April 2015

Beyond the hype

What is the value of

customer satisfaction to

aregulated utility?

Beyond the hype: What is the value of customer satisfaction to aregulated utility?2

Beyond the hype

What is the value of customer

satisfaction to aregulated utility?

3

The “traditional”

customer-utility model

is rapidly evolving as a

result of new technology,

competition, an evolving

smart grid, and an

increasingly tech-savvy

consumer class. Across

industries, businesses

are being told that

customer satisfaction

should be a priority, and

that it’s not only good

for customers, it’s good

for business. However,

do happier customers

translate into real value

for utilities, especially

regulated monopolies with

a captive customer base?

This question has been

difcult to answer with

certainty—even as these

same utilities dedicate

signicant resources to

play catch-up in providing

a superior experience

that can increase

customersatisfaction.

To get to an answer that goes beyond

the hype, we’ve conducted research

focused specically on answering “what

is the value of customer satisfaction to a

regulated utility?” The short answer is:

Customer satisfaction does translate

into real and tangible value for power

and utility companies in a number

of ways and is indeed better for

business.

Overview of key ndings:

• Customer satisfaction is clearly

an important factor in regulatory

outcomes. While our analysis

does not point to a direct cause-

and-effect relationship between

customer satisfaction levels and

higher authorized returns on rate

base, maintaining a minimum level of

customer satisfaction appears to make

a difference when regulated utilities

seek a rate increase.

• Customer satisfaction as a

competitive differentiator can be

instrumental for utilities seeking

growth via new unregulated

services and products, or

protecting their core business from

disruptive entrants. Higher levels of

consumer trust and condence can

raise the barriers for market entrants

creating disruption and discourage

your customer base from making a

change to an unknown and untried

service provider.

• Utilities are investing in customer

experience and the baseline

customer satisfaction level is rising.

There appears to be a race among

utilities to deliver the best experience

within the industry and the bar for

staying in the top quartile of customer

satisfaction keeps getting reset—

andhigher.

To keep pace with the “changing

customer”, utilities should create the

foundation for a superior experience

by simplifying complex interactions,

personalizing interactions through the

application of advanced analytics to

customer data, and proactively seek

opportunities and take actions that drive

customer loyalty. Now is the time to

act: because consumers today are more

engaged with their energy consumption

and do so through various technology

tools and mediums, utilities have an

enviable opportunity to shape the

customer experience in ways that may

not have been previously possible.

In the sections to follow, we’ll explore

further what it “means” to have satised

customers drive value for your business,

and offer recommendations on the

actions to take to get the greatest value

from customer experience investments.

4 Beyond the hype: What is the value of customer satisfaction to aregulated utility?

What are the tangible benets to

having “Satised Customers”?

Customer satisfaction is a measure

of the positive experience customers

have when interacting with a company

and thus can be viewed as an outcome

of a positive customer experience.

Maintaining at least a minimum level

of customer satisfaction appears to

make a difference in the rate case

process when regulated utilities seek

to establish the return on their rate

base. Our analysis suggests there is

a relationship between the customer-

satisfaction metric developed by J.D.

Power and Associates and the outcomes

of these regulated utilities’ requests for

rate increases. Utilities with a lower

score in the customer satisfaction metric

appear less likely to receive a high

portion of their requested return on

ratebase.

