Construction and

Building Contractors

Preface

This publication is designed for building construction contractors, subcontractors, and restaurant equipment

contractors. It provides basic information on the California Sales and Use Tax Law and applicable regulations.

If you cannot find the information you are looking for in this publication, please visit our website at www.cdtfa.ca.gov

or call our Customer Service Center at 1-800-400-7115 (TTY:711). Customer service representatives are available

Monday through Friday from 7:30 a.m. to 5:00 p.m. (Pacific time), except state holidays.

This publication complements publication 73, Your California Seller’s Permit, which includes general information

about obtaining a permit, using a resale certificate, collecting and reporting sales and use taxes, buying, selling,

and keeping records. Also, please refer to our website or the For More Information section of this publication for

the complete list of California Department of Tax and Fee Administration (CDTFA) regulations and publications

referenced in this publication.

We welcome your suggestions for improving this or any other publication. If you would like to comment, please

provide your comments or suggestions directly to:

Audit and Information Section, MIC:44

California Department of Tax and Fee Administration

PO Box 942879

Sacramento CA 94279-0044

Please note: This publication summarizes the law and applicable regulations in effect when the publication was

written. However, changes in the law or in regulations may have occurred since that time. If there is a conflict

between the text in this publication and the law, the decision will be based on the law and not on this publication.

Contents

Section Page

Definition of Terms 1

General Application of Tax to Construction Contractors 4

(Other than United States Contractors)

Application of Tax to United States Construction Contractors 7

Subcontractors 8

Liability by Type of Contract 9

Application of Tax to Different Types of Construction Contracts 10

Repair Contracts

Sales of Prefabricated Buildings

Factory-Built School Buildings

Restaurant Equipment Contractors

Cabinet Contractors

Countertops

On-Premise Electric Signs

Signs (Other than On-Premise Electric Signs)

Solar Cells, Solar Panels, and Solar Modules

Modular Furniture

Landscape Contractors

Construction of Certain Military and Medical Facilities 18

Procedures for Determining Tax Liability 19

Method of Purchasing

Purchasing on an Ex-Tax (Without Tax) Basis

Purchasing on a Tax-Paid Basis

Recordkeeping

Construction Contractors’ Use of Resale Certificates 21

Leased Fixtures

Materials and Fixtures Used Outside of California 22

Sales in Interstate and Foreign Commerce 22

Transportation Charges 23

Contents

Section Page

District Taxes 24

Property Purchased Prior to the Operative Date of a District Tax

Jobsite as Place of Business Installation or Delivery Location

Purchasing Materials and Fixtures in One Location and Using

Them in Another Location

Determining the Applicable District Use Tax Rate

Fixed Price Contracts

Finding the Appropriate Tax Rate

Local Tax Allocation 28

Required Registration to Report Use Tax—How to Register

and File a Return 29

Other Tax Issues 30

Consumer Use Tax Account

Farm Equipment and Machinery

Construction Contractors and American Indian Reservations

Bad Debts

Supplies and Tools for Self-Use

Sales of Short Ends or Pieces

Miscellaneous

Lumber and Engineered Wood Products

For More Information 34

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Definition of Terms

Construction contracts

A construction contract is a contract, whether on a lump sum, time and material plus tax, cost-plus a fee, or other basis, to:

1. Erect, construct, alter, or repair any building or other structure, project, development, or other

improvement on or to real property, or

2. Erect, construct, alter, or repair any fixed works such as waterways and hydroelectric plants, steam and

atomic electric generating plants, electrical transmission and distribution lines, telephone and telegraph

lines, railroads, highways, airports, sewers and sewage disposal plants and systems, waterworks and

water distribution systems, gas transmission and distribution systems, pipelines and other systems for the

transmission of petroleum and other liquid or gaseous substances, refineries and chemical plants, or

3. Pave surfaces separately or in connection with any of the above works or projects, or

4. Furnish and install the property that becomes a part of a central heating, air-conditioning, or electrical

system of a building or other structure, and furnish and install wires, ducts, pipes, vents, and other conduit

imbedded in or securely affixed to the land or a structure.

Construction contracts do not include the sale and installation of property such as machinery and equipment. In

addition, construction contracts do not include the furnishing of property if the person furnishing the property is not

responsible for the final affixation or installation of the property.

Construction contractors

Construction contractors are persons who perform construction contracts. Construction contractors may include

general contractors, subcontractors, and specialty contractors that engage in building trades such as:

• Carpentry

• Landscaping

• Bricklaying

• Cement work

• Steelwork

• Plastering

• Drywall installation

• Sheet metal work

• Roofing

• Tile and terrazzo work

• Electrical work

• Plumbing

• Heating

• Air-conditioning

• Elevator installation and construction

• Painting

• Installation of floor coverings, such as:

• Linoleum

• Floor tile

• Wall-to-wall carpeting

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

United States construction contractors

A United States (U.S.) construction contractor is a construction contractor who performs a construction contract for

the U.S. government.

Materials

Materials include construction materials and components, and other tangible personal property incorporated into,

attached to, or affixed to, real property by contractors performing a construction contract. When combined with

other tangible personal property, materials lose their identity to become an integral and inseparable part of the real

property. Examples of materials are in Regulation 1521, Construction Contractors, Appendix A, and include but are not

limited to:

• Bricks

• Cement

• Doors

• Electric wiring

• Flooring

• Lumber

• Paint

• Piping

• Stucco

• Tile

• Windows

Fixtures

Fixtures are items which are accessory to a building or other structure and do not lose their identity as accessories

when installed. Examples of fixtures are in Regulation 1521, Appendix B, and include but are not limited to:

• Air-conditioning units

• Awnings

• Furnaces

• Lighting fixtures

• Plumbing fixtures

• Prefabricated cabinets

• Venetian blinds

Machinery and equipment

Machinery and equipment include property intended to be used in the production, manufacturing or processing

of tangible personal property, the performance of services, or for other purposes (for example: research, testing,

or experimentation). Machinery and equipment are not essential to the fixed works, building, or structure itself. It

incidentally may, on account of its nature, be attached to the realty without losing its identity as a particular piece of

machinery or equipment and, if attached, is readily removable without damage to the unit or the realty. Examples of

machinery and equipment are in Regulation 1521, Appendix C, and include but are not limited to:

• Drill presses

• Electric generators

• Lathes

• Machine tools

• Printing presses

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Time and material contract

A time and material contract is a contract under which the contractor agrees to furnish and install materials and/or

fixtures and provides a separate charge for the materials or fixtures and the installation or fabrication for these items.

Lump sum contract

A lump sum contract is a contract under which the contractor for a stated lump sum agrees to furnish and install

materials and/or fixtures. A lump sum contract does not become a time and material contract when the amounts

attributable to materials, fixtures, labor, or tax are separately stated in the invoice.

Cost-plus-a-fee contract

A cost-plus-a-fee contract is a construction contract where the contractor furnishes and installs goods in exchange for

the cost of the goods (not a marked-up selling price) plus a fee, which may be a lump sum or a percentage of the costs.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

General Application of Tax to Construction Contractors

(Other than United States Contractors)

Applying tax to the sale and use of tangible personal property that is furnished and installed in the performance of a

construction contract generally depends on whether the property is considered “materials” or “fixtures” and the type of

contract with the customer.

Materials

Whether a construction contractor is the consumer or retailer of materials furnished and installed in the performance

of a construction contract will depend on the type of contract. Construction contractors are generally the consumers

of materials. However, under certain types of contracts, a contractor may be considered the retailer, rather than

consumer, of the materials they furnish and install under the construction contract. This will be described later in this

publication.

