Other than statutory and regulatory requirements included in the document, the contents of this guidance do not have

the force and effect of law and are not meant to bind the public. This document is intended only to provide clarity to

the public regarding existing requirements under the law or agency policies.

Higher Education Emergency Relief Fund III

Frequently Asked Questions

American Rescue Plan Act of 2021

Published May 11, 2021

Questions 7 and 11 updated May 24, 2021

Question 36, 38, and 39 updated October 25, 2022

2

Table of Contents

A. Overview Questions ................................................................................................................ 3

B. Emergency Financial Aid Grant to Students Questions .......................................................... 7

C. Institutional Uses of Funds Questions ................................................................................... 11

D. New Required Uses of Funds Questions ............................................................................... 16

E. Grant Administration Questions ............................................................................................ 21

3

Higher Education Emergency Relief Fund III

Frequently Asked Questions (FAQs)

On March 11, 2021, President Biden signed the American Rescue Plan Act of 2021 (ARP) (Pub.

L. 117-2). The ARP appropriated approximately $39.6 billion for the Higher Education

Emergency Relief Fund (HEERF) and represents the third stream of funding appropriated for

HEERF to prevent, prepare for, and respond to coronavirus. Taken together, the Coronavirus

Aid, Relief, and Economic Security Act (CARES Act) (Pub. L. 116–136), the Coronavirus

Response and Relief Supplemental Appropriations Act, 2021 (CRRSAA) (Pub. L. 116-260), and

the ARP represent HEERF I, HEERF II, and HEERF III, respectively.

HEERF III is structured like the HEERF II programs under the CRRSAA, with certain important

differences that will be discussed within these FAQs. These FAQs are intended to describe the

features and allowable uses of grants received under the HEERF III programs and may be

updated with additional information in the future.

A. Overview Questions

1. Question: What changes did Congress make to the HEERF programs in ARP (HEERF

III) that are different from the HEERF programs in CRRSAA (HEERF II)?

Answer: Congress made the following major changes in creating the HEERF III

programs:

Provided supplemental funding under the CRRSAA framework: As noted above,

Congress appropriated approximately $39.6 billion to be distributed under the following

funding streams originally established within the CRRSAA:

• Approximately $36 billion under ARP (a)(1) for public and private nonprofit

institutions as defined in section 101 or section 102(c) of the Higher Education

Act of 1965, as amended (HEA). At least half of an institution’s allocation under

ARP (a)(1) must be used to make emergency financial aid grants to students (the

Student Aid Portion); the remainder may be used for institutional purposes

(Institutional Portion). For more information on how the minimum amount that

must be used for grants to students is determined under ARP, see Question 20 or

the ARP (a)(1) methodology document.

• Approximately $3 billion under ARP (a)(2) for Historically Black Colleges and

Universities (HBCUs), Tribally Controlled Colleges and Universities (TCCUs),

Minority Serving Institutions (MSIs), and Strengthening Institutions Program

(SIPs) institutions. An announcement regarding the availability of these funds is

forthcoming.

• Approximately $198 million under ARP (a)(3) for institutions that the

Department determines have, after allocating other funds available under HEERF

III, the greatest unmet needs related to coronavirus. A Notice of Proposed

Eligibility Requirements for these funds is available in a separate notice here

(May 11, 2021).

4

• Approximately $396 million under ARP (a)(4) for proprietary institutions (as

defined in section 102(b) of the HEA) to be used only for emergency financial aid

grants to students. For more information on how the ARP (a)(4) amount was

determined, see the ARP (a)(4) methodology document.

New required uses of grant funds: The ARP has two new required uses of HEERF III

Institutional Portion grant funds for public and private nonprofit institutions in which, if

the Institutional Portion is not used entirely for emergency financial grants to students, a

portion of funds must be used to: (a) implement evidence-based practices to monitor and

suppress coronavirus in accordance with public health guidelines; and (b) conduct direct

outreach to financial aid applicants about the opportunity to receive a financial aid

adjustment due to the recent unemployment of a family member or independent student,

or other circumstances, described in section 479A of the HEA.

More information on these new required uses is in Section D, Questions 28-35 of this

FAQ document. The allowable uses of institutional funds remain the same as they were

in the CRRSAA. Please see Question 21 for more information.

Modified the share of (a)(1) funds that must be used for emergency financial aid grants to

students: As described in Question 20, the ARP provides a new formula for the amount of

(a)(1) funds that must be used for financial aid grants to students. This amount is

represented in the “Student Aid Portion” column listed on the ARP (a)(1) allocation table

and explained in the accompanying ARP (a)(1) methodology document.

Maintained a separate program for proprietary institutions: As under CRRSAA,

proprietary institutions are not eligible to receive awards under the (a)(1) program but are

eligible under the (a)(4) program. This program supports only emergency financial aid

grants to students. Please see the ARP (a)(4) allocation table and Questions 4 and 5 for

more information about the ARP (a)(4) program.

Eliminated the CRRSAA requirement for institutions paying the endowment excise tax:

The ARP eliminated the previous requirement under the CRRSAA that institutions that

paid or would be required to pay the endowment excise tax in tax year 2019 would have

their total (a)(1) allocation reduced by 50%.

2. Question: My public or private nonprofit institution received (a)(1) funding under the

CRRSAA and is on the ARP (a)(1) allocation table. How will we receive (a)(1) funds

under the ARP?

Answer: The Department will make supplemental awards to your existing Student Aid

Portion and Institutional Portion grants (Assistance Listing Numbers (ALNs) 84.425E

and 84.425F). No action is required by your institution to receive these supplemental

awards. The Project Director identified on the most current Grant Award Notification

(GAN) will automatically receive an email indicating a supplement award is made to

your institution.

5

Please note that drawing down any amount of these supplemented funds constitutes your

institution’s acceptance of the applicable terms and conditions under the ARP and as

described in the Supplemental Agreements that will be emailed to the Project Director

separately. For reference, examples of the new Supplemental Agreements for the Student

Aid Portion and Institutional Portion grants are available in our notice announcing the

availability of these new funds in the ARP (a)(1) notice inviting applications (NIA)

published in the Federal Register here.

3. Question: My public or private nonprofit institution is on the ARP (a)(1) allocation table

but did not receive funding under the CRRSAA. How can we receive funds under the

ARP?

Answer: Eligible public or private nonprofit institutions that did not receive Student Aid

Portion or Institutional Portion grants (ALNs 84.425E and 84.425F) under the CRRSAA

may apply via Grants.gov for Student Aid Portion or Institutional Portion grants under

ARP (a)(1). Institutions must submit separate applications to receive the Student Aid

Portion and Institutional Portion grants. Institutions must submit a Student Aid Portion

application in order to receive Institutional Portion funding but may also choose to apply

solely for Student Aid Portion funds.

Each completed application for a Student Aid Portion or Institutional Portion grant must

consist of:

1) SF-424 form and SF-424 Department supplemental information form

(completed in Grants.gov); and

2) A Certification and Agreement (either the ARP Student Aid Portion

Certification and Agreement (ARP (a)(1) Student Aid), or the ARP Institutional

Portion Certification and Agreement (ARP (a)(1) Institutional), as appropriate).

Applications must be submitted within 90 days of the ARP (a)(1) NIA published in the

Federal Register regarding the availability of funding (August 11, 2021). To register to

use Grants.gov, please visit their “How to Apply for Grants” webpage here, or call their

Applicant Support helpdesk at 1-800-518-4726. More information about how to apply is

also available on our HEERF III ARP website.