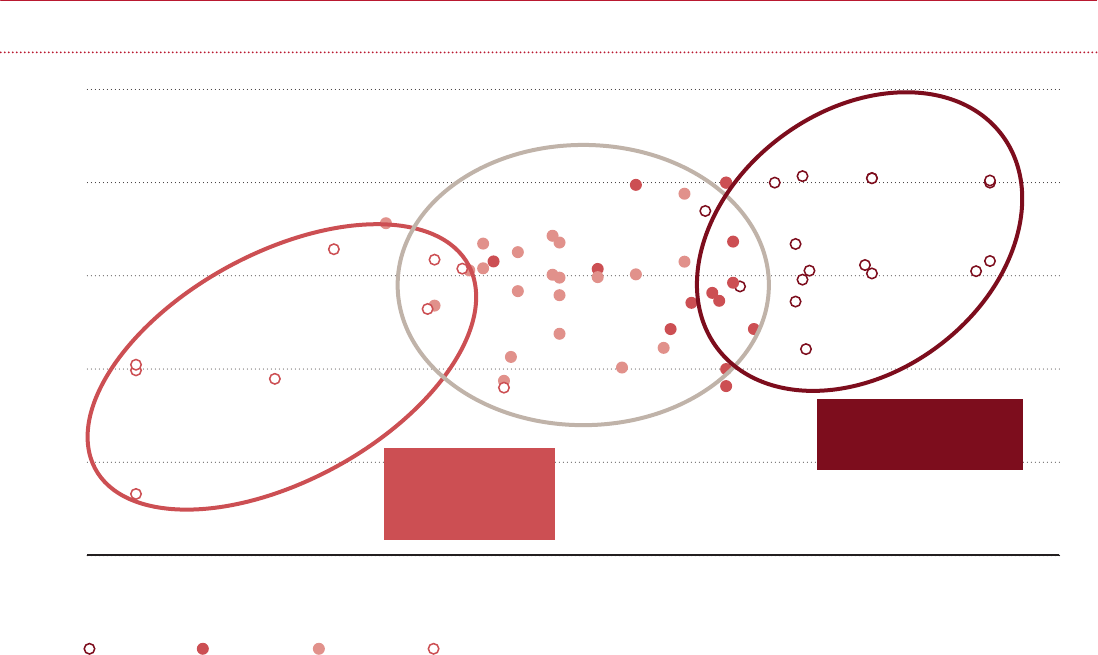

Although there are many factors that

inuence regulatory outcomes, we

found that utilities with lower customer

satisfaction than their industry peers

were less successful in rate negotiations.

Specically, utilities in the bottom

quartile of customer satisfaction were

granted a lower percentage of the

requested rate of return than utilities in

the top quartile (see Figure)

550 570 590 610 630 650 670 690

0.80

0.85

0.90

0.95

1.00

1.05

Utilities with higher customer satisfaction achieved better regulatory outcomes

Utility rate case success compared to Customer Satisfaction (CSAT)

Percent of requested RORB authorized

Customer Satisfaction Score (JDP, actual, 2009-2013)

THE FLOOR: Utilities

in the bottom quartile

saw a steep drop in

regulatory returns

THE CEILING: There is a

point of diminishing

returns to improving CSAT

Quartile 1 Quartile 2 Quartile 3 Quartile 4

*Percent of requested Return on Rate Base calculated

as the ratio of requested RORB and actual RORB

for each case of rate adjustment published in SNL

Rate Case History reports. Customer Satisfaction

score in each year corresponding to rate request is

plotted to the ratio. Source: JD Power Gas Utility

Industry reports (2009, 2010, 2011, 2012 and 2013);

SNL Industry reports and Rate Case History, data

obtained 11/01/2014

Note: Companies represented in each plot may vary,

according to available information and data

The debt component of return on rate base is based

on interest rates of outstanding debt and often has

a smaller delta between requested and authorized

amounts. Thus, the benefits of higher customer

satisfaction would contribute primarily to the negotiation

over the equity component of return on rate base.

5

Customer satisfaction is a measure of the positive

experience customers have when interacting with a

company and thus can be viewed as an outcome of a

positive customer experience.

While our analysis has not

found a direct cause-and-

effect relationship between

customer satisfaction levels

and authorized rate of returns,

customer satisfaction is clearly

an important factor in regulatory

negotiations.

Customer satisfaction levels often

receive higher attention from regulators

in the aftermath of widespread

reliability issues, such as following major

storms, or when customer satisfaction

is consistently low or has recently

declined. In such contexts, utilities can

expect heightened regulatory scrutiny

of their customer-service performance.

