PwC

Revenue from contracts with customers

The standard is final – A comprehensive look at the

new revenue model

What’s inside:

Overview .........................1

Defining the contract ..... 2

Determining the

transaction price............ 4

Accounting for multiple

performance obligations.7

Allocating the transaction

price ..............................10

Recognising revenue ..... 11

Other considerations.....16

Final thoughts ...............19

Engineering and construction industry

supplement

At a glance

On 28 May 2014, the IASB and FASB issued their long-awaited converged standard on

revenue recognition. Almost all entities will be affected to some extent by the

significant increase in required disclosures. But the changes extend beyond

disclosures, and the effect on entities will vary depending on industry and current

accounting practices.

This supplement highlights some of the areas that could create the most significant

challenges for engineering and construction entities as they transition to the new

standard.

Overview

Entities in the engineering and construction (E&C) industry applying IFRS or US GAAP

have primarily been following industry guidance for construction contracts

1

to account

for revenue. These standards were developed to address particular aspects of long-term

construction accounting and provide guidance on a wide range of industry-specific

considerations including:

• Defining the contract, such as when to combine contracts, and when and how to

account for change orders and other modifications.

• Defining the contract price, including variable consideration, customer-furnished

materials, and claims.

• Recognition methods, such as the percentage-of-completion method (and, in the case

of US GAAP, the completed contract method) and input/output methods to measure

performance.

• Accounting for contract costs, such as pre-contract costs and costs to fulfil a contract.

• Accounting for loss-making contracts.

2

The new revenue standard will replace the construction contract guidance and substantially all existing revenue

recognition guidance under IFRS and US GAAP. This includes the percentage-of-completion method and the related

construction cost accounting guidance as a stand-alone model.

Defining the contract

Current guidance covers:

• When two or more contracts should be combined and accounted for together.

• When one contract should be segmented and accounted for separately as two or more contracts.

• When a contract modification should be recognised.

These situations and, in particular, contract modifications such as change orders, are commonplace in the E&C

industry. The new standard applies only to contracts with customers that meet the following criteria:

• The contract has commercial substance.

• The contract has been approved by the parties to the contract and such parties are committed to satisfying their

perspective obligations.

• It is probable that the entity will collect the consideration to be received in exchange for the goods or services to be

transferred to the customer.

• The contract has enforceable rights that can be identified regarding the goods or services to be transferred.

• The payment terms can be identified.

Current practice is not expected to significantly change in the assessment of whether contracts should be combined.

The standard does not contain guidance on segmenting contracts; however, construction companies that segment

contracts under current guidance might not be significantly affected because of the requirement to account for

separate performance obligations (refer to ‘Accounting for multiple performance obligations’ below). Construction

companies currently exercise significant judgement to determine when to include change orders and other contract

modifications in contract revenue and therefore there is diversity in practice. We expect that the use of judgement will

continue to be needed and do not expect current practice (or existing diversity) in this area to be significantly affected

by the new standard, including the accounting for unpriced change orders.

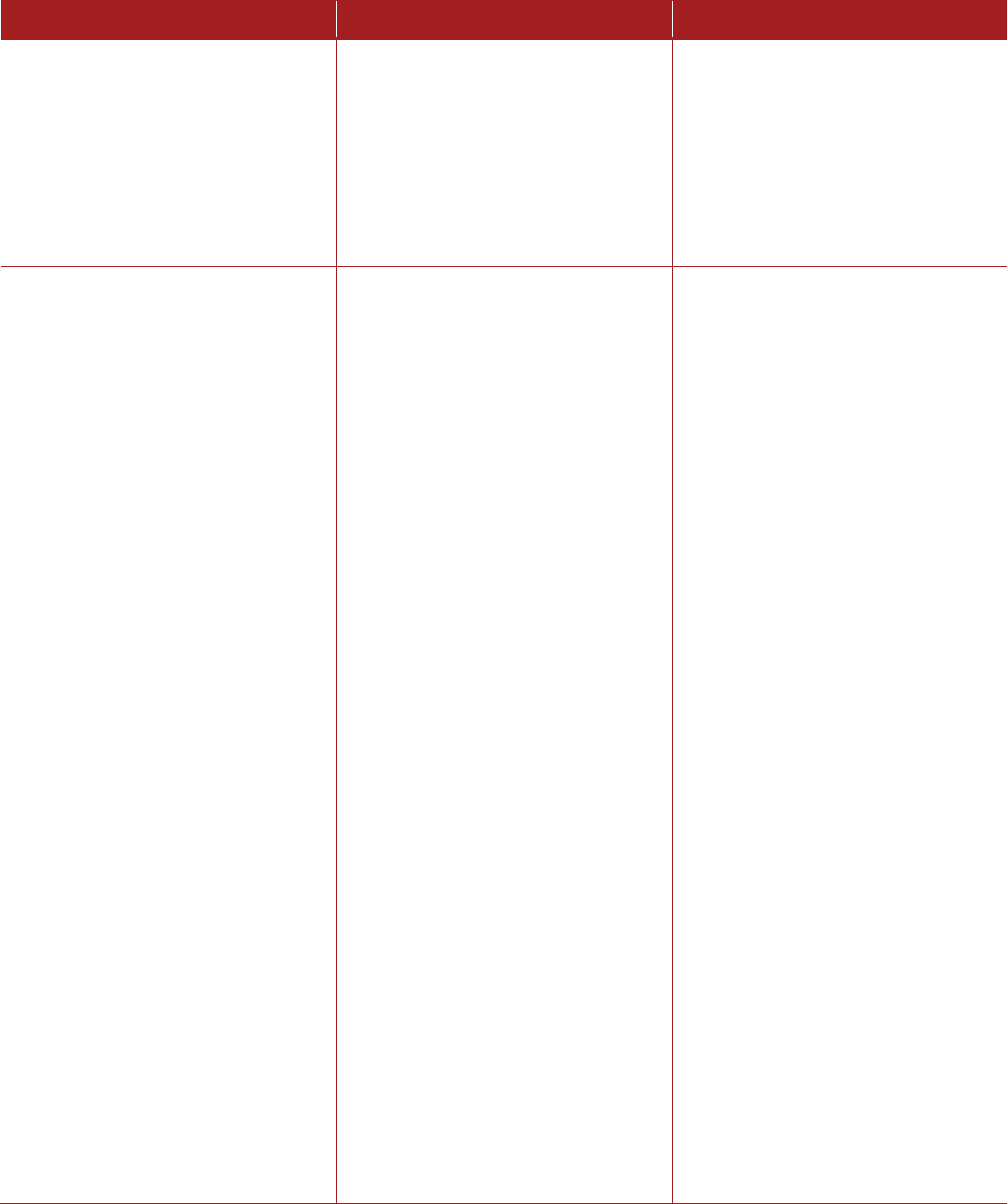

New standard Current US GAAP Current IFRS

Combining contracts

Two or more contracts (including

contracts with parties related to the

customer) are combined and

accounted for as one contract if the

contracts are entered into at or near

the same time and one or more of the

following conditions are met:

• The contracts are negotiated with

a single commercial objective.