Lump sum contract

Construction contractors are always the consumers of materials which they furnish and install in the performance of a

lump sum contract. Tax applies to the cost of materials to the construction contractor. Either sales tax applies to the sale

of the materials to the construction contractor or use tax applies to the use of materials by the construction contractor.

When a construction contractor fabricates or processes materials prior to installation and is not acting as a seller of the

materials, no tax is due on the processing costs; only the contractor’s actual material cost is subject to the tax. Where

the contractor subcontracts the fabrication or processing of materials to an outside firm, the fabrication is considered

part of the taxable cost of materials.

Generally, construction contractors who only furnish and install materials in lump sum contracts are not required to

hold a seller’s permit. However, construction contractors may be required to register with us as qualified purchasers.

(See Required registration to report use tax—how to register and file a return.)

For more information on the requirements of holding a seller’s permit, please call our Customer Service Center at

1-800-400-7115 (TTY:711).

Time and material contract

Under a time and material contract, the construction contractor is generally the consumer of materials, and tax is

owed on the purchase price.

However, under the following circumstances, the construction contractor will be the retailer of the materials.

If the contractor bills their customer for an amount for sales tax computed on the marked-up billing for materials, it is

considered a time and material plus tax contract. Contractors are the retailers of materials used in these contracts. The

measure of tax is the amount on which tax reimbursement is charged.

The contractor will also be considered the retailer of the materials if the contract explicitly provides for:

1. The transfer of title to the materials prior to installation, and

2. Separately state the sales price of the materials from the installation charge.

If the sale occurs in California, sales tax applies to the contractor’s gross receipts from the sale of the materials. If the

sale occurs prior to the time the property is brought into this state, the customer is generally considered the consumer

and must pay the use tax based on the sales price. Contractors must collect the use tax from the customer and pay it

to the State of California.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

When you are the consumer of materials and fabricate materials prior to installation, no tax is due on your labor

charges; only the actual material cost is subject to tax. When contractors sublet the fabrication or processing of

materials to an outside firm, that labor is taxable to the contractor as part of the cost of materials.

In an instance when you are acting as a retailer of materials, your charge for the labor to prepare materials for

installation is considered fabrication labor and is a step in the process of creating the item to be installed, according

to Regulation 1526, Producing, Fabricating and Processing Property Furnished by Consumers—General Rules. Your entire

charge for materials and fabrication labor to your customer is subject to sales tax.

Fixtures

Contractors are the retailers of fixtures they furnish and install in construction contracts, and tax applies to their sales

of the fixtures. Accordingly:

• If the contract states the selling price of the fixture, tax applies to that price.

• If no sales price is stated, such as in a lump sum contract, the taxable retail selling price is the cost price of

the fixture to the contractor.

• If a contractor purchases a manufactured fixture, the cost price is the sales price of the fixture to them,

including any manufacturer’s excise tax or import duty imposed on the sale to the contractor.

Self-manufactured xtures

If the contractor manufactures the fixture, the cost price is considered to be:

• The prevailing price at which similar fixtures in similar quantities, ready for installation, are sold by the

contractor to other contractors, or

• If similar fixtures are not sold to other contractors, then the cost price is deemed to be the amount stated in

the price lists, bid sheets, or other records. If the sale price cannot be established in the above manner, the

cost price is the combination of the following:

• Cost of materials, including freight-in and import duties,

• Direct labor, including fringe benefits and payroll taxes,

• Specific factory costs attributable to the fixture,

• Any manufacturer’s excise tax,

• Pro rata share of all overhead attributable to the manufacture of the fixture, and

• Reasonable profit from the manufacturing operations, generally considered to be five percent of the sum

of the preceding factors.

Additionally, jobsite fabrication labor and its prorated share of manufacturing overhead must be included in either the

cost price or sales price of the fixture. Jobsite fabrication labor includes assembly labor performed prior to attaching a

component or a fixture to real property.

Leased xtures

A construction contractor may furnish and install a fixture for a person, other than the owner of the realty, who intends

to lease the fixtures in place as tangible personal property and pay tax measured by rental receipts. In this case, the

contractor may take a resale certificate from the lessor at the time of the transaction, and the sale to the lessor will be

considered a sale for resale.

Machinery and equipment

Construction contractors are the retailers of machinery and equipment even though the machinery and equipment

are furnished in connection with a construction contract. The sale of machinery and equipment by a construction

contractor is subject to tax, the same as any sale of tangible personal property. If the contract only requires the

furnishing and installation of machinery and equipment, the contract is not considered a construction contract and

tax generally applies to the total contract price, less installation labor charges and other excludable charges.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

If a lump sum contract includes the furnishing and installation of materials, fixtures, and machinery and equipment,

tax applies to the retail selling price of the machinery and equipment in which similar quantities ready for installation

are sold at retail. If no retail price for the machinery and equipment exists, then tax applies to the retail price

determined from contracts, price lists, bid sheets, or other records.

If contractors manufacture the machinery and equipment, and if gross receipts cannot be established in the above

manner, the gross receipts from the sale shall be a combination of the following:

• Cost of materials, including freight-in and import duties;

• Direct labor, including fringe benefits and payroll taxes;

• Specific factory costs attributable to the machinery or equipment;

• Any manufacturer’s excise tax;

• Pro rata share of all overhead attributable to the machinery or equipment, including overhead attributable

to manufacturing, selling, contracting, and administration; and

• Reasonable profit from the manufacture and sale of the machinery or equipment, generally considered to

be five percent of the sum of the preceding factors.

Please note: Jobsite fabrication labor and its prorated share of manufacturing overhead must be included in the sale

price of the machinery or equipment. Jobsite fabrication labor includes assembly labor performed prior to attaching

the machinery or equipment to real property.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Application of Tax to United States Construction Contractors

A United States construction contractor is a contractor who performs a construction contract for the U.S. government.

Materials and xtures

U.S. construction contractors are the consumers of materials and fixtures furnished and installed in the performance

of construction contracts with the U.S. government. There is no distinction between the application of tax to

materials and fixtures. Either the sales tax or the use tax applies to sales to U.S. construction contractors or use by

the contractors. Contractors owe tax on the cost of fixtures that are self-manufactured, furnished, and installed in

a U.S. government construction contract. The fact that the contract may provide principally for the manufacture or

acquisition of tangible personal property is immaterial. The sales tax, but not the use tax, applies even though the

contractor purchases the property as the agent of the United States.

Please note: Generally, U.S. construction contractors are not the retailer of materials and fixtures furnished and installed

in U.S. government construction contracts.

Machinery and equipment

U.S. construction contractors are retailers of machinery and equipment furnished in the performance of a construction

contract with the U.S. government. Sales to the U.S. government are generally exempt from tax. Tax does not apply to

sales of machinery and equipment to U.S. contractors or subcontractors, provided the title to the property passes to

the U.S. government before the contractor makes any use of it. The contract must contain a clause that passes title to

the U.S. before the contractor makes any use of the property.

Under these circumstances, the U.S. construction contractor may issue a resale certificate. If the contractor uses the

machinery or equipment before passage of title to the U.S., then:

• The contractor is the consumer of the machinery or equipment, and

• Either sales tax or use tax applies to the sale to, or use by, the contractor of the machinery and equipment.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

Subcontractors

A subcontractor who has furnished and installed materials or fixtures for a prime contractor must pay tax on:

• The cost of the materials, and/or

• The retail selling price of the fixtures, in the case of non-U.S. contractors.

Please note: A subcontractor may not accept a resale certificate from a prime contractor for materials the subcontractor

furnishes and installs in the performance of a construction contract.

