Melrose Industries PLC

Final offer for GKN – unlocking the potential

March 2018

Disclaimer

IMPORTANT: YOU MUST READ THE FOLLOWING BEFORE CONTINUING. THIS PRESENTATION CONTAINS INSIDE INFORMATION. NOT FOR RELEASE, PRESENTATION, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM THE UNITED

STATES, CANADA, JAPAN, AUSTRALIA, SOUTH AFRICA OR ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH JURISDICTION

This presentation has been prepared by or on behalf of Melrose Industries plc (“Melrose”) in connection with the potential acquisition of the entire issued and to be issued share capital of GKN plc (“GKN”) by Melrose (the “Proposed Acquisition”). The information set out in this

presentation is not intended to form the basis of any contract. By attending (whether in person, by telephone or webcast) this presentation or by reading the presentation slides, you agree to the conditions set out below. This presentation (including any oral briefing and any question-and-

answer session in connection with it) is for information only. The presentation is not intended to, and does not constitute, represent or form part of any offer, invitation, inducement or solicitation of any offer to purchase, otherwise acquire, subscribe for, sell or otherwise dispose of, any

securities or the solicitation of any vote or approval in any jurisdiction. It must not be acted on or relied on in connection with any contract or commitment whatsoever. It does not constitute a recommendation regarding any securities. Past performance, including the price at which

Melrose’s securities have been previously bought or sold and the past yield on Melrose’s securities, cannot be relied on as a guide to future performance. Nothing herein should be construed as financial, legal, tax, accounting, actuarial or other specialist advice.

No shares are being offered to the public by means of this presentation. You should conduct your own independent analysis of Melrose, GKN and the Proposed Acquisition, including consulting your own independent advisers in order to make an independent determination of the

suitability, merits and consequences of the Proposed Acquisition. The release, presentation, publication or distribution of this presentation in jurisdictions other than the United Kingdom may be restricted by law and therefore any persons who are subject to the laws of any jurisdiction

other than the United Kingdom should inform themselves about and observe any applicable requirements. It is your responsibility to satisfy yourself as to the full observance of any relevant laws and regulatory requirements. Any failure to comply with applicable requirements may

constitute a violation of the laws and/or regulations of any such jurisdiction.

In the European Economic Area (“EEA”), this presentation is only intended for and directed at persons in member states who are “qualified investors” within the meaning of Article 2(1)(e) of the Prospectus Directive (Directive 2003/71/EC) and amendments thereto, including Directive

2010/73/EU (to the extent implemented in the relevant member state of the EEA) and any implementing measure in each relevant member state of the EEA (“Qualified Investors”).

In addition, in the United Kingdom, this presentation is being made available only to persons who fall within the exemptions contained in Article 19 and Article 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”) and Qualified Investors. This

presentation is not intended to be available to, and must not be relied upon, by any other person.

This document must not be acted on or relied on (i) in the United Kingdom, by persons who do not fall within the Order and (ii) in any member states of the European Economic Area other than the United Kingdom, by persons who are not Qualified Investors. Nothing in this presentation

constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. None of Melrose, its shareholders, subsidiaries, affiliates,

associates, or their respective directors, officers, partners, employees, representatives and advisers (the “Relevant Parties”) makes any representation or warranty, express or implied, as to the accuracy or completeness of the information contained in this presentation, or otherwise

made available, nor as to the reasonableness of any assumption contained in such information, and any liability therefor (including in respect of direct, indirect, consequential loss or damage) is expressly disclaimed. No information contained herein or otherwise made available is, or

shall be relied upon as, a promise, warranty or representation, whether as to the past or the future and no reliance, in whole or in part, should be placed on the fairness, accuracy, completeness or correctness of such information. The information contained in this presentation relating to

GKN is derived from publicly available information only. None of the Relevant Parties has independently verified the material in this presentation.

Unless expressly stated otherwise, no statement in this presentation (including any statement of estimated synergies) is intended as a profit forecast or estimate for any period and no statement in this presentation should be interpreted to mean that cash flow from operations, free cash

flow, earnings or earnings per share for Melrose, GKN or the combined group, as appropriate, for the current or future financial years would necessarily match or exceed the historical published cash flow from operations, free cash flow, earnings or earnings per share of Melrose or

GKN, as appropriate.

Statements of estimated cost savings and synergies relate to future actions and circumstances which, by their nature, involve risks, uncertainties and contingencies. As a result, any cost savings or synergies referred to may not be achieved, may be achieved later or sooner than

estimated, or those achieved could be materially different from those estimated. Nothing in this presentation constitutes a quantified financial benefits statement for the purposes of Rule 28 of the City Code on Takeovers and Mergers (the “Takeover Code”). No statement in this

presentation should be construed as a profit forecast or interpreted to mean that the combined group's earnings in the first full year following implementation of the Proposed Acquisition, or in any subsequent period, would necessarily match or be greater than or be less than those of

Melrose or GKN for the relevant preceding financial period or any other period.

The Proposed Acquisition relates to the shares of two UK companies and is subject to UK procedural and disclosure requirements that are different from certain of those of the US. Any financial statements or other financial information included in this presentation may have been

prepared in accordance with non-US accounting standards that may not be comparable to the financial statements of US companies or companies whose financial statements are prepared in accordance with generally accepted accounting principles in the US. It may be difficult for US

holders of shares to enforce their rights and any claims they may have arising under the US federal securities laws in connection with the Proposed Acquisition, since Melrose and GKN are located in countries other than the US, and some or all of their officers and directors may be

residents of countries other than the United States. US holders of shares in Melrose or GKN may not be able to sue Melrose, GKN or their respective officers or directors in a non-US court for violations of US securities laws. Further, it may be difficult to compel Melrose, GKN and their

respective affiliates to subject themselves to the jurisdiction or judgment of a US court.

It is intended that the Proposed Acquisition will be implemented by way of a takeover offer under English law (the “Offer”). No document relating to the Offer will be posted into the US, but an accredited investor may be permitted to participate in the Offer pursuant to the “Tier II” tender

offer rules included in Regulation 14E under the US Exchange Act, , together with the requirements of the City Code. Accordingly, the Offer will be subject to disclosure and other procedural requirements, including with respect to withdrawal rights, offer timetable, settlement procedures

and timing of payments that may be different from those applicable under US domestic tender offer procedures and law.

Alternatively, if the Proposed Acquisition is implemented by way of a scheme of arrangement under English law (with the consent of the Takeover Panel and the agreement of GKN), it will be subject to the disclosure requirements and practices applicable in the UK to schemes of

arrangement which differ from the disclosure requirements of the US tender offer rules. If the Proposed Acquisition is implemented by way of a scheme of arrangement, any Melrose shares proposed to be issued to GKN shareholders pursuant to the terms of the Proposed Acquisition

are expected to be issued in reliance upon the exemption from the registration requirements of the US Securities Act provided by Section 3(a)(10) of the US Securities Act. Section 3(a)(10) exempts securities issued in exchange for one or more outstanding securities from the general

requirements of registration where the terms and conditions of the issuance and exchange of such securities have been approved by a court, after a hearing on the fairness of the terms and conditions of the issuance and exchange at which all persons to whom such securities will be

issued have the right to appear and be heard. The Court will hold a hearing on the scheme’s fairness to GKN shareholders, at which hearing all such shareholders will be entitled to attend in person or through counsel.

Investors should be aware that Melrose may purchase or arrange to purchase GKN Shares otherwise than under any takeover offer or scheme of arrangement related to the Proposed Acquisition, such as in open market or privately negotiated purchases.

