STOCKHOLDERS & PROXY STATEMENT

NEW ERA OF UNCARRIER

O

F

U

N

C

A

R

R

I

E

R

We translated that growth into an industr

y

-leading financial

performance—includin

g

the hi

g

hest rate of postpaid

serv

i

ce revenue

g

rowt

h

, core a

dj

uste

d

EBITDA

g

rowt

h

, an

d

free cash flow

g

rowth—all while continuin

g

to inte

g

rate two

distinct companies after the bi

gg

est and most successful

merger in U.S. telecommunications histor

y.

[THIS PAGE INTENTIONALLY LEFT BLANK]

Notice of Annual Meeting of Stockholders

DATE:

June 16, 2023

TIME:

8:00 a.m. PDT

LOCATION:

Online only at

www.virtualshareholder meeting.com/TMUS2023

AGENDA:

• Elect 13 director nominees named in the Proxy Statement to the Company’s Board of Directors;

• Ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for

the fiscal year ending December 31, 2023;

• Conduct an advisory vote to approve the compensation provided to the Company’s named executive officers for 2022;

• Conduct an advisory vote on the frequency of future advisory votes to approve the compensation provided to the

Company’s named executive officers;

• Approve the T-Mobile US, Inc. 2023 Incentive Award Plan;

• Approve the T-Mobile US, Inc. Amended and Restated 2014 Employee Stock Purchase Plan; and

• Consider any other business that is properly brought before the Annual Meeting or any continuation, adjournment or

postponement of the Annual Meeting.

Record Date: You can vote your shares if you were a stockholder of record at the close of business on April 17, 2023.

YOUR VOTE IS VERY IMPORTANT. Whether or not you plan to virtually attend the Annual Meeting, please vote as soon as possible

by internet, by telephone or by signing and returning your proxy card if you received a paper copy of the proxy card by mail.

The Annual Meeting will be held solely by means of remote communication, in a virtual only format. You can virtually attend

the Annual Meeting at the meeting time by visiting www.virtualshareholdermeeting.com/TMUS2023 and entering the 16-digit

control number included on your Notice of Internet Availability of Proxy Materials, proxy card or on the instructions that

accompany your proxy materials. The Annual Meeting will begin promptly at 8:00 a.m. PDT. Online check-in will begin at

7:45 a.m. PDT, and you should allow ample time for the online check-in procedures.

By hosting the Annual Meeting online, the Company is able to ensure the health and safety of its directors, officers,

employees and stockholders. This approach also aligns with the Company’s broader sustainability goals. Attendance at the

virtual Annual Meeting will provide you with the same rights to participate as you would have at an in-person meeting. Once

admitted to the Annual Meeting, you may submit questions, vote or view our list of stockholders by following the instructions

that will be available on the meeting website.

By Order of the Board of Directors,

Timotheus Höttges

Chairman of the Board of Directors

April 28, 2023

Broady R. Hodder

Secretary

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS

FOR THE ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 16, 2023

The Proxy Statement and Annual Report to Stockholders are available at

https://t-mobile.com/Proxy2023 and https://www.proxyvote.com.

Cautionary Statement Regarding Forward-Looking Statements

This Proxy Statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995.

All statements, other than statements of historical fact, including information concerning our future results of operations, are forward-

looking statements. These forward-looking statements are generally identified by the words “anticipate,” “believe,” “estimate,”

“expect,” “intend,” “may,” “could” or similar expressions. Forward-looking statements are based on current expectations and

assumptions, which are subject to risks and uncertainties that may cause actual results to differ materially from the forward-looking

statements, including unexpected delays, difficulties, and expenses in executing against our environmental, climate, diversity and

inclusion or other “Environmental, Social, and Governance (ESG)” targets, goals and commitments outlined in this document,

including, but not limited to, our efforts to reduce our greenhouse gas emissions, as well as changes in laws or regulations affecting

us, such as changes in cybersecurity, data privacy, environmental, safety and health laws, and other risks as disclosed in our most

recent annual report on Form 10-K and other filings with the Securities and Exchange Commission (the “SEC”). Given these risks and

uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. T-Mobile does not undertake,

and expressly disclaims any duty, to update any statements contained herein, whether as a result of new information, new

developments, or otherwise, except to the extent that disclosure may be required by law. In addition, some of the statements

contained in this Proxy Statement may rely on third-party information and projections that management believes to be reputable;

however, T-Mobile does not independently verify or audit this information, and any inaccuracies or deviations in such information and

projections may materially impact our ability to execute on our strategy, achieve our goals, or otherwise adversely impact our business.

This Proxy Statement contains ESG-related statements based on hypothetical scenarios and assumptions as well as estimates that are

subject to a high level of uncertainty, and these statements should not necessarily be viewed as being representative of current or

actual risk or performance, or forecasts of expected risk or performance. In addition, historical, current, and forward-looking

environmental and social-related statements may be based on standards for measuring progress that are still developing, and internal

controls and processes that continue to evolve. For example, our disclosures based on existing standards may change due to revisions

in framework requirements, availability of information, changes in our business or applicable government policies, or other factors

which may be beyond our control. Forward-looking and other statements in this document may also address our corporate

responsibility and sustainability progress, plans, and goals. Our inclusion of such ESG-related information herein or in other

documents is not necessarily “material” under the federal securities laws for SEC reporting purposes, even if we use the word

“material” or “materiality” in relation to those statements, but is informed by various ESG standards and frameworks (including

standards for the measurement of underlying data), and the interests of various stakeholders. Website references throughout this

document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into this

document.

Table of Contents

Proxy Statement Summary 1

Corporate Governance at T-Mobile 5

About the Board of Directors 6

Annual Board and Committee Evaluations 8

How to Communicate with our Board 8

Board Committees and Related Matters 9

Risk Oversight 13

Director Compensation 15

Director Nomination, Selection and Qualifications 16

Environmental, Social, and Governance Practices 20

Proposal 1 - Election of Directors 28

Executive Officers 36

Proposal 2 - Ratification of the Appointment of Deloitte & Touche LLP as the Company’s Independent Registered Public

Accounting Firm for Fiscal Year 2023 38

Changes in Certifying Accountant 38

Required Vote 38

Pre-Approval Process 39

Fees Paid to PricewaterhouseCoopers LLP 39

Fees Paid to Deloitte & Touche LLP 39

Audit Committee Report 40

Proposal 3 - Advisory Vote to Approve the Compensation Provided to the Company’s Named Executive Officers for 2022 41

Required Vote 41

Executive Compensation 42

Compensation Discussion and Analysis 42

Compensation Committee Report 54

Executive Compensation Tables 55

Pay Ratio 69

Pay Versus Performance 70

Proposal 4 - Advisory Vote on the Frequency of Future Advisory Votes to Approve the Compensation Provided to the Company’s

Named Executive Officers 72

Required Vote 72

Proposal 5 - Approval of T-Mobile US, Inc. 2023 Incentive Award Plan 73

Background 73

Stockholder Approval 73

Reasonable Equity Dilution and Key Historical Equity Metrics 73

Material Terms of the Plan 74

Federal Income Tax Consequences of the Plan 77

Stock Price 78

New Plan Benefits 78

Required Vote 78

Equity Compensation Plan Information 79

Proposal 6 - Approval of T-Mobile US, Inc. Amended and Restated 2014 Employee Stock Purchase Plan 82

Background 82

Stockholder Approval 82

Key Historical Equity Metrics 82

Material Terms of the 2023 ESPP 83

Federal Income Tax Consequences of the 2023 ESPP 85

Stock Price 85

New Plan Benefits 85

Plan Benefits 86

Required Vote 86

Security Ownership of Principal Stockholders and Management 87

Transactions with Related Persons and Approval 89

Related Person Transactions 89

Related Person Transaction Policy 89

Transactions with Deutsche Telekom 89

Questions and Answers About the Annual Meeting and Voting 95

Other Information and Business 98

Appendix A—Reconciliation of Non-GAAP Financial Measures A-1

Annex A: T-Mobile US, Inc. 2023 Incentive Award Plan Annex A-1

Annex B: T-Mobile US, Inc. Amended and Restated 2014 Employee Stock Purchase Plan Annex B-1

PROXY STATEMENT SUMMARY

THIS SUMMARY HIGHLIGHTS INFORMATION YOU WILL FIND IN THIS PROXY STATEMENT. AS IT IS ONLY A

SUMMARY, PLEASE REVIEW THE COMPLETE PROXY STATEMENT BEFORE YOU VOTE.

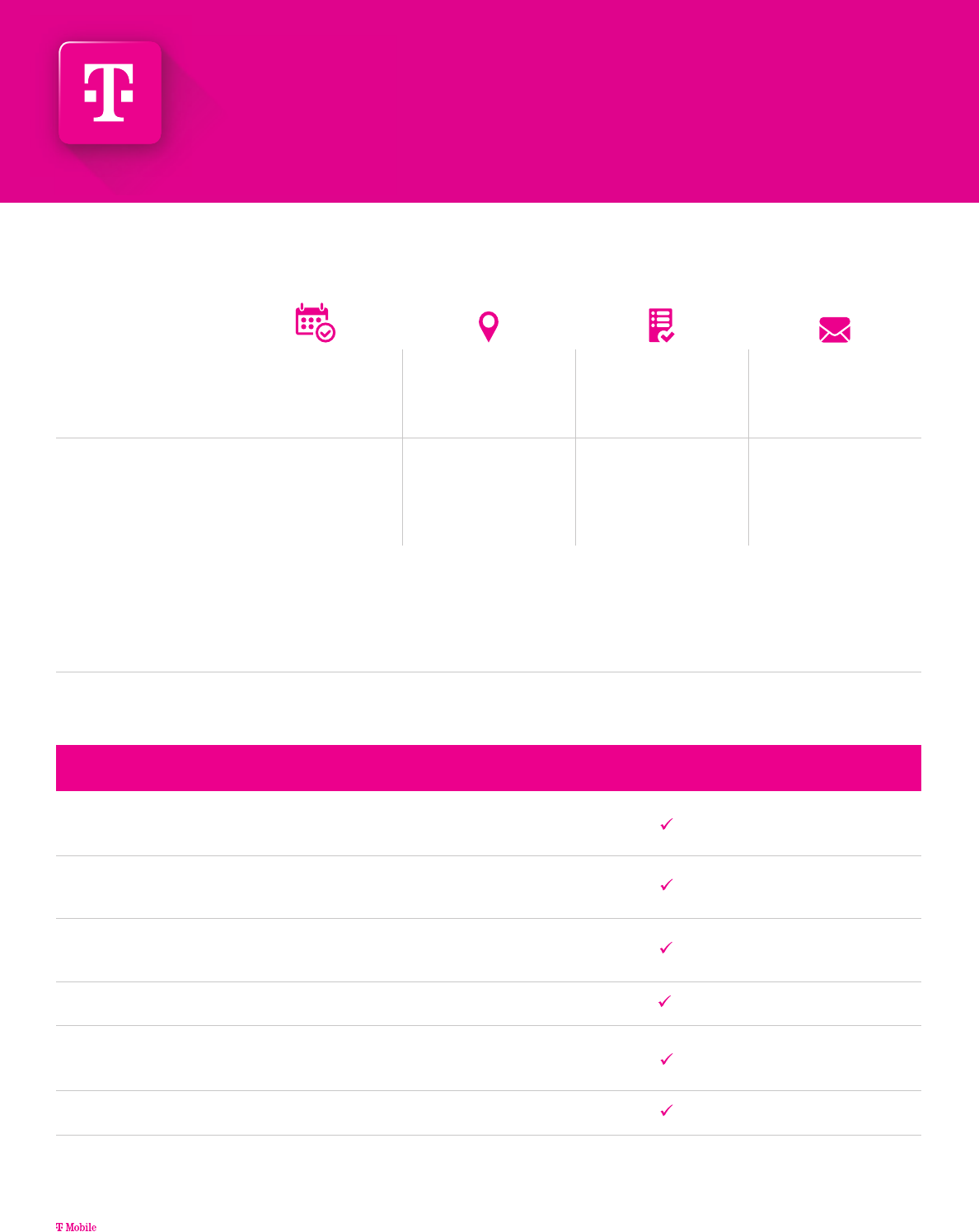

Annual Meeting

Information

DATE AND TIME:

June 16, 2023 at

8:00 a.m. PDT

LOCATION:

Online only at

www.virtualshareholder

meeting.com/TMUS2023

RECORD DATE:

April 17, 2023

PROXY MAIL DATE:

On or about

April 28, 2023

How to Vote

BY INTERNET:

Visit the website

listed on your

proxy card

BY PHONE:

Call the telephone

number on your

proxy card

BY MAIL:

Sign, date and return

your proxy card in the

enclosed envelope

AT THE ANNUAL

MEETING:

Vote electronically

at the virtual

Annual Meeting

Voting:

Each share of common stock is entitled to one vote for each director nominee and one vote for the other proposals to be voted on.