If an institution has previously received a Student Aid Portion grant but not an

Institutional Portion grant under the CARES Act, that institution will have to submit an

application for only an Institutional Portion grant and its Student Aid Portion grant will

be supplemented as described above.

4. Question: My proprietary institution received (a)(4) funding under the CRRSAA and is

on the ARP (a)(4) allocation table. How will we receive (a)(4) funds under the ARP?

Answer: The Department will make supplemental awards to your existing Proprietary

Institution Grant Funds for Students Award (ALN 84.425Q). However, to assist with

management and oversight, proprietary institutions must first submit the Required

Proprietary Institution Certification form signed by the proprietary institution’s President

6

or CEO and any owners with at least 25% ownership in the institution. Proprietary

institutions must submit the form by August 11, 2021, as specified in our ARP (a)(4) NIA

published in the Federal Register here. Once that certification document has been

completed, institutions must email it to [email protected]. Then, your institution

will receive a supplemental award. After that date, the Department may choose to

redistribute funds to proprietary institutions by re-running the appropriate HEERF

distribution formulas and making additional supplemental awards to those proprietary

institutions that submitted completed forms.

Please note that drawing down any amount of these supplemental funds constitutes your

institution’s acceptance of the applicable terms and conditions under the ARP and as

described in the Supplemental Agreements for the supplemental awards. For reference,

examples of the new Supplemental Agreements for the Student Aid Portion and

Institutional Portion grants are available in our notice announcing the availability of these

new funds in our ARP (a)(4) NIA published in the Federal Register here.

5. Question: My proprietary institution is on the ARP (a)(4) allocation table but did not

receive funding under the CRRSAA (a)(4) Proprietary Institution Grant Funds for

Students program. How can we receive funds under the ARP?

Answer: Eligible proprietary institutions that did not receive a Proprietary Institution

Grant Funds for Students award under the CRRSAA (ALN 84.425Q) may apply via

Grants.gov for ARP (a)(4). Each completed application must consist of:

1) SF-424 form and SF-424 Department supplemental information form

(completed in Grants.gov);

2) A Certification and Agreement (ARP Proprietary Institution Grant Funds for

Students); and

3) Signed Required Proprietary Institution Certification form.

Applications must be submitted within 90 days of the ARP (a)(4) NIA published in the

Federal Register. Applications not received by August 11, 2021 will no longer be eligible

for funding. To register to use Grants.gov, please visit their “How to Apply for Grants”

webpage here, or call their Applicant Support helpdesk at 1-800-518-4726. More

information about how to apply is also available on our HEERF III ARP website.

6. Question: My institution has determined that we do not need some or all of our ARP

supplemental funds and would like to decline our HEERF III ARP supplemental award(s)

and redirect our allocation to institutions with greater needs due to the coronavirus. Can

we do this?

Answer: Yes. Any institution, such as those with high endowment per student ratios or

that have received significant philanthropic support during the pandemic, may decline its

full award or a portion of its award. Institutions wanting to decline their award or a

specified amount should submit the Voluntary Decline of HEERF Grant Funds form to

[email protected]. If the Department has already made an ARP supplemental

7

award to the institution, the Department will deobligate those supplemented funds in G5

by the amount specified in the form.

Any voluntary decline of funds will be redistributed to institutions with greater needs due

to the coronavirus by re-running the appropriate HEERF distribution formulas and

making additional supplemental awards to those institutions that have not declined funds.

Institutions have 90 days, until August 11, 2021, to indicate they would like to decline or

return unneeded ARP supplemental funds. After, the Department intends to make the

redistribution.

B. Emergency Financial Aid Grant to Students Questions

7. Question: Which students are eligible to receive emergency financial aid grants?

Answer: As announced in the Department’s final rule, “Eligibility To Receive

Emergency Financial Aid Grants to Students Under HEERF” (May 14, 2021, 86 FR

26608) (final rule), the term “student,” for purposes of the phrases “grants to students,”

“emergency financial aid grants to students,” and “financial aid grants to students” as

used in the HEERF programs, is now defined as any individual who is or was enrolled (as

defined in 34 CFR § 668.2) at an eligible institution (as defined in 34 CFR § 600.2) on or

after March 13, 2020, the date of declaration of the national emergency due to the

coronavirus (85 FR 15337). Thus, students are no longer required to be eligible for Title

IV student financial aid in order to receive HEERF grants to students.

Put more plainly, students who are or were enrolled in an institution of higher education

during the COVID-19 national emergency are eligible for emergency financial aid grants

from the HEERF, regardless of whether they completed a Free Application for Federal

Student Aid (FAFSA) or are eligible for Title IV. As under the CRRSAA, institutions are

directed with the ARP funds to prioritize students with exceptional need, such as students

who receive Pell Grants or are undergraduates with extraordinary financial circumstances

in awarding emergency financial aid grants to students.

Beyond Pell eligibility, other types of exceptional need could include students who may

be eligible for other federal or state need-based aid or have faced significant unexpected

expenses, such as the loss of employment (either for themselves or their families),

reduced income, or food or housing insecurity. In addition, the CRRSAA and ARP

explicitly state that emergency financial aid grants to students may be provided to

students exclusively enrolled in distance education provided the institution prioritizes

exceptional need.

1

1

This FAQ updated on May 24, 2021 to clarify that exceptional need must be prioritized when awarding

emergency financial aid grants to students. Exceptional need is not specifically required as an eligibility

threshold for students exclusively enrolled in distance education.

8

8. Question: May undocumented students and international students receive HEERF?

Answer: Yes. The Department’s final rule on student eligibility for HEERF states that all

students who are or were enrolled in an institution of higher education during the

COVID-19 national emergency are eligible for emergency financial aid grants from the

HEERF, regardless of whether they completed a FAFSA or are eligible for Title IV. That

includes citizens, permanent residents, refugees, asylum seekers, Deferred Action for

Childhood Arrival (DACA) recipients, other DREAMers, and similar undocumented

students.

International students may also receive HEERF. However, as noted in Questions 11 and

12, institutions must ensure that funds go to students who have exceptional need. The

Department encourages institutions to prioritize domestic students, especially

undergraduates, in allocating this funding. This includes citizens, permanent residents,

refugees, asylum seekers, DACA recipients, other DREAMers, and similar

undocumented students.

9. Question: Can students who are studying abroad receive HEERF emergency financial

aid grants?

Answer: Yes. Students studying abroad may receive HEERF emergency financial aid

grants from the recipient institution where they are enrolled. These students must meet

the criteria based on prioritizing exceptional need that the institution has established for

distributing its HEERF emergency financial aid grants.

10. Question: What civil rights requirements must institutions comply with when

distributing emergency financial aid grants to students under the HEERF programs?

Answer: HEERF grantees must not distribute student emergency financial aid grants in a

manner that discriminates against individuals on the basis of race, color, national origin,

disability, or sex. See, e.g., 42 U.S.C. § 2000d et seq., (Title VI), 29 U.S.C. § 701 et seq.

(Rehabilitation Act), 20 U.S.C. § 1681 (Title IX).

11. Question: What are the requirements for making emergency financial aid grants to

students?

Answer: Students who are or were enrolled in an institution of higher education on or

after the date of the declaration of the national emergency due to the coronavirus (March

13, 2020) are eligible for emergency financial aid grants from the HEERF, regardless of

whether they completed a FAFSA or are eligible for Title IV. The CRRSAA requires that

institutions prioritize students with exceptional need, such as students who receive Pell

Grants or are undergraduates with extraordinary financial circumstances, in awarding

emergency financial aid grants to students.