This presentation does not constitute an offer of securities for sale in the US or an offer to acquire or exchange securities in the US. Securities may not be offered or sold in the US absent registration or an exemption from registration, and any public offering of securities to be made in

the United States will be made by means of a prospectus that may be obtained from the issuer or the selling security holder and that will contain detailed information about the company and management, as well as financial statements. No offer to acquire securities or to exchange

securities for other securities has been made, or will be made, directly or indirectly, in or into, or by use of the mails, any means or instrumentality of interstate or foreign commerce or any facilities of a national securities exchange of, the US or any other country in which such offer may

not be made other than (i) in accordance with the US Securities Act, as amended, or the securities laws of such other country, as the case may be, or (ii) pursuant to an available exemption from such requirements.

Nothing in this presentation shall be deemed an acknowledgement that any SEC filing is required or that an offer requiring registration under the US Securities Act may ever occur in connection with the Proposed Acquisition.

The Melrose shares proposed to be issued to GKN shareholders pursuant to the terms of the Proposed Acquisition have not been, and will not be, registered under the securities laws of any state or jurisdiction in the United States and, accordingly, will only be issued to the extent that

exemptions from the registration or qualification requirements of state “blue sky” securities laws are available or such registration or qualification requirements have been complied with.

By attending the presentation to which this document relates and/or by accepting this document you will be taken to have represented, warranted and undertaken that: (i) you are a person who is not resident of, or located in, the United States, Canada, Japan, Australia or South Africa

and you are permitted by law to receive it; (ii) you have read and agree to comply with the contents of this notice; and (iii) you will not at any time during the offer period have any discussion, correspondence or contact concerning the information in this document with any of the

employees or shareholders of Melrose or GKN or their respective affiliates nor with any of Melrose or GKN’s suppliers or customers or any governmental or regulatory body without the prior written consent of Melrose or GKN (as applicable).

N M Rothschild & Sons Limited, Investec Bank plc and RBC Capital Markets are acting only for Melrose and will not be responsible to anyone other than Melrose for providing the protections afforded to clients of N M Rothschild & Sons Limited, Investec Bank plc and RBC Capital

Markets for providing advice in relation to any potential offering of securities of Melrose.

This presentation contains material, non-public information regarding Melrose and GKN. The insider dealing and market abuse provisions of the Criminal Justice Act 1993, the EU Market Abuse Regulation (No. 596/2014) and the rules of the Financial Conduct Authority in the United

Kingdom prohibit any persons who have material, non-public information from, among other things, disclosing the information except in the proper performance of their employment, office or profession, from purchasing or selling securities of a publicly traded company or related financial

instruments, and from encouraging any other person to do so. Securities laws relating to material non-public information in other applicable jurisdictions will also apply.

This presentation contains forward-looking statements concerning the financial condition, results of operations and businesses of Melrose and of the Proposed Acquisition. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements.

Forward-looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those

expressed or implied in these statements. Forward-looking statements include, among other things, statements concerning the potential exposure of Melrose to market risks and statements expressing management’s expectations, beliefs, estimates, forecasts, projections and

assumptions including as to future potential cost savings, synergies, earnings, cash flow, return on average capital employed, production and prospects. These forward-looking statements are identified by their use of terms and phrases such as ‘‘anticipate’’, ‘‘believe’’, ‘‘could’’,

‘‘estimate’’, ‘‘expect’’, ‘‘intend’’, ‘‘may’’, ‘‘plan’’, ‘‘objectives’’, ‘‘outlook’’, ‘‘probably’’, ‘‘project’’, ‘‘will’’, ‘‘seek’’, ‘‘target’’, ‘‘risks’’, ‘‘goals’’, ‘‘should’’ and similar terms and phrases. There are a number of factors that could affect the future operations of Melrose and could cause those results

to differ materially from those expressed in the forward-looking statements included in this presentation, including (without limitation): (a) changes in demand for Melrose’s products; (b) currency fluctuations; (c) loss of market share and industry competition; (d) risks associated with the

identification of suitable potential acquisition properties and targets, and successful negotiation and completion of such transactions; and (e) changes in trading conditions. All forward-looking statements contained in this presentation are expressly qualified in their entirety by the

cautionary statements contained or referred to in this section. Readers should not place undue reliance on forward-looking statements. Each forward-looking statement speaks only as at the specified date of the relevant document within which the statement is contained. Neither Melrose

nor GKN undertake any obligation to publicly update or revise any forward-looking statement as a result of new information, future events or other information. In light of these risks, results could differ materially from those stated, implied or inferred from the forward-looking statements

contained in this presentation.

IMPORTANT NOTICE

Each of the Melrose directors, whose names are set out on the “Board of Directors” page of the Melrose website at www.melroseplc.net/about-us/directors (the “Melrose Directors”), accepts responsibility for the information contained in this presentation, provided that the only

responsibility accepted by them in respect of information relating to GKN and the GKN directors, which has been compiled from published sources, is to ensure that such information is correctly and fairly reproduced and presented.

To the best of the Melrose Directors’ knowledge and belief (who have taken all reasonable care to ensure that such is the case), the information contained in this presentation is in accordance with the facts and, where appropriate, does not omit anything likely to affect the import of such

information.

Certain financial data has been rounded. As a result of this rounding, the totals of data presented in this presentation may vary slightly from the actual arithmetic totals of such data.

2

Highlights

3

Our Final Offer: a deliverable and valuable proposition

Final offer

valued at 467 pence per share, valuing GKN at £8.1 billion

GKN shareholders to own 60% of Melrose, a UK listed manufacturing powerhouse, and receive £1.4 billion

in cash

Attractive immediate premium of 43%

All recent attempts to engage in constructive discussions have been refused by the GKN Board

Dana transaction is prejudicial to GKN’s UK shareholders and is, in our view, a bad deal for other

stakeholders including UK PLC

Deadline for acceptances is 1.00 p.m. on Thursday, 29 March 2018

1

Offer will not be increased under any circumstances

1. Code reservation: Melrose reserves the right to extend this deadline if GKN consents to such extension for the purposes of gaining CFIUS approval only (as GKN said it

would be willing to consider doing in its announcement of 9 February 2018)

Melrose’s model: consistently creating high shareholder returns

4

Melrose

performance

Melrose has consistently generated significant financial returns

1. As at close of business on 5 January 2018, the last business day prior to the approach

2. Assuming participation in all equity issuances, based on 5 January 2018 share price

3. Comprises McKechnie/Dynacast, FKI and Elster

Total shareholder investment £ billion

Total money invested (3.64)

