7MAR202104151341

16FEB201120481109

7MAR202104154117

7MAR202104153130

7MAR202104154259

7MAR202104153974

7MAR202104152545

500 Jackson Street, Box 3005, Columbus, Indiana 47202-3005

11

8

NOTICE IS HEREBY GIVEN that the 2021 Annual Meeting of the Shareholders of Cummins Inc. will be held

virtually on Tuesday, May 11, 2021, at 11:00 a.m. Eastern Time, for the following purposes:

to elect the thirteen nominees named in the attached proxy statement as directors for the ensuing year;

to consider an advisory vote on the compensation of our named executive officers;

to ratify the appointment of PricewaterhouseCoopers LLP as our auditors for 2021;

VOTING

to consider a proposal from a shareholder regarding professional services allowance for our named

executive officers; and

to transact any other business that may properly come before the meeting or any adjournment thereof.

Due to the ongoing public health impact of the coronavirus outbreak (COVID-19) and to support the

health and well-being of our employees, shareholders and other stakeholders, the Annual Meeting of

Shareholders will be held in a virtual meeting format only. You will not be able to attend the Annual

Meeting physically.

Only shareholders of our Common Stock of record at the close of business on March 8, 2021, are entitled to

notice of and to vote at the meeting.

If you do not expect to be present virtually at the meeting, you are urged to vote your shares by telephone, via

the Internet, or by completing, signing and dating the enclosed proxy card and returning it promptly in the

envelope provided.

You may revoke your proxy card at any time before the meeting. Except with respect to shares attributable to

accounts held in the Cummins Retirement and Savings Plans, any shareholders entitled to vote at the annual

meeting who attend the meeting will be entitled to cast their votes electronically during the meeting.

SHARON R. BARNER,

Secretary

March 29, 2021

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2021 ANNUAL

SHAREHOLDER MEETING TO BE HELD ON MAY 11, 2021:

the Annual Report and Proxy Statement are available at www.proxyvote.com

DATE

NOTICE OF 2021

TIME

ANNUAL MEETING OF

SHAREHOLDERS

To Our Shareholders:

RECORD DATE

1.

2.

3.

4.

5.

BY THE INTERNET

BY TELEPHONE

BY MAIL

May 11, 2021

11:00 a.m. Eastern Time

March 8, 2021

Visit the website noted on your

proxycard to vote online.

Use the toll-free telephone number

on your proxy card to vote by

telephone.

Sign, date, and return your proxy

card in the enclosed envelope to

vote by mail.

TABLE OF CONTENTS

NOTICE OF 2021 ANNUAL MEETING OF SHAREHOLDERS

PROXY STATEMENT FOR 2021 ANNUAL SHAREHOLDERS MEETING

PROXY SUMMARY 1

CORPORATE GOVERNANCE 7

ELECTION OF DIRECTORS (Items 1 through 13 on the Proxy Card) 16

NOMINEES FOR BOARD OF DIRECTORS 16

EXECUTIVE COMPENSATION 26

ADVISORY VOTE ON THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

(Item 14 on the Proxy Card) 71

RATIFICATION OF INDEPENDENT PUBLIC ACCOUNTANTS (Item 15 on the Proxy Card) 72

SHAREHOLDER PROPOSAL (Item 16 on the Proxy Card) 76

STATEMENT IN OPPOSITION 77

STOCK OWNERSHIP OF DIRECTORS, MANAGEMENT AND OTHERS 79

OTHER BUSINESS 81

ANNEX A RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

16FEB201120481109

We are furnishing this proxy statement in connection with the solicitation by our Board of Directors of proxies to be voted at our 2021 Annual Meeting

of Shareholders to be held on Tuesday, May 11, 2021, and at any adjournment thereof, which we refer to as our ‘‘Annual Meeting.’’ This proxy

statement, together with the enclosed proxy card, is first being made available to our shareholders on or about March 29, 2021.

Holders of our Common Stock of record at the close of business on March 8, 2021 are entitled to vote at the Annual Meeting. On that date there

were issued and outstanding 146,544,468 shares of Common Stock, each of which is entitled to one vote on each matter submitted to a shareholder

vote at the Annual Meeting.

Each share of Common Stock represented by a properly executed and delivered proxy card will be voted at the Annual Meeting in accordance with

the instructions indicated on that proxy card, unless such proxy card has been previously revoked. If no instructions are indicated on a signed proxy

card, the shares represented by such proxy card will be voted as recommended by our Board.

A shareholder may revoke his or her proxy card at any time before the Annual Meeting by delivering to our Secretary written notice of such

revocation. This notice must include the number of shares for which the proxy card had been given and the name of the shareholder of such shares

as it appears on the stock certificate(s), or in book entry form on the records of our stock transfer agent and registrar, Broadridge Corporate Issuer

Solutions, Inc., evidencing ownership of such shares. In addition, except with respect to shares attributable to accounts held in the Cummins

Retirement and Savings Plans (the ‘‘Cummins RSPs’’), any shareholder who has executed a proxy card but is present virtually at the Annual Meeting

will be entitled to cast his or her vote electronically instead of by proxy card, thereby canceling the previously executed proxy card.

Participants in the Cummins RSP who hold shares of Common Stock in their account and provide voting instructions to the trustee with respect to

such shares will have their shares voted by the trustee as instructed. Such participants will be considered named fiduciaries with respect to the shares

allocated to their accounts solely for purposes of this proxy solicitation. If no voting instructions are provided, shares held in the accounts will be voted

in the same manner and proportion as shares with respect to which valid voting instructions were received. Any instructions received by the trustee

from participants regarding their vote shall be confidential. Cummins RSP participants may attend the Annual Meeting virtually but cannot vote the

shares in their Cummins RSP accounts at the Annual Meeting.

Due to the global COVID-19 pandemic, we will conduct a virtual Annual Meeting to help protect the safety of all stakeholders. Our virtual Annual

Meeting will be conducted on the Internet via live webcast. You will be able to participate online and submit your questions during the Annual Meeting

by visiting www.virtualshareholdermeeting.com/CMI2021. Shareholders will be able to vote their shares electronically during the Annual Meeting.

To participate in the Annual Meeting, you will need the 16-digit control number included on your proxy card or your voting instruction form. The

Annual Meeting will begin promptly at 11:00 a.m. Eastern Time. We encourage you to access the Annual Meeting prior to the start time. Online

access will begin at 10:45 a.m. Eastern Time.

PROXY STATEMENT FOR 2021

ANNUAL SHAREHOLDERS MEETING

Generally

Information About the Virtual Annual Meeting

Attendance and Participation

The virtual Annual Meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops,

tablets, and cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet

connection wherever they intend to participate in the Annual Meeting. Participants should also allow plenty of time to log in and ensure that they can

hear streaming audio prior to the start of the Annual Meeting.

Following adjournment of the formal business of the Annual Meeting, the chairman will give a presentation about the company’s business. At the

conclusion of this presentation, the company will address appropriate general questions from shareholders regarding the company. Shareholders

eligible to vote may submit questions to the chairman by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/CMI2021,

typing a question into the ‘‘Ask a Question’’ field, and clicking ‘‘Submit.’’

Your question or comment should be addressed to the chairman, who will either respond or refer it to others as appropriate. Time permitting, the

chairman will attempt to answer as many questions as possible. It will help us if questions are succinct and cover only one topic per question.

Questions from multiple shareholders on the same topic or that are otherwise related may be grouped, summarized and answered together.

If there are any matters of individual or personal concern to a shareholder and not of general concern to all shareholders, or if a question posed was

not otherwise answered, such matters may be raised separately after the Annual Meeting by contacting Investor Relations at www.cummins.com.

Recording of the Annual Meeting is prohibited. A webcast playback, including responses to shareholder questions, will be available at

www.virtualshareholdermeeting.com/CMI2021 24 hours after the completion of the meeting.

Technical support, including related technical support phone numbers, will be available on the virtual meeting platform at

www.virtualshareholdermeeting.com/CMI2021 beginning at 10:45 a.m. Eastern Time on May 11, 2021 through the conclusion of the Annual Meeting.

IMPORTANT: If you hold your shares in a brokerage account, you should be aware that, due to New York Stock Exchange, or NYSE,

rules, if you do not affirmatively instruct your broker how to vote within 10 days prior to our Annual Meeting, your broker will not be

permitted to vote your shares (i) for the election of directors; (ii) on the advisory vote on the compensation of our named executive

officers; or (iii) on the shareholder proposal regarding professional services allowance for our named executive officers. Therefore, you

must affirmatively take action to vote your shares at our Annual Meeting. If you do not affirmatively vote your shares, your shares will

not be voted (i) for the election of directors, (ii) on the advisory vote on the compensation of our named executive officers, or (iii) on

the shareholder proposal regarding professional services allowance for our named executive officers.

Questions

Technical Difficulties

11JAN202009361989

17FEB202103565207 17FEB202103565207 17FEB202103565207

11JAN202009360258

17FEB20210356520717FEB202103565207 17FEB202103565207

11JAN202009354787

17FEB20210356520717FEB202103565207 17FEB202103565207

11JAN202009354447

17FEB202103565207 17FEB202103565207

7MAR202104151194

11JAN202009361165

17FEB20210356520717FEB20210356520717FEB202103565207

7MAR202108425555

17FEB202103565207 17FEB202103565207

7MAR202104151194

11JAN202009360787

17FEB20210356520717FEB202103565207

7MAR202104151194

11JAN202009354048

17FEB202103565207 17FEB202103565207

7MAR202104151194

11JAN202009361506

17FEB20210356520717FEB202103565207 17FEB202103565207

11JAN202009362310

17FEB202103565207 17FEB202103565207

7MAR202104151194

11JAN202009355147

17FEB202103565207 17FEB202103565207 17FEB202103565207

7MAR202103254383

17FEB202103565207 17FEB202103565207 17FEB202103565207

11JAN202009355501

7MAR20210415119417FEB202103565207

1

This summary highlights selected information contained in this proxy statement, but it does not contain all the information you should

consider. We urge you to read the whole proxy statement before you vote. This proxy statement is being made available to shareholders

on or about March 29, 2021.

