fast, easily and efficient. The service is available for Barclays’ customers

and non-customers as long as they have a UK current bank account and a UK mobile phone number.

Pingit has been downloaded over 4.2 million times, while over 67 000 businesses have registered to

use the service (Moore, 2015). Initially, Pingit was launched as one-sided platform and later expanded

to become two-sided.

6.1 Pingit as one-sided platform

Pingit was first launched as a payment app enabling peer-to-peer transactions (P2P) between a receiver

and a sender who are subject to same-side network effects. The more people use the app, the more

valuable it becomes. As the sender and receiver of P2P payments can change their roles easily, they

form one distinct group of users. Thus, upon its launch Pingit functioned as one-sided platform.

6.1.1 Range

Upon its launch, Pingit’s main functionality was to enable P2P payments among Barclays’ bank

account holders who can select the recipient’s phone number, enter the amount and press the send

button. The app allowed users to split the bill, send a personal message and receive a SMS

confirmation for each transaction. App users could also set up and customize their profile by adding a

photo. In May 2012 Barclays released a new version of Pingit removing the cap on payments and

incorporating new features such as integration with current accounts, and user-friendly options for

handling joint accounts and multiple phone numbers, thus expanding the reach of the platform.

Barclays customers can also view current account transactions alongside Pingit transactions. In August

2012, Pingit enabled the possibility for users to send money abroad free of charge. In March 2015

Pingit allowed its users to use Twitter accounts to send and receive payments, thus broadening the

range of the platform. By increasing the number of features offered by the app, Barclays aimed at

creating more interactions on the platform, which will drive value for the app users. At the same time

the introduction of new features is directed not only towards more interactions within current app

users, but also towards attracting more users. Thus, by increasing the range of the app, Barclays also

tried to increase its reach.

6.1.2 Reach

Upon its launch Pingit was available only to Barclays’ bank account holders who can use the app to

send P2P payments. Payments, however, could be received by both Barclays and non-Barclays

customers with the latter having to log-in a website to claim the transferred money. Initially the app

was available only to Barclays’s customers over 18 years old who had iOS, Android or Blackberry

devices. Just 5 days after its launch, Pingit was downloaded over 120 000 times (Sheerman, 2012).

Following the successful launch, with two subsequent updates in February and April 2012, the app

was expanded beyond Barclays’ customers and was made available to anyone in Britain over the age

of 16 years with a current British bank account. Furthermore, in July 2014 Pingit become available for

Windows Phones devices. Thus, Barclays extended the platform’s reach by changing the rules of

access to the platform and by making the app available across multiple devices.

6.2 Pingit as two-sided platform

By adding new functionalities and easing the rules for platform access, Pingit’s user base grew

significantly and reached 1,8 million users within an year and a half. As the Pingit’s user base grew in

size, it became attractive to small businesses that form a second distinctive group of users who pay to

get access to the installed user base. As Barclays started to add various small and large businesses, the

app was transformed from being one-sided to being two-sided platform. Thus, Pingit has to design

strategies for managing two sides (users and sole traders) each of which has its own reach and range.

The management of the reach and range for businesses requires strategies for attracting more business

owners (reach) and features which increase the interactions between the two sides (range).

6.2.1 Range

In May 2012 Pingit enabled users to pay sole traders such as carpenters, plumbers and beauticians by

scanning a QR code on their bills, thus eliminating the need for exchange of bank account details.

With the introduction of the “Pay Now with Pingit” button to third-party app and the “Buy it” button

within the Pingit app in September 2013, the app allows for users to connect to merchants, thus

enabling the possibility for more types of platform interactions. In November 2013 Barclays retooled

its Pingit app to enable large firms to send funds for insurance claims, utility refunds and other

corporate payments directly to consumers. Large businesses use Barclays’ existing File Gateway

channel to send electronic payments directly into an individual’s Barclays Pingit account. Even though

Pingit was extended to cover B2C payments, the app still functions as two-sided platform.

6.2.2 Reach

By bringing sole traders on board and enabling the interactions between users and small business,

Pingit become two-sided platform and started building the reach of its second side. In 2013 Barclays

announced that Pingit can be used for paying utilities bills, thus adding utility providers to its reach

and enabling new uses. Couple of months later, in September 2013, when Pingit had 1,8 million users,

the app enabled functionalities which extended the reach to encompass small and large merchants.

Thus, Pingit expanded the reach of its second side by absorbing gradually different types of business.