Total money returned to investors 4.35

Net shareholder investment returned 0.71

Market capitalisation

1

4.22

Net shareholder gain 4.93

Generated net

shareholder

value of

£4.9bn

£1 invested in 2003

Average annual return for a shareholder since incorporation

Average return on equity across all three

3

exited acquisitions

£17.7 today

2

21.9%

2

2.7x

Source Melrose

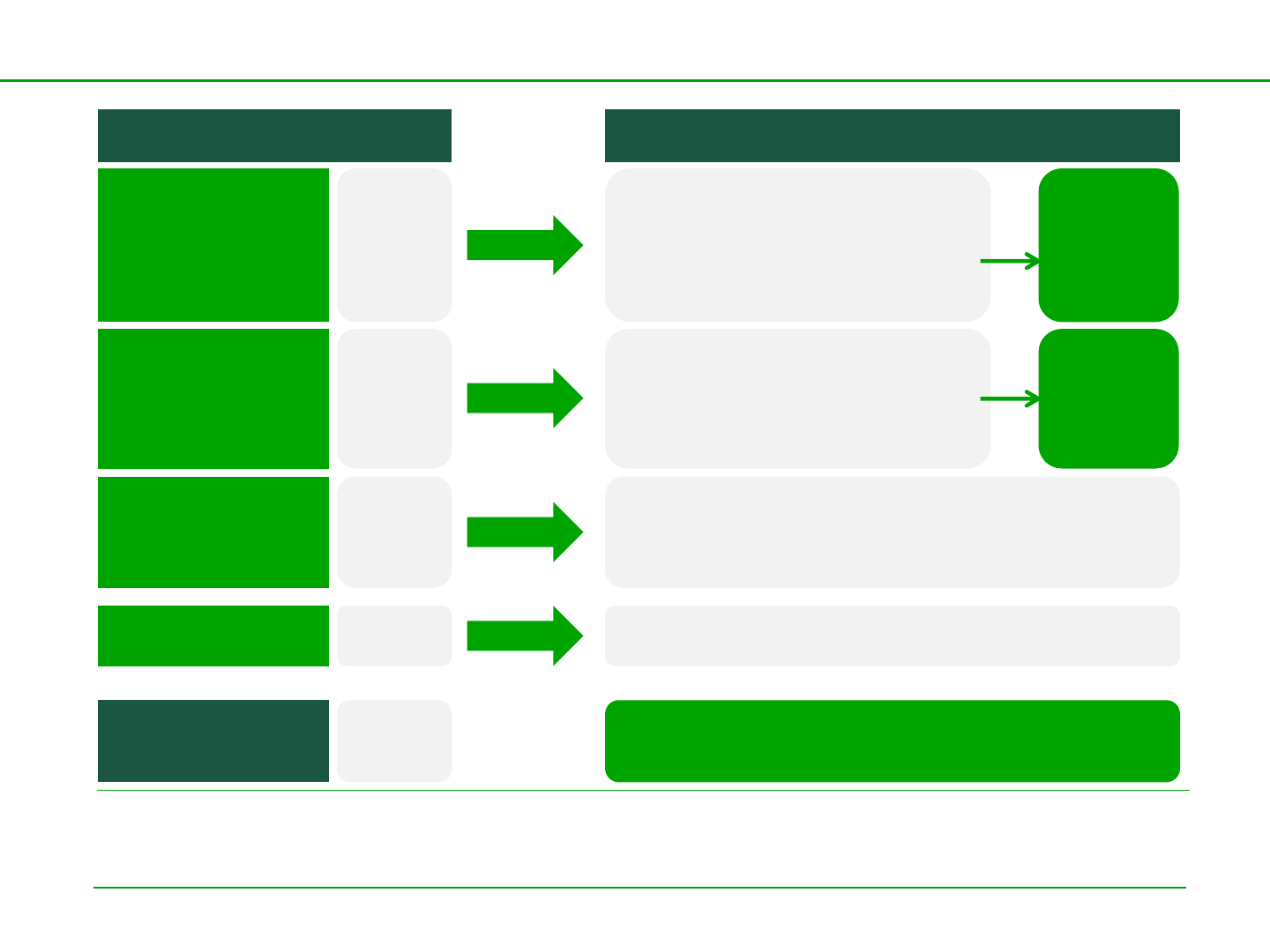

Melrose delivers: the Melrose record for margin improvement

5

(>30% improvement)

(>70% improvement)

(>40% improvement)

(>50% improvement)

McKechnie +6ppts

Elster +9ppts

Dynacast +5ppts

FKI +5ppts

(>60% improvement)

Nortek +6ppts

1

Melrose underlying operating margin improvement

1. Nortek operating profit margin up to 31 December 2017

18%

24%

13%

22%

11%

16%

10%

15%

9%

15%

Entry Current Exit

Elster Nortek

Returns on capex and

restructuring and other

commercial actions

Central cost

savings

Exit of low margin

sales channels

+9ppts

+6ppts

+1ppt

+1ppt

+4ppts

+6ppts

+1ppt

+2ppts

How Elster and Nortek operating margin improved

Operating margins always improved through management actions

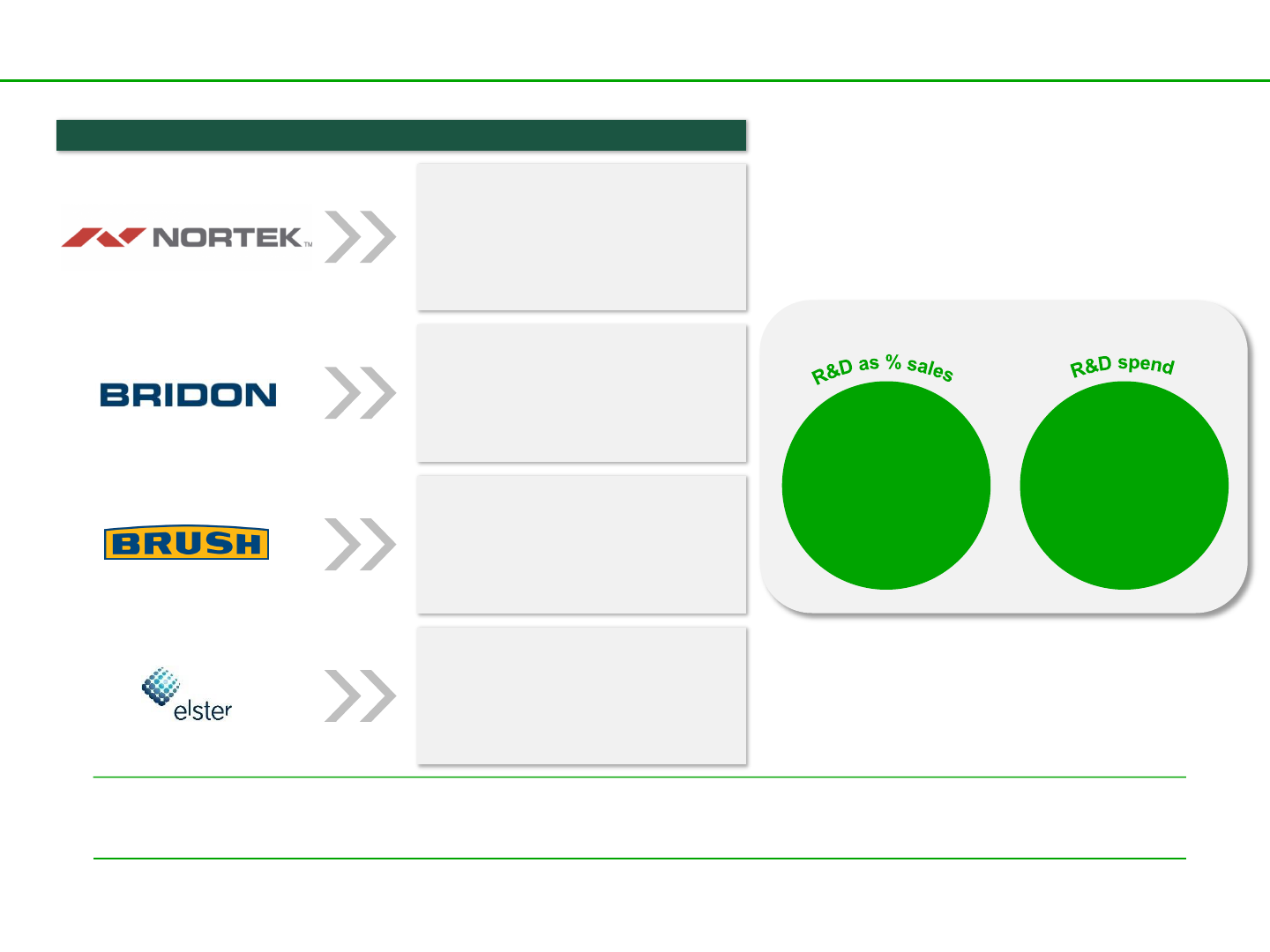

Melrose invests: investment is at the heart of our strategy

6

Melrose is a consistent investor in research and development,

investing for the long-term – as if it will own the business forever

Upgrades to production facilities and

warehousing for its Air Quality and

Home Solutions business

Production facility for Air Solutions

Production facility and R&D for HVAC

business

State of the art factory in Newcastle

Doncaster Technology Centre

New balancing pit for the US

Aftermarket business and new

machining centres in Loughborough

and Plzen

Key investment examples

Tooling and production facilities to

support the development of smart

meters

4%

Approximate

R&D investment

(last 5 years)