Beyond Pell eligibility, other types of exceptional need could include students who may

be eligible for other federal or state need-based aid or have faced significant unexpected

9

expenses either for themselves or that would affect their financial circumstances, such as

the loss of employment, reduced income, or food or housing insecurity. In addition, the

CRRSAA and ARP explicitly state that emergency financial aid grants to students may

be provided to students exclusively enrolled in distance education provided the institution

prioritizes exceptional need.

2

The Department encourages institutions to prioritize domestic students, especially

undergraduates, in allocating this funding. Domestic students include citizens, permanent

residents, refugees, asylum seekers, DACA recipients, other DREAMers, and similar

undocumented students.

Institutions may not (1) condition the receipt of emergency financial aid grants to

students on continued or future enrollment in the institution, (2) use the emergency

financial aid grants to satisfy a student’s outstanding account balance, unless it has

obtained the student’s written (or electronic), affirmative consent, or (3) require such

consent as a condition of receipt of or eligibility for the emergency financial aid grant.

Institutions should carefully document how they prioritize students with exceptional need

in distributing emergency financial aid grants to students, as the Department is exploring

reporting requirements regarding the distribution of emergency financial aid grants to

students (see 2 CFR § 200.334).

12. Question: When might the Department determine that an institution has failed to

prioritize emergency financial aid grants to students with exceptional need?

Answer: The Department will make an individualized determination about whether an

institution failed to prioritize emergency financial aid grants to students with exceptional

need. The Department may determine an institution has failed to do so if the institution

established preconditions for students to receive emergency financial aid grants (e.g., (1)

establishing a minimum GPA, (2) imposing other academic or athletic performance or

good standing requirements, (3) requiring continued enrollment in the institution or (4)

required the student to first pay any outstanding debt or balance) that results in failure to

prioritize students with exceptional need.

13. Question: How may students use their emergency financial aid grants?

Answer: Emergency financial aid grants may be used by students for any component of

their cost of attendance or for emergency costs that arise due to coronavirus, such as

tuition, food, housing, health care (including mental health care) or child care. Students

determine how they may use their emergency financial aid grant within the allowable

uses.

2

This FAQ updated on May 24, 2021 to clarify that exceptional need must be prioritized when awarding

emergency financial aid grants to students. Exceptional need is not specifically required as an eligibility

threshold for students exclusively enrolled in distance education.

10

14. Question: Can an institution direct or control what students may use their emergency

financial aid grants on?

Answer: No. The student emergency financial aid grant is provided to the student, and

may be used by the student for any component of the student’s cost of attendance or for

emergency costs that arise due to coronavirus, such as tuition, food, housing, health care

(including mental health care), or child care.

For example, as described in Questions 11 and 12, institutions may not compel a student

to use a portion of their grants to satisfy any existing debts or balance.

15. Question: Are emergency financial aid grants to students under the HEERF program

considered taxable income?

Answer: No. Emergency financial aid grants made by a federal agency, State, Indian

tribe, higher education institution or scholarship-granting organization (including a tribal

organization) to a student because of an event related to the COVID-19 national

emergency are not included in the student's gross income. For more information, please

see the Internal Revenue Service (IRS) bulletin Emergency aid granted to students due to

COVID is not taxable (March 30, 2021).

16. Question: Should institutions include a student’s receipt of a HEERF emergency

financial aid grant when calculating that student’s Expected Family Contribution?

Answer: As stated in the Department’s April 3, 2020 Electronic Announcement, “[a]ny

aid (in the form of grants or low-interest loans) received by victims of an emergency

from a federal or state entity for the purpose of providing financial relief is not counted as

income for calculating a family’s Expected Family Contribution (EFC) under the Federal

Methodology or as estimated financial assistance for packaging purposes.” As such, any

HEERF emergency financial aid grant received by a student under the CARES Act,

CRRSAA, or ARP should not be counted as income when calculating a family’s EFC.

17. Question: Can institutions include the amount of a HEERF student emergency financial

aid grant in students’ financial aid award package?

Answer: No, these emergency financial aid grants are not financial aid. As always,

students have discretion about how they receive their grants, and institutions must receive

affirmative written consent from students before using emergency financial aid grants to

satisfy a student’s outstanding account balance. Additionally, as described in Question

27, institutions may not use HEERF grant funds to advertise or recruit students by

promoting the opportunity to receive a student emergency financial aid grant.

11

18. Question: What steps can my institution take if a student does not cash a check issued for

student’s emergency financial aid grant?

Answer: If a student does not cash their emergency financial aid grant check by a

reasonable date, the institution may choose to void the check and redistribute the funds to

other students by the end of their HEERF grant performance period. Institutions should

engage in reasonable attempts to contact a student prior to voiding a check for an

emergency financial aid grant and should document the procedures, policies, and general

student contact efforts made and followed as part of their administration of their HEERF

grants.

3

19. Question: Can my institution use HEERF grant funds for students (ALNs 84.425E or

84.425Q) to recover stop-payment fees incurred due to voided and re-issued student

financial aid checks that were lost or never received by the student?

Answer: No. Stop-payment fees on checks that were lost or never received by the student

are administrative costs associated with administering the Student Aid Portion award.

Such administrative costs are not allowable expenses under the ARP (a)(1) Student Aid

Portion and (a)(4) grants since all those funds must be distributed to students as

emergency financial aid grants. However, stop payment fees may be an allowable

expenditure under the HEERF (a)(1) Institutional Portion grant provided the fees are

reasonable.

C. Institutional Uses of Funds Questions

20. Question: What amount of ARP (a)(1) funds must my institution devote to emergency

financial aid grants to students?

Answer: The amount of ARP (a)(1) funds that a public and private nonprofit institution

must devote to financial aid grants to students is based on of the formula contained in

section 314(a)(1) of the CRRSAA. More specifically, an institution must use:

• 50 percent of the portion of its allocation received under subparagraphs (A)

through (D) (the formula factors based on Pell and non-Pell recipients who were

NOT exclusively enrolled in distance education prior to national emergency) for

emergency financial aid grants to students, in accordance with ARP section

2003(7); and

• 100 percent of the portion of its allocation received under subparagraphs (E) and

(F) (the formula factors based on Pell recipients who WERE exclusively enrolled

in distance education prior to the national emergency) for emergency financial

aid grants to students, in accordance with CRRSAA section 314(d)(9).

3

Please see Question 19 of the Higher Education Emergency Relief Fund (HEERF) Frequently Asked

Questions (FAQ) Rollup Document for more details as to how institutions may distribute the emergency

financial aid grants to students, if not applying directly it to a student’s account after obtaining the student’s

written (or electronic), affirmative consent.

12

Institutions are not responsible for performing this calculation. Rather, this minimum

amount that institutions must spend on emergency financial aid grants to students has

been calculated by the Department and is represented in the institution’s ARP (a)(1)

Student Aid Portion grant (ALN 84.425E) as well as on the ARP (a)(1) allocation table.

21. Question: What are the allowable uses of funds for institutional uses?

Answer: Under the ARP, similar to the CRRSAA, allowable uses under the HEERF III

(a)(1) Institutional Portion awards include:

• Defraying expenses associated with coronavirus (including lost revenue,

reimbursement for expenses already incurred, technology costs associated with a

transition to distance education, faculty and staff trainings, and payroll); and

• Making additional emergency financial aid grants to students.