Combining and segmenting contracts

is permitted provided certain criteria

are met, but it is not required so long

as the underlying economics of the

transaction are fairly reflected.

Combining and segmenting contracts

is required when certain criteria are

met.

3

New standard Current US GAAP Current IFRS

• The amount of consideration in

one contract depends on the other

contract.

• The goods or services promised are

a single performance obligation

(refer to ‘Accounting for multiple

performance obligations’ below).

Contract modifications (for

example, change orders)

An entity will account for a

modification if the parties to a

contract approve a change in the scope

and/or price of a contract. If the

parties have approved a change in the

scope, but have not yet determined the

corresponding change in price (for

example, unpriced change orders), the

entity should estimate the change to

the contract price as variable

consideration.

A contract modification is accounted for

as a separate contract if:

• the modification promises distinct

goods or services that result in a

separate performance obligation;

and

• the entity has a right to

consideration that reflects the

stand-alone selling price of the

additional goods or services.

A modification that is not a separate

contract is accounted for either as:

• A prospective adjustment if the

goods or services in the

modification are distinct from those

transferred before the modification.

The remaining consideration in the

original contract is combined with

the consideration promised in the

modification to create a new

transaction price that is then

allocated to all remaining

performance obligations.

A change order is generally included in

contract revenue when it is probable

that the change order will be approved

by the customer and the amount of

revenue can be reliably measured.

US GAAP also includes detailed

revenue and cost guidance on the

accounting for unpriced change orders

(or those in which the work to be

performed is defined, but the price is

not).

A change order (known as a variation)

is generally included in contract

revenue when it is probable that the

change order will be approved by the

customer and the amount of revenue

can be reliably measured.

There is no detailed guidance on the

accounting for unpriced change

orders.

4

New standard Current US GAAP Current IFRS

• A cumulative adjustment to

contract revenue if the remaining

goods and services are not distinct

and are part of a single

performance obligation that is

partially satisfied.

Example 1 - Unpriced change orders

Facts: A contractor has a single performance obligation to build an office building. The contractor has a history of

executing unpriced change orders; that is, those change orders where price is not defined until after scope changes

are agreed upon. It is not uncommon for the contractor to commence work once the parties agree to the scope of the

change, but before the parties agree on the price.

When would these unpriced change orders be included in contract revenue?

Discussion: The contractor might be able to determine that it expects the price of the scope change to be approved

based on its historical experience. If so, after the scope changes are approved, the contractor will account for the

unpriced change order as variable consideration. The contractor will estimate the transaction price based on a

probability-weighted or most likely amount approach (whichever is more predictive) provided that it is highly

probable (IFRS) or probable (US GAAP) that a significant reversal in the amount of cumulative revenue recognised

will not occur when the price of the change order is approved.

The contractor will need to determine whether the unpriced change order is accounted for as a separate contract. This

will often not be the case based on the following:

• Change orders often don’t provide distinct goods or services because they are highly interrelated with the goods or

services in the original contract, and are part of the contractor’s service of integrating goods and services into a

combined item for the customer.

• Change orders are typically based on the contractor’s goal of obtaining one commercial objective for the overall

contract. The pricing of a change order may, as a result, not represent the stand-alone selling price of the

additional goods or services.

The contractor in this case will update the transaction price and measure of progress toward completion of the

contract (that is, a cumulative catch-up adjustment) because the remaining goods or services, including the change

order, are not distinct and are part of a single performance obligation that is partially satisfied.

Determining the transaction price

The transaction price (or contract revenue) is the consideration the contractor expects to be entitled to in exchange

for satisfying its performance obligations. This determination is more complex when the contract price is variable.

Common considerations in this area for E&C include the accounting for awards or incentive payments,

customerfurnished materials, claims, liquidated damages, and the time value of money. Revenue related to awards or

incentive payments might be recognised earlier under the new standard in some situations. A significant change in

practice as it relates to customer-furnished materials, claims, liquidated damages, and the time value of money is not

expected.