Admission:

You can virtually attend the Annual Meeting at the meeting time by visiting www.virtualshareholdermeeting.com/TMUS2023 and entering

the 16-digit control number included on your Notice of Internet Availability of Proxy Materials, proxy card or on the instructions that accompany

your proxy materials. The Annual Meeting will begin promptly at 8:00 a.m. PDT. Online check-in will begin at 7:45 a.m. PDT, and you should

allow ample time for the online check-in procedures.

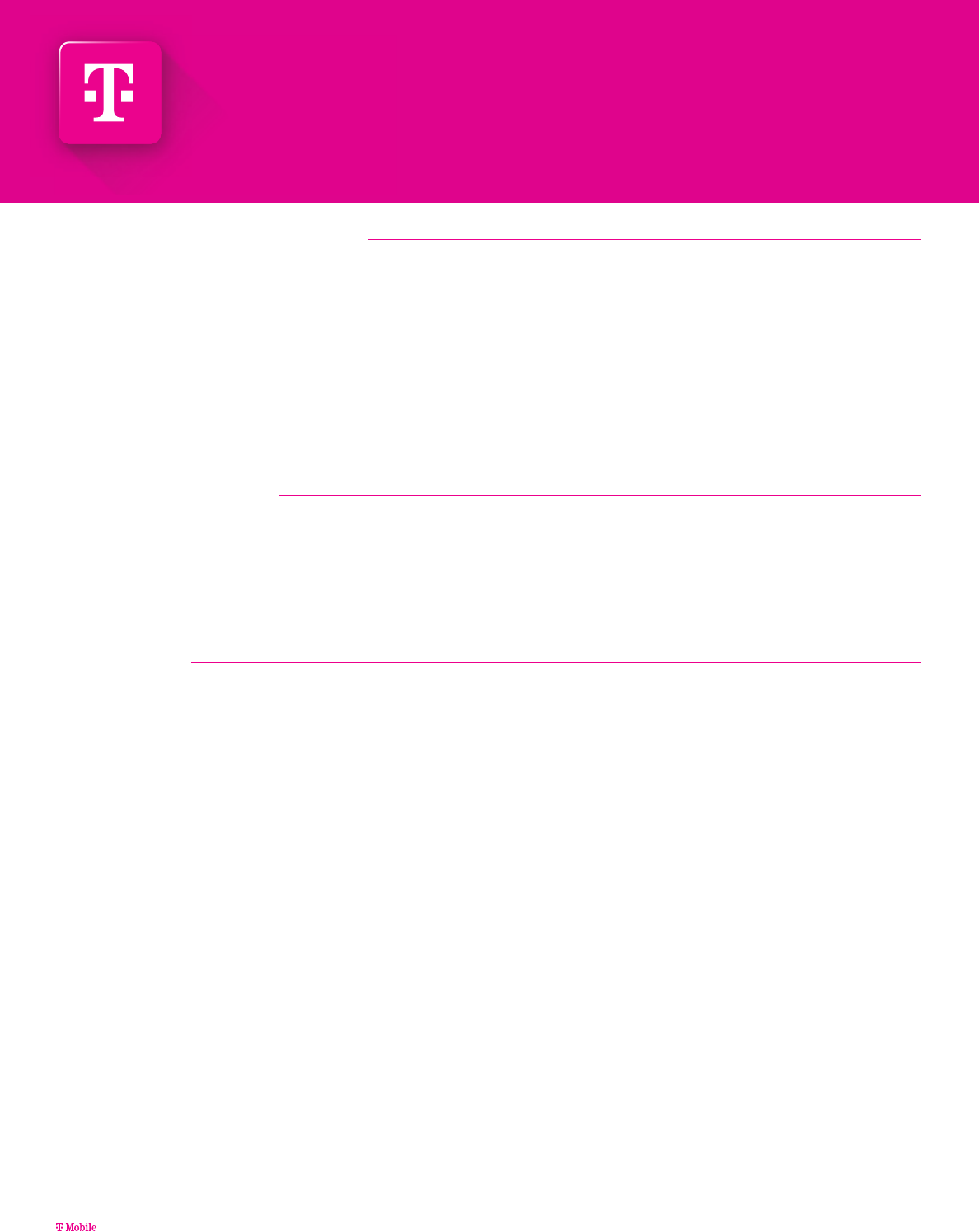

Annual Meeting Agenda and Vote Recommendations:

Matter

Board Vote

Recommendation

Page Reference

(for more details)

Proposal 1 Election of Directors FOR 28

Proposal 2

Ratification of the Appointment of Deloitte & T ouche LLP as the

Company’s Independent Registered Public Accounting Firm for

Fiscal Year 2023

FOR 38

Proposal 3

Advisory Vote to Approve the Compensation Provided to the

Company’s Named Executive Officers for 2022

EVERY

THREE

YEARS

41

Proposal 4

Advisory Vote on the Frequency of Future Advisory Votes to Approve the

Compensation Provided to the Company’s Named Executive Officers

FOR 72

Proposal 5 Approval of T-Mobile US, Inc. 2023 Incentive Award Plan FOR 73

Proposal 6

Approval of T-Mobile US, Inc. Amended and Restated 2014

Employee Stock Purchase Plan

FOR 82

In this Proxy Statement, “we,” “our,” “us,” “T-Mobile” and the “Company” refer to T-Mobile US, Inc. as a standalone company prior to April 1, 2020, the date we completed the Sprint

Combination (as defined below), and after April 1, 2020, refer to the combined company as a result of the Sprint Combination. “Annual Meeting” refers to the 2023 Annual Meeting of

Stockholders. We first made this Proxy Statement and form of proxy card available to stockholders on or about April 28, 2023.

䡵

PROXY STATEMENT 2023

1

Proxy Statement Summary

Good Corporate Governance Practices

Governance is real at T-Mobile. We became a publicly traded company in 2013 with a significant s tockholder, Deutsche Telekom AG

(“Deutsche Telekom”) following a business combination with MetroPCS Communications, Inc. (the “Metro Combination”). On April 1,

2020, we completed the merger with Sprint Corporation (“Sprint”) in an all-stock transaction (the “Sprint Combination” or the

“Merger”). Immediately after the Sprint Combination, we had two significant stockholders, Deutsche Telekom and SoftBank Group

Corp. (“SoftBank”). In connection with the Sprint Combination, on April 1, 2020, Deutsche Telekom and SoftBank entered into a

Proxy, Lock-up and ROFR Agreement (the “SoftBank Proxy Agreement”), and on June 22, 2020, Deutsche Telekom, Marcelo Claure

and Claure Mobile LLC (“Claure Mobile”), a Delaware limited liability company wholly owned by Mr. Claure, entered into a Proxy,

Lock-up and ROFR Agreement (the “Claure Proxy Agreement” and together with the SoftBank Proxy Agreement, the “Proxy

Agreements”). As a result of the Proxy Agreements, as of March 31, 2023, Deutsche Telekom has voting control over approximately

54.0% of the outstanding T-Mobile common stock, including approximately 0.4% and 3.3% shares of the outstanding T-Mobile

common stock held by Claure Mobile and SoftBank, respectively.

Deutsche Telekom has the right to designate 10 of our directors. A s a result, we have stockholder representation on our Board. The

Nominating and Corporate Governance Committee has the right to designate three of our directors, all of whom are independent

based on the applicable NASDAQ and SEC rules. Directors approach each Board decision with a mindset that is intellectually

independent from management. In addition, our Board has structured our corporate governance program to promote the long-term

interest of stockholders, strengthen the Board’s and management’s accountability and help build public trust in the Company.

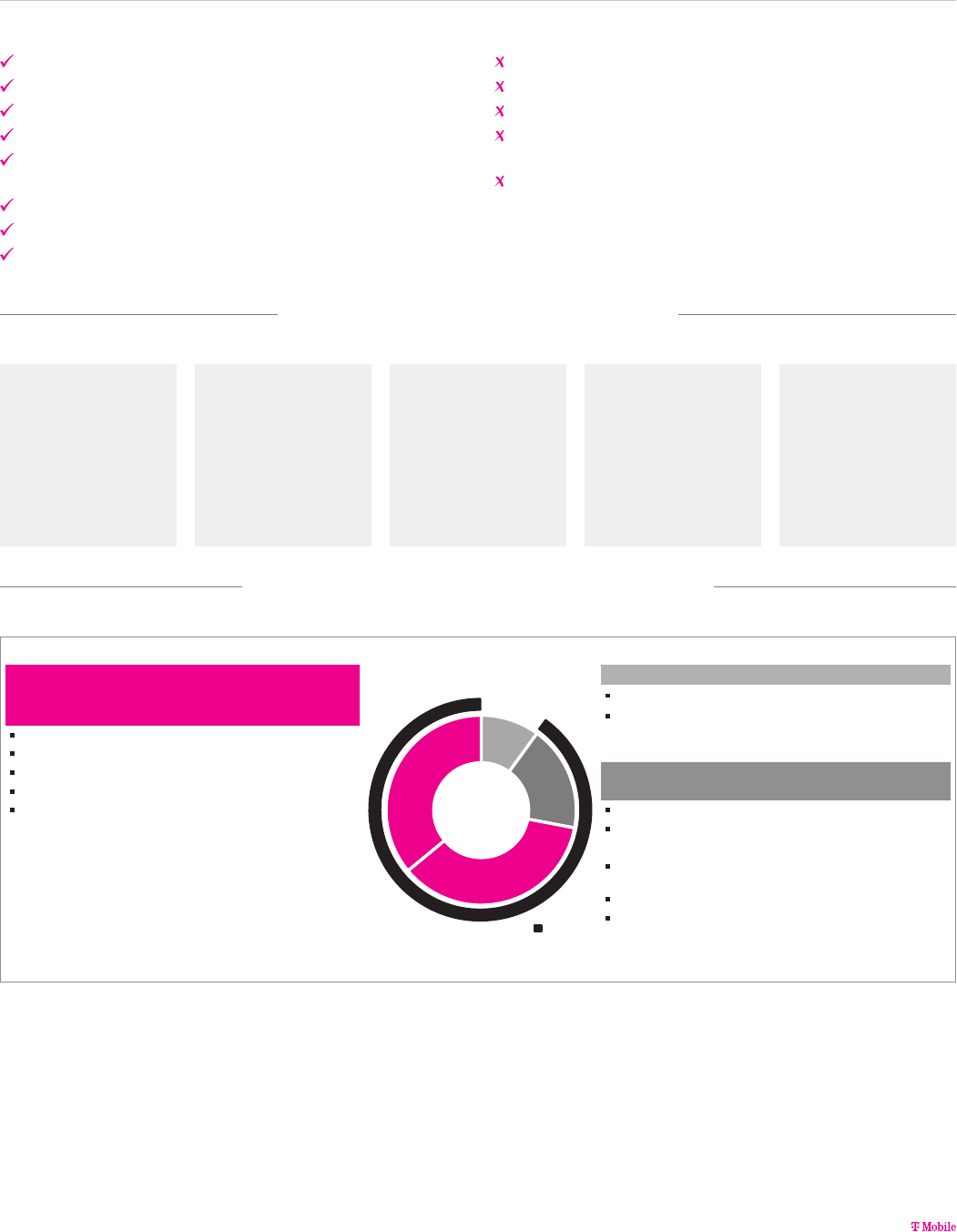

Unclassified Board and Annual Election of Directors

Annual Board and Committee Self-Evaluations

13 Director Nominees

No Poison Pill

Separation of Chairman and Chief Executive Officer Roles

Stockholder Right to Call Special Meeting and Act by Written Consent

Lead Independent Director

Anti-Hedging, Anti-Short Sale and Anti-Pledging Policies

Independent Chairs of the Audit, Compensation and Nominating and Corporate Governance Committees