Under most circumstances, subcontractors may not accept a resale certificate from a prime contractor for

fixtures the subcontractor furnishes and installs. When fixtures are furnished and installed by a subcontractor, the

subcontractor is the retailer and the prime contractor is the consumer. Consequently, no additional tax is due under

the prime contractor’s contract with the real property owner. However, a subcontractor may furnish and install a

fixture for a person, other than the owner of the realty, who intends to lease the fixture in place as tangible personal

property and pay tax on the rental receipts. In this latter case, the subcontractor may accept a resale certificate from

the lessor at the time of the transaction.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

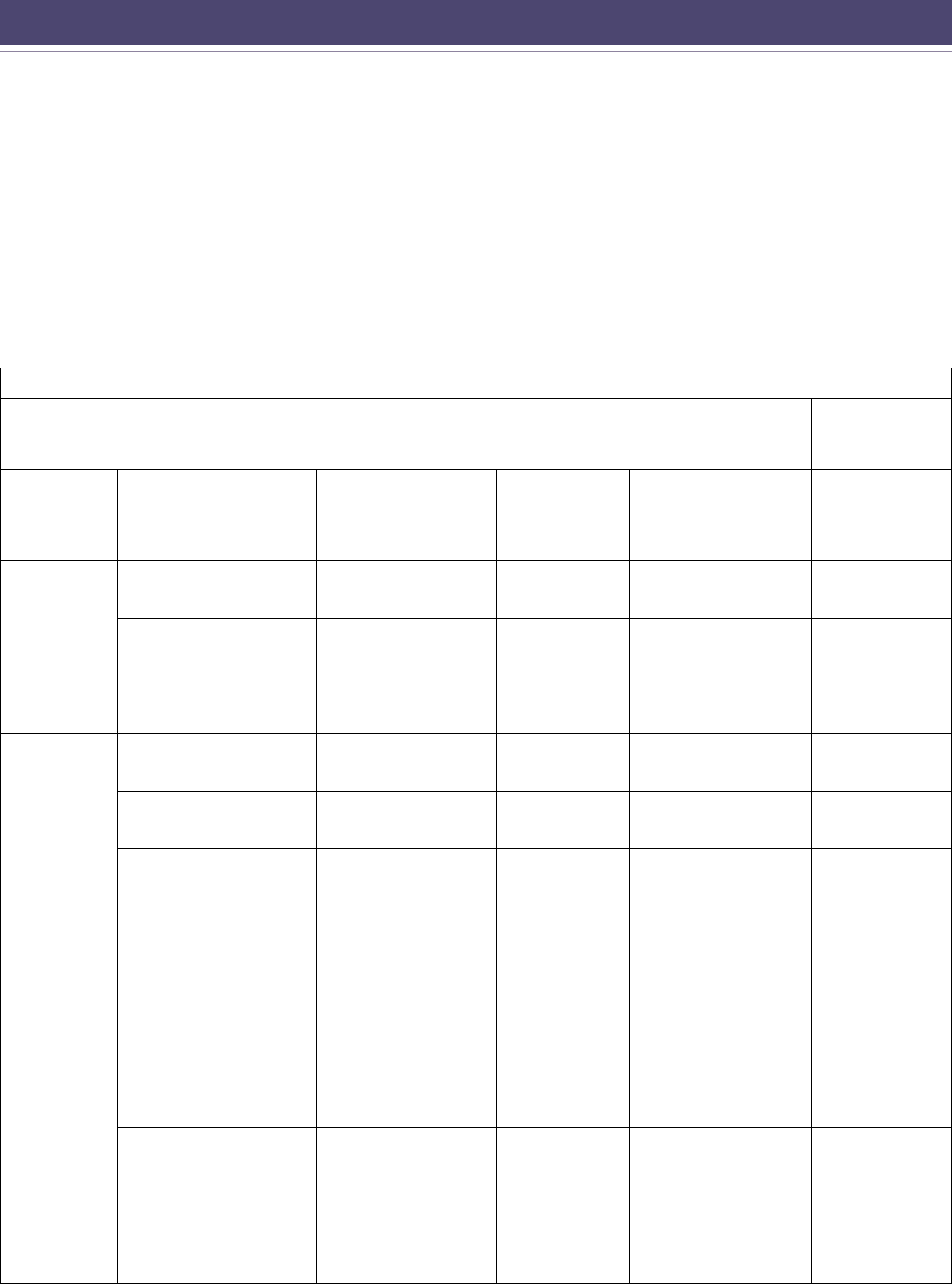

Liability by Type of Contract

Construction contracts include:

• Lump sum contracts,

• Cost-plus-a-fee contracts,

• Time and material contracts, or

• Time and material contracts where the contractor is the retailer of materials.

The type of contract affects the application of tax to materials and fixtures furnished and installed by construction

contractors. Additionally, the application of tax depends on whether or not the contract is a U.S. construction contract.

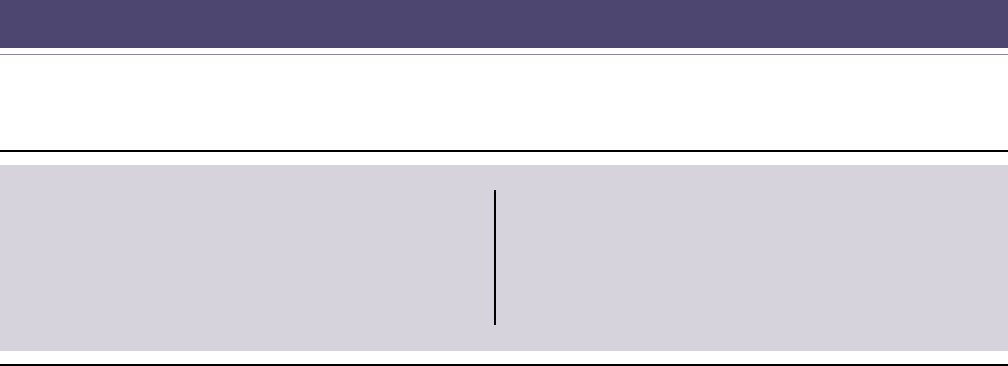

The following chart presents a synopsis of the application of tax to various construction contracts as they apply to U.S.

construction contractors and construction contracts other than U.S. construction contractors.

Liability by Type of Contract

Contractors Other than United States Contractors

United States

Construction

Contractors

Kind of Item How Acquired

Lump Sum or

Cost-Plus-a-Fee

Time and

Material

Time and Material

under which the

Contractor is the

Retailer of Materials

Measure

Materials

Purchased without

paying tax

Cost Cost Billed price Cost

Purchased tax-paid None None

Excess of billed price

over cost

None

By conversion of realty None None

Excess of billed price

over cost

None

Fixtures

Purchased without

paying tax

Cost Billed price Billed price Cost

Purchased tax-paid None

Excess of billed

price over cost

Excess of billed price

over cost

None

Manufactured from

materials, purchased

without paying tax, by

installing contractor

Prevailing price

to contractors or,

if that cannot be

established, the

amount stated in the

price lists, bid sheets,

or other records, or

manufactured cost,

including profit

to the contractor-

manufacturer.

Billed price Billed price Cost

Manufactured from

tax-paid materials by

installing contractor

Excess of

prevailing price or

manufactured cost,

including profit

over tax-paid cost of

materials.

Excess of billed

price over tax-

paid material

cost

Excess of billed

price over tax-paid

material cost

None

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

Application of Tax to Different Types of Construction Contracts

This section provides guidance on the application of tax to various types of construction contracts. For examples not

discussed in this publication, please refer to Regulation 1521, Construction Contractors. If further information is needed,

please contact our Customer Service Center at 1-800-400-7115 (TTY:711).

Contracts for the erection and installation of buildings on land or the repair and remodeling of buildings

A construction contractor is generally the consumer of materials and the retailer of fixtures furnished and installed in

construction contracts. Tax will apply according to the Liability by Type of Contract chart on the previous page.