For example, after a utility experienced

a decline in customer satisfaction

levels over a two year period, the State

Public Service Commission required an

audit of this utility’s customer-service

practices. The audit report attributed

the decline to aggressive cost cutting,

a failed implementation of a new

online customer channel, and a lack

of commitment to customer service. In

response, the utility made an investment

to improve customer service, particularly

through digital channels. The utility

invested capital and increased operating

expenses to shore up the customer

service function and regain customer

satisfaction which ultimately eroded

the cost savings they had originally

achieved.

How do I capture the full benets

of customer satisfaction?

To capture the full benets of customer

satisfaction, utilities need to regard

themselves as incumbents in their core

business and, potentially, as entrants

into new service areas. In each role,

they will have specic opportunities

to make investments in customer

service and operations that promote

customer satisfaction and help to

differentiate them from the competition.

Higher levels of consumer trust and

condence can raise the barriers for

market entrants creating disruption and

discourage your customer base from

making a change for an “unknown”

and “untried” service provider. Our

analysis suggests that utilities in general

“agree” as investments in customer

experience along with baseline customer

satisfaction levels are rising. And, the

bar for staying in the top quartile of

customer satisfaction keeps getting

reset—and higher as the race among

utilities to deliver the best experience

within the industry is intensifying.

When exploring new services or

products, utilities should consider the

experience that incumbents deliver and

the corresponding level of customer

satisfaction. A new entrant must deliver

a superior experience and exceed

current customer expectations to grab

market share and grow revenue. On

the other hand, to defend their core

business against innovative, disruptive

entrants, utilities need to maintain their

focus on customer satisfaction through

continual improvements in customer

service and innovative product and/or

serviceofferings.

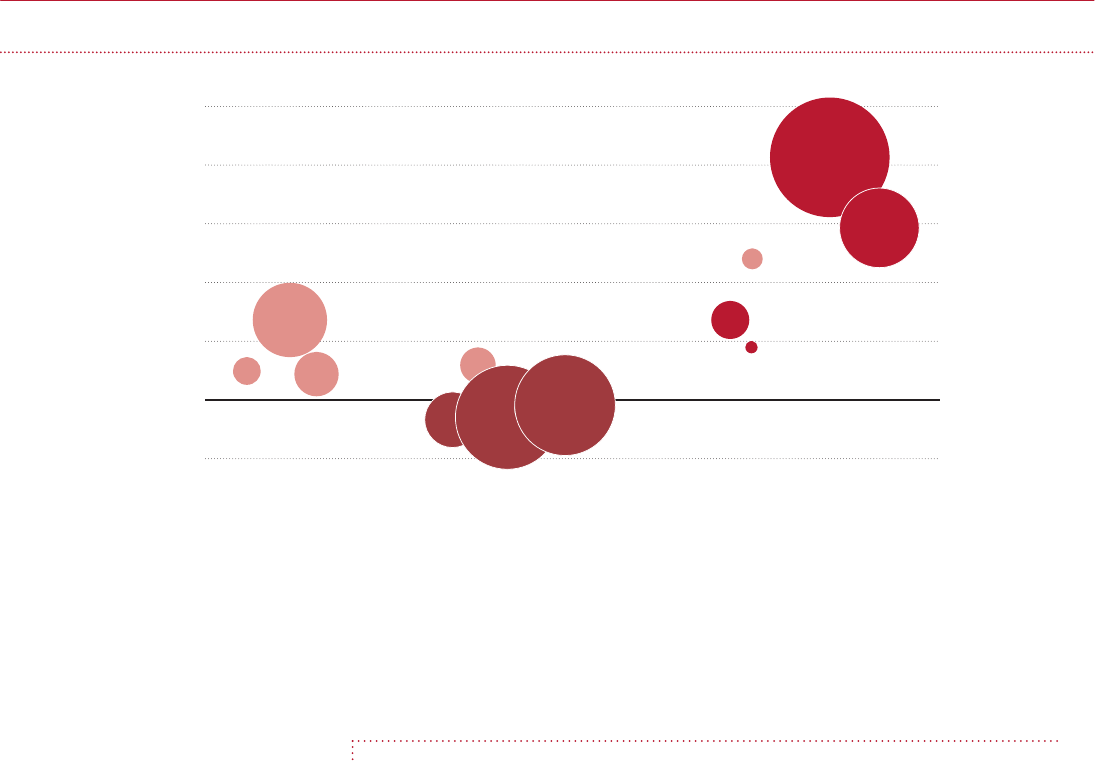

Certain industries have been disrupted

by new entrants that deliver especially

high customer satisfaction. Netix,

Apple, and Amazon are some companies

that are harnessing technology to

deliver impressive customer experiences

and consequently are achieving high

customer satisfaction levels and revenue

growth, as shown below.