Executive Compensation Driven by Pay for Performance

Regular Executive Sessions of Independent Directors

Stock Ownership Guidelines for Executive Officers and Directors

Comprehensive Risk Oversight by the Board and its Committees

Clawback Policy to Recapture Incentive Payments

2

PROXY STATEMENT 2023

䡵

Proxy Statement Summary

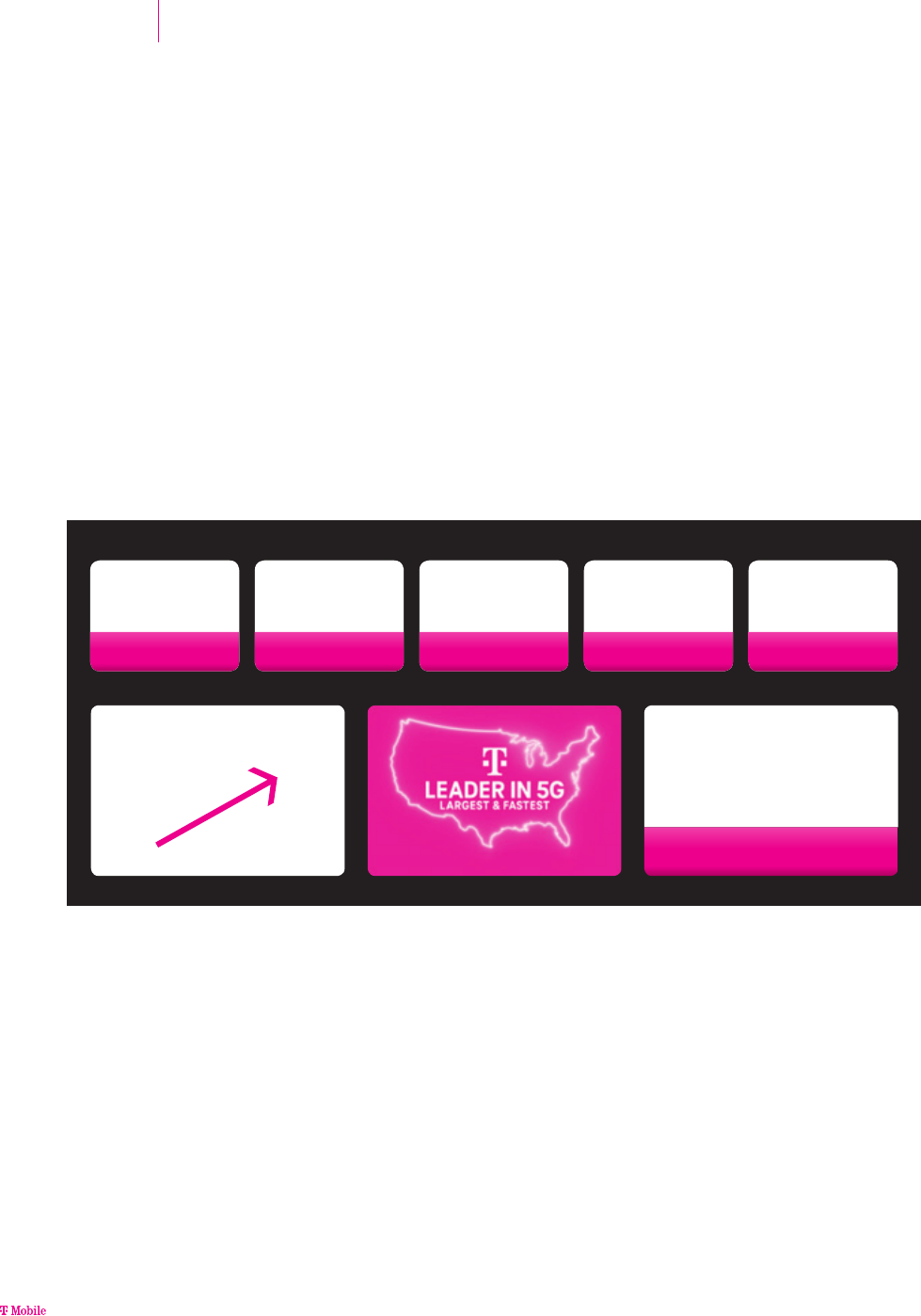

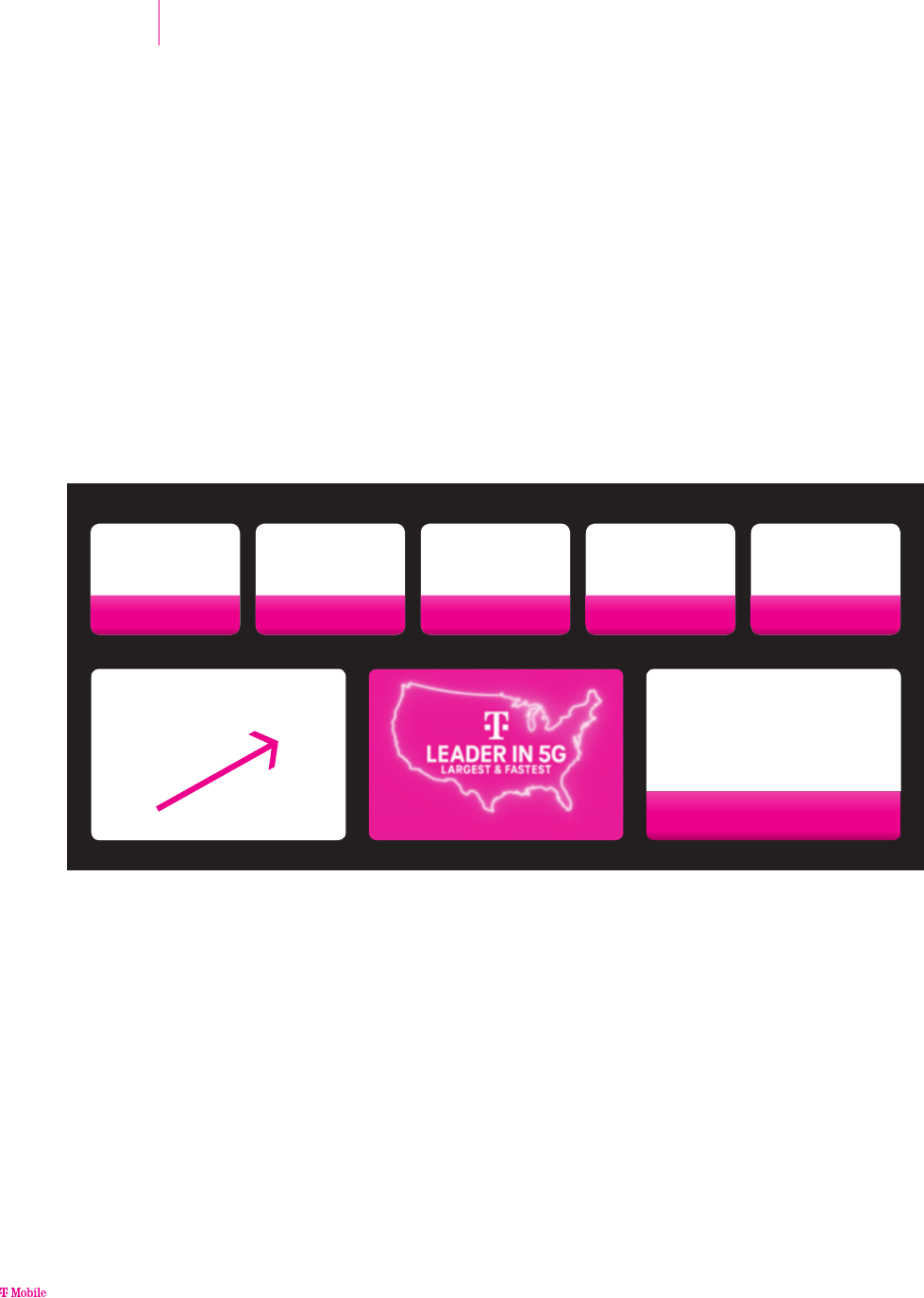

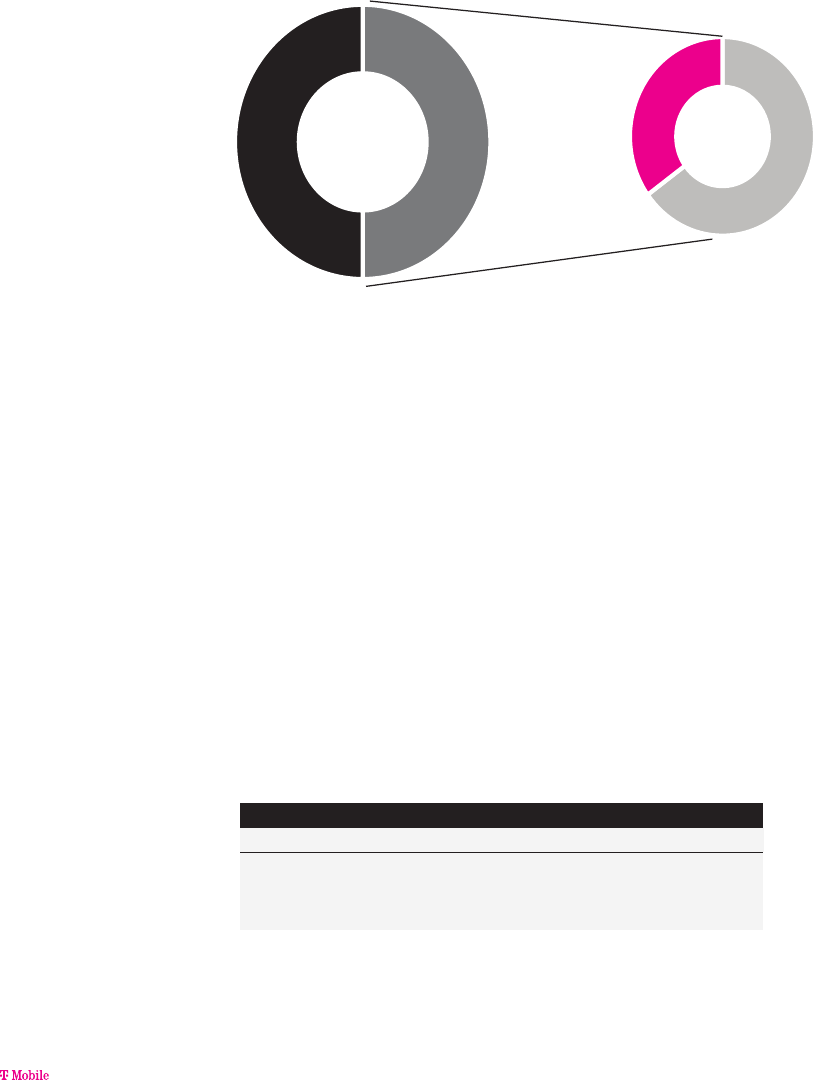

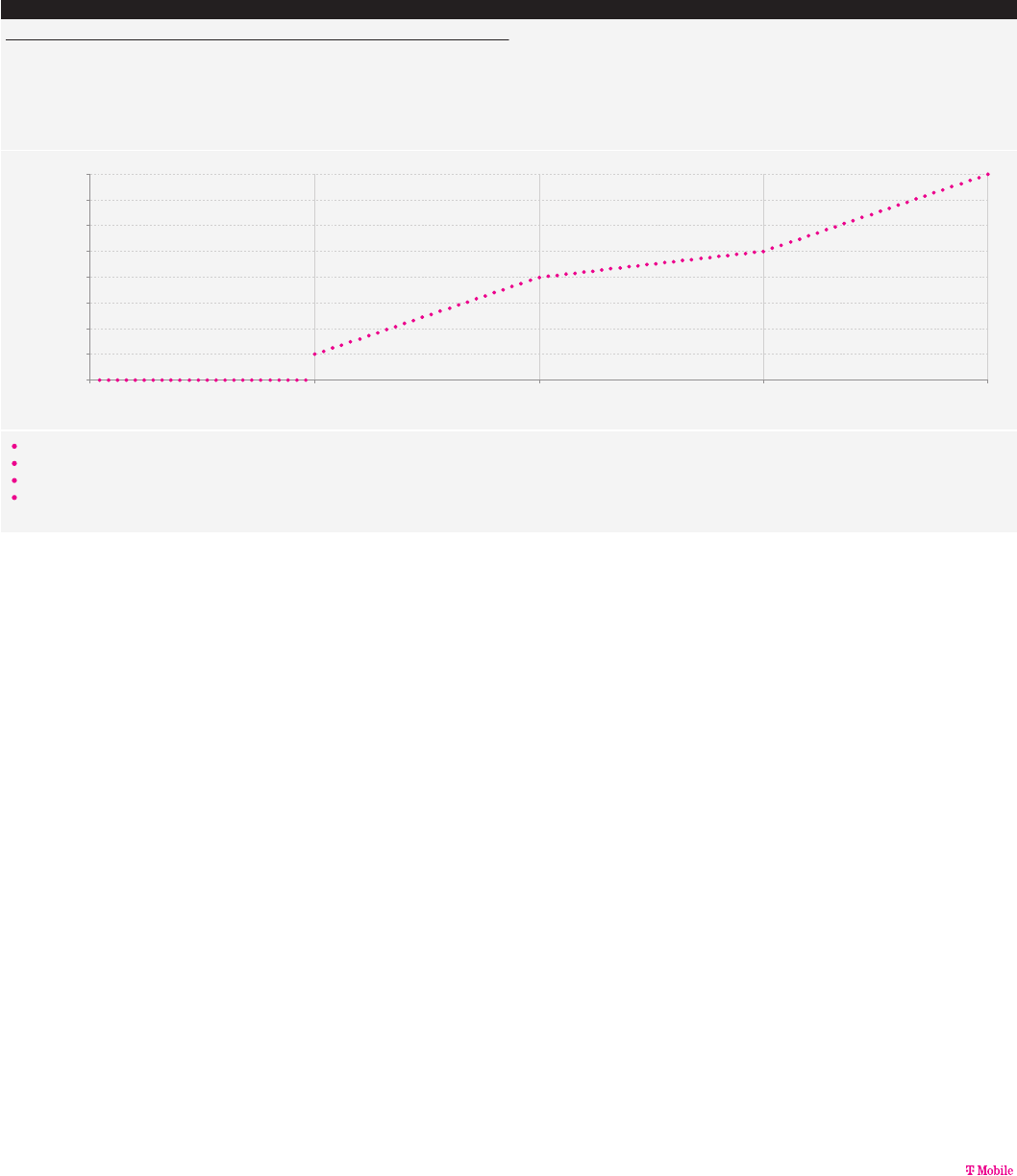

T-MOBILE DELIVERS INDUSTRY-LEADING CUSTOMER, POSTPAID

SERVICE REVENUE AND CASH FLOW GROWTH IN 2022

Our differentiated growth strategy drove industry-best growth in postpaid net account additions of 1.4 million

1

, postpaid net customer

additions of 6.4 million and High Speed Internet net customer additions of 2.0 million in 2022. We ended 2022 with a record high in

total customers of 113.6 million.

Our record customer growth translated into industry-leading postpaid service revenue and cash flow growth in 2022. We ended 2022

with total service revenues of $61.3 billion, postpaid service revenues of $45.9 billion, net income of $2.6 billion, Core Adjusted

EBITDA of $26.4 billion, net cash provided by operating activities of $16.8 billion and Free Cash Flow of $7.7 billion. We realized

approximately $6.0 billion of synergies from the Sprint Combination in 2022.

We further extended our reputation for value while translating our 5G lead into overall network leadership for the first time, as noted by

multiple third parties. At the end of 2022, our 5G network covered 325 million people (98% of Americans), and our super-fast Ultra

Capacity 5G covered 263 million people nationwide.

Our stock price increased by 64.5% from April 1, 2020 (the closing date of the Sprint Combination) to December 31, 2022.

Core Adjusted EBITDA and Free Cash Flow are non-GAAP financial measures. Each of the non-GAAP financial measures should be

considered in addition to, but not as a substitute for, the information provided in accordance with U.S. generally accepted accounting

principles (“GAAP”). Reconciliations to the most directly comparable GAAP financial measures are provided in Appendix A to this

Proxy Statement. Additionally, starting in the first quarter of 2023, we have renamed Free Cash Flow to Adjusted Free Cash Flow. This

change in name did not result in any change to the definition or calculation of this non-GAAP financial measure.

SERVICE

REVENUE

$61.3B $2.6B $16.8B $7.7B

113.6M

TOTAL CUSTOMERS

$26.4B

TMUS STOCK PRICE UP 64.5% SINCE

THE SPRINT COMBINATION

$85.13

*

4/01/2020

$140.00

*

12/30/2022

*closing price as of the date

NET

INCOME

CORE ADJUSTED

EBITDA

NET CASH PROVIDED BY

OPERATING ACTIVITIES

FREE CASH

FLOW

See 5G device, coverage, & access details at T-Mobile.com. Fastest; Based on median, overall combined

5G speeds according to analysis by Ookla

®

of Speedtest Intelligence

®

data 5G download speeds for Q4 2022.

1 AT&T Inc. historically does not disclose postpaid net account additions.

䡵

PROXY STATEMENT 2023

3

Proxy Statement Summary

Executive Compensation Highlights – Paying for Performance

Our executive compensation program is aligned with our business strategy and is designed to attract and retain top talent, reward

short-term and long-term business results and exceptional individual performance, and, most importantly, maximize stockholder value.

KEY FEATURES OF OUR EXECUTIVE COMPENSATION PROGRAM

WHAT WE DO

Emphasis on pay for performance

Independent compensation consultant

Executive and director stock ownership guidelines

Clawback policy to recapture incentive payments

Use of multiple performance measures and caps on potential

incentive payments

Substantial majority of target total compensation is variable

Use of executive compensation statements (“tally sheets”)

Annual risk assessment of compensation programs

WHAT WE DON’T DO

No excise tax gross ups

No guaranteed bonuses

No plans that encourage excessive risk taking