Over

£230m

Fully expensed

R&D spend

(last 5 years)

Melrose invests in R&D – Elster & Nortek

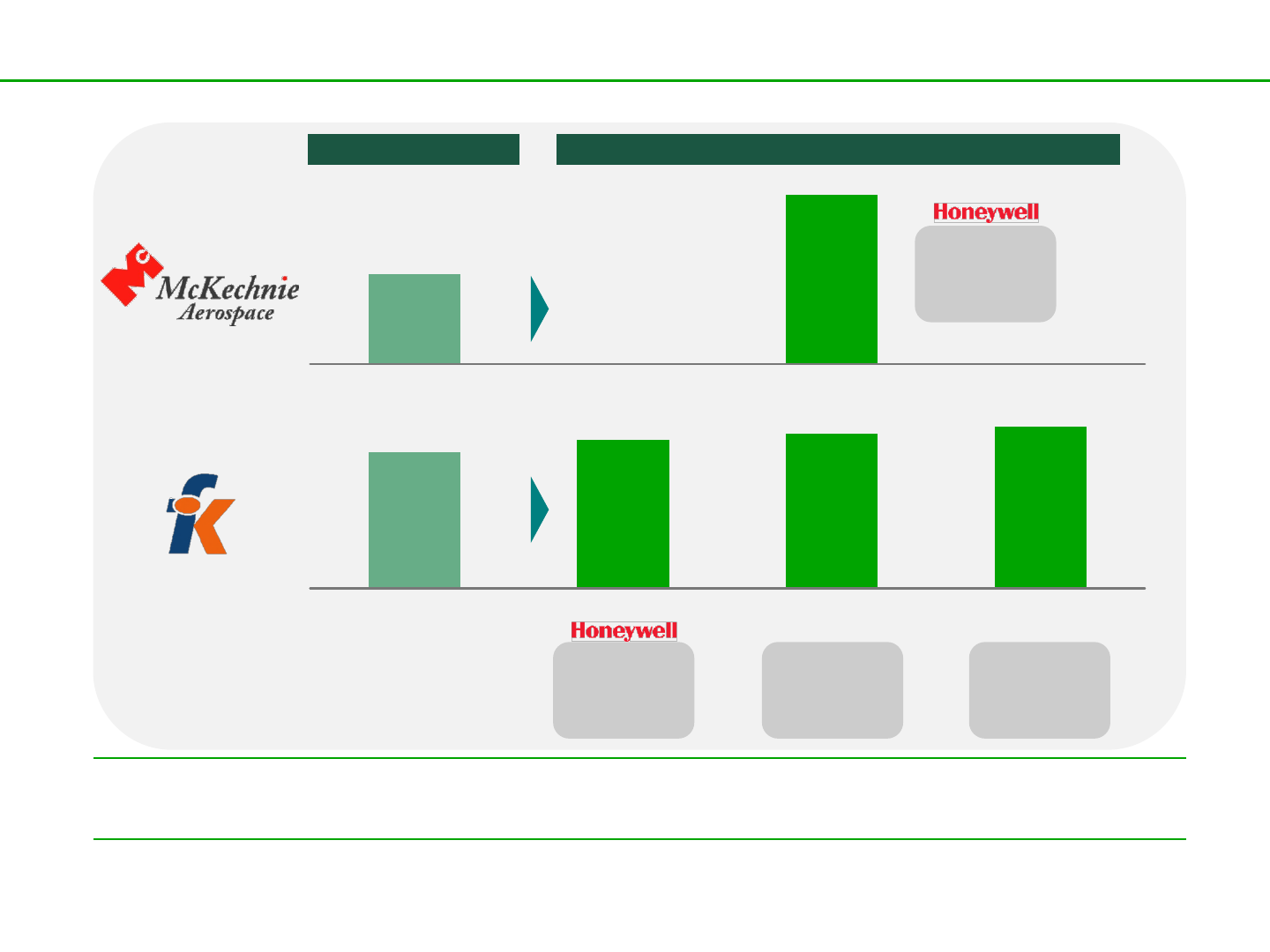

Melrose protects: an impeccable steward of pension schemes

7

Funding % (IFRS basis) On acquisition

On sale

McKechnie UK Plan

58%

109%

FKI UK Plan

87%

Separated into 3 schemes in June 2013

- residual FKI Plan 95%

- Bridon 99%

- Brush 103%

Melrose has an excellent track record of managing pension schemes

On acquisition

UK Plan

UK Plan

Transferred with

the Bridon

business to

Ontario Teachers’

Pension Plan

On sale

Funding % (IFRS basis)