Repair contracts

A contract to repair a fixture in place, or a fixture the contractor is required to reaffix to the realty is a construction

contract. As with any construction contract, whether the contractor is a retailer or consumer will depend on the type

of contract and whether they are replacing a fixture or merely repairing it.

Considered a retailer when:

• The contractor is replacing the fixture.

• The parts are furnished in the performance of a construction contract to repair a fixture when the sale price

of the parts is billed separately from the repair labor.

Considered a consumer when:

• The parts are furnished in the performance of a lump sum construction contract to repair a fixture.

• A U.S. construction contractor furnishes parts in the performance of a construction contract to repair

materials or fixtures.

Sales of prefabricated buildings

A contract to furnish and install a prefabricated or modular building similar in size to, but is not, a factory-built school

building (relocatable classroom), is a construction contract. This is true whether the building rests in place by its own

weight or is physically attached to realty. It is immaterial whether the building is erected upon or affixed to land owned

by the owner of the building or is leased to the landowner or lessee of the land.

Tax applies to the total sales price of small prefabricated buildings, such as a shed or kiosk, which are furnished and

installed but not physically attached to real property by the seller. When these buildings are required to be physically

attached to real property, such as a concrete foundation, they are considered to be construction contracts.

Factory-built school buildings

Factory-built school buildings (relocatable classroom), eective September 13, 1990, include:

• Any building which is designed or intended for use as a school building, and

• Is wholly or substantially manufactured at an offsite location for the purpose of being:

• Assembled, erected, or installed on a site owned or leased by a school district or a community college

district.

A factory-built school building must be designed and manufactured in accordance with building standards adopted

and approved pursuant to Chapter 4 (commencing with section 18935) of Part 2.5 of Division 13 of the Health and

Safety Code and must be approved by the structural safety section in the Office of the State Architect.

The term “factory-built school building” does not include:

• Buildings licensed by either the Department of Motor Vehicles or the

Department of Housing and Community Development.

• Prefabricated or modular buildings that are similar in size to, but are not, factory-built school buildings.

It is immaterial whether the building is erected upon or affixed to land owned by the owner of the building or is leased

to the landowner or lessee of the land.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Consumer, eective September 13, 1990, means either:

1. A school district or a community college district, or

2. A contractor who purchases a factory-built school building for the purpose of fulfilling an existing contract

with a school district or a community college district to furnish and install the building.

The place of sale or purchase of a factory-built school building is the retailer’s place of business regardless of whether

the sale of the building includes installation or the building is placed upon a permanent foundation.

Application of Tax

1. Tax applies to 40 percent of the sales price of the building to the consumer, excluding any charges for

placing the completed building on the site. The sales price of the building includes charges for tangible

personal property installed in the building by a subcontractor, provided the installation for such property is

required in the prime contract for the building.

2. A separate contract to furnish and install tangible personal property in a factory-built school building

after installation of the building is a construction contract. Any contract or subcontract for site

preparation (for example: a foundation) is a construction contract. For the application of tax, see

Liability by Type of Contract.

3. The sale of a factory-built school building to a purchaser who will resell the building without installation is

a sale for resale and the seller may accept a resale certificate from the purchaser. If the purchaser then sells

to a contractor who has an existing contract to install the building on a school site, tax will apply as stated

in number 1 above. If tax has been paid on the purchase price of a factory-built school building which is

then resold for installation, a deduction for cost of tax-paid purchases resold prior to use may be taken as

provided in Regulation 1701, Tax-paid Purchases Resold.

For more information regarding the application of tax to mobilehomes, factory-built housing, and factory-built school

buildings, see publication 47, Mobilehomes and Factory-Built Housing.

Restaurant equipment contractors

Tax applies to restaurant equipment contractors for construction contracts involving the furnishing and installation

of materials, fixtures, and machinery and equipment in the same manner as other construction contracts. We, in

conjunction with the Restaurant Equipment Contractors Association, have made a study of components involved in

construction contracts for the furnishing and installation of restaurant equipment.

1. Materials

The following are some items that are considered to be materials when furnished and installed by construction

contractors in performing contracts for the food industry:

• Carpeting, including padding and trim when affixed to the real property by glue, nails, and so forth

• Doors

• Ducts installed in walls, ceilings, and floors

• Grab bars (for accessible lavatories)

• Millwork

• Pass window frames and shelves

• Wall corner pieces and wall caps

• Wall covering materials (wallpaper, paneling, and so forth)

• Wall flashing

• Wall mirrors

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

2. Fixtures

The following items are usually considered to be fixtures when furnished and installed by a construction contractor in

performing a contract for the food service industry:

• Bolt-down counter stool bases with stools attached

• Bolt-down table bases with table tops affixed

• Custom fabricated cash stands

• Custom fabricated cocktail back bar superstructures

• Custom fabricated cocktail back bar

• Custom fabricated cocktail bars

• Custom fabricated counters

• Custom fabricated dish table assemblies

• Custom fabricated make-up tables

• Custom fabricated pot racks

• Custom fabricated scullery sink assemblies

• Custom fabricated seating assemblies/booth units

• Custom fabricated serving counters

• Custom fabricated service stands

• Custom fabricated soffits

• Custom fabricated walk-in coolers and freezers that are affixed to the real estate (either through a fastening

to a building wall or when the walls are embedded or coved into the building surfaces)

• Dispensers for soap, towels, or toilet tissue

• Faucets

• Freezers (remote)

• Hoods

• Lighting fixtures

• Motors

• Plumbing fixtures

• Refrigeration compressors

• Refrigerators (remote)

• Safes (embedded in concrete in the buildings)

• Water heaters (built into fixtures or into water systems)

• Water softeners (built into fixtures or into water systems)

Fixtures also include the following items which are built into fixtures or otherwise built into the realty and may not be

removed without damage to the items or the realty:

• Charbroilers

• Dish dispensers

• Dishwashers that are built into a dish table

• Disposals

• Drink dispensers

• Freezers

• Griddles

• Ice cream cabinets

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

• Ovens

• Refrigerators

• Roll warmers

• Scrap chutes

• Soda fountain systems

• Soup warmers

• Syrup rails

3. Machinery and equipment

The following items are generally considered to be machinery and equipment. In order to maintain this classification,

the machinery and equipment must be:

• Freestanding, or

• Affixed to the building, or built into it or built into another fixture, and can be readily removed without

damage to the building, the unit, or other fixture:

• Bar stools

• Beverage and juice dispensers

• Bulletin boards

• Can openers

• Chairs

• Charbroilers

• Chinaware, silverware, pots and pans, paper goods, and culinary items

• Coffee makers

• File cabinets

• Flight-type dishwashers

• Floor racks

• Griddles

• Hot water hoses

• Ice bins

• Ice cream cabinets

• Ice-making machinery

• Iced tea dispensers

• Iced tea machine

• Lockers

• Microwave ovens (freestanding)

• Milk dispensers

• Mixers

• Ovens

• Portable bins and tables

• Ranges

• Reach-in freezers (self-contained)

• Reach-in refrigerators (self-contained)

• Roll covers

• Safes

• Salamanders (broilers)

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

• Scales

• Shelving units

• Silverware boxes

• Slicers

• Table lamps

• Tables

• Time card racks

• Time clocks

• Toasters

Cabinet contractors

A cabinet will be considered “prefabricated and, therefore, a fixture” when at least 90 percent of the total direct cost of

labor and material in fabricating and installing the cabinet is incurred prior to affixation to the realty. If this is not the

case, the component parts of the cabinet will be considered materials and tax will apply to the use of those materials,

the same as with other construction contracts.