No single-trigger payments or vesting of equity awards upon a

change in control

No significant perquisites

4

PROXY STATEMENT 2023

䡵

CORPORATE GOVERNANCE

AT T-MOBILE

T-Mobile is Committed to Good Corporate Governance

Our corporate governance practices and policies promote the long-term interests of our stockholders, strengthen the accountability of

our Board and management and help build public trust.

Our Board has established a boardroom dynamic that encourages meaningful and robust discussions based on each director’s unique

and diverse background, resulting in informed decision-making that seeks to maximize stockholder value and promotes stockholder

interests. Directors exercise thorough oversight of decisions regarding the Company’s strategy and outlook. T he Board regularly

reviews developments in corporate governance and updates its practices and governance materials as it deems necessary and

appropriate.

Key Governance Materials

Certificate of Incorporation

Bylaws

Corporate Governance Guidelines

Director Selection Guidelines

Stockholders’ Agreement

Charter for Each Board Committee

Code of Business Conduct

Code of Ethics for Senior Financial Officers

Environmental Policy

Human Rights Statement

Speak Up Policy (f.k.a. Whistleblower Protection Policy)

Supplier Code of Conduct

These documents are available under the “Governance” section of our website at http://investor.t-mobile.com or are included in our

filings with the SEC. In addition, our key Privacy Notices are available on our website at https://www.t-mobile.com/privacy-center.

䡵

PROXY STATEMENT 2023

5

Corporate Governance at T-Mobile

About the Board of Directors

GOVERNANCE FRAMEWORK AND CODE OF BUSINESS CONDUCT

Our Board has adopted Corporate Governance Guidelines that, together with our certificate of incorporation, our bylaws and the

Second Amended and Restated Stockholders’ Agreement we entered into with Deutsche Telekom and SoftBank on June 22, 2020 (the

“Stockholders’ Agreement”), provide a framework for the effective governance of the Company.

The Board also adopted our Code of Business Conduct, which establishes the standards of ethical conduct applicable to our

directors, officers and employees. In addition, we have a Code of Ethics for Senior Financial Officers. In the event of a waiver by the

Board of any provisions of the Code of Business Conduct or Code of Ethics for Senior Financial Officers applicable to directors or

executive officers or any amendment thereto, we will promptly disclose the Board’s actions on our website.

OUR BOARD

Our Board currently consists of 13 directors. One of the directors is currently employed by the Company. We are required to have a

“National Security Director” pursuant to our national security commitments entered into in connection with the Sprint Combination.

Letitia A. Long currently serves in such capacity. Pursuant to our certificate of incorporation and the Stockholders’ Agreement,

Deutsche Telekom has certain rights to designate director nominees and to have such designees serve on the committees of the

Board. See “Transactions with Related Persons and Approval—Transactions with Deutsche Telekom and SoftBank—Stockholders’

Agreement” for more information.

WE ARE A CONTROLLED COMPANY WITH CERTAIN EXEMPTIONS

Pursuant to the Proxy Agreements, Deutsche Telekom has voting control, as of March 31, 2023, over approximately 54.0% of the

outstanding shares of our common stock (including approximately 0.4% and 3.3% of the outstanding shares of common stock held by

Claure Mobile and SoftBank, respectively), and we are deemed a “controlled company” under the NASDAQ Stock Market LLC

(“NASDAQ”) rules. These rules exempt “controlled companies,” like us, from certain corporate governance requirements, including:

(i) that a majority of our Board be independent, (ii) that our Nominating and Corporate Governance Committee be composed entirely

of independent directors, and (iii) that our Compensation Committee be composed entirely of independent directors.