5

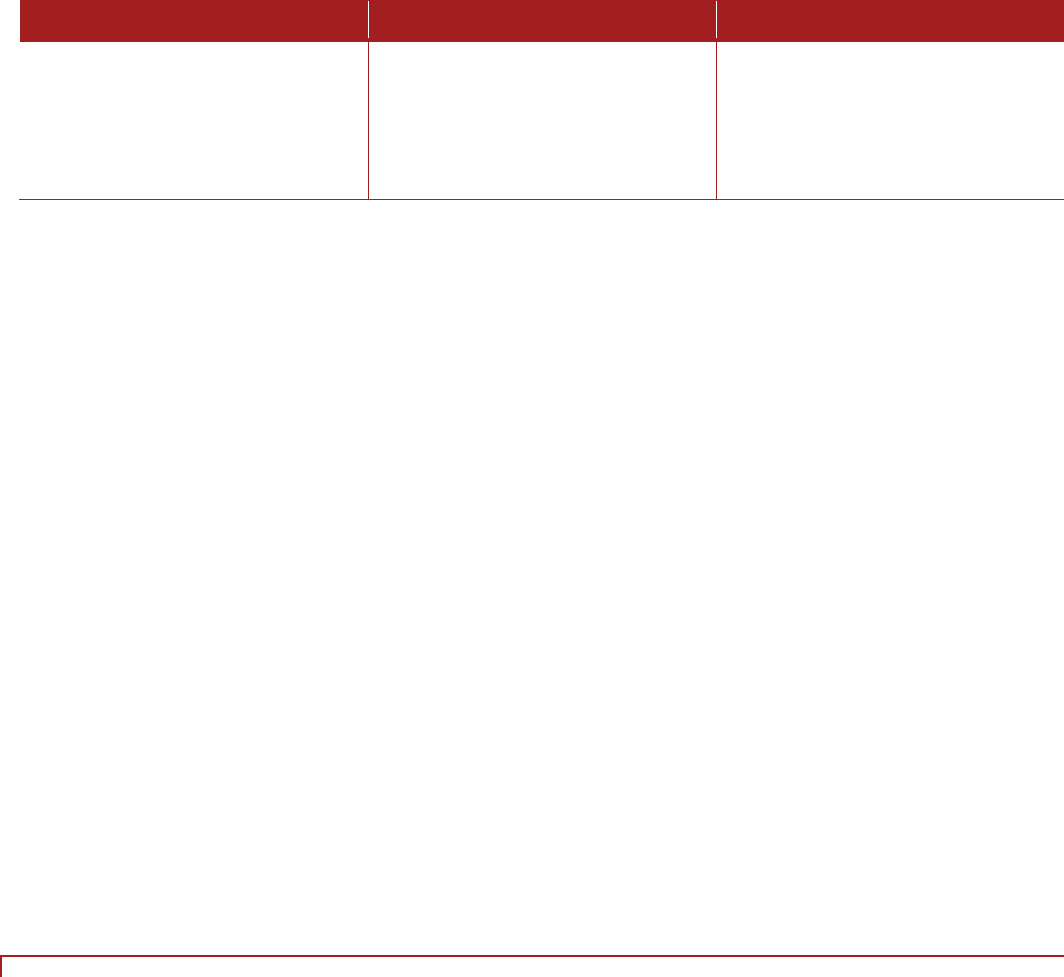

New standard Current US GAAP Current IFRS

Awards/incentive payments

Awards/incentive payments are accounted for

as variable consideration. They are included in

contract revenue using the expected value or

most likely amount approach (whichever is

more predictive of the amount the entity

expects to be entitled to receive). These

amounts are included in the transaction price

only if it is highly probable (IFRS) or probable

(US GAAP) that a significant reversal in the

amount of cumulative revenue recognised will

not occur in the future.

An entity should assess its experience with

similar types of performance obligations and

determine whether, based on that experience,

the entity expects a significant reversal in

future periods in the cumulative amount of

revenue recognised.

Awards/icentive payments should

be included in contract revenue

when the specified performance

standards are probable of being met

or exceeded and the amount can be

reliably measured.

Awards/incentive payments

should be included in contract

revenue when the specified

performance standards are

probable of being met or exceeded

and the amount can be reliably

measured.

Customer-furnished materials

The value of goods or services contributed by

a customer (for example, materials,

equipment, or labour) to facilitate the

fulfilment of the contract is included in

contract revenue (as non-cash consideration)

if the entity controls these goods or services

after they are provided. Noncash

consideration is measured at fair value unless

fair value cannot be reasonably estimated, in

which case it is measured by reference to the

selling price of the goods or services

transferred.

The value of customer-furnished

materials is included in contract

revenue when the contractor has the

associated risk for these materials.

There is no explicit guidance on

the accounting for non-cash

consideration in the construction

contracts standard. Management

follows general principles on non-

monetary exchanges, which

generally require companies to use

the fair value of goods or services

received in measuring the amount

to be included in contract revenue.

Claims

Claims are accounted for as variable

consideration. They are included in contract

revenue using the expected value or most

likely amount approach (whichever is more

predictive of the amount the entity expects to

be entitled to receive) provided that it is highly

probable (IFRS) or probable (US GAAP) that a

significant reversal in the amount of

cumulative revenue recognised will not occur

when the uncertainty associated with the

claim is subsequently resolved.

A claim is recorded as contract

revenue when it is probable and can

be estimated reliably (determined

based on specific criteria), but only

to the extent of contract costs

incurred. Profits on claims are not

recorded until they are realised.

A claim is included in contract

revenue only if negotiations have

reached an advanced stage such

that it is probable the customer

will accept the claim and the

amount can be reliably measured.

6

New standard Current US GAAP Current IFRS

Time value of money

Contract revenue should reflect the time value

of money whenever the contract includes a

significant financing component. An entity is

not required to consider the time value of

money if the period between payment and the

transfer of the promised goods or services is

one year or less, as a practical expedient.

All relevant facts and circumstances should be

considered when assessing if a contract

contains a significant financing component.

Revenue is discounted in only

limited situations, including

receivables with payment terms

greater than one year.

The interest component is

computed based on the stated rate

of interest in the instrument or a

market rate of interest if the stated

rate is considered unreasonable

when discounting is required.

Revenue is discounted when the

inflow of cash or cash equivalents

is deferred. An imputed interest

rate is used to determine the

amount of revenue to be

recognised as well as the separate

interest income to be recorded

over time.

Example 2 - Variable consideration

Facts: A contractor enters into a contract for the expansion of an existing two-lane highway to a three-lane highway.

The contract price is C65 million plus a C5 million award fee if the expansion is complete before the holiday travel

season. The contract is expected to take one year to complete. The contractor has a long history of performing this

type of highway work. The award fee is binary; that is, if the job is finished before the holiday travel season, the

contractor receives the full award fee. The contractor does not receive any award fee if the highway is not finished

before the holiday season. The contractor believes, based on its significant past experience, that it is 95 percent likely

that the contract will be completed in advance of the holiday travel season.

How should the contractor account for the award fee?

Discussion: The contractor is likely to conclude, given the binary award fee, that it is appropriate to use the most

likely amount approach to determine the amount of variable consideration to include in the estimate of the

transaction price. The contract’s transaction price is therefore C70 million: the fixed contract price of C65 million

plus the C5 million award fee (the most-likely amount). This estimate is regularly revised and adjusted, as

appropriate, using a cumulative catch-up approach, which is consistent with current practice.

The contractor will then assess, based on its experience with similar types of performance obligations, whether it is

highly probable (IFRS) or probable (US GAAP) that the award fee included in the transaction price will not be subject

to a significant reversal when the contract is completed. Factors to consider in making this assessment include, but

are not limited to:

• The contractor has a long history of performing this type of work.

• It is largely within the contractor’s control to complete the work before the holiday travel season.

• The uncertainty will be resolved within a relatively short period of time.

• There are only two possible final consideration amounts.

This assessment will determine whether the award fee is eligible to recognise as revenue when the performance

obligation is satisfied (that is, as the construction occurs).

Example 3 - Claims

Facts: Assume the same fact pattern as Example 2, except that due to reasons outside of the contractor’s control (for

example, customer-caused delays), the cost of the contract far exceeds original estimates, but a profit is still expected.

7

The contractor submits a claim against the customer to recover a portion of these costs. The claim process is in its

early stages, but the contractor has a long history of successfully negotiating claims with customers, albeit sometimes

at a discount from the amount sought.

How should the contractor account for the claim?

Discussion: Claims are highly susceptible to external factors (such as the judgement of, or negotiations with, third

parties), and the possible outcomes are highly variable. The contractor might have experience in successfully

negotiating claims, but it might be challenging to assert that such experience has predictive value in this fact pattern

(because of the highly uncertain variables). The contractor might therefore conclude that it is highly probable (IFRS)

or probable (US GAAP) that the amount of the claim, if recognised, could be subject to significant reversal in future

periods.