6 Beyond the hype: What is the value of customer satisfaction to aregulated utility?

55 60 65 70 75 80 85 90

-10%

0%

10%

20%

30%

40%

50%

Amazon

Charter

Comcast

Time Warner

Sprint

DirecTv

AT&T

Verizon

eBay

Netflix

Overstock

Apple

T—Mobile

Revenue growth compared to CSAT

Across industries, companies delivering higher customer satisfaction levels have also seen significant increases in revenue CAGR.

Total Revenue CAGR (2009–13)

Average customer satisfaction score (ACSI, 2009–13)

Size of the bubble based on 2013 revenue

*Source: ACSI Customer Satisfaction by company; Financial data sourced from SNL Company snapshots

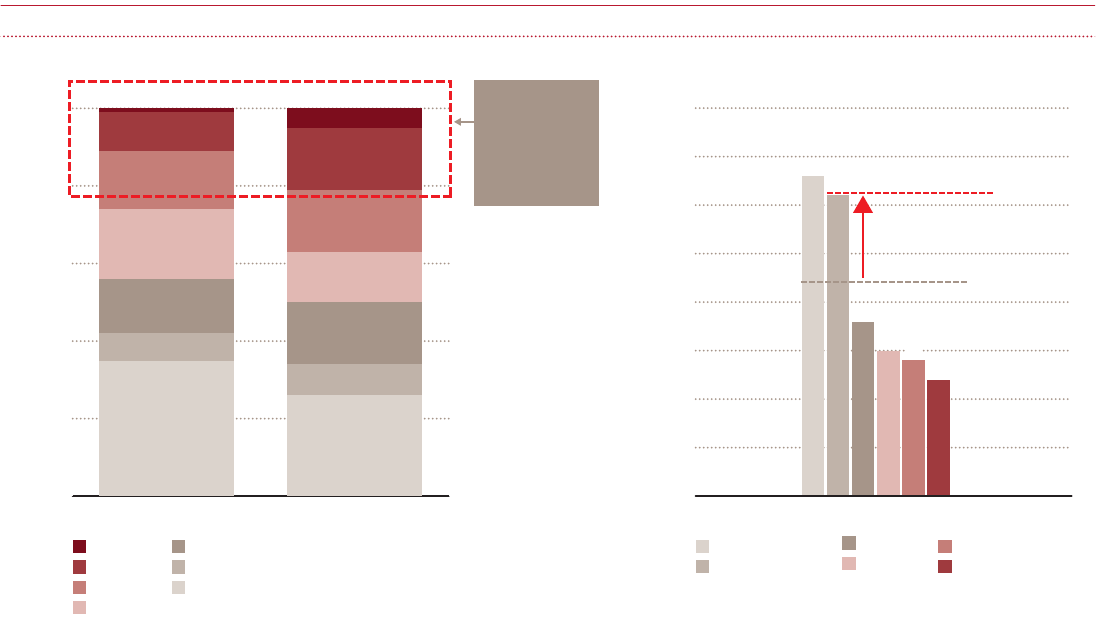

The airline industry provides another example

where higher customer satisfaction can have an

impact on market share growth.