DIRECTOR INDEPENDENCE

On an annual basis, our Board evaluates the independence of each director, including nominees for election to the Board, in

accordance with NASDAQ rules and our Corporate Governance Guidelines. For certain types of relationships, NASDAQ rules require

us to consider a director’s relationship with the Company, and also with any parent or subsidiary in a consolidated group with the

Company, which includes Deutsche Telekom and its affiliates. Each of the following directors or director nominees is an “independent

director” under NASDAQ rules and our Corporate Governance Guidelines:

䡵 Marcelo Claure

䡵 Srikant M. Datar*

䡵 Bavan M. Holloway*

䡵 Letitia A. Long

䡵 Teresa A. Taylor*

䡵 Kelvin R. Westbrook

* The Board has determined that each member of the Audit Committee meets the heightened independence criteria applicable to audit committee members under NASDAQ and SEC rules.

BOARD LEADERSHIP

OUR CHAIRMAN AND OUR CHIEF EXECUTIVE OFFICER ROLES ARE SEPARATED

We believe that separating the roles of Chief Executive Officer and Chairman of the Board is appropriate for the Company and in the

best interests of the Company and its stockholders at this time. Timotheus Höttges, Deutsche Telekom’s Chief Executive Officer, is the

Chairman of the Board. Key responsibilities of our Chairman include:

• Managing the overall Board function

• Chairing all regular sessions of the Board

• Establishing the agenda for each Board meeting in consultation with the lead independent director, our Chief Executive

Officer and other senior management, as appropriate

• Assisting in establishing, coordinating and reviewing the criteria and methods for evaluating, at least annually, the

effectiveness of the Board and its committees

6

PROXY STATEMENT 2023

䡵

Corporate Governance at T-Mobile

Absent any changes to the Stockholders’ Agreement, which will require Deutsche Telekom’s approval, the Company does not foresee

a possibility that the Chairman of the Board and CEO roles will be filled by a single individual. The separation of the offices allows

Mr. Höttges to focus on management of Board matters and allows our Chief Executive Officer to focus on managing our business.

Additionally, we believe the separation of the roles ensures the objectivity of the Board in its management oversight role, specifically

with respect to reviewing and assessing our Chief Executive Officer’s performance. The Board believes that the current leadership

structure chosen by the Board is conducive to the Board’s role in risk oversight. The Company would engage with stockholders prior

to the Board making a decision to combine the Chairman and Chief Executive Officer roles, and would promptly publicly disclose such

a decision by the Board.

WE HAVE A LEAD INDEPENDENT DIRECTOR

Our Board has also chosen to appoint a lead independent director. The lead independent director has significant authority, provides

leadership for our independent directors, and strengthens the Board’s oversight of the Company’s business. Teresa A. Taylor is our

current lead independent director. She also serves as the Chair of Nominating and Corporate Governance Committee. Key

responsibilities of our lead independent director include:

• Coordinating the activities of our independent directors

• Calling and presiding over the executive sessions of the independent directors

• Functioning as a liaison between the independent directors and the Chairman of the Board and/or the Chief Executive Officer

• Providing input on design of the Board

• Providing input on the flow of information to the Board, including the Board’s agenda and schedule

• Facilitating discussion among the independent directors on key issues and concerns outside of Board meetings, including

with respect to risk management

• Chairing the annual stockholders’ meeting when the Chairman of the Board is not present

• When requested, representing the Board with internal and external audiences, including stockholders

BOARD MEETINGS AND DIRECTOR ATTENDANCE

Our Board meets regularly throughout the year. Committees typically meet the day prior to the Board meeting, and, depending on the

schedule of the Board meeting, the Audit Committee holds additional meetings in connection with quarterly earnings releases.

Directors are expected to attend all meetings of the Board and each committee on which they serve, as well as the Annual Meeting. At

each regularly scheduled Board meeting (or more frequently if necessary), time is set aside for executive sessions where outside

(non-management) directors meet without management present. In addition, our Corporate Governance Guidelines require the

independent directors to meet at least twice each year in executive sessions, with the lead independent director presiding at such

executive sessions.

• Our Board met five times during 2022

• Each director attended at least 75% of the total number of meetings of the Board and Board committees on which he or she

served

• All directors who then served on the Board attended our 2022 annual meeting of stockholders

䡵

PROXY STATEMENT 2023

7

Corporate Governance at T-Mobile

Annual Board and Committee Evaluations

The Nominating and Corporate Governance Committee oversees the annual Board and committee self-evaluation process. In 2022, the

Committee engaged an outside consultant to coordinate and provide insight on the annual self-evaluation process.

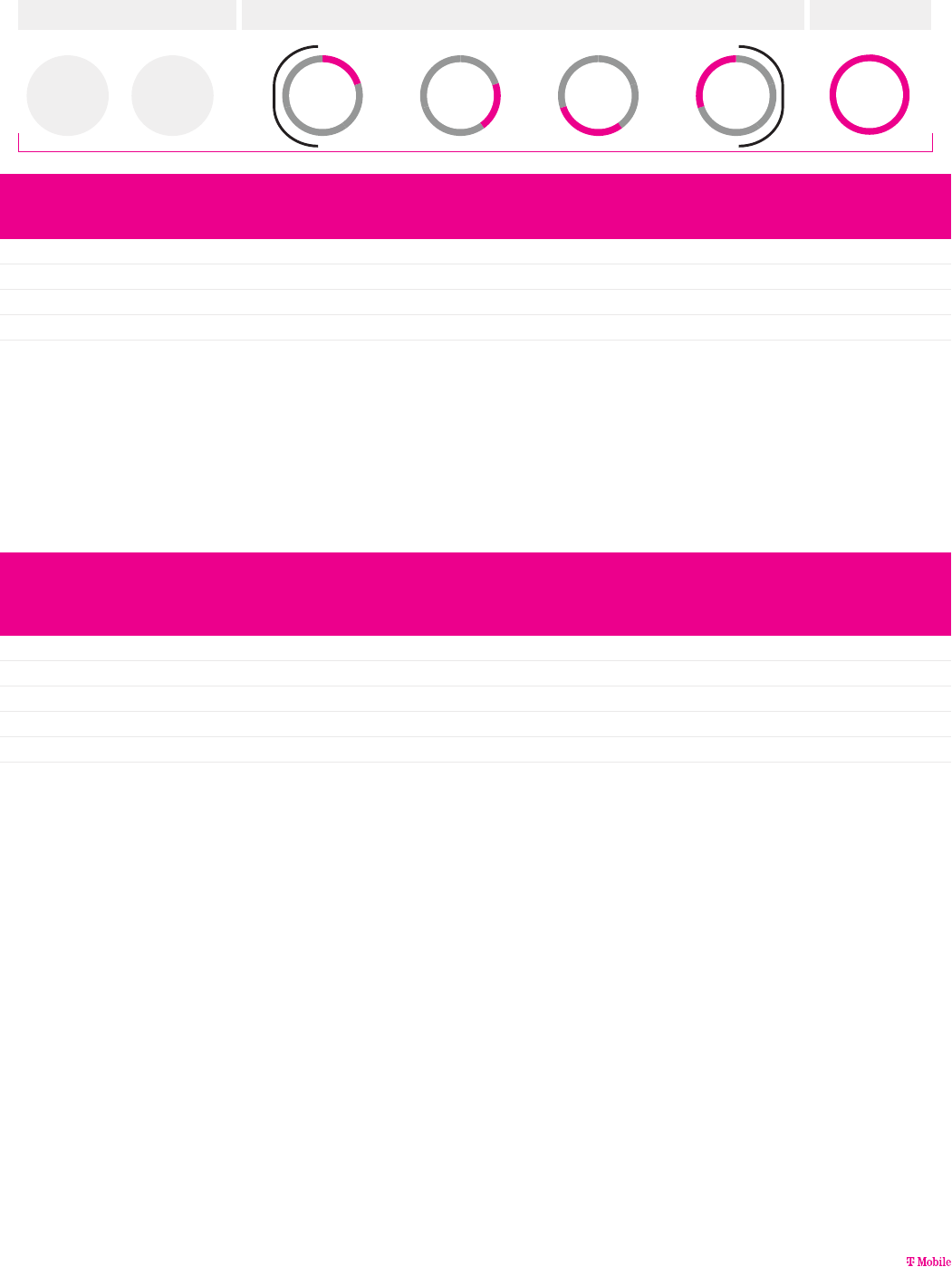

THE BOARD IS COMMITTED TO A COMPREHENSIVE SELF-EVALUATION PROCESS

TO REVIEW THE BOARD’S AND EACH COMMITTEE’S OVERALL EFFECTIVENESS.

BOARD EVALUATION PROCESS

BEGIN EVALUATION PROCESS

EVALUATION

Strategic Oversight

Scope & Content of Presentations

Risk Management

Succession Planning

ANALYSIS

RESULTS AND FINDINGS

The Nominating and Corporate Governance chair, with assistance from the outside consultant, presents the

results and fi ndings to the Board. Each committee reviews the committee results and fi ndings.

FOLLOW UP

Results requiring additional consideration are addressed at subsequent board and committee meetings and

reported back to the Board, where appropriate.

STEP

STEP

STEP

STEP

STEP

1

2

3

4

5

The Chair of the Nominating and Corporate Governance Committee initiates, with the assistance of the

Corporate Secretary, the annual evaluation process by engaging an outside evaluation consultant.

Working closely with management, the outside consultant distributes comprehensive questionnaires to each

director soliciting feedback on the Board’s and each relevant committee’s effectiveness, covering topics such as:

The outside consultant reviews the responses and prepares an executive summary for the Board and each

committee, which includes an overview of director responses and guidance on any material issues. The Chair of

the Nominating and Corporate Governance Committee reviews the reports together with management and works

directly with the consultant to evaluate the findings.

How to Communicate With Our Board

You may contact the Chairman of the Board, the Board as a whole, the lead independent director, or any individual director as follows:

T-Mobile US, Inc.

The Board of Directors

c/o Corporate Secretary

12920 SE 38th Street

Bellevue, Washington 98006

After receipt, communications will generally be forwarded to the Chairman of the Board,

the whole Board, the lead independent director or specific directors as the Corporate

Secretary deems appropriate based on the content of, and the matters raised in, the

communications. Communications that are unrelated to the duties and responsibilities of

the Board or are unduly hostile, threatening, potentially illegal or similarly unsuitable will

not be forwarded. Responses to letters and any communications that are excluded are

maintained by the Company and are available to any director upon request.

8 PROXY STATEMENT 2023

䡵

Corporate Governance at T-Mobile

Board Committees and Related Matters

Our Board has six standing committees: Audit, CEO Selection, Compensation, Executive, Nominating and Corporate Governance and

Transaction. The CEO Selection and Transaction Committees were formed upon the Sprint Combination. The Board makes committee

and committee chair assignments annually at its meeting immediately following the annual meeting of stockholders, although further

changes may be made from time to time as deemed appropriate by the Board.

Each committee has a Board-approved charter, which is reviewed annually by the respective committee. Recommended changes, if

any, are submitted to the Board for approval. Each committee may retain and compensate consultants or other advisors as necessary

for it to carry out its duties, without consulting with or obtaining the approval of the Board or the Company. A copy of the charter for

each standing committee can be found on the Investor Relations section of our website at http://investor.t-mobile.com by selecting

“Governance Documents” under the “Governance” tab.