The amount of the claim is excluded from the transaction price (contract revenue) until the contractor determines it

is highly probable (IFRS) or probable (US GAAP) it will not be subject to significant reversal in future periods. The

contractor will then estimate the amount of the claim using the expected value method (which is more predictive in

this fact pattern) and include the amount not subject to significant reversal in the transaction price.

It could be highly probable (IFRS) or probable (US GAAP) that some portion of the claim will not result in a

significant revenue reversal, such as when a contractor can demonstrate that specific direct costs were incurred as a

result of the customer-caused delay. Based on the underlying contractual terms, the contractor might determine that

it has an enforceable right to receive payment from its customer. If the contractor has a history of successful

negotiations it might therefore conclude that it is highly probable (IFRS) or probable (US GAAP) that a portion (that

is, a minimum amount) of the claim will not be subject to significant reversal in the future periods. The contractor

will need to reassess the estimates of the claim amount at each reporting date until the uncertainty is resolved.

Example 4 - Time value of money

Facts: A contractor enters into a contract for the construction of a hospital that includes scheduled milestone

payments. The performance obligation will be satisfied over time and the contractual milestone payments are

estimated to coincide with the revenue to be earned. The contract specifies that the customer will retain 5% of each

milestone payment and the retainage will be paid to the contractor only when the hospital is complete.

Does the contract include a significant financing component?

Discussion: The contractor will likely conclude that the contract does not include a significant financing component

and therefore will not reflect the time value of money in the transaction price. The milestone payments are estimated

to coincide with the contract revenue to be earned. Further, the contract requires amounts to be retained for reasons

other than to provide financing; that is, retainage is intended to protect the customer from the contractor failing to

adequately complete some or all of its obligations under the contract.

Accounting for multiple performance obligations

Performance obligations are promises to deliver goods or perform services. Contractors often account for each

contract at the contract level today; that is, contractors account for the ‘macro-promise’ in the contract (for example,

to build a road or build a refinery). Current guidance permits this approach, although a contractor effectively

promises to provide a number of different goods or services in delivering such macro-promises. Determining when to

separately account for these performance obligations under the new standard will require judgement.

It is possible to account for a contract at the contract level (for example, the macro-promise to build a road) under the

new standard when the criteria for combining a bundle of goods or services into one performance obligation are met.

Judgement will be needed in many situations to determine if all of the promises in the contract should be bundled

together, particularly when assessing contracts such as engineering, procurement, and construction (EPC) or design /

build contracts.

8

New standard Current US GAAP Current IFRS

An entity should assess the goods or

services promised in a contract and

identify as a performance obligation

each promise to transfer to a customer

either:

(a) A good or service (or bundle of

goods or services) that is distinct.

(b) A series of distinct goods or

services that are homogenous and

meet both of the following criteria:

• Each distinct good or service that is

transferred consecutively is a

performance obligation satisfied

over time.

• The same method would be used to

measure the entity’s progress

toward satisfying the performance

obligation for each distinct good or

service.

A good or service is distinct if both of

the following criteria are met:

• The customer can benefit from the

good or service either on its own or

together with other resources that

are readily available to the

customer.

• The entity’s promise to transfer the

good or service to the customer is

separable from other promises in

the contract.

Factors that indicate a performance

obligation is separable from other

promises in the contract include, but

are not limited to:

• The goods or services are not highly

dependent on or interrelated with

other goods or services in the

contract.

• The entity does not provide a

significant service of integrating

The basic presumption is that each

contract is the profit centre for revenue

recognition, cost accumulation, and

income measurement. That

presumption may be overcome only if

a contract or a series of contracts

meets the conditions described above

for combining or segmenting

contracts.

There is no further guidance for

separately accounting for more than

one deliverable in a construction

contract under the construction

contract guidance.

The basic presumption is that each

contract is the profit centre for revenue

recognition, cost accumulation, and

income measurement. That

presumption is overcome when a

contract or a series of contracts meets

the conditions described for combining

or segmenting contracts.

There is no further guidance for

separately accounting for more than

one deliverable in a construction

contract.

9

New standard Current US GAAP Current IFRS

the

goods or services into the

combined item(s) for which the

customer has contracted.

• The goods or services do not

significantly modify or customise

another good or service in the

contract.

Goods and services that are not

distinct and therefore not separate

performance obligations should be

combined with other goods or services

until the entity identifies a bundle of

goods or services that is distinct.

Example 5 - Design and build contract

Facts: A contractor enters into a contract to design and build an airport terminal. The contractor is responsible for

the design and overall management of the project build, including engineering, site clearance, foundation,

procurement, construction of terminal space, gates with loading bridges, customs and immigration, airline office

space, distribution systems required for its operations, and installation of equipment and finishing.

How many distinct performance obligations are in the contract?

Discussion: The contractor will likely account for the design and build contract as a single performance obligation

because these goods and services are not distinct. The goods and services are highly interrelated and the contract

includes a significant service of integrating the goods and services into the combined item the customer contracted

for; that is, the airport terminal. Revenue is recognised over time by selecting an appropriate measure of progress

toward satisfaction of the single performance obligation.

Example 6 - Procurement of specialised equipment

Facts: Assume the same fact pattern as Example 5 above, except the contract requires the contractor to procure

specialised equipment from a subcontractor and integrate the equipment into the airport terminal. The contractor

expects to transfer control of the equipment approximately one year from the contract inception. The installation and

integration of the equipment continue throughout the contract.

How many distinct performance obligations are in the contract?

Discussion: The contractor will likely account for the design and build contract as well as the procurement of

specialised equipment as a single performance obligation. The goods and services in the bundle are highly

interrelated and providing them to the customer requires the contractor also provide significant services of

integrating the services into the combined item the customer has contracted to receive (the airport terminal).

Revenue is recognised over time by selecting an appropriate measure of progress toward satisfaction of the

performance obligation. (See discussion of accounting for uninstalled materials in Example 12 below.)

10

Allocating the transaction price

The transaction price is allocated to the performance obligations in a contract that require separate accounting. Of

particular interest will be the allocation of variable consideration (for example, award or incentive payments)

associated with only one performance obligation, rather than the contract as a whole. An entity can allocate the

transaction price entirely to one (or more) performance obligations when certain conditions are met.

New standard Current US GAAP Current IFRS

The transaction price (and any

subsequent changes in estimate of the

transaction price) is allocated to each

separate performance obligation based

on the relative stand-

alone selling price

of each performance obligation. The

best evidence of a stand-alone selling

price is the observable price of a good

or service when sold separately.