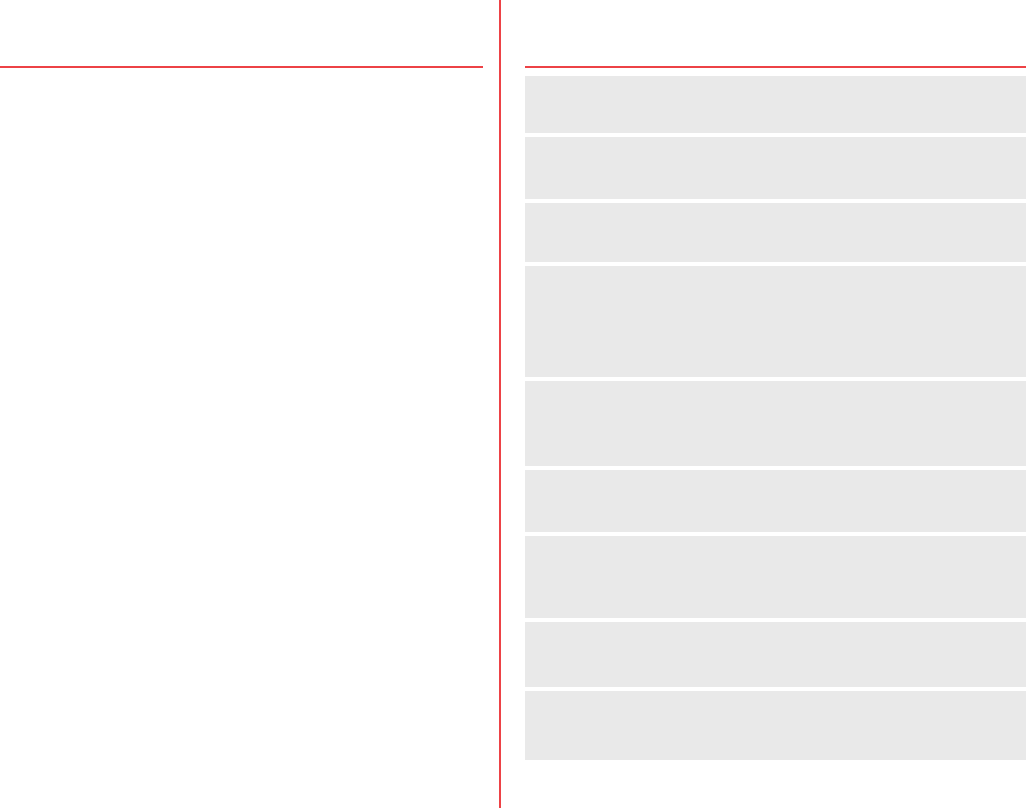

1. Election of thirteen directors nominated by Cummins’ Board FOR EACH NOMINEE Page 16

2. Advisory vote on the compensation of our named executive officers FOR Page 71

3. Ratification of independent public accountants FOR Page 72

4. Shareholder proposal regarding professional services allowance for our named executive officers AGAINST Page 76

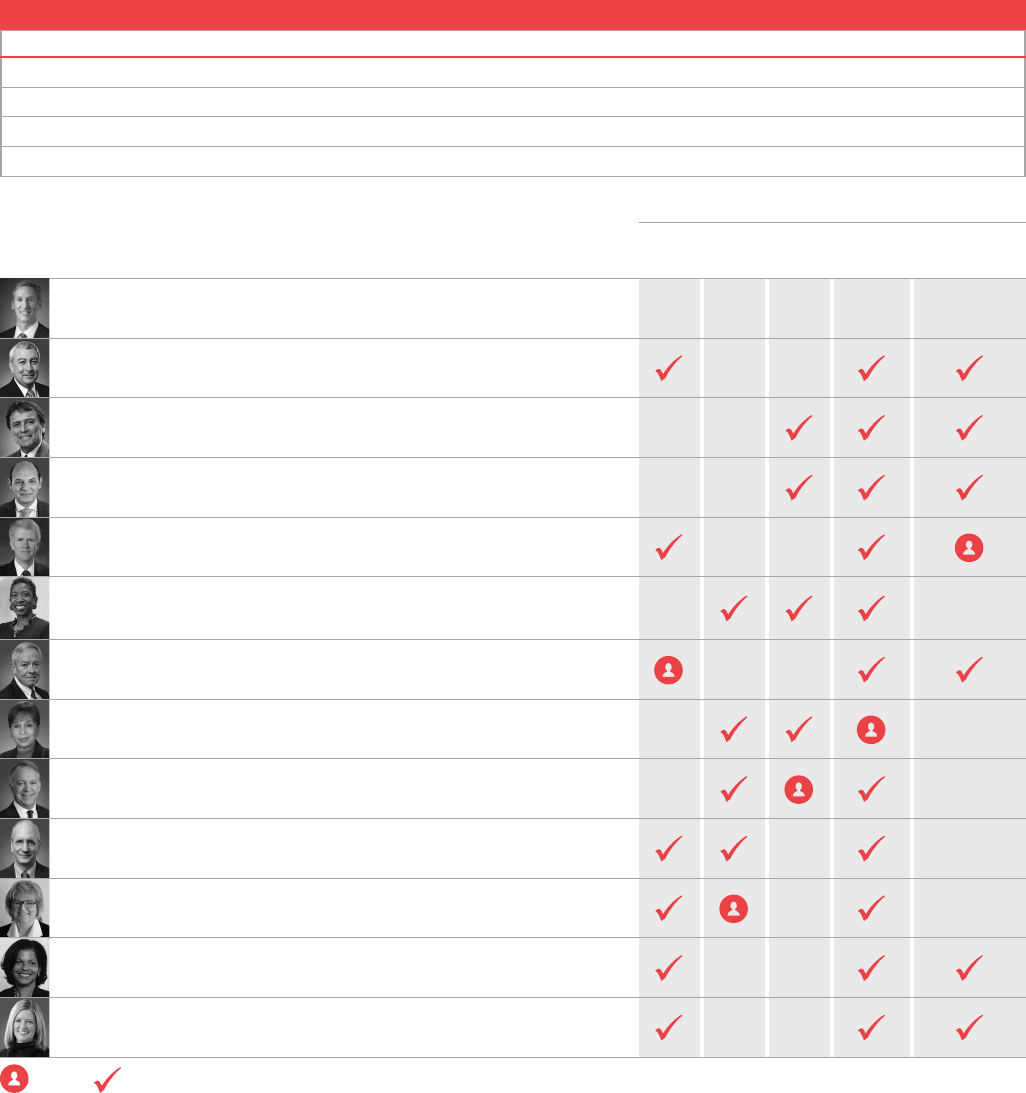

58 2009

68 2008

70 2009

64 2015

64 2010

58 —

72 2008

73 2001

66 2015

64 1989

71 2004

58 2020

57 2017

Chair Member

CUMMINS

PROXY SUMMARY

WE WILL BE VOTING ON THE FOLLOWING MATTERS:

N. THOMAS LINEBARGER

ROBERT J. BERNHARD

FRANKLIN R. CHANG DIAZ

BRUNO V. DI LEO

STEPHEN B. DOBBS

CARLA A. HARRIS

ROBERT K. HERDMAN

ALEXIS M. HERMAN

THOMAS J. LYNCH

WILLIAM I. MILLER

GEORGIA R. NELSON

KIMBERLY A. NELSON

KAREN H. QUINTOS

PROXY SUMMARY 2021 PROXY 1

Agenda Item Voting Recommendation More Information

Committee Memberships

Talent Safety

Director and Environment

Age Since Audit Comp Finance Governance and Tech

Chairman and Chief Executive Officer, Cummins Inc.

Vice President for Research, University of Notre Dame

Chairman and CEO, Ad Astra Rocket Company

Managing Director, Bearing North LLC

Retired Senior Group President, Fluor Corporation

Vice Chairman, Managing Director, Morgan Stanley

Managing Director, Kalorama Partners, LLC

Chairman and CEO, New Ventures, LLC

Chairman, TE Connectivity Ltd.

President, The Wallace Foundation

Retired President and CEO, PTI Resources, LLC

Retired Senior Vice President, External Relations of General Mills, Inc.

Retired Chief Customer Officer, Dell Technologies Inc.

11MAR202103331537

2

In 2020, Cummins delivered strong financial performance. The COVID-19 pandemic had an unprecedented impact on the global economy, resulting in

lower demand in nearly all of our end markets and manufacturing shutdowns for ourselves, our suppliers and our customers.

In response to the unprecedented decline in demand, we took a series of actions to maintain the financial strength of our company, including

instituting temporary salary reductions for our officers and other exempt employees, cutting discretionary spending, and reducing capital expenditures.

These actions, combined with the restructuring work initiated at the end of 2019, allowed us to deliver solid profitability despite the magnitude of the

decline in sales.

We experienced the largest decline in sales in the company’s history in the second quarter, followed by the largest sequential increase in the third

quarter. Many markets improved in the second half of the year as economic activity improved. For the full year, our earnings per share (EPS) of

$12.01 improved from our prior cyclical trough, and our decremental margin percentage was 17 percent.

Key business highlights include:

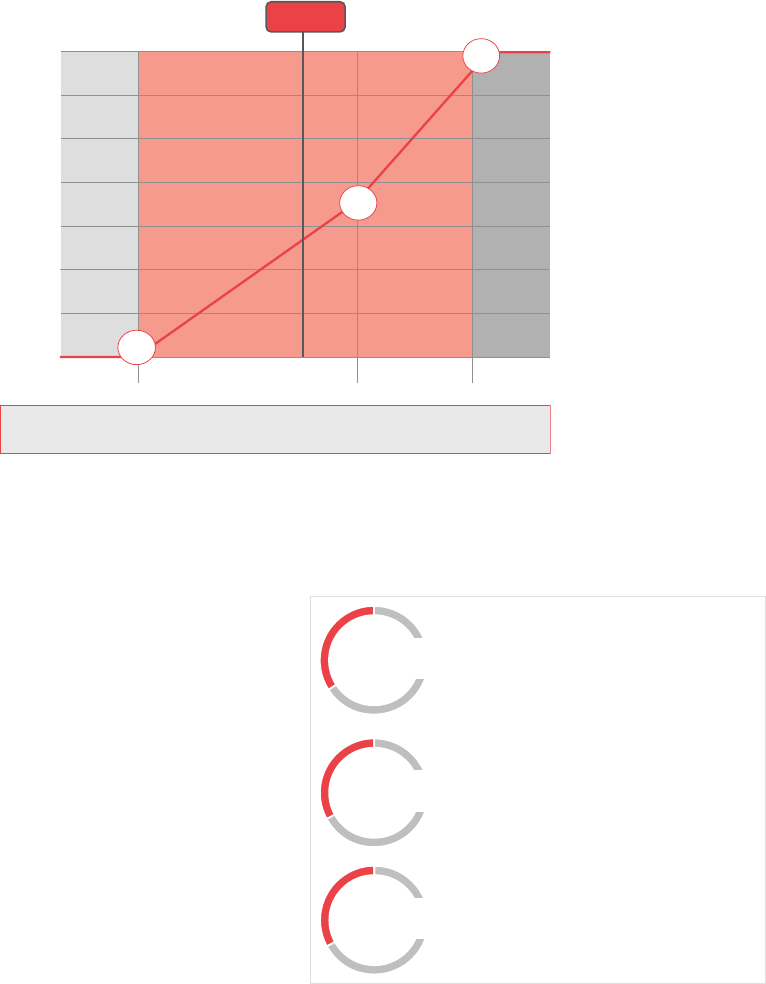

TSR

EBITDA

$3.1B

EBITDA was $3.1

billion or 15.7 percent of sales.

Return on invested

capital (ROIC) was 15%.

Net Income was $1.8 billion.

ROIC

15%

NET INCOME

$1.8B

12%

Average annual total

shareholder return (TSR) over

the three-year period ending

in 2020.

OPERATING

CASH FLOW

$2.7B

We generated $2.7B in

operating cash flow in 2020.