It is even more interesting to note that Pingit introduced different features (range) in order to add a

particular business types (sole traders vs. merchants).Thus, Pingit partitioned the second (business)

side of the platform by designing different features for each of the different business types.

7 Discussion and Conclusion

In this paper we adopted a framework which allows us to gain a better insight in some of the strategic

considerations which platform providers face in order to ensure the success of their platforms. To this

end, we introduced the Reach and Range framework, which we adapted for studying MSPs and

applied it to two selected case studies of successful digital payment platforms. We found that the key

to successfully launch and manage digital payment platforms is to balance the reach and range on

each of the platform’s sides and across sides. Thus, a platform provider needs to design and execute

strategies to grow the number of participants and types and volume of interactions on each side and to

have in place a strategy which nurtures the interactions across sides. To do so, a platform provider

leverages the reach and range of each side.

If platform providers wish to attract more participants to their platforms, they can increase the range

of the platform by adding new functionalities and features which will unlock new uses. An example of

this is MobilePay which added “split the bill” functionality in its platform in order to give more value

to its users (see Table 2). A platform can also expand its reach by changing its access rules as Pingit

did when it lowered the age limit for the use of the app from 18-years old to 16-years old. A third

possible way to expand the reach of a platform’s side is to enable cross-side functionalities by adding

another group of participants. For example, both MobilePay and Pingit are used as a payment method

by merchants who add a payment button on their websites or apps. Thus, by enabling cross-side

functionality a platform could unlock new uses for its app and expand its reach. Finally, the expansion

of the reach of a platform’s side can also be proportionate to the expansion of the reach of the other

platform’s sides. As more users join Pingit and MobilePay, more merchants would become affiliated

with the platform.

Even though a platform has managed to increase its reach i.e. it has attracted a significant number of

users, it also needs to deepen its value proposition in order to lock-in the existing participants. In order

to do so, platform providers need to design and enable reoccurring interactions by adding new

functionalities, thus expanding the reach of the platform. As peer-to-peer payment transactions occur

on sporadic basis (f.e. most people don’t transfer money to their friends on daily basis, but just on

some occasions) users have low levels of engagement within the app. To solve this, both MobilePay

and Pingit enabled C2B interactions by allowing people to use their apps in more contexts, thus

increasing the types and volume of interactions on the platform. Apart from enabling cross-side

interactions, another possible way to increase the value of a platform is to increase the types of same-

side interactions. For example, MobilePay and Pingit allow their customers to split the bill among

multiple customers in addition to being able to transfer money between two users.

We also found that successful digital payment platforms follow a particular evolutionary path which

ensures high adoption rate among the platform participants. Both MobilePay and Pingit were launched

as one-sided platforms and expanded into being two-sided. Thus, platforms tend to carefully

orchestrate their move into the market. User adoption on either side of the platform is not an automatic

event, but rather requires a carefully designed step-by-step strategy, where not only platform’s sides

are gradually added to the platform (i.e. first one-sided, then two-sided platform), but also participants

on each of the affiliated to the platform sides. Even though a platform has added a new distinct group

of participants, a platform provider still needs to nurture the reach and range of the already existing

platform side(s). An example of this is Pingit, which enabled Twitter payments to grow the reach of

its first group of participants after it added its second side, i.e businesses.

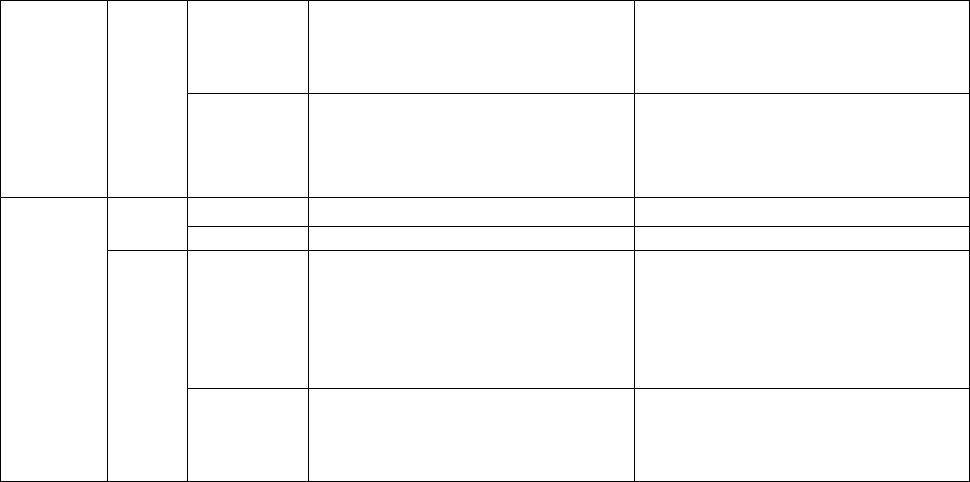

By using the Reach and Range framework we were able to find evidence for the heterogeneity of the