The stand-alone selling price should

be estimated if the actual selling price

is not directly observable. The

standard does not prescribe a specific

estimation method. For example, a

contractor might use cost plus a

reasonable margin to estimate the

selling price of a good or service. An

entity should maximise the use of

observable inputs when estimating the

stand-alone selling price.

Entities may use a residual approach

to estimate the stand-alone selling

price if the stand-alone selling price of

a good or service is highly variable or

uncertain.

An entity may also allocate a discount

or an amount of contingent

consideration entirely to one (or more)

performance obligations if certain

conditions are met.

Except for allocation guidance related

to contract segmentation, there is no

explicit guidance on allocating contract

revenue to multiple deliverables in a

construction contract, given the

presumption that the contract is the

profit centre for determining revenue

recognition.

Except for allocation guidance related

to contract segmentation, there is no

explicit guidance on allocating contract

revenue to multiple deliverables in a

construction contract, given the

presumption that the contract is the

profit centre for determining revenue

recognition.

Example 7 - Allocating contract revenue to more than one performance obligation

Facts: A contractor enters into a contract to build both a road and a bridge (assume there are two separate

performance obligations: building the road and building the bridge). The contractor determines at inception that the

contract price is C151 million, which includes a C140 million fixed price and an estimated C11 million award fee. The

amount of the award fee is variable depending on how early the contractor finishes the project. The contractor will

receive a base award fee of C10 million if it finishes the project 30 days ahead of schedule. The award fee increases

(decreases) by 10% for each day before (after) the 30 days it finishes the project. The contractor has experience with

similar contracts. The contractor uses the most likely amount to estimate the variable consideration associated with

the incentive bonus of C10 million. Based on the contractor’s prior experience and its current estimates, the

11

contractor determines that it will finish the project 30 days ahead of schedule and be entitled to the C10 million

award fee. The contractor uses the expected value method to estimate the additional variable consideration associated

with the 10% daily penalty or incentive and determines it will be entitled to a 10% increase or C1 million. The

contractor concludes that it is highly probable (IFRS) or probable (US GAAP) that a change in estimate would not

result in a significant revenue reversal in the future.

How should the contractor allocate the contract price to the two separate performance obligations?

Discussion: The contractor must first assign a stand-alone selling price to each of the road and the bridge in order to

allocate the contract price (including both the fixed and variable amounts). The contractor constructs roads and

bridges of a similar type and nature to those required by the contract on a stand-alone basis. The stand-alone selling

price of the road, based on prior experience, is C140 million. The stand-alone selling price of the bridge, based on

prior experience, is C30 million. There is an inherent discount of C19 million built into the bundled contract. The

C151 million transaction price is allocated as follows using a relative allocation model:

Road:

C124.4m (C151m * (C140m / C170m))

Bridge: C 26.6m (C151m * (C 30m / C170m))

Example 8 - Allocating contract revenue – changes in the transaction price

Facts: Assume the same fact pattern as Example 7 above, except that the amount of variable consideration changes

from an expected C11 million to an expected C13 million after contract inception. The changes are due to improved

weather conditions during the construction period and therefore an expectation that the contractor will complete the

entire project earlier than expected.

How should the contractor allocate the change in the estimated contract price?

Discussion: The basis for allocating the transaction price to performance obligations (that is, the percentage used to

allocate based on relative stand-alone selling prices) does not change after contract inception. The additional C2

million of transaction price is allocated to the road and bridge using the initially developed allocation percentages as

follows:

Road: C1.6m (C2m * (C140m / C170m))

Bridge: C0.4m (C2m * (C 30m / C170m))

The change in estimate is recognised using a cumulative catch-up approach. For example, if the road is 90% complete

and work on the bridge has not yet commenced when the estimate changes, the contractor will recognise cumulative

revenue of C113.4 million (C124.4 million x 90% +C1.6 million x 90%) for the portion of the performance obligation

already satisfied for the road. The contractor will recognise additional revenue of C12.6 million (C124.4 million x 10%

+ C1.6 million x 10%) as the remaining performance obligations related to the road are satisfied and C27 million

((C26.6 million + C0.4 million) x 100%) as the bridge is completed.

Assume the same fact pattern as above, except that the bridge is completed and the amount of the award fee only

relates to the completion of the road. In this situation, the contractor will allocate the entire change in the estimated

contract price of C2 million to the road. The contractor will recognise additional revenue of C1.8 million (C2 million x

90%) in the period of the change of estimate for the portion of the performance obligation already satisfied for the

road. The contractor will recognise the remaining revenue of C12.6 million (C124.4 million x 10% + C2 million x 10%)

as the remaining performance obligations related to the road are satisfied.

Recognising revenue

Revenue recognition under existing guidance is based on the activities of the contractor; that is, provided reasonable

estimates are available, revenue can be recognised as the contractor performs (known as the percentage-of-

completion method). Revenue is recognised under the new standard when a performance obligation is satisfied,

12

which occurs when control of a good or service transfers to the customer. Control can transfer either at a point in time

or over time. The change to a control transfer model requires careful assessment of when a contractor can recognise

revenue. Many construction-type contracts will transfer control of a good or service over time and therefore might

result in a similar pattern of revenue recognition as today’s guidance. This should not, however, be assumed.

Contractors will not be able to default to the method used today, and will need to perform a careful assessment of

when control transfers.

New standard Current US GAAP Current IFRS

Transfer of control

Revenue is recognised upon the satisfaction of

performance obligations, which occurs when

control of the good or service transfers to the

customer. Control can transfer at a point in

time or, perhaps more common for the E&C

industry, over time.

A performance obligation is satisfied over time

when at least one of the following criteria is

met:

• The customer receives and consumes the

benefits of the entity’s performance as the

entity performs.

• The entity’s performance creates or

enhances a customer-controlled asset.

• An asset with an alternative use to the entity

is not created but the entity has a right to

payment for performance completed to

date.

A performance obligation is satisfied at a point

in time if it does not meet the criteria above.

Determining when control transfers will

require a significant amount of judgement.

Indicators that might be considered in

determining whether the customer has

obtained control of an asset at a point in time

include:

• The entity has a present right to payment.

• The customer has legal title.

• The customer has physical possession.

• The customer has the significant risks and

rewards of ownership.

• The customer has accepted the asset.

Revenue is recognised using the

percentage-of-completion method

when reliable estimates are

available. The percentage-of-

completion method based on a

zero-profit margin is used when

reliable estimates cannot be made,

but there is an assurance that no

loss will be incurred on a contract

(for example, when the scope of

the contract is ill-defined, but the

contractor is protected from an

overall loss) until more precise

estimates can be made.

The completed-contract method is

required when reliable estimates

cannot be made.

Revenue is recognised using the

percentage-of-completion method

when reliable estimates are

available.