Chair: Srikant M. Datar

Additional Members:

Teresa A. Taylor

Bavan Holloway

Meetings Held in 2022: 11

Audit Committee

As more fully described in its charter, the primary responsibilities of the Audit

Committee are to:

• Assist the Board in oversight of the integrity of the Company’s financial statements and the

accounting and financial reporting processes, disclosure controls and procedures and internal

audit functions

• Directly appoint, compensate and retain our independent auditor, including the evaluation of the

independent auditor’s qualifications, performance and independence

• Pre-approve the retention of the independent auditor for all audit and such non-audit services as

the independent auditor is permitted to provide the Company and approve the fees for such

services

• Discuss and oversee the Company’s financial risk assessment and risk management

• Develop and oversee compliance with the Code of Ethics for Senior Financial Officers

• Establish procedures for the confidential, anonymous submission by employees of concerns

regarding questionable accounting or auditing matters

• Review and approve all related person transactions pursuant to the Company’s Related Person

Transaction Policy

Our Board has determined that each member of the Audit Committee meets all of the

requirements for audit committee members under applicable NASDAQ rules, and each of

Mr. Datar and Ms. Holloway is an “audit committee financial expert” as defined in applicable

SEC rules.

䡵

PROXY STATEMENT 2023

9

Corporate Governance at T-Mobile

Compensation Committee

As more fully described in its charter, the primary responsibilities of the

Compensation Committee are to:

• Review and approve the Company’s overall executive compensation philosophy and its programs,

policies and practices regarding the compensation of its executive officers at least annually

• Review and approve corporate goals and objectives relevant to the Chief Executive Officer’s

compensation, evaluate the Chief Executive Officer’s performance in light of those goals and

objectives and determine and approve the Chief Executive Officer’s compensation

• Review and approve annual and long-term compensation for and all compensation arrangements

to be entered into with the Company’s executive officers

• Oversee the development of succession plans for the Chief Executive Officer and senior

management

• Assist the Board in reviewing the results of any stockholder advisory votes, or respond to other

stockholder communications that relate to executive officer compensation, and consider whether

to make or recommend adjustments to the Company’s policies and practices as a result of such

votes or communications

• Review a report from management regarding potential material risks, if any, created by the

Company’s compensation policies and practices

• Review and make recommendations to the Board with respect to compensation for non-employee

members of the Board

• Review and make recommendations to the Board with respect to all Company equity

compensation plans and oversee the administration of such plans

• The Section 16 Subcommittee has the authority to approve all equity or equity-based awards

granted to the Company’s officers who are subject to Section 16 of the Securities Exchange Act of

1934, as amended (the “Exchange Act”), provided that if the Section 16 Subcommittee does not

consist of at least two directors, the full Board shall have such authority.

Chair: Kelvin R. Westbrook

Additional Members:

Marcelo Claure

Srinivasan Gopalan

Christian P. Illek

Raphael Kübler

Meetings Held in 2022:8

Section 16 Subcommittee:

Kelvin R. Westbrook

Marcelo Claure

Compensation Committee

THE COMPENSATION COMMITTEE HAS ENGAGED AN INDEPENDENT COMPENSATION CONSULTANT

The Compensation Committee has retained Mercer (a wholly owned subsidiary of Marsh & McLennan Companies, Inc.), a well-

recognized employee benefits and compensation consulting firm, as its independent compensation consultant. Mercer assists the

Compensation Committee in its evaluation of the compensation and benefits provided to the Chief Executive Officer and the other

executive officers. Mercer generally attends Compensation Committee meetings at which executive officer compensation is discussed

and provides information, research and analysis pertaining to executive compensation as requested by the Compensation Committee.

Mercer also updates the Compensation Committee on market trends. During 2022, the aggregate fees for such services were

approximately $321,000. In addition, Mercer provided services to the Company for investment and benefits consulting and retirement

plan consulting, which services were approved by management. During 2022, the aggregate fees for such services were approximately

$1,294,000.

䡲 The Compensation Committee determined that Mercer is (and was, during 2022) independent and that its engagement does

not (and did not, during 2022) present any conflicts of interest that would prevent Mercer from serving as an independent

consultant to the Compensation Committee.

䡲 Mercer also determined that it was independent from management and confirmed this in a written statement delivered to the

Compensation Committee.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

During 2022, the following individuals served on the Compensation Committee for all or part of the year: Messrs. Claure, Gopalan,

Illek, Kübler, Westbrook and Wilkens. Mr. Wilkens ceased to be a member of the Board and the Compensation Committee on

August 31, 2022. No member of the Compensation Committee who served during 2022 was an officer or employee of the Company or

any of its subsidiaries during the year, was formerly a Company officer or had any relationship otherwise requiring disclosure as

compensation committee interlock pursuant to Item 407(e)(4) of Regulation S-K.

10 PROXY STATEMENT 2023

䡵

Corporate Governance at T-Mobile

Chair: Timotheus Höttges

Additional Members:

Marcelo Claure

Christian P. Illek

Thorsten Langheim

Teresa A. Taylor

Meetings Held in 2022: 0*

*Per the CEO Selection Committee’s

charter, the Committee meets as

often as it determines necessary

CEO Selection Committee

As more fully described in its charter, the primary responsibilities of the CEO

Selection Committee are to:

• Select, appoint, hire, fire and recall from office the Chief Executive Officer of the Company

• Consult with SoftBank as required for certain decisions to fire and recall from office the Chief

Executive Officer of the Company

Chair: Timotheus Höttges

Additional Members:

Marcelo Claure

Christian P. Illek

Raphael Kübler

Thorsten Langheim

G. Michael Sievert

Meetings Held in 2022: 0*

*Per the Executive Committee’s charter,

the committee meets as often as it

determines necessary

Executive Committee

As more fully described in its charter, the primary responsibilities of the

Executive Committee are to:

• Monitor the Company’s operating performance relative to its operating objectives, strategy, plans

and actions

• Provide management with feedback regarding the Company’s operating objectives, strategy,

plans, and actions, as well as the Company’s operating performance

• Consider strategic operating goals, opportunities and risks

• Recommend changes to the Company’s operating objectives, strategy, plans, and actions for

consideration by the Board, as appropriate

䡵

PROXY STATEMENT 2023

11

Nominating and Corporate Governance Committee

As more fully described in its charter, the primary responsibilities of the

Nominating and Corporate Governance Committee are to:

• Subject to the terms of the Company’s certificate of incorporation and the Stockholders’

Agreement, review, approve and recommend for Board consideration director candidates based

on the director selection guidelines then in effect, and advise the Board with regard to the

nomination or appointment of such director candidates

• Periodically review and make recommendations to the Board regarding the appropriate size, role

and function of the Board

• Develop and oversee a process for an annual evaluation of the Board and its committees

• Monitor the process for preparing agendas for, organizing and running Board meetings (including

the occurrence of regular executive sessions) in coordination with the Chairman of the Board and

Chief Executive Officer

• Recommend to the Board, as appropriate, the number, type, functions, and structure of

committees of the Board, and the chairperson of each such committee

• Oversees director succession planning

• Develop and oversee compliance with the Code of Business Conduct for all employees, officers

and directors

• Discuss the Company’s risk assessment and risk management policies, as well as annually review

the implementation and effectiveness of our compliance and ethics programs

• Periodically review the Company’s report on political and charitable contributions and other

environmental, sustainability, and corporate social responsibility matters

• Periodically review and consult with management on the Company’s data privacy and information

security programs, including cybersecurity

• Periodically review the Company’s director orientation program and recommend changes, as

appropriate

• Monitor, plan and support continuing education activities of the directors

• Develop, update as necessary and recommend to the Board corporate governance principles and

policies

Chair: Teresa A. Taylor

Additional Members:

Dominique Leroy

Letitia A. Long

Meetings Held in 2022: 7

Transaction Committee

As more fully described in its charter, the primary responsibilities of the

Transaction Committee are to:

• Evaluate with the Company’s management and provide recommendations to the Board with

respect to proposed strategic transactions f or the Company and its businesses, including, but not

limited to, mergers, acquisitions, divestitures, joint ventures, and other similar transactions

• Monitor the progress of pending and potential strategic transactions involving the Company, its

businesses and its competitors

Chair: Thorsten Langheim

Additional Members:

Christian P. Illek

Kelvin R. Westbrook

Meetings Held in 2022: 0*

*Per the Transaction Committee’s

charter, the committee meets as often as

it determines necessary

Corporate Governance at T-Mobile

12 PROXY STATEMENT 2023

䡵

Risk Oversight

MANAGEMENT’S ROLE IN RISK OVERSIGHT

Management of the Company, including the Chief Executive Officer and other executive officers, is primarily responsible for managing

the risks associated with the business, operations, and financial and disclosure controls. Management conducts a quarterly enterprise-

wide risk assessment and considers financial, integration, strategic, IT, cybersecurity, technology, operational, compliance, legal/

regulatory, and reputational risks to the Company, including risks that are short-term, intermediate-term and/or long-term. In addition,

management conducts an annual fraud risk assessment and an annual compliance risk assessment, and periodically assesses future

trends in ESG oversight, practices, disclosure controls and disclosures. Periodically, the Company engages third-party experts as part

of the Company’s risk assessment, including assessment of future threats and trends, and risk mitigation processes. All enterprise

risks that are considered are prioritized based on potential impact to the Company. Risk trending is also evaluated, and management

action plans and timelines are developed and tracked to address the immediacy of the risk assessed. The results of these assessments

are considered in connection with the operational, financial, and business activities of the Company.

Management Has Established a Third-Party Risk Management Program

Management has established a centralized Third-Party Risk Management program to evaluate multiple aspects of risk related to doing

business with third parties, including, but not limited to, cybersecurity, geopolitical, privacy, financial, anti-corruption, fourth-party

risks and risks relating to foreign ownership and compliance with national security commitments.

Management Has Established an Enterprise Risk and Compliance Committee and an Information Security and Privacy Council

The Enterprise Risk and Compliance Committee oversees risk management and compliance activities as a means of bringing risk

issues to the attention of senior management. Responsibilities for risk management and compliance are distributed throughout

various functional areas of the business, and the Enterprise Risk and Compliance Committee consists of representatives of

management, the enterprise risk organization, the enterprise compliance and ethics function, leaders from these functional areas of

business and subject matter experts from across the Company. The committee is co-led by our Executive Vice President and Chief

Financial Officer and Executive Vice President and General Counsel. It regularly meets and reviews the Company’s activities in these

areas. The Enterprise Risk and Compliance Committee drives the identification, prioritization, and mitigation of the Company’s most

significant risks, enables coordinated actions across the Company, and provides input to the Chief Audit Executive’s report to the

Audit Committee and the Chief Compliance Officer’s report to the Nominating & Corporate Governance Committee.

The Information Security and Privacy Council oversees the strategic governance and prioritization of the Company’s information

security (including cybersecurity), privacy and national security initiatives to help protect information assets and safeguard our

network infrastructure for the business, the Company’s employees, and the Company’s customers. The Information Security and

Privacy Council consists of representatives of management and subject matter experts from across the Company. It is co-chaired by

our Senior Vice President and Chief Security Officer and Vice President and Chief Privacy Officer. The Information Security and

Privacy Council provides strategic direction as well as oversight and acts as an escalation point concerning critical decisions, strategy

direction, and risk acceptance and mitigation.