Retained within

the Brush

business and in

surplus

Transferred into

Honeywell with a

full Honeywell

guarantee

58%

109%

McKechnie UK Plan McKechnie UK Plan

87%

95%

99%

103%

FKI UK Plan Residual FKI Plan Bridon Brush

Transferred into

Honeywell with a

full Honeywell

guarantee

£10.4bn

10.8%

8.8%

7.4%

6.4%

-

100

200

300

400

500

600

700

800

900

1,000

1,100

1,200

1,300

1,400

1,500

1,600

1,700

1,800

1,900

2,000

-

2.0

4.0

6.0

8.0

10.0

12.0

2012 2013 2014 2015 2016 2017

8

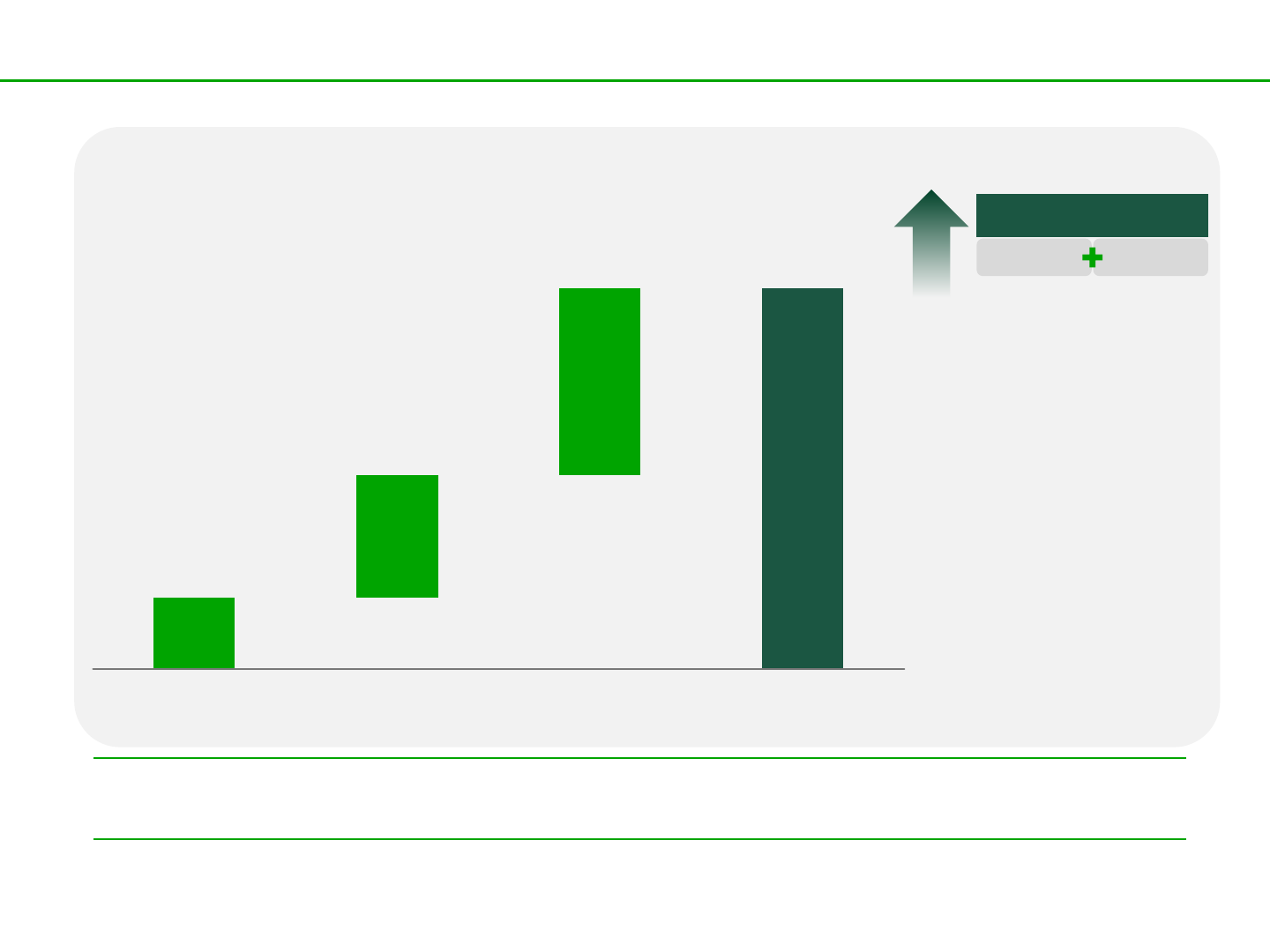

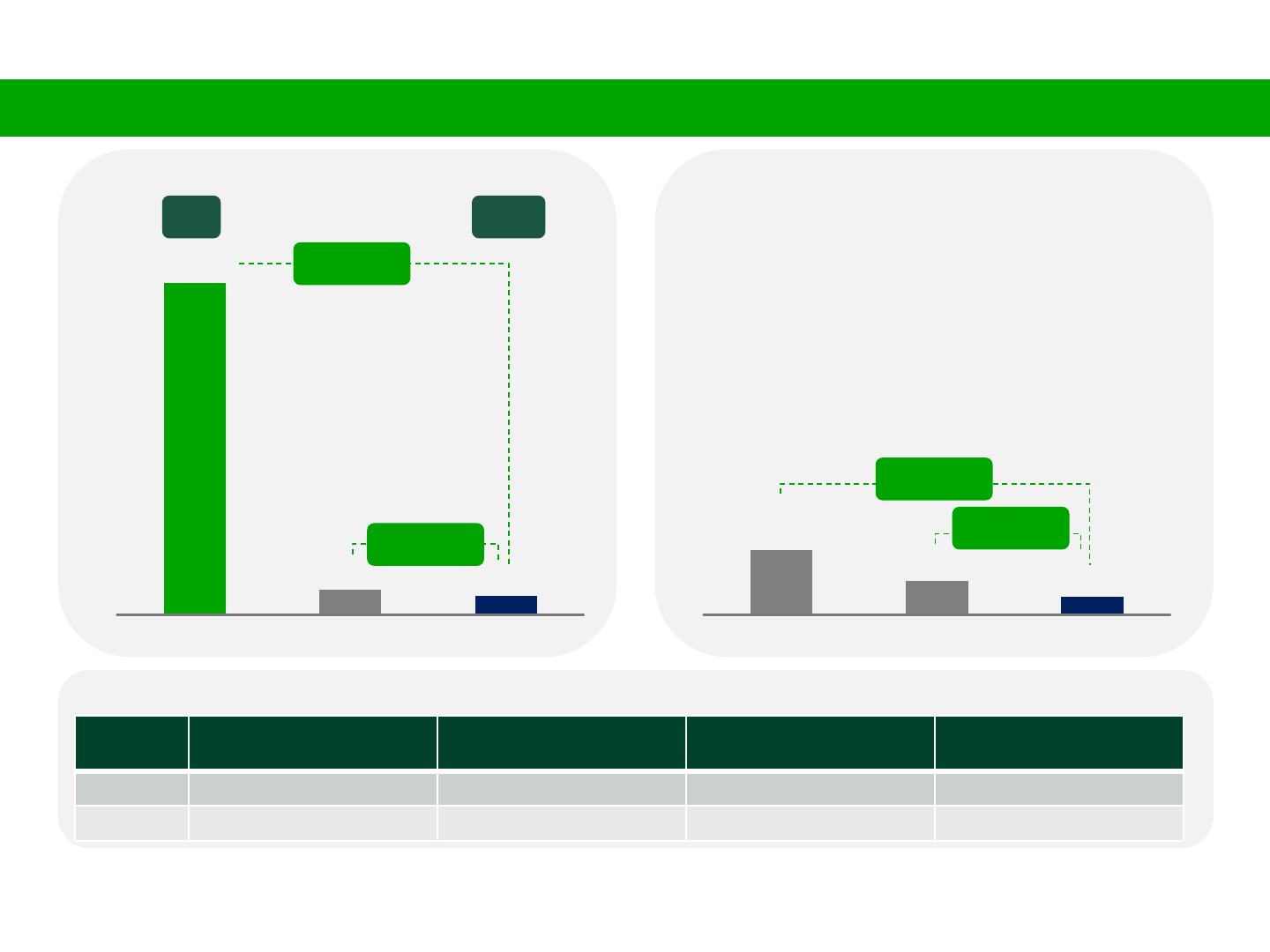

The lost opportunity for GKN shareholders

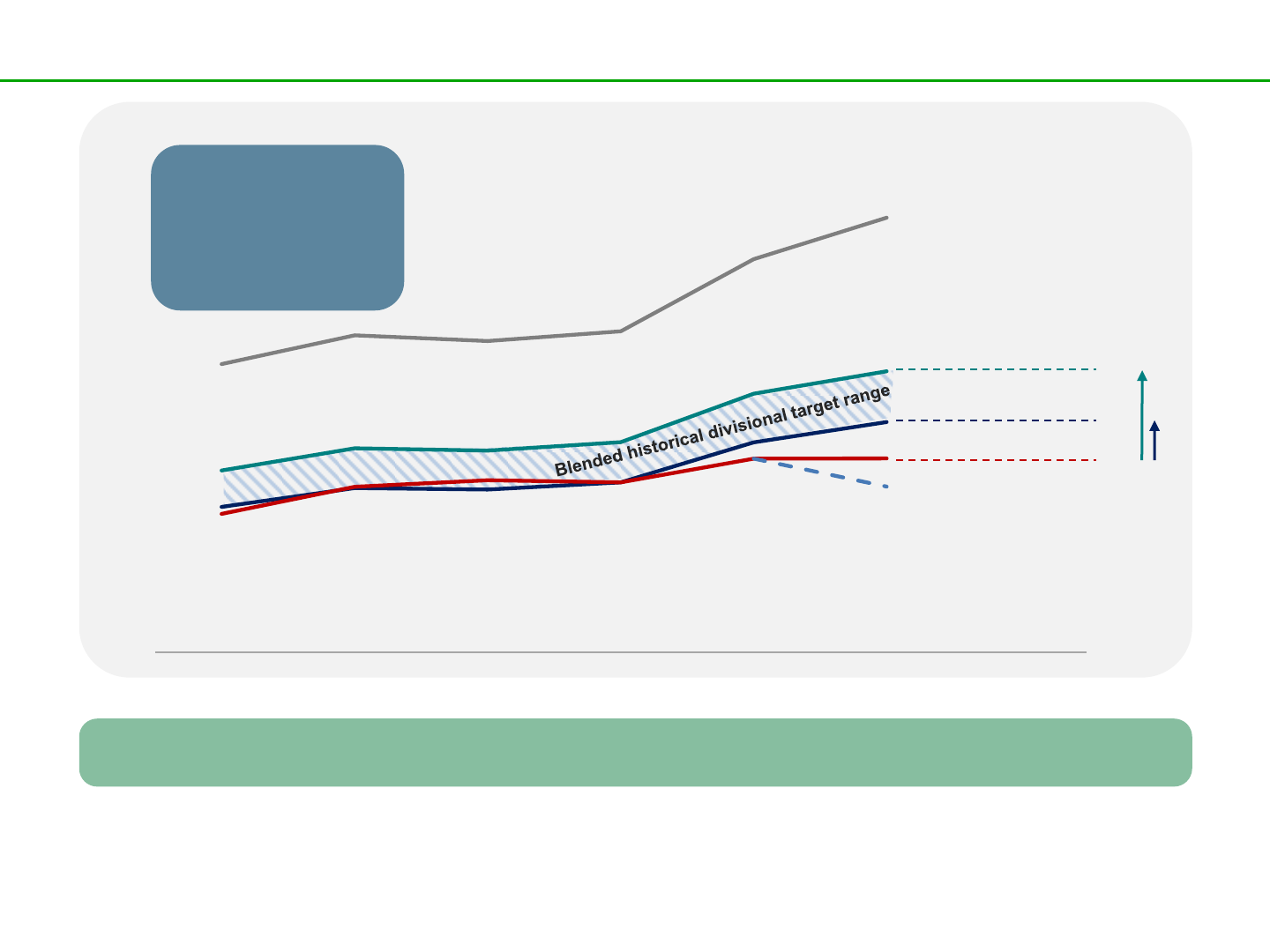

If GKN had achieved its divisional target margins in 2017

trading profit would have been approximately £100m+ to £300m+ higher

Sales (£bn)

Trading profit (£m)

1. Full-year 2017 results as set out in the GKN Preliminary Results announcement (27 February 2018)

2. Arithmetical sum of applying top end or bottom end divisional targets (pre Project Boost) to respective divisional 2017 year-end revenues, adding trading profit for the Other

division of £16m and deducting £27m central costs (calculated as £31 million in corporate costs less the £4 million charge for the one-off North America Aerospace balance

sheet review, as set out on p.11 of the GKN Preliminary Results announcement).

£100m +

£300m +

2

2

1

Top end margin

targets

Bottom end margin

targets

Actual margin

1

Actual 2017 –

adjusted for £112m

North American

Aerospace balance

sheet review

adjustments

Sales

Historical divisional target

trading margins

Aerospace 11% to 13%

Driveline 8% to 10%

Powder Metallurgy 9% to 11%

Includes central costs

GKN’s conflicting strategies

9

GKN plans to sell all but one of its businesses prior to any improvement

The GKN Board has had four conflicting strategies for GKN in the last two months:

Project Boost to improve margins by 2020; proposal for the hasty sale of Powder

Metallurgy

2

Initial “4Ps” strategy; abruptly abandoned without as much as a backward glance

1

Plans for a formal demerger to take place in 2019

3

Proposed sale of Driveline to a foreign buyer, scheduled for Q4 2018

4

14 February

2018

1 February

2018

27 February

2018

9 March

2018

GKN’s transaction with Dana: a bad deal for GKN shareholders

10

Sells the majority of the potential of GKN Driveline before any of the improvement clearly achievable

Forces GKN shareholders to accept shares in a foreign listed company, controlled outside the UK

o Many GKN Shareholders will have no alternative but to sell these shares

Forces UK tax-paying GKN shareholders to pay tax on receipt of Dana shares without any cash payment to fund it

Leaves the remaining GKN Group with approximately £3.0 billion

1

of gross pension liabilities

o Post sale of Powder Metallurgy gross pension liabilities could be approximately 11x

2

Aerospace

management profits

Commits GKN to a lengthy and uncertain process in relation to anti-trust, US tax inversion and other conditions

o Dana shareholders have an option to “walk away” at a cost of only $54 million in the last quarter of 2018

1. The approximately £3.0 billion of gross pension liabilities that will remain with the GKN group following the proposed sale of Dana is calculated by taking GKN’s reported full-year 2017 total gross

pension liabilities of £4,405 million and subtracting the amount of gross pension liabilities that GKN has confirmed will transfer to Dana, being £1,375 million, leaving £3,030 million of total gross

pension liabilities in the remaining group as shown on slide 21 of GKN’s presentation on 9 March 2018;

2. GKN has announced its intention to reduce this liability by using methods such as incentivising pension members to give up some of their benefits, or to leave the scheme altogether. Following

this, it is expected that the gross pension liabilities will reduce to approximately £2.2 billion. This is based on the c. £1,988 million UK liabilities that GKN estimates will remain in the UK scheme,

(p.22 of the 9 March 2018 presentation), plus the £254 million non-UK gross pension liabilities that will remain with the GKN Group following the proposed sale to Dana. The £254 million non-UK