The percentage-of-completion

method based on a zero-profit

margin is used when reliable

estimates cannot be made, but

there is assurance that no loss will

be incurred on a contract (for

example, when the scope of the

contract is ill-defined, but the

contractor is protected from an

overall loss) until more precise

estimates can be made.

Contract costs that are not probable

of being recovered are recognised

as an expense immediately. The

completed contract method is

prohibited.

13

New standard Current US GAAP Current IFRS

This list is not intended to be a checklist

or all-inclusive. No one factor is

determinative on a stand-alone basis.

Measuring performance

obligations satisfied over time

A contractor should measure progress

toward satisfaction of a performance

obligation that is satisfied over time

using the method that best depicts the

transfer of goods or services to the

customer. Methods for recognising

revenue when control transfers over time

include:

• Output methods that recognise

revenue on the basis of direct

measurement of the value to the

customer of the entity’s performance

to date (for example, surveys of goods

or services transferred to date,

appraisals of results achieved).

• Input methods that recognise revenue

on the basis of the entity’s efforts or

inputs to the satisfaction of a

performance obligation (for example,

cost-to-cost, labour hours, labour

cost, machine hours, or material

quantities).

The method selected should be applied

consistently to similar contracts with

customers. Once the metric is calculated

to measure the extent to which control

has transferred, it must be applied to

total contract revenue to determine the

amount of revenue to be recognised.

The effects of any inputs that do not

represent the transfer of goods or

services to the customer, such as

abnormal amounts of wasted materials,

should be excluded from the

measurement of progress.

It may be appropriate to measure

progress by recognising revenue equal to

the costs of the transferred goods if goods

are transferred at a significantly different

time from the related service

A contractor can use either an input

method (for example, cost-to-cost,

labour hours, labour cost, machine

hours, or material quantities), an

output method (for example,

physical progress, units produced,

units delivered, or contract

milestones), or the passage of time

to measure progress toward

completion.

There are two different approaches

for determining revenue, cost of

revenue, and gross profit once a

‘percentage complete’ is derived: the

Revenue method and the Gross

Profit method.

A contractor can use either an input

method (for example, cost-to-cost,

labour hours, labour cost, machine

hours, or material quantities), an

output method (for example, physical

progress, units produced, units

delivered, or contract milestones), or

the passage of time to measure

progress toward completion.

IFRS requires the use of the Revenue

method to determine revenue, cost of

revenue, and gross profit once a

‘percentage complete’ is derived. The

Gross Profit method is not permitted.

14

New standard Current US GAAP Current IFRS

(such

as materials the customer controls

before the entity installs the materials).

Estimates to measure the extent to which

control has transferred (for example,

estimated costs to complete when using a

cost-to-cost calculation) should be

regularly evaluated and adjusted using a

cumulative catch-up method.

Example 9 - Recognising revenue

Facts: A contractor enters into a construction contract with an owner to build an oil refinery. The contract has the

following characteristics:

• The oil refinery is highly customised to the owner’s specifications and changes to these specifications by the owner

are expected over the contract term.

• The oil refinery does not have an alternative use to the contractor.

• Non-refundable, interim progress payments are required as a mechanism to finance the contract.

• The owner can cancel the contract at any time (with a termination penalty); any work in process is the property of

the owner. As a result, another entity would not need to re-perform the tasks performed to date.

• Physical possession and title do not pass until completion of the contract.

The contractor determines that the contract has a single performance obligation to build the refinery.

How should the contractor recognise revenue?

Discussion: The preponderance of evidence suggests that the contractor’s performance creates an asset that the

customer controls and control is being transferred over time. The contractor will have to select either an input or

output method to measure the progress toward satisfying the performance obligation.

Example 10 - Recognising revenue - use of cost-to-cost

Facts: Assume the same fact pattern as Example 9 above. Additional contract characteristics are:

• Contract duration is three years.

• Total estimated contract revenue is C300 million.

• Total estimated contract cost is C200 million.

• Year one cost is C120 million (including C20 million related to contractor-caused inefficiencies).

The contractor concludes that cost-to-cost is a reasonable method for measuring the progress toward satisfying its

performance obligation.

How much revenue and cost should the contractor recognise during the first year?

15

Discussion: The contractor should exclude any costs that do not depict the transfer of goods or services to determine

the amount of revenue to recognise under a cost-to-cost model. The costs associated with contractor-caused

inefficiencies should be excluded in this situation. The amounts of contract revenue and cost recognised at the end of

year one are:

Revenue: C150m (C300m * (C100m / C200m))

Contract cost (excluding inefficiencies): C100m

Gross contract margin: C 50m

Contract inefficiencies: C 20m

Adjusted contract margin: C 30m

Example 11 - Recognising revenue - use of cost-to-cost with changes in estimates

Facts: Assume the same fact pattern as Examples 9 and 10 above, except that the total estimated cost to complete the

contract increases at the end of the second year to C250 million due to an increase in the cost of materials. Actual

cumulative costs incurred as of the end of the second year (excluding year-one inefficiencies) is C200 million.

How much revenue and cost should the contractor recognise during the second year?

Discussion: The amount of contract revenue and cost recognised during the second year:

Cumulative revenue:

C240m (C300m * (C200m / C250m)

Revenue recognised year one: C150m

Revenue recognised year two: C 90m

Cumulative costs (excluding inefficiencies): C200m

Costs recognised year one (excluding inefficiencies): C100m

Costs recognised year two: (excluding inefficiencies):

C100m

Gross contract margin year two: C (10m) (C90m - C100m)

Gross contract margin to-date (excluding inefficiencies): C 40m (C240m - C200m)

Adjusted contract margin to

-date: C 20m (C240m - C200m - C20m)

Example 12 - Recognising revenue – uninstalled materials

Facts: Assume the same fact pattern as Example 6 above and at contract inception the contractor estimates the

following:

Contract price: C100 million

Contract costs: C50 million

Cost of the specialised equipment: C20 million

Discussion: The contractor concludes that including the costs to procure the specialised equipment in measuring

progress would overstate the extent of the contractor’s performance. Therefore, revenue should be recognised for the

specialised equipment in an amount equal to the cost of the specialised equipment upon the transfer of control to the

customer. As such, the contractor excludes the cost of the specialised equipment from its measure of progress toward

complete satisfaction of the performance obligation on a cost-to-cost basis. During the first six months, the contractor

incurs C25 million of costs compared to the total of C50 million of expected costs to complete (excluding the C20

million cost of the specialised equipment). Therefore, the contractor estimates that the performance obligation is 50

percent complete (C25 million ÷ C50 million) and recognises revenue of C40 million (50% × (C100 million total

transaction price – C20 million revenue for the specialised equipment)). Upon transfer of control of the specialised

16

equipment, the contractor recognises revenue and costs of C20 million. Subsequently, the contractor continues to

recognise revenue on the basis of costs incurred relative to total expected costs (excluding the revenue and cost of the

specialised equipment).