26%

Return on average net assets

(ROANA) was 26 percent.

ROANA

* See Annex A for reconciliation of GAAP to non-GAAP measures referenced in this section.

CUMMINS

OUR 2020 PERFORMANCE*

2 2021 PROXY PROXY SUMMARY

7MAR202104150912

7MAR202104153417

3

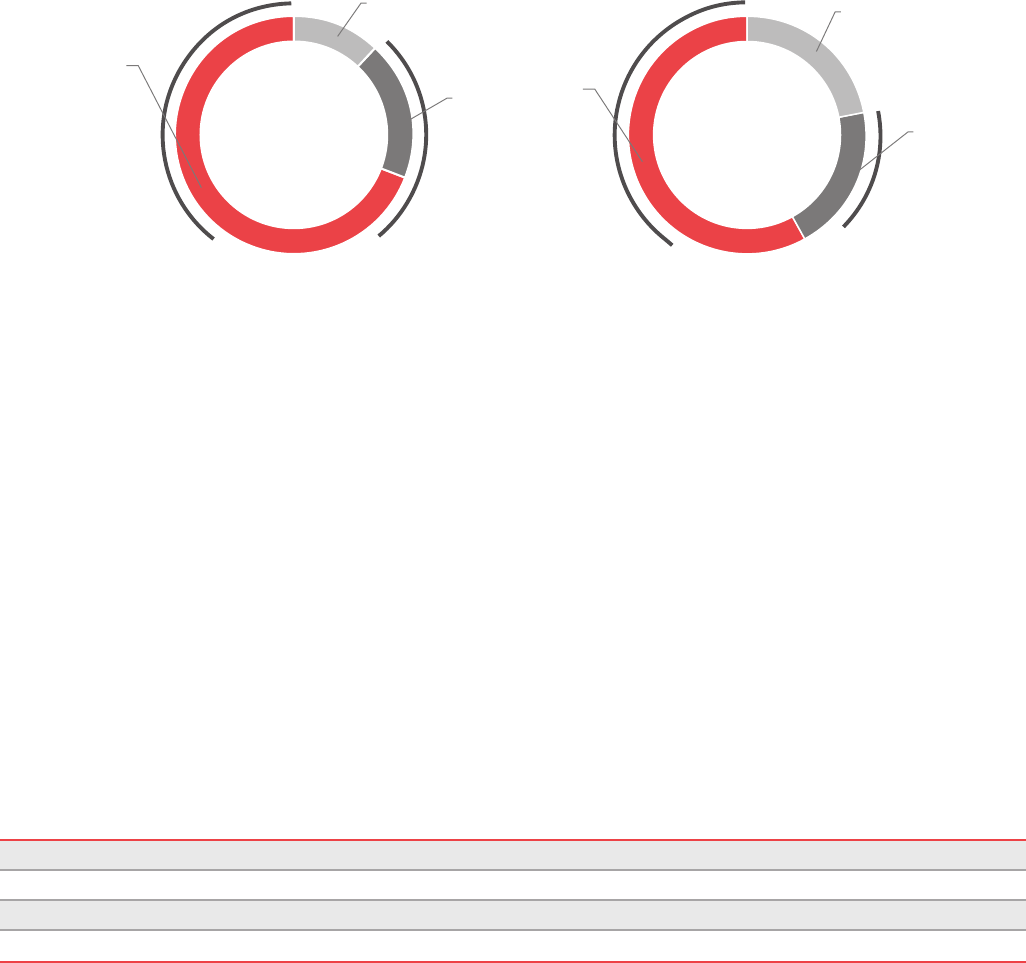

Our Board embodies a broad and diverse set of qualifications, skills and experiences as illustrated below.

Automotive and

Transportation

Government

Sales/

Marketing

4 out of 12 2 out of 12 4 out of 12

Manufacturing International Financial

10 out of 12 10 out of 12 5 out of 12

Technology Academics

8 out of 12 1 out of 12

CUMMINS

COMPOSITION OF THE BOARD

PROXY SUMMARY 2021 PROXY 3

BOARD INDEPENDENCE AND DIVERSITY

QUALIFICATIONS, SKILLS AND EXPERIENCE

Our Board represents a balance of longer-tenured members with in-depth knowledge of

our business and newer members who bring valuable additional attributes, skills and

experience. Eleven of our twelve directors are independent and provide strong oversight

of our long-term strategy. We believe that directors with different backgrounds and

experiences makes our boardroom and our company stronger.

4 of 12 are female

4 of 12 are ethnically diverse

11 of 12 are independent

DIVERSITY DIRECTOR INDEPENDENCE

4

We long have believed that good corporate governance is important in ensuring that we are managed for the long-term benefit of our shareholders.

Due to challenges of the global pandemic, our All directors are elected annually via majority Use of third party consultant to further facilitate

Board met 15 times in 2020 to provide strong voting standard feedback discussions for Board and individual

oversight of the company’s efforts to ensure Our Board has adopted proxy access, shareholder director performance and areas of improvement

employee safety and business continuity right to call special meetings, and shareholder Annual feedback and evaluation session by each

Annual assessment and determination of Board right to amend by-laws Committee Chair with its members on Committee

leadership structure performance

Our Board and its Committees exercise robust Board members routinely meet with top 4 new directors added to Board since 2015 and a

oversight of the company’s enterprise risk shareholders for conversations focused on our fifth new female, African-American member is

management program with dedicated time at every Board’s skill set and refreshment and its oversight standing for election at the Annual Meeting

regular Board meeting of a variety of topics including company strategy, Board members represent diverse perspectives,

Our Board reviews ESG strategy and risks at growth, risk management, governance and ESG including 4 female directors, 2 African-American

least once a year issues directors and 2 directors from Latin America

Our practices and policies have earned Cummins recognition on a range of issues.

NAMED TO THE DOW JONES INDICES OF THE MOST NAMED NO. 24 ON NEWSWEEK’S LIST OF AMERICA’S

SUSTAINABLE COMPANIES IN NORTH AMERICA. IT WAS MOST RESPONSIBLE COMPANIES FOR 2021

THE YEAR CUMMINS MADE THE LIST.

NAMED ONE OF THE WORLD’S MOST ETHICAL NAMED TO BARRON’S LIST OF AMERICA’S 100 MOST

COMPANIES BY THE ETHISPHERE INSTITUTE, A LEADER SUSTAINABLE COMPANIES BASED ON ENVIRONMENTAL,

IN ADVANCING ETHICAL BUSINESS PRACTICES. THE SOCIAL AND GOVERNANCE PERFORMANCE

COMPANY HAS BEEN ON THE LIST FOR

YEARS.

CUMMINS

CORPORATE GOVERNANCE HIGHLIGHTS

Board Leadership Board Accountability Board Evaluation and Effectiveness

•••

•

•

•

Board Oversight of Risk & ESG Shareholder Engagement Board Refreshment and Diversity

•••

•

•

2020 RECOGNITION HIGHLIGHTS

15

TH

CONSECUTIVE

14 CONSECUTIVE

4 2021 PROXY PROXY SUMMARY

5

Our long-term success depends on our ability to attract, motivate, focus and retain highly talented individuals committed to Cummins’ vision, strategy,

and corporate culture. To that end, our executive compensation program is designed to link our executives’ pay to their individual performance, to

Cummins’ annual and long-term performance, and to successful execution of Cummins’ business strategies. We also use our executive compensation

program to encourage high-performing executives to remain with us over the course of their careers.

We believe the compensation packages for our Named Executive Officers reflect their extensive management experience, continued high performance,

and exceptional service to Cummins. We also believe our compensation strategies have been effective in attracting executive talent and promoting

performance and retention.

We believe the level of compensation received by executives should be closely tied to our corporate financial and stock price performance. This

principle is apparent in the design of our executive compensation program and in the specific compensation packages we award.

In addition to aligning our executives’ pay with performance, we follow several other principles when designing and implementing our executive

compensation program.

market positioning pay at risk simple and transparent

short-term/long-term mix retention alignment with shareholders’ interests

Base salary Cash Individual Performance Market-based to attract and retain skilled

executives. Designed to recognize scope

of responsibility, individual performance,

and experience.

Annual bonus Cash Return on Average Net Assets (ROANA) Rewards operational performance.

using EBITDA ROANA balances growth, profitability, and

asset management.

Long-term incentive Performance cash (34%), Performance Return on Invested Capital (ROIC), ROIC and EBITDA provide an incentive

compensation shares (33%) and Stock options (33%) weighted at 80% and EBITDA, weighted for profitable growth and correlate well

at 20% over a three-year period for with shareholder value.

performance cash and performance

shares.