4

As described in Question 42, grant expenses may be incurred back to March 13, 2020, the

date of the declaration of the national emergency due to the coronavirus.

Additionally, as mentioned in Question 1, the ARP has added two new required uses of

HEERF III institutional portion grant funds for public and private nonprofit institutions.

Namely, a portion of their institutional funds must:

(a) implement evidence-based practices to monitor and suppress coronavirus in

accordance with public health guidelines; and

(b) conduct direct outreach to financial aid applicants about the opportunity to

receive a financial aid adjustment due to the recent unemployment of a family

member or independent student, or other circumstances, described in section

479A of the HEA.

Please see Section D, Questions 28-35 below for more information on these two new

required uses.

22. Question: What uses of funds are unallowable for the HEERF grant programs (HEERF I,

II, and III)?

Answer: HEERF grant funds must not be used for:

• funding contractors for the provision of pre-enrollment recruitment activities;

• marketing or recruitment; (See Question 27 on reengagement activities)

• endowments;

• capital outlays associated with facilities related to athletics, sectarian instruction,

or religious worship;

4

If institutions use their institutional funds (e.g. (a)(1) institutional portion, (a)(2), or (a)(3) funds) to make

additional emergency financial aid grants to students, they must make those additional awards consistent with

the requirements for making emergency financial aid grants to students (i.e., determining exceptional need) but

may employ different methodologies.

13

• senior administrator or executive salaries, benefits, bonuses, contracts, incentives,

stock buybacks, shareholder dividends, capital distributions, and stock options, or

any other cash or other benefit for a senior administrator or executive;

• religious worship, instruction, or proselytization or equipment or supplies to be

used for religious worship, instruction, or proselytization; or

• construction or purchase of real property (See Question 23, below).

As with most Federal grants, grantees must also comply with the Cost Principles

contained in the 2 CFR part 200 subpart E of the Uniform Guidance. Some examples of

costs specifically prohibited under the Uniform Guidance include using grant funds for

lobbying, bad debts, or purchasing goods or services for personal use.

23. Question: Can grantees use HEERF grant funds to engage in construction or purchase

real property?

Answer: No. In addition to the unallowable uses specified above in Question 22,

grantees are prohibited from using HEERF funding for the acquisition of real property or

construction under 34 CFR § 75.533. This includes using HEERF grant funds on capital

projects, including deferred maintenance and capital improvement.

However, this general prohibition on construction and acquisition of real property does

not extend to activities that meet the definition of “minor remodeling” under 34 CFR §

77.1. Please see Question 24, below, for more information including examples.

24. Question: What are some examples of permissible “minor remodeling” that HEERF

grant funds may support under the definition in 34 CFR § 77.1?

Answer: Minor remodeling means minor alterations in a previously completed building,

for purposes associated with the coronavirus. The term also includes the extension of

utility lines, such as water and electricity, from points beyond the confines of the space in

which the minor remodeling is undertaken but within the confines of the previously

completed building. The term does not include permanent building construction,

structural alterations to buildings, building maintenance, or repairs.

Some examples of permissible minor remodeling may include, but are not limited to:

• The installation or renovation of an HVAC system, to help with air filtration to

prevent the spread of COVID-19.

• The purchase or lease of temporary trailer classroom units to increase social

distancing.

• The purchase or costs of the installation of “room dividers” within a previously

completed building to increase social distancing.

14

25. Question: Can ARP funding be spent on payroll to defray costs associated with

transitioning to remote learning, defraying expenses to hire more staff, or expanding class

sections as a result of the impact of COVID-19?

Answer: Yes, under certain circumstances. Institutions may use ARP, CRRSAA funds,

and unspent CARES Act funds to pay for certain payroll costs, including employee

benefits, if (1) such costs are newly associated with coronavirus and (2) the costs were

incurred on or after March 13, 2020, the date of the declaration of the national emergency

due to the coronavirus. Consistent with these principles, an institution may also use ARP

funds to pay students for internships and job training experiences that are aligned with

local coronavirus-related recovery needs.

For example, HEERF grant funds can be used to pay for any new staff, or repurposed

staff, if the new or repurposed staff’s work is associated with coronavirus (e.g., contact

tracers, IT staff, additional medical personnel, teaching assistants, offering smaller class

sizes to support social distancing, etc.). HEERF grant funds can also be used to pay the

salaries (from March 13, 2020 onward) of staff who were unable to work during a period

of any full or partial campus closures due to the pandemic (e.g., cafeteria workers,

maintenance staff, bookstore clerks, etc.). Finally, any additional/overtime work any staff

incurred from March 13, 2020 onward associated with coronavirus (e.g., deep cleaning of

dormitories, additional trainings to assist with transitioning to online learning, etc.) can

also be paid for with HEERF grant funds.

In using HEERF grant funds to transition to online and remote learning, institutions

should carefully document how the funds were used to respond to the pandemic

consistent with 2 CFR § 200.334. If an institution is accelerating a previously planned

expansion of online learning, the institution should separate out the costs associated with

the acceleration as a result of the coronavirus and only charge those costs to the HEERF

grant.

26. Question: Can my institution use ARP or other HEERF institutional grant funds to

discharge student debt or unpaid balances to their institutions?

Answer: Yes. Institutions may discharge student debt or unpaid balances by discharging

the complete balance of the debt as lost revenue and reimbursing themselves through

their HEERF institutional grants or by providing additional emergency financial grants to

students (with their permission). The Department strongly encourages institutions to

discharge such debt. The following examples are listed to provide guidance to institutions

on handling these situations:

Example 1: Transcript withholding: A student who was enrolled in an

institution at any point on or after March 13, 2020 with a now-completed degree

owes an unpaid debt to the institution and could not obtain an official transcript

until the debt is paid off.

15

Example 2: Enrollment hold: A student who is enrolled at the institution at any

point on or after March 13, 2020 and in progress toward a degree is blocked from

enrolling in the next term because of an unpaid balance.

Example 3: Transfer student: A student who is enrolled at the institution at any

point on or after March 13, 2020 and has completed progress toward a degree is

blocked from obtaining an official transcript to transfer their credits because of an

unpaid balance.

The following are two possible solutions to address the three examples above:

Solution #1: Get affirmative written consent to provide an emergency

financial aid grant to the student’s account:

o What the institution can do: Institutions can provide an emergency

financial aid grant to the student in the amount of the outstanding balance

through their HEERF grants, including associated fees and penalties. The

Department encourages institutions to waive associated fees and/or

penalties that may have resulted from delays, actions, or needs related to

the pandemic.

5

o What the institution cannot do: Institutions cannot discharge a student’s

outstanding account balance, without prior written consent from the

student. As always, students have discretion about how they receive their

grants, and institutions must receive affirmative written consent from

students before using emergency financial aid grants to satisfy a student’s

outstanding account balance. In obtaining such affirmative written

consent, the Department encourages institutions to include a disclaimer

whereby students are expressly notified that they have the ability to

decline the emergency financial aid grant to pay off debts and instead may

use the funds for any component of the student’s cost of attendance or for

emergency costs that arise due to coronavirus, such as tuition, food,

housing, health care (including mental health care), or child care.

Solution #2: Discharge the student’s outstanding balance and count it as lost

revenue:

o What the institution can do: Institutions can discharge the complete

balance of the debt as lost revenue and reimburse themselves through their

HEERF grants, including associated fees and penalties.