Other considerations

Warranties

Most warranties in the construction industry provide coverage against latent defects. There is currently diversity in

the way E&C companies account for these and other types of warranties. Warranty costs are either accounted for

within contract accounting (for example, as a contract cost) or outside of contract accounting in accordance with the

existing loss contingency guidance. We expect practice to become less diverse and potentially change significantly for

some entities that utilise a cost-to-cost input method for measuring progress and do not currently include warranty as

a contract cost.

New standard Current US GAAP Current IFRS

Warranties that the customer has the option

to purchase separately give rise to a separate

performance obligation. A portion of the

transaction price is allocated to that separate

performance obligation at contract inception.

The warranty is accounted

for as a cost accrual

if a customer does not have the option to

purchase a warranty separately from the

entity.

An entity might provide a warranty that calls

for a service to be provided to the customer

(for example, maintenance) in addition to a

promise that the entity’s past performance

was as specified in the contract. The entity

will account for the service component of the

warranty as a separate performance obligation

in these circumstances. An entity that cannot

reasonably account for an assurance warranty

separately from services also provided under

the warranty should account for both

warranties together as a single performance

obligation.

Contractors typically account for

warranties that protect against latent

defects outside of contract

accounting and in accordance with

existing loss contingency guidance. A

contractor recognises revenue and

concurrently accrues any expected

cost for these warranty repairs.

Revenue is deferred for warranties

that protect against defects arising

through normal usage (that is,

extended warranties) and recognised

over the expected life of the contract.

Contractors are required to

account for the estimated costs of

rectification and guarantee work,

including expected warranty

costs, as contract costs. However,

contractors typically account for

standard warranties protecting

against latent defects outside of

contract accounting and in

accordance with existing

provisions guidance. A

contractor will recognise revenue

and concurrently accrue any

expected cost for these warranty

repairs.

Revenue is deferred for

warranties that protect against

defects arising through normal

usage (that is, extended

warranties) and recognised over

the expected life of the contract.

Example 13 - Accounting for warranties

Facts: Assume the same fact pattern as Example 9 above. The contractor also provides a warranty that covers latent

defects for certain components of the oil refinery. This warranty is automatically provided by the contractor and the

customer does not have an option to purchase the warranty separately from the contractor.

How should the contractor account for such a warranty?

Discussion: The contractor should account for this warranty as a cost accrual. Contractors who determine that cost-to

cost is an appropriate method to measure transfer of control over time might therefore have to consider these costs in

their cost-to-cost calculation.

17

Contract costs

Existing construction contract guidance contains a substantial amount of cost capitalisation guidance, both related to

pre-contract costs and costs to fulfil a contract. The new standard also includes contract cost guidance that could

result in a change in the measurement and recognition of contract costs as compared to today. In particular,

measurement and recognition could change for those contractors that currently use the Gross Profit method for

calculating revenue and cost of revenue.

New standard Current US GAAP Current IFRS

All costs related to satisfied performance

obligations and costs related to

inefficiencies (that is, abnormal costs of

materials, labour, or other costs to fulfil)

are expensed as incurred.

Incremental costs of obtaining a contract

are costs that the entity would not have

incurred if the contract had not been

obtained and are recognised as an asset if

they are expected to be recovered. As a

practical expedient, such costs may be

expensed as incurred if the amortisation

period of the asset that the entity otherwise

would have recognised is one year or less.

Costs to obtain a contract that would have

been incurred regardless of whether the

contract was obtained (for example, certain

bid costs) are recognised as an expense

when incurred, unless those costs are

explicitly chargeable to the customer

regardless of whether the contract is

obtained.

Direct costs of fulfilling a contract are

accounted for in accordance with other

standards (for example, inventory,

intangibles, fixed assets) if they are within

the scope of that guidance.

Direct costs of fulfilling a contract are

capitalised under the new standard if not

within the scope of other standards and if

they relate directly to a contract, relate to

future performance, and are expected to be

recovered under the contract.

Capitalised costs are amortised as control

of the goods or services to which the asset

relates is transferred to the customer,

which may include goods or services to be

provided under specific anticipated

contracts (for example, a contract

renewal).

There is a significant amount of

detailed guidance relating to the

accounting for contract costs within

the construction contract guidance.

This is particularly true with respect

to accounting for pre-contract costs.

Pre-contract costs that are incurred

for a specific anticipated contract

generally may be deferred only if

their recoverability from that

contract is probable.

Other detailed guidance on costs to

fulfil a contract is also prescribed by

current guidance.

There is a significant amount of

detailed guidance relating to the

accounting for contract costs.

Costs that relate directly to a contract

and are incurred in securing the

contract are included as part of

contract costs if they can be separately

identified, measured reliably, and it is

probable that the contract will be

obtained.

Other detailed guidance on costs to

fulfil a contract is also prescribed by

current guidance.

18

Example 14 - Accounting for contract costs

Facts: Assume the same fact pattern as Examples 9 and 10 above. At the beginning of the contract, the contractor

incurs certain mobilisation costs amounting to C1 million. The contractor has concluded that such costs should not be

accounted for in accordance with existing asset standards (for example, inventory, fixed assets, or intangible assets).

How should the contractor account for the mobilisation costs?

Discussion: These costs to fulfil a contract would be capitalised if they: (a) relate directly to the contract; (b) relate to

future performance; and (c) are expected to be recovered. Assuming the mobilisation costs meet these criteria and are

capitalised, C500,000 would be amortised as of the end of year one (coinciding with 50 percent control transfer using

a cost-to-cost method) using the fact pattern in Examples 9 and 10 above. Amortisation of capitalised mobilisation

costs would be included in the measurement of the contractor’s satisfaction of its performance obligation.

Contract assets and liabilities

Existing construction contract guidance requires a contractor to record an asset for unbilled accounts receivable when

revenue is recognised but not billed. The unbilled accounts receivable is transferred to a billed accounts receivable

when the invoice is submitted to the customer. Under the new standard, if a contractor delivers services to a customer

before the customer pays consideration, the contractor should record either a contract asset or a receivable depending

on the nature of the contractor’s right to consideration for its performance. The transfer from a contract asset to an

accounts receivable balance (when the contractor has a right to payment) may not coincide with the timing of the

invoice as is required under the existing guidance. Cost in excess of billings and billings in excess of cost initially

recognised on the balance sheet under current GAAP should be similar to the contract asset and contract liability

recognised under the new standard.