CUMMINS

EXECUTIVE COMPENSATION

•••

•••

Compensation Element Form of Payment Performance Metrics Rationale

PROXY SUMMARY 2021 PROXY 5

ADVISORY VOTE ON EXECUTIVE COMPENSATION

EXECUTIVE COMPENSATION PRINCIPLES

EXECUTIVE COMPENSATION ELEMENTS

8MAR202101551952

6

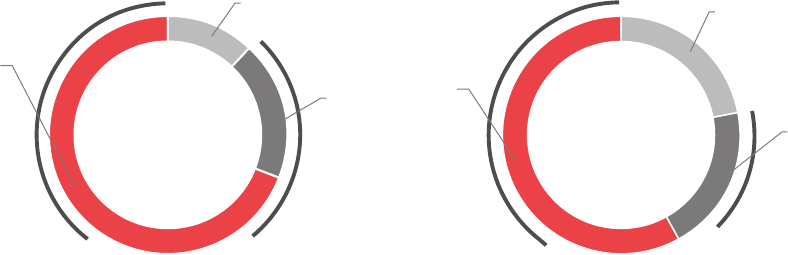

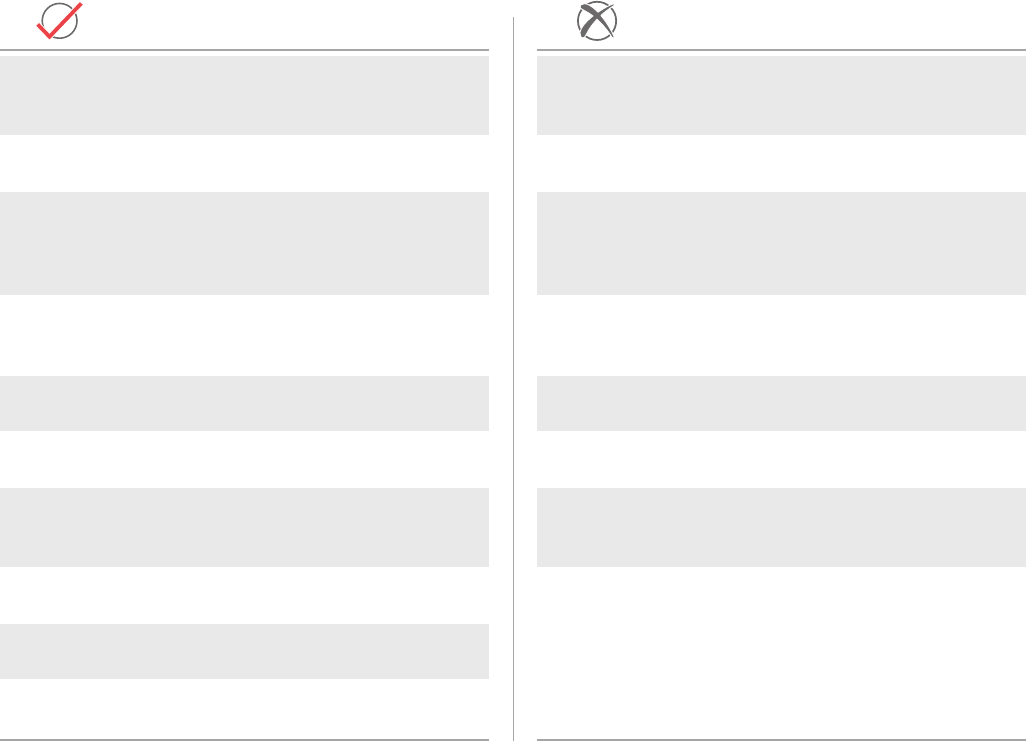

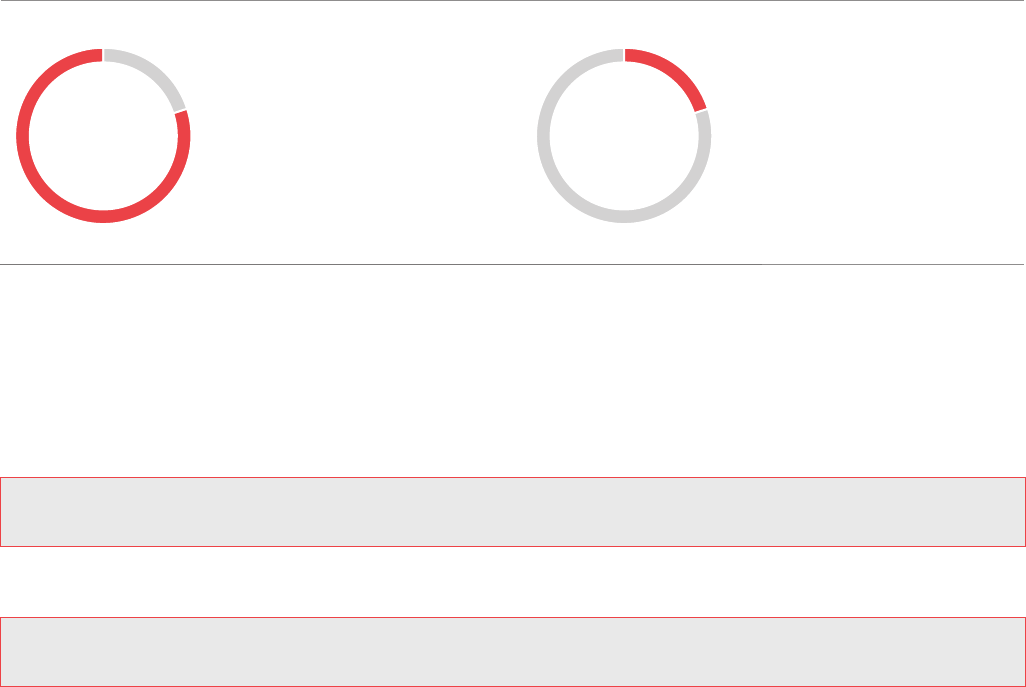

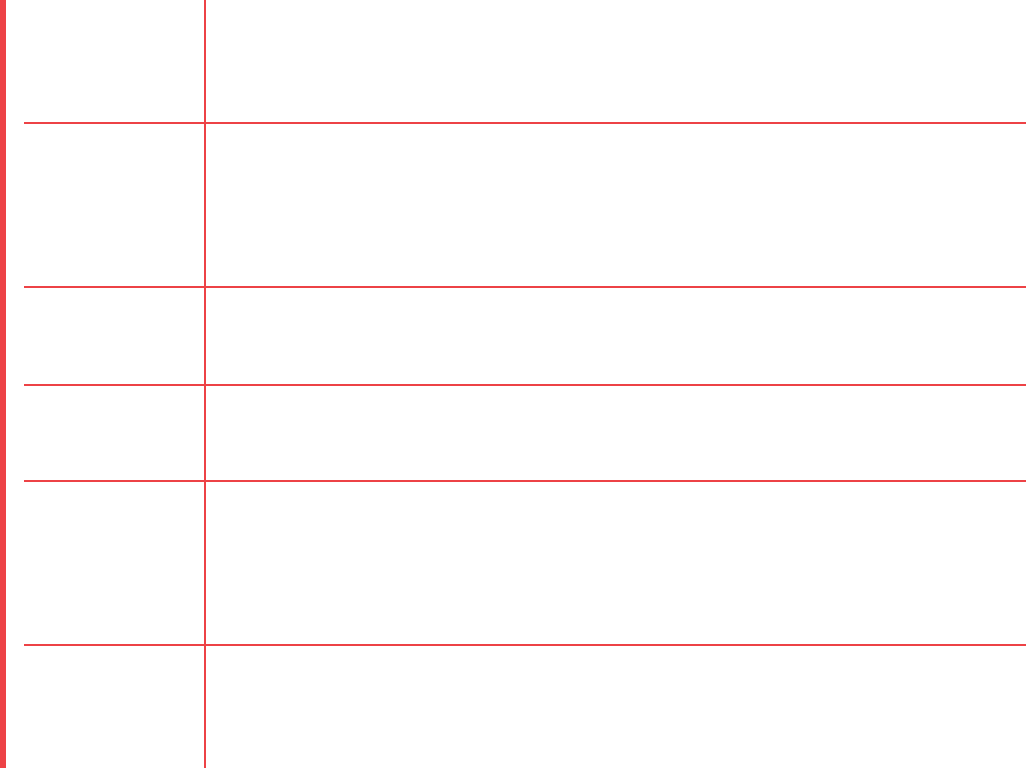

We believe the compensation of our most senior executives should be based on Cummins’ overall performance. Every executive’s pay is tied to the

same financial metrics and a significant amount of their pay is incentive-based and therefore at risk.

TARGET TOTAL DIRECT COMPENSATION MIX – FISCAL YEAR 2020

12%

Salary

22%

Salary

19%

20%

69%

Long-Term

Incentive

58%

Long-Term

Incentive

CHAIRMAN OF THE

BOARD AND CEO

OTHER NEOS AS A

GROUP (AVERAGE)

P

E

R

F

O

R

M

A

N

C

E

L

I

N

K

E

D

8

8

%

P

E

R

F

O

R

M

A

N

C

E

L

I

N

K

E

D

7

8

%

Annual

Bonus

Annual

Bonus

CUMMINS6 2021 PROXY PROXY SUMMARY

TARGET COMPENSATION MIX

7

We long have believed that good corporate governance is important in ensuring that we are managed for the long-term benefit of our shareholders.

We regularly engage with our shareholders to understand their expectations. We also benchmark our governance structure and policies against

industry best practices and the practices of other comparable public companies. Our corporate governance principles, charters for each of our Board’s

Audit, Talent Management and Compensation and Governance and Nominating Committees, our code of business conduct and our by-laws, along with

certain other corporate governance documents, are available on our website, www.cummins.com, and are otherwise available in print to any

shareholder who requests them from our Secretary.

12 of 13 director nominees are independent Due to challenges of the global pandemic, All directors are elected annually via majority

Board met 15 times in 2020 to provide voting standard

5 fully independent Board Committees: Audit;

strong oversight of the company’s efforts to

Talent Management & Compensation; Shareholder right to call special meetings

ensure employee safety and business

Governance & Nominating; Finance; and (10% of voting power threshold)

continuity

Safety, Environment & Technology

Proxy access for director nominees available

Annual assessment and determination of

to a shareholder, or group of up to 20

Board leadership structure

shareholders, holding a total of at least 3%

Annual election of independent Lead Director of our common stock for at least 3 years

whenever Chairman/CEO roles are combined

Shareholder right to unilaterally amend the

or when the Chairman is not independent

by-laws (upon a majority vote)

Detailed Board and Committee evaluation The Board and its Committees exercise Board members routinely meet with top

process coordinated by our Lead Director robust oversight of the company’s enterprise shareholders for conversations focused on

and Governance and Nominating Committee risk management program with dedicated our Board’s skill set and refreshment and its

Chair time at every regular Board meeting oversight of a variety of topics including

company strategy, growth, risk management,

Use of third party consultant to further Top tier risks are assigned to members of

governance and ESG issues

facilitate feedback discussions for Board and the Cummins Leadership Team

individual director performance and areas of

Board and its Committees provide strong

improvement

oversight of ESG risks and opportunities

Annual feedback and evaluation session by including at least one annual review by full

each Committee chair with its committee Board of ESG strategy and challenges

members on Committee performance

Annual two-way feedback and evaluation

sessions by Chairman with each director

Annual independent director evaluation of

Chairman and CEO

4 new directors added to Board since 2015 All of the directors attended 75% or more of Clawback policy permits us to recoup certain

and a fifth new female, African-American the aggregate number of meetings of our compensation payments in the event any of

member is standing for election at the Board and the Committees on which they our financial statements are required to be

Annual Meeting served during 2020 materially restated resulting from the

fraudulent actions of any officer or the

Board members represent diverse Limits on director/CEO membership on other

non-fraudulent or individual behavioral actions

perspectives, including 4 female directors, 2 public company boards

of Section 16 officers resulting in reputational

African-American directors and 2 directors

Our directors routinely visit company

harm

from Latin America

locations without our CEO present to interact

Directors and officers prohibited from

Goal of rotating Committee assignments directly with managers and employees; in

engaging in any pledging, short sales or

every 3 to 5 years 2018-2019, individual directors visited 13

hedging investments involving our common

different locations in China, India, Australia

Mandatory director retirement age

stock

and the United States. We suspended these

in-person visits in 2020 due to the global

pandemic

CUMMINS

CORPORATE

GOVERNANCE

CORPORATE GOVERNANCE OVERVIEW

Director Independence Board Leadership Board Accountability

•••

•

•

•

•

•

•

Board Evaluation and Effectiveness Board Oversight of Risk and ESG Shareholder Engagement

•••

••

•

•

•

•

Board Refreshment and Diversity Director Engagement Clawback and Anti-Hedging Policies

•••

••

•

•

•

•

CORPORATE GOVERNANCE 2021 PROXY 7

11MAR202111402162

8

It is a top priority of our Board and our Governance and Nominating Committee that our directors have the skills, background and values to effectively

represent the long-term interests of our shareholders and other stakeholders. Throughout the year, our Board reviews a matrix of the qualifications,

skills and experience that we believe our Board needs to have and discusses whether there are any gaps that need to be filled that will improve our

Board’s performance. We assess potential new director candidates in light of the matrix and whether they possess the qualifications, skills and

experience needed by our Board. When we identify potential new director candidates, we review extensive background information compiled by our

professional search firm, evaluate their references, consider their prior board experience and conduct virtual and in-person interviews.