participants which take part in each of the platform sides. In particular, neither MobilePay, nor Pingit

added the merchants as one homogenous group (or one side). Instead they gradually added different

types of business as a second side starting by first offering solutions to small merchants, and then

expanding to online retailers, large retail chains, insurance companies (see Table 2). Thus, by

partitioning the business side the digital payment platforms take into account the heterogeneity of the

different actors and design specific solutions in order to get them on board.

The contribution of this paper is threefold: First, we have conceptualized a framework, which provides

vehicle lens to understand what makes digital payment platforms successful. Secondly, we also offer

insights how a payment provider can design and execute strategies for platform’s launch and

expansion. Lastly, although we applied the framework to the cases of digital payment platforms, we

demonstrate that the Reach and Range Framework can be used to guide the strategic planning of every

business which functions as a platform.

Transformation from one-sided

to two-sided platform

MobilePay

Pingit

One-

Sided

Platform

Side 1

Range

P2P payments

Increase payment per transaction

limit

Split the bill

P2P payments

joint accounts

multiple phone numbers

send money abroad

Reach

All banks customers

15-years old

iOS, Android

All banks customers

16-years old

iOS, Android

remittance receivers

Two-

Sided

Platform

Side 1

Range

Increase daily payment limit

Twitter payments

Reach

Windows Phones

Windows Phones

Side 2

Range

Mobile Business App with

functionalities for merchants

MobilePay Button in third-party apps

NFC/Bluetooth device at check out

QR Codes on bills/increase payment

transaction limit

Pay now with Pingit button in third-

party apps

Buy it button in Pingit

Send payment button

Reach

Small merchants

Online retailers

Large Retailers

Sole Traders

Utility companies

Small merchants

Insurance companies

Table 2. Reach and Range Framework for MobilePay and Pingit

We limit our analysis to investigating only the number of platform sides and platform features. In

reality, the success of a platform is also dependent on other factors such as pricing, governance, choice

of right technology. Nonetheless, we believe that the ability to balance the reach and range of the

platform’s sides is the main key to platform success as it defines the platform’s value proposition.

Future research may pinpoint how the Reach and Range Framework relates to broader topics such as

platform governance and platform-based ecosystems. The framework can also be applied to MSPs

other than digital payments. Finally, applying the Reach and Range Framework to cases of failed

mobile payment solutions can also be used to further validate and improve this analytical tool.

References

Andersen, P. (2014). Nu kan du betale med Mobilepay i andre apps, Politiken, 19. Jun. 2014. Can be

retrieved at: http://politiken.dk/oekonomi/virksomheder/ECE2320556/nu-kan-du-betale-med

mobilepay-i-andre-apps/.

Armstrong, M. (2006). Competition in two-sided markets. RAND Journal of Economics 37 (3), 668–

691.

Asif, A.S. (2011). Next Generation Mobile Communications Ecosystem: Technology Management for

Mobile Communications. John Wiley & Sons.

Baxter, P. and S. Jack (2008). Qualitative Case Study Methodology: Study Design and

Implementation for Novice Researchers.The Qualitative Report, 13 (4), 544-559.

Chae, C. J. and J. Hedman (2015). Business Models for NFC Based Mobile Payments. Journal of

Business Models, 3 (1), 2015, 29-48.

Deans,P. C. and Karwan, K. R. (1993). Global Information Systems and Technology: Focus on the

Organization and Its Functional Areas. Idea Group Inc (IGI).

Eisenmann, T. (ed.), 2002. Internet Business Models: Text and Cases. New York: McGraw-Hill/Irwin.

Eisenmann, T., P. Geoffrey and M. van Alstyne (2011). Platform envelopment. Strategic Management

Journal, 32 (12), 1270-1285.

Eisenmann, T. R., Parker, G. and M. van Alstyne (2006). Strategies for Two-Sided Markets. Harvard

Business Review, 84(10).