To determine this 90 percent, the total direct cost of all labor and materials in fabricating the cabinet up to the

point of installation will be compared to the total direct cost of all labor and materials in completely fabricating and

installing the cabinet.

If more than one cabinet is fabricated and installed under the contract, each cabinet will be considered separately.

Example: You contract to furnish and install an overhead cabinet that is attached to the wall and ceiling. You build

the cabinet in your shop, except the doors are not attached until after the cabinet is affixed to the realty. Your direct

costs are:

Material Cost

Fabrication Labor

Prior to Installation

Installation Labor Total

Cabinet $2,750 $3,500 $850 $7,100

Calculation: $2,750 + $3,500 = 88.03%

$7,100

Since less than 90 percent of the direct cost of labor and materials in fabricating and installing the cabinet is incurred

prior to attaching it to the realty, the cabinet is considered materials and not considered a prefabricated fixture. In this

example, you would pay tax on your purchase price of the materials, $2,750.

Countertops

Countertops are generally regarded as materials, even when prefabricated. However, there are some countertops,

primarily countertops that have a sink built in or the sink is installed in the countertop prior to final installation of

the countertop, which are considered fixtures. Regardless of the type of countertop, the 90 percent rule does not

apply to contracts to furnish and install a countertop.

On-premise electric signs

On-premise electric signs are specifically discussed in Regulation 1521, Construction Contractors, and have their own

tax treatment. An on-premise electric sign is any electrically powered or illuminated structure, housing, sign, device,

figure, statuary, painting, display, message, placard, or other device or part thereof affixed to real property.

These on-premise electric signs must be used to advertise, or to provide data or information in the nature of

advertising, for any of the following purposes:

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

1. To designate, identify, or indicate the name or business of the premises where the advertising display is

located, or

2. To advertise the business conducted, services available, or goods produced or available for sale on the

property where the advertising display has been built.

An on-premise electric sign is a fixture, and tax applies to the sale price of the sign. When furnishing and installing an

on-premise electric sign in a contract that does not state the selling price of the sign, tax applies to 33 percent of the

contract price of the on-premise electric sign that is furnished and installed by the contractor.

“Contract price” includes all charges for:

• Materials,

• Fabrication labor,

• Installation labor,

• Overhead,

• Profit, and

• Any additional charges associated with the sale and installation of the sign.

If a contractor installs an on-premise electric sign supplied by a third party, the installation charges are not taxable. If a

seller furnishes but does not install an on-premise electric sign, the seller is a retailer of the sign and tax applies to the

total contract price for the sale of the sign.

Example 1

You were hired to furnish and install an on-premise electric sign for a lump sum contract price of $20,000. You are

required to report and pay tax on $6,600 (33% x $20,000 = $6,600) at the tax rate in effect at the location where the

sign will be installed. The remaining $13,400 ($20,000 - $6,600 = $13,400) is considered nontaxable installation labor.

Example 2

You were hired to furnish and install an on-premise electric sign for which you separately stated a sales price of $15,000

for the sign and $5,000 for installation labor. Because you have separately stated the selling price of the electric sign,

tax applies to the sales price of $15,000 at the tax rate in effect at the location where the sign will be installed.

You may also be required to provide documentation to support that the charges for installation do not include taxable

labor charges for fabrication of the sign.

Please note: The reporting method discussed in this section applies only for contracts to furnish and install on-premise

electric signs. You may not use it to report and pay tax on the sale of a nonelectric sign. As stated above, this does not

affect your responsibility to pay tax on the selling price of a sign when you sell a sign without installing it, or when you

separately state the selling price of a sign you install.

Signs (other than on-premise electric signs)

Generally, a contract to furnish and install a sign on real property is a construction contract. Large outdoor advertising

signs built on land are considered structures. Contractors who furnish and install these signs are consumers of the

materials furnished and installed. Therefore, tax is due on the cost of the materials. Signs attached to buildings are

generally considered to be fixtures. Because contractors are retailers of the fixtures, tax is due either on the retail

selling price or the cost price of the fixtures depending on the type of contract. (See Fixtures.)

Solar cells, solar panels, and solar modules

Solar energy installations are specifically discussed in Regulation 1521, Construction Contractors. A solar energy system

is any solar energy device that provides for the collection and distribution of solar energy and, where applicable, the

storage of solar energy.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

A contract to furnish and install a solar energy system onto a structure or realty is a construction contract that involves

furnishing and installing both materials and fixtures.

1. Materials

Photovoltaic (PV) cells, solar panels, and solar modules (including solar thermal panels and solar electric PV panels), are

considered materials when they function in the same manner as other materials such as roofing, walls, or windows.

Examples of materials include:

• PV integrated skylights

• PV panels used as a roof on a parking lot shade structure

• PV integrated roofing tiles

• Wiring

• Wiring harnesses

• Strapping

• Mounting systems, which include rack framing brackets that are installed on roofs

2. Fixtures

Photovoltaic (PV) cells, solar panels, and solar modules (including solar thermal panels and solar electric PV panels),

are considered fixtures when they are attached to a building or other structure and do not lose their identity as

accessories when installed. Examples of fixtures include:

• Rack-mounted solar panels installed on roofs

• Solar panels used in freestanding solar arrays

• Terminal boxes

• Direct current (DC) and alternating current (AC)

disconnect boxes

• Inverters

• Transformers

• Batteries

• Pumps

A labor charge to attach solar panels purchased in a completed condition to a mounting system is not subject to tax.

When furnishing and installing solar energy systems that include fixtures, construction contractors are required to

hold a seller’s permit.

A construction contractor may furnish and install solar panels that are considered fixtures for a person, other than the

owner of the realty who intends to lease the fixtures (panels) in place as tangible personal property and elects to pay

tax measured by rental receipts. In this case, the contractor may take a resale certificate from the lessor at the time of

the transaction, and the sale to the lessor will be considered a sale for resale.

The partial tax exemption for leases of solar panels considered farm equipment and machinery may apply under

certain circumstances. For additional information, see publication 66, Agricultural Industry.

Modular furniture

Contracts to furnish and install modular furniture are generally not construction contracts. Regulation 1583, Modular

Systems Furniture, provides guidelines for sales of modular systems furniture. The regulation specifically states that a

contract to sell and install modular systems furniture is a contract for the retail sale of tangible personal property and not

a construction contract. This is true whether or not the systems are affixed to realty. The regulation allows persons

selling and installing the modular systems to claim ten percent of the total contract price as the charge for nontaxable

installation labor. Total contract price does not include charges for freestanding furniture and other property not

attached to panels or other components.

The ten percent deduction does not apply to contracts if:

• A subcontractor has contracted with the seller to assemble and install a modular system (the system

components provided by a prime contractor or others), or

• The contract is for reconfiguring an existing system.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

It is important to report and separately account for taxable and nontaxable labor charges. For more information

regarding sales of modular furniture, please call our Customer Service Center at 1-800-400-7115 (TTY:711).

Landscape contractors

The installation of plants, trees, and lawns is considered an improvement to realty. Landscape contractors who enter

into contracts for landscaping in which they furnish and install plants, trees, and lawns are construction contractors.

Sod and flowers are generally considered materials, and the contractor is the consumer of these items.

Plants, trees, and shrubs are generally considered fixtures, and the contractor is considered the retailer of these items

when they are installed in connection with their services. Tax generally applies to the sales price of plants, trees, and

shrubs. In the case of lump sum contracts, the selling price of the plants, trees, and shrubs is generally regarded as the

cost price to the landscape contractor.

If nurseries install plants, trees, and shrubs that have been grown or produced by them under a lump sum contract,

the cost price is considered to be the price at which similar plants or trees in similar quantities ready for installation are

sold by the nursery to other contractors.