gross pension liabilities is GKN’s reported full-year 2017 non-UK gross pension liabilities of £1,096 million less the £842 million non-UK gross pension liabilities that GKN has confirmed will transfer

to Dana, being £1,375 million of total gross pension liabilities (slide 21 of the 9 March 2018 presentation) less £533 million of UK IAS 19 liabilities that will transfer to Dana (p.18 of the 9 March

2018 announcement). The proposed sale of Driveline and the proposed future sale of Powder Metallurgy assumes that no pension liabilities are transferred on the disposal of the latter;

3. The total gross pension liabilities of £3,030 million that will remain with the GKN Group post the disposals is approximately 11 times the 2017 management trading profit for Aerospace of £283

million (referred to on p.10 of GKN’s announcement on 14 February 2018), assuming that no pension liabilities are transferred with the sale of Powder Metallurgy.

The Dana transaction:

Driveline Sale to Dana Breaks GKN’s Promises

15

Feb.

2018

“Precedent transaction average Driveline

EV/ EBITDA multiple of 8.9x”

9

Mar.

2018

Proposed sale to Dana values GKN

Driveline at only 7.5x 2017 EBITDA

Fact…

“GKN’s current owners should retain 100%

of the benefits of the upside potential in

GKN”

17

Jan.

2018

9

Mar.

2018

GKN's shareholders “to receive 47.25%”

of the enlarged Dana / Driveline business

15

Feb.

2018

“GKN’s leadership team is best placed to

maximise value creation”

9

Mar.

2018

President and CEO of Dana will “be

President and CEO of the Combined

Group”

15

Feb.

2018

“Automotive companies typically have low

leverage because the automotive sector is

inherently cyclical”

9

Mar.

2018

Dana to have pro forma leverage of

“approximately 2.0x net debt (excluding

IAS19 pension deficit) to Adjusted

EBITDA”

GKN Statement…

Knee-jerk sale of Driveline contradicts GKN’s promises in less than four weeks

11

GKN: Dana deal causes Aerospace to be overburdened with liabilities

Proposed disposals would leave behind a GKN Aerospace business

burdened by disproportionate gross pension liabilities

Full-year 2017

1

£4.4bn

£3.0bn £3.0bn

Liability transfer as part

of proposed transaction

Post proposed Dana

transaction

2

Post proposed sale of

Powder Metallurgy

3

Gross pension liabilities

Ratio of gross pension

liabilities to management

trading profit

1. The current total gross pension liabilities of £4,405 million is 5.7 times the 2017 group management trading profit of £774 million as set out in the GKN Preliminary Results announcement ;

2. The £3,030 million (or approximately £3.0 billion) of gross pension liabilities that will remain with the GKN group following the proposed sale of Dana (as set out on slide 10) is equivalent to 69%

of the total gross pension liabilities of £4,405 million currently in the GKN Group. Management trading profit post proposed Dana transaction calculated as £774m full-year 2017 management

trading profit, less Driveline full-year 2017 management trading profit of £394m as referred to on p.18 of GKN’s presentation on 9 March 2018. The £3,030 million of gross pension liabilities is

8.0 times the trading profit post proposed Dana transaction;

3. Following the subsequent disposal of Powder Metallurgy (assuming no pension liabilities are transferred on disposal), the total gross pension liabilities of £3,030 million (or £2,242 million post

GKN’s proposed liability reduction exercise as set out on slide 10) that will remain with the GKN Group is approximately 11 times (or 8 times) the 2017 management trading profit for Aerospace

of £283 million respectively (p.10 of GKN’s announcement on 14 February 2018);

4. UK related gross pension liabilities proposed to be transferred to Dana of £533 million (as set out on p.18 of the announcement on 9 March 2018), are approximately 15% of the UK-related full-

year 2017 total gross pension liabilities of £3,309 million (as set out in the GKN Preliminary Results announcement on 27 February 2018)

15%

Group UK

liabilities

51%

Group trading

profits

UK scheme left overexposed

Most of the gross liabilities

Dana would take are foreign

vs.

