1

NATIONAL HOUSING BANK

Frequently Asked Questions (FAQs)

1. How to make a complaint?

If you are not satisfied with the services of the housing finance company (HFC):

(a) Approach the Grievance Redressal Officer of the HFC’s branch. You may also

approach the concerned officer of the Grievance Redressal Mechanism of the

company through email provided by the HFC at the company’s website.

(b) Submit your complaint in writing along with necessary support documents.

(c) Take a written acknowledgement of your complaint with the date of

submission or complaint registration number provided by the HFC after

registering the complaint through email.

The HFC is expected to resolve your complaint within 30 days.

In case the complaint is not resolved or if you are not satisfied with the resolution, you

may escalate your complaint to National Housing Bank (NHB). This can be done by:

(a) Lodging a complaint on the online grievance handling portal of NHB - GRIDS.

Once you register a complaint, you’ll be given a unique identification number

which may be used in future to track the status of your complaint.

(b) Sending the complaint to NHB by post. Click here to download the Complaint

Form. You may fill and send the form along with letters or enclosures, if any,

by post or courier to the following address:

Complaint Redressal Cell

Department of Regulation and Supervision,

National Housing Bank,

Core 5 A, India Habitat Centre, Lodhi Road,

New Delhi – 110 003

2. What is GRIDS?

NHB has launched the Grievance Registration & Information Database System

(GRIDS) as a grievance redressal monitoring tool. Customers of HFCs who are

dissatisfied with the resolution provided by the respective HFCs may lodge their

complaints in GRIDS. The system is designed to assign, store and track unique

identification numbers of complaints. A complaint registered through GRIDS will

flow to the HFC’s system as well as NHB repository. Updating of status will be

mirrored in the NHB’s system. Users may track the status of their complaint.

2

3. How to use GRIDS?

An aggrieved customer can make optimum use of the system by giving accurate

information about the complaint like the loan account number, name and contact

details of the customer, etc. It would be useful if any necessary documents regarding

the complaint are uploaded while registering the complaint. Click here to open GRIDS

website. To register a complaint on the website, you can click ‘New Complaint’ and

fill the online complaint form. After you submit complaint details, you will be given

a complaint acknowledgement number for future reference. This number may be used

for tracking the status of your complaint.

4. When can you approach NHB Complaint Redressal Cell (CRC) for

grievances pertaining to an HFC?

You may file a complaint with Complaint Redressal Cell (CRC), after you have

approached the concerned HFC for redressal of your grievance and either there is no

response from the HFC within 30 days of filing the complaint or you are dissatisfied

by the resolution provided by the HFC.

5. Can CRC help you if there is some judicial matter pending related to your

loan?

In a case where there is a judicial/quasi-judicial matter pending, CRC shall not

consider it as a customer complaint and the decision taken by judicial/quasi-judicial

authority will prevail.

6. What if you are not satisfied by the resolution provided by CRC?

In case if you are not satisfied by the redressal provided by CRC, you can file an appeal

to the Chief Grievance Redressal Officer of NHB within 30 days from the date of status

intimation of your complaint.

7. How does tenure affect cost of loan?

Shorter tenures mean greater EMI, but your loan is repaid faster. The longer the tenure

of the loan, the lesser will be the EMI outflow. But longer tenures mean payment of

larger interest towards the loan.

8. What is an amortization schedule?

It is a table that gives details of the periodic principal and interest payments on a loan

and the scheduled amount outstanding at any point of time. It also shows the gradual

decrease of the loan balance until it reaches zero.

3

9. Can you repay your loan ahead of schedule? Is pre-payment of loan allowed?

Yes, most HFCs allow you to repay the loan ahead of schedule by making lump sum

payments. However, NHB has issued some circulars to HFCs, on levy of prepayment

charges. Which are available in NHB’s Website.

10. What are Switch over charges/ balances transfer charges?

When other HFCs/banks reduce the interest rate, you may prefer to close your

account with the HFC from whom you have availed the loan, to avail of the loan from

the HFC/bank offering reduced rates of interest. You have to pay pre-payment

charges for doing so, subject to the norms prescribed by NHB.

In order to ensure that their customers do not approach other HFCs/banks for

availing reduced interest rates, HFCs allow customers to switch over from a higher

interest loan to a lower interest loan by paying a switch over fees/conversion

fees/interest adjustment charges which is lesser than the pre-payment charges.

Generally the said fee is taken as percentage of the outstanding loan amount.