In addition, in the fall 2021, a new information security office, the Cyber Transformation Office, was formed under the Company’s Chief

Executive Officer, overseeing the Company’s data security organization, and tasked with elevating the Company’s cyber security

capabilities and reinforcing a security-first mindset throughout T-Mobile business and operations functions.

THE BOARD’S ROLE IN RISK OVERSIGHT

Selective Delegation of Risk Oversight to Committees

Our directors have deep experience and expertise in strategic planning and execution. Through regular and s pecial Board meetings,

the Board engages with management in robust discussions about the Company’s financial and operational performance, competitive

landscape, strategic goals, operational objectives and challenges and regulatory developments.

While the full Board has overall responsibility for risk oversight, the Board has delegated risk oversight responsibility for certain risks

to committees of the Board. On a regular basis, reports of all committee meetings are presented to the Board, and the Board

periodically conducts deep dives on key enterprise risks.

Audit Committee

The Audit Committee has primary responsibility for overseeing the Company’s various risk assessment, risk management policies, and

procedures and controls. The Audit Committee considers and discusses policies with respect to risk assessment and risk

management, including the Company’s major financial risk exposures and the steps management has taken to monitor and control

such exposures.

䡵

PROXY STATEMENT 2023

13

Corporate Governance at T-Mobile

Corporate Governance at T-Mobile

To assist the Audit Committee with its risk assessment function, the Senior Vice President, Internal Audit & Risk Management, who

serves as the Chief Audit Executive, has a direct communication channel to the Audit Committee for purposes of reporting or

discussing concerns, and has regular meetings with the Audit Committee and/or its members. The Chief Audit Executive provides a

quarterly enterprise-wide risk assessment (including risks relating to cybersecurity and privacy), annual fraud risk assessment, and

SOX and Internal Audit reporting or assessments to the Audit Committee, and updates the Audit Committee on significant issues

raised by the Enterprise Risk and Compliance Committee. The Audit Committee discusses the potential impact of the Company’s risk

exposures on the Company’s business, financial results, operation and reputation. The Company’s General Counsel provides periodic

reports to the Audit Committee on the Company’s significant litigation matters.

As an integral part of the Company’s disclosure controls and procedures, the Audit Committee reviews enterprise risk assessments,

provides feedback to executive management and shares the risk assessments with the Board. The Audit Committee also has other

responsibilities with respect to the Company’s financial and accounting compliance and complaint procedures, internal audit, SOX

Compliance program and related person transactions, as more fully set out in its charter. Additionally, the Chief Compliance Officer

also has a direct communication channel to the Audit Committee f or purposes of discussing or reporting financial misconduct matters

with the Audit Committee and/or its members.

CEO Selection Committee

The CEO Selection Committee oversees risks related to the selection, appointment, hiring, firing and recall from office the Chief

Executive Officer of the Company.

Compensation Committee

The Compensation Committee has certain responsibilities with respect to succession planning and the assessment of risk in

connection with our compensation programs. The Compensation Committee periodically reviews with management an assessment of

whether risks arising from the Company’s compensation policies and practices for all employees are reasonably likely to have a

material adverse effect on the Company, as well as the means by which any potential risks may be mitigated, such as through

governance and oversight policies. The Company designs the compensation programs to encourage appropriate risk-taking while

discouraging behavior that may result in unnecessary or excessive business risk. In this regard, the following elements have been

incorporated in our compensation programs for executive officers:

• Use of multiple metrics in the annual incentive plan and use of two long-term incentive vehicles (time-based and performance-

based incentive awards) for executive officers

• Annual incentive award payouts capped at 200% of target

• Performance-based long-term incentive awards capped at 200% of target

• Emphasis on long-term and performance-based compensation

• The Compensation Committee has discretion to reduce incentive awards, as appropriate

• Alignment of interests of our executive officers with the long-term interests of our stockholders through stock ownership

guidelines that call for significant share ownership by our executive officers

• Formal clawback policy applicable to both cash and equity compensation

• Generally, long-term incentive awards vest ratably over three years or at the end of a three-year performance period

• No excessive perquisites for executive officers

Based on an assessment conducted by management consultant Willis Towers Watson, which was presented to and discussed with

the Compensation Committee, management concluded that our compensation policies and practices for all employees do not

create risks that are reasonably likely to have a material adverse effect on the Company.

Executive Committee

The Executive Committee is available to review and provide guidance to senior management regarding the Company’s strategy,

operating plans and operating performance. The Executive Committee also plays a role in helping the Board perform its risk oversight

function by considering strategic operating goals, opportunities and risks.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee oversees Board process and corporate governance-related risks, management

of compliance risks, risks related to our diversity, corporate social responsibility and sustainability practices, and risks related to the

Company’s data privacy and information security programs, including cybersecurity.

14

PROXY STATEMENT 2023

䡵

Corporate Governance at T-Mobile

Our Chief Communications Officer provides periodic reports to the Nominating and Corporate Governance Committee on the

Company’s charitable spending and related policies and other environmental, sustainability, and corporate social responsibility

matters. Our General Counsel provides periodic reports to the Nominating and Corporate Governance Committee on the Company’s

political spending and related policies.

Our Chief Compliance Officer provides quarterly reports to the Nominating and Corporate Governance Committee on the Company’s

compliance and ethics program, including enterprise compliance risk assessments and mitigation activities. The Chief Compliance

Officer also has a direct communication channel to the Nominating and Corporate Governance Committee for purposes of reporting or

discussing concerns relating to the Company’s compliance and ethics programs. Matters brought to the Nominating and Corporate

Governance Committee’s attention that could have a significant impact on the Company’s financial statements or may concern the

integrity, adequacy, and effectiveness of the Company’s accounting and financial reporting processes and internal control and

external reporting policies and procedures will be reported to the Audit Committee by the Chief Compliance Officer.

The Chief Cyber Transformation Officer, Chief Security Officer and Chief Privacy Officer provide periodic reports to the Nominating

and Corporate Governance Committee on the Company’s data privacy and information and infrastructure security programs, including

cybersecurity. The Nominating and Corporate Governance Committee discusses with management the Company’s privacy and data

security, including cybersecurity, risk exposures, policies, and practices, including the steps management has taken to detect, monitor

and control such risks. The Nominating and Corporate Governance Committee, as well as the Board, receive reports from officers with

responsibilities for the Company’s data privacy and information and infrastructure security programs, including cybersecurity.

Transaction Committee

The Transaction Committee oversees risks related to strategic transactions involving the Company and its businesses.

Director Compensation

NON-EMPLOYEE DIRECTOR COMPENSATION PROGRAM

Our “non-employee directors”—directors who are not employees of the Company or officers or employees of Deutsche Telekom or

SoftBank—are eligible to participate in the Company’s non-employee director compensation program, described below. The

Compensation Committee periodically reviews the compensation of our non-employee directors. As part of the review, the

Compensation Committee engages Mercer to assess our non-employee director compensation program in comparison to our peer

group (see “Executive Compensation—Factors Considered in Determining Executive Compensation—Executive Compensation Peer

Group” for more information on our peer group). Based on such assessment, the non-employee director compensation program is

adjusted as appropriate to ensure alignment with market practices. There were no changes to the Company’s non-employee director

compensation program in 2022.

KEY FEATURES OF OUR NON-EMPLOYEE DIRECTOR COMPENSATION PROGRAM

• A larger allocation of total director compensation to equity-based compensation rather than cash compensation

• All equity-based compensation is subject to a vesting period

• Stock ownership guidelines of five times the non-employee director’s annual cash retainer for Board services

Elements of Non-Employee Director Compensation Amount ($)

Annual cash retainer 135,000

Additional annual cash retainer for:

Lead Independent Director 55,000

Audit Committee Chair 60,000

Compensation Committee Chair 25,000

Nominating and Corporate Governance Committee Chair 20,000

Additional Retainer for Audit Committee Members (including the Audit Committee Chair) 15,000

National Security Director 75,000

Annual award of Restricted Stock Units 240,000

Additional cash amounts for each Board and committee meeting:

Board 3,000

Committee 2,000

䡵

PROXY STATEMENT 2023

15

Corporate Governance at T-Mobile

The annual award of time-based restricted stock units (“RSUs”) is made immediately after each annual meeting of stockholders. The

RSUs vest on the one-year anniversary of the grant date or, for directors not standing for re-election, on the date of the next annual

meeting of stockholders, subject to continued service as a non-employee director through the vesting date. In the event of a director’s

termination of service prior to vesting, all RSUs are automatically forfeited. The RSUs immediately vest on the date of a change in

control of the Company, subject to the applicable director’s continued service as a non-employee director through such date. Annual

cash retainers and the annual RSU awards are prorated f or any person who becomes a non-employee director and/or committee chair,

or who otherwise becomes entitled to an additional annual cash retainer as described above, at any time of the year other than the

date of the Company’s annual meeting of stockholders. Non-employee directors also receive reimbursement of expenses incurred in

connection with their Board and committee services and are eligible to receive up to two handsets per year and up to 10 lines of U.S.

service pursuant to the Board of Directors Phone Perquisite program.

OUR DIRECTORS ARE REQUIRED TO ACQUIRE AND MAINTAIN OWNERSHIP OF SHARES OF T-MOBILE

Under our stock ownership guidelines, each non-employee director is expected to acquire and maintain ownership of shares of

common stock equal in value to five times his or her annual cash retainer for Board service measured as of September 30 of each year.

Each non-employee director is expected to meet the ownership guidelines within the later of five years from (a) the date we adopted

the policy and (b) the date on which he or she became a non-employee director, and is expected to retain at least 50% of the net

shares of common stock acquired through equity awards until the ownership threshold is met.

䡲 As of December 31, 2022, all then-serving non-employee directors were in compliance with our stock ownership guidelines.

2022 NON-EMPLOYEE DIRECTOR COMPENSATION TABLE

During fiscal year 2022, the Company’s non-employee directors received the following compensation for their services:

Name

Fees Earned or

Paid in Cash

2

($)

Stock

Awards

3

($)

All Other

Compensation

4

($)

Total

($)

Marcelo Claure

1

87,048 — 9,459 96,507

Srikant M. Datar 257,000 230,461 9,974 497,435

Bavan Holloway 187,000 230,461 35,832 453,293

Letitia A. Long 239,000 213,795 89,740 542,535

Teresa A. Taylor 274,000 230,461 8,995 513,456

Kelvin R. Westbrook 191,000 230,461 11,858 443,319

1 Mr. Claure started to receive compensation for his services on the Board on June 15, 2022 following the completion of his services as an employee of SoftBank.

2 Includes annual cash retainers and cash meeting fees earned in accordance with the non-employee director compensation program.

3 The value of stock awards is determined using the aggregate grant-date fair value computed in accordance with Financial Accounting Standards Board Accounting Standards Codification

Topic 718, “Compensation–Stock Compensation,” or ASC 718, excluding the effect of any estimated forfeitures. These amounts reflect the Company’s accounting expense and do not

correspond to the actual value that will be realized by the directors. See Note 11 to the Consolidated Financial Statements included in the Company’s Annual Report on Form 10-K for the

year ended December 31, 2022 for a summary of the assumptions we apply in calculating these amounts. As of December 31, 2022, each of Mses. Holloway, Long and Taylor and Messrs.

Claure, Datar and Westbrook held 1,897 unvested time-based RSUs.

4 Includes (i) phone perquisites under the Board of Directors Phone Perquisite program, (ii) personal travel expenses in connection with Board and committee meetings, and (iii) for Ms. Long,

$50,000 in fees for her services to the Company’s National Security Agreement Compliance Committee and $12,500 in fees for her services as a member of the Special Security Agreement

Committee for the Company’s secure subsidiaries, which services ended in March of 2022.