12

69% of pension

obligations remain with

Residual GKN (which

accounts for less than

half of GKN's 2017

trading profit)

Limited deficit reduction

measures for Residual

GKN as a result of Dana

transaction

Gross liabilities increased

from 5.7x of trading profit

to approximately 11x

Management trading profit

Assume no transfer of

liability with sale

Plan to reduce

liabilities (if

successful) to c.

£2.2bn – c. 8x

trading profit,

involves

controversial

methods

£774m

£380m

£283m

5.7x

8.0x

c. 11x

c. 8x

Melrose’s proposal to the GKN pension trustees

Formal proposal to the GKN Pension Scheme trustees following a

series of constructive discussions

Comprises potential contributions to the GKN Pension Schemes of

up to c. £1 billion over the Melrose ownership period

£450m of contributions irrespective of any business disposals

£150 million upfront contribution (as announced previously)

Part of this contribution funding the 2016 scheme to

self-sufficiency

£300m in annual contributions over a 5 year period

Double the annual contributions to the 2012 Scheme,

the larger of the two schemes, from £30 million

currently to £60 million

Contributions into the schemes upon the sale of existing GKN or

Melrose businesses.

Capped at an agreed funding level

Represents almost twice the size of the GKN deficit reduction

package of £528m under the alternative sale to Dana

The proposal is in line with Melrose’s original assumptions in respect

of the acquisition and has been taken into account in its approach

Funding the GKN pension schemes for the future as a responsible owner

– in line with our investment criteria

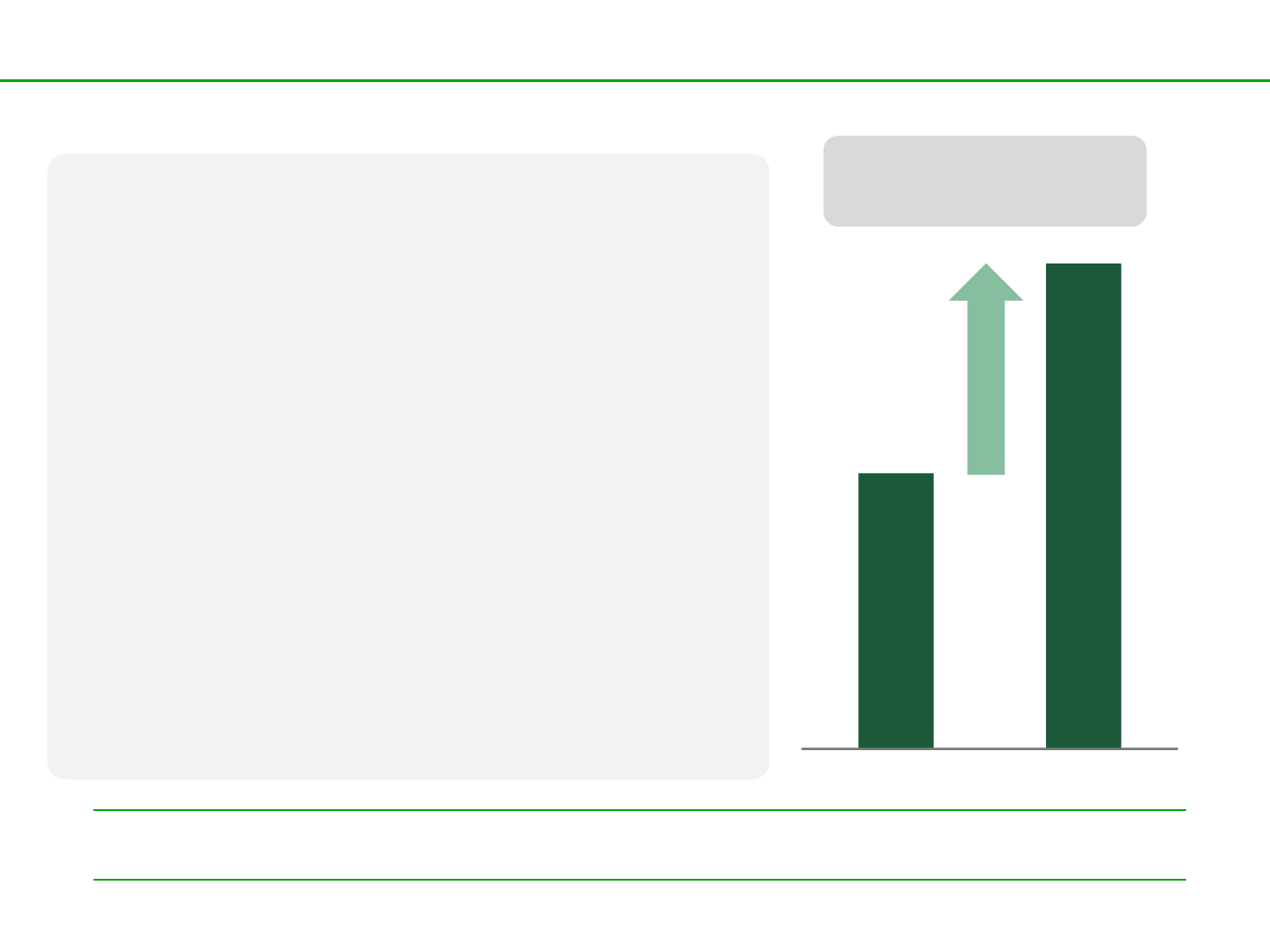

Melrose proposal

c. twice the size of GKN’s

deficit reduction package

£528m

c. £1bn

GKN's plan Melrose's proposal

1. GKN’s £528 million deficit reduction package comprises the following: £124 million special contribution by Dana (as set out in Clause 12.4 of ‘Letter from GKN to Chairmen of the GKN Group

Pension Schemes’, dated 9 March 2018); £105 million additional contribution to the 2012 scheme from non-core disposals (Clause 5.1); the Walnut termination amount of £273.7 million

(Schedule 5); and a £25 million contribution (net of tax) to the 2016 UK Scheme (as set out on p. 18 of the Proposed combination announcement on 9 March 2018)

13

• Minority stake

• Many UK shareholders can’t hold US

paper

• Share flowback

• Long completion risk

• Tax cost implications

GKN: a questionable 503p tomorrow

Aerospace overburdened

A risky 503p – No certainty in delivery

1. SOTP as set out on p. 23 of GKN’s Second Response Circular released 12 March 2018

2. 3.7x average pension liabilities of Aerospace peers (as identified by GKN in its Response Circular dated 15 February 2018) include Meggitt, Rolls Royce, Safran, Latecoere, Heroux-Devtek,

MTU, Senior and Spirit

14

…relies on a number of risks and an

unproven GKN management team

Aerospace

303p

221p

Driveline

Powder Metallurgy

Other items

121p

(142p)

Total

503p

• Execution risk (no previous track

record)

• Jam tomorrow based on 2020

• Pension liabilities: c.8 - 11x the profit

• Valuation derating risk due to heavy

liabilities

• “Gem” business last year … Hasty sale instead

• Exit before improvement

• Any associated tax charge?