We also believe that new perspectives and ideas are essential for an innovative and strategic board. Since 2015, we have added four new directors

to our Board, and a fifth new member, Carla Harris, is standing for election at the Annual Meeting. Ms. Harris will be a strong addition to our Board

and will bring valuable perspectives in finance and strategy as well as extensive leadership experience.

The Governance and Nominating Committee routinely reviews the Board’s committee assignments with a goal of rotating membership on committees

every three to five years. The committee assignments were most recently rotated in May 2020. Our Board will continue to review and refresh the

skills, qualifications and experiences that our Board needs to have to serve the long-term interests of our shareholders.

As required by our corporate governance principles, our Governance and Nominating Committee must recommend director nominees such that our

Board is comprised of a substantial majority of independent directors and possesses a variety of experience and backgrounds, including those who

have substantial experience in the business community, those who have substantial experience outside the business community (such as public,

academic or scientific experience), and those who will represent our stakeholders as a whole rather than special interest groups or individual

constituencies.

Each candidate must have sufficient time available to devote to our affairs and be free of any conflict of interest that would violate any applicable law

or regulation or interfere with the proper performance of his or her responsibilities, including being able to represent the best long-term interests of all

of our shareholders and other stakeholders. Each candidate also should possess substantial and significant experience that would be of particular

importance to us in the performance of his or her duties as a director. The Committee does not intend to alter the manner in which it evaluates

candidates, including the foregoing criteria, based on whether or not the candidate was recommended by a shareholder.

One of our core values is diversity, equity and inclusion. In evaluating candidates for our Board, our Governance

and Nominating Committee considers only potential directors who share this value, as well as our other core

values of integrity, caring, excellence and teamwork. As reflected in our corporate governance principles, we are

committed to equal employment opportunities in assembling our Board. We believe that directors with different

backgrounds and experiences makes our boardroom and our company stronger. As our Committee considers

possible directors, it seeks out candidates who represent the diverse perspectives of all of our stakeholders. We

believe our Board has been effective in assembling a highly-qualified, diverse group of directors. Our slate of

director nominees for this Annual Meeting has five female directors, three African-American directors and two

directors from Latin America. We will continue to identify opportunities to enhance our Board diversity as we

consider future candidates.

• We believe that directors

with different backgrounds

and experiences makes our

boardroom and our

company stronger.

• Our slate of director nominees

for this Annual Meeting has

five female directors, three

African-American directors

and two directors from Latin

America.

CUMMINS

ADDITIONAL GOVERNANCE FEATURES

DIRECTOR SELECTION AND BOARD REFRESHMENT

IMPORTANCE OF DIVERSITY

8 2021 PROXY CORPORATE GOVERNANCE

9

We believe that meaningful corporate governance should include regular conversations between our directors and our shareholders. Our Board

members routinely meet with shareholders for conversations focused on our Board’s skill set and refreshment and its oversight of a variety of topics,

including company strategy, growth, risk management, and ESG issues. In addition, our Corporate Secretary held discussions in 2020 with several top

investors to capture their input on governance matters and practices. We capture the feedback from these sessions and present it to the full Board for

its consideration.

CEO and leadership succession planning is one of our Board’s most important responsibilities. Many times throughout the year, our full Board

discusses succession planning for our CEO and other critical leaders of the company. At least once a year, our Board dedicates itself to examining

the succession plans for our complete leadership team.

With the support and oversight of our Board, we continue to focus on sustainability, including our efforts related to environmental, social and governance

issues (ESG). Various aspects of ESG are handled in the following committees depending upon the topic: Talent Management and Compensation

CUMMINS

SHAREHOLDER OUTREACH

SUCCESSION PLANNING

SUSTAINABILITY AND ESG

CORPORATE GOVERNANCE 2021 PROXY 9

11MAR202111402018

10

Committee, Safety, Environment and Technology Committee, and the Governance and Nominating Committee. In 2020, the company created a cross-

functional Management Review Group of top leaders to oversee ESG work. Below is a summary of our achievements over the past 12 months:

2020 ESG ACHIEVEMENTS

• Produced first report aligned to the Sustainability Accounting Standards Board

(SASB) in addition to Cummins’ 2019 Sustainability Progress Report and the

company’s Global Reporting Initiative (GRI) Content Index and Data Book.

Initiated reporting consistent with the Task Force on Climate-related Financial

Disclosures (TCFD) for publication in 2021.

• Expanded no- and low-carbon products, including hydrogen fuel cells, as well as

electrolyzers that separate hydrogen from water to increase the supply of green

hydrogen. The company’s New Power business segment held its first virtual

Hydrogen Day in 2020 to showcase its work with this promising low-carbon fuel

source, drawing nearly 2,000 analysts, reporters, environmental advocates

and more.

• Started implementing PLANET 2050, the company’s environmental sustainability

strategy announced in 2019 to address climate change and other environmental

challenges. The strategy includes environmental goals aligned to 2030 and the

aspiration to power customer success by carbon neutral technologies that

address air quality by 2050.

• Partnered with DuPont and 3M in separate initiatives to supply personal

protective equipment to medical professionals on the frontlines of the pandemic.

Supplied filter media in one case and in the other utilized equipment for

making engine filters to instead manufacture filters for respirators. In total,

Cummins supplied an estimated 146 tons of filtration media in 2020 to mask

manufacturers across the globe, which was used to produce more than 108

million masks. The company also purchased equipment to begin manufacturing

face coverings which it has been providing to all employees free of charge.

• Launched Cummins Advocating for Racial Equity (CARE) to take a leadership

role in undoing systemic discrimination against the Black community in U.S.

cities with a significant company presence. CARE has four key components:

police reform; criminal justice reform; economic empowerment and reform in

healthcare, housing, workforce development and civil rights. The company

launched four new U.S.-based Cummins Technical Education for Communities

programs as part of the effort.

• Our Board immediately changed its practices to provide robust oversight and

strategic direction to the company during the global pandemic. The Board held

15 meetings during 2020.

• Our Board continued its commitment to diversity and inclusion with a diverse

slate of directors including 5 women, 3 African-Americans and 2 directors from

Latin America.

To learn more about the company’s sustainability efforts, go to the company’s web page at https://www.cummins.com/about/sustainability. Websites

disclosed herein are not incorporated into this proxy statement by reference.

CUMMINS10 2021 PROXY CORPORATE GOVERNANCE

11

Twelve of our thirteen director nominees qualify as independent directors within the meaning of the rules adopted by the Securities and Exchange

Commission, or SEC, and the corporate governance standards for companies listed on the NYSE. Our Board has adopted independence standards

that meet or exceed the independence standards of the NYSE, including categorical standards to assist the Governance and Nominating Committee

and our Board in evaluating the independence of each director. The categorical standards are included in our corporate governance principles, which

are available on our website at www.cummins.com. A copy also may be obtained upon written request.

Following a discussion and applying the standards referenced above, the Governance and Nominating Committee of our Board determined that all

director nominees standing for election, except N. Thomas Linebarger, our Chief Executive Officer, qualify as independent. Based on the

recommendation of the Committee, our full Board approved this conclusion.

OUR LEAD DIRECTOR’S

Our corporate governance principles describe in detail how our Board must conduct its

RESPONSIBILITIES INCLUDE:

oversight responsibilities in representing and protecting our company’s stakeholders. As stated

in the principles, our Board has the freedom to decide whom our Chairman and Chief Executive

as Chairman of the Governance andOfficer should be based solely on what it believes is in the best interests of our company and

its shareholders. Currently, our Board believes it is in the best interests of our company for the Nominating Committee;

roles of our Chairman and Chief Executive Officer to be combined and to appoint a Lead

with the Chairman on, and

Director from among our independent directors.

approving, Board meeting agendas and meeting

schedules to assure there is sufficient time for

Our Board believes that this leadership structure currently assists our Board in creating a

discussion of all agenda items;

unified vision for our company, streamlines accountability for our performance and facilitates our

over all meetings ofBoard’s efficient and effective functioning.

the Board at which the Chairman is not present,

including executive sessions of independent

Our Board evaluates its policy on whether the roles of our Chairman and Chief Executive

directors and communicating feedback on

Officer should be combined on an annual basis. In doing so, our Board considers the skills,

executive sessions to the Chairman;

experiences and qualifications of our then-serving directors (including any newly elected

directors), the evolving needs of our company, how well our leadership structure is functioning,

the annual performance reviews of the

and the views of our shareholders.

Chief Executive Officer and the Board;

that there is open communication

Based on its review of our leadership structure, our Board continues to believe that

between our independent directors and the

Mr. Linebarger, our Chief Executive Officer, is the person best qualified to serve as our

Chairman and other management members;

Chairman given his history in executive positions with our company and his skills and

experience in the industries in which we operate. Alexis M. Herman is our independent Lead

, when deemed appropriate

Director. Ms. Herman was selected for this position because of her service on our Board since

by the Board, for consultation and direct

2001, her experience as the U.S. Secretary of Labor and her other leadership positions in the

communication with shareholders;

private and public sectors. Ms. Herman is actively involved in setting and approving the Board’s

, at his or her discretion, informationagendas and focus. She works to create a collaborative atmosphere that leverages the

strengths of our diverse Board and encourages directors to actively question management when to be sent to the Board; and

necessary and seeks to ensure that our Board is receiving the information necessary to

with the Chairman on other

complete its duties. Ms. Herman meets with other directors and members of senior

issues of corporate importance, as appropriate.

management outside of the regularly scheduled Board meetings to ensure that our Board is

functioning effectively and to identify areas of potential improvement.

CUMMINS

INDEPENDENCE

LEADERSHIP STRUCTURE

SERVING

CONFERRING

CALLING AND PRESIDING

LEADING

ENSURING

BEING AVAILABLE

REVIEWING

CONFERRING

CORPORATE GOVERNANCE 2021 PROXY 11

12

Our Board and its committees are involved on an ongoing basis in the oversight of our material enterprise-related risks. The company has a mature

enterprise risk management program that identifies, categorizes and analyzes the relative severity and likelihood of the various types of material

enterprise-related risks to which we are or may be subject. The company has an executive risk council, comprised of the Chief Operating Officer,

Chief Financial Officer, General Counsel and Corporate Secretary, Vice President—Corporate Strategy and Chief Administrative Officer that meets

quarterly with our leader of enterprise risk management to review and update our material enterprise-related risks and their mitigation plans. We

assign ownership of our most significant enterprise risks to a member of our Leadership Team.

Our Board, Audit Committee, Finance Committee, Talent Management and Compensation Committee, Governance and Nominating Committee and/or

Safety, Environment and Technology Committee receive periodic reports and information directly from our senior leaders who have functional

responsibility over our enterprise risks. Our Board and/or its appropriate committees then review such information, including management’s proposed

mitigation strategies and plans, to monitor our progress on mitigating the risks. For example, to oversee the company’s work to mitigate cybersecurity

risks, we have identified separate risks for enterprise cybersecurity and product cybersecurity. The Audit Committee provides primary oversight for

enterprise cybersecurity while the Safety, Environment and Technology Committee provides oversight of product cybersecurity. Our Board’s and its

committees’ roles in the oversight process of our identified material risks have not impacted our Board’s leadership structure.