Director Nomination, Selection and Qualifications

QUALIFICATIONS AND DIVERSITY

T-Mobile understands that diversity, inclusive of gender, race and experience, is a critical attribute of a well-functioning board of

directors and a measure of sound corporate governance. T-Mobile follows its director selection guidelines as we strive to maintain a

board composed of individuals with a mix of expertise, experience, skills and backgrounds to reflect the diverse nature of the business

environment in which we operate and the customers we serve. In connection with the Sprint Combination, we adopted an Equity In

Action Plan to further advance diversity, equity and inclusion efforts across T-Mobile, including at the Board level.

Subject to Deutsche Telekom’s board designation rights, the Nominating and Corporate Governance Committee is responsible for

identifying and evaluating director nominees and recommending to the Board a slate of nominees for election at each annual meeting

of stockholders.

16 PROXY STATEMENT 2023

䡵

Corporate Governance at T-Mobile

The Nominating and Corporate Governance Committee considers, among others, the following factors:

• Professional experience, industry knowledge, skills and expertise

• Diversity in all forms, including gender, race, age, ethnic, geographic, cultural and professional backgrounds

• Leadership qualities, public company board and committee experience and non-business-related activities and experience

• High standard of personal and professional ethics, integrity and values

• Training, experience and ability at making and overseeing policy in business, government and/or education sectors

• Willingness and ability to:

• keep an open mind when considering matters affecting interests of the Company and its constituents

• devote the required time and effort to effectively fulfill the duties and responsibilities related to Board and committee

membership

• serve on the Board for multiple terms, if nominated and elected, to enable development of a deeper understanding of the

Company’s business affairs

• Willingness to refrain from engaging in activities or interests that may create a conflict of interest with a director’s

responsibilities and duties to the Company and its constituents

• Willingness to act in the best interests of the Company and its constituents and to objectively assess Board, committee and

management performances

Diversity is one of many factors under our director selection guidelines that the Nominating and Corporate Governance Committee

considers when evaluating potential director candidates. Our director selection guidelines define diversity broadly to include not just

factors such as gender and race, but also factors such as age, ethnic, geographic, cultural and professional diversity. Our director

selection guidelines mandate that the skills and backgrounds collectively represented on the Board should reflect the diverse nature of

the business environment in which the Company operates and the customers it serves. In addition, according to our director selection

guidelines, the Nominating and Corporate Governance Committee will include, and will require any outside consultant that it engages

to include, women and minority candidates in the pool from which the committee selects director candidates. Eight of our current 13

directors are women or minorities, and all of our core Board committees are chaired by a woman or diverse director.

In connection with its general responsibility to monitor and advise the Board on the size, role, function and composition of the Board,

the Nominating and Corporate Governance Committee will periodically consider whether the Board represents the overall mix of skills

and characteristics described in the director selection guidelines, including diversity and the other factors described above. Subject to

Deutsche Telekom’s board designation rights, the selection process for director candidates is intended to be flexible, and the

Nominating and Corporate Governance Committee, in the exercise of its discretion, may deviate from the selection process when

particular circumstances warrant a different approach.

The table below summarizes the key qualifications, skills, and attributes most relevant to the decision to nominate candidates to serve

on the Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not having a mark does not

mean the director does not possess that qualification or skill. Our director nominees’ biographies describe each director’s background

and relevant experience in more detail.

䡵

PROXY STATEMENT 2023

17

Corporate Governance at T-Mobile

Director Nominee Qualifications, Skills and Attributes

Qualifications and

Expertise

Almeida

Claure

**

Datar

**

Gopalan

Höttges

Illek

*

Kübler

Langheim

Leroy

Long

*

Sievert

Taylor

Westbrook

**

Executive Management Experience ✓ ✓✓✓✓✓✓✓✓✓✓✓✓

Marketing & Sales ✓ ✓ ✓✓✓ ✓ ✓✓✓

Mergers & Acquisitions ✓ ✓✓✓✓✓✓✓✓✓✓✓✓

Technology & Innovation ✓ ✓✓✓✓ ✓✓✓✓✓✓✓

Industry & Experience ✓ ✓✓✓✓✓✓✓✓ ✓✓✓

ESG & Human Capital Management ✓ ✓✓✓✓✓✓✓✓✓✓✓✓

Government Affairs, Regulatory & Legal ✓ ✓ ✓✓ ✓✓✓✓✓✓

Global and International Operations ✓ ✓✓✓✓✓✓✓✓✓✓

Designation

Deutsche Telekom ✓ ✓ ✓✓✓✓✓✓ ✓

Nom & Gov ✓✓✓

T-Mobile CEO ✓

Tenure and

Independence

Tenure Nominee 2020 2013 2022 2013 2018 2013 2013 2020 2021 2018 2013 2013

Independence No Yes Yes No No No No No No Yes No Yes Yes

Demographics

Age 46 52 69 52 60 58 60 57 58 64 53 59 67

Gender M MMMMMMM F F M F M

Asian ✓✓

African American ✓

Hispanic ✓

White/Asian ✓

White ✓ ✓✓ ✓✓✓✓✓

* Expertise in Cybersecurity.

** Financial expert as defined by Item 407(d)(5) of Regulation S-K.

18 PROXY STATEMENT 2023

䡵

Corporate Governance at T-Mobile

Board Diversity Matrix (as of March 31, 2023)

Board Size:

Total Number of Directors 13

Gender: Male Female Non-Binary

Gender

Undisclosed

Number of directors based on gender identity 9 4 — —

Number of directors who identify in any of the categories below

African American or Black 1 1 — —

Alaskan Native or Native American — — — —

Asian 2— — —

Hispanic or Latinx 1 — — —

Native Hawaiian or Pacific Islander — — — —

White 43 — —

Two or More Races or Ethnicities

2

1— — —

LGBTQ+

1

—— — —

Undisclosed — — — —

1 None of our directors self-identified as lesbian, gay, bisexual, transgender, or a member of the queer community.

2 One director self-identified as both Asian and White.

NOMINATION PROCESS

In addition to candidates designated by Deutsche Telekom, the Nominating and Corporate Governance Committee may consider

possible director candidates from a number of sources, including those recommended by stockholders, directors, or officers. In

addition, the Nominating and Corporate Governance Committee may engage the services of outside consultants and search firms to

identify potential director candidates.

A stockholder who wishes to suggest a director candidate for consideration by the Nominating and Corporate Governance Committee

should submit the suggestion to the Chair of the Nominating and Corporate Governance Committee, care of our Corporate Secretary,

at 12920 SE 38th Street, Bellevue, Washington 98006, and include the candidate’s name, biographical data, relationship to the

stockholder and other relevant information. The Nominating and Corporate Governance Committee may request additional information

about the suggested candidate and the proposing stockholder. Subject to Deutsche Telekom’s board designation rights, the full

Board will approve all final nominations after considering the recommendations of the Nominating and Corporate Governance

Committee.

䡵

PROXY STATEMENT 2023

19

ENVIRONMENTAL, SOCIAL,

AND GOVERNANCE PRACTICES

AT T-MOBILE

Our business has a big impact on the way society lives, works,

learns, and engages with the world. That’s why our

environmental, social, and governance (ESG) approach is

guided by a simple yet bold aspiration to create a connected

world where everyone can thrive.

That means responsibly operating our business to create long-

term value for our stakeholders, while never losing sight of our

opportunity to leverage our size, scale, technology, and the

power of our brand to be a force for good.

We actively manage and address a range of ESG matters—from

championing diversity, equity, and inclusion in our workforce

and society, to providing equitable access to connectivity, and

managing our environmental footprint for greater sustainability

as we continue to grow our business.

Fundamental to this work is our ongoing commitment to

responsible business practices that promote accountability,

transparency, and ethical conduct.

䡵

ESG HIGHLIGHTS

䡵

Environmental Sustainability

• T-Mobile was first in U.S. wireless to set a science-based net-zero emissions goal for its entire carbon footprint, aiming to reach

it by 2040. This includes two greenhouse gas (GHG) emissions reduction targets validated by the Science Based Targets

initiative (SBTi) using their Net-Zero Standard:

• Reduce absolute Scope 1, 2 and 3 GHG emissions 55% by 2030 from a 2020 base year.

• Reduce absolute Scope 1, 2 and 3 GHG emissions 90% by 2040 from a 2020 base year.

• Signed The Climate Pledge, a commitment to reach the Paris Agreement 10 years early and achieve net-zero carbon by 2040.

The Climate Pledge, co-founded by Amazon and Global Optimism, is a cross-sector community of companies and

organizations working together to solve the challenges of cutting global carbon emissions for a sustainable future.

• Continued to source 100% of our purchased electricity from renewable energy

1

.

• Published T-Mobile’s Pathway to Net-Zero report.

• Received an A- for our 2022 CDP Climate Change response.

• Collected 11.7 million devices through our device reuse and recycling program in 2022.

Social Impact

• T-Mobile has connected more than 5.3 million students nationwide and provided over $4.8 billion in products and services

through education initiatives including Project 10Million, our $10.7 billion initiative aimed at closing the education gap.

1

For T-Mobile’s 100% renewable electricity commitment, please note that T-Mobile matches its own annual electrical usage with renewable energy from a portfolio of sources including: virtual

power purchase agreements, a green direct program, renewable retail agreements, and unbundled Renewable Energy Certificate purchases.

20 PROXY STATEMENT 2023

䡵

Environmental, Social and Governance Practices

• Provided $2.2B in funding and in-kind products and services to support communities across the continental U.S. and Puerto

Rico, inclusive of disaster relief and support.

• Continued to make progress on the diversity, equity and inclusion (“DE&I”) Promises in our Equity In Action Plan, achieving

over half of the Promises by the end of 2022 and remaining on track to achieve the remaining Promises by 2025.

• Published T-Mobile’s EEO-1 workforce data alongside the 2021 Corporate Responsibility Report.

• Received a score of 100% on the Human Rights Campaign’s Corporate Equality Index and Disability Equality Index.

• Named Disability:IN’s Employer of the Year and 2022 Leading Disability Employer by the National Organization on Disability

(NOD).

Responsible Business Practices

• Enhanced the online Privacy Center to be more mobile-first and consumer friendly and deployed a new privacy dashboard that

centralizes and simplifies consumer privacy controls.

• The Cyber Transformation Office continued to make substantial, multi-year investments to strengthen our cybersecurity

program and enhance our tools and capabilities.

• JUST Capital ranked T-Mobile #20 on its 2023 Rankings of America’s Most JUST Companies, including #1 in the

telecommunications industry for environment, in recognition for ongoing progress and commitment to driving responsible

business practices and positive environmental and social impact.

• Published annual Political Engagement and Transparency Reports.

Social – Investing in Our People and Communities

INVESTING IN OUR PEOPLE & CULTURE

We are a celebratory, inclusive, customer-obsessed team of people united in our commitment to change our industry for the better.

Our culture begins and ends with our employees—the heart and soul of the Un-carrier. We know we are a stronger company when

every employee feels valued for who they are and equipped to constantly learn, aim high, and offer the best for our customers. This

last year we emphasized the power of coming together—sometimes in-person with teammates for the first time—and fueling our

relentless spirit to innovate, grow, and propel our business forward.

Diversity, Equity, and Inclusion

We come together as one team, made up of people with unique talents, backgrounds and perspectives, which enables us to continue

to deliver growth and profitability. Our strength comes from investing in a diverse workforce that reflects the communities and

customers we serve. It’s this diversity that fuels the Un-carrier spirit.