Ernst & Young (2013). Mobile money — the next wave of growth. Report. Can be retrieved from:

http://www.ey.com/Publication/vwLUAssets/EY_-_Mobile_money_-

_the_next_wave_of_growth_in_telecoms/$FILE/EY-mobile-money-the-next-wave.pdf

Evans, D. S. (2009). How Catalysts Ignite: The Economics of Platform-Based Start-Ups. In: Gawer,

A. (ed.). Platform, markets and innovation. Cheltenham, UK and Northampton, MA, US: Edward

Elgar.

Evans, D. S. and R. Schmalensee (2013). The Antitrust Analysis of Multi-Sided Platform Businesses.

In R. Blair and D. Sokol (Eds.) Oxford Handbook on International Antitrust Economics, Oxford

University Press.

Evans, D. S. and R. Schmalensee (2008). Markets with Two-Sided Platforms. Issues in Competition

Law and Policy (ABA Section of Antitrust Law), 1 (28).

Finextra (2015). Danske Bank integrates PowaTag into MobilePay. Can be retrieved from:

http://www.finextra.com/news/fullstory.aspx?newsitemid=27367

Gannamaneni, A., Ondrus, J. and Lyytinen, K. (2015). A Post-failure Analysis of Mobile Payment

Platforms. In Proceedings of the 48th Hawaii International Conference on System Sciences.

Hagiu, A. (2006). Multi-Sided Platforms: From Microfoundations to Design and Expansion Strategies.

Harvard Business School Strategy Unit Working Paper No. 09-115.

Hagiu, A. and J. Wright (2011). Multi-Sided Platforms. Harvard Business School Working Paper 12-

024.

Henningsson, S. and J. Hedman (2015). The New Normal : Market Cooperation in the Mobile

Payments Ecosystem. Electronic Commerce Research and Applications, xx.

Kazan, E., and Damsgaard, J. (2013). A Framework for Analyzing Digital Payment as a Multi-sided

Platform: A Study of Three European NFC Solutions. In ECIS 2013 Proceedings, Atlanta, GA :

Association for Information Systems. AIS Electronic Library (AISeL), 2013.

Keen, P. G. W. (1997). On-line Profits: A Manager's Guide to Electronic Commerce. Harvard

Business School Press.

Keen, P. G. W. (1991). Shaping the Future: Business Design Through Information Technology.

Harvard Business School Press.

Moore, M. (2015). Zapp Takes The Fight To Apple Pay With Barclays Pingit Deal. Tech Week

Europe. Can be retrieved from: http://www.techweekeurope.co.uk/e-marketing/zapp-barclays-

pingit-apple-pay-171962#7rXHDHxoeYYKjEX7.99.

Ondrus, J., Gannamaneni, A. and Lyytinen, K. (2015). The impact of openness on the market potential

of multi-sided platforms: a case study of mobile payment platforms. Journal of Information

Technology, 30, 260–275.

Ondrus, J., Lyytinen, K., and Pigneur, Y. (2009). Why Mobile Payments Fail? Towards a Dynamic

and Multi-perspective Explanation. Proceedings of the 42th Annual Hawaii International

Conference on System Sciences (HICSS’09), IEEE Computer Society, 5-8 Jan 2009, Hawaii, USA.

Shapiro, C. and H. Varian (1999). Information Rules. Boston: Harvard Business School Press.

Shearman, S. (2012). Barclays Pingit app attracts 120,000 downloads in five days. Can be retrieved

from: http://www.marketingmagazine.co.uk/article/1118578/barclays-pingit-app-attracts-120000-

downloads-five-days.

Staykova, K. S., and Damsgaard, J. (2014). A Model Of Digital Payment Infrastructure Formation

And Development : The EU Regulator's Perspective. In Proceedings of 13th International

Conference on Mobile Business, 2014 ICMB 2014, London, UK.

Staykova, K. and Damsgaard, J. (2015). The race to dominate mobile payments: Entry and expansion

strategies. Electronic commerce research and Appplications, XXX, xxx-xxx.

Weill, P., and Broadbent, M. (2000). Managing IT Infrastructure: A Strategic Choice. In R.W. Zmud

(ed.) Framing the Domains of IT Management: Projecting the Future Through the Past. Pinnaflex,

Cincinnati, Ohio.

Yin, R. K. (2003). Case study research: Design and methods, 3rd Edition. Thousand Oaks, CA: Sage.

Zhu, F., and Iansiti, M. (2007). Dynamics of Platform Competition: Exploring the Role of Installed

Base, Platform Quality and Consumer Expectations. Working paper 08-031. Harvard Business

School.