Due to the challenges raised by the global pandemic, our Board pivoted quickly to hold an unprecedented number of meetings to provide strategic

direction and support to the company in 2020. Our Board held 15 meetings during 2020. All of the directors attended 75% or more of the aggregate

number of meetings of our Board and the committees on which they served that were held during the periods in which they served. The

non-employee members of our Board also met in executive session without management present as part of each regular meeting. Alexis M. Herman,

our Lead Director, presided over these sessions.

Under our corporate governance principles, our Board has established six standing committees, with five of the committees consisting entirely of

independent directors. Certain of the principal functions performed by these committees and the members of our Board currently serving on these

committees are as follows:

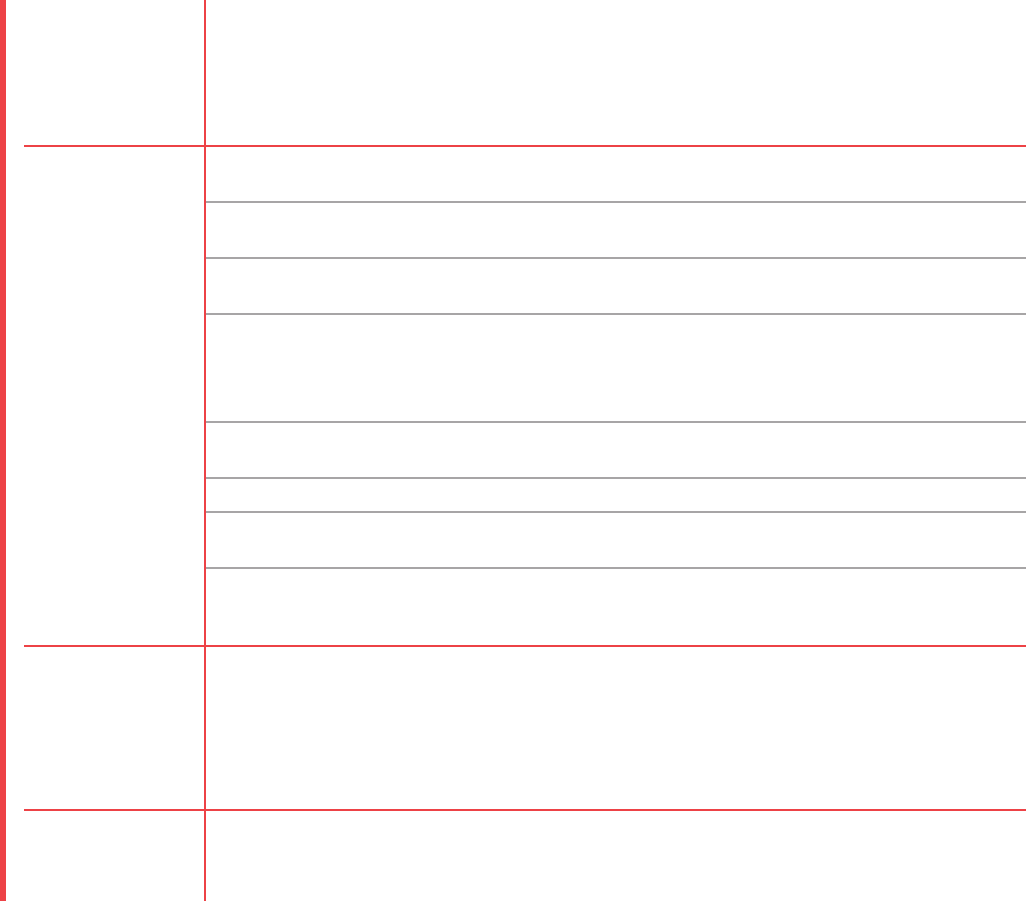

KEY RESPONSIBILITIES

Meetings in 2020 9 Oversees the integrity of our financial statements and related financial disclosures and internal controls

over financial reporting.

Members

Robert K. Herdman (Chair) Reviews our accounting principles and procedures.

Robert J. Bernhard

Monitors the independence and performance of our external and internal auditors.

Stephen B. Dobbs

William I. Miller

Exercises oversight of the company’s enterprise risk management program with dedicated time for

Georgia R. Nelson

review and discussion at every regular Board meeting.

Kimberly A. Nelson

Oversees the company’s compliance with its ethics policies and legal and regulatory requirements.

Karen H. Quintos

All members are independent directors as defined under our independence criteria, SEC rules and NYSE

listing standards, including those specifically applicable to audit committee members. Our Board has

determined that Mr. Herdman is an ‘‘audit committee financial expert’’ for purposes of the SEC’s rules.

CUMMINS

RISK OVERSIGHT

BOARD OF DIRECTORS AND COMMITTEES

AUDIT COMMITTEE

: •

•

•

•

•

12 2021 PROXY CORPORATE GOVERNANCE

13

KEY RESPONSIBILITIES

Reviews and approves the company’s compensation philosophy and strategy primarily for the Board and

Meetings in 2020 8 the officers of the company and others as the committee may designate from time to time.

Members Reviews and oversees the company’s strategies for talent management.

Georgia R. Nelson (Chair)

Assesses talent management policies, programs and processes, including leadership, culture, diversity

Alexis M. Herman

and inclusion and succession.

Thomas J. Lynch

William I. Miller

Administers and determines eligibility for, and makes awards under, our incentive plans.

Establishes goals and approves the compensation for our Chief Executive Officer following a review of

his performance, including input from all of the other independent directors.

Reports annually in the proxy statement regarding the company’s executive compensation programs.

Conducts an annual compensation risk assessment.

All members are independent directors as defined under our independence criteria, SEC rules and NYSE

listing standards, including those specifically applicable to compensation committee members. The Talent

Management and Compensation Committee engaged Farient Advisors LLC as its independent compensation

consultant in 2020 to provide input and advice to the Committee concerning the compensation of our officers

and our Board and related matters.

KEY RESPONSIBILITIES

Meetings in 2020 4 Reviews and advises our management and our Board on our financial strategy pertaining to our capital

structure, creditworthiness, dividend policy, share repurchase policy, and financing requirements.

Members

Thomas J. Lynch (Chair) Reviews our banking relationships and lines of credit.

Franklin R. Chang Diaz

Reviews and advises on financing proposals for acquisitions, partnerships and other alliances of the

Bruno V. Di Leo

company.

Alexis M. Herman

Discusses key areas of shareholder interest and feedback on our performance and strategy.

Monitors our shareholder base and provides counsel on investor relations activity.

All members are independent directors as defined under our independence criteria, SEC rules and NYSE

listing standards.

KEY RESPONSIBILITIES

Reviews and makes recommendations to our Board with respect to its membership, size, composition,

Meetings in 2020 5 procedures and organization.

Members Identifies potential director candidates to ensure the Board is composed of well qualified and diverse

Alexis M. Herman (Chair) candidates to oversee the company; engages a professional search firm to identify potential director

Robert J. Bernhard candidates based on criteria selected by the Committee; and interviews identified candidates.

Franklin R. Chang Diaz

Ensures the Board has a robust process for evaluating its performance and the performance of its

Bruno V. Di Leo

committees and individual directors, including the use of a third party consultant to facilitate feedback

Stephen B. Dobbs

among Board members.

Robert K. Herdman

Thomas J. Lynch

Ensures the Board is providing effective ongoing director education and new director orientation.

William I. Miller

All members are independent directors as defined under our independence criteria, SEC rules and NYSE

Georgia R. Nelson

listing standards.

Kimberly A. Nelson

Karen H. Quintos

CUMMINS

TALENT MANAGEMENT AND

COMPENSATION COMMITTEE

•

:

•

•

•

•

•

•

FINANCE COMMITTEE

: •

•

•

•

•

GOVERNANCE AND NOMINATING

COMMITTEE

•

:

•

•

•

CORPORATE GOVERNANCE 2021 PROXY 13

14

KEY RESPONSIBILITIES

Reviews the company’s safety program with an emphasis on employee, workplace and product safety.

Meetings in 2020 5

Reviews the environmental management of our facilities and operations.

Members

Reviews our key technology developments that may impact product competitiveness for both core and

Stephen B. Dobbs (Chair)

new business areas.

Robert J. Bernhard

Franklin R. Chang Diaz

Reviews public policy developments, strategies and positions taken by us with respect to safety,

Bruno V. Di Leo

environmental and technological matters that significantly impact us or our products.

Robert K. Herdman

Reviews product and service quality performance and guides our strategies and improvement initiatives.

Kimberly A. Nelson

Karen H. Quintos

The members of our Executive Committee are N. Thomas Linebarger (Chairman), Alexis M. Herman and William I. Miller. Our Executive Committee is

authorized to exercise the powers of our Board in the management and direction of our business and affairs during the intervals between meetings of

our Board. It also acts upon matters specifically delegated to it by our Board. Our Executive Committee did not meet during 2020.

Shareholder director candidate recommendations, including biographical information as to the proposed candidate and a statement from the

shareholder as to the qualifications and willingness of such person to serve on our Board, along with the required disclosures set forth in our by-laws,

must be properly and timely submitted in writing to our Secretary, as further described below. Any shareholder entitled to vote for the election of

directors at a meeting may nominate a person or persons for election as directors only if written notice of such shareholder’s intent to make such

nominations is given, either by personal delivery or by mail, postage prepaid, to the Secretary of our company not later than 160 days in advance of

the originally scheduled date of such meeting (provided, however, that if the originally scheduled date of such meeting is earlier than the anniversary

of the date of the previous year’s annual meeting, such written notice may be so given and received not later than the close of business on the

10th day following the date of the first public disclosure, which may include any public filing by us with the SEC, of the originally scheduled date of

such meeting).

Each notice required by our by-laws must be signed manually or by facsimile by the shareholder of record and must set forth the information required

by our by-laws, including (i) the name and address, as they appear on our books, of the shareholder who intends to make the nomination and of any

beneficial owner or owners on whose behalf the nomination is made; (ii) a representation that the shareholder is a holder of record of shares of our

Common Stock entitled to vote at such meeting and intends to appear in person or by proxy at the meeting to nominate the person or persons

specified in the notice; (iii) certain other information regarding the shareholder and its interests in our company; (iv) the name, age, business address

and residential address of each nominee proposed in such notice; (v) the principal occupation or employment of each such nominee; (vi) the number

of shares of our capital stock that are owned of record or beneficially by each such nominee; (vii) with respect to each nominee for election or

reelection to our Board, a completed and signed questionnaire, representation and agreement described in our by-laws; (viii) such other information

regarding each nominee proposed by such shareholder as would have been required to be included in a proxy statement filed pursuant to the proxy

rules of the SEC had each nominee been nominated, or intended to be nominated, by our Board; (ix) a description of all direct and indirect

compensation and other material monetary agreements, arrangements and understandings during the past three years, and any other material

relationships, including all arrangements or understandings pursuant to which the nominations are being made, between or among such shareholder

and beneficial owner, if any, and their respective affiliates and associates, or others acting in concert therewith, on the one hand, and each proposed

nominee, and his or her respective affiliates and associates, or any other person or persons (naming such person or persons), on the other hand; and

(x) the written consent of each nominee to serve as a director if so elected.