If the landscaper makes a taxable sale of fixtures, they may be entitled to a deduction for ‘‘tax-paid purchases resold

prior to use’’ on their sales and use tax return if they:

• Purchase plants and trees (fixtures) from nurseries to install in a construction contract;

• Pay an amount as sales tax reimbursement on those purchases; and

• Make no use of them prior to installation (other than for retention, demonstration, or display while holding

them for resale)

For additional information, see Regulation 1701, Tax-Paid Purchases Resold.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

Construction of Certain Military and Veteran Medical Facilities

Beginning January 1, 2019, through December 31, 2024, Revenue and Taxation Code (R&TC) section 6369.7 provides

for a sales and use tax exemption for the sale and use of building materials and supplies purchased by a qualified

person for use by that qualified person in the construction of a qualified facility.

A qualified person is either or both of the following:

• A “qualified nonprofit organization” which means an organization exempt from taxation under section

501(c)(3) of the Internal Revenue Code that constructs a “qualified facility” as a gift to the United States

Department of Defense (USDOD), pursuant to section 2601 of Title 10 of the United States Code; or the

United States Department of Veterans Affairs (USDVA), pursuant to section 8301 of Title 38 of the United

States Code; or

• A contractor, subcontractor, or builder working under contract with a “qualified nonprofit organization” to

construct a qualified facility.

A “qualified facility” is:

• A medical facility located on a U.S. military base in California;

• A temporary residential facility for families or patients receiving care (including either or both inpatient and

outpatient care) at a medical facility located on a U.S. military base in California;

• A USDVA medical center located in California; or

• A temporary residential facility for families of patients receiving care at or on behalf of a USDVA medical

center located in California.

Building materials and supplies that may be purchased under this exemption include any machinery, equipment,

materials, accessories, appliances, contrivances, furniture, fixtures, and all technical equipment or other tangible

personal property of any other nature or description that:

• Are necessary to construct and equip a qualified facility;

• Become part of the completed qualified facility; and

• Are transferred to the USDOD or USDVA as a gift, as specified.

The exemption does not apply to purchases of tools or other construction equipment that are not specified above and

meet the three listed criteria.

This exemption from tax only applies to sales and purchases made after the date the USDOD or USDVA accepts the

qualified nonprofit organization’s offer to construct the qualified facility and on or before the date the USDOD or

USDVA accepts the qualified facility.

If you are a contractor, subcontractor, or builder working under contract with a qualified nonprofit organization to

construct a qualified facility, you may issue a CDTFA-230-C-2, Exemption Certificate for Property Used in the Construction

of a Qualified Facility, to your vendors for your qualifying purchases of building materials and supplies.

A purchaser that issues an exemption certificate for its purchases made pursuant to R&TC section 6369.7 who

subsequently uses the items purchased in a manner not qualifying for the exemption will be liable for the payment of

tax (calculated on the sales price of the property), plus any applicable interest.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Procedures for Determining Tax Liability

Method of purchasing

Depending on the type of property furnished and installed and the terms of the specific contract, a construction

contractor may be a consumer of some property and a retailer of other property. For example:

• A construction contractor may be the consumer of materials used in performing a construction contract

and pay tax on their purchases.

• A construction contractor may be a retailer by making over-the-counter sales of materials or because the

terms of a particular contract make them the retailer of materials furnished and installed.

This raises the question of the most efficient method of purchasing. Usually, contractors will find it easier to set up their

purchases based on the type of jobs they conduct. If most of their tax liability is related to their own self-consumption,

they may prefer to purchase everything on a tax-paid basis. Then, when they make a retail sale of property, they may

take a deduction for tax-paid purchases resold prior to use. (See Regulation 1701, Tax-Paid Purchases Resold.)

On the other hand, it may be difficult to determine at the time of purchase whether the item purchased will be resold

or consumed if the contractor is the retailer of most of the property purchased, either because of the:

• Type of property

• Terms of their construction contracts

• Volume of over-the-counter sales

In such cases, the contractor may prefer to issue a resale certificate to the vendor when the property is purchased and

then report the use tax on items they consume. Contractors with complex operations will often purchase on the basis

of the type of commodity, in which case they will purchase some items either on a tax-paid basis or ex-tax (without

tax) basis. Whatever method is used, great care must be exercised in recording purchase data and determining tax

liability.

Purchasing on an ex-tax (without tax) basis

When construction contractors purchase items without tax, their liability will depend in part on the type of property

purchased. The types of property are:

• Materials

• Fixtures

• Machinery and equipment

• Other types of tangible personal property

Materials purchased without tax:

• When materials are purchased by issuing a valid resale certificate and if the contractor uses the materials,

liability for tax arises when the materials are committed to the fulfillment of a construction contract.

Materials withdrawn from inventory and delivered to the jobsite constitute such a commitment. The tax

must be reported with the return for the period in which the commitment took place. It is not permissible

under the law to wait until the job is completed before reporting and paying tax on the purchase price of

materials consumed or sold during the performance of the contract.

• In the case of materials purchased without tax from out-of-state vendors for use (not resale) in California,

the tax liability arises when the materials enter California.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

Fixtures, machinery, and equipment purchased without tax:

• In the case of fixtures, machinery and equipment, or other tangible personal property sold by the

contractor, liability for the tax generally arises when the fixture, machinery, equipment, or other tangible

personal property is installed, as this is when the sale takes place.

Where merchandise is purchased without tax, contractors should consider the following points:

• Have resale certificates been timely filed with the vendors for the materials, fixtures, and machinery and

equipment purchased without tax and resold under the construction contract? When making purchases for

resale, the resale certificate should be provided to the vendor at the time of purchase. (See Regulation 1668,

Sales for Resale.)

• Have proper exemption certificates been timely filed with the vendors for the materials,

fixtures, and machinery and equipment used or sold at an out-of-state point? (See

Materials and Fixtures Used Outside of California.) When making exempt purchases, the claim for exemption

should be made at the time of purchase. (See Regulation 1667, Exemption Certificates.)

Purchasing on a tax-paid basis

When merchandise is purchased on a tax-paid basis, contractors should see that the following points, among others,

are covered:

• Have vendors charged tax on freight which might not be subject to the tax? (See Regulation 1628,

Transportation Charges.)

• Has any tax been paid to the vendor on any items (materials sold, fixtures, or machinery and equipment)

upon which the contractor collected tax reimbursement?

Recordkeeping

Great care must be taken when gathering data and preparing returns. Taxpayers must determine the points in their

accounting and office procedures at which they will best be able to ascertain their correct tax liability.

Important points to be covered are:

All purchases, sales, or uses must be accounted for and analyzed for proper tax application. Contractors’ records should

be maintained in such a manner to be certain whether items were:

• Purchased tax-paid or without tax,

• Consumed,

• Sold as a taxable sale, or

• Sold or used as a nontaxable transaction.

Accurate record keeping will depend on the terms of the construction contract. If contractors manufacture

their own fixtures, their tax liability will apply based on Regulation 1521 and as explained in the section entitled

Construction Contractors (Other than U.S. Government Contractors).

Duplicate accounting processes should be eliminated to avoid duplicate reporting of tax.

• Withdrawals from ex-tax inventory (purchased without tax) for the contractor’s own use may be reconciled

using requisition slips.

• You can support purchases subject to use tax by using purchase or cost records.

These are just some examples, and contractors should develop procedures best suited to their particular operations.

For additional questions not covered in this publication, please contact our Customer Service Center at

1-800-400-7115 (TTY:711).