6

o What the institution cannot do: The institution cannot condition, nor imply

that it will condition, discharging these funds on the condition the student

takes any specified actions (i.e., no conditioning a discharge of debt on

5

Fees and/or penalties that have increased from pre-pandemic rates must be “necessary and reasonable,” in

accordance with the Cost Principles in 2 CFR part 200 subpart E of the Uniform Guidance

.

6

For more information regarding using HEERF institutional grant funds to reimburse lost revenue, please see

our Lost Revenue FAQs

(March 19, 2021).

16

continued reenrollment). Additionally, institutions may only charge the

debt as lost revenue and reimburse themselves through one of the HEERF

programs (i.e., no double-dipping).

27. Question: What efforts to reengage students are allowable, and would not be classified as

impermissible “marketing and recruitment”?

Answer: The Department recognizes the personal and communal loss that can occur

when students are forced to delay or entirely forgo their postsecondary education. While

direct “marketing and recruitment” activities are an impermissible use of HEERF funds,

efforts to engage or reengage students who would otherwise be at risk of not completing

their college degrees as a result of coronavirus is a permissible use of HEERF funds that

can have a positive impact for students, institutions, and their local communities.

For example, HEERF institutional funds may be used for:

• Retention: To support additional academic or mental health support systems that

will help students to overcome additional barriers that have arisen as a result of

coronavirus that may otherwise prevent them from completing their education.

• Reengagement: Institutions can discharge the complete balance of a student’s

institutional debt as lost revenue and reimburse themselves through their HEERF

institutional grants, including associated fees and penalties, so students can re-

enroll, continue their education, or obtain their official transcript to transfer and/or

secure employment.

However, as noted, HEERF funds may not be used to pay for the costs of advertising (for

example, paid media, commercial advertising, recruitment services) to students.

Moreover, no portion of HEERF funds may be used to directly fund staff or contractor

salaries who are engaged in marketing and recruitment.

D. New Required Uses of Funds Questions

Practices to Monitor and Suppress COVID-19

28. Question: What does the requirement to spend HEERF grant funds to “implement

evidence-based practices to monitor and suppress coronavirus in accordance with public

health guidelines” mean?

Answer: This provision of ARP requires institutions to use some of their ARP (a)(1)

Institutional Portion funds to help fight the spread and transmission of COVID-19 on

their campuses and among their student, faculty, and staff community members.

7

This

provision also applies to future ARP awards the Department will make under (a)(2) and

(a)(3).

7

This provision also applies to future ARP awards the Department will make under (a)(2) and (a)(3).

17

It is critical that institutions take steps to prevent and mitigate the spread of coronavirus

on their campuses and local communities.

Congress did not prescribe any specific practices, strategies, or methods that institutions

must use to implement this required activity, and institutions have flexibility to carry out

activities tailored to their unique needs and circumstances that are evidence-based and in

accordance with public health guidelines. Congress also did not set a specific threshold or

amount of an institution’s ARP (a)(1) Institutional Portion funds that must be used to

implement this provision. Please see Question 35, below, for more information on

determining an appropriate expenditure level.

Some examples of allowable expenditures and activities include, but are not limited to,

costs associated with the following:

Testing:

• Establishing a diagnostic or screening testing strategy, such as setting up a testing

site, purchasing tests, or hiring additional personnel to administer tests.

• Hiring personnel to support contact tracing efforts in collaboration with local

public health authorities.

Prevention:

• Setting up vaccination sites on or off campus to bring the vaccine to students,

faculty, and staff, including costs of bringing sites to rural and satellite locations

and costs associated with building awareness and confidence of the vaccine

among students.

• Providing masks and other Personal Protective Equipment (PPE) to students,

faculty, and staff.

• Supporting clean and sanitary campus environments, including purchasing hand

sanitizer and handwashing stations that can be placed throughout the campus.

• Cleaning and disinfection.

• Enhancing ventilation in classrooms or common areas.

• Using mask campaigns to increase mask compliance on campus.

• Implementing physical distancing guidelines, such as modified layouts.

• Costs associated with vaccination efforts.

• Redesigning food service facilities.

• Developing training and communication systems to communicate with students.

Cost associated with campus and local outreach on the benefits of vaccination as a

virus-mitigation strategy.

Reducing Barriers to Vaccination:

• Paying for time off for staff to get the vaccine.

• Providing sick leave to employees to get vaccinated.

18

• Spreading awareness and building confidence in getting vaccinated, including

setting up clinics for students to receive vaccinations or other confidence and

awareness building efforts.

Supporting Students:

• Procuring additional space both on or off campus to house students and

supporting other costs associated with meeting the basic needs of students in

isolation and quarantine.

• Providing academic support services and mental health services for students in

isolation or quarantine.

• Supporting coping and resilience for students.

Additionally, the CDC has developed some COVID-19-focused resources tailored to

institutions of higher education here: https://www.cdc.gov/coronavirus/2019-

ncov/community/colleges-universities/index.html. This site includes “Considerations for

Institutions of Higher Education” available here: https://www.cdc.gov/coronavirus/2019-

ncov/community/colleges-universities/considerations.html. Also relevant are those

activities found on the Department’s Best Practices Clearinghouse.

29. Question: What are considered examples of “public health guidelines”?

Answer: Public health guidelines are generally those guidelines distributed by the CDC

and State, Territorial, Local, and Tribal Health Departments that recommend best

practices to fight the spread and transmission of COVID-19. Some public health

resources that include guidelines are the following:

• The Federal Government’s Coronavirus webpage: https://www.coronavirus.gov/

• The CDC’s public health guidelines: https://www.cdc.gov/coronavirus/2019-

ncov/communication/guidance.html

• The CDC’s State, Territorial, Local and Tribal Health Department search:

https://www.cdc.gov/coronavirus/2019-ncov/php/hd-search/index.html

As part of the proper administration of their HEERF grants, institutions should document

how they utilized public health guidelines in implementing this required activity.

Outreach to Financial Aid Applicants

30. Question: What does the requirement to spend HEERF grant funds to “conduct direct

outreach to financial aid applicants about the opportunity to receive a financial aid

adjustment due to the recent unemployment of a family member or independent student,

or other circumstances” mean?

Answer: This requires institutions to provide notice to financial aid applicants and

current financial aid recipients that they may be able to receive a financial aid adjustment

due to the recent unemployment of a family member or independent student, or other

19

circumstances. Federal Student Aid (FSA) notes the following for students and their

families:

Changes to Your Family’s Financial Situation

If you or your family’s financial situation has changed significantly from what is

reflected on your federal income tax return (for example, if you’ve lost a job or

otherwise experienced a drop in income), you may be eligible to have your

financial aid adjusted. Complete the FAFSA questions as instructed on the

application (including the transfer of tax return and income information), submit

your FAFSA form, then contact the school you plan to attend to discuss how your

current financial situation has changed. Note that the school’s decision is final and

cannot be appealed to the U.S. Department of Education.

Similarly, the Office of Postsecondary Education published guidance in January 2021

reminding financial aid administrators that they may use professional judgment to reduce

or adjust to zero the income earned from work for a student and/or parent if the student or

parent has received unemployment benefits. As such, institutions should work to

disseminate this opportunity widely for their financial aid applicants and make use of the

professional judgment authority as needed.

31. Question: What does “direct outreach” for this required activity mean?

Answer: “Direct outreach” requires an institution to actively engage financial aid

applicants and recipients regarding the opportunity to receive a financial aid adjustment.

Such outreach should be more than a passive notification of the opportunity to receive a

financial aid adjustment, such as posting this opportunity on the institution’s website.