The deadline for receiving any written notice of a shareholder’s intent to make a nomination with respect to the Annual Meeting was the close of

business on December 2, 2020, which was 160 days in advance of the Annual Meeting (which is typically held on the second Tuesday of each May).

We received no such qualifying nominations before this deadline with respect to the Annual Meeting.

CUMMINS

SAFETY, ENVIRONMENT AND

TECHNOLOGY COMMITTEE

•

:

•

•

•

•

EXECUTIVE COMMITTEE

SHAREHOLDER NOMINATIONS

14 2021 PROXY CORPORATE GOVERNANCE

15

Shareholders and other interested parties may communicate with our Board, including our Lead Director and other non-management directors, by

sending written communication to the directors c/o our Secretary, 301 East Market Street, Indianapolis, Indiana 46204. All such communications will be

reviewed by the Secretary or his or her designee to determine which communications are appropriate to be forwarded to the directors. All

communications will be forwarded except those that are related to our products and services, are solicitations or otherwise relate to improper or

irrelevant topics as determined in the sole discretion of the Secretary or his or her designee.

Our Secretary maintains and provides copies of all such communications received and determined appropriate to be forwarded to the Governance and

Nominating Committee in advance of each of its meetings and reports to the Committee on the number and nature of communications that were not

determined appropriate to be forwarded.

We require all of our director nominees standing for election at an annual meeting of shareholders to attend such meeting. All director nominees

standing for election at our 2020 Annual Meeting of Shareholders were present at the virtual meeting. We currently expect all director nominees to be

present virtually at the Annual Meeting.

CUMMINS

COMMUNICATION WITH THE BOARD OF DIRECTORS

CORPORATE GOVERNANCE 2021 PROXY 15

16

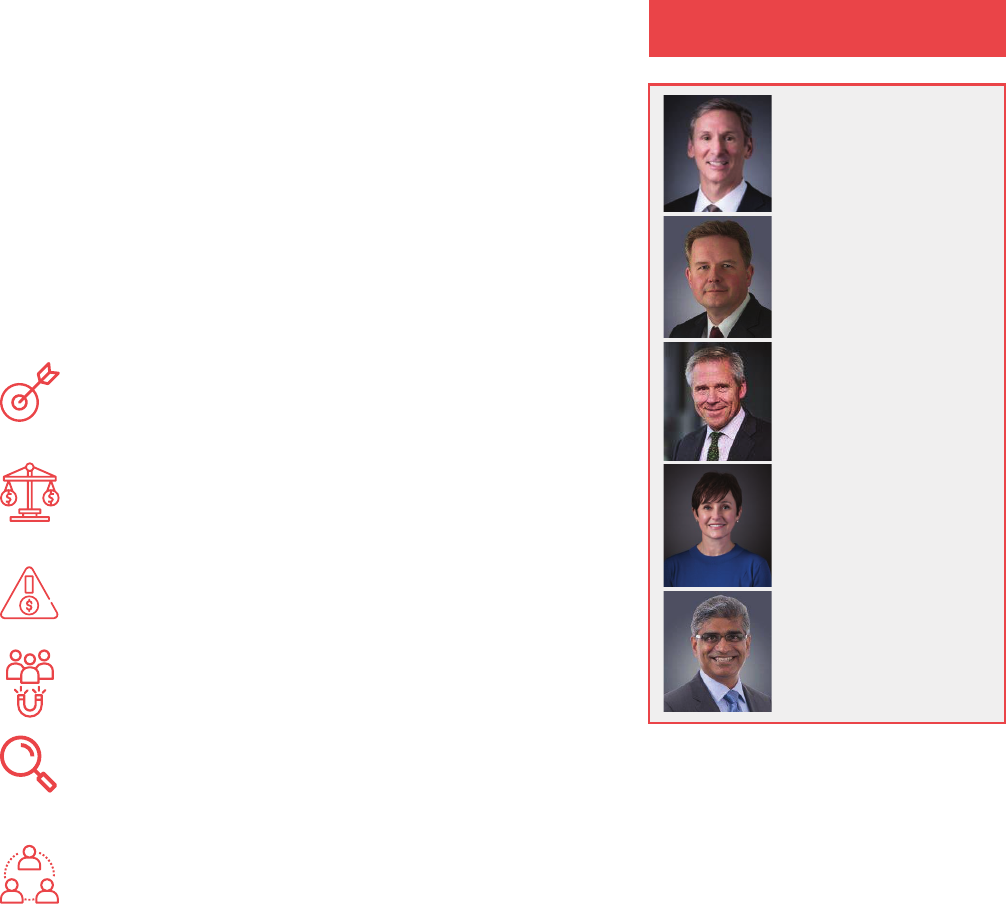

All twelve of our current directors are nominated for reelection at the Annual Meeting to hold office until our 2022 annual meeting of shareholders and

until their successors are elected and qualified. Any submitted proxy will be voted in favor of the nominees named below to serve as directors unless

the shareholder indicates to the contrary on his or her proxy. Except for director nominee, Carla A. Harris, all nominees have been previously elected

to our Board by our shareholders and have served continuously since the date indicated below.

To be elected, each director nominee must receive a majority of the votes cast by shareholders at the Annual Meeting. Receipt by a nominee of the

majority of votes cast means that the number of shares voted ‘‘for’’ exceeds the number of votes ‘‘against’’ that nominee. Abstentions and broker

non-votes are not counted as a vote either ‘‘for’’ or ‘‘against’’ a nominee. Our by-laws provide that the term of any incumbent director who receives

more ‘‘against’’ votes than ‘‘for’’ votes in an uncontested election will automatically terminate at the shareholder meeting at which the votes were cast.

In the case of a contested election, directors will be elected by a plurality of the votes represented in person or by proxy and entitled to vote in the

election.

Our Board expects that each of the nominees will be able to serve as a director if elected at the Annual Meeting, but if any of them is unable to

serve at the time the election occurs, proxies received that have been voted either for such nominee or for all nominees or which contain no voting

instructions will be voted for the election of another nominee to be designated by our Board, unless our Board decides to reduce the number of our

directors.

The names of the nominees for directors, together with biographical sketches, including their business experience during the past five years,

directorships of other public corporations and their qualifications to serve on our Board are set forth below, beginning with our Chairman and Chief

Executive Officer, then followed by our independent directors in alphabetical order.

CUMMINS

ELECTION

OF DIRECTORS

(ITEMS 1 THROUGH 13 ON THE PROXY CARD)

GENERAL

MAJORITY VOTE REQUIRED FOR DIRECTOR ELECTIONS

NOMINEES FOR BOARD OF DIRECTORS

16 2021 PROXY ELECTION OF DIRECTORS

11JAN202009361989

7MAR202104150764 7MAR202104151796 7MAR202104152249 7MAR202104152693 7MAR202104153277 7MAR202104153683

11JAN202009360258

7MAR202104150610 7MAR202104150764 7MAR202104152693 7MAR202104153683

17

Mr. Linebarger became the Chairman of the Board and Chief Executive Officer of our company on January 1, 2012.

Mr. Linebarger was our President and Chief Operating Officer from 2008-2011 after serving as Executive Vice

President and President, Power Generation Business from 2003 to 2008 and as Vice President, Chief Financial

Officer from 2000 to 2003. From 1998 to 2000, he was our Vice President, Supply Chain Management, after holding

various other positions with us. Mr. Linebarger received a B.S. from Stanford University and a B.A. from Claremont

McKenna College in 1986 and M.S. and M.B.A. degrees from Stanford in 1993. He has been a director of Harley-

Davidson, Inc. since 2008.

Director Since: 2009

Automotive and

transportation

experience

Financial

expertise

International

experience

Manufacturing

background

Sales and marketing

background

Technology

background

Age: 58

Board Committees:

Provides strategic leadership for the Board with decades of experience with our global business

Executive

Seeks to ensure directors are informed of significant issues impacting our company and receive necessary

information

Works collaboratively with our Lead Director to set agendas for Board meetings and assess the engagement and

effectiveness of our Board, its committees, and individual directors

Ensures that there are strong succession plans in place for the CEO and other key leaders

Mr. Bernhard joined the University of Notre Dame in 2007 and prior to that was Associate Vice President for

Research at Purdue University since 2004. He also held Assistant, Associate and full Professor positions at Purdue

University. He was Director of the Ray W. Herrick Laboratories at Purdue’s School of Mechanical Engineering from

1994 to 2005. Mr. Bernhard is also a Professional Engineer and earned a B.S.M.E. and Ph.D., E.M. from Iowa State

University in 1973 and 1982, and an M.S.M.E. from the University of Maryland in 1976. He was the Secretary

General of the International Institute of Noise Control Engineering (I-INCE) from 2000 to 2015, and is currently the

President of I-INCE. He is a Fellow of the I-INCE, the Acoustical Society of America and the American Society of

Mechanical Engineering.

Director Since: 2008

Age: 68

Board Committees:

Academic

leader

Automotive and

transportation

experience

Manufacturing

background

Technology

background

Audit; Governance and

Nominating; Safety,

Leverages technical background to offer valuable insight

Environment and

Technology

Pushes for improvement in safety and technology planning

Mentors our technical leaders

CUMMINS

OUR BOARD RECOMMENDS THAT SHAREHOLDERS VOTE FOR

EACH OF THE NOMINEES SET FORTH BELOW.

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

•

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

ELECTION OF DIRECTORS 2021 PROXY 17

N. THOMAS LINEBARGER—Chairman and Chief Executive Officer, Cummins Inc.

ROBERT J. BERNHARD—Vice President for Research and Professor in the Department of Aerospace and

Mechanical Engineering, University of Notre Dame

11JAN202009354787

7MAR202104152249 7MAR202104152693 7MAR202104153683

18

Dr. Chang Diaz is Chairman and Chief Executive Officer of Ad Astra Rocket Company, a U.S. spaceflight engineering

company based in Houston, Texas and dedicated to the development of advanced in-space electric propulsion

technology. Ad Astra also develops space-derived Earth applications in clean renewable hydrogen energy storage for

stationary applications and electric transportation. Dr. Chang Diaz founded Ad Astra in 2005 following his retirement

from NASA after a 25-year career during which he flew seven space missions and logged over 1,600 hours in space.

In 1994, Dr. Chang Diaz founded and directed NASA’s Advanced Space Propulsion Laboratory at the Johnson Space

Center where he managed a multicenter research team developing new plasma rocket technology. Dr. Chang Diaz is

a dual citizen of Costa Rica and the United States. As part of his involvement in Costa Rica’s development,

Dr. Chang Diaz currently leads the implementation of the ‘‘Strategy for the XXI Century,’’ a plan to transform Costa

Rica into a fully developed nation by the year 2050. Dr. Chang Diaz received the Liberty Medal in 1986 from

Director Since: 2009

President Ronald Reagan and is a four-time recipient of NASA’s Distinguished Service Medal, the agency’s highest

honor. Dr. Chang Diaz also serves as an Adjunct Professor of Physics at Rice University and the University of

Age: 70

Houston.