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Construction Contractors’ Use of Resale Certificates

Construction contractors are generally considered consumers of materials that they furnish and install in the

performance of a construction contract to improve real property. Under such circumstances, the construction

contractor should not issue a resale certificate on its purchases of materials.

However, as discussed earlier in this publication, the contractor will be deemed to be selling the materials if:

• A contractor bills their customer an amount for sales tax computed upon a marked-up billing for materials

under a time and material contract.

• The contract (other than a U.S. government contract) explicitly provides for transfer of title to the materials

prior to installation, and

• The sales price of the materials is separately stated in the contract.

When construction contractors sell (as opposed to consume) materials they install in a construction contract, they are

the retailers of the materials. They may issue a resale certificate to their supplier for materials and fixtures sold under a

construction contract.

Please note: When subcontractors are retailers, they generally may not accept resale certificates from prime contractors

for materials they furnish and install in a construction contract.

Construction contractors (other than U.S. construction contractors), including subcontractors, are generally the

retailers of fixtures they furnish and install and generally may not accept a resale certificate on their sale of the fixtures.

Leased xtures

A construction contractor may accept a resale certificate for the furnishing and installation of a fixture from a

person who:

• Is not the owner or lessor of the realty,

• Intends to lease the fixture in place as tangible personal property, and

• Pays tax measured by rental receipts.

In this case, the sale to the lessor will be considered a sale for resale.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

Materials and Fixtures Used Outside of California

Where you, as a contractor, have a contract to improve real property outside of California, your purchase of materials

and sales of fixtures are not subject to tax provided you meet certain conditions.

Your purchases of materials in California are not subject to tax when all of the following conditions are met:

• You hold a valid seller’s permit,

• You incorporate the property into real property located outside this state, and

• You certify in writing to the seller at the time of purchase that the property will be used in the specified

manner.

Your sales of fixtures are not subject to tax when all of the following conditions are met:

• You are the retailer of the fixture,

• Title to the fixture transfers to the customer at the point of installation, and

• Title to the fixture transfers at a location outside of California.

When you purchase materials under these conditions, you may either provide an exemption certificate as described

in Regulation 1667, Exemption Certificates, or issue a valid California resale certificate to the seller when purchasing

materials and fixtures for use outside California. (See Regulation 1668, Sales for Resale, and publication 103, Sales for

Resale.)

Sales in Interstate and Foreign Commerce

Sales of buildings without installation or erection are exempt from the tax when:

• The contract of sale provides that the seller shall deliver the buildings to the purchaser at an out-of-state

destination, and

• The property is shipped to a point outside this state by means of:

• Facilities that are operated by the retailer,

• Delivery by the retailer to a carrier for shipment to a consignee at such point, or

• Delivery by the retailer to a customs broker or forwarding agent for shipment outside this state.

Sales of buildings or other tangible personal property are also exempt if they are:

• Intended for installation in a foreign country,

• Irrevocably committed to be exported at the time of sale, and

• Actually delivered to the foreign country prior to any use of the property.

You must retain proof indicating that the property was delivered to a foreign destination.

For additional information, see Regulation 1620, Interstate and Foreign Commerce, and publication 101, Sales Delivered

Outside California.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Transportation Charges

In making purchases subject to tax, the transportation (freight) charges by the seller to the contractor may or may not

be subject to tax, depending on the conditions of the sale. For example, where a prefabricated building is sold without

erection or installation, and the building is shipped directly to the purchaser, tax will not apply if all the following

conditions are met:

• Freight charges are separately stated,

• Charges for the shipment of the building by an independent contract or common carrier, and

• The contractor’s charges for transportation do not exceed the actual cost of delivery.

Freight charges for delivery to the supplier (freight-in) are generally subject to tax. If the contractor’s charge includes a

handling charge or a “shipping and handling” term, the amount of the charge that exceeds the actual cost of shipment

is subject to tax.

Where tangible personal property is shipped by the seller’s own truck or facility, separately stated charges for delivery

are subject to tax unless the sales agreement specifically provides that title to the goods passes at the seller’s place of

business.

Construction contractors who bill their customers for sales tax on materials used on time and material contracts

are “retailers” of the materials. Contractors generally deliver materials to jobsites using their own transportation

facilities and separately charge to the customers for delivery. Generally, unless otherwise stated in the contract, title

to the materials is transferred at time of delivery to the jobsite. Under such circumstances, the sales of materials and

separately stated delivery charges are subject to sales tax. However, separately stated delivery charges are not subject

to tax if title to the materials explicitly passes to the customer prior to delivery.

For further information on transportation charges, refer to Regulation 1628, Transportation Charges, and

publication 100, Shipping and Delivery Charges.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

District Taxes

District taxes are either transactions (sales) or use taxes. The transaction (sales) tax is due from retailers on their

taxable sales and district use tax is due from purchasers for their use of tangible personal property in a district.

A retailer engaged in business in a district may be required to collect applicable district use tax. There are both

citywide and countywide district taxes. District taxes may be imposed at various rates, and more than one district

tax may apply to a transaction.

Construction contractors and district tax

District tax law provides that:

• Materials purchased before the effective date of a district tax and installed after that date may not be

subject to the district tax.

• The contractor’s jobsite is considered the place of business for purposes of determining the applicable tax.

• Certain fixed-price contracts may be exempt from district taxes enacted after the contract date.

Consequently, to determine if a contractor’s sales or purchases are subject to district tax, you need to take into

account:

• The date of purchase,

• The place at which the materials, fixtures, and equipment are delivered or installed, and

• Whether the construction contract qualifies as a fixed-price contract.

These points are discussed in more detail below.

Property purchased prior to the operative date of a district tax

Materials

Materials purchased before the operative date of a district tax and installed after that date are not subject to the new

additional district tax. This does not apply to:

• Materials purchased under a resale certificate, or

• Materials purchased without paying tax to out-of-state suppliers when the materials are consumed or sold

after the effective date of the district tax.

Fixtures

District tax generally applies to fixtures installed on non-U.S. government contracts if the fixtures are installed after the

operative date of the tax.

However, since contractors are considered the consumers of both materials and fixtures on U.S. government

construction contracts, materials and fixtures are not subject to the district tax if they are:

• Purchased tax-paid before the operative date of a district tax, and

• Installed after that date.

Machinery and equipment

Generally, on both non-U.S. government and U.S. government contracts, the contractor is considered the retailer liable

for tax on their selling price of machinery and equipment.

Machinery and equipment purchased under a resale certificate prior to the operative date of a district tax is generally

subject to the district tax when sold after the operative date of the district tax.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Installation or delivery location

The place of sale or place of first use determines whether district tax applies to a sale or purchase of tangible personal

property. However, for materials not purchased under a resale certificate, district tax applies at the time of purchase.

For purchases by construction contractors:

• District transactions (sales) tax applies when a contractor picks up materials or fixtures in a district even if the

contractor intends to install them at a jobsite located outside the district.

• District use tax applies when materials or fixtures are installed at a jobsite in a tax district and they have

been purchased without district tax or at a lower rate of district tax. Generally, the contractor is responsible

for reporting and paying the tax.

• District tax will not apply if the sale occurs in a district, but the supplier ships the property to a location that

is not in a taxing district where the property is installed.

The only exception to these general rules is certain purchases of fixtures. The law allows contractors a credit for district

tax paid on fixtures that are subsequently installed at a location not in a taxing district.

For example, if you purchase air conditioning units in a district that has a total district tax rate of 1.5 percent and install

them on a structure in a location that has no district taxes, you are eligible for a credit of the 1.5 percent district tax

paid at the higher tax rate on the purchase of the air conditioning units.