New standard Current US GAAP Current IFRS

The entity should present either a contract

asset or a receivable depending on the nature

of the entity’s right for its performance, if an

entity recognises revenue before the

customer pays consideration.

(a) A contract asset is an entity’s right to

payment in exchange for goods or services

that the entity has transferred to a customer,

when that right is conditioned on something

other than the passage of time (for example,

the entity’s future performance).

(b) A receivable is an entity’s right to

payment that is unconditional.

If a customer makes a payment or an amount

of payment is due before an entity satisfied

its performance obligations, the entity should

present that amount as a contract liability. A

contract liability is an entity’s obligation to

transfer goods or services to a customer for

which the entity has received payment from

the customer.

Unbilled receivables arise when

revenues have been recognised

as the performance of contract

work is being performed, but the

amount cannot be billed under

the terms of the contract until a

later date.

Billings in excess of costs and

estimated earnings represent

obligations for work to be

performed with the exception of

when billings exceed total

estimated costs at completion of

the contract plus contract profits

earned to date.

A contractor may have incurred

contract costs that relate to future

activities on the contract. Such

contract costs are recognised as an

asset provided it is probable that they

will be recovered. Such costs represent

an amount due from the customer and

are often classified as contract work in

process.

Advances received before the related

work has been performed are

recognised as a liability.

19

Onerous performance obligations

Existing construction contract guidance requires a loss to be recorded when the expected contract costs exceed the

total anticipated contract revenue. Existing guidance related to the recognition of losses arising from contracts with

customers will be retained for entities within the scope of that guidance.

Final thoughts

The above discussion does not address all aspects of the new standard. Companies should continue to evaluate how

the new standard might change current business activities, including contract negotiations, key metrics (including

debt covenants, surety, and prequalification capacity calculations), taxes, budgeting, controls and processes,

information technology requirements, and accounting.

Entities can adopt the final standard retrospectively or use a simplified approach. Entities using the simplified

approach will: (a) apply the revenue standard to all existing contracts as of the effective date and to contracts entered

into subsequently; (b) recognise the cumulative effect of applying the new standard in the opening balance of retained

earnings on the effective date; and (c) disclose, for existing and new contracts accounted for under the new revenue

standard, the impact of adopting the standard on all affected financial statement line items in the period the standard

is adopted. An entity that uses this approach must disclose this fact in its financial statements.

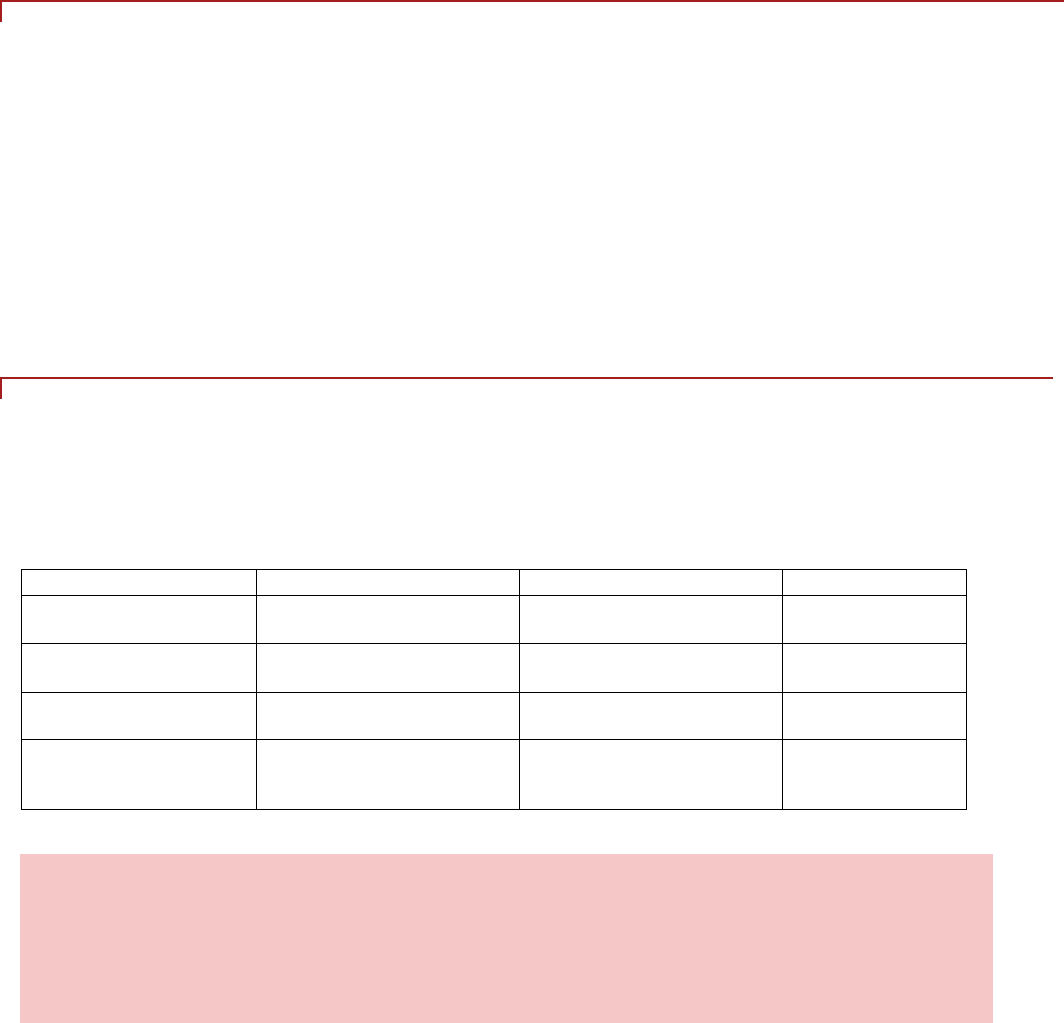

Contact us

Questions?

To have a deeper discussion, please contact:

Name

E

-

mail

Designation

Telephone

Steven Drake

s.drake

@ae.pwc.com

Partner

–

Accounting

Advisory Services

+971 4 3043 421

Gavin Steel

Partner

–

Accounting

Advisory Services

+971 4 3043 308

Mohamed Ashraf

Kashef

mohamed.ashraf.kashef

@ae.pwc.com

Director

–

Accounting

Advisory Services

+

971 4 3043 187

Mahjid Malik

mahjid.mali[email protected]

Senior Manager

–

Accounting Advisory

Services

+971 4 3043 379

This content is for general information purposes only, and should not be used as a substitute for consultation

with professional advisors.

© 2016 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member firms,

each of which is a separate legal entity. Please see www.pwc.com/structure for further details.