7

*Source: United States Department of Transportation, Bureau of Transport

Statistics, http://www.transtats.bts.gov/Data_Elements.aspx; ACSI Customer Satisfaction index for airline industry

0%

20%

40%

60%

80%

100%

20132002

50%

55%

60%

65%

70%

75%

80%

85%

90%

2013

Jet Blue

Southwest

Delta

United

US Airways

Other airlines

American

Share of domestic revenue passenger miles (%)

ACSI Customer satisfaction score

26%

62

65

68

81

83

8%

16%

13%

16%

16%

5%

35%

7%

14%

18%

15%

10%

1%

JetBlue Airways

Southwest

US Airways

United

Delta

American

64

Airline Industry—Market share vs. CSAT

Southwest’s

market share

has increased

by 60%,

a 4% CAGR

over the period

8 Beyond the hype: What is the value of customer satisfaction to aregulated utility?

In these examples, high customer

satisfaction is clearly not the only driver

of revenue and market share gains.

However, it is difcult to ignore the

high customer satisfaction achieved

by companies such as Netix or

Southwest, as a leading indicator of the

differentiated customer experience and

its role in capturing market share.

How do I keep up with evolving

customer demands and create a

superior customer experience?

Solar panels and energy management

devices, among other technologies

have opened up a new world of energy

supply and control possibilities for

customers. As a result, some customers

are becoming more attuned to their

energy consumption and thinking

about their energy and the relationship

with their utility in new and different

ways. For the incumbent utility, the

increased penetration of advanced

metering infrastructure (AMI) and

“behind the meter” devices has

created more potential interactions

between customers and their energy

utilities. This means there are

more opportunities to please—or

displease—customers with the service

they receive. Moreover, customers

are demanding multichannel access to

utilities through call centers, web sites,

mobile apps, and walk-in centers. They

want the convenience and availability

of digital technology, including mobile

and social media, to enable easier

and simplied use of services, get

information from the utility and other

customers, and express their opinions.

To meet these evolving customer demands

for digitally supported interactions,

utilities should:

1. Create the foundation. To simplify

complex interactions and create

enjoyable experiences, utilities

should focus on their highest-volume

interactions—billing, eld service,

and outages. The start-service

experience should be the highest

priority, so that new customer

relationships begin with a positive

rst impression. Utilities should

segment the start-service experience

into each of its components, from

receiving the request and initiating

service to providing the rst bill, and

strive for excellence throughout the

end-to-end process.

2. Personalize interactions. Today’s

consumers expect personalized

interactions, which means that

utilities must take a more ne-grained

approach to providing products and

services than traditional customer

segmentations allow for. Fortunately,

by applying advanced analytics to

increasingly available customer

data, utilities can gain insights

into customer preferences on an

individual level and tailor products

and services accordingly—offering

them at the right time and through

the right channel. Understanding the

preferences of self-service customers

is critical. In addition, timely and

personalized communications about

outage events can work to ease

customer dissatisfaction during

uncertain and emotional situations.

3. Add value. When designing a

personalized customer experience,

it is essential that utilities maintain

a sharp focus on providing value-

added products and services. This

value-added focus will require a

signicant mindset shift for utilities

that have spent generations providing

commoditized products and

services to ratepayers. The ultimate

aspiration should be to motivate

customers to proactively pursue new

and different ways to engage with

a utility, in contrast to customers

regarding such interactions as a

necessaryinconvenience.

For many utilities, the starting point on

the journey to providing a value-added

customer experience will begin with

applying this new mindset to customer

service and operations. Utilities can

apply advanced analytics to anticipate

customer behavior and take proactive

steps to resolve situations before they

become bigger problems. For example,

analyses of customer inquiries can be

used to proactively address area-wide

service problems and resolve issues

before most customers contact the

utility. The mobile and social media

strategies included in the foundation of

the customer experience are essential

elements of a value-added approach to

service and operations. Utilities should

strive for mobile and social interactions

that enhance service and operations and

provide measurable outcomes.

Utilities have traditionally taken pride in providing

“safe, reliable, and affordable” energy and this

promise should continue to lie at the heart of their

value proposition.

9

Beyond value-added customer service

and operations, utilities that provide

a truly superior customer experience

will offer innovative products and

services that meet “customers”

evolving needs. Achieving this goal will

require building capabilities to identify

what customers really want based on

analyses of consumption and behavior.