Direct outreach is not considered advertising or recruiting.

Direct outreach could include, but is not limited to, any of the following:

• Email to students who receive financial aid,

• Mail to students who receive financial aid,

• Phone or voice communication,

• Webinar invitations, and

• In-person interviews or meetings.

Please note that direct outreach does not require in-person interaction to financial aid

applicants. Additionally, grantees are reminded that marketing is an impermissible use of

HEERF III funds. Please see Question 27 for more information.

32. Question: What does “other circumstances” for this required activity mean?

Answer: Other circumstances are generally any circumstances that impact the ability of a

financial aid applicant to afford their attendance at an institution and would therefore

make the student eligible to receive a financial aid adjustment. Please refer to Chapter 5

20

of the Federal Student Aid Handbook for additional guidance on the exercise of

professional judgment to account for special circumstances of a student.

Applicable to both required uses of funds

33. Question: Which institutions must implement these two required activities?

Answer: Any institution that receives an ARP (a)(1) Institutional Portion award (both

supplemental awards and new awards) or ARP (a)(2) or (a)(3) award must implement

these two required activities as part of the implementation of its HEERF III grant,

provided it has not allocated its entire institutional portion to emergency financial aid

grants for students.

34. Question: What does it mean that institutions must “use a portion of funds” on these two

required activities mean?

Answer: Congress did not set a specific threshold or amount that institutions must use to

implement these two required activities. As such, recognizing that each institution’s

needs and circumstances are different, institutions should be guided by the Cost

Principles in 200 CFR part 200 subpart E, which require that an institution spend a

reasonable and necessary portion of its HEERF grant funds in order to successfully

implement these two required grant activities.

35. Question: What should my institution do to document its expenditures under these two

required activities?

Answer: As noted in several places above, institutions should document how they

implemented these two required activities consistent with 2 CFR § 200.334. Specifically,

institutions should document (1) the strategies used to monitor and suppress COVID-19,

(2) the evidence to support those strategies, (3) how those strategies were in accordance

with public health guidelines, (4) the manner and extent of the direct outreach the

institution conducted to financial aid applicants, and (5) how the amount of the HEERF

grant spent on these two required activities was reasonable and necessary given the

unique needs and circumstances of the institution.

The Department is exploring following up by collecting more information on an

institution’s implementation of these two required activities in the 2021 HEERF Annual

Report to be submitted in early 2022.

21

E. Grant Administration Questions

36. Question: What are the quarterly reporting requirements for HEERF III grants?

8

Answer: Beginning with the second quarter 2022 quarterly report (due July 10, 2022)

institutions must complete and post on their websites using a new combined institutional

and student reporting form available here. This new form includes new reporting

categories on mental health spending, HEERF (a)(2) construction flexibilities, and lost

revenue and combines the separate institutional and student reporting requirements.

As before, this form must be conspicuously posted on the institutions’ website no later

than 10 days after the calendar quarter (January 10, April 10, July 10, and October 10) as

long as the institution’s HEERF grant is active.

Additional considerations and requirements:

• As before, each report is separate for the calendar quarter reporting period and not

cumulative.

• The Department encourages institutions to use HEERF grants to support student,

faculty, and staff mental health, as described in “Using HEERF Institutional

Portion Grant Funds to Meet the Mental Health and Substance Use Disorder

Needs of Students” guidance published on May 19, 2022.

• Please report using construction flexibilities for HEERF (a)(2) grantees in

accordance with the “Using HEERF (a)(2) Grant Funds for Construction,

Renovation, and Real Property Projects” guidance published on May 23, 2022.

• Please report on information regarding lost revenue expenditures in accordance

with the “HEERF Lost Revenue FAQs” guidance published on March 19, 2021.

• As before, institutions are encouraged to also submit their quarterly report to the

Department by emailing those reports as PDF attachments to

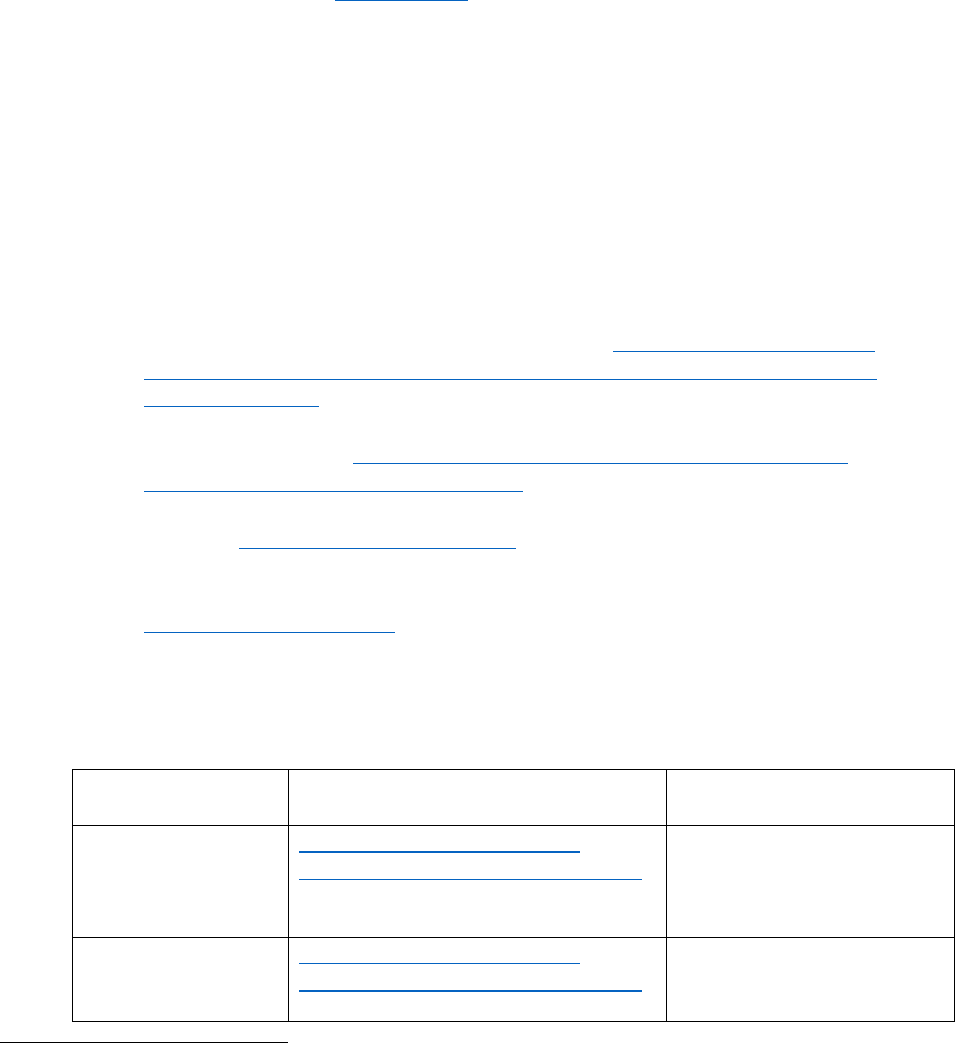

Since HEERF quarterly reporting has had several iterations, please see the chart below

for the forms and requirements that were applicable during different specific reporting

timeframes:

Reporting

Timeframe

Form(s) or Requirements

Applicable

Notes

Q2 – Q4 2020

Student Posting Requirement (2020)

Institutional Quarterly Report Form

(2020)

Institutional form was

effective from October 30,

2020 for Q2 and Q3 2020

reporting periods.