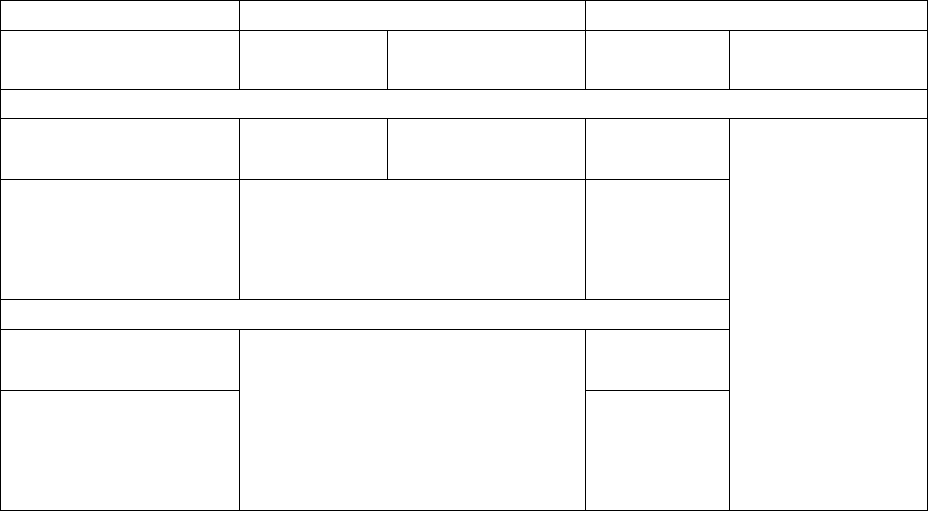

11. In which cases HFCs can levy Pre-payment/Pre-closure Charges?

ROI Type

Fixed Rate

Floating Rate

Applicant/Co-

applicant

Individual

Non-individual

Individual

Non-individual

Housing Loan

Pre-closed by ‘Own

Source’

No

No

No

No, if in cases

where the terms

& conditions of

the loans

sanctioned

indicate that no

foreclosure

charges/pre-

payment

penalties shall

be levied.

Pre-closed by

Balance

Transfer/Other

than ‘Own source’

As per the Loan Agreement

No

Non-housing Loan

Pre-closed by ‘Own

Source’

As per the Loan Agreement

No

Pre-closed by

Balance

Transfer/Other

than ‘Own source’

No

4

12. Is it mandatory to buy insurance with a home loan?

No, it is not mandatory to buy insurance with a home loan. But sometimes insurance

is one of the conditions for loan sanction. In such cases, a housing finance company

cannot force you to buy an insurance product from a particular company. You have

the option to choose the insurance product that is best suitable for you.

13. List of HFCs which can take possession of the property under the provisions

of Securitisation and Reconstruction of Financial Assets and Enforcement of

Security Interest Act, 2002, in case of defaults in repayment of loans?

There are 60 HFCs (as in January 2018) notified as ‘Financial Institution’ under sub-

clause (iv) of clause (m) of sub-section (1) of Section 2 of the Securitisation and

Reconstruction of Financial Assets and Enforcement of Security Interest Act, 2002, by

the Government of India, Ministry of Finance, Department of Financial Services.

The list of SARFAESI notified HFCs is available at http://egazette.nic.in.

In addition, HUDCO is also covered under the above provisions, since it is notified

public financial institution.

14. What are the various fees collected by HFCs?

A home loan often requires payment of various fees, such as –

i. Loan origination or processing charges;

ii. Administrative charges;

iii. Documentation;

iv. Technical inspection fee;

v. Late payment;

vi. Changing the loan tenure;

vii. Switching to different loan package during the loan tenure;

viii. Restructuring of loan;

ix. Changing from fixed to floating interest rate loan and vice versa;

x. Legal fee;

xi. Recurring annual service fee;

xii. Document retrieval charges; and

xiii. Most importantly, pre-payment charges, if you want to prepay the loan. Every

lender should be able to give you an estimate of its fees. Many of these fees are

negotiable / can be waived also.

Sometimes several components are lumped into one fee.

5

15. When can you get your original documents back?

The HFC should release securities on repayment of all dues. The HFC may take a

reasonable period of time for retrieval of concerned documents.

16. How can you know about the business practices followed by your HFC?

You can refer to the Fair Practice Code of the concerned HFC. The company may have

provided you a copy of the document at some point of time. Alternatively, you can

request a copy of the code from the HFC through their website or email. You can visit

a branch of the HFC to get the document.

Disclaimer: The following questions and answers are provided for general

information and education purpose only and may not be completely suitable in every

circumstance. Furthermore, the information provided in this FAQ section does not

purport to address all matters. Any statements in any FAQ describing or referring to

documents and agreements are summaries only and are qualified in their entirety by

reference to such documents and agreements.

----------------------------------------------------------------------------------------------------------------