Utilities may also want to accelerate

the speed of product development to

keep pace with rapidly changing trends

anddemands.

As incumbents, utilities should take

advantage of their position to become

the “go-to resource” for meeting

customers’ evolving energy needs.

Success will require creating an

ecosystem of partners to serve broader

customer wants and expectations, such

as connecting customers with ancillary

energy services—including solar

providers, water heater installation, and

energy efciency products.

What can I do now?

A utility should take three steps

to begin its journey to providing a

superior customer experience and

promoting world-class levels of customer

satisfaction. Utilities that fail to master

any one of these steps are likely to fall

short of their customer-experience goals.

First, utilities should dene a

customer experience that is aligned

with their brand promise. Utilities

have traditionally taken pride in

providing “safe, reliable, and affordable”

energy and this promise should

continue to lie at the heart of their value

proposition. However, some utilities may

wish to expand their brand promise,

striving to become customers’ “go to”

energy adviser. For example, Powershop,

a New Zealand company, has achieved

world-class customer satisfaction ratings

by dening itself as an electric utility

“where you make the rules.” Customers

can instantly access their energy usage

and costs, pay in advance or as they

use energy, and take advantage of

frequentdiscounts.

Utilities should conduct a formal

maturity assessment to understand their

current performance in each of the ve

attributes of customer experience.

For some utilities, this assessment

will reveal areas of strength for which

continued investment will create

a valuable source of competitive

differentiation and brand building.

However, most utilities are likely

to nd one or more attributes

requiring additional investments to

reach the levels expected by today’s

demandingconsumers.

Quality

Performance and

value received

Support

Friendliness and ease

of receiving help

Convenience

Anywhere,

anytimeaccess

Presentation

Aesthetics, arrangement,

and pride in presentation

Community

Customer’s personal brand

and connections with others

Five attributes of customer experience.

10 Beyond the hype: What is the value of customer satisfaction to aregulated utility?

Second, utilities should take an

inventory of all projects, programs,

and committees that are trying

to move the needle on customer

experience and satisfaction, such

as website redesign or social media

strategy denition. These efforts

are often dispersed throughout an

organization and conducted without

central oversight. Once a utility has

identied “who, what, when, and

where” for each of these initiatives, it

should seek to centrally coordinate them

and give them executive-level oversight

and exposure. To build momentum

and seize opportunities to innovate, all

initiatives should aim to achieve small,

agile improvements at a fast pace and

allow for continual renements along

the way. In today’s rapidly changing

environment, big capital projects

related to customer experience are at

risk of obsolescence before they can

deliverresults.

Finally, utilities need to transition

to a culture in which employees are

focused on the customer experience

and prepared to design and support

innovative approaches that raise

customer satisfaction. Customer

experience programs will not deliver

their intended results without such a

supporting culture. Transitioning from

an engineering culture to a customer-

centered culture is a signicant change

and will require training and new

organizational enablers.

Utilities that apply these insights and

dene a robust customer-experience

strategy can be better positioned to

weather the challenges of evolving

customer demands and a changing

customer-utility business model.

Utilities successful in securing satised

customers stand to gain tangible

business benets that go beyond simply

having “happy customers.”

11

www.pwc.com

To have a deeper conversation

about how this subject

may affect your business,

please contact:

Jim Curtin

PwC | Principal

+1 (281) 794 2698

james.m.curtin@us.pwc.com

Geoff Plese

PwC | Managing Director

+1 (678) 419 1585/+1 (678) 428 3876

geoffrey.e.plese@us.pwc.com

H. Austin Clark

PwC | Senior Manager—Lead Power &

Utilities Analyst

+1 (401) 419 4035

austin.clark@us.pwc.com

© 2015 PricewaterhouseCoopers LLP, a Delaware limited liability partnership. All rights reserved. PwC refers to the US member firm, and may sometimes refer to the

PwC network. Each member firm is a separate legal entity. Please see www.pwc.com/structure for further details. This content is for general information purposes only,

and should not be used as a substitute for consultation with professional advisors. MW-15-1920

pwc.com