• Accounting deficit

• Does not account for funding position

Share price pre approach = 326.3p

Implied valuation assuming Project

Boost achieved…

vs. 3.7x

average for

Aerospace

peers

Option for

Dana with

$54m get

out of jail

card

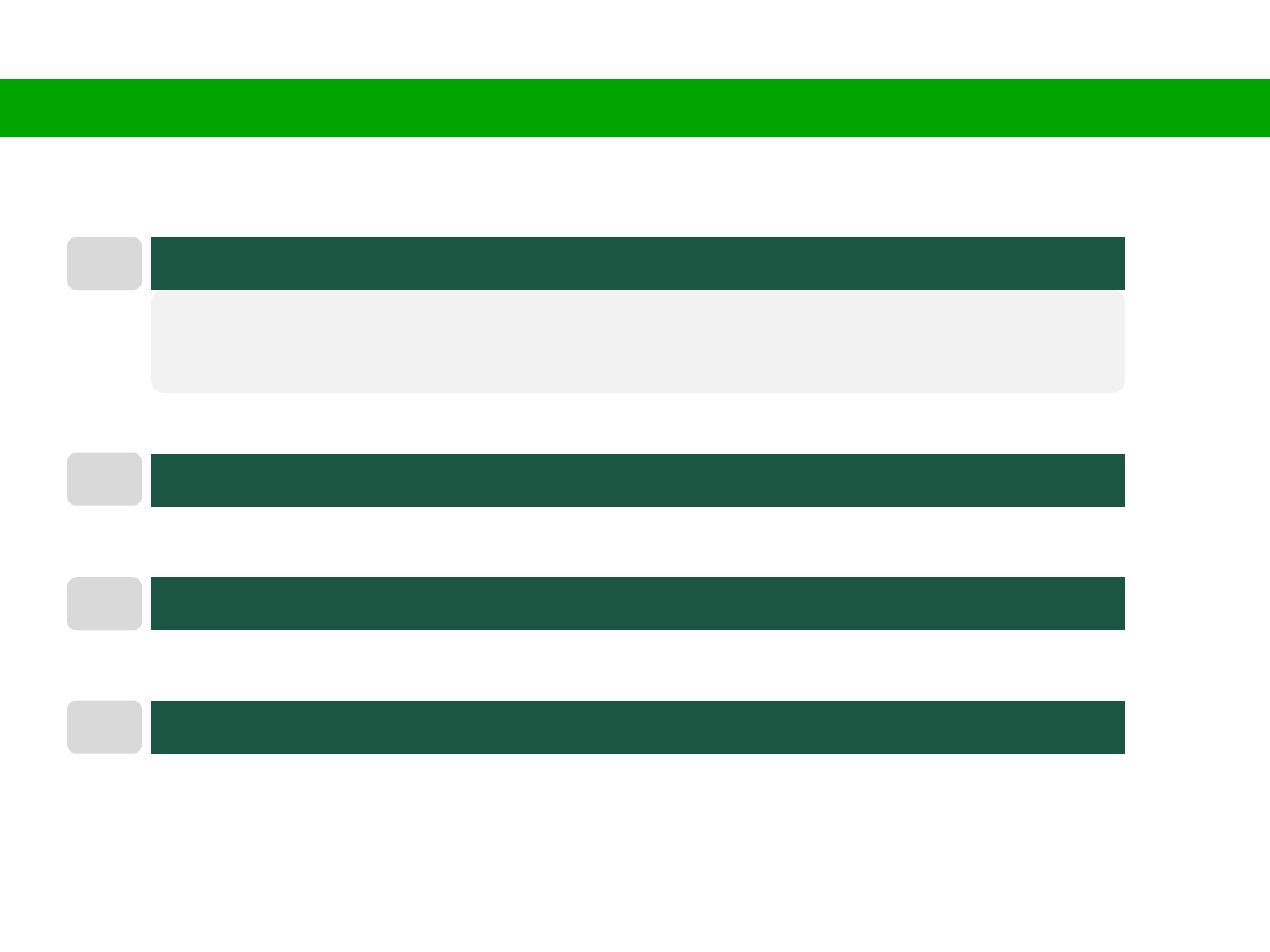

The Melrose plan

Our immediate actions:

1. Head office to be restructured Simplify management structure

2. Culture to be changed Focus on performance and reduced cost base

3. Focus on profitability not sales Exit unprofitable or low margin sales

4. Investment in operations to produce return Not growth only

5. Management focus back on business Targets there to be achieved – incentives restructured

6. Fast economic-based decision making Speedy, flat, unbureaucratic organisation

15

How to simplify GKN within Melrose

• Reduce number of businesses to concentrate our efforts

• Disposal at the right moment, timing also affected by pension situation

Look to exit non core activities from within Aerospace and Automotive divisions in due course

once improved

Exit Powder Metallurgy in the medium term once improved

In parallel, continue with strategy of exiting Nortek businesses in next 2 – 3 years

Disposals will result in substantial capital returns to shareholders

2

1

3

4

Focus on GKN’s main businesses

16

Summary of the proposal

Proposal to acquire GKN for 467

1

pence per share represents:

‒ Immediate premium of approximately 43% over the closing share price of GKN on 5 January, the last business day

prior to the approach

‒ Value today ahead of GKN’s 10 year high share price of 414.9

2

pence per share on 24 February 2014 with further

significant upside through continued shareholding of the enlarged group

‒ Implied offer value of approximately £8.1 billion

GKN shareholders to receive 1.69 new Melrose shares and 81 pence in cash for each GKN share and retain the GKN final

2017 dividend of 6.2 pence per share

‒ GKN shareholders would own approximately 60% of the enlarged group and would become major participants in

potential future value creation

‒ Net leverage in line with Melrose declared strategy of c 2.5x combined group EBITDA

1. Share prices at 9 March 2018 (the last business day before the announcement of the final offer)

2. Before 5 January 2018, the last business day prior to the approach

17

£1.5bn

£8.1bn

£2.6bn

£4.0bn

Cash element of the Offer

plus Dividend

60% share of

Melrose

60% share of

GKN

Total value

Value of Melrose offer

Shareholders must decide: 467p today + 60% of future value improvement

vs. a questionable 503p

5

tomorrow

467p

1. Share prices at 9 March 2018 (the last business day before the announcement of the final offer)

2. 81 pence per GKN share to be received in cash plus the final 2017 dividend of 6.2 pence payable to GKN Shareholders

3. Based on Melrose’s market capitalisation at 9 March 2018

4. Based on Melrose’s offer as set out in the announcement on 12 March 2018, adjusted for the cash portion of the offer

5. 503p as set out on p. 23 of GKN’s Second Response Circular released 12 March 2018

87p

151p 229p

60% of the future value

Melrose GKN

Per GKN share

2 3 4

18

Appendix

593%

315%

171%

MSCI World A&D MSCI World Auto

Components

GKN

Total shareholder returns (TSR) compared

GKN has underperformed

1. As at close of business on 5 January 2018, the last business day prior to the approach

2. Top 10 TSR performance over the period: Ashtead Group, JD Sports Fashion, Melrose, Micro Focus, Paddy Power Betfair, Dechra Pharmaceuticals, Domino’s Pizza,

Croda, Hill & Smith and Diploma in order of performance

3. TSR calculated since respective acquisition completion dates

Source Datastream

TSR

MELROSE VS. FTSE 350 VS. GKN

Since Melrose IPO – Oct 2003

#3 #227

Ranking

1,2

c 18x higher

TSR

TSR

GKN VS. ITS SECTORS

Since Melrose IPO – Oct 2003

c 3x higher

TSR

c 2x higher

TSR

TSR – GKN VS. MELROSE

Since Melrose acquisitions

3

McKechnie/Dynacast

May 2005

FKI

Jul 2008

Elster

Aug 2012

Nortek

Aug 2016

Melrose

2,223% 1,624% 426% 49%

GKN

168% 190% 70% 8%

c 26% lower

than market

3,019%

231%

171%

Melrose FTSE 350 GKN

20