Board Committees:

Finance; Governance

and Nominating;

International

experience

Manufacturing

background

Technology

background

Safety, Environment

and Technology

Brings an expansive view of technology matters

Pushes our Board to think long-term in technology planning

Well-versed in international business issues

Strong engagement in the development of our Latin America business

CUMMINS

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

•

18 2021 PROXY ELECTION OF DIRECTORS

DR. FRANKLIN R. CHANG DIAZ—Founder, Chairman and Chief Executive Officer, Ad Astra Rocket Company

11JAN202009354447

7MAR202104152249 7MAR202104152400 7MAR202104153277 7MAR202104153683

19

Mr. Di Leo has been the Managing Director of Bearing-North LLC, an independent advisory firm focused on business

expansion and senior executive counseling in strategy and operations, since 2018. Prior to this role, Mr. Di Leo

served as Senior Vice President of International Business Machines Corporation, or IBM, a globally integrated

technology and consulting company, from January 2018 until his retirement in June 2018. He had previously served

as Senior Vice President, Global Markets, for IBM since 2012. In that position, he was accountable for revenue,

profit, and client satisfaction in Japan, Asia Pacific, Latin America, Greater China and the Middle East and Africa. He

also oversaw IBM’s Enterprise and Commercial client segments globally. From 2008 to 2011, he was General

Manager for IBM’s Growth Markets Unit based in Shanghai. Mr. Di Leo has more than 40 years of business

leadership experience in multinational environments, having lived and held executive positions on four continents.

Director Since: 2015

Mr. Di Leo has served as a director of Ferrovial, S.A., since 2018. Mr. Di Leo is a member of the international

advisory board of Instituto de Estudios Superiores de la Empresa (IESE Business School) as well as a member of

Age: 64

the Deming Center Advisory Board of Columbia Business School. He holds a business administration degree from

Board Committees:

Ricardo Palma University and a postgraduate degree from Escuela Superior de Administracion de Negocios, both in

Finance; Governance

his native Peru. He is fluent in Spanish, Portuguese, English and Italian.

and Nominating;

Safety, Environment

and Technology

International

experience

IT experience

Sales and marketing

background

Technology

background

Brings perspective on international business issues having lived and held executive positions on four continents

Offers insight regarding technology and sales and marketing issues

Works to ensure customer-focused approach in addressing product and service-related issues

CUMMINS

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

ELECTION OF DIRECTORS 2021 PROXY 19

BRUNO V. DI LEO ALLEN—Managing Director, Bearing-North LLC

11JAN202009361165

7MAR202104150764 7MAR202104151796 7MAR202104152249 7MAR202104152693 7MAR202104153683

20

Mr. Dobbs is a former executive of Fluor Corporation, a publicly traded professional services firm providing

engineering, procurement, construction, fabrication and modularization, commissioning and maintenance, as well as

project management services on a global basis. Mr. Dobbs served as Senior Group President over Fluor’s Industrial

and Infrastructure Group until his retirement in 2014. In that role, Mr. Dobbs was responsible for a wide diversity of

the markets served by Fluor, including infrastructure, telecommunications, mining, operations and maintenance,

transportation, life sciences, heavy manufacturing, advanced technology, microelectronics, commercial, institutional,

health care, water, and alternative power. Mr. Dobbs served Fluor in numerous U.S. and international locations

including Southern Africa, Europe, and China. He is an industry recognized expert in project finance in Europe and

the United States, particularly public private partnerships and private finance initiatives. In 2019, Mr. Dobbs retired

from the Board of Directors of Lendlease Corporation Limited, an international property and infrastructure group that is

Director Since: 2010

publicly traded in Australia, where he had served on the Board since 2015.

Age: 64

Mr. Dobbs earned his doctorate in engineering from Texas A&M University and holds two undergraduate degrees in

Board Committees:

nuclear engineering, also from Texas A&M. Until his retirement from Fluor, he served on the World Economic Forum’s

Audit; Governance

Global Agenda Council on Geopolitical Risk as well as the Governor’s Business Council for the State of Texas. He

and Nominating;

also served as a director of the U.S. China Business Council.

Safety, Environment

and Technology

Automotive and

transportation

experience

Financial

expertise

International

experience

Manufacturing

background

Technology

background

Chair of Safety, Environment and Technology Committee

Leverages technical background to provide insight regarding technology matters

Possesses emerging market/international experience from his Fluor career

Adds perspective gained from leading business operations in U.S., Southern Africa, Europe and China

Experience in project finance

CUMMINS

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

•

•

20 2021 PROXY ELECTION OF DIRECTORS

STEPHEN B. DOBBS

7MAR202108425555

7MAR202104151796 7MAR202104152099 7MAR202104152249 7MAR202104151645

11JAN202009360787

7MAR202104151796 7MAR202104152099 7MAR202104152249 7MAR202104152693

21

Ms. Harris is Vice Chairman, Managing Director and Senior Client Advisor at Morgan Stanley. She is responsible for

increasing client connectivity and penetration to enhance revenue generation across the firm. Her prior experience

with Morgan Stanley includes investment banking, equity capital markets, equity private placements, and initial public

offerings in a number of industries such as technology, media, retail, telecommunications, transportation, healthcare,

and biotechnology. In August 2013, Ms. Harris was appointed by President Barack Obama to chair the National

Women’s Business Council.

Ms. Harris currently serves on the board of Walmart Corporation and serves on its Compensation and Management

Development, Nominating and Governance, and Strategic Planning and Finance Committees. She also serves on the

boards of several nonprofit organizations including Seize Every Opportunity (SEO), Harvard University Board of

Overseers and the Morgan Stanley Foundation. Ms. Harris received an MBA from Harvard Business School and an

A.B. from Harvard University.

New Director Nominee

Age: 58

Board Committees:

Financial

expertise

Government/regulatory

affairs background

International

experience

Diversity initiatives

experience

Finance; Governance and

Nominating; Talent

Management and

Brings broad-based and valuable insights in finance and strategy

Compensation

Contributes extensive work experience in a regulated industry

Possesses senior leadership experience

Mr. Herdman has been Managing Director of Kalorama Partners LLC, a Washington, D.C. consulting firm specializing

in providing advice regarding corporate governance, risk assessment, crisis management and related matters since

2004. He was the Chief Accountant of the SEC from October 2001 to November 2002 prior to joining Kalorama. Prior

to joining the SEC, he was Ernst & Young’s Vice Chairman of Professional Practice for its Assurance and Advisory

Business Services (AABS) practice in the Americas and the Global Director of AABS Professional Practice for Ernst &

Young International. He was the senior Ernst & Young partner responsible for the firm’s relationships with the SEC,

FASB and AICPA. Mr. Herdman served as a member of the Board of Directors of WPX Energy, Inc. from 2011 to

2021 and served on its Compensation Committee. He chaired the Audit Committee of WPX Energy, Inc. through April

2018. In April 2015, he retired from the Board of Directors of HSBC Finance Corporation and HSBC USA Inc.

Mr. Herdman had served on the Audit Committees of both companies through April 2013. Mr. Herdman also retired

from the Board of Directors of HSBC North America Holdings, Inc. in April 2015 and was past Chairman of both its

Director Since: 2008

Audit and Risk Committees.

Age: 71

Board Committees:

Audit; Governance and

Financial

expertise

Government/regulatory

affairs background

International

experience

Manufacturing

background

Nominating, Safety,

Environment and

Technology

Chair of Audit Committee

Provides insight concerning financial and risk management matters

Mentors finance leaders and helps our finance function enhance skills and talent

Actively engaged in our Enterprise Risk Management program

CUMMINS

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

Summary of Qualifications and Experience:

Key Contributions to the Board:

•

•

•

•

ELECTION OF DIRECTORS 2021 PROXY 21

CARLA A. HARRIS—Vice Chairman, Managing Director and Senior Client Advisor, Morgan Stanley

ROBERT K. HERDMAN—Managing Director, Kalorama Partners LLC

11JAN202009354048

7MAR202104151645 7MAR202104152249 7MAR202104152099 7MAR202104152693

11JAN202009361506

7MAR202104151050 7MAR202104151796 7MAR202104152249 7MAR202104152693 7MAR202104153683

22

Ms. Herman serves as Chair and Chief Executive Officer of New Ventures LLC, a corporate consulting company, and

has held these positions since 2001. She serves as Chair of Toyota Motor Corporation’s North American Diversity

Advisory Board and is a member of Toyota’s Global Advisory Board. From 1997 to 2001, she served as U.S.

Secretary of Labor. She has also served as a director of The Coca Cola Company since 2007, Entergy Corporation

since 2003, and MGM Resorts International since 2002. In addition, Ms. Herman is Co-Chair for the Bush Clinton

Presidential Leadership Scholars Program and the Senior Vice Chair of the National Urban League. In 2014,

Ms. Herman was named to the 2014 National Association of Corporate Directors (NACD) Directorship 100 in

recognition of exemplary leadership in the boardroom and promoting the highest standards of corporate governance.

Director Since: 2001

Diversity initiatives

experience

International

experience

Government/regulatory

affairs background

Manufacturing

background

Age: 73

Board Committees:

Lead Director and Chair of the Governance and Nominating Committee

Executive; Finance;

Governance and

Brings knowledge of the U.S. government and regulatory process

Nominating; Talent

Offers strategic worldview due to her work with global corporations

Management and

Works with management on diversity and talent development initiatives

Compensation

Creates a culture that fosters open discussion and full Board participation

Mr. Lynch is the Chairman of TE Connectivity Ltd. (formerly Tyco Electronics Ltd.), a global provider of connectivity

and sensor solutions, and harsh environment applications. Mr. Lynch served as the Chief Executive Officer of TE

Connectivity Ltd. from January 2006 to March 2017 and has served as a member of its board of directors since 2007

and as Chairman of the Board since January 2013. From September 2004 to January 2006, Mr. Lynch was at Tyco

International as the President of Tyco Engineered Products & Services, a global manufacturer of industrial valves and

controls. Mr. Lynch joined Tyco from Motorola, where he served as Executive Vice President of Motorola, and

President and Chief Executive Officer of Motorola’s Personal Communications sector, a leading supplier of cellular

handsets. Mr. Lynch has served as a director of Thermo Fisher Scientific Inc. since 2009 and as Lead Director since

February 2020. He has also served as a director of Automatic Data Processing, Inc. since 2018. Mr. Lynch serves on

the Board of The Franklin Institute and on the Rider University Board of Trustees.

Director Since: 2015

Age: 66

Board Committees:

CEO of public company

from 2006 to 2017

Financial

expertise

International

experience

Manufacturing

background

Technology

background

Finance; Governance

and Nominating;

Talent Management

Chair of Finance Committee

and Compensation

Brings perspective of a sitting Chairman and former CEO of a publicly traded global company