Fixed-price construction contracts

Purchases of materials, fixtures, and equipment under a qualified fixed-price contract are exempt from district tax

increases. To qualify as an exempt fixed-price contract, a contract must:

• Be entered into prior to the effective date of the district tax,

• Be for a fixed amount,

• Have all parties obligated to the terms of the contract, and

• Have the sales tax amount or rate specifically stated in the contract.

This exemption also applies to the purchases subcontractors make as part of a fixed-price prime contract. If you are

unsure whether a construction contract qualifies as “fixed-price,” you may request a review of the contract by one of

our offices.

If the total district tax rate in a location decreases after the parties enter into a fixed-price contract, there is nothing in

the law that requires the payment of more tax than is due. Thus, the tax rate will be the new lower rate and not the rate

in the fixed-price contract.

Please note: The exemption allowed for the purchase of materials, fixtures, and equipment under a qualified fixed-

price contract does not apply to purchases of supplies such as tools, scaffolding, or welding gases, which are used

on the construction site. Supply purchases are only exempt if made under a fixed-price supply contract entered into

directly with the supplier prior to the effective date of the district tax.

Construction contractors—examples

If I am a contractor with a business in an area without district taxes and I install materials and fixtures that are delivered

to a jobsite located in a district, am I liable for the district tax?

Yes. Under the Transactions and Use Tax Law, your jobsite is considered your place of business. Consequently,

if your jobsite is in a tax district, district tax is due on the cost of materials you use or on the selling price of the

fixtures that you furnish and install.

As a construction contractor, am I responsible for district tax on materials that I purchase prior to the operative date of a

district tax and use after that date?

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

No, unless you originally purchased the materials under a resale certificate and you are using them for a purpose

other than that stated on the certificate.

If I purchase construction materials after the effective date of a district tax, does district tax apply?

Yes, if you are purchasing and picking up the materials in the district or materials are delivered to a jobsite in the

district. (If you are operating under a fixed-price contract, see Fixed-price construction contracts.)

If I purchase construction materials and fixtures from a vendor in a district for use outside the district, does the district

tax apply?

Yes, if you take delivery of the materials or property in the district. However, if you take delivery outside the district

and use the property outside the district, district tax does not apply unless your jobsite is in another district. Under

certain circumstances, you may be entitled to a credit for tax-paid purchases.

Unless materials are purchased under a resale certificate, the district tax applies to materials purchased and

delivered within a special taxing district even though such materials may be purchased for installation outside

the district. The district tax does not apply to property purchased from a retailer within the district, for use outside

the district, when the property is shipped to a point outside the district as agreed to in the contract of sale, and is

shipped directly by the retailer or delivered by the retailer to a carrier for subsequent delivery to the out-of-district

location.

Credit against a use tax liability for materials purchased

If materials are purchased tax-paid in an area with district taxes, the person liable for the use tax may only claim a

credit against a use tax liability that is equal to the district tax rate in which the materials were installed (jobsite), but

not at a tax rate exceeding the district tax where the materials were installed. Accordingly, if the contractor purchased

materials, tax-paid, in a county with a total tax rate of 8.75 percent and installs the materials in a county with a tax

rate of 8.25 percent, the contractor does not have an additional district use tax liability. In this example, the sale to

the contractor is a sales tax transaction, and the contractor is considered the consumer of materials and would not be

entitled to a credit of the .50 percent district tax difference paid for the materials at the 8.75 percent tax rate.

If a contractor purchased materials tax-paid in a county with a district tax rate of 7.75 percent and installs the materials

in a county with a district tax rate of 8.75 percent, the contractor is liable for the additional 1.00 percent district use

tax. If the contractor has a seller’s permit, an adjustment can be made on Schedule A to allocate the district tax to

the proper district of installation. If the contractor does not hold a seller’s permit or is not otherwise required by law

to report use tax in a different manner, the additional use tax liability can be paid by providing, in writing, all the

following information:

1. A request that the correspondence be accepted as a return or a statement, regardless of how brief,

indicating that you are attempting to file a return, and

2. The reporting period for which the correspondence (return) is filed, and

3. The amount of tax due for each district.

Your total reported use tax should be segregated by district based on where the materials were installed. This will

assist us in allocating the use tax to the proper district.

Contractors with ongoing use tax amounts due should apply for a California Consumer Use Tax Account. You can

register on our website at www.cdtfa.ca.gov, by selecting Register, and then select Register a New Business Activity. You

can also register to report use tax in person at any of our local offices. Please contact our Customer Service Center for

assistance at 1-800-400-7115 (TTY:711).

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Credit against a use tax liability for xtures purchased

If fixtures are purchased by a contractor tax-paid in an area with district taxes, the contractor, upon installing the

fixtures at a jobsite without a district tax, or with a lower tax rate, is entitled to a credit for the full amount of the district

tax of the district of purchase.

Finding the appropriate tax rate

California City & County Sales & Use Tax Rates provides recent tax rate changes, the history of sales and use tax rates,

the rates and effective dates of district taxes, and the combined sales, use, and district tax rate in certain cities and

communities in California.

As an additional resource, we offer an online mapping tool on our website to determine the current sales

and use tax rate for a specific address. Be sure the address information you enter is the address you intend.

The tax rate given will reflect the current rate of tax for the address that you enter. To find a tax rate, see

Find Sales and Use Tax Rates by Address.

Some cities have developed a database of addresses available at www.cdtfa.ca.gov/taxes-and-fees/cityaddresses.htm to

assist retailers and consumers in identifying addresses located within the special taxing jurisdictions. In cooperation

with these cities, our website provides links to their address databases. If you have questions about the addresses, you

should contact the cities directly.

CONSTRUCTION AND BUILDING CONTRACTORS

|

JULY 2024

Local Tax Allocation

Generally, the local tax portion of the sales or use tax is allocated to the place of sale or place of use of property. When

a retailer registers with us, their physical location (storefront) is noted in our records for the purpose of distributing

local taxes. However, the local tax on materials consumed and fixtures sold by construction contractors (when self-

reporting the use tax) is generally reported according to the county location of the jobsite, rather than on the physical

location of the contractor’s business. This tax is generally allocated through the countywide pool unless a construction

contractor obtains a permit or sub-permit for the jobsite location as discussed below.

In order to properly distribute the local tax, permits issued to construction contractors who report or intend to report

over $600 per year in local tax are provided a schedule in their return for reporting the local tax due by jobsite in the

appropriate county.

A construction contractor who enters into a construction contract equal to or greater than $5,000,000 may elect to

obtain a sub-permit for the jobsite of the qualifying contract, enabling the contractor to make a direct allocation of tax

to the jurisdiction in which the jobsite is located rather than an indirect allocation through the countywide pool. The

qualifying contract price applies to each contract or subcontract for work performed at the jobsite, not the total value

of the prime contract.

JULY 2024

|

CONSTRUCTION AND BUILDING CONTRACTORS

Required Registration to Report Use Tax—How to Register

and File a Return

Some construction contractors act only as consumers (not retailers) and are not required to register with us as sellers. If

you are not required to hold a seller’s permit and are not currently registered with us for use tax purposes, you may be

required to register as a “qualified purchaser.” A “qualified purchaser” must register with us and annually report and pay

use tax directly to us, as required by R&TC section 6225.

Prior to January 1, 2024, a “qualified purchaser” was defined as a person that received at least $100,000 in gross

receipts from their business operations per calendar year and was not otherwise required to be registered with us.

Gross receipts are the total of all receipts from both in-state and out-of-state business operations.

Beginning January 1, 2024, the definition of a “qualified purchaser” was revised* to eliminate the requirement that

the person receives at least $100,000 in gross receipts per calendar year from business operations. It instead requires

that the person makes more than $10,000 in purchases subject to use tax (excluding vehicles, vessels, or aircraft) per