Q1 2021 – Q2 2021

Student Posting Requirement (2021)

Institutional Quarterly Report Form

(May 2021)

Reflects policy changes

effective with ARP

HEERF implementation.

8

This FAQ updated on October 25, 2022 with new reporting requirements effective for the July 10, 2022

quarterly reporting period.

22

Q3 2021 – Q1 2022

Student Posting Requirement (2021)

Institutional Quarterly Report Form

(September 2021)

Includes new institutional

form and specific

formatting requirements.

Q2 2022 – Forward

Combined New Form for

Institutional and Student Reporting

(July 2022)

Includes new categories

and combines student and

institutional reporting.

More information regarding quarterly reporting is available on our HEERF III ARP

website.

37. Question: What are the annual reporting requirements for HEERF III grants?

Answer: The Department will be collecting an annual report for HEERF III ARP

grantees. The Department will share more information regarding this annual report,

which will also require institutions to report on their uses of any remaining HEERF I

CARES Act funds and HEERF II CRRSAA funds, in advance of the ARP annual

reporting deadline.

38. Question: What auditing requirements apply to my institution?

9

Answer: Thorough and comprehensive auditing is an important component of

accountability in ensuring the appropriate use of HEERF grant funds. Depending on the

type of institution and the amount of HEERF or federal grant funds expended, your

institution may be required to have the HEERF grant programs (HEERF I, HEERF II,

and HEERF III) audited, or be subject to audit, for several institutional fiscal years.

More information regarding HEERF institution auditing is available in our March 8, 2021

HEERF Grant Program Auditing Requirements and Second Year HEERF Grant Program

Auditing Requirements letters.

39. Question: How long does my institution have to expend its HEERF III grant funding?

10

Answer: The Department announced on April 4, 2022 that the performance period of all

open HEERF grants at that time with a balance greater than $1,000 is extended through

June 30, 2023. This blanket extension is not considered a no-cost extension under 2 CFR

200.308(e)(2) and 34 CFR 75.261.

The Department understands that some grantees, even given the emergency nature of the

HEERF grant, may be unable to expend funds by this time. Consequently, no-cost

extensions (NCEs) of up to 12 months are available as provided for in 2 CFR §

200.308(e)(2). NCEs extend a grant’s period of performance. NCEs may not be exercised

merely for the purpose of using unobligated balances.

9

This FAQ updated on October 25, 2022 to include the newer HEERF Grant Program Auditing requirements

letter.

10

This FAQ updated on October 25, 2022 to reflect our Notice of Automatic Extension of Performance Period

for All Open Grants Issued Under the Higher Education Emergency Relief Fund (87 FR 19496, April 4, 2022).

23

Additionally, HEERF (a)(2) grantees with approved construction, renovation, or real

property projects may receive an additional project period extension beyond June 30,

2023 for the sole purpose of completing approved construction, renovation, or real

property project(s). More information regarding HEERF (a)(2) grantees and construction,

renovation, and real property project periods is available in our HEERF (a)(2) FAQs.

Please note that after the end of the grant period of performance, grantees must close out

their HEERF grants. For more information on winding down your HEERF grants, please

see Question 51.

40. Question: When should my institution draw down funds once they have been obligated

by the Department?

Answer: Although the entire amount of a grantee’s HEERF III grant award or

supplemental award will be available to the grantee as soon as it has been obligated by

the Department, under 2 CFR § 200.305(b), HEERF grantees are under an obligation to

minimize the time between drawing down funds from G5 and paying obligations incurred

by the grantee (liquidation).

If a HEERF grantee is using HEERF grant funds to make emergency financial aid grants

to students, the Department may evaluate for compliance with the rule grantees who have

not drawn down the funds from G5 and not paid the obligations (the emergency financial

aid grants to students) to the students within fifteen calendar days.

For all other allowable uses of institutional funds, the Department may evaluate grantees

who have not taken these steps within three calendar days. This enhanced flexibility for

student grant programs is because students may not accept and draw down their financial

aid grants from grantees’ accounts within the three day window, or an institution may

experience difficulties in contacting eligible students due to factors related to the

pandemic.

41. Question: My institution has received an ARP (a)(1) or (a)(4) supplemental award. Do I

have to begin drawing down funds by a certain date?

Answer: Yes. Institutions that receive an ARP (a)(1) or (a)(4) supplemental award(s)

must draw down any amount of its grant funds within 90 days of the date of each

supplemental award. Failure to draw down any amount of the institution’s award(s) may

constitute nonacceptance of the terms, conditions, and requirements of the Supplemental

Agreement and the Department may choose to deobligate and redistribute the ARP

supplemental grant funds or take other appropriate administrative action, up to and

including terminating the grant award pursuant to 2 CFR § 200.340. Please note this

requirement is the same as it was for CRRSAA (a)(1) supplemental awards.

42. Question: Can my institution charge expenses to my ARP award if those expenses were

incurred before March 11, 2021, the date of enactment of ARP?

24

Answer: Yes. Institutions may charge expenses associated with coronavirus (pre-award

costs) that were incurred on or after March 13, 2020, the day the national emergency was

declared due to the coronavirus, to their ARP awards.

43. Question: Can my institution charge indirect costs to its HEERF grants?

Answer: Indirect costs may be charged only to Institutional Portion awards, both new

and supplemental, and may not be charged to any student grant awards (under either ARP

(a)(1) or ARP (a)(4)) because the student allocation represents an amount of funds that

must be distributed to students.

Generally, this indirect cost rate will be the on-campus rate specified in an institution’s

negotiated indirect cost rate agreement. If an institution does not have a current

negotiated indirect cost rate with its cognizant agency for indirect costs, it may

appropriately charge the de minimis rate of ten percent of Modified Total Direct Costs

(MTDC).

11

Please note that as described in 2 CFR § 200.403, costs must be consistently charged as

either indirect or direct costs, but they may not be double-charged or inconsistently

charged as both. For more information, please see the Department’s Indirect Cost

website.

44. Question: Can my institution charge direct administrative costs to its HEERF grants?

Answer: Reasonable direct administrative costs may be charged only to Institutional

Portion awards, both new and supplemental, and may not be charged to any Student Aid

Portion awards (under either ARP (a)(1) or ARP (a)(4)) because the student allocation

represents an amount of funds that must be distributed to students.

Any direct administrative costs charged to the grant must be documented and, as with all

costs, must be reasonable and necessary for the performance of the grant per the Cost

Principles of the Uniform Guidance, 2 CFR part 200 subpart E.

45. Question: Under the Uniform Guidance requirements, institutions must receive prior

written approval (prior approval) for many types of costs under 2 CFR § 200.407. Is that

prior approval required for HEERF grants?

Answer: Generally, no. This FAQ extends the prior approval previously provided for

CARES Act and CRRSAA funds to now include prior approval for ARP grant funds for

the following cost items for all formula grants under the HEERF program from March

13, 2020 through the period of grant performance specified under your institution’s

GANs:

• § 200.308 Revision of budget and program plans

11

Please see “Direct and Indirect (F&A) Costs” in the Uniform Guidance, 2 CFR part 200, for more

information.

25

• § 200.313 Equipment

• § 200.430 Compensation—personal services, paragraph (h)

• § 200.431 Compensation—fringe benefits

• § 200.456 Participant support costs (defined at § 200.75)

• § 200.458 Pre-award costs

• § 200.475 Travel costs

All cost items charged under these categories must be documented and, as with all costs,

must be reasonable and necessary for the performance of the grant per the Cost Principles

of the Uniform Guidance, 2 CFR part 200 subpart E.

Please note that, per section 314(d)(3) of the CRRSAA (which applies to HEERF III

grants made under the ARP), senior administrator and executive salaries, benefits,

bonuses, contracts, and incentives; stock buybacks, shareholder dividends, capital

distributions, and stock options; and any other cash or other benefit for a senior

administrator or executive are not allowable costs under the HEERF program.

Other cost items listed in 2 CFR § 200.407 that require prior approval continue to require

the institution to seek approval from the Department prior to charging those cost items to

your HEERF grant. Please email your assigned education ED program contact as

indicated in Box 3 in your GAN with any questions.

46. Question: Do the Education Stabilization Fund (ESF) maintenance of effort (MOE)

requirements apply to the HEERF program?

Answer: No. The ESF MOE requirements in section 18008(a) of the CARES Act,

section 317(a) of CRRSAA, and section 2004(a)(1) of the ARP, apply to the Governors

of each State and each State educational agency (SEA) as recipients of the Elementary

and Secondary School Emergency Relief (ESSER) fund and the Governor’s Emergency

Education Relief (GEER) fund. HEERF institutional grantees are not required to meet

any ESF MOE requirements; however, States are required to maintain their State support

for higher education as a condition of its ESSER and GEER grants. More information

regarding State ESF MOE requirements is available in the Department’s Guidance on

Maintenance of Effort Requirements and Waiver Requests document (April 19, 2021).

47. Question: My institution received an automatic email alert about excessive cash

drawdowns because we drew down all our HEERF grant funds at one time. What

response, if any, is required of my institution?

Answer: Institutions that receive this notification that have validly incurred large

obligations should send an email to the ED program contact with the award number and a

summary of how funds were expended. This notification is triggered when grantees draw

down large balances, instead of gradually throughout the entire length of their

performance periods.

26

Because of the nature of the HEERF grant program, some institutions may have a large

expense that requires a drawdown of all or most of their HEERF grant funds at once. For

example, if an institution has determined which students will receive emergency financial

aid grants, it may incur an expense for all or most of its (a)(1) Student Aid Portion grant.

Once an institution has incurred these valid obligations (as opposed to drawing down

funds in advance of need; please see Question 40 for more information), a large

drawdown in your HEERF grant may prompt G5 to send an automated “Excessive Cash

Drawdown” email.

48. Question: My institution is merging or closing. What must we do?

Answer: Institutions that are merging or closing must immediately contact their assigned

ED program contact specified in Box 3 of your GAN, as required by the Supplemental

Agreement or Certification and Agreement.

12

The Department will provide specific

procedures for each merging or closing institution to follow, including (but not limited to)

procedures regarding allowability of grant transfers, auditing, reporting, and close-out

responsibilities. Institutions that fail to provide timely written notice to the Department of

their merging or closing may be subject to the enforcement actions described in Question

50.

49. Question: My institution’s HEERF grant(s) were placed on route pay status and my

institution is unable to draw down funds. What do we need to do to remove this status?

Answer: Your institution’s HEERF grants may have been placed on route pay status for

several reasons. Those could include:

• Your institution is suspected of being closed or closing soon

• Your institution has not complied with the HEERF quarterly or annual reporting

requirements (please see Questions 36 and 37 for more information)

• Your institution has been flagged for other performance or financial integrity

issues

Importantly, route pay status does not prohibit an institution’s use of HEERF grant funds;

it merely requires the institution to seek the Department’s prior authorization and

describe how an institution intends to use the grant funds before accessing funds and

drawing them down. Institutions that are on route pay status that are not sure why they

were placed on route pay are encouraged to contact their ED program contact specified in

Box 3 of their GAN with a copy to H[email protected]ov.

50. Question: What are some of the possible enforcement actions the Department can take

against institutions that misuse HEERF grant funds?

Answer: The Department has a range of possible enforcement actions for institutions that

have been identified as having an elevated risk or are suspected of improperly

12

The institution is also encouraged to send an email to HEERF@ed.gov with the subject “School Closing”.

27

administering their HEERF grant funds. Those actions include, but are not limited to, the

following:

• Heightened or more frequent reporting, monitoring, or auditing of your

institution.

• Placing your HEERF grants on “Route Payment Status.” This freezes the ability

of your institution to draw down any remaining HEERF grant funds absent the

prior authorization of the Department.

• Placing your institution on “High Risk Status.” This flags your institution as a

high-risk institution and impacts the ability of your institution to receive other

Department grants and may bring scrutiny of your institution from our Office of

Inspector General (OIG).

• Initiate suspension or debarment proceedings for culpable individuals as

authorized under 2 CFR part 180 and other authorities.

• Terminating your institution’s HEERF grants. Grant termination is publicly

reported governmentwide, and it may trigger additional auditing or investigatory

efforts.

51. Question: My institution has expended all the funds associated with one of its HEERF

grants and is preparing to close out this grant. What must we do?

Answer: Institutions that are winding down their HEERF grants must do the following to

comply with the close out requirements described in 2 CFR § 200.344:

• Contact the ED Program Contact listed in Box 3 of your GAN.

• Ensure that they have liquidated remaining funds for expenditures incurred during

the grant period of performance. Per recent changes to the Uniform Guidance,

institutions now have 120 calendar days to liquidate all financial obligations

incurred under the award after the period of performance.

13

• Ensure that all quarterly reporting is properly publicly posted online and

submitted to the Department as required by the HEERF Quarterly Reporting

requirements (please see Question 36). Additionally, public quarterly reports

should remain online for a period of at least three years after the submission of the

last quarterly or annual performance report.

• Submit the annual performance report covering the last period of grant

performance when the Department opens the system for annual performance

reporting.

• Maintain all grant financial records, supporting documents, statistical records, and

all other entity records pertinent to the HEERF grant award for a period of three

years from the date of submission of the last quarterly or annual performance

report per 2 CFR § 200.334.

13

If an institution has as determined that it does not need some or all of our ARP supplemental funds, that

institution may submit the Voluntary Decline of HEERF Grant Funds form to HE[email protected]ov

that

allows an institution to formally decline a specified amount of unneeded HEERF grant funds by August 11,

2021.

28

• Submit all required audits as described in Question 38 and the Department’s

March 8, 2021 HEERF Grant Program Auditing Requirements and Second Year

HEERF Grant Program Auditing Requirements letters.

52. Question: Which previously issued HEERF FAQs and documents apply to the HEERF

III programs?

Answer: The following FAQ documents remain, in whole or in part, applicable to the

HEERF III ARP programs (unless superseded by the text of ARP):

• Lost Revenue FAQs (issued on March 19, 2021)

• CRRSAA HEERF II (a)(1) FAQs (issued on January 14 and updated March 19,

2021)

• CRRSAA HEERF II (a)(4) FAQs (issued on January 14 and updated March 19,

2021)

• HEERF CARES Act Rollup FAQs (issued October 14, 2020 and revised January

28, 2021)

• HEERF Grant Program Auditing Requirements Letter (issued on March 8, 2021)

The Department intends to consolidate all applicable HEERF FAQs into a single

document in the near future for ease of program administration and compliance.

53. Question: Where can I obtain more information about the HEERF programs?

Answer: Institutions should regularly check our HEERF III ARP website for the latest

ARP information and program guidance. For earlier CARES Act and CRRSAA

information and program guidance, please visit either the HEERF CARES Act website or

the HEERF II